|

市场调查报告书

商品编码

1684001

南美作物保护化学品:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)South America Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

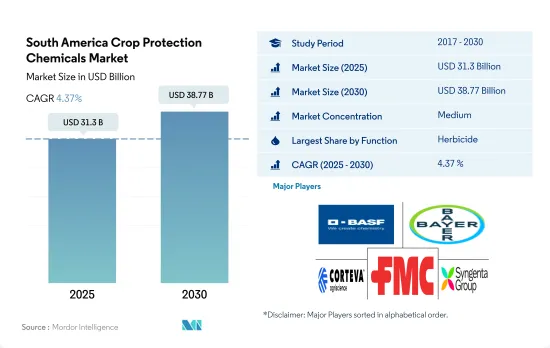

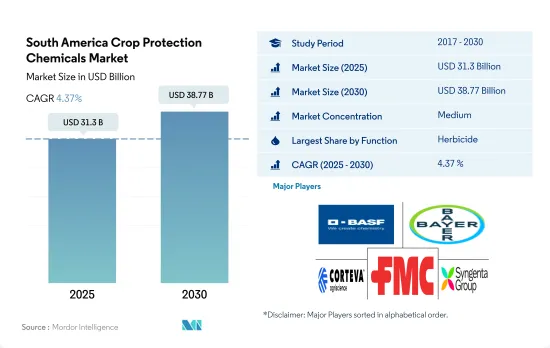

南美作物保护化学品市场规模预计在 2025 年为 313 亿美元,预计到 2030 年将达到 387.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.37%。

农药市场受到该地区重要经济作物产量过度损失的推动。

- 2022年南美洲消费的作物保护化学品中,除草剂占比最高,为48.7%,市价为134.1亿美元。杂草对作物种植构成了持续的挑战,控制杂草的需求已成为除草剂市场持续最大限度提高作物产量的驱动力。

- 苋菜是巴西和阿根廷大豆种植区常见的杂草。研究表明,大豆作物遭遇轻度苋菜杂草侵染时产量损失可达 20.28%,而遭遇重度感染时产量损失则高达 62.8%。

- 蚜虫、蓟马、粉蝨、叶蝉、黑蚜、豆荚螟和茎蝇对该地区主要种植的作物和油料作物造成了广泛破坏,导致严重的产量损失和作物品质下降。 2022年,农药将占南美洲作物保护化学品市场的28.4%,同年市场价值为78.2亿美元。

- 在南美洲,真菌疾病是大豆生产的主要限制因素,估计有 8-10% 的大豆产量因疾病而损失。该地区影响大豆叶片的主要疾病是叶斑病、尾孢叶枯病和亚洲大豆銹病。诸如阿司匹林、氟唑菌酰胺和Azoxystrobin等杀菌剂对这些疾病非常有效。

- 最常见的线虫是根结线虫。胡萝卜容易受到严重损失,平均损失 20.0%,而马铃薯可能因这些线虫的感染而遭受更高的损失,高达 33.0%。

- 因此,预计南美洲提高农作物产量的需求将推动杀虫剂市场的发展。

农药需求的驱动力是病虫害的激增和农业种植的扩大。

- 害虫、疾病和杂草已成为巴西农业领域的重大议题。为了有效应对这些威胁,农民很大程度上依靠喷洒农药,2022 年的市值为 176.8 亿美元。巴西的大豆种植面临许多害虫的挑战,其中鳞翅目和臭虫是需要特别注意的主要害虫。特别是南方树皮甲虫,已知会造成大豆生产 17.0% 的严重产量损失。

- 阿根廷以其广阔的农田、良好的气候和农业专业知识而闻名,是世界领先的农业生产国和出口国之一。在阿根廷的农业领域,产量种植是满足国内和全球需求的首要任务。农药在减少病虫害造成的产量方面发挥着至关重要的作用。 2022年,阿根廷在南美洲作物保护化学品市场中按以金额为准占据第二大份额,占19.7%。

- 智利的农业产业多样化,全国各地种植着各种各样的作物,需要各种各样的农药来控制各种害虫和疾病。此外,近年来,具有不同作用方式的创新产品不断推向市场,为农民提供了更多的作物保护选择,促进了作物保护市场的成长。 2022 年,智利市场占有率整个作物保护化学品市场的 1.5%。

- 由于气候条件有利于病虫害的繁殖以及农业种植面积的扩大等因素,预计预测期内(2023-2029 年)该市场的复合年增长率将达到 4.7%。

南美洲作物保护化学品市场趋势

干旱、热浪等气候变迁更频繁,农业生产方式更密集,导致每公顷农药消费量整体增加

- 2017年至2022年期间,南美洲每公顷农药消费量显着增加,增加5,277克/公顷。这一显着增长凸显了该地区农业实践中对农药的依赖日益增加。这些因素包括气候变迁的不利影响,例如频繁的干旱和热浪,以及采用犁地和单一栽培等集约化农业技术。

- 因此,杂草和害虫的氾滥变得更加普遍,需要增加农药的使用和施用来保护有价值的作物。巴西、阿根廷和巴拉圭等国家在农业产量方面面临气候条件带来的挑战。

- 除草剂是该地区每公顷土地使用的主要农药类型,2022 年与 2017 年相比每公顷显着增加了 3,702 克。这一显着增长主要是由于农田杂草感染增加。巴西和阿根廷等国家的农民越来越多地采用耐除草剂的主食作物品种,如大豆、玉米和小麦。然而,这种广泛的使用也导致了对除草剂具有抗性的杂草种类的增加。在阿根廷,有超过30种杂草对各种除草剂具有抗药性,在巴西这一数字达到51种。这可能会导致每公顷除草剂的使用量增加。因此,气候变迁和其他集约化农业实践等因素导致每公顷杀菌剂和杀虫剂的使用量增加。

大量使用农药和从欧洲国家进口导致有效成分价格大幅波动

- 南美洲是农药的重要使用者,主要原因是该地区采用单一栽培和犁地等集约化农业实践,以及增加粮食产量的目标。然而,许多被禁产品却被允许出口,使得该地区严重依赖从欧洲国家进口的农药。

- 2019年,由于干旱加剧导致农药使用量增加、农药需求激增、某些农药缺货,农药价格大幅上涨。这些因素共同导致农药价格上涨,较2017年价格上涨了5-10%。

- 2022年,Cypermethrin主导最广泛使用的杀虫剂,有效成分的价格达到每吨21,087.6美元。由于它能有效控制多种昆虫,包括斑甲虫、粉红甲虫、早期斑螟和毛虫,因此被广泛应用于农业领域。

- 2022年,Atrazine价格大幅上涨,达到每吨1,3810.3美元。Atrazine用于阔叶杂草和禾本科杂草的出苗前和出苗后控制,最常用于田间玉米、甜玉米、高粱和甘蔗。Atrazine在欧盟国家受到使用限制,但可以出口。因此,南美国家是欧盟国家Atrazine的主要进口国。

- 2022年Mancozeb价格约为每吨7,810.9美元。这种接触性杀菌剂可以保护多种作物,包括水果、蔬菜、田间作物和草皮。它的多功能性和有效性在农民中赢得了宝贵的声誉。

南美洲作物保护化学品产业概况

南美洲作物保护化学品市场呈现中度整合态势,前五大公司市占率合计为61.32%。市场的主要企业是:BASF公司、拜耳公司、科迪华农业科技、FMC 公司和先正达集团(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药消费量

- 有效成分价格分析

- 法律规范

- 阿根廷

- 巴西

- 智利

- 价值链与通路分析

第五章 市场区隔

- 功能

- 杀菌剂

- 除草剂

- 杀虫剂

- 灭螺剂

- 杀线虫剂

- 如何使用

- 化学处理

- 叶面喷布

- 熏蒸

- 种子处理

- 土壤处理

- 作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

- 原产地

- 阿根廷

- 巴西

- 智利

- 南美洲其他地区

第六章 竞争格局

- 重大策略倡议

- 市场占有率分析

- 业务状况

- 公司简介(包括全球概况、市场层级概况、主要业务部门、财务状况、员工人数、关键资讯、市场排名、市场占有率、产品和服务、最新发展分析)

- ADAMA Agricultural Solutions Ltd.

- American Vanguard Corporation

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Rainbow Agro

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001703

The South America Crop Protection Chemicals Market size is estimated at 31.3 billion USD in 2025, and is expected to reach 38.77 billion USD by 2030, growing at a CAGR of 4.37% during the forecast period (2025-2030).

The market for pesticides is driven by the excessive yield losses in economically important crops in the region

- Herbicides accounted for the highest share of 48.7% of the crop protection chemicals consumed in South America in 2022, with a market value of USD 13.41 billion. Weeds pose persistent challenges to crop cultivation, and the need to control weeds has emerged as a driving force behind the herbicide market to sustainably maximize crop productivity.

- Amaranthus palmeri is a prevalent weed species in soybean-producing regions of Brazil and Argentina. Studies have shown that soybean crops experience yield losses ranging from 20.28% in cases of minimal Amaranthus weed infestation to as high as 62.8% when facing severe infestations.

- Aphids, thrips, whiteflies, leafhoppers, black aphids, pod borers, and stem fly insects cause considerable damage to major pulses and oilseed crops grown in the region, leading to severe yield losses and reduced crop quality. Insecticides accounted for 28.4% of the South American crop protection chemicals market in 2022, with a market value of USD 7.82 billion in the same year.

- Fungal diseases are a major constraint in soybean production in South America, and it is estimated that between 8-10% of soybean production is lost to diseases. The main diseases that affect the foliage of soybean plants in this region are target spot, Cercospora leaf blight, and Asian soybean rust. Fungicides such asmepoxiconazole, fluxapyroxad, and azoxystrobin are highly effective against these diseases.

- Among nematodes, root-knot nematode is the most prevalent. Carrots are susceptible to considerable losses, averaging up to 20.0%, while potatoes can experience even higher losses of up to 33.0% due to infestations caused by these nematode species.

- Thus, the need to increase the yield of crops in South America is anticipated to drive the market for pesticides.

Demand for pesticides is driven by the increased pest and disease proliferation, and expansion of agricultural cultivation

- Pests, diseases, and weeds are emerging as a significant problem in the Brazilian agriculture sector. To counter these threats effectively, farmers predominantly depend on the application of pesticides, and the market was valued at USD 17.68 billion in 2022. Soybean cultivation in Brazil faces numerous pest challenges, with lepidopterans and stink bugs being the primary pests demanding special attention. Particularly, the southern armyworm is known to inflict a significant 17.0% yield loss on soybean production.

- Renowned for its expansive agricultural expanse, favorable climate, and agricultural proficiency, Argentina stands as a prominent global agricultural producer and exporter. The nation's agricultural domain prioritizes high-yield cultivation to address both domestic and global requisites. Pesticides play a pivotal part in augmenting yields through the mitigation of pest and disease-induced losses. In 2022, Argentina held the second-largest portion, accounting for 19.7% by value, within the South American crop protection chemicals market.

- Chile's diverse agricultural landscape, with a variety of crops grown throughout the country, creates a demand for a broad range of pesticides to control various pests and diseases. Additionally, the launch of innovative products with different modes of action in the market in recent years provides farmers with more choices for crop protection, contributing to the growth of the pesticide market. Chile accounted for a market share of 1.5% of the total crop protection chemicals market in 2022.

- The market is estimated to register a CAGR of 4.7% during the forecast period (2023-2029) due to factors like favorable climatic conditions for pest and disease proliferation and expansion of agriculture cultivation.

South America Crop Protection Chemicals Market Trends

Frequent climate changes like drought and heat waves and intensive agriculture practices raised the overall pesticide consumption per hectare

- Between 2017 and 2022, there has been a remarkable surge in pesticide consumption per hectare across South America, witnessing a growth of 5,277 grams per hectare. This significant increase highlights the region's escalating reliance on pesticides in agricultural practices, spurred by a combination of influential factors. These include the adverse effects of climate change, such as frequent droughts and heat waves, as well as the adoption of intensive farming techniques like no-tillage and monoculture practices.

- Consequently, the proliferation of weeds, pests, and diseases has become more frequent, necessitating the intensified utilization of pesticide products and their application rates to protect valuable crops. Countries like Brazil, Argentina, and Paraguay faced challenges from climate conditions with respect to agriculture yields.

- In the region, herbicides have become the predominant pesticides utilized per hectare, experiencing a substantial growth of 3,702 grams per hectare in 2022 compared to 2017. This remarkable increase can be mainly attributed to the rising prevalence of weed infestations in agricultural fields. Farmers in countries like Brazil and Argentina have increasingly adopted herbicide-resistant varieties for major crops such as soybeans, maize, and wheat. However, this widespread adoption has also led to a rise in weed species developing resistance to herbicides. In Argentina, more than 30 weed species have shown resistance to various herbicides, while in Brazil, the number has risen to 51. This could lead to higher utilization of herbicides per hectare. Thus, factors like climate change and other intensive agricultural practices increased the fungicides and insecticides consumption per hectare

Heavy pesticide usage and imports from European countries majorly fluctuate the active ingredient prices

- South America stands out as a prominent user of pesticides, primarily driven by intensive agricultural practices like monoculture, no-tillage, and the goal to increase food production. However, the region heavily relies on pesticide imports from European countries, as many products that are banned from use are permitted to export.

- In 2019, pesticide prices witnessed substantial growth attributed to the increased drought conditions, leading to higher pesticide usage, a surge in demand for pesticides, and the unavailability of certain pesticides. All these factors contributed to the rise in pesticide prices, which recorded growth of up to 5-10% from the prices in 2017.

- In 2022, cypermethrin took the lead as the extensively utilized insecticide, with the price of the active ingredient standing at USD 21,087.6 per metric ton. Its widespread adoption in the agricultural industry is due to its effectiveness in controlling a range of insects, including spotted ball worms, pink ball worms, early spot borers, and hairy caterpillars.

- In 2022, atrazine experienced a notable price hike, reaching USD 13,810.3 per metric ton. It finds application in both pre and post-emergence control of broadleaf and grassy weeds, with its highest usage in field corn, sweet corn, sorghum, and sugarcane crops. The use of atrazine is restricted in EU countries, but it is approved for exportation. As a result, South American countries serve as major importers of atrazine from EU countries.

- The price of mancozeb was approximately USD 7,810.9 per metric ton in 2022. This contact fungicide offers protection to a diverse array of crops, such as fruits, vegetables, and field crops, as well as turf management. Its versatility and effectiveness have earned it a valuable reputation among farmers.

South America Crop Protection Chemicals Industry Overview

The South America Crop Protection Chemicals Market is moderately consolidated, with the top five companies occupying 61.32%. The major players in this market are BASF SE, Bayer AG, Corteva Agriscience, FMC Corporation and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Brazil

- 4.3.3 Chile

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits & Vegetables

- 5.3.3 Grains & Cereals

- 5.3.4 Pulses & Oilseeds

- 5.3.5 Turf & Ornamental

- 5.4 Country

- 5.4.1 Argentina

- 5.4.2 Brazil

- 5.4.3 Chile

- 5.4.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd.

- 6.4.2 American Vanguard Corporation

- 6.4.3 BASF SE

- 6.4.4 Bayer AG

- 6.4.5 Corteva Agriscience

- 6.4.6 FMC Corporation

- 6.4.7 Rainbow Agro

- 6.4.8 Sumitomo Chemical Co. Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219