|

市场调查报告书

商品编码

1687105

印尼货运与物流:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Indonesia Freight and Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

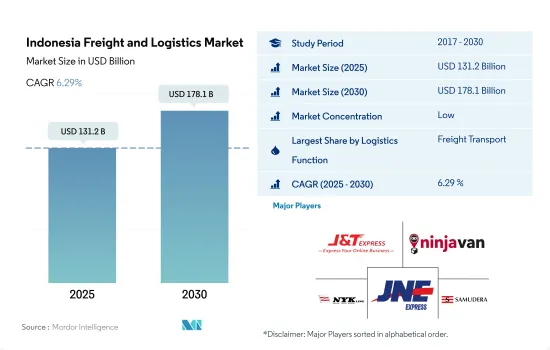

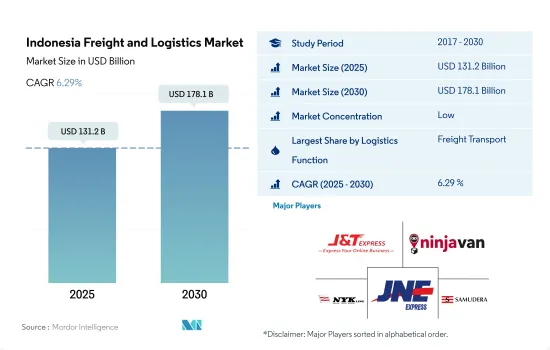

印尼货运代理和物流市场规模预计在 2025 年为 1,312 亿美元,预计到 2030 年将达到 1,781 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.29%。

政府对印尼基础设施的投资正在推动市场成长

- 2024 年 10 月,联邦快递在印尼峇里岛登巴萨开设了一个新的门户设施。该设施旨在简化运输流程,减少运输时间并提供满足登巴萨出口商需求的服务。联邦快递强调,由于能够从登巴萨直接出口到新加坡,绕过经雅加达的传统出口路线,客户可以享受更快、更可靠的运输服务。此外,该设施还为第 9 类危险物品(包括固态干冰和麻醉物品)提供全面的物流服务。

- 对于 2025 财年,公共工程和住宅部(PUPR)公路总局分配的预算上限为 21 亿美元。同时,2025 年国家预算草案 (RAPBN)提案为 PUPR 部分配总计 49.1 亿美元的预算。在这项拨款中,公路总局已拨款 6.6 亿美元用于道路基础设施,3.4 亿美元用于桥樑基础设施,5.8 亿美元用于国家公路和桥樑的保护和维护。

印尼货运及物流市场趋势

受基础设施计划增加的推动,运输和仓储行业预计将增加其对 GDP 的贡献

- 2024年5月,日本政府为印尼雅加达高铁建设提供了约1,407亿日圆(9亿美元)的贷款。东西铁路计划全长84.1公里,将于2026年至2031年分两阶段实施。该铁路的列车和号誌系统将采用日本先进的技术。这些倡议将有助于提高运输和仓储产业对GDP的贡献。

- 交通运输是国家基础建设工作的重中之重。在该领域,正在进行和计划中的倡议总数的 29% 用于公路计划,22% 用于铁路计划,23% 用于港口基础设施。这些计划对于加强连结性和促进经济成长至关重要。印尼的一个重点项目是全长135公里的洛修马威-朗萨收费公路。这个雄心勃勃的计划计划于 2024 年初开始,并于 2027 年底完成,目标是缓解交通拥堵并缩短旅行时间。收费公路将有助于优化物流,提高运输和仓储产业对GDP的贡献。

2022年,印尼在油价上涨和补贴压力下面临财政挑战,但税率将维持不变,直至2024年。

- 2024年11月,印尼改革了燃料补贴制度。新总统的目标是削减补贴,2023 年补贴约占政府支出的 16%。虽然液化石油气补贴将保持不变,但政府正在决定调整燃料和电力补贴。印尼的能源补贴有助于抑制通货膨胀,但也使其面临全球油价波动的影响。政府计划以对贫困家庭的现金转移支付来取代这些补贴,旨在透过更有针对性的援助节省约 129.9 亿美元。

- 截至 2024 年 6 月,印尼能源和矿产资源部 (ESDM) 正在起草法规,为绿氢开发者提供奖励和税收减免,以鼓励绿色氢产业的发展。 ESDM 的目标是到 2060 年每年生产 990 万吨氢气,以满足工业(390 万吨/年)、运输(110 万吨/年)、电力(460 万吨/年)和国内天然气网路(28 万吨/年)的需求。这些产业也可能成为出口产品。

印尼货运及物流业概况

印尼的货运和物流市场较为分散,主要五家参与者分别是 J&T Express、Ninja Van(包括 Ninja Express)、NYK Line、PT Jalur Nugraha Ekakurir(JNE Express)和 PT Samudera Indonesia Tangguh(按主要企业顺序排列)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口统计

- 按经济活动分類的 GDP 分布

- 经济活动带来的 GDP 成长

- 通货膨胀率

- 经济表现及概况

- 电子商务产业趋势

- 製造业趋势

- 交通运输仓储业生产毛额

- 出口趋势

- 进口趋势

- 燃油价格

- 卡车运输成本

- 卡车持有量(依类型)

- 物流绩效

- 主要卡车供应商

- 模态共享

- 海运能力

- 班轮连结性

- 停靠港和演出

- 货运趋势

- 货物吨位趋势

- 基础设施

- 法律规范(公路和铁路)

- 印尼

- 法律规范(海运和空运)

- 印尼

- 价值链与通路分析

第五章 市场区隔

- 最终用户产业

- 农业、渔业和林业

- 建设业

- 製造业

- 石油和天然气、采矿和采石

- 批发和零售

- 其他的

- 物流功能

- 快递、快递和包裹 (CEP)

- 目的地

- 国内的

- 国际的

- 货物

- 按运输方式

- 航空

- 海上和内陆水道

- 其他的

- 货物

- 按运输方式

- 航空

- 管道

- 铁路

- 路

- 海上和内陆水道

- 仓库存放

- 透过温度控制

- 无温度控制

- 温度管理

- 其他服务

- 快递、快递和包裹 (CEP)

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介.

- Deutsche Bahn AG(including DB Schenker)

- DHL Group

- DSV A/S(De Sammensluttede Vognmaend af Air and Sea)

- Expeditors International of Washington, Inc.

- FedEx

- J&T Express

- Kuehne+Nagel

- Linfox Pty Ltd.

- LOGWIN

- Ninja Van(including Ninja Express)

- NYK(Nippon Yusen Kaisha)Line

- Pancaran Group

- PT ABM Investama TBK(including CKB Logistics)

- PT Bina Sinar Amity(BSA Logistics Indonesia)

- PT Cardig International

- PT Citrabati Logistik International

- PT Dunia Express Transindo

- PT Jalur Nugraha Ekakurir(JNE Express)

- PT Kamadjaja Logistics

- PT Lautan Luas TBK

- PT Pandu Siwi Group(Pandu Logistics)

- PT Perusahaan Perdagangan Indonesia(including BGR Indonesia)

- PT Pos Indonesia(Persero)

- PT Repex Wahana(RPX)

- PT Samudera Indonesia Tangguh

- PT Satria Antaran Prima TBK(SAPX Express)

- PT Siba Surya

- PT Soechi Lines Tbk

- Puninar Logistics

- SF Express(KEX-SF)

- SINOTRANS

- United Parcel Service of America, Inc.(UPS)

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(市场驱动因素、限制因素、机会)

- 技术进步

- 资讯来源和进一步阅读

- 图表清单

- 关键见解

- 资料包

- 词彙表

- 外汇

The Indonesia Freight and Logistics Market size is estimated at 131.2 billion USD in 2025, and is expected to reach 178.1 billion USD by 2030, growing at a CAGR of 6.29% during the forecast period (2025-2030).

Government investments in Indonesia's infrastructure are set to drive the market's growth

- In October 2024, FedEx inaugurated a new gateway facility in Denpasar, Bali, Indonesia. This move aims to streamline shipping processes, enhance delivery times, and provide services tailored to the distinct needs of Denpasar's exporters. FedEx highlighted that customers can expect quicker and more dependable shipping services, with exports now being routed directly from Denpasar to Singapore, bypassing the previous route through Jakarta. Additionally, the facility provides comprehensive logistics services for Class 9 dangerous goods, including solid dry ice and items with anesthetic properties.

- For Fiscal Year (FY) 2025, the Highways Directorate General of the Public Works and Housing (PUPR) Ministry allocated a budget ceiling of USD 2.10 billion. Meanwhile, the 2025 Draft State Budget (RAPBN) proposes a total budget ceiling of USD 4.91 billion for the PUPR Ministry. Within this allocation, the Highways Directorate General designates USD 0.66 billion for road infrastructure, USD 0.34 billion for bridge infrastructure, and USD 0.58 billion for the preservation and maintenance of national roads and bridges

Indonesia Freight and Logistics Market Trends

The transportation and storage sector expected to witness boost in GDP contributions, fueled by rising infrastructure projects

- In May 2024, the Japanese government extended a loan of approximately JPY140.7 billion (USD 900 million) for the construction of a high-speed rail line in Jakarta, Indonesia. Spanning 84.1 km, the East-West rail project will be executed in two phases, commencing in 2026 and concluding by 2031. The rail line will incorporate advanced Japanese technology for both trains and signaling systems. These initiatives are poised to enhance the GDP contribution from the transport and storage sector.

- Transportation is at the forefront of the nation's infrastructure expansion efforts. In this domain, ongoing and upcoming initiatives allocate 29% of their overall value to road projects, 22% to rail, and 23% to port infrastructure. These projects are crucial for enhancing connectivity and boosting economic growth. A significant undertaking in Indonesia is the Lhokseumawe to Langsa Toll Road, spanning 135 km. Commencing in early 2024, this ambitious project is slated for completion by late 2027, with the goal of alleviating traffic congestion and shortening travel times. This toll road will be instrumental in optimizing logistics and boosting the transport and storage sector's contribution to GDP.

Indonesia faced fiscal challenges amid surging crude oil prices and subsidy pressures in 2022, however the rates remained unchanged till 2024

- In November 2024, Indonesia reformed its fuel subsidy system. The new president is targeting a reduction in subsidies, which constituted roughly 16% of government spending in 2023. While the subsidy for LPG will stay the same, the government is still determining adjustments for fuel and electricity subsidies. Indonesia's energy subsidies help keep inflation low but expose the nation to global oil price swings. The government plans to replace these subsidies with cash transfers for needy families, aiming to save about USD 12.99 billion through more targeted support.

- As of June 2024, the Indonesian Ministry of Energy and Mineral Resources (ESDM) was drafting regulations to provide incentives and tax relief for green hydrogen developers to boost the industry's growth. ESDM aimed to produce 9.9 million tons of hydrogen per year by 2060 to meet the needs of industry (3.9 Mtpa), transportation (1.1 Mtpa), electricity (4.6 Mtpa), and household gas networks (0.28 Mtpa). These sectors could also become export commodities.

Indonesia Freight and Logistics Industry Overview

The Indonesia Freight and Logistics Market is fragmented, with the major five players in this market being J&T Express, Ninja Van (including Ninja Express), NYK (Nippon Yusen Kaisha) Line, PT Jalur Nugraha Ekakurir (JNE Express) and PT Samudera Indonesia Tangguh (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Logistics Performance

- 4.13 Major Truck Suppliers

- 4.14 Modal Share

- 4.15 Maritime Fleet Load Carrying Capacity

- 4.16 Liner Shipping Connectivity

- 4.17 Port Calls And Performance

- 4.18 Freight Pricing Trends

- 4.19 Freight Tonnage Trends

- 4.20 Infrastructure

- 4.21 Regulatory Framework (Road and Rail)

- 4.21.1 Indonesia

- 4.22 Regulatory Framework (Sea and Air)

- 4.22.1 Indonesia

- 4.23 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes 1. Market value in USD for all segments 2. Market volume for select segments viz. freight transport, CEP (courier, express, and parcel) and warehousing & storage 3. Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode Of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode Of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Deutsche Bahn AG (including DB Schenker)

- 6.4.2 DHL Group

- 6.4.3 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.4 Expeditors International of Washington, Inc.

- 6.4.5 FedEx

- 6.4.6 J&T Express

- 6.4.7 Kuehne+Nagel

- 6.4.8 Linfox Pty Ltd.

- 6.4.9 LOGWIN

- 6.4.10 Ninja Van (including Ninja Express)

- 6.4.11 NYK (Nippon Yusen Kaisha) Line

- 6.4.12 Pancaran Group

- 6.4.13 PT ABM Investama TBK (including CKB Logistics)

- 6.4.14 PT Bina Sinar Amity (BSA Logistics Indonesia)

- 6.4.15 PT Cardig International

- 6.4.16 PT Citrabati Logistik International

- 6.4.17 PT Dunia Express Transindo

- 6.4.18 PT Jalur Nugraha Ekakurir (JNE Express)

- 6.4.19 PT Kamadjaja Logistics

- 6.4.20 PT Lautan Luas TBK

- 6.4.21 PT Pandu Siwi Group (Pandu Logistics)

- 6.4.22 PT Perusahaan Perdagangan Indonesia (including BGR Indonesia)

- 6.4.23 PT Pos Indonesia (Persero)

- 6.4.24 PT Repex Wahana (RPX)

- 6.4.25 PT Samudera Indonesia Tangguh

- 6.4.26 PT Satria Antaran Prima TBK (SAPX Express)

- 6.4.27 PT Siba Surya

- 6.4.28 PT Soechi Lines Tbk

- 6.4.29 Puninar Logistics

- 6.4.30 SF Express (KEX-SF)

- 6.4.31 SINOTRANS

- 6.4.32 United Parcel Service of America, Inc. (UPS)

7 KEY STRATEGIC QUESTIONS FOR FREIGHT AND LOGISTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate