|

市场调查报告书

商品编码

1684036

德国MLCC:市场占有率分析、产业趋势与统计、成长预测(2025-2030年)Germany MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

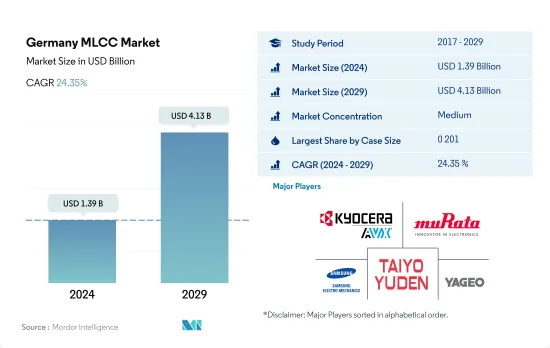

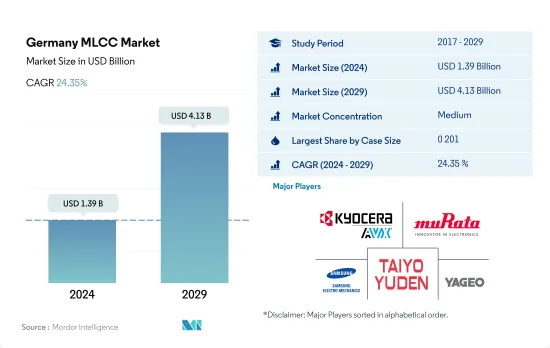

预计 2024 年德国 MLCC 市场规模将达到 13.9 亿美元,预计到 2029 年将达到 41.3 亿美元,在市场估计和预测期(2024-2029 年)内复合年增长率为 24.35%。

穿戴式医疗设备的日益普及以及个人电脑和 5G 智慧型手机等消费性电子产品的普及将推动 MLCC 的需求

- 就 2022 年的销售量而言,0.201 型錶壳尺寸部分成为领先者,占据最大的市场占有率36.64%,其次是 0.402 型錶壳尺寸部分,占 14.94%,0.603 型錶壳尺寸部分,占 13.84%。

- 外壳尺寸 0 402 最紧凑,可实现电路基板更大的元件密度。由于德国消费者对健康和保健的兴趣日益浓厚,他们越来越多地使用健身追踪器和智慧型手錶等穿戴式医疗设备。例如,2021年德国有74,485人死于慢性缺血性心臟疾病。预计医疗设备对电容低于 100uF 的 X7R 电介质 0402 MLCC 的需求将会增加,因为它们在维持心臟心律调节器和心臟去颤器等心血管设备的可靠和高效的电源性能方面发挥着至关重要的作用。

- 0603微型MLCC广泛应用于家用电子电器产业,包括智慧型手机、平板电脑、笔记型电脑、数位相机和游戏机。它们体积小、电容高、集成度高,因此非常受欢迎。 0 603 MLCC需求受德国家电力产业推动。个人电脑、笔记型电脑、空调、冰箱等家用电器需要小型化元件,例如电容值为100uF的0603 MLCC。

德国MLCC市场趋势

电动轻型商用车预计将对市场产生正面影响

- 轻型商用车是德国商用车市场的重要组成部分。截至 2019 年,该国共生产了约 28,350 辆轻型商用车。

- 新冠疫情导致的封锁和其他限制措施为轻型商用车产业的供应链带来了前所未有的挑战。疫情导致该国境内的行动和旅行限制达到了前所未有的程度和类型。基础设施、运输和物流等运输货物的最终用户产业完全陷入停滞,为製造业和货运业带来了新的挑战。

- 轻型商用车(eLCV)是城市交通的支柱,也是德国应对交通排放气体的下一步。 2018 年,德国新註册的轻型商用车中,纯电动的不到 2%。柴油引擎仍然占据该市场的主导地位。

- 政府优先发展电池、汽车、充电站、数位行动应用程式、资讯通讯技术、智慧运输和能源服务,以加速未来几年电动车的普及。由于电子商务和物流活动的成长,轻型商用车的需求预计会增加。

ADAS 的普及推动乘用车需求

- 德国是欧洲第二人口大国,也是该地区最大的经济体。 2019年至2022年,乘用车产量下降。产量将从2019年的460万辆下降到2022年的348万辆。四年复合年增长率约为-7.06%,反映了欧洲汽车产业面临的严峻市场条件和动盪。

- 在疫情封锁期间,一些工厂的生产暂停,而当时各家公司已经在努力从柴油和汽油汽车转向「更环保」的电动车。这对德国出口型经济的支柱——汽车产业造成了沉重打击。

- 德国政府的长期目标之一是摆脱石化燃料,增加电动车的使用。预计到2022年,德国的电动车销量将逐年成长。毫无疑问,汽车本身的价格和国内物价上涨是造成这一数字的因素,但另一个因素是电动车充电基础设施仍不发达。插混合动力汽车补贴的终止也导致电动车市场发展放缓。

- 随着人工智慧和物联网的发展和日益依赖,对汽车的需求不再局限于电动车。 ADAS软体将成为未来乘用车的驱动因素,从而增加对MLCC的需求。公司正在建立合资企业和伙伴关係来推出新产品,以获得竞争优势。 2022 年 1 月,博世与大众汽车子公司 Cariad 建立合作伙伴关係,共同开发自动驾驶汽车和高级驾驶辅助系统的新技术。

德国MLCC产业概况

德国MLCC市场格局适度整合,前五大厂商市占率合计为43.45%。市场的主要企业有:京瓷AVX元件株式会社(京瓷株式会社)、村田製作所、三星电机、太阳诱电和国巨株式会社。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 家电销售

- 空调销售

- 桌上型电脑销量

- 游戏机销售

- 笔记型电脑销量

- 冰箱销售

- 智慧型手机销量

- 仓储设备销售

- 平板电脑销量

- 电视销售

- 汽车製造

- 轻型商用车产量

- 乘用车生产

- 汽车产量

- 电动汽车生产

- BEV(纯电动车)生产

- PHEV(插电式混合动力汽车)产量

- 工业自动化销售

- 工业机器人销售

- 服务机器人销售

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 介电类型

- 1级

- 2级

- 錶壳尺寸

- 0 201

- 0 402

- 0 603

- 1 005

- 1 210

- 其他的

- 电压

- 500V~1000V

- 小于500V

- 超过1000V

- 电容

- 100uF~1,000uF

- 小于100uF

- 超过 1,000uF

- Mlcc安装类型

- 金属盖

- 径向引线

- 表面黏着技术

- 最终用户

- 航太和国防

- 车

- 家用电子电器

- 工业设备

- 医疗设备

- 电力和公共产业

- 通讯设备

- 其他的

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

第 7 章 CEO 的关键策略问题CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001978

The Germany MLCC Market size is estimated at 1.39 billion USD in 2024, and is expected to reach 4.13 billion USD by 2029, growing at a CAGR of 24.35% during the forecast period (2024-2029).

The increasing utilization of wearable medical devices and the rising adoption of consumer electronics like PCs and 5G-enabled smartphones driving MLCC demand

- The 0 201 case size segment emerged as the frontrunner, capturing the largest market share of 36.64%, followed by the 0 402 case size segment, with a 14.94% share, and the 0 603 case size segment, with 13.84%, in terms of volume in 2022.

- The case size of 0 402 is among the most compact available, thus increasing the component density of the circuit board. German consumers are increasingly using wearable medical devices like fitness trackers and smartwatches due to increased interest in health and wellbeing. For instance, in Germany, 74,485 passed away due to chronic ischaemic heart disease in 2021. The need for 0 402 MLCCs with X7R dielectric with low capacitance of less than 100uF is expected to grow in medical devices in cardiovascular devices like pacemakers and defibrillators due to their essential role in sustaining dependable and efficient power performance.

- 0 603 compact MLCCs are widely used in consumer electronic industries such as smartphones, tablets, laptop computers, digital cameras, and gaming consoles. They are popular due to their compact size and high capacitance, as well as their smooth integration. The demand for 0 603 MLCCs is being driven by Germany's consumer electronics industry. Consumer electronics like PCs, laptops, air conditioners, and refrigerators require miniaturized components like 0 603 MLCCs with low capacitance of 100uF.

Germany MLCC Market Trends

Electric light commercial vehicles are expected to have a positive impact on the market

- Light commercial vehicles represent an important part of the commercial vehicle market in Germany. As of 2019, roughly 28.35 thousand light commercial vehicles were manufactured in the country.

- The COVID-19 pandemic resulted in lockdowns and other restrictions that caused supply chain issues in the light commercial vehicle industry that had never been seen before. The pandemic caused unprecedented levels and types of mobility and travel limitations in the country. End-user industries that transport goods, such as infrastructure, transportation, and logistics, were completely shut down, posing new challenges for the manufacturing and freight industries.

- Electric light commercial vehicles (eLCVs), the centerpiece of urban transport, are the next step in Germany's endeavors to combat traffic-related emissions. eLCVs have struggled to build significant market demand so far. In 2018, less than 2% of all newly registered LCVs in Germany were all-electric vehicles. Diesel engines still dominate this market.

- The government has prioritized the development of batteries, cars, charging stations, digital mobility apps, ICT, smart mobility, and energy services in order to speed up the adoption of electric vehicles in the next years. The demand for electric light commercial vehicles is anticipated to increase due to the growth of e-commerce and logistical activities.

Increased adoption of ADAS is propelling the demand for passenger vehicles

- Germany is the second most populous country in Europe and has the largest economy in the region. The production of passenger vehicles witnessed a decline from 2019 to 2022. The production volume of 4.6 million units in 2019 decreased to 3.48 million units in 2022. The observed CAGR of approximately -7.06% over the four-year period mirrors the difficult market conditions and disruptions encountered by the European automotive industry.

- During the pandemic-resultant lockdown, production was stopped at some sites, which happened when companies were already struggling to shift from diesel- and gasoline-powered cars toward "green" electric vehicles. This hit the car industry, the main driver of Germany's export-based economy.

- One of the long-term targets of the German government is a fossil fuel exit and an increase in electric vehicles. German electric car sales increased annually until 2022. While the prices of the vehicles themselves and the rising cost of living in the country are undoubtedly contributing factors to these numbers, another is the still-developing infrastructure for charging electric cars. Discontinuation of subsidies for plug-in hybrids is also slowing the electric vehicles market.

- With advancements in AI and IoT and ever-growing dependence, the demand for automobiles is no longer limited to electric vehicles. ADAS software will become the driving factor for the future of passenger vehicles, thereby increasing the demand for MLCCs. Several companies are entering joint ventures and partnerships to launch newer products to have an edge over their competitors. In January 2022, Bosch and Cariad, Volkswagen's subsidiary, formed a partnership to develop new technology for automated vehicles and advanced driver-aid systems.

Germany MLCC Industry Overview

The Germany MLCC Market is moderately consolidated, with the top five companies occupying 43.45%. The major players in this market are Kyocera AVX Components Corporation (Kyocera Corporation), Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd and Yageo Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumer Electronics Sales

- 4.1.1 Air Conditioner Sales

- 4.1.2 Desktop PC's Sales

- 4.1.3 Gaming Console Sales

- 4.1.4 Laptops Sales

- 4.1.5 Refrigerator Sales

- 4.1.6 Smartphones Sales

- 4.1.7 Storage Unit Sales

- 4.1.8 Tablets Sales

- 4.1.9 Television Sales

- 4.2 Automotive Production

- 4.2.1 Light Commercial Vehicles Production

- 4.2.2 Passenger Vehicles Production

- 4.2.3 Total Motor Production

- 4.3 Ev Production

- 4.3.1 BEV (Battery Electric Vehicle) Production

- 4.3.2 PHEV (Plug-in Hybrid Electric Vehicle) Production

- 4.4 Industrial Automation Sales

- 4.4.1 Industrial Robots Sales

- 4.4.2 Service Robots Sales

- 4.5 Regulatory Framework

- 4.6 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Dielectric Type

- 5.1.1 Class 1

- 5.1.2 Class 2

- 5.2 Case Size

- 5.2.1 0 201

- 5.2.2 0 402

- 5.2.3 0 603

- 5.2.4 1 005

- 5.2.5 1 210

- 5.2.6 Others

- 5.3 Voltage

- 5.3.1 500V to 1000V

- 5.3.2 Less than 500V

- 5.3.3 More than 1000V

- 5.4 Capacitance

- 5.4.1 100µF to 1000µF

- 5.4.2 Less than 100µF

- 5.4.3 More than 1000µF

- 5.5 Mlcc Mounting Type

- 5.5.1 Metal Cap

- 5.5.2 Radial Lead

- 5.5.3 Surface Mount

- 5.6 End User

- 5.6.1 Aerospace and Defence

- 5.6.2 Automotive

- 5.6.3 Consumer Electronics

- 5.6.4 Industrial

- 5.6.5 Medical Devices

- 5.6.6 Power and Utilities

- 5.6.7 Telecommunication

- 5.6.8 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219