|

市场调查报告书

商品编码

1906988

北美作物保护化学品:市场份额分析、行业趋势、统计数据和成长预测(2026-2031 年)North America Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

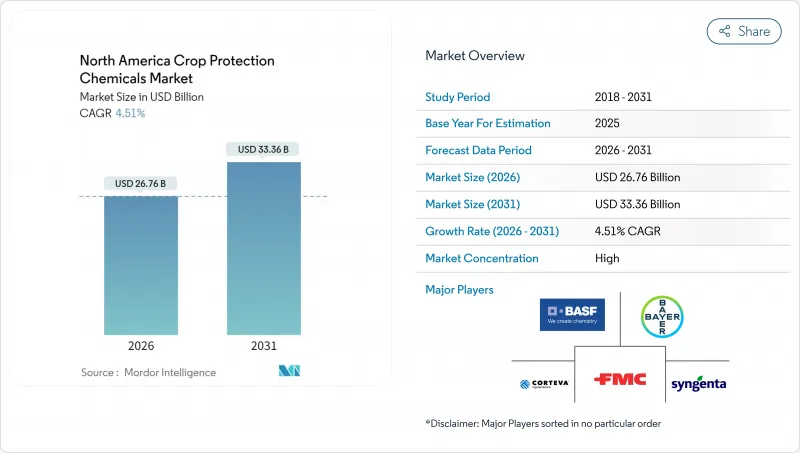

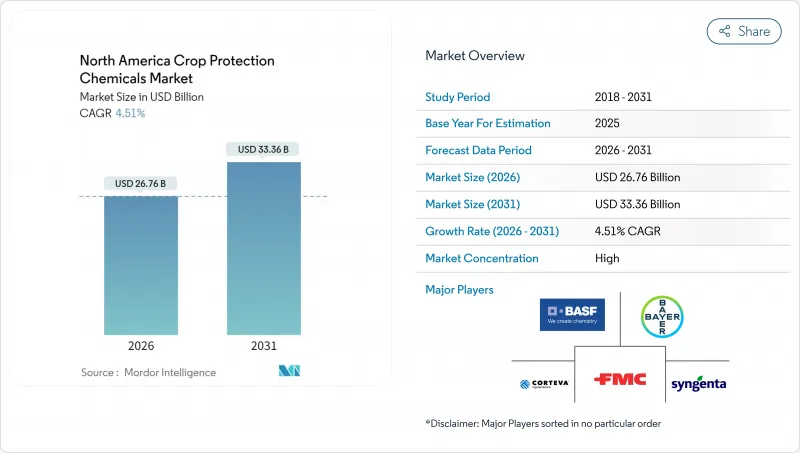

预计到 2026 年,北美作物保护化学品市场价值将达到 267.6 亿美元,高于 2025 年的 256 亿美元。

预计到 2031 年将达到 333.6 亿美元,2026 年至 2031 年的复合年增长率为 4.51%。

杂草抗药性、真菌病害激增以及监管机构对低风险活性成分日益增长的偏好,正在推动化学品需求,而精密农业工具则在减少浪费方面发挥重要作用。儘管种植者仍然青睐合成除草剂,因为它们在大面积田地中高效,但美国环保署 (EPA) 的快速核准流程正在推动生物製剂和生物合理性製剂的迅速扩张。该地区大规模的粮食生产基地、美国墨加协定 (USMCA) 下稳定的出口管道以及保护性耕作措施的碳信用激励,都有助于维持支出,儘管传统化学品面临诉讼。随着主要企业整合种子、化学品和数位农艺技术以赢得市场份额,同时应对日益严格的基准值,竞争仍然激烈。

北美作物保护化学品市场趋势与洞察

加速采用耐除草剂性状

在主要产区,耐除草剂大豆的推广率已超过95%,玉米的推广率也达到了89%。这些特性使得除草剂的后处理窗口期得以延长,从而增加了季节性除草剂的使用量,并提高了作物轮作的柔软性。随着抗Glyphosate杂草(例如长芒苋)日益受到关注,美国环保署批准了基于麦草畏和2,4-D的平台,引入了新的作用机制。诸如科迪华的Enlist E3和拜耳的XtendFlex等组合技术正在推高价格,并促进化学品和种子捆绑包装的销售。整合变数施药技术优化了特定区域的用药剂量,进一步巩固了这些特性在现代农艺中的地位。儘管面临来自非专利药的价格压力,基因技术与精准仪器的协同作用仍维持着对选择性除草剂的需求。

精准喷洒设备可降低每英亩成本

正如约翰迪尔的「目视喷洒」田间试验所证明的那样,电脑视觉喷雾器能够逐一识别杂草,在保持有效控制的同时,减少高达77%的化学药剂用量。美国农业部农民补助津贴(美国 FARMER grants)的公共支持正在加速这项技术的普及,因为它可以抵消设备成本。机载感测器能够即时调整喷洒量,最大限度地减少重迭和漂移,从而降低投入成本,并解决监管方面对脱靶行为的担忧。减少补药时间和节省人力成本提高了管理数千英亩土地的大型农场的运作效率。设备经销商现在将数据分析服务的订阅服务捆绑销售,使种植者能够检验节省的成本,并鼓励他们继续购买相容的化学药剂。

加拿大提案的最大残留限量基准值将限制出口

加拿大卫生署提案将几种活性成分(包括2,4-D)的最大残留基准值(MRL)减半,这些成分适用于可能因国际买家采用更严格标准而面临出口风险的农产品。标准的差异将要求生产商达到最低标准,从而增加分析检测成本,并促使他们转向使用低残留农药。依赖出口的卑诗省和安大略省的生产商预计运输时间将缩短,合规文件工作量将增加。化学品製造商正在为残留研究和标籤修订拨出额外预算,这可能会延长新产品的投资回收期。

细分市场分析

到2025年,除草剂将占北美作物保护化学品市场收入的51.65%,反映出1.8亿英亩玉米和大豆田普遍依赖化学除草。精准施药技术和性状驱动的选择性促使种植者继续偏好后处理产品,以在整个生长季节保护产量潜力。抗性管理需要多种作用机制,加上保护性耕作措施导致除草剂用量增加,预计到2031年,该细分市场将以4.88%的复合年增长率成长。同时,焦油斑病和大豆銹病的日益普遍正在加速杀菌剂的使用,并使整体支出更加多元化。虽然杀虫剂面临着来自生物竞争和日益严格的授粉媒介保护条例法规的压力,但它们在针对西部玉米根虫零星爆发的综合防治方案中仍然至关重要。

可迭加使用的生物除草剂正逐渐被采用,尤其是在对残留基准值有限制的蔬果面积。主要企业正在推出微胶囊配方,将合成活性成分和微生物活性成分结合,以延长药效持续时间,同时满足环境标准。产品管理倡议正在教育种植者轮作和使用覆盖作物来减少抗药性的产生。这些趋势共同作用,使得除草剂即使在整体化学成分变化的情况下,仍能保持其在市场上的基石地位。

北美作物保护化学品市场报告按功能(杀菌剂、除草剂、杀虫剂等)、施用方法(化学灌溉、叶面喷布、熏蒸、种子处理等)、作物类型(经济作物、果蔬作物、谷类等)和地区(加拿大、墨西哥等)进行细分。市场预测以价值(美元)和数量(公吨)两种单位提供。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

- 调查方法

第二章 报告

第三章执行摘要和主要发现

第四章 主要产业趋势

- 每公顷农药消费量

- 活性成分价格分析

- 法律规范

- 加拿大

- 墨西哥

- 美国

- 价值炼和通路分析

- 市场驱动因素

- 加速采用耐除草剂性状

- 精准喷洒设备可降低每英亩成本

- 大豆銹病和焦油斑病迅速增加。

- 美国环保署 (EPA) 加速核准生物活性成分

- 排碳权计画旨在鼓励犁地

- 墨西哥政府对IPM工具的补贴

- 市场限制

- Glyphosate诉讼导致零售商停业

- 拟议降低加拿大最大基准值(MRL)限制了出口

- 生物替代品的兴起对合成农药的利润率带来压力

- 由于西海岸港口拥堵,投入成本上涨

第五章 市场规模和成长预测(价值和数量)

- 按功能

- 消毒剂

- 除草剂

- 杀虫剂

- 杀软体动物剂

- 杀线虫剂

- 透过应用方法

- 化学灌溉

- 叶面喷布

- 熏蒸

- 种子处理

- 土壤处理

- 按作物类型

- 经济作物

- 水果和蔬菜

- 谷物和杂粮

- 豆类和油籽

- 草坪和观赏植物

- 按地区

- 加拿大

- 墨西哥

- 美国

- 北美其他地区

第六章 竞争情势

- 重大策略倡议

- 市占率分析

- 企业趋势

- 公司简介

- Corteva Agriscience

- Syngenta Group

- Bayer AG

- BASF SE

- FMC Corporation

- Sumitomo Chemical Co. Ltd.

- UPL Limited

- Nufarm Ltd.

- Albaugh LLC

- American Vanguard Corp.

- Bioceres Crop Solutions

- Gowan Company LLC

- Atticus LLC

- Helm Agro US Inc.

- Certis Biologicals

第七章:CEO们需要思考的关键策略问题

The North America crop protection chemicals market size in 2026 is estimated at USD 26.76 billion, growing from 2025 value of USD 25.6 billion with 2031 projections showing USD 33.36 billion, growing at 4.51% CAGR over 2026-2031.

Rising weed resistance, surging fungal outbreaks, and the widening regulatory preference for reduced-risk actives are reinforcing chemical demand even as precision-agriculture tools curb waste. Growers continue to favor synthetic herbicides for broad-acre efficiency, yet biological and biorational products are scaling rapidly under the United States Environmental Protection Agency (EPA) fast-track pathway. The region's large grain footprint, stable export channels under the United States-Mexico-Canada Agreement, and carbon-credit incentives for conservation tillage all sustain spending despite litigation over legacy chemistries. Competitive intensity remains high as leading firms bundle seeds, chemistry, and digital agronomy to capture wallet share while navigating tightening residue thresholds.

North America Crop Protection Chemicals Market Trends and Insights

Accelerated herbicide-tolerant trait adoption

Adoption rates of herbicide-tolerant soybeans now exceed 95% while corn reaches 89% across principal production areas. These traits allow wider post-emergence windows that lift seasonal herbicide volumes and expand rotational flexibility. The EPA clearance of dicamba- and 2,4-D-based platforms delivers new modes of action just as glyphosate-resistant weeds such as Palmer amaranth intensify. Stacked technologies like Corteva Enlist E3 and Bayer XtendFlex foster premium pricing and encourage bundled chemistry-seed packages. Integrated variable-rate spraying optimizes dose by zone, further embedding these traits into modern agronomy. The resulting synergy between genetics and precision hardware sustains demand for selective herbicides despite price pressure from generics.

Precision-spraying equipment lowering cost per acre

Computer-vision sprayers identify individual weeds and reduce chemical volumes by up to 77% while maintaining control levels, as field trials of John Deere See and Spray demonstrate. Public support through the United States Department of Agriculture (USDA) FARMER grants accelerates adoption by offsetting equipment costs. On-board sensors adjust rates in real time, minimizing overlaps and drift, which lowers input spend and addresses regulatory scrutiny of off-target movement. The time saved on refills and the labor reductions boost operational efficiency for large farms that manage thousands of acres. Equipment dealers now bundle data analytics subscriptions that help growers verify savings, reinforcing repeat purchases of compatible chemistries.

Canada's proposed MRL cutbacks limiting exports

Health Canada proposes halving MRLs for several actives, such as 2,4-D, in agricultural exports at risk if foreign buyers adopt stricter thresholds. Divergent standards compel growers to meet the lowest common denominator, adding analytical testing costs and encouraging shifts toward lower-residue actives. Export-dependent producers in British Columbia and Ontario foresee tighter shipment windows and higher compliance documentation. Chemical firms allocate extra budget to residue studies and label amendments, elongating return-on-investment timelines for new products.

Other drivers and restraints analyzed in the detailed report include:

- Surge in soybean rust and tar spot outbreaks

- U.S. EPA fast-track approvals for biorational actives

- Rising biological alternatives squeezing synthetic margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Herbicides generated 51.65% of the North America crop protection chemicals market revenue in 2025, reflecting widespread reliance on chemical weed control across 180 million corn and soybean acres. Precision application and trait-driven selectivity support continuous grower preference for post-emergence products that safeguard season-long yield potential. The segment is projected to expand at a 4.88% CAGR through 2031 as resistance management requires multiple modes of action and as conservation tillage increases herbicide intensity. At the same time, fungicide usage accelerates due to expanding tar spot and soybean rust zones, further diversifying overall spending. Insecticides face pressure from biological competitors and tightened pollinator safety rules, yet remain essential in integrated programs for sporadic outbreaks of Western corn rootworm.

A shift toward stackable biological herbicides is emerging, particularly in fruit and vegetable acreage where buyers impose residue caps. Leading firms launch micro-encapsulated formulations that combine synthetic and microbial actives to prolong efficacy while meeting environmental standards. Product stewardship initiatives now educate growers on rotating chemistries and incorporating cover crops to slow resistance. Collectively these trends ensure that herbicides remain market linchpins even as the broader mix evolves.

The North America Crop Protection Chemicals Market Report is Segmented by Function (Fungicide, Herbicide, Insecticide, and More), Application Mode (Chemigation, Foliar, Fumigation, Seed Treatment and More), Crop Type (Commercial Crops, Fruits and Vegetables, Grains and Cereals, and More), and Geography (Canada, Mexico, and More). The Market Forecasts are Provided in Terms of Both Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Corteva Agriscience

- Syngenta Group

- Bayer AG

- BASF SE

- FMC Corporation

- Sumitomo Chemical Co. Ltd.

- UPL Limited

- Nufarm Ltd.

- Albaugh LLC

- American Vanguard Corp.

- Bioceres Crop Solutions

- Gowan Company LLC

- Atticus LLC

- Helm Agro US Inc.

- Certis Biologicals

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Consumption of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Canada

- 4.3.2 Mexico

- 4.3.3 United States

- 4.4 Value Chain and Distribution Channel Analysis

- 4.5 Market Drivers

- 4.5.1 Accelerated herbicide-tolerant trait adoption

- 4.5.2 Precision-spraying equipment lowering cost per acre

- 4.5.3 Surge in soybean rust and tar spot outbreaks

- 4.5.4 U.S. EPA fast-track approvals for biorational actives

- 4.5.5 Carbon-credit programs rewarding reduced tillage

- 4.5.6 Mexican government subsidies for IPM tools

- 4.6 Market Restraints

- 4.6.1 Glyphosate litigation-driven retailer delisting

- 4.6.2 Canada's proposed MRL cutbacks limiting exports

- 4.6.3 Rising biological alternatives squeezing synthetic margins

- 4.6.4 West Coast port congestion inflating input prices

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits and Vegetables

- 5.3.3 Grains and Cereals

- 5.3.4 Pulses and Oilseeds

- 5.3.5 Turf and Ornamental

- 5.4 Geography

- 5.4.1 Canada

- 5.4.2 Mexico

- 5.4.3 United States

- 5.4.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 Corteva Agriscience

- 6.4.2 Syngenta Group

- 6.4.3 Bayer AG

- 6.4.4 BASF SE

- 6.4.5 FMC Corporation

- 6.4.6 Sumitomo Chemical Co. Ltd.

- 6.4.7 UPL Limited

- 6.4.8 Nufarm Ltd.

- 6.4.9 Albaugh LLC

- 6.4.10 American Vanguard Corp.

- 6.4.11 Bioceres Crop Solutions

- 6.4.12 Gowan Company LLC

- 6.4.13 Atticus LLC

- 6.4.14 Helm Agro US Inc.

- 6.4.15 Certis Biologicals