|

市场调查报告书

商品编码

1687223

食品服务包装:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Food Service Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

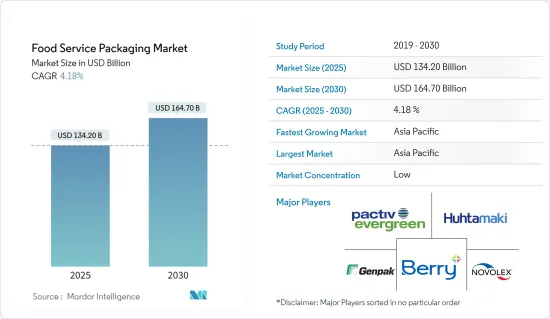

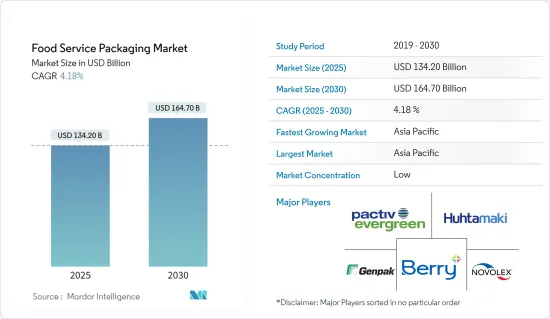

食品服务包装市场规模预计在 2025 年为 1,342 亿美元,预计到 2030 年将达到 1,647 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.18%。

关键亮点

- 线上配送平台和行动应用程式正在推动餐饮包装产品的成长。随着科技再形成食品格局并吸引更多投资,这种成长动能将更加强劲。第三方线上食品订购服务预计将激增,使许多小型独立餐厅能够接触到更广泛的基本客群。此外,快餐店(QSR)的成长,包括线上送餐卡车,将刺激对食品服务包装的需求,尤其是一次性包装。

- 过去几年,网路订餐和餐厅外送增加了20%以上。随着线上食品配送系统的日益普及,可持续包装的需求和使用也不断增加,促使製造商选择永续包装解决方案。

- 全球各地的咖啡馆和餐厅正在兴起,推动了食品服务包装市场的发展。根据第一财经日报报道,光是在中国,咖啡馆数量就从 2022 年的 115,820 家跃升至 2023 年的 132,830 家。咖啡馆数量的增加直接推动了对食品包装的需求。鑑于许多咖啡馆将优先考虑外带选择,对纸袋和塑胶容器等包装的需求将至关重要。因此,随着咖啡馆和餐厅的扩张,对零售袋的需求只会增加。

- 一些包装公司,例如 Hinojosa,正在帮助企业在食品和饮料行业推广更环保的消费习惯,从而更容易将永续性策略性地纳入竞争优势。餐饮业是塑胶包装的最大需求产业之一,预计2021年塑胶使用量将成长33%以上。

关键亮点

- 2023 年 3 月,Hinojosa 包装集团推出了一系列新的食品服务包装产品,采用食品接触安全印刷方法提供多种解决方案。这种容器与其他包装不同,因为它完全由可回收纸製成,并且生物分解性。

- 然而,永续包装的开发成本高昂,并且面临许多挑战。许多公司需要更多的资源,更好的包装需要在研发方面进行投资。还必须考虑透过包装合理化来降低成本的可能性。使用永续包装的成本高于传统包装。这是因为所涉及的材料及其来源(原始材料和二手)、供应链和製造流程不完善以及规模经济较差。

- 增强的包装材料和客製化是食品服务包装市场成长的重要驱动力。这些不仅满足了不断变化的消费者偏好,而且还加强了品牌形象并解决了永续性问题。 2024 年 4 月,食品包装领域的领先创新者 Sabert Corporation 推出了其最新产品线:纸浆蛋白托盘和农产品托盘。这些托盘经过商业性可堆肥认证,为餐饮服务业者提供了传统发泡托盘的可持续替代品,同时保持了一流的品质和性能。

食品服务包装市场的趋势

快餐店(QSR)预计将占最大份额

- 肯德基、达美乐和星巴克等全球巨头和本地公司提供的菜单项目数量迅速增加,全球消费者对快餐的兴趣日益浓厚。这一趋势是由人们越来越喜欢外出用餐、不同文化的饮食偏好趋同以及快餐在我们快节奏生活中的便利性所推动的。国际品牌提供的多样化食品选择推动了 QSR 产业的成长。千禧世代和婴儿潮世代的人口结构变化和日益增强的健康意识正在扩大对健康食品的需求。

- QSR 专营价格实惠的快餐,并专注于服务效率。快餐店与传统餐厅的差别在于,它尽量减少餐桌服务,并强调自助服务。 QSR 通常使用一次性塑胶产品,例如硬质聚苯乙烯 (PS)、发泡聚苯乙烯 (EPS)、聚丙烯 (PP)、聚对苯二甲酸乙二醇酯 (PET) 和聚乳酸 (PLA)。

- 封锁期间,许多咖啡馆和餐厅将重点转向路边取餐和外带。其他公司则减少了店内容量,并推出创新的配送服务来满足食品配送的需求。因此,食品和饮料业对食品服务包装的需求将会增加。这主要是由于人们越来越重视卫生和永续性,从而将纸张推向了包装材料的前沿。

- 随着发泡聚苯乙烯杯、塑胶盖和无机肉越来越普遍,该产业正在朝着越来越环保的方向发展。在客户对永续实践的偏好日益增长的推动下,许多企业正在采取更环保的替代方案。麦当劳独立特许经营商 Arcos Dorados Holdings 于 2024 年 6 月采用了强生绿皮书的「全天然」阻隔涂层。此举旨在消除塑胶和 PFAS 化学物质并减少消费者废弃物,标誌着快餐业永续性努力迈出的重要一步。

- 外出用餐的日益增长的趋势和食品成本的上涨正在加强 QSR 领域,从而推动对食品服务包装的需求。根据 Yum! 2024 年 2 月的一份报告品牌方面,肯德基的全球门市数量已从 2020 年的约 25,000 家飙升至 2023 年的惊人的 29,900 家。全球 QSR 领域的这种成长将在未来几年进一步增加对餐饮包装的需求。

亚太地区占最大市场占有率

- 亚太地区由人口稠密的国家和中国、印度等新兴经济体组成。餐饮服务需求正在快速成长,永续包装的采用也正在获得发展动力。

- 塑胶是包装产业的重要组成部分,构成了消费者便利文化的基础。由于其成本绩效,塑胶取代了食品服务业的纸板、玻璃和金属等传统包装材料。

- 可堆肥食品服务品牌 CHUK 已与快速贸易公司 Blinkit 合作作为其永续发展合作伙伴。 Blinkit 透过在 10 分钟内将产品送到消费者手中,将消费者与 CHUK 连结起来。透过此次伙伴关係,CHUK 将在 2022-23 年之前在平台上向消费者提供 1 兆种产品。

- 日本人均包装材料消费量较高,且食品工业与包装工业有密切关係。日本食品製造商以使用高科技包装技术和包装设计的创意而闻名。对包装创新的关注促使日本开发出有吸引力且高效的包装解决方案。

- 由于中国菜、印度菜、日本菜和泛亚亚洲料理各种亚洲料理的消费量增加,印度的食品安全报告 (FSR) 在过去几年中实现了强劲增长。印度菜深受东亚文化的影响,尤其受到年轻一代的欢迎。

- 根据 Speciality Restaurants 的报告,2023 财年,印度 Speciality Restaurants Limited 将拥有约 127 家分店,高于两年前的 117 家。预计这种成长趋势将在未来几年持续下去,从而加强对食品包装产品的需求。

- 业内相关人员表示,食品服务包装製造商正倾向于软包装,因为它外观美观、成本效益高、使用寿命更长。根据印度品牌资产基金会(IBEF)的数据,印度的食品和杂货市场是世界第六大市场,其中零售业贡献了 70% 的销售额。印度食品加工产业占全国食品市场总量的32%,在产量、消费量、出口量和预期成长量方面排名第六。

食品服务包装产业概况

食品服务包装市场是细分的,许多参与企业都凭藉其产品占据强大的市场地位。创新和需求使得市场对新参与企业有吸引力。

- 2023 年 9 月,Berry 在其软质塑胶包装中引入了食品级再生材料,其中食品级低密度聚乙烯 (LLDPE) 薄膜含有至少 30% 的消费后再生塑胶 (PCR)。透过丰富其强大的薄膜产品组合,Berry 为该品牌将 PCR 纳入食品包装的永续性承诺提供了解决方案。

- 2023年2月,Pactiv Evergreen与AmSty合作推出循环聚苯乙烯食品包装产品。 Pactiv Evergreen 包装将采用 AmSty 的 ISCC PLUS 认证再生聚苯乙烯製成,并且 Evergreen 将开始向客户提供购买与 ISCC PLUS 认证的消费后再生聚苯乙烯相关的包装的机会,这种聚苯乙烯采用先进的回收技术利用物料平衡分配生产。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业生态系统分析

第五章市场动态

- 市场驱动因素

- 主要市场对简便食品的需求不断增长

- 永续性重点促使供应商转向再生塑料

- 市场问题

- 环境压力和聚合物价格波动推动软包装稳定成长

第六章市场区隔

- 依产品类型

- 瓦楞纸箱和纸盒

- 塑胶瓶

- 托盘、盘子、食品容器、碗

- 杯子和盖子

- 泡壳

- 其他的

- 按最终用户产业

- 速食店(QSR)

- 全方位服务餐厅(FSR)

- 设施

- 招待(堂食、咖啡和小吃等)

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 亚洲

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 北美洲

第七章竞争格局

- 公司简介

- Pactiv Evergreen Inc.

- Dart Container Corporation

- Amhil North America

- Genpak LLC

- Huhtamaki Oyj

- Berry Global Inc.

- Novolex Holdings LLC

- Sabert Corporation

- Silgan Plastic Food Container

- B& R Plastics Inc.

- Graphic Packaging International Inc.

- Amcor PLC

- Sonoco Products Company

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 56762

The Food Service Packaging Market size is estimated at USD 134.20 billion in 2025, and is expected to reach USD 164.70 billion by 2030, at a CAGR of 4.18% during the forecast period (2025-2030).

Key Highlights

- Online delivery platforms and mobile apps fuel the growth of foodservice packaging products. This surge is poised to intensify as technology reshapes the food landscape, drawing in more investments. Third-party online food ordering services are expected to surge, empowering numerous small, independent eateries to tap into a wider customer base. Additionally, the growth of quick service restaurants (QSRs), including online delivery food trucks, bolsters the demand for foodservice packaging, especially disposables.

- Over the last few years, online food ordering and restaurant delivery have grown more than 20%. With the increasing adoption of the online food delivery system, the demand and use of sustainable packaging are rising, causing manufacturers to opt for sustainable packaging solutions.

- Cafes and restaurants worldwide are on the rise, propelling the foodservice packaging market. In China alone, the cafe count surged from 115.82 thousand in 2022 to 132.83 thousand in 2023, as reported by CBN-Data. This uptick in cafe numbers directly fuels the demand for foodservice packaging. Given that many cafes prioritize takeout options, the need for packaging, such as paper bags and plastic containers, becomes paramount. Consequently, with the expanding cafe and restaurant landscape, the demand for retail bags is poised to climb.

- Several packaging companies, such as Hinojosa, assist firms in promoting more environmentally friendly consumption habits in the food and beverage industry, strategically making it easier to include sustainability as a competitive advantage. Foodservice was one of the industries with the most significant demand for plastic packaging, which witnessed plastic usage climb by more than 33% in 2021.

- In March 2023, Hinojosa Packaging Group launched a new line of foodservice packaging products that offers a range of solutions using printing methods safe for contact with food. This container is constructed entirely of recyclable paper and is biodegradable, which makes it stand out from other packaging.

- However, sustainable packaging can be expensive and challenging to develop. Many businesses need more resources, and investing in R&D would be required for better packaging. The potential cost savings from streamlined packaging must be considered. The cost of using sustainable packaging is higher than conventional packaging. This is due to the materials involved and their sourcing (both virgin and used), the less-established supply chains, manufacturing processes, and lower economies of scale.

- Enhanced packaging materials and customization are pivotal drivers of growth in the foodservice packaging market. They not only meet evolving consumer preferences but also bolster brand identity and tackle sustainability concerns. In April 2024, Sabert Corporation, a leading innovator in food packaging, unveiled its latest range: Pulp Protein and Produce Trays. These Trays, certified as commercially compostable, offer foodservice operators a sustainable choice over conventional foam trays, all while maintaining top-tier quality and performance.

Key Highlights

Food Service Packaging Market Trends

Quick Service Restaurants (QSR) Are Expected to Hold the Largest Share

- Global consumers are increasingly turning to fast food, with a surge in offerings from global giants like KFC, Domino's, and Starbucks, as well as regional players. This trend is fueled by the growing penchant for dining out, a melding of cross-cultural dietary tastes, and fast food's convenience in fast-paced lives. The QSR segment's growth is bolstered by the diverse culinary options offered by international brands. Shifting population demographics and a growing health consciousness among millennials and baby boomers are amplifying the demand for food products that prioritize wellness.

- QSRs specialize in affordable, fast food and prioritize service efficiency. They stand out from traditional dining establishments by offering minimal table service and a strong focus on self-service. Commonly, QSRs utilize single-use plastic products such as rigid polystyrene (PS), expanded polystyrene (EPS), polypropylene (PP), polyethylene terephthalate (PET), and polylactic acid (PLA).

- During the lockdowns, many cafes and restaurants pivoted to emphasize curbside pickup and carryout exclusively. Others slashed their in-store capacities, introducing innovative delivery services to meet the demand for food delivery. As a result, the food and beverage industry is poised to generate increased demand for foodservice packaging. This can be largely attributed to the heightened emphasis on hygiene and sustainability, propelling paper to the forefront as a preferred packaging material.

- Amidst the prevalence of styrofoam cups, plastic lids, and inorganic meat, the industry is increasingly pivoting toward eco-friendliness. Driven by a rising customer preference for sustainable practices, numerous companies are embracing greener alternatives. Arcos Dorados Holdings, an independent McDonald's franchisee, adopted J&J Green Paper's 'all-natural' barrier coating in June 2024. This move aimed to eliminate plastics and PFAS chemicals and reduce consumer waste, marking a significant step in the fast food industry's sustainability efforts.

- The rising trend of on-the-go dining and heightened food expenditures have bolstered the QSR segment, consequently driving up the demand for foodservice packaging. As per Yum! Brands' February 2024 report, the global count of KFC outlets surged from approximately 25,000 in 2020 to a staggering 29,900 by 2023. This global uptick in QSR establishments is poised to further escalate the need for foodservice packaging in the coming years.

Asia-Pacific Accounts for the Largest Market Share

- Asia-Pacific comprises densely populated countries and emerging economies like China and India. The demand for foodservice is growing rapidly, and the adoption of sustainable packaging is gaining momentum; it is expected to increase further during the forecast period.

- Plastic is an essential part of the packaging industry that forms the foundation of the consumer convenience culture. Owing to their cost-to-performance ratio, traditional packaging materials, such as corrugated paper boards, glass, and metals, have been substituted by plastics in foodservice.

- CHUK, a compostable foodservice brand, joined quick commerce firm Blinkit as its sustainability partner. Blinkit delivers CHUK's products to consumers within 10 minutes, bridging the gap between the consumers and CHUK. The partnership helped CHUK to serve one crore pieces to consumers on the platform FY 2022-23.

- Japan has a high per capita consumption of packaging materials, and there is a close relationship between the food and packaging industries in the country. Japanese food manufacturers are known for using high-tech packaging techniques and their tendency toward ingenuity in packaging designs. This focus on packaging innovation has led to the development of attractive and efficient packaging solutions in Japan.

- There has been strong growth of FSRs in India during the past years due to the rise in the consumption of different varieties of Asian cuisine, including Chinese, Indian, Japanese, and Pan-Asian. Indian cuisine is significantly influenced by East Asian culture and is particularly popular among the younger generation.

- As per the Speciality Restaurants report, in FY 2023, there were about 127 outlets of Speciality Restaurants Limited in India, up from 117 stores two years prior. This uptrend is also expected to be witnessed in the upcoming years, thereby bolstering the demand for foodservice packaging products.

- According to industry insiders, foodservice packaging manufacturers are gravitating toward flexible packaging as it is visually appealing, cost-effective, and long-lasting. According to the India Brand Equity Foundation (IBEF), the Indian food and grocery market is the sixth-largest globally, with retail accounting for 70% of sales. The Indian food processing industry accounted for 32% of the country's overall food market, ranking sixth in production, consumption, export, and expected growth.

Food Service Packaging Industry Overview

The foodservice packaging market is fragmented, as many players have a strong presence due to their offerings. With innovations and demand, the market is attractive for new players.

- September 2023: Berry introduced food-grade recycled content in flexible plastic packaging with food-grade low-density polyethylene (LLDPE) films containing at least 30% (PCR) post-consumer recycled plastic. Through this addition to its robust film portfolio, Berry offered brands a solution to their sustainability commitments to include PCR in food packaging.

- February 2023: Pactiv Evergreen collaborated with AmSty to launch Circular Polystyrene Food Packaging Products, where Pactiv Evergreen packaging will use ISCC PLUS-certified recycled polystyrene from AmSty, and Evergreen will begin offering customers the ability to purchase packaging linked to ISCC PLUS-certified post-consumer recycled polystyrene derived from advanced recycling technologies using mass balance allocation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Ecosystem Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand For Convenience Food Continues In Major Markets

- 5.1.2 Increasing Vendor Focus On Recycled Plastic Due To Emphasis On Sustainability

- 5.2 Market Challenges

- 5.2.1 Steady Growth Of Flexible Packaging Due To Environmental Pressure And Uncertainty In Polymer Prices

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Corrugated Boxes And Cartons

- 6.1.2 Plastic Bottles

- 6.1.3 Trays, Plates, Food Containers, And Bowls

- 6.1.4 Cups And Lids

- 6.1.5 Clamshells

- 6.1.6 Other Product Types

- 6.2 By End-user Industries

- 6.2.1 Quick Service Restaurants (QSR)

- 6.2.2 Full-service Restaurants (FSR)

- 6.2.3 Institutional

- 6.2.4 Hospitality (Dine-ins, Coffee & Snack, Etc.)

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Argentina

- 6.3.4.3 Mexico

- 6.3.5 Middle East and Africa

- 6.3.5.1 Saudi Arabia

- 6.3.5.2 United Arab Emirates

- 6.3.5.3 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Pactiv Evergreen Inc.

- 7.1.2 Dart Container Corporation

- 7.1.3 Amhil North America

- 7.1.4 Genpak LLC

- 7.1.5 Huhtamaki Oyj

- 7.1.6 Berry Global Inc.

- 7.1.7 Novolex Holdings LLC

- 7.1.8 Sabert Corporation

- 7.1.9 Silgan Plastic Food Container

- 7.1.10 B&R Plastics Inc.

- 7.1.11 Graphic Packaging International Inc.

- 7.1.12 Amcor PLC

- 7.1.13 Sonoco Products Company

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219