|

市场调查报告书

商品编码

1685900

视讯点播 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Video-on-Demand - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

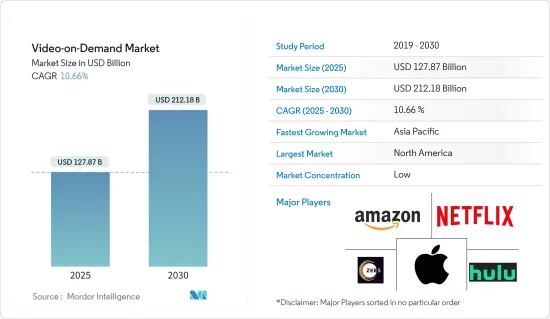

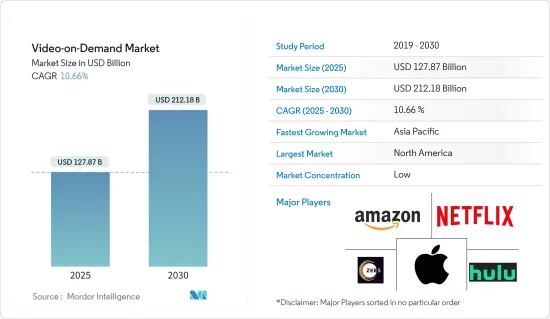

预计 2025 年视讯点播市场规模为 1,278.7 亿美元,到 2030 年将达到 2,121.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.66%。

主要亮点

- 不间断连接、行动装置作为内容消费的主要来源以及智慧型手机的先进功能等主要因素正在推动视讯点播市场的发展。

- 由于 Netflix、Amazon Prime 等 OTT 平台的使用率不断提高,随选视讯服务在过去几年中变得越来越受欢迎。这些业务的存在和云端平台的普及为市场的成长做出了重大贡献。

- 数位媒体设备需求的激增、可从远端位置存取媒体内容的高速互联网的出现以及由于社交媒体平台日益普及而导致的行动电话的迅速普及,正在推动视讯点播市场的成长。最近的技术趋势和全球网路普及率的提高使得随选视讯服务供应商能够提供高品质的内容。同时,疫情期间这些平台上推出的新节目和电影也促进了SVoD服务的成长。

- 数位影片领域,尤其是优质影片广告的发展,随着串流服务的广告观看次数而持续成长。随着观众接受广告的数位影片内容,广告观看量增加了 45%。最近的一项研究发现,美国观众透过广告支援和无广告订阅了超过七种影片串流服务,其中以视讯点播服务最为活跃。该行业已将重点从内容转向用户体验。然而,在印度等国家,本地客製化内容可能会在推动视讯点播市场方面发挥关键作用。

- 市场相关人员对盗版和视讯内容保护的担忧日益增加,这可能会阻碍视讯点播市场的成长并导致严重的收益损失。因此,观看您内容的观众可能会减少。例如,根据数位公民联盟和NAGRA的联合研究,美国约有900万用户使用盗版订阅IPTV服务。

- COVID-19 疫情导致世界各地实施封锁。由于疫情期间旅行受到限制,随选视讯业务成为隔离期间的一大福音。世界各地的消费者正在转向串流娱乐。根据Rapid TV News预测,新冠疫情危机将导致全球SVoD用户数量成长5%,达到9.49亿。疫情过后,先进网路技术的广泛应用可能会支持该产业的扩张。

视讯点播市场趋势

行动网路用户的快速成长推动市场

- 串流平台上连续观看的流行增强了客户的观看体验。行动装置在丰富观看体验方面发挥关键作用。行动装置提供了急需的观看体验以及一些便利。此外,各种内容与行动装置和高速网路的不断融合使得用户可以随时随地消费内容。

- 网路存取的增加和行动装置的普及等因素意味着客户不必等待就能跟上数位世界的最新动态。因此,用户采用了智慧型手机、平板电脑和个人电脑等行动设备,即时满足已成为消费世界中的一股强大力量。

- 资料通讯设备和游戏、视讯串流等高频宽应用是行动资料流量呈指数增长的主要驱动力。根据GSMA 2022年报告,全球超过55%的人使用行动网路。到 2021 年底,将有约 43 亿人使用行动互联网,比 2020 年底增加约 3 亿。中低收入国家 (LMIC) 的人们正在为扩大行动网路存取做出重大贡献。由此,中低收入国家首次有一半人口可以使用行动网路。

- 此外,爱立信预测,到2025年5G用户将达到26亿,覆盖全球65%的人口,并产生全球45%的行动资料流程量。世界广告研究中心(WARC)根据行动产业机构 GSMA 的资料发布的另一份报告称,到 2025 年,预计将有超过 13 亿人透过智慧型手机或个人电脑存取网路。

- 行动互联网用户的成长也受到需要 4G LTE 资源的内容和相关服务消费的推动,通讯业者增加对 5G 网路的采用。印度和中国等国家是每月行动互联网使用量最高的国家。服务供应商提供的诱人资料方案和千禧世代不断变化的影片观看习惯正在推动月度用户的成长。

- 因此,智慧型手机合约数量不断增加,每个合约的资料使用量不断上升,影片内容的观看量不断增加,所有这些都导致网路流量增加。

北美占最大市场占有率

- 北美洲由美国和加拿大组成。美国是世界上最大的经济体,也是北美VoD的重要市场。灵活性、舒适性、内容个人化以及内容的多样性和数量是采用 VoD 服务的主要驱动力。

- 据 nScreenMedia 称,在过去九年里,该国的视讯串流市场已发展成为一个价值 160 亿美元的产业。这种成长主要归功于贸易和租赁视讯市场。

- 随着智慧型手机传输速度大幅提升,我国在4G转型为5G方面取得了初步进展。随着 5G 速度的提升,更高解析度的影片有望为消费者带来更难忘的体验。这样的体验将推动更多消费者采用数位内容。

- 在 COVID-19 疫情期间,大多数人都待在家里以阻止病毒传播。因此,许多内容创作者选择影片串流平台来适应影院关闭的影响。

- 例如,美国军事网路 (AFN) 于 2022 年 11 月推出了一项新的串流服务 AFN Now。 AFN Now 应用程式允许驻扎海外的军事人员、家属和退休人员随时随地在他们最常用的设备上观看 AFN 的顶级电视节目。国防媒体活动 (DMA) 很快就会推出新的视讯点播和直播应用程序,供授权观众下载。

- 加拿大对 VoD 服务的需求正面临令人兴奋的成长机会,这受到多种因素的推动,包括加拿大日益增长的流动性机会、不断增长的互联网普及率、在线串流媒体服务的兴起以及内容创作者和串流媒体合作伙伴之间前所未有的合作。

视讯点播行业概览

在竞争激烈的 VoD 市场中,多家全球和区域企业正在争取关注。然而,Netflix、亚马逊、Disney+ 和苹果等公司占据着市场主导地位。市场的主要企业正在采取各种策略,包括製作原创内容,以利用他们的竞争优势。预计预测期内企业集中度将实现高速成长。在封锁通讯协定后出现惊人成长之后,许多公司都将该市场视为一个有利可图的机会,以加强其服务产品。

2022 年 7 月,Netflix 宣布与微软合作开发和销售将广告引入该平台的广告工具。该公司准备推出新的基于广告的计划,即基本计划、标准计划和高级计划。新计划旨在吸引来自不同地区和国家的新用户,这些地区的人们愿意为高级订阅付费。

2022 年 5 月,Amazon Prime Video 宣布与监督Sajid Nadiadwala 旗下的 Nadiadwala Grandson Entertainment (NGE) 达成多画面授权合约。作为交易的一部分,该串流媒体服务在 NGE 即将上映的电影上映后立即託管该电影的上映时间表。此外,这些电影在影院上映后,所有 Prime 会员均可在 Amazon Prime Video 上观看。此外,Amazon Prime Video 还允许所有亚马逊客户(无论是否为 Prime 会员)在「抢先体验租赁」期间租借该影片。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响

- 关键指标

- 使用者渗透率

- 每用户平均收入

第五章市场动态

- 市场驱动因素

- 数位视讯发展

- 行动网路用户快速成长

- 市场限制

- 影片内容盗版威胁日益严重

第六章 技术简介

- 付费电视 VOD

- Over-The-Top(OTT)

- 网际网路通讯协定电视(IPTV)

第七章市场区隔

- 按经营模式

- 订阅视讯点播 (SVoD)

- 交易视讯点播 (TVoD)

- 其他经营模式

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 世界其他地区

第八章竞争格局

- 公司简介

- Amazon.com Inc.(Amazon Prime Video)

- Netflix Inc.

- Apple Inc.

- Zee Entertainment Enterprises Ltd(Zee5)

- Hulu LLC

- Warner Bros. Discovery Inc.

- The Walt Disney Company(Disney+)

- Popcornflix LLC

- Novi Digital Entertainment Private Limited(Hotstar)

- Comcast Xfinity

- DirecTV

- DISH Network LLC

- Fujitsu

- Midwest Tape LLC(Hoopla Digital)

- Vubiquity Inc.

- Fandango Media LLC(Vudu)

- Edgio

- Dacast Inc.

- Kaltura

- Wistia Inc.

第九章投资分析

第十章 市场机会与未来趋势

The Video-on-Demand Market size is estimated at USD 127.87 billion in 2025, and is expected to reach USD 212.18 billion by 2030, at a CAGR of 10.66% during the forecast period (2025-2030).

Key Highlights

- Fundamental factors, such as uninterrupted connectivity, mobile devices as a primary source of content consumption, and advanced capabilities of smartphones are likely propelling the video-on-demand market.

- Video-on-demand services gained popularity in the past few years due to the increasing use of OTT platforms, such as Netflix, Amazon Prime, and others. The presence of these businesses and the widespread accessibility of cloud platforms contributed significantly to the market's growth.

- The surging demand for digital media devices and the availability of faster internet to access media content remotely, along with the rapid adoption of mobile phones, owing to the growing popularity of social media platforms, drive the growth of the video-on-demand market. Recent technological developments and increasing penetration of the internet in several countries over the globe allow video-on-demand service providers to offer high-quality content. At the same time, the launch of new shows and movies on these platforms during the pandemic contributed to the growth of SVoD services.

- Developments in the digital video landscape, especially with premium video advertising, continue to grow with the ad views on streaming services. Ad views increased by 45% because viewers embraced ad-supported digital video content. A recent study found that U.S. audiences use upwards of seven video streaming services via ad-supported and ad-free subscriptions, which drives the Video-on -demand services. The industry has shifted its focus on user experience from content. However, in countries like India, specific customized regional content will play an essential role in driving the video demand market.

- Increasing concerns among market players about video content piracy and protection are expected to hinder the video-on-demand market growth and may lead to substantial revenue loss. As a result, the number of viewers watching content may decline. For instance, according to a joint Digital Citizens Alliance-NAGRA study, the pirate subscription IPTV service is being used by around 9 million subscribers in the United States.

- The COVID-19 pandemic led to the lockdown all over the world. Due to the limits on travel during the pandemic, there has been a beneficial effect on the video-on-demand business due to the lockdown. Consumers all around the world are increasingly streaming entertainment. According to predictions made by Rapid TV News, the COVID-19 pandemic crisis would increase the number of SVoD users worldwide by 5% and reach 949 million. Following the pandemic, the growing popularity of advanced networking technologies would support industry expansion.

Video on Demand Market Trends

Surge in Mobile-based Internet Users to Drive the Market

- The popularity of binge-watching on streaming platforms enhanced the customer's viewing experience. Mobile devices have played a key role in enriching the experience. They provide a much-needed viewing experience with a kind of convenience. Further, the continuous integration of various contents across mobile devices with high-speed internet enabled the users to watch the content anywhere and anytime.

- Factors such as increasing access to the internet and widespread usage of mobile devices helped customers stay up-to-date with the digital world without having to wait. Hence, instant satisfaction evolved as a powerful force in the consumer world, with users adopting mobile devices like smartphones, tablets, and PCs.

- Data-capable devices and high-bandwidth applications like gaming and video streaming are the main drivers of exponential growth in mobile data traffic. According to the GSMA Report 2022, more than 55% of people worldwide used mobile internet. Around 4.3 billion people were using mobile internet by the end of 2021, an increase of about 300 million since the end of 2020. People in low- and middle-income nations (LMICs) have largely been responsible for the growth in the use of mobile internet. As a result, for the first time, mobile internet is being used by half of the population in LMICs.

- Further, Erricson expects that there will be 2.6 billion 5G subscriptions, covering up to 65% of the world's population and generating 45% of the world's total mobile data traffic by 2025. Another report published by the World Advertising Research Centre (WARC), based on data from mobile trade body GSMA, indicated that over 1.3 billion people are anticipated to access the internet via smartphone and PC by 2025.

- The growth of mobile-based internet users is also attributed to the operators' rising adoption of 5G networks due to the consumption of content and related services, which requires 4G LTE resources. Countries like India and China have the highest mobile internet monthly usage. Attractive data plans offered by service providers and millennials' changing video viewing habits drive monthly user growth.

- As a result, both the growing number of smartphone subscriptions and the need for more data per subscription, which in turn leads to increased viewing of video content, are driving factors in internet traffic growth.

North America to Hold the Largest Market Share

- The region comprises the United States and Canada. The United States is the largest economy in the world and has been a significant market for VoD in the North American region. Flexibility, comfort, and content personalisation, as well as the availability of diverse content and the volume of content, have largely driven the adoption of VoD services.

- According to nScreenMedia, the video streaming market in the country has grown into a USD 16 billion industry over the last nine years. The transactional and rental video markets have significantly impacted such growth.

- With smartphone transmission speeds increasing dramatically, the country is witnessing an early transition from 4G to 5G. With the increased speeds of 5G, higher-resolution videos are expected to make consumers' experiences more memorable. Such experiences drive consumers to significantly adopt digital content.

- Amid the COVID-19 pandemic, a major share of the population was staying at home to stop the spread of the virus. Due to this, a number of content producers are selecting video streaming platforms to cope with theater closures.

- For instance, the American Forces Network (AFN) launched its new streaming service, AFN Now, in November 2022. The AFN Now app allows military members, families, and retirees who are stationed abroad to watch top-rated AFN television shows whenever and wherever they want on the regular devices they use. Authorized viewers are invited to download the new video-on-demand and live-streaming app straight away by the Defence Media Activity (DMA).

- The demand for VoD services in Canada finds exciting growth opportunities owing to various factors that include increased mobility trends in Canada, the increasing proliferation of the internet, the rise of online streaming services, and an unprecedented alliance among content producers and streaming partners.

Video on Demand Industry Overview

The VoD market comprises several global and regional players vying for attention in a fairly contested market space. However, players like Netflix, Amazon, Disney+, and Apple Inc. have dominated the market studied. Major players in the market are adopting various strategies, such as the production of original content, to leverage their competitive advantage. The firm concentration ratio is expected to record higher growth during the forecast period. Several players are looking at the market as a lucrative opportunity to consolidate their service offerings, following the tremendous growth after the lockdown protocols.

In July 2022, Netflix announced a partnership with Microsoft to develop ad tools and sales to bring advertisements to the platform. It was to launch a new advertising-based plan, titled the Basic Standard Premium plan. The new plan aimed to bring new subscriptions from various regions and countries where people sometimes pay for premium subscriptions.

In May 2022, Amazon Prime Video announced a multi-film licencing deal with Sajid Nadiadwala's Nadiadwala Grandson Entertainment (NGE). As part of the agreement, the streaming service hosted NGE's upcoming schedule of films shortly after their theatrical release. Furthermore, the films are available to all Prime members on Amazon Prime Video following their theatrical release. Additionally, the films can be rented on Amazon Prime Video for all Amazon customers (Prime or otherwise) in the 'Early Access Rental' window.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

- 4.5 Key Metrices

- 4.5.1 User Penetration Rate

- 4.5.2 Average Revenue Per User

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Developments in Digital Video Landscape

- 5.1.2 Surge in Mobile Based Internet Users

- 5.2 Market Restraints

- 5.2.1 Growing Threat of Video Content Piracy

6 TECHNOLOGY SNAPSHOT

- 6.1 Pay-TV VOD

- 6.2 Over-the-top (OTT)

- 6.3 Internet Protocol Television (IPTV)

7 MARKET SEGMENTATION

- 7.1 By Business Model

- 7.1.1 Subscription Video-on-demand (SVoD)

- 7.1.2 Transactional Video-on-demand (TVoD)

- 7.1.3 Other Business Models

- 7.2 By Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia Pacific

- 7.2.4 Middle East and Africa

- 7.2.5 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Amazon.com Inc. (Amazon Prime Video)

- 8.1.2 Netflix Inc.

- 8.1.3 Apple Inc.

- 8.1.4 Zee Entertainment Enterprises Ltd (Zee5)

- 8.1.5 Hulu LLC

- 8.1.6 Warner Bros. Discovery Inc.

- 8.1.7 The Walt Disney Company (Disney+)

- 8.1.8 Popcornflix LLC

- 8.1.9 Novi Digital Entertainment Private Limited (Hotstar)

- 8.1.10 Comcast Xfinity

- 8.1.11 DirecTV

- 8.1.12 DISH Network LLC

- 8.1.13 Fujitsu

- 8.1.14 Midwest Tape LLC (Hoopla Digital)

- 8.1.15 Vubiquity Inc.

- 8.1.16 Fandango Media LLC (Vudu)

- 8.1.17 Edgio

- 8.1.18 Dacast Inc.

- 8.1.19 Kaltura

- 8.1.20 Wistia Inc.