|

市场调查报告书

商品编码

1684051

日本MLCC:市场占有率分析、产业趋势与统计、成长预测(2025-2030年)Japan MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

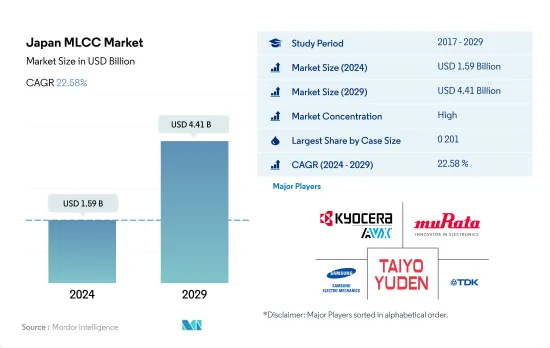

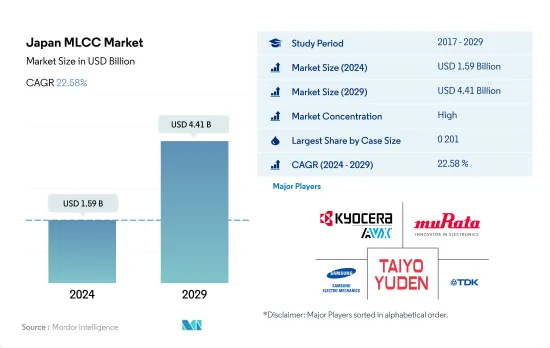

预计日本MLCC市场规模将在2024年达到15.9亿美元,2029年达到44.1亿美元,预测期间(2024-2029年)的复合年增长率为22.58%。

ADAS 和其他产品需求的成长预计将推动表面黏着技术MLCC 的需求

- 预计 2022 年 0 201 型机壳将占据最大的市场占有率,按出货量计算为 35.01%,到 2029 年将产生 5,343 万美元的收益。 1,005 型机壳是成长最快的细分市场,预计复合年增长率为 24.35%(2022-2029 年)。

- 持续的小型化趋势加上对更高组件密度的需求正在推动对这些组件的需求。可携式和连网装置的日益普及进一步促进了对 0 201 MLCC 元件的需求,使製造商能够在不影响效能的情况下实现小型化设计。

- 0 1005 MLCC 具有广泛的应用,尤其是在智慧型手机、穿戴式装置和物联网设备等小型电子设备中,使製造商能够在不影响效能的情况下创造出时尚、紧凑的设计。随着海外公司寻求加强其在不断扩大的市场中的影响力,日本的智慧型手錶产业正在不断发展。

- 紧凑的 0402 外壳尺寸是表面黏着技术陶瓷电容器的流行外形规格。在汽车产业,0402MLCC 用于各种应用,包括引擎控制单元、资讯娱乐系统、ADAS(高级驾驶辅助系统)和照明控制。这些电容器在恶劣的汽车环境中提供可靠的性能。驾驶辅助功能的需求不断增长,提高了技术在日本汽车製造业中的作用。例如,日产汽车公司与日立汽车系统公司合作,为日产汽车提供ADAS ECU和地图定位单元,开拓日本MLCC市场的发展机会。

日本MLCC市场动向

电子商务的兴起、都市区的扩大和基础设施的发展推动了轻型商用车的需求。

- 日本轻型卡车市场在经历了近年来的不稳定表现后,目前呈现温和成长。 2019年,该国生产了83,950辆轻型商用车。这些卡车用于农业、建筑和其他业务。受新冠疫情及俄乌战争影响,轻型商用车市场产量与前一年同期比较下降16.93%。此外,由于采用了结合石化燃料和电力的最新技术,混合动力轻型商用车(LCV)成为日本市场上成长最快的细分市场。

- 汽车工业仍然是日本经济的重要组成部分,丰田、本田、日产和三菱等公司享有全球声誉。这种主导地位延伸至商用车领域,五十铃、日野和扶桑是该领域的产业领导者。日本以其技术专长而闻名,推动了燃油效率、车辆安全性的进步以及混合动力和电力系统作为替代能源的出现。

- 矿产和能源资源对于工业至关重要,而自主性则提供了将人们从危险中解救出来并提高安全性的机会。儘管面临持续的劳动力短缺挑战,自动驾驶轻型车辆 (ALV) 除了能够采购关键矿物外,还为操作多台设备的矿场提供了额外的安全措施,以减少人为错误造成的事故。 2023 年 5 月,日本日本小松公司公司和丰田汽车公司宣布,他们将启动一个联合计划,开发基于日本小松公司自动运输系统 (AHS) 运行的自动轻型车辆 (ALV)。

电动车补贴计画不断增加,刺激乘用车需求

- 日本拥有向世界提供产品和服务的汽车製造商。丰田、铃木、大发、日产是日本本土乘用车品牌。日本2019年生产了832万辆乘用车。

- 受疫情和日本全国经济衰退影响,日本汽车产量大幅下降,与前一年同期比较下降16.43%,4月日本乘用车出口量减半,降至约16.8万辆的历史最低水准。 2021年日本经济开始復苏,电动车销量较2020年大幅成长,年平均成长超过50%。

- 日本绿色成长策略的目标是到2035年实现汽车销量100%为电动车。 《合理使用能源法》(2023年)将加速实现此策略目标,并支持日本电动车市场的成长。由于政府以奖励和回扣形式提供的支持,日本对电动车的需求正在增长。政府已承诺将购买电动车的补贴和奖励增加两倍。到 2022 年,日本将把电动车补贴计画的资金增加到 5.3 亿美元,对纯电动车 (BEV) 购买的支持金额增加一倍至最高 6,500 美元,对插电式混合动力车 (PHEV) 购买的支持金额最高至 4,200 美元。

- 为了扩大该国的电动车销量,许多公司正在开发和推出新产品。在日本,2022年5月,丰田推出了新款电动SUV Bz4x,电池容量为71.4kWh。向电动车的转变已经改变了贸易平衡,并且未来这种趋势可能还会继续。日本是电动车、马达和锂离子电池的净出口国。日本已准备好从日益增长的电动车市场中获益,2022 年日本的乘用车产量为 656 万辆,预计未来还将进一步成长。

日本MLCC产业概况

日本MLCC市场格局较为集中,前五大厂商的市占率合计达76.37%。市场的主要企业有:京瓷AVX元件株式会社(京瓷株式会社)、村田製作所、三星马达、太阳诱电和TDK株式会社(依字母顺序排列)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 价格趋势

- 原油价格趋势

- 白银价格趋势

- 家电销量

- 空调销售

- 桌上型电脑销量

- 游戏机销售

- 笔记型电脑销售

- 冰箱销售

- 智慧型手机销量

- 仓储设备销售

- 平板电脑销量

- 电视销售

- 汽车製造

- 客车生产

- 重型卡车生产

- 轻型商用车生产

- 乘用车生产

- 汽车製造

- 电动汽车生产

- BEV(纯电动车)生产

- PHEV(插电式混合动力汽车)产量

- 工业自动化销售

- 工业机器人销售

- 服务机器人销售

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 介电类型

- 1级

- 2级

- 錶壳尺寸

- 0 201

- 0 402

- 0 603

- 1 005

- 1 210

- 其他的

- 电压

- 500V~1000V

- 小于500V

- 1000V以上

- 电容

- 100uF~1,000uF

- 小于100uF

- 超过 1,000uF

- Mlcc安装类型

- 金属盖

- 径向引线

- 表面黏着技术

- 最终用户

- 航太和国防

- 车

- 家用电子电器

- 工业设备

- 医疗设备

- 电力和公共产业

- 通讯设备

- 其他的

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

第 7 章 CEO 的关键策略问题CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001997

The Japan MLCC Market size is estimated at 1.59 billion USD in 2024, and is expected to reach 4.41 billion USD by 2029, growing at a CAGR of 22.58% during the forecast period (2024-2029).

Rising demand for ADAS and other technologies is expected to increase demand for surface-mount MLCCs

- Case size 0 201 held the largest market share of 35.01% in terms of volume in 2022 and is expected to generate a revenue of USD 53.43 million in 2029. Case size 1 005 is the fastest-growing segment with an expected CAGR of 24.35% (2022-2029).

- The ongoing trend of miniaturization, coupled with the need for higher component density, drives the demand for these components. The increasing popularity of portable and connected devices further contributes to the demand for 0 201 MLCC components, enabling manufacturers to achieve compact designs without compromising performance.

- The usage of 0 1005 MLCCs spans diverse applications, particularly in compact electronic devices such as smartphones, wearables, and IoT devices, enabling manufacturers to achieve sleek and compact designs without compromising performance. Japan's smartwatch industry is growing as foreign companies are looking to strengthen their presence in the expanding market.

- The compact 0 402 case size is widely adopted as a form factor for surface-mount ceramic capacitors. The automotive industry relies on 0 402 MLCCs for various applications, including engine control units, infotainment systems, advanced driver-assistance systems (ADAS), and lighting control. These capacitors provide reliable performance in harsh automotive environments. The rising demand for driver-assist functions has raised the role of technology in the Japanese auto manufacturing sector. For instance, Nissan and Hitachi Automotive Systems have partnered to provide Nissan vehicles with ADAS ECU and map position units, developing an opportunity for the MLCC market in the country.

Japan MLCC Market Trends

The demand for light commercial vehicles is fueled by the increase in e-commerce, the expansion of urban areas, and the development of infrastructure

- The Japanese light truck market is witnessing moderate growth, following volatile performance in recent years. The country produced 83.95 thousand light commercial vehicles in 2019. These trucks are used in operations such as agriculture and construction. Due to the COVID-19 pandemic and the Russia-Ukraine war, the light commercial vehicle market witnessed a Y-o-Y drop of 16.93% in production. Moreover, Hybrid light commercial vehicles (LCV) are experiencing the most rapid growth in the Japanese market as a result of the combination of fossil fuel and electricity in modern technology.

- The automotive industry remains a crucial component of Japan's economy, and companies like Toyota, Honda, Nissan, and Mitsubishi have gained worldwide recognition. This dominance extends to the commercial vehicle sector, with Isuzu, Hino, and Fuso being industry leaders. Japan is renowned for its technological expertise, leading to developments in fuel efficiency, vehicle safety, and the emergence of hybrid and electric systems as alternative energy sources.

- While minerals and energy resources are essential for industries, autonomy offers the opportunity to remove people from harm's way and enhance safety. Along with sourcing critical minerals despite the ongoing challenge of labor shortages, autonomous light vehicles (ALV) provide additional safety measures at mine sites on which multiple pieces of equipment are operated to reduce accidents due to human error. In May 2023, Japan's Komatsu Ltd and Toyota Motor Corporation announced the launch of a joint project to develop an autonomous light vehicle (ALV) that will run on Komatsu's Autonomous Haulage System (AHS).

Increasing EV subsidy schemes are increasing the demand for passenger vehicles

- Japan is home to automotive manufacturers that supply their products and services globally. Toyota, Suzuki, Daihatsu, and Nissan are the domestic passenger vehicle brands in Japan. The country produced 8.32 million passenger vehicles in 2019.

- Following the pandemic and a nationwide recession in Japan, production slumped and witnessed a Y-o-Y decline of 16.43%, while exports of Japanese-made cars halved in April and reached a low of about 168,000. In 2021, the economy of the nation began to recover, and sales of electric automobiles increased significantly by more than 50% annually in 2021 compared to 2020.

- Japan's Green Growth Strategy aims to reach 100% electric car sales by 2035. The 2023 Act on the Rational Use of Energy tracks accelerates the targets set under the Strategy, helping the Japanese electric vehicle market grow. The country's demand for electric cars is increasing because of government support in the form of incentives and refunds. The government declared that it would treble the grants and incentives for buying electric automobiles. In 2022, Japan increased its EV subsidy scheme to fund USD 530 million, doubling the support for BEV purchases up to USD 6,500 and USD 4,200 for PHEVs.

- To expand the number of electric vehicles sold in the nation, numerous companies are developing and releasing new products. In Japan, in May 2022, Toyota launched its new electric SUV, Bz4x, which has a battery capacity of 71.4 kWh. The transition to e-mobility is shifting and will continue to shift trade balances. Japan is a net exporter of electric cars, electric motors, and Li-ion batteries. The country is well-positioned to benefit from a growing electric car market, which produced 6.56 million passenger cars in 2022; it is expected to grow further in the future.

Japan MLCC Industry Overview

The Japan MLCC Market is fairly consolidated, with the top five companies occupying 76.37%. The major players in this market are Kyocera AVX Components Corporation (Kyocera Corporation), Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd and TDK Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Price Trend

- 4.1.1 Oil Price Trend

- 4.1.2 Silver Price Trend

- 4.2 Consumer Electronics Sales

- 4.2.1 Air Conditioner Sales

- 4.2.2 Desktop PC's Sales

- 4.2.3 Gaming Console Sales

- 4.2.4 Laptops Sales

- 4.2.5 Refrigerator Sales

- 4.2.6 Smartphones Sales

- 4.2.7 Storage Unit Sales

- 4.2.8 Tablets Sales

- 4.2.9 Television Sales

- 4.3 Automotive Production

- 4.3.1 Buses and Coaches Production

- 4.3.2 Heavy Trucks Production

- 4.3.3 Light Commercial Vehicles Production

- 4.3.4 Passenger Vehicles Production

- 4.3.5 Total Motor Production

- 4.4 Ev Production

- 4.4.1 BEV (Battery Electric Vehicle) Production

- 4.4.2 PHEV (Plug-in Hybrid Electric Vehicle) Production

- 4.5 Industrial Automation Sales

- 4.5.1 Industrial Robots Sales

- 4.5.2 Service Robots Sales

- 4.6 Regulatory Framework

- 4.7 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Dielectric Type

- 5.1.1 Class 1

- 5.1.2 Class 2

- 5.2 Case Size

- 5.2.1 0 201

- 5.2.2 0 402

- 5.2.3 0 603

- 5.2.4 1 005

- 5.2.5 1 210

- 5.2.6 Others

- 5.3 Voltage

- 5.3.1 500V to 1000V

- 5.3.2 Less than 500V

- 5.3.3 More than 1000V

- 5.4 Capacitance

- 5.4.1 100µF to 1000µF

- 5.4.2 Less than 100µF

- 5.4.3 More than 1000µF

- 5.5 Mlcc Mounting Type

- 5.5.1 Metal Cap

- 5.5.2 Radial Lead

- 5.5.3 Surface Mount

- 5.6 End User

- 5.6.1 Aerospace and Defence

- 5.6.2 Automotive

- 5.6.3 Consumer Electronics

- 5.6.4 Industrial

- 5.6.5 Medical Devices

- 5.6.6 Power and Utilities

- 5.6.7 Telecommunication

- 5.6.8 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Taiyo Yuden Co., Ltd

- 6.4.7 TDK Corporation

- 6.4.8 Vishay Intertechnology Inc.

- 6.4.9 Walsin Technology Corporation

- 6.4.10 Wurth Elektronik GmbH & Co. KG

- 6.4.11 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219