|

市场调查报告书

商品编码

1685798

中国货运与物流-市场占有率分析、产业趋势与统计、成长预测(2025-2030)China Freight and Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

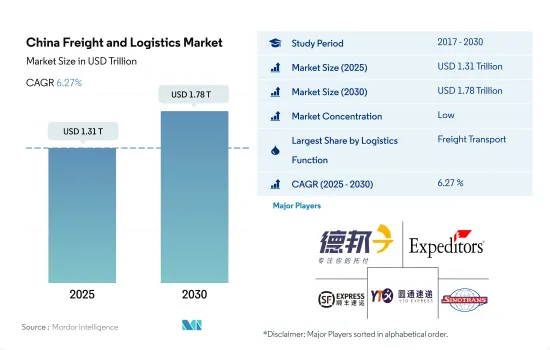

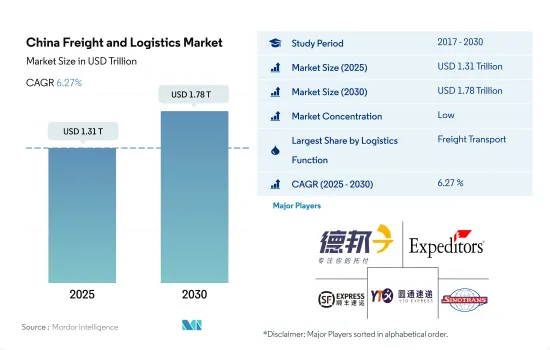

预计 2025 年中国货运和物流市场规模将达到 1.31 兆美元,到 2030 年预计将达到 1.78 兆美元,预测期内(2025-2030 年)的复合年增长率为 6.27%。

强劲的行业需求和适度的供应导致内部物流服务的采用率增加

- 2022年,同城快递累计业务量达1,280亿件。 2022 年前 11 个月,宅配部门的营收与前一年同期比较增 1.6%。随着消费者转向网路购物日常必需品,在封锁期间他们对宅配服务的依赖增加,这一增长随之而来。电子商务的蓬勃发展促进了国内宅配、快递和小包裹(CEP) 服务的需求和数量增长。 2023年6月,菜鸟集团宣布与全球速卖通合作,加速跨国小包裹递送速度。

- 中国正在积极投资基础设施,以加强其物流行业并确保供应链的无缝衔接。光是2022年,我们就拨款超过34亿美元用于改善道路运输基础设施。展望未来,国家发展和改革委员会和交通运输运输部製定了雄心勃勃的公路扩建目标。到2035年,中国的目标是将公路网扩展至29.9万公里高速公路和16.2万公里公路。

中国货运及物流市场趋势

根据「十四五」规划,成长将由清洁能源基础设施的发展和交通运输领域的投资推动。

- 2023年,中国清洁能源产业为国家经济成长做出了重大贡献。根据能源与清洁空气中心(CREA)统计,中国对可再生能源基础设施的投资达8,900亿美元,几乎与当年全球对石化燃料供应的投资相当。清洁能源,包括再生能源来源、核能、电网、能源储存、电动车和铁路,到2023年将占中国GDP的9.0%,与前一年同期比较7.2%。 2023年电动车产量与前一年同期比较成长36%。

- 中国在其「十四五」规划(2021-2025年)中公布了扩大交通网络的目标。到2025年,高铁里程将由2020年的3.8万公里增加到5万公里,覆盖95%的50万人口以上城市,线路长度达到250公里。到2025年,全国铁路营业里程将达到16.5万公里,民用机场270个以上,都市区地铁营业里程将达到1万公里,高速公路营业里程将达到19万公里,高等级内河航道营业里程将达到1.85万公里。 2025年,实现全面发展是首要目标,重点转变交通运输方式,提高交通运输对GDP的贡献率。

受俄乌战争影响,中国柴油、汽油零售价格飙升至历史高点。

- 预计2023年中国原油进口量将较2022年成长11%,达到5.6399亿吨,即1,128万桶/日。受俄乌战争影响,全球油价上涨,中国燃油价格创历史新高。 2024年1-2月原油进口量达8,831万吨,年增5.1%。这一增长是由于之前以较低价格购买了原油。布伦特期货在2023年9月达到高峰97.69美元,12月跌至72.29美元,2024年3月升至84.05美元。 2024年3月OPEC+集团决定将减产协议延长至6月底,进一步推高了油价。此举引发了人们对全球石油需求的担忧,因为该组织将减产近6%的全球需求。近期原油价格上涨也可能从2024年下半年开始抑制中国的进口。

- 中国计划根据近期国际原油价格波动调整汽油、柴油零售价格。价格上涨反映出全球供应紧张和需求前景改善。根据国发改委预测,2024年中国汽油和柴油价格将上涨28美元/吨。儘管预计燃料需求将下降,但到2035年,石油基燃料仍可能是主要选择。

中国货运及物流业概况

中国的货运和物流市场较为分散,市场上主要企业(按字母顺序排列):德邦物流、华盛顿国际快递、顺丰速运(KEX-SF)、上海圆通速递(物流)和中国外运。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口统计

- 按经济活动分類的GDP分布

- 经济活动GDP成长

- 通货膨胀率

- 经济表现及概况

- 电子商务产业趋势

- 製造业趋势

- 交通运输仓储业GDP

- 出口趋势

- 进口趋势

- 燃油价格

- 卡车运输成本

- 卡车持有量(按类型)

- 物流绩效

- 主要卡车供应商

- 模态共享

- 海运能力

- 班轮连结性

- 停靠港和演出

- 货运趋势

- 货物吨位趋势

- 基础设施

- 法律规范(公路和铁路)

- 中国

- 法律规范(海运和空运)

- 中国

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 农业、渔业和林业

- 建设业

- 製造业

- 石油和天然气、采矿和采石

- 批发和零售

- 其他的

- 物流功能

- 快递、快递和小包裹(CEP)

- 目的地

- 国内的

- 国际的

- 货物

- 按交通方式

- 航空

- 海上和内陆水道

- 其他的

- 货物

- 交通方式

- 航空

- 管道

- 铁路

- 路

- 海上和内陆水道

- 仓库存放

- 温度管理

- 无温度控制

- 温度管理

- 其他服务

- 快递、快递和小包裹(CEP)

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介.

- Deppon Logistics Co., Ltd.

- Deutsche Bahn AG(including DB Schenker)

- DHL Group

- Dimerco

- DSV A/S(De Sammensluttede Vognmaend af Air and Sea)

- Expeditors International of Washington, Inc.

- Kuehne+Nagel

- SF Express(KEX-SF)

- Shanghai YTO Express(Logistics)Co., Ltd.

- SINOTRANS

- United Parcel Service of America, Inc.(UPS)

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(市场驱动因素、限制因素、机会)

- 技术进步

- 资讯来源及延伸阅读

- 图表清单

- 关键见解

- 资料包

- 词彙表

- 外汇

简介目录

Product Code: 47655

The China Freight and Logistics Market size is estimated at 1.31 trillion USD in 2025, and is expected to reach 1.78 trillion USD by 2030, growing at a CAGR of 6.27% during the forecast period (2025-2030).

Rising adoption of in-house logistics services owing to booming demand and moderate supply in the industry

- In 2022, intra-city express deliveries reached a cumulative volume of 128 billion. The parcel delivery sector saw a 1.6% Y-o-Y revenue increase in the first 11 months of 2022. This uptick was driven by heightened reliance on parcel services during lockdowns, as consumers increasingly turned to online shopping, even for daily essentials. This surge in e-commerce bolstered domestic demand and volume for courier, express, and parcel (CEP) services. In June 2023, Cainiao Group, in collaboration with AliExpress, announced plans to expedite cross-border parcel deliveries, aiming to cut delivery times to five working days, a 30% acceleration from the industry average.

- China is actively investing in infrastructure to bolster its logistics sector and ensure a seamless supply chain. In 2022 alone, the country allocated over USD 3.4 billion for road transport infrastructure improvements. Looking ahead, the National Development and Reform Commission, along with the Ministry of Transport, has set ambitious goals for road expansion. By 2035, they aim to extend the national road network to 299,000 kilometers of highways and 162,000 kilometers of expressways.

China Freight and Logistics Market Trends

Rising focus on developing clean energy infrastructure and transport sector investment under 14th Five-Year Plan driving growth

- In 2023, China's clean energy sector significantly contributed to the country's economic expansion. According to Energy and Clean Air (CREA), China's investment in renewable energy infrastructure amounted to USD 890 billion, almost matching global investments in fossil fuel supply for the same year. Clean energy, including renewable energy sources, nuclear power, electricity grids, energy storage, electric vehicles (EVs), and railways, constituted 9.0% of China's GDP in 2023, up from 7.2% YoY. EV production grew by 36% YoY in 2023.

- In the 14th Five-Year Plan (2021-2025), China revealed goals for expanding its transportation network. By 2025, high-speed railways will extend to 50,000 kms, up from 38,000 kms in 2020, with 95% of cities with populations above 500,000 covered by 250-km lines. The country aims to increase its railway length to 165,000 kms, civil airports to over 270, subway lines in cities to 10,000 kms, expressways to 190,000 kms, and high-level inland waterways to 18,500 kms by 2025. The primary objective is to achieve integrated development by 2025, emphasizing advancements in the transformation of the transportation system and its contribution to GDP.

China's retail diesel and gasoline prices were soared to historically high levels amid the Russia-Ukraine War

- In 2023, China imported 11% more crude oil than in 2022, totaling 563.99 mn metric tons (MMT), or 11.28 mn barrels per day. This surge was due to increased global crude oil prices amid the Russia-Ukraine War, causing fuel prices in China to reach historic highs. In Jan-Feb 2024, crude oil imports rose by 5.1% YoY, reaching 88.31 MMT. This increase was driven by purchasing crude oil at lower prices earlier. Brent futures peaked at USD 97.69 in September 2023, fell to USD 72.29 in December, and rose to USD 84.05 by March 2024. The decision made by the OPEC+ group in March 2024 to extend output cuts until the end of June has further boosted crude prices. This move has raised concerns about global oil demand, as the group is reducing production by nearly 6% of world demand. The recent increase in crude prices may also dampen China's imports starting from H2 2024.

- China plans to adjust retail prices for gasoline and diesel to align with recent shifts in global crude oil prices. The price hike reflects a tightening of global supply and a positive forecast for demand. According to NDRC, gasoline and diesel prices in China will increase by USD 28 per ton in 2024. Although there's expectation of declining demand for fuels, oil-based fuels will remain the primary choice until 2035.

China Freight and Logistics Industry Overview

The China Freight and Logistics Market is fragmented, with the major five players in this market being Deppon Logistics Co., Ltd., Expeditors International of Washington, Inc., SF Express (KEX-SF), Shanghai YTO Express (Logistics) Co., Ltd. and SINOTRANS (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Logistics Performance

- 4.13 Major Truck Suppliers

- 4.14 Modal Share

- 4.15 Maritime Fleet Load Carrying Capacity

- 4.16 Liner Shipping Connectivity

- 4.17 Port Calls And Performance

- 4.18 Freight Pricing Trends

- 4.19 Freight Tonnage Trends

- 4.20 Infrastructure

- 4.21 Regulatory Framework (Road and Rail)

- 4.21.1 China

- 4.22 Regulatory Framework (Sea and Air)

- 4.22.1 China

- 4.23 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes 1. Market value in USD for all segments 2. Market volume for select segments viz. freight transport, CEP (courier, express, and parcel) and warehousing & storage 3. Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode Of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode Of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Deppon Logistics Co., Ltd.

- 6.4.2 Deutsche Bahn AG (including DB Schenker)

- 6.4.3 DHL Group

- 6.4.4 Dimerco

- 6.4.5 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.6 Expeditors International of Washington, Inc.

- 6.4.7 Kuehne+Nagel

- 6.4.8 SF Express (KEX-SF)

- 6.4.9 Shanghai YTO Express (Logistics) Co., Ltd.

- 6.4.10 SINOTRANS

- 6.4.11 United Parcel Service of America, Inc. (UPS)

7 KEY STRATEGIC QUESTIONS FOR FREIGHT AND LOGISTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

02-2729-4219

+886-2-2729-4219