|

市场调查报告书

商品编码

1687180

印尼作物保护化学品市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Indonesia Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

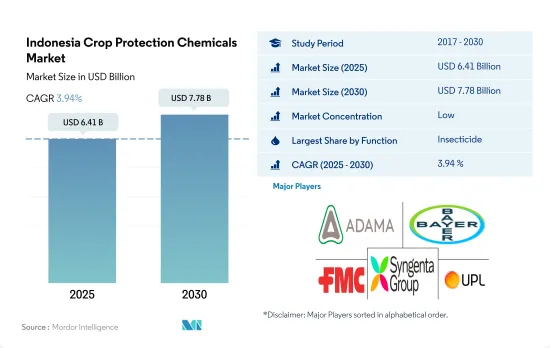

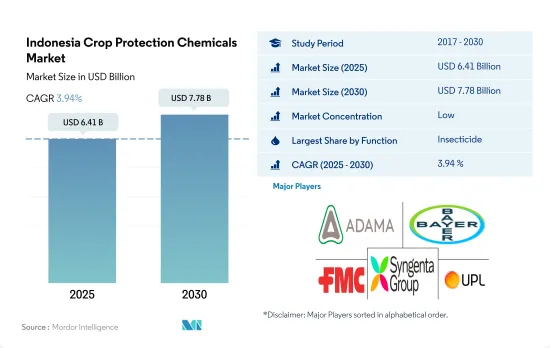

印尼作物保护化学品市场规模预计在 2025 年为 64.1 亿美元,预计到 2030 年将达到 77.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.94%。

农药主导印尼作物保护化学品市场

- 印尼拥有丰富的自然资源和良好的气候条件,是亚洲最重要的农业市场之一。特别是,人们越来越重视产量作为实现粮食安全的关键手段,这刺激了对作物保护化学品的需求。印尼的作物保护化学品市场稳步增长,在历史时期(2017-2022年)内价值增长了22亿美元。

- 由于农业用地的扩大和农业技术的进步,作物保护化学品在该国变得越来越普遍。印尼是世界上最大的棕榈油生产国和第四大咖啡生产国。水稻生产中作物保护化学品的使用量仍然很高。

- 以以金额为准计算,杀虫剂在 2022 年占据最大份额,为 74.4%。农民必须能够使用多种已註册的农药组,以便在田间轮调使用不同组别的农药。截至2021年2月,印尼註册的杀虫剂品牌共有1059个,包含80种不同的活性成分。印尼登记的杀虫剂有效成分中90%以上是由拟除虫菊酯、有机磷酸盐、阿维菌素和米尔贝霉素等混合而成。

- 由于农业在经济中发挥至关重要的作用,印尼政府正在推动精密农业产业的发展,以提高 GDP。此举对该国作物保护化学品市场产生了正面影响。预计害虫侵扰的增加和农民意识的不断提高,加上新耕作方式的采用和维护食品安全和品质的需求,将推动该国作物保护化学品市场在预测期内(2023-2029 年)实现 4.1% 的复合年增长率。

印尼作物保护化学品市场趋势

抗除草剂杂草的增加导致每公顷除草剂消费量增加

- 印尼是着名的农业国,土壤肥沃,气候属于热带气候,适合种植多种作物。然而,该国的农业部门面临许多挑战,包括杂草感染、害虫和真菌疾病。为了解决这些问题并提高作物产量,印尼农民严重依赖农药产品来减少作物损失。

- 在过去的研究期间,每公顷除草剂消费量显着增加了 2.7%。出现这种激增主要是由于主要作物中杂草侵染加剧所致。令人担忧的是,这些入侵杂草每年造成严重的产量损失,根据具体作物及其相关环境的不同,损失幅度从 10% 到惊人的 60% 不等。为了应对这些有害损失,农民越来越多地使用除草剂作为主要的控制方法。然而,随着作物不断喷洒除草剂,杂草对这些药剂产生了抗药性。这导致除草剂消费量增加以及每公顷施用量增加,加剧了印尼农民面临的挑战。

- 每公顷杀菌剂、杀虫剂和其他农业化学品的消费量保持相对稳定,没有显着变化。然而,由于农业活动的扩大,该国每公顷土地的农药使用量总体增加。这种成长趋势是由于缺乏限制农药最大残留量的法规所造成的。因此,每公顷土地的农药消费量不断上升。

由于农药製造商将增加的活性成分成本转嫁给消费者,农药价格可能会上涨。

- 活性成分的价格直接影响农业化学品的生产成本。当活性成分价格上涨时,农药製造商可能会将这些增加的成本转嫁给消费者,导致农药价格上涨。

- 2022 年Cypermethrin的价格为每吨 20,900 美元。Cypermethrin是一种合成拟除虫菊酯杀虫剂,用于大规模商用农业应用,即使在施用后立即使用低剂量也能有效控制昆虫。它还能有效控制昆虫引起的疾病,如斑点宝石甲虫、粉红球虫、早期斑点螟虫和毛虫。Cypermethrin替代品的可用性将影响定价。

- Atrazine的价格大幅上涨,2022 年的价格为每吨 9,900 美元。Atrazine用于农田出苗前和出苗后控制阔叶杂草和禾本科杂草,最常用于田间玉米、甜玉米、高粱和甘蔗。据预测,透过控制杂草,Atrazine可以使作物产量提高 6%。由于这些因素,随着需求的增加,这种活性成分的价格近年来可能会上涨。农民关于使用除草剂的决定可能会受到活性成分价格的影响。更高的价格可能会鼓励农民考虑使用替代除草剂。

- 截至 2022 年,Mancozeb化学杀菌剂的价格约为每吨 7,700 美元。Mancozeb是一种接触性杀菌剂,能够保护多种作物,包括水果、蔬菜、坚果和田间作物。它也常用于专业草坪护理。它的多功能性和有效性使其成为农民和其他专业人士保护作物的宝贵工具。

印尼作物保护化学品产业概况

印尼农化市场较为分散,前五大企业市占率合计为1.67%。该市场的主要企业包括 ADAMA Agricultural Solutions Ltd、拜耳股份公司、FMC Corporation、先正达集团、UPL limited 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药消费量

- 活性成分价格分析

- 法律规范

- 印尼

- 价值炼和通路分析

第五章市场区隔

- 功能

- 杀菌剂

- 除草剂

- 杀虫剂

- 杀软体动物剂

- 杀线虫剂

- 执行模式

- 化学喷涂

- 叶面喷布

- 熏蒸

- 种子处理

- 土壤处理

- 作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

第六章竞争格局

- 重大策略倡议

- 市场占有率分析

- 商业状况

- 公司简介

- ADAMA Agricultural Solutions Ltd

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- PT BIoTis Agrindo

- Syngenta Group

- UPL limited

- Wynca Group(Wynca Chemicals)

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 56086

The Indonesia Crop Protection Chemicals Market size is estimated at 6.41 billion USD in 2025, and is expected to reach 7.78 billion USD by 2030, growing at a CAGR of 3.94% during the forecast period (2025-2030).

Insecticides dominate the Indonesian crop protection chemicals market

- Given its natural resources and the right climatic conditions, Indonesia is one of the most important agricultural markets in Asia. In particular, demand for crop protection chemicals has been stimulated by a greater emphasis on yield as the primary instrument of achieving food security. The Indonesian crop protection chemicals market grew steadily, increasing by USD 2.2 billion in value during the historical period (2017-2022).

- Crop protection chemicals have become increasingly common in this country due to the expansion of agricultural land and advancements in farming techniques. Indonesia is the largest producer of palm oil globally and ranks fourth in coffee production. The use of crop protection chemicals in rice production remains high.

- Insecticides held the largest share of 74.4% by value in 2022. Farmers must have access to a diverse range of registered pesticide groups, which enables them to rotate among the groups in the field. Until February 2021, there were 1,059 insecticide brands registered in Indonesia, consisting of 80 different active ingredients. More than 90% of active ingredients registered in Indonesia consist of a combination of pyrethroids, organophosphates, avermectins, and milbemycins.

- The government is promoting the precision agriculture industry in Indonesia to boost its GDP, as agriculture plays a significant role in the economy. This move has had a positive impact on the crop protection chemicals market in the country. Owing to the increase in pest infestations and rise in awareness among farmers, coupled with the adoption of new farming practices and a demand to maintain food safety and quality, the crop protection chemicals market in the country is anticipated to record a CAGR of 4.1% during the forecast period (2023-2029).

Indonesia Crop Protection Chemicals Market Trends

Increased number of herbicide-resistant weed species has increased the herbicide consumption per hectare

- Indonesia stands out as a prominent agricultural country, distinguished by its abundance of fertile land and tropical climate, both of which create advantageous conditions for cultivating a wide variety of crops. However, the agricultural sector in the country faces numerous challenges, including weed infestation, insect pests, and fungal diseases. To address these issues and bolster crop production, Indonesian farmers are heavily relying on pesticide products as a means of controlling crop losses.

- The per hectare consumption of herbicides has witnessed a significant 2.7% increase during the historical period. This surge is primarily attributed to the escalating weed infestation observed in major crops. Disturbingly, these invasive weeds are causing substantial annual yield losses, ranging from 10% to a staggering 60%, depending on the specific crop and its associated environment. In order to combat these detrimental losses, farmers have increasingly turned to herbicides as their primary method of control. However, the continuous application of herbicides on crops has led the weeds to develop resistance against these chemical agents. This consequence has resulted in increased consumption of herbicides and an elevated application rate per hectare, exacerbating the challenge faced by Indonesian farmers.

- The per hectare consumption of fungicides, insecticides, and other pesticide products remains relatively stable without any significant changes. However, the overall usage of pesticides per hectare in the country is increasing due to the expansion of agricultural activities. This upward trend can be attributed to a lack of regulations that set limits on the maximum residual use of pesticides. As a result, the consumption of pesticides per hectare is on the rise.

Pesticide manufacturers may pass on the increase in active ingredient prices to consumers, resulting in higher pesticide prices

- The price of active ingredients directly affects the cost of producing pesticides. When the price of active ingredients rises, pesticide manufacturers may pass on these increased costs to consumers, resulting in higher pesticide prices.

- Cypermethrin was valued at USD 20.9 thousand per metric ton in 2022. It is a synthetic pyrethroid used as an insecticide in large-scale commercial agricultural applications and is very effective in controlling the insects immediately after application, even at lower doses. It is also effective in controlling diseases by insects such as spotted ball worms, pink ball worms, early spot borers, and hairy caterpillars. The availability of alternatives to cypermethrin can impact its pricing.

- Atrazine witnessed a significant increase in its price, valued at USD 9.9 thousand per metric ton in 2022. It is used to stop pre- and post-emergence broadleaf and grassy weeds in crops, with the highest use on field corn, sweet corn, sorghum, and sugarcane. It is projected that atrazine can raise crop production by up to 6% by managing weeds. Due to these factors, the prices of this active ingredient may have gone up in recent years in line with the rising demand. Farmers' decisions on herbicide usage can be affected by active ingredient prices. Higher prices may lead farmers to explore alternative herbicide applications.

- As of 2022, the price of mancozeb chemical fungicide was valued at approximately USD 7.7 thousand per metric ton. It is a contact fungicide that has the ability to provide protection for a wide range of crops, including fruits, vegetables, nuts, and field crops. It is also commonly utilized in professional turf management. Its versatility and effectiveness make it a valuable tool for farmers and other professionals to protect crops.

Indonesia Crop Protection Chemicals Industry Overview

The Indonesia Crop Protection Chemicals Market is fragmented, with the top five companies occupying 1.67%. The major players in this market are ADAMA Agricultural Solutions Ltd, Bayer AG, FMC Corporation, Syngenta Group and UPL limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Indonesia

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits & Vegetables

- 5.3.3 Grains & Cereals

- 5.3.4 Pulses & Oilseeds

- 5.3.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Nufarm Ltd

- 6.4.7 PT Biotis Agrindo

- 6.4.8 Syngenta Group

- 6.4.9 UPL limited

- 6.4.10 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219