|

市场调查报告书

商品编码

1907331

欧洲作物保护化学品:市场占有率分析、产业趋势与统计、成长预测(2026-2031 年)Europe Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

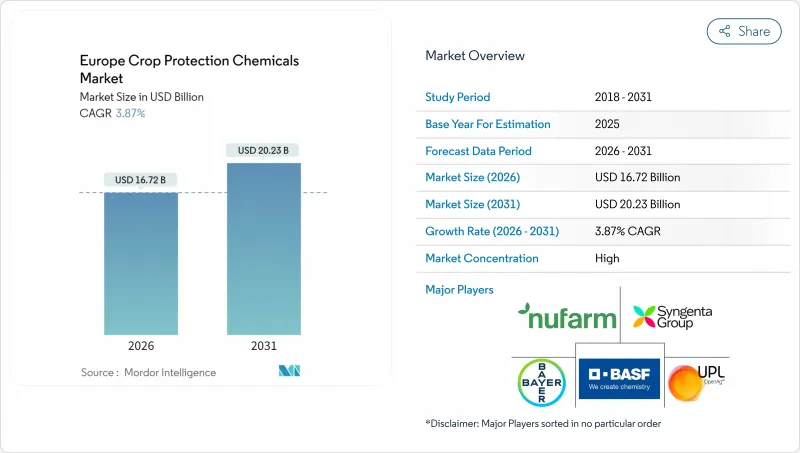

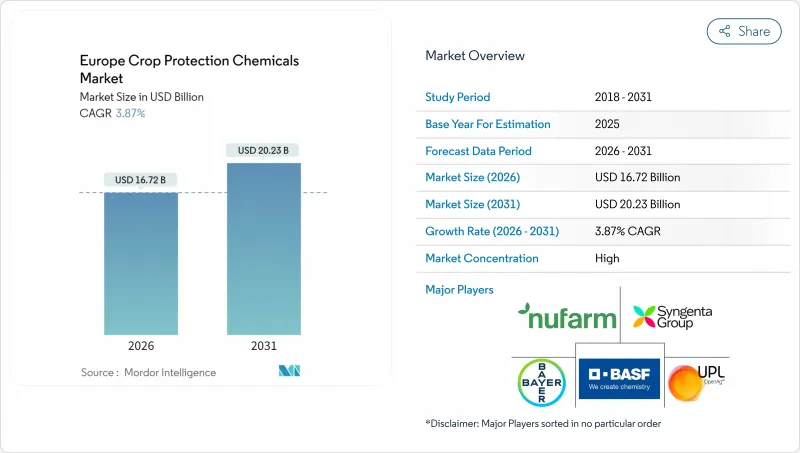

2025年欧洲作物保护化学品市场价值为161亿美元,预计2031年将达到202.3亿美元,高于2026年的167.2亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 3.87%。

持续的监管压力、气候变迁导致的虫害加剧以及向高价值、低风险配方的转变,共同推动了这个市场的稳定扩张。全部区域的农民持续投资于综合虫害管理 (IPM) 工具和数位化咨询平台,以平衡盈利和合规性。领先的生产商正在调整其产品组合,转向生物刺激剂-杀虫剂复配配方,而经销商则将基于人工智慧 (AI) 的决策支援整合到其服务包中。同时,东欧对价格敏感的细分市场正在采用经济实惠的非专利药,巩固了欧洲作物保护化学品市场的双层需求结构。随着化学品註册、评估、授权和限制 (REACH) 成本的不断上涨,主要企业的规模经济效益日益增强,市场竞争仍然激烈。然而,拥有RNA干扰(RNAi) 技术和微生物解决方案的新兴参与企业正为市场带来创新潜力。

欧洲作物保护化学品市场趋势与洞察

扩大综合虫害管理(IPM)的采用

综合虫害管理(IPM)的普及率不断提高,农民的采购标准也从大量采购转向精准防治。欧洲食品安全局(EFSA)的数据显示,到2024年,IPM的实施率将成长23%,荷兰商业种植者的IPM采用率将达到89%。这种转变推动了对监测设备、选择性化学药剂和生物防治剂的需求,这些产品的价格溢价高达15-30%。数位化监测和感测器网路可以将活性成分的使用量减少高达40%,使欧洲作物保护化学品市场的供应商能够从以销售量为基础的收入模式转向以服务为导向的收入模式。

保护性耕作技术的普及

根据欧盟委员会联合研究中心的数据,包括犁地和条耕在内的保护性耕作方式已涵盖欧盟19%的耕地,高于2023年的14%。农民采用这些耕作方式是为了控制土壤侵蚀、节省用水和降低柴油成本,但杂草压力的增加推动了除草剂的需求。高残留圆盘播种机和耐除草剂作物等设备的升级换代,也促进了选择性除草剂和精准施药服务的销售。

迅速禁用关键活性成分(例如Glyphosate)

对传统农药成分的加速审查,例如关于2024年逐步淘汰Glyphosate的讨论,正在造成投资的不确定性。新烟碱种子处理剂的突然禁用,导致每年13亿美元的销售额损失,迫使企业进行配方调整和库存减损。虽然多元化的产品系列可以减轻这种影响,但依赖单一活性成分的小型公司正被迫退出欧洲作物保护化学市场。这种监管转变有利于拥有多元化产品系列的公司,而不利于依赖特定活性成分的公司,这为灵活的竞争对手重新分配市场份额创造了机会。

细分市场分析

由于传统活性成分面临监管限制,先进的杂草抗性管理正在推动除草剂创新。到2025年,除草剂将占据35.01%的市场份额,而杀虫剂则展现出更强的成长潜力,到2031年复合年增长率将达到4.45%,这反映了气候变迁带来的病虫害压力以及精准施药技术的广泛应用。除草剂市场面临双重压力:一方面是Glyphosate的逐步淘汰计划,另一方面是杂草抗性的进化,导致现有化学物质在40%的欧洲农田中失效。由于气候变迁带来的病害压力,杀菌剂的需求将保持稳定,而贝类杀虫剂和杀线虫剂则占据着成长潜力有限的特定市场领域。

永续使用法规 (SUR) 的合规性为开发新型作用机制的公司创造了机会。欧洲药品管理局 (EMA) 对低风险物质的快速审批流程为投资RNA干扰技术和微生物解决方案的公司提供了竞争优势。精准施用技术使除草剂生产商能够在限制使用的情况下,透过靶向递送系统优化药效,从而在保持杂草控製作用的同时减少环境暴露,进而维持市场份额。

欧洲作物保护化学品市场按功能(杀菌剂、除草剂、杀虫剂等)、施用方法(化学灌根、叶面喷布、熏蒸等)、作物类型(经济作物、水果和蔬菜、谷类等)以及地区(法国、德国、荷兰、俄罗斯、西班牙、乌克兰等)进行细分。市场预测以价值(美元)和数量(公吨)为单位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

- 调查方法

第二章 报告

第三章执行摘要和主要发现

第四章:主要产业趋势

- 每公顷农药用量

- 活性成分价格分析

- 法律规范

- 法国

- 德国

- 义大利

- 荷兰

- 俄罗斯

- 西班牙

- 乌克兰

- 英国

- 价值炼和通路分析

- 市场驱动因素

- 扩大综合虫害管理(IPM)的采用

- 保护性耕作技术的普及

- 气候变迁导致害虫压力增加

- 生物表面活性剂-杀虫剂组合製剂的快速市场推广

- 人工智慧驱动的处方喷洒平台

- 东欧谷物种植面积扩大

- 市场限制

- 早期禁用关键活性成分(例如Glyphosate)

- REACH法规下的报名费用不断上涨

- 假农药透过灰色进口管道渗透

- 素食/有机消费族群的影响力日益增强

第五章 市场规模和成长预测(价值和数量)

- 功能

- 杀菌剂

- 除草剂

- 杀虫剂

- 杀软体动物剂

- 杀线虫剂

- 如何申请

- 化学灌溉

- 叶面喷布

- 熏蒸

- 种子处理

- 土壤处理

- 作物类型

- 经济作物

- 水果和蔬菜

- 谷类和杂粮

- 豆类和油籽

- 草坪和观赏植物

- 国家

- 法国

- 德国

- 义大利

- 荷兰

- 俄罗斯

- 西班牙

- 乌克兰

- 英国

- 其他欧洲地区

第六章 竞争情势

- 重大策略倡议

- 市占率分析

- 企业趋势

- 公司简介

- Syngenta Group

- Bayer AG

- BASF SE

- Corteva Agriscience

- FMC Corporation

- UPL Limited

- Nufarm

- Sumitomo Chemical Co., Ltd.

- Albaugh LLC

- Rovensa(Bridgepoint Group plc)

- Belchim Crop Protection(Mitsui and Co.)

- Koppert BV

- Sipcam SpA

- Zhejiang Wynca Chemical Group Co., Ltd.

第七章:CEO们需要思考的关键策略问题

The Europe crop protection chemicals market was valued at USD 16.1 billion in 2025 and estimated to grow from USD 16.72 billion in 2026 to reach USD 20.23 billion by 2031, at a CAGR of 3.87% during the forecast period (2026-2031).

Sustained regulatory pressure, climate-driven pest incidence, and the premiumization of low-risk formulations together underpin this steady expansion. Farmers across the region continue to invest in integrated pest management (IPM) tools, and digital advisory platforms that balance profitability with compliance. Large manufacturers are reshaping portfolios toward biostimulant-pesticide co-formulations, while distributors integrate artificial-intelligence (AI) decision support into service packages. At the same time, price-sensitive segments in Eastern Europe adopt cost-effective generics, anchoring a two-tiered demand structure within the Europe crop protection chemicals market. Competitive intensity remains high as rising Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) costs elevate scale advantages for the top players, yet novel entrants armed with RNA interference (RNAi) and microbial solutions introduce disruptive possibilities.

Europe Crop Protection Chemicals Market Trends and Insights

Expanding Integrated Pest Management Adoption

Integrated pest management adoption is rising, shifting farmer purchasing criteria from bulk volume toward targeted efficacy. The European Food Safety Authority (EFSA) recorded a 23% increase in IPM implementation during 2024, with Dutch commercial growers achieving 89% adoption. This shift increases demand for monitoring devices, selective chemistries, and biological control agents that command 15-30% price premiums. Digital scouting and sensor networks reduce active ingredient use by up to 40%, allowing suppliers to transition from volume-driven to service-oriented revenue models within the Europe crop protection chemicals market.

Surge in Conservation-Tillage Practices

Conservation tillage, including no-till and strip-till, now covers 19% of the European Union's arable land, up from 14% in 2023, according to the Joint Research Centre of the European Commission. Farmers adopt these practices to reduce soil erosion, retain moisture, and lower diesel costs, though increased weed pressure boosts herbicide demand. Equipment upgrades like high-residue disc drills and herbicide-tolerant crops drive sales of selective chemistries and precision spraying services.

Fast-track Bans on Key Actives (e.g., Glyphosate)

Accelerated reviews of legacy molecules, exemplified by the 2024 glyphosate phase-out debate, inject investment uncertainty. Sudden neonicotinoid seed-treatment bans removed USD 1.3 billion in annual sales, forcing reformulation cycles and inventory write-downs. Diversified portfolios cushion impact yet smaller firms reliant on single actives face market exit in the Europe crop protection chemicals market. This regulatory volatility favors companies with diversified product portfolios but penalizes firms dependent on specific active ingredients, creating market share redistribution opportunities for agile competitors.

Other drivers and restraints analyzed in the detailed report include:

- Climate-Change-Driven Pest Pressure

- Rapid Biostimulant Pesticide Co-formulation Launches

- Escalating Registration Costs Under REACH

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Advanced weed resistance management drives herbicide innovation as traditional active ingredients face regulatory restrictions. Herbicides command 35.01% market share in 2025, yet insecticides demonstrate superior growth dynamics with 4.45% CAGR through 2031, reflecting climate-driven pest pressure and precision application adoption. The herbicide segment confronts dual pressures from glyphosate phase-out timelines and evolved weed resistance that renders established chemistries ineffective across 40% of European agricultural land. Fungicides maintain steady demand driven by climate-induced disease pressure, while molluscicides and nematicides serve specialized market niches with limited growth potential.

Regulatory compliance under the Sustainable Use Regulation creates opportunities for companies developing novel modes of action. The European Medicines Agency's expedited review process for low-risk substances provides competitive advantages for firms investing in RNA interference technologies and microbial-based solutions. Precision application technologies enable herbicide manufacturers to maintain market share despite volume restrictions by optimizing efficacy through targeted delivery systems that reduce environmental exposure while preserving weed control effectiveness.

The Europe Crop Protection Chemicals Market is Segmented by Function (Fungicide, Herbicide, Insecticide, and More), Application Mode (Chemigation, Foliar, Fumigation, and More), Crop Type (Commercial Crops, Fruits and Vegetables, Grains and Cereals, and More), and Geography (France, Germany, Netherlands, Russia, Spain, Ukraine, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Syngenta Group

- Bayer AG

- BASF SE

- Corteva Agriscience

- FMC Corporation

- UPL Limited

- Nufarm

- Sumitomo Chemical Co., Ltd.

- Albaugh LLC

- Rovensa (Bridgepoint Group plc)

- Belchim Crop Protection (Mitsui and Co.)

- Koppert B.V.

- Sipcam SpA

- Zhejiang Wynca Chemical Group Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 France

- 4.3.2 Germany

- 4.3.3 Italy

- 4.3.4 Netherlands

- 4.3.5 Russia

- 4.3.6 Spain

- 4.3.7 Ukraine

- 4.3.8 United Kingdom

- 4.4 Value Chain and Distribution Channel Analysis

- 4.5 Market Drivers

- 4.5.1 Expanding Integrated Pest Management adoption

- 4.5.2 Surge in conservation-tillage practices

- 4.5.3 Climate-change-driven pest pressure

- 4.5.4 Rapid biostimulant pesticide co-formulation launches

- 4.5.5 AI-based prescription spraying platforms

- 4.5.6 Rising cereal acreage in Eastern Europe

- 4.6 Market Restraints

- 4.6.1 Fast-track bans on key actives (e.g., glyphosate)

- 4.6.2 Escalating registration costs under REACH

- 4.6.3 Counterfeit pesticide penetration via gray imports

- 4.6.4 Growing vegan / organic consumer lobby

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits and Vegetables

- 5.3.3 Grains and Cereals

- 5.3.4 Pulses and Oilseeds

- 5.3.5 Turf and Ornamental

- 5.4 Country

- 5.4.1 France

- 5.4.2 Germany

- 5.4.3 Italy

- 5.4.4 Netherlands

- 5.4.5 Russia

- 5.4.6 Spain

- 5.4.7 Ukraine

- 5.4.8 United Kingdom

- 5.4.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (Includes Global Level Overview, Market Level overview, Core Business Segments, Financials, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Syngenta Group

- 6.4.2 Bayer AG

- 6.4.3 BASF SE

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 UPL Limited

- 6.4.7 Nufarm

- 6.4.8 Sumitomo Chemical Co., Ltd.

- 6.4.9 Albaugh LLC

- 6.4.10 Rovensa (Bridgepoint Group plc)

- 6.4.11 Belchim Crop Protection (Mitsui and Co.)

- 6.4.12 Koppert B.V.

- 6.4.13 Sipcam SpA

- 6.4.14 Zhejiang Wynca Chemical Group Co., Ltd.