|

市场调查报告书

商品编码

1687271

光子积体电路:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Photonic Integrated Circuit - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

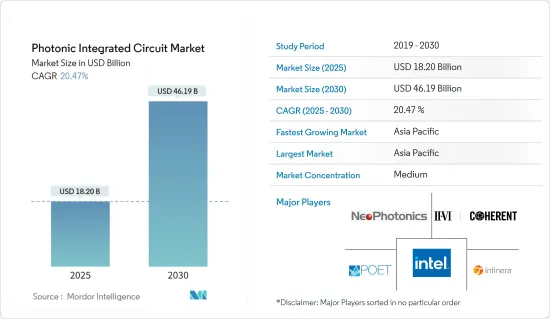

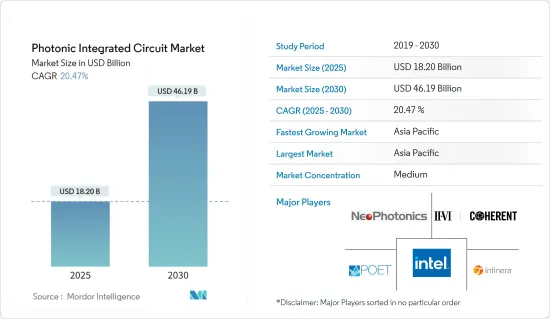

预计 2025 年光子积体电路市场价值将达到 182 亿美元,到 2030 年预计将达到 461.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 20.47%。

不断扩展的应用推动光子积体电路市场

关键亮点

- 由于通讯和资料中心应用范围的扩大,光子积体电路 (PIC) 市场正在经历强劲成长。 PIC 的性能优于传统积体电路,具有速度更快、频宽更大、功率效率更高等优点。这些优势使得PIC成为短距离资料中心连接和远距光纤网路的颠覆性技术。

- 提高效率:PIC 可将关键应用中的功耗降低至少 50%。

- 频率优势:PIC的频率比微电子的频率高1000至10000倍。

- 更节能:此技术支援更高的频率,同时比传统 IC 更节能。

通讯和资料中心应用推动成长

关键亮点

- 在通讯,由于对高速网路通讯系统的需求不断增加,PIC 的采用正在扩大。随着行动资料使用量每年增长约 40%,PIC 在满足频宽需求方面发挥关键作用。北美在行动资料消费方面处于领先地位,预计到 2023 年底,每部智慧型手机每月的流量将达到 48GB。

- 节省空间和成本:嵌入光纤通讯系统的 PIC 可显着节省空间、功耗和成本。

- 增加容量:此技术增加了传输容量,同时实现了新的功能。

- 资料中心创新:用于资料中心远距通讯网路的混合光电将光子资料转换为电讯号进行处理,促进向光子交换元件的过渡。

- 投资和研究推动小型化:PIC小型化受到汽车、航空和通讯等领域的推动。该公司正在开发更小、更具成本效益和更可靠的 PIC,用于光谱仪和雷射雷达等设备。

- 最新进展:2020年8月,研究人员开发出最小的片光调变器,其开关速度高达11 Gbit/s。

- 三菱创新:该公司正在探索新的硅光电建构模组,以扩展其处理器的功能。

- 感测器和测量领域的新兴应用:PIC 在光学感测器中的使用日益增多,包括用于 ADAS(高级驾驶辅助系统)的 LiDAR,正在推动市场的发展。机械和检查等行业对高精度距离感测器的需求不断增加也促进了市场的成长。

- 英特尔投资:Mobileye 计划到 2025 年在其下一代 LiDAR 技术中采用 PIC。

- 新的合作伙伴关係:Tower Semiconductor 正在与光电合作开发用于汽车雷射雷达等的低损耗硅光波导技术。

- 市场动态与未来展望:策略伙伴关係和收购正在定义市场,公司赢得新契约并扩展到各个领域。 PIC市场前景看好,预计未来三年硅光子晶片将在资料中心之间的高速资料传输中广泛应用。

- 伙伴关係主导成长:2022 年 3 月,Ansys 和 GlobalFoundries (GF) 合作增强其光子设计能力。

- 长期预测:阿里巴巴达摩院预测,5到10年内,硅光子晶片将在各类电脑产业取代电子晶片。

光子积体电路市场趋势

资料中心领域占据市场主导地位

资料中心应用引领光子积体电路(PIC)市场,2021 年占 67.88% 的市场占有率。这项优势是由高速资料传输的需求和云端运算基础设施的快速扩展所驱动的。

- 流量激增 思科云端指数预测,到 2021 年,北美每年将产生 7.7ZB 的云端流量,凸显了对高效能资料处理日益增长的需求。

- 资料中心集中度:美国拥有约2,600个资料中心,占全球整体的33%。

- 协作创新:IBM、英特尔和思科等公司正在与学术界和政府合作开发基于 PIC 的解决方案。

- 成长预测:预计该部分将从 2021 年的 54.2964 亿美元成长到 2027 年的 174.8597 亿美元,复合年增长率为 19.96%。

亚太地区成长强劲

亚太地区是 PIC 市场成长最快的地区,预计在技术进步和投资增加的推动下,2022 年至 2027 年的复合年增长率将达到 23.36%。

- 市场激增:亚太地区 PIC 市场预计将从 2021 年的 16.1515 亿美元成长到 2027 年的 61.5074 亿美元。

- 革命性突破:2021 年 11 月,伊利诺大学的调查团队创建了一个微型光子电路,利用声波分离和调製光。

- 战略伙伴关係,例如 2022 年的 ANSYS-GF 合作伙伴关係,正在推动该地区资料中心和超级计算的光子设计的进步。

- 政府支持:安大略光电产业网络等公私倡议正在推动该地区的 PIC 创新。

光子积体电路产业概况

竞争格局分析:光子积体电路(PIC)市场由少数几家全球性公司主导,其中 Neophotonics Corporation、Poet Technologies、II-VI Incorporated 和 Intel Corporation 等公司主导市场。这些公司拥有强大的区域影响力和稳固的市场占有率,塑造了行业的竞争格局。

技术领先:主要企业正在大力投资研发,并专注于创新和小型化。例如,II-VI Incorporated 的高效多功能超透镜专为超小型光学感测器而设计。

策略伙伴关係:合作是维持市场领导地位的关键。 Ansys 与 GF 的伙伴关係就是一个例子,扩展了各领域的光电设计能力。

未来成功策略:希望在 PIC 市场取得未来成功的公司应该专注于几个关键策略。

研发投资:对 PIC 技术进步的投资,尤其是小型化和整合化,至关重要。

经济高效的解决方案:您需要扩大製造能力以降低生产成本并提高可扩展性。

伙伴关係与协作:策略伙伴关係(例如 POET Technologies 和 Liobate Technologies 之间的合作伙伴关係)可以加快产品开发速度。

多样化:开发传统领域以外的新应用,如汽车、航太和生物医药产业,开启了新的市场机会。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 评估关键宏观经济因素对市场的影响

第五章市场动态

- 市场驱动因素

- 通讯和资料中心应用的成长

- 对 PIC 小型化的投资与研究

- 不断扩展的应用推动光子积体电路市场

- 感测器和测量领域的新应用

- 市场问题

- 传统积体电路的需求持续成长

- 光纤网路容量不足

第六章市场区隔

- 依原料类型

- III-V族材料

- 铌酸锂

- 硅基二氧化硅

- 其他的

- 按整合过程

- 杂交种

- 单片

- 按应用

- 通讯

- 生物医学

- 资料中心

- 其他应用(光学感测器(LiDAR)、测量设备)

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- NeoPhotonics Corporation

- POET Technologies

- II-VI Incorporated

- Infinera Corporation

- Intel Corporation

- Cisco Systems Inc.

- Source Photonics Inc.

- Lumentum Holdings

- Caliopa(Huawei Technologies Co. Ltd)

- Effect Photonics

- Colorchip Ltd

第八章投资分析

第九章:市场的未来

The Photonic Integrated Circuit Market size is estimated at USD 18.20 billion in 2025, and is expected to reach USD 46.19 billion by 2030, at a CAGR of 20.47% during the forecast period (2025-2030).

Growing Applications Drive Photonic Integrated Circuit Market

Key Highlights

- The Photonic Integrated Circuit (PIC) market is experiencing robust growth due to expanding applications in telecommunications and data centers. PICs provide superior performance compared to traditional integrated circuits, offering advantages like higher speed, increased bandwidth, and improved power efficiency. These benefits make PICs a disruptive technology for short-range connections in data centers and long-haul optical communication networks.

- Efficiency improvement: PICs reduce power consumption in critical applications by at least 50%.

- Frequency advantage: PIC frequencies are 1,000 to 10,000 times higher than those of microelectronics.

- Higher energy efficiency: The technology supports much higher frequencies while being more energy-efficient than traditional ICs.

Telecommunications and Data Center Applications Fuel Growth:

Key Highlights

- Telecommunications is seeing widespread PIC adoption due to the growing demand for high-speed internet communication systems. With mobile data usage expanding by about 40% annually, PICs play a key role in meeting bandwidth needs. North America leads in mobile data consumption, with traffic forecasted to reach 48 GB per month per smartphone by the end of 2023.

- Space and cost savings: PICs integrated into optical communication systems provide significant space, power, and cost reductions.

- Capacity enhancement: The technology increases transmission capacity while enabling new functionalities.

- Data center innovations: Hybrid photonics for long-haul communication networks in data centers convert photonic data to electrical signals for processing, facilitating the shift towards photonic switching components.

- Investments and Research Drive Miniaturization: The push for miniaturizing PICs is driven by sectors like automotive, aeronautics, and telecommunications. Companies are developing smaller, cost-effective, and reliable PICs for use in devices like spectrometers and LiDAR.

- Recent advances: In August 2020, researchers developed the smallest on-chip optical modulator with a switching speed of up to 11 Gbit/s.

- Mitsubishi's innovations: The company is exploring new silicon photonics building blocks to extend processor capabilities.

- Emerging Applications in Sensors and Metrology: The rising use of PICs in optical sensors, including LiDAR for Advanced Driver Assistance Systems (ADAS), is boosting the market. The increasing demand for high-precision distance sensors in industries like machinery and inspection contributes to market growth.

- Intel's investment: Mobileye plans to use PICs in its next-gen LiDAR technology by 2025.

- New collaborations: Tower Semiconductor's partnership with AnelloPhotonics is developing low-loss Silicon Optical Waveguide technology for automotive LiDAR and other applications.

- Market Dynamics and Future Outlook: Strategic partnerships and acquisitions define the market, with companies securing new contracts and expanding into different sectors. The future of the PIC market looks promising, with silicon photonic chips expected to become widespread in high-speed data transmission between data centers over the next three years.

- Partnership-driven growth: In March 2022, Ansys and GlobalFoundries (GF) partnered to enhance photonic design capabilities.

- Long-term predictions: Alibaba's DAMO Academy predicts silicon photonic chips will replace electronic chips in various computer industries within 5-10 years.

Photonic Integrated Circuit Market Trends

Data Center Segment Dominates Market

Data center applications are leading the Photonic Integrated Circuit (PIC) market, accounting for 67.88% of the market share in 2021. This dominance is driven by the need for high-speed data transmission and the rapid expansion of cloud computing infrastructure.

- Traffic surge: Cisco's Cloud Index forecasts North America generating 7.7 ZB of cloud traffic annually by 2021, highlighting the growing need for efficient data processing.

- Data center concentration: The U.S. has about 2,600 data centers, representing 33% of the global total, creating a sizable market for PIC solutions.

- Collaborative innovation: Companies like IBM, Intel, and Cisco are developing PIC-based solutions in collaboration with academia and government.

- Growth forecast: The segment is projected to grow from USD 5,429.64 million in 2021 to USD 17,485.97 million by 2027, with a CAGR of 19.96%.

Asia-Pacific Witness Major Growth

Asia-Pacific is the fastest-growing region in the PIC market, expected to achieve a CAGR of 23.36% between 2022 and 2027, driven by technological advancements and increasing investment.

- Market surge: The Asia-Pacific PIC market is forecasted to grow from USD 1,615.15 million in 2021 to USD 6,150.74 million by 2027.

- Innovative breakthroughs: In November 2021, researchers at the University of Illinois created a miniature photonic circuit using sound waves to isolate and regulate light.

- Strategic partnerships: Collaborations like the one between Ansys and GF in 2022 are driving advancements in photonic design for data centers and supercomputing in the region.

- Government support: Public-private initiatives, such as the Ontario Photonics Industry Network, are boosting PIC innovation in the region.

Photonic Integrated Circuit Industry Overview

Competitive Landscape Analysis: The Photonic Integrated Circuit (PIC) market is dominated by a few global players, with companies such as Neophotonics Corporation, Poet Technologies, II-VI Incorporated, and Intel Corporation leading the market. These companies have strong geographical presence and robust market shares, shaping the competitive landscape of the industry.

Technological leadership: Leading companies invest heavily in research and development, focusing on innovation and miniaturization. For example, II-VI Incorporated's high-efficiency multifunctional metalenses are designed for ultracompact optical sensors.

Strategic partnerships: Collaborations are key to maintaining market leadership. Ansys' partnership with GF is one example, expanding photonic design capabilities across sectors.

Strategies for Future Success: Companies aiming for future success in the PIC market should focus on several critical strategies:

R&D investment: Investing in the advancement of PIC technology, particularly in miniaturization and integration, is crucial.

Cost-effective solutions: Expanding manufacturing capabilities to lower production costs and improve scalability is necessary.

Partnerships and collaborations: Strategic partnerships like POET Technologies' with Liobate Technologies will enable faster product development.

Diversification: Exploring new applications beyond traditional sectors, including automotive, aerospace, and biomedical industries, will open new market opportunities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of the Impact of Key Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Applications in Telecommunications and Data Centers

- 5.1.2 Investments and Research to Miniaturize the PICs

- 5.1.3 Growing Applications Drive Photonic Integrated Circuit Market

- 5.1.4 Emerging Applications in Sensors and Metrology

- 5.2 Market Challenges

- 5.2.1 Continued Demand for Traditional ICs

- 5.2.2 Optical Networks Capacity Crunch

6 MARKET SEGMENTATION

- 6.1 By Type of Raw Material

- 6.1.1 III-V Material

- 6.1.2 Lithium Niobate

- 6.1.3 Silica-on-silicon

- 6.1.4 Other Raw Materials

- 6.2 By Integration Process

- 6.2.1 Hybrid

- 6.2.2 Monolithic

- 6.3 By Application

- 6.3.1 Telecommunications

- 6.3.2 Biomedical

- 6.3.3 Data Centers

- 6.3.4 Other Applications (Optical Sensors (LiDAR), Metrology)

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 NeoPhotonics Corporation

- 7.1.2 POET Technologies

- 7.1.3 II-VI Incorporated

- 7.1.4 Infinera Corporation

- 7.1.5 Intel Corporation

- 7.1.6 Cisco Systems Inc.

- 7.1.7 Source Photonics Inc.

- 7.1.8 Lumentum Holdings

- 7.1.9 Caliopa (Huawei Technologies Co. Ltd)

- 7.1.10 Effect Photonics

- 7.1.11 Colorchip Ltd