|

市场调查报告书

商品编码

1690934

北美食品服务包装:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)North America Foodservice Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

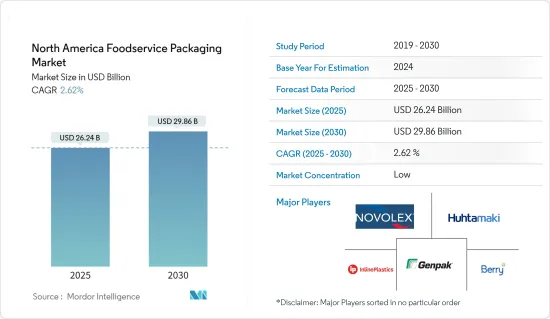

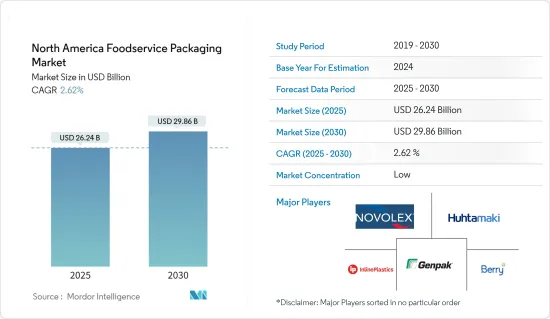

北美食品服务包装市场规模预计在 2025 年为 262.4 亿美元,预计到 2030 年将达到 298.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 2.62%。

主要亮点

- 市场成长的扩大得益于消费者对包装食品的高度依赖以及食品加工企业强大的区域影响力。随着越来越多的食品服务者成功实现业务数位化,线上食品订购需求的不断增长预计将振兴该行业,为北美创造市场成长机会。

- 过去十年,由于基材选择的变化、新市场的扩张、所有权的动态以及瓦楞纸箱、纸箱和塑胶包装市场的众多发展,北美食品服务包装业务一直经历着持续的成长。尤其是在美国,永续性和环境问题仍然是优先事项。

- 瓦楞纸箱是用于运输各种食品的一种产品类型。它们通常由纸板製成,纸板主要由木材中的纤维素纤维製成。这些盒子坚固、刚性、灵活、耐用、轻巧且美观。它还是环保的,因为它可回收并且在生产过程中不使用有害化学物质。瓦楞纸箱用于北美食品服务业包装产品。 宝特瓶包装是聚乙烯的主要用途。聚乙烯是一种半结晶质、轻质热塑性树脂,具有优异的隔音性能、耐化学性和低吸湿性。

- 该行业最大的担忧是该地区严格的环境法规。预计在预测期内,国家和州一级禁止使用塑胶製品将对该行业构成重大挑战。此外,由于宏观经济因素导致的原材料价格上涨和聚合物树脂供应链的不确定性可能会对预测期内的市场成长构成挑战。

- 餐饮业的利润率受到了新冠肺炎疫情的严重影响。该行业内的公司已经看到消费量大幅下降,并伴随供应链中断。受新冠疫情影响,美国餐饮业停业严重,导致包装食品销售暂时下降,但儘管面临经济挑战,该产业已逐步復苏。预计疫情过后,有限服务餐厅和全方位服务餐厅将增加面向消费者的包装。随着经济重新开放和消费者养成新的饮食习惯,食品包装必须适应这些不断变化的需求,从而推动市场成长。

北美食品服务包装市场趋势

瓦楞纸箱和纸盒板块成长最快

- 瓦楞纸箱仅使用一次然后回收,最大限度地减少了交叉污染的风险。此外,生产过程中采用的高温可确保其不含细菌和其他污染物。由于它为食品在运输、储存和分销过程中提供了一个清洁、安全的环境,因此它在北美食品服务包装市场的采用正在加速。

- 瓦楞纸箱以其安全性而闻名,并被批准可以直接接触食物。此外,这些盒子可以涂上食品安全材料,使其成为更具吸引力的食品包装。食品安全涂层的一个标准选择是符合直接食品接触监管标准的水性或植物性涂层。该涂层可充当保护层,并可防止盒子中的物质潜在地迁移到食物中。它们无毒、防潮,旨在确保包装保持完好且食品安全,支持其在研究市场中的成长。

- 永续性在所有行业中发挥关键作用,包括食品包装。瓦楞纸箱在这方面得分很高,因为它们是由可再生资源製成的。大多数瓦楞纸箱都是用可回收材料製成的,易于重复使用,支持循环经济并减少环境影响,从而支持预测期内北美市场的成长。

- 根据美国纸浆和造纸公司国际纸业公司的报告,美国瓦楞包装的出货量随着该国包装产品出货量的增加而增加,这表明该领域在所研究市场中的未来成长潜力。

- 此外,瓦楞纸箱和纸板的坚固结构、多功能性和安全性使其成为食品包装的首选。它们保护和保存里面的食物并确保其安全地运送到消费者手中。瓦楞纸箱加上其永续的特性,是一种合适的双赢解决方案,它将使食品业受益,并支持所研究市场中这一领域的成长。

快餐店占最高市场占有率

- 在 QSR 中使用永续食品服务包装已变得至关重要。越来越多的人选择速食作为晚餐,因为他们没有时间在家做饭。餐饮企业可以使用永续的包装方式来安全且经济地包装餐食,为顾客提供快速简便的餐点运输方式。

- 快餐店使用的大多数食品服务产品都是由塑胶製成的,例如发泡聚苯乙烯 (EPS)、聚对苯二甲酸乙二醇酯 (PET)、聚丙烯 (PP) 和聚乳酸,或由纸、纸板和模製纸浆製成。与传统餐厅或咖啡馆相比,QSR 能够更快地提供更高品质的食品和饮料。为了确保公平分配和提供这些服务的高度一致性,一些快餐店引入了分配控制份量的分配器,以支持市场的成长。

- 一些 QSR 将餐厅的便利性与顾客透过容量控制分配器的自助服务自由结合起来,帮助 QSR 提供卓越的客户服务,消除产品浪费并降低成本。该地区的 QSR 对这些小袋和小包的包装解决方案的需求不断增加,预计将在预测期内为市场创造成长机会。

- 美国的速食和 QSR 连锁店正在扩大其在加拿大的业务,以满足日益增长的包装食品需求,这将支持市场成长。例如,以汉堡和薯条闻名的美国速食连锁店 Shake Shack 预计将于 2024 年 6 月在多伦多开设其第一家加拿大门市,预计将在预测期内推动食品服务业对包装解决方案的需求。

- 此外,2023 年 8 月,上下文行动广告公司 Inmobi 报告称,越来越多的人选择订购披萨和汉堡作为美国最受欢迎的速食。这些因素可能会在预测期内创造该国食品服务包装市场的需求并支持区域市场的成长。

北美食品服务包装产业概况

预测期内,北美食品包装市场高度分散,有 Inline Plastics、Berry Global Inc.、Novolex Holdings LLC、Genpak LLC 和 Huhtamaki America Inc. 等多家公司。该地区本地供应商之间的竞争正在加剧。食品服务包装供应商范围广泛,买家可以从多个供应商中进行选择。

- 2024 年 5 月-食品服务製造公司 Genpak 投资 2,280 万美元对其位于阿拉巴马州蒙哥马利的工厂维修。此次升级将使工厂的当地员工数量增加一倍,升级重点包括增强安全性和提高製造商为便利商店到餐厅等广泛客户提供食品包装解决方案的效率。

- 2024 年 4 月 - 北美公司 Novolex Holdings LLC 宣布对罗德岛的可重复使用系统和容器品牌 OZZI 进行策略性投资。作为投资的一部分,Novolex 的业务部门和食品服务业循环解决方案的领导者 Eco Products 将加速 OZZI 的发展。 OZZI 系列产品和解决方案包括用于食品服务包装的 O2GO 容器、杯子和刀叉餐具。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 美国对简便食品的需求仍然很高

- 对永续性的日益关注促使供应商转向再生塑料

- 市场挑战

- 环境压力导致政府加强对包装的监管,以及聚合物定价的不确定性

- 市场机会

- 产业生态系统分析 – 材料供应商、转换器、经销商、最终使用组织、客户、回收商

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估微观经济因素对市场的影响

第五章 市场区隔

- 按包装类型

- 瓦楞纸箱和纸箱

- 塑胶瓶

- 托盘、盘子、食品容器、碗

- 杯子和盖子

- 泡壳

- 其他包装形式(刀叉餐具、搅拌器/吸管等)

- 按最终用户

- 速食店

- 全方位服务餐厅

- 咖啡和小吃

- 零售商

- 公共及款待

- 其他最终用户

- 按国家

- 美国

- 加拿大

第六章 竞争格局

- 公司简介

- Pactiv Evergreen Inc.

- Dart Container Corporation

- Amhil North America

- Genpak LLC

- Huhtamaki America Inc.

- Berry Global Inc.

- Inline Plastics

- Novolex Holdings LLC

- Sabert Corporation

- Silgan Plastic Food Container

- Bennett Plastics Inc.

- B&R Plastics Inc.(Gilster-Mary Lee Corp.)

- Graphic Packaging

- Amcor PLC

- Sonoco Products Company

第七章食品服务包装产业经销商及供应商名单

The North America Foodservice Packaging Market size is estimated at USD 26.24 billion in 2025, and is expected to reach USD 29.86 billion by 2030, at a CAGR of 2.62% during the forecast period (2025-2030).

Key Highlights

- The market's growth expansion has been brought on by consumers' heavy reliance on packaged foods and the significant regional presence of food processing businesses. The rising number of foodservice suppliers successfully digitalizing their operations is expected to fuel the industry, supported by the increasing demand for online food ordering, creating an opportunity for market growth in North America.

- The North American foodservice packaging business has experienced consistent growth over the last decade due to changes in substrate choice, new market expansion, ownership dynamics, and numerous developments serving the market for corrugated boxes, cartons, and plastic packaging. Sustainability and environmental issues will continue to be prioritized, especially in the United States.

- Corrugated boxes are types of packaging used to ship different food products. They are often constructed of paperboard, primarily made of cellulose fibers from wood. These boxes are strong, stiff, flexible, long-lasting, light, and attractive. Due to their recyclable nature and lack of use of hazardous chemicals during production, the boxes are advantageous for the environment. Corrugated boxes are used in the North American foodservice industry to package goods. Plastic bottle packing is the principal application for polyethylene. It is a semi-crystalline, lightweight thermoplastic resin with excellent sound insulation, chemical resistance, and low moisture absorption.

- The industry's most significant source of worry is the region's strict environmental restrictions. Over the projection period, bans on plastic items at the national and state levels are projected to present significant difficulties to the industry. Additionally, the growth of raw material prices and the supply chain uncertainty in polymer resins due to macroeconomic factors may challenge the market's growth during the forecast period.

- The foodservice industry's profit margins have been significantly affected by the COVID-19 pandemic. Businesses in this industry are witnessing a notable drop in consumption, coupled with disruptions in their supply chains. The COVID-19 pandemic-induced lockdowns substantially impacted the US foodservice industry with a temporary dip in packaging volumes, and the industry gradually recovered, defying economic challenges. Limited and full-service restaurants are expected to ramp up their consumer-facing packaging post-pandemic. As the economies reopen and diners embrace new eating habits, foodservice packaging must adapt to cater to these evolving needs, driving market growth.

North America Foodservice Packaging Market Trends

Corrugated Boxes and Cartons Segment to Exhibit the Highest Growth Rate

- Corrugated boxes are used only once and then recycled, minimizing the risk of cross-contamination. Additionally, the high heat used in manufacturing ensures they are free from bacteria and other contaminants. They provide a clean, safe environment for food items during transit, storage, and delivery, which is boosting their adoption in the foodservice packaging market in North America.

- Corrugated boxes boast a safety feature and are approved for direct food contact. Moreover, these boxes can be coated with food-safe materials, bolstering their appeal for food packaging. One standard option for a food-safe coating is a water-based or vegetable-based coating that complies with regulatory standards for direct food contact. This coating can be used as a protective layer, preventing any potential migration of substances from the box to the food. It is designed to be non-toxic and moisture-resistant, ensuring the packaging remains intact and safe for food items, supporting its growth in the market studied.

- Sustainability plays a crucial role in all industries, including food packaging. Corrugated boxes score highly in this regard as they are made from renewable resources. Most are manufactured from recycled materials and support circular economies as they can be easily recycled again, which reduces their environmental footprint, thereby supporting their growth in the North American market during the forecast period.

- The International Paper Company, a US-based pulp and paper company, reported the shipments of corrugated packaging in the United States to be growing in line with the increasing growth of shipments of packing products in the country, showing the future growth potential of the segment in the market studied.

- Additionally, with their sturdy construction, versatility, and safe properties, corrugated boxes and cartons have secured their place as a preferred choice in food packaging. They protect and preserve the food products inside and ensure their safe transportation to consumers. Coupled with their sustainable nature, corrugated boxes are a proper win-win solution, benefiting the food industry and supporting the segment's growth in the market studied.

Quick-service Restaurants Hold the Highest Market Share

- The use of sustainable foodservice packaging in QSRs has become crucial. More people are turning to fast food as a supper option because they have less time to prepare meals at home. Foodservice businesses may package meals safely and affordably using sustainable packaging styles, giving clients a quick and easy way to transport meals.

- Most of the foodservice items used in QSRs are either made of plastic, such as expanded polystyrene (EPS), polyethylene terephthalate (PET), polypropylene (PP), and polylactic acid, or paper, including paper, paperboard, and molded pulp. QSRs deliver high-quality food and beverages more quickly than traditional restaurants or cafes. To achieve fair distribution and a high level of consistency in offering these services, several QSRs have implemented dispensers that supply a controlled volume, supporting market growth.

- Some QSRs combine restaurant conveniences with the freedom for customers to express their uniqueness through self-service elements through controlled-volume dispensers, which can help QSRs deliver exceptional customer service, reduce product waste, and save money. The demand for packaging solutions for these small-volume sachets or packets across QSRs in the region is expected to create a growth opportunity for the market over the forecast period.

- Fast food and QSR chains based in the United States are expanding their portfolios in Canada to address the increasing demand for packaged foods, which would support market growth. For instance, in June 2024, the US fast-food chain Shake Shack, known for its burgers and fries, opened its first Canadian location in Toronto, which would fuel the demand for packaging solutions in the foodservice industry during the forecast period.

- Additionally, in August 2023, Inmobi, a contextual mobile advertising company, reported that people were ordering pizza and burgers as the most preferred fast food items in the United States. Such factors could create demand for the foodservice packaging market in the country and support the regional market's growth during the forecast period.

North America Foodservice Packaging Industry Overview

The North American foodservice packaging market will be highly fragmented over the forecast period, with the presence of many players, such as Inline Plastics, Berry Global Inc., Novolex Holdings LLC, Genpak LLC, and Huhtamaki America Inc. There will be increasing competition among local vendors in the region. Owing to the wide range of foodservice packaging suppliers, buyers can choose from multiple vendors.

- May 2024 - Foodservice manufacturing company Genpak invested USD 22.8 million in renovating its Montgomery, Alabama, plant. The upgrades allowed the facility to double its local workforce and included safety enhancements and upgrades focused on better efficiency for the manufacturer's food packaging solutions for clients ranging from convenience stores to restaurants.

- April 2024 - Novolex Holdings LLC, a North American company, announced a strategic investment in Rhode Island-based reusable systems and container brand OZZI. As a part of this investment, Eco-Products, a Novolex business unit and leader in circular solutions for the foodservice industry, will help accelerate OZZI's growth. The OZZI family of products and solutions includes O2GO containers, cups, and cutlery for foodservice packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand for Convenience Food Remains High in the United States

- 4.2.2 Increasing Emphasis on Sustainability is Causing Vendors to Focus on Recycled Plastic

- 4.3 Market Challenges

- 4.3.1 Increasing Governmental Regulations on Packaging Due to Environmental Pressure and Uncertainty in Polymer Prices

- 4.4 Market Opportunities

- 4.5 Industry Ecosystem Analysis - Material Suppliers, Convertors, Distributors, End-use Organizations, Customers, and Recycling

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of the Impact of Microeconomic Factors on the Market

5 MARKET SEGMENTATION

- 5.1 By Packaging Format

- 5.1.1 Corrugated Boxes and Cartons

- 5.1.2 Plastic Bottles

- 5.1.3 Trays, Plates, Food Containers, and Bowls

- 5.1.4 Cups and Lids

- 5.1.5 Clamshells

- 5.1.6 Other Packaging Formats (Cutlery, Stirrers/Straws, etc.)

- 5.2 By End User

- 5.2.1 Quick-service Restaurants

- 5.2.2 Full-service Restaurants

- 5.2.3 Coffee and Snack Outlets

- 5.2.4 Retail Establishments

- 5.2.5 Institutions and Hospitality

- 5.2.6 Other End Users

- 5.3 By Country

- 5.3.1 United States

- 5.3.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Pactiv Evergreen Inc.

- 6.1.2 Dart Container Corporation

- 6.1.3 Amhil North America

- 6.1.4 Genpak LLC

- 6.1.5 Huhtamaki America Inc.

- 6.1.6 Berry Global Inc.

- 6.1.7 Inline Plastics

- 6.1.8 Novolex Holdings LLC

- 6.1.9 Sabert Corporation

- 6.1.10 Silgan Plastic Food Container

- 6.1.11 Bennett Plastics Inc.

- 6.1.12 B&R Plastics Inc. (Gilster-Mary Lee Corp.)

- 6.1.13 Graphic Packaging

- 6.1.14 Amcor PLC

- 6.1.15 Sonoco Products Company