|

市场调查报告书

商品编码

1685858

印度作物保护化学品-市场占有率分析、产业趋势与统计、2025-2030年成长预测India Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

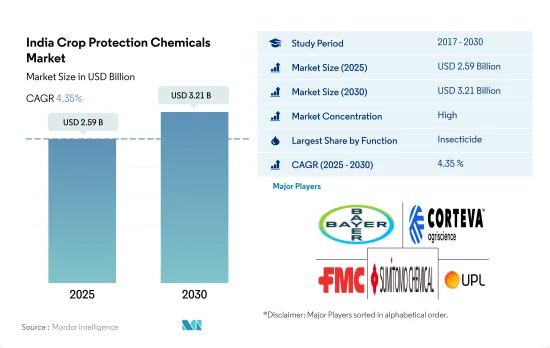

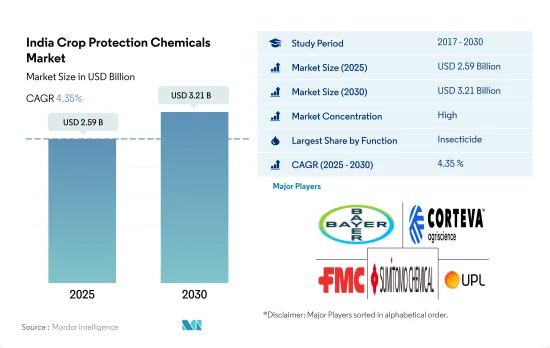

印度作物保护化学品市场规模预计在 2025 年为 25.9 亿美元,预计到 2030 年将达到 32.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.35%。

害虫和疾病增加推动杀虫剂市场

- 印度作物保护化学品市场多年来一直保持持续成长,预计到 2022 年市场规模将达到 23 亿美元。人口增长、粮食需求增加以及保护作物免受病虫害和杂草侵害的需求等因素推动了这一市场的成长。

- 最常使用的作物保护化学物质是杀虫剂,2022 年的市场占有率为 72.5%,其次是除草剂,占 13.4%,杀菌剂占 8.9%。这是因为害虫对各种作物造成了经济损失。蚜虫、叶蝉、茎虫和粘虫是影响印度主要作物生产的主要害虫。

- 2022年杀线虫剂的份额为2.6%。虽然目前的市场占有率相对较低,但这些农药的市场成长空间很大,因为已知植物寄生线虫每年在印度造成 21.3% 的产量损失,相当于每年 15.8 亿美元,影响到该国种植的各种具有重要经济意义的作物。例如,印度种植面积最大的作物水稻易受根结线虫(Meloidogyne graminicola)的侵害,每年造成 2.961 亿美元的经济损失。

- 同样,在印度北部的科达古邦,约有 40-45 个占地 300 英亩的农场因软体动物侵扰而遭受严重损失。然而,Kodagu 的农民已成功将虫害减少了 90%,主要是透过使用杀软体动物剂,这可能会促进市场成长。

- 由于该国病虫害发生率增加以及需要提高作物产量等因素,预计该市场在预测期内的复合年增长率将达到 4.6%。

印度作物保护化学品市场趋势

主要作物因各种病虫害造成的损失大幅增加,以及对更高生产率的需求导致每公顷农药消费量

- 印度的多样化气候为农业部门种植各种作物创造了有利条件。然而,儘管拥有多样化气候的优势,但它也面临着杂草、害虫和真菌疾病等重大挑战。这些挑战导致每年作物损失惨重:45% 因杂草造成,35% 因虫害造成,20% 因真菌病害造成。

- 为了解决这些问题,农民越来越多地使用杀虫剂。因此,每公顷农药的整体消费量几乎没有变化。

- 杂草对印度的农业部门构成了重大威胁,导致水稻、小麦和玉米等主要作物遭受严重损失。为了减轻这些损失,由于劳动力短缺和工资上涨导致手工除草成本高昂,农民开始使用除草剂。然而,抗除草剂杂草的出现正成为一个问题,可能需要增加每公顷土地使用的除草剂的数量。

- 在指定时间内,每公顷农药的消费量维持不变。杀虫剂已成为提高作物产量的重要工具,可以对抗臭虫、尺蠖、黏虫、蚜虫、粉蝨等害虫的有害影响。这些害虫对农业产量构成重大威胁,导致严重的作物损失。为了对抗这些吸食汁液的害虫并提高作物产量,农民开始使用杀虫剂。

- 其他因素包括农业活动的增加和增加农作物产量的需求,正在推高全国每公顷农药的消费量。

政府支持农业农村经济发展对物价的影响

- Cypermethrin是一种合成除虫菊酯,用于控制跳甲、麝猫、蟑螂、白蚁、瓢虫、蝎子和黄蜂。 2022 年的价格为 21,000 美元。在印度,Cypermethrin已由 CIBRC 註册用于八种特定作物,包括捲心菜、小麦、棉花、水稻、甘蔗、茄子、向日葵和秋葵。

- Atrazine是一种广泛用于印度玉米和水稻作物的除草剂,用于控制稗草、苋菜属植物和苋菜等阔叶杂草和禾本科杂草。 2022年,该除草剂的价值为13,500美元。印度是世界上最大的莠Atrazine技术进口国,主要来自中国、义大利和以色列。

- Malathion是一种有机磷杀虫剂。 2022 年,它的估价为 12,500 美元。它用于控制蚜虫、蓟马、螨虫、介壳虫、扫帚虫、蚯蚓、潜叶虫、跳蚤、蚱蜢、臭虫、蛆等。根据 CIBRC 指南,Malathion仅允许用于高粱、豌豆、大豆、蓖麻、向日葵、秋葵、茄子、花椰菜、萝卜、芜菁、番茄、苹果、芒果和葡萄。

- 丙森锌是一种接触性杀菌剂。 2022 年其价格为每吨 3,500 美元。它用于控制苹果、马铃薯、辣椒和番茄等作物的多种疾病,包括早期和晚期疮痂、七叶树腐烂、霜霉病、果叶斑病病、叶斑病和窄叶斑病。

- 印度政府正在提供持续的预算支持,以振兴农村经济并增加农民收入。 2022 财政年度预算提案并宣布了多项政策和倡议,以改善农业部门和农村经济。这可能会进一步影响该国作物保护化学品的价格。

印度作物保护化学品产业概况

印度作物保护化学品市场相当集中,前五大公司占了 74.59% 的市占率。市场的主要企业有:拜耳股份公司、科迪华农业科技、FMC 公司、住友化学和 UPL 有限公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药消费量

- 活性成分价格分析

- 法律规范

- 印度

- 价值炼和通路分析

第五章市场区隔

- 功能

- 杀菌剂

- 除草剂

- 杀虫剂

- 杀软体动物剂

- 杀线虫剂

- 执行模式

- 化学喷涂

- 叶面喷布

- 熏蒸

- 种子处理

- 土壤处理

- 作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

第六章竞争格局

- 重大策略倡议

- 市场占有率分析

- 商业状况

- 公司简介

- ADAMA Agricultural Solutions Ltd.

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Gharda Chemicals Ltd

- PI Industries

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 48615

The India Crop Protection Chemicals Market size is estimated at 2.59 billion USD in 2025, and is expected to reach 3.21 billion USD by 2030, growing at a CAGR of 4.35% during the forecast period (2025-2030).

The market for pesticides is driven by increasing pest and disease incidence

- The Indian crop protection chemicals market experienced consistent growth over the years, with a market value of USD 2.3 billion in 2022, driven by factors such as increasing population, rising food demand, and the need to protect crops from pests, diseases, and weeds.

- Insecticides are the most used crop protection chemicals, with a market share of 72.5% in 2022, followed by herbicides and fungicides, with a market share of 13.4% and 8.9%, respectively. This is attributed to the economic damage that insect pests can cause in a variety of crop types. Aphids, leafhoppers, stem borers, and armyworms are the dominant insect pests that affect the production of major crops in India.

- Nematicides accounted for a share of 2.6% in 2022. Although the current market share is relatively less, these pesticides have higher scope for market growth as plant parasitic nematodes are known to cause an annual yield loss of 21.3% in India, which amounts to USD 1.58 billion annually, affecting various economically important crops grown in the country. For instance, rice (the most grown crop in India) is susceptible to root-knot nematode, Meloidogyne graminicola,leading to annual economic losses of 296.1 million.

- Similarly, around 40-45 plantations spanning 300 acres of land in the northern parts of Kodagu, India, have suffered significant losses due to mollusk infestations. However, the farmers in Kodagu have achieved a 90% reduction in the infestation by primarily utilizing molluscicides, which may result in market growth.

- Due to factors like increasing pest and disease incidence in the country and the need for higher crop productivity, the market is estimated to register a CAGR of 4.6% during the forecast period.

India Crop Protection Chemicals Market Trends

A significant increase in crop losses by various pests and diseases in major crops and the need for higher production contributed to the per-hectare pesticide consumption

- India's diverse climate creates favorable conditions for the agricultural sector to cultivate a wide range of crops. However, alongside the benefits of climatic diversity, the sector also faces significant challenges from weeds, insect pests, and fungal diseases. These challenges have resulted in substantial annual crop losses, with weeds accounting for 45% of the losses, insects for 35%, and fungal diseases for 20%.

- In response to these issues, farmers have increasingly relied on pesticides as their primary tool to combat crop losses. As a result, there has been limited change in the overall consumption of pesticides per hectare.

- Weeds pose a significant threat to the Indian agricultural sector, resulting in substantial losses for major crops such as rice, wheat, and maize. To mitigate these losses, farmers have increasingly relied on herbicides as manual weeding has become costlier due to labor shortages and rising wages. However, the emergence of herbicide-resistant weeds has become a concerning issue, leading to a potential escalation in the application of herbicides per hectare.

- The per-hectare consumption of insecticides has remained constant over the specified period. Insecticides have emerged as vital tools in enhancing crop production by combating the detrimental impact of insect pests, including stink bugs, loopers, armyworms, aphids, and whiteflies. These pests pose significant threats to agricultural yields, leading to substantial crop losses. To counter these sucking insect pests and boost their crop productivity, farmers are increasingly relying on the use of insecticides.

- Other factors like increased agricultural activities and the need for higher crop production are increasing per-hectare pesticide consumption in the country.

Influence of Government support for the improvement of the agriculture sector and the rural economy on prices

- Cypermethrin is a synthetic pyrethroid used to control flea beetles, boxelder bugs, cockroaches, termites, ladybugs, scorpions, and yellow jackets. It was priced at USD 21.0 thousand in 2022. In India, cypermethrin is registered by CIBRC for use in eight specified crops, such as cabbage, wheat, cotton, rice, sugarcane, brinjal, sunflower, and okra.

- Atrazine is an herbicide widely used for control of broadleaf and grassy weeds like Echinocloa, Elusine spp., and Amaranthus viridis in maize and rice crops in India. The herbicide was valued at USD 13.5 thousand in 2022. India is the largest importer of Atrazine technical in the world and imports majorly from China, Italy, and Israel.

- Malathion is an organophosphate insecticide. It was valued at USD 12.5 thousand in 2022. It is used to control aphids, thrips, mites, scales, borers, worms, leaf miners, fleas, grasshoppers, bugs, and maggots. As per guidelines of CIBRC, malathion is permitted to be used only in sorghum, pea, soybean, castor, sunflower, bhindi, brinjal, cauliflower, radish, turnip, tomato, apple, mango, and grape crops.

- Propineb is a contact fungicide. It was valued at USD 3.5 thousand per metric ton in 2022. It is used to control various diseases like scab early and late blight dieback, buckeye rot, downy mildew, fruit spots, and brown and narrow leaf spot diseases in apple, potato, chili, and tomato crops.

- The Government of India has been continuously providing budgetary support toward reviving the rural economy and increasing the farmers' income. Several measures and initiatives were proposed and announced during the FY22 budget for the improvement of the agriculture sector and the rural economy. This will further influence the prices of crop protection chemicals in the country.

India Crop Protection Chemicals Industry Overview

The India Crop Protection Chemicals Market is fairly consolidated, with the top five companies occupying 74.59%. The major players in this market are Bayer AG, Corteva Agriscience, FMC Corporation, Sumitomo Chemical Co. Ltd and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 India

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits & Vegetables

- 5.3.3 Grains & Cereals

- 5.3.4 Pulses & Oilseeds

- 5.3.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd.

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Gharda Chemicals Ltd

- 6.4.7 PI Industries

- 6.4.8 Sumitomo Chemical Co. Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219