|

市场调查报告书

商品编码

1687462

越野车:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Off-road Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

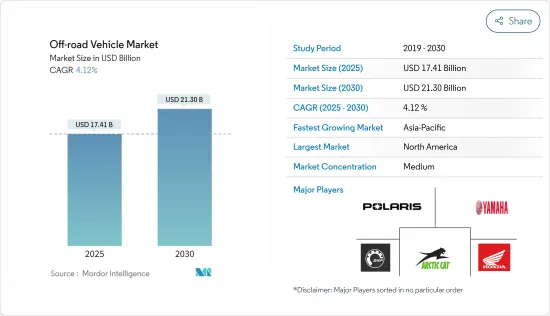

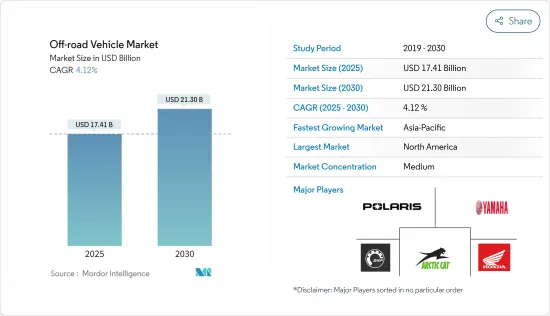

越野车市场规模预计在 2025 年为 174.1 亿美元,预计到 2030 年将达到 213 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.12%。

由于关闭门户和旅行限制导致需求放缓,COVID-19 疫情对市场造成了沉重打击。然而,疫情过后,随着限制措施的放宽,我们看到休閒和体育活动呈现正面趋势。因此,预计预测期内越野车的需求将会增加。

越野运动的日益普及以及对坚固而紧凑的设备的需求推动了对越野车的需求。此外,由于越野车广泛应用于农业、采矿业和建筑业等多个领域,预计将实现乐观的成长。此外,最低的维护成本、降低的燃料消耗和低保险成本也促进了建设产业对这些车辆的需求。

由于全地形车和多功能车不允许在高速公路和其他主要道路上行驶,政府官员正在拨出更多资金来建造新的越野路。预计这将推动市场发展。此外,该公司还专注于推出具有改进功能的新产品,以吸引更多客户并在市场上获得竞争优势。

电动传动系统等新技术发展可能为越野车市场带来新的成长机会。由于人们对排放问题的日益担忧,电动越野车越来越受欢迎,推动了越野车产业的发展。

预计北美仍将是越野车的最大市场,其次是欧洲。亚太地区预计将成为越野车市场成长最快的地区。这是由于高渗透率和蓬勃发展的汽车产业推动了越野车的生产,尤其是在中国和印度。

越野车市场趋势

全地形车(ATV)领域预计将显着成长

随着汽车製造商开发出多种最终用途的全地形车,全地形车市场正在蓬勃发展。人们对体育和休閒的兴趣日益浓厚,是这一领域发展的主要驱动力。此外,製造商对各种环保车型不断改进开发的兴趣可能会促进市场的发展。

2022年8月,北极星在印度推出了全新旗舰车型RZR(R) Pro R Sport ATV。这款新型 ATV 配备了强大的 1997cc 4 衝程 DOHC 直列 4 缸发动机,最大输出为 225bhp。 2022 年,Arctic Cat 推出了四种不同装饰等级的新款 Alterra 600 ATV。 2021 年 4 月,Arctic Cat 宣布新款 ATV 将作为其 2022 年车型系列的一部分,预计将于 7 月上市。新款 Alterra 600 EPS 采用全新的引擎、传动系统和底盘,可提供更强大的动力、更好的操控性和更轻鬆的维修服务。这款 ATV 的推出恰逢 Arctic Cat 为强力运动带来创新新产品的 60 週年。 2020 年 9 月, Yamaha发布了其最新 ATV 车型:2021 年 Grizzly 以及 Kodiak 700 和 450。该公司还宣布了其 2021 年青少年 ATV 阵容,包括装甲灰色的 Grizzly 90(建议零售价 3,099 美元)、Yamaha团队蓝白配色的 Raptor 90(建议零售价 3,099 美元)和Yamaha团队蓝白配色的 YFZ50(建议零售价 2,199 美元)。 2020 年 9 月,Polaris 宣布与 Zero Motorcycles 成立合资企业,开发电动全地形车和雪上摩托车。

预计全地形车的市场占有率将稳步增长。这是由于管理和製定全地形车使用标准的规则和法规发生了变化。总部位于加州的非营利组织和监管机构(例如全地形车安全研究所 (ASI))制定了全地形车的正确使用规定,并推广已通过核准的产品和配件,例如安全带、脚踏板、头盔和紧急开关。

预计北美将占据市场主导地位

预计预测期内北美将占据越野车市场的大部分份额。儘管受到疫情影响,2020年北美市场在销售方面仍然是非常成功的一年,年轻人对运动休閒活动的偏好日益增加,全地形车销量也显着增长。

休閒支出的增加和越野驾驶活动数量的增加是推动该地区 ATV 市场发展的因素。此外,预计在预测期内,各种价位的产品供应也将推动成长。

2022 年 3 月,Polaris Inc. 公布了首款搭载 Zero Motorcycles动力传动系统的全尺寸越野电动 RANGER UTV 的试运行。 2022年2月,美国Landmaster将进军电动UTV市场,推出2门、4门版本,牵引力1200LBS,4X2驾驶模式的电动UTV。 2022 年 2 月,Segway 强力运动将 Fugelman Side-by-Sides 的销售范围扩大到美国 40 多家经销店。 2020 年 6 月,川崎发布了 2020 年 MULE 和 ATV 系列。它包括暴力破解 ATV 系列、MULE PRO 和 SX 系列。为了帮助减轻这些事故的影响,美国休閒非公路用车协会 (ROHVA)、美国消费品安全委员会 (CPSC) 和美国环保署 (EPA) 等监管机构颁布了许多有关全地形车使用和乘员安全的法规。因此,预计在预测期内,政府倡议和年轻人对休閒日益增长的兴趣将成为推动该地区越野车市场成长的因素。

越野车产业概况

越野车市场由多家公司主导。业界领先的市场参与者正专注于推出新产品和新技术来吸引来自世界各地的客户。北极猫 (Arctic Cat)、北极星工业 (Polaris Industries) 和庞巴迪休閒产品 (BRP) 等大型公司已经占据了相当大的市场份额。预计电动 ATV 和 UTV 将在未来几年为该行业的公司提供丰厚的机会。

- 2022 年 3 月,Polaris Inc. 扩建了其位于俄亥俄州威尔明顿的配送中心。透过此次扩张,该公司增强了分销能力,扩大了产品种类,改善了交付和客户服务,并优化了其在北美的业务。

- 2022 年 2 月,Polaris Inc. 与全球大型公司的电动车 (EV) 充电和能源管理解决方案提供商 Wallbox NV 合作。透过此次合作,Wallbox将为美国和加拿大的Polaris电动车提供充电解决方案。

- 2021 年 3 月,Arctic Cat 宣布了 2022 年雪上摩托车阵容。新款 Thundercat 是第一款配备电子动力方向盘(EPS) 的高性能涡轮增压雪橇。 BLAST 产品线进一步扩展,增加了 BLAST XR 4000 和 BLAST XR Touring 4000,为该系列添加了第一款中型旅行雪橇。

- 2021 年 3 月,BRP 承诺在未来五年内投资 3 亿美元,到 2026 年底实现其现有产品线的电气化。 BRP 开发了自己的 Rotax 模组化电力组技术,可用于所有产品线。

- 2020 年 11 月,美国 Landmaster 推出了全新 2021 年并排卡车系列,名为 Landmaster。 2021 年 Landmaster UTV 配备了 30 多项受客户和经销商启发的新功能、一流的悬吊系统、汽车级组件和防风雨电气系统。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 按车辆类型

- 全地形车(ATV)

- 多用途车辆(UTV)

- 按应用

- 运动的

- 农业

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- Polaris Inc.

- Bombardier Recreational Products Inc.

- Yamaha Motor Corporation

- Arctic Cat Inc.

- Kawasaki Motors Corp.

- Suzuki Motor Corporation

- American LandMaster

- Kwang Yang Motor Co. Ltd

- Honda Company Motor Ltd

第七章 市场机会与未来趋势

The Off-road Vehicle Market size is estimated at USD 17.41 billion in 2025, and is expected to reach USD 21.30 billion by 2030, at a CAGR of 4.12% during the forecast period (2025-2030).

The COVID-19 pandemic hurt the market as lockdowns and travel restrictions resulted in a slowdown in demand. However, post-pandemic, as restrictions eased, recreational and sports activities started seeing positive trends. Due to this, the demand for off-road vehicles is expected to increase during the forecast period.

The growing popularity of off-road sports and the need for robust, compact equipment are elevating the demand for off-road vehicles. Moreover, as off-road vehicles have a wide range of users across the agriculture, mining, construction, and other sectors, they are expected to witness optimistic growth. Additionally, minimal maintenance costs, reduced fuel consumption, and low insurance costs will aid the demand for these vehicles in the construction industry.

ATVs and UTVs are not allowed to operate on highways and other main roads, so government authorities have allocated more funds to build new off-road trails, which may be useful for recreational enthusiasts and boost adventure sports activities worldwide. This is expected to drive the market. In addition, companies are also focusing on introducing new products with improved features to attract more customers and gain a competitive position in the market.

New technological developments, such as electric drive trains, will create new growth opportunities for the off-road vehicles market. The growing popularity of electric off-road vehicles owing to rising emission concerns will spur the off-road vehicles industry.

North America is expected to remain the largest market for off-road vehicles, followed by Europe, owing to growing consumer demand in the region. Asia-Pacific is expected to witness the fastest growth in the off-road vehicle market, owing to the high adoption rate and the booming automotive sector, leading to increased production of off-road vehicles, especially in China and India.

Off-Road Vehicle Market Trends

The All-Terrain Vehicle Segment is Likely to Witness Significant Growth

The ATV market is growing rapidly as vehicle manufacturers are developing ATVs for many end-use applications. The increasing interest of people in sports and recreational activities has emerged as a significant driving factor for the segment. Moreover, manufacturers' interest in frequent advancements in the development of various eco-friendly vehicle versions is likely to boost the market.

In August 2022, Polaris launched a new flagship RZR (R) Pro R Sport ATV model in India. The new ATV has a powerful 1997 cc 4-stroke DOHC inline four-cylinder engine responsible for delivering 225 bhp of maximum power. In 2022, Arctic Cat introduced the new Alterra 600 ATV in four different trim levels. In April 2021, Arctic Cat announced a new ATV as part of its model year 2022 line-up for dealerships in July. The new Alterra 600 EPS features an all-new engine, drivetrain, and chassis offering, with increased power, better handling, and easier servicing. The launch of the ATV coincides with Arctic Cat's 60th anniversary of bringing new and innovative products to power sports. In September 2020, Yamaha unveiled its latest ATV models, the Grizzly 2021 and Kodiak 700 and 450 models. The company unveiled its 2021 Youth ATV lineup, including the Grizzly 90 in Armor Gray (USD 3,099 MSRP), Raptor 90 in Team Yamaha Blue and White (USD 3,099 MSRP), and YFZ50 in Team Yamaha Blue and White (USD 2,199 MSRP). In September 2020, Polaris announced entering a joint venture with Zero Motorcycles to develop electric ATVs and snowmobiles.

ATVs' market share is projected to witness steady growth. This is owing to the change in the rules and regulations that govern and define the standards in the way ATVs are used. Regulatory authorities, such as the California-based non-profit organization and the All-terrain Vehicle Safety Institute (ASI), determine proper ATV usage regulations and promote approved products and accessories, such as seatbelts, footrests, helmets, and kill switches.

North America is Expected to Hold a Prominent Share in the Market

The North American region is anticipated to hold a significant share of the off-road vehicle market during the forecast period. Despite the pandemic, in 2020, the North American market had a very successful year in sales, with significant growth seen in all-terrain vehicles as the preference for sports and recreational activities rose among youth.

The increasing recreational expenditure and the increasing number of off-roading events are the factors driving the ATV market in the region. Furthermore, the availability of a wide range of products at varied prices is anticipated to enhance growth during the forecast period.

In March 2022, Polaris Inc. showed the testing of the first full-size off-road electric RANGER UTV with a Zero Motorcycles powertrain, which will be launched by the end of 2022. In February 2022, American Landmaster joined the electric UTV fray to provide electric-powered UTVs with a towing capacity of 1,200 LBS in 2-door and 4-door versions in 4X2 driving mode. In February 2022, Segway Powersports expanded the availability of Fugleman side-by-side to over 40 dealerships across the United States. In June 2020, Kawasaki unveiled the 2020 line-up for its MULE and ATV range of vehicles. It consists of the Brute Force ATV line-up, MULE PRO, and SX series. In order to reduce the impact of the hindrances, regulatory authorities, such as the Recreational Off-Highway Vehicle Association (ROHVA), the United States Consumer Product Safety Commission (CPSC), and the US Environmental Protection Agency (EPA), established numerous regulations regarding the use of ATVs and occupant safety. Thus, government initiatives and the growing interest of the youth in recreational events are the factors expected to drive the growth of the off-road vehicles market in the region during the forecast period.

Off-Road Vehicle Industry Overview

The off-road vehicle market is dominated by numerous players. The key market players in the industry emphasize introducing new products and technologies to attract customers worldwide. Some of the major players, like Arctic Cat, Polaris Industries, and Bombardier Recreational Products (BRP), captured significant shares of the market. Electric ATVs and UTVs are expected to offer lucrative opportunities for players in the industry over the coming years.

- In March 2022, Polaris Inc. expanded its distribution facility in Wilmington, Ohio. Through this expansion, the company enhanced distribution capacity, expanded product assortment, improved delivery, customer service, and optimized operations across North America.

- In February 2022, Polaris Inc. collaborated with Wallbox N.V., a leading provider of electric vehicle (EV) charging and energy management solutions worldwide. Through this collaboration, Wallbox provides charging solutions for Polaris electric vehicles in the United States and Canada.

- In March 2021, Arctic Cat announced the launch of the 2022 snowmobile line-up. The new Thundercat offers electronic power steering (EPS) for the first time on a high-performance, turbocharged sled. The BLAST line-up welcomes two new sleds to the family with the addition of the BLAST XR 4000 and BLAST XR Touring 4000, the first mid-sized touring sled.

- In March 2021, BRP invested USD 300 million over the next five years to electrify its existing product lines by the end of 2026. BRP developed its Rotax modular electric powerpack technology in-house, which may be leveraged across all product lines.

- In November 2020, American Landmaster revealed its all-new line-up of 2021 side-by-sides called the Landmaster. The 2021 Landmaster UTVs are equipped with over 30 new customer and dealer-inspired features, a best-in-class suspension system, automotive-grade components, and a weather-sealed electrical system.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Billion)

- 5.1 By Vehicle Type

- 5.1.1 All-terrain Vehicle (ATV)

- 5.1.2 Utility Task Vehicle (UTV)

- 5.2 By Application

- 5.2.1 Sports

- 5.2.2 Agricultural

- 5.2.3 Other Applications

- 5.3 By Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Polaris Inc.

- 6.2.2 Bombardier Recreational Products Inc.

- 6.2.3 Yamaha Motor Corporation

- 6.2.4 Arctic Cat Inc.

- 6.2.5 Kawasaki Motors Corp.

- 6.2.6 Suzuki Motor Corporation

- 6.2.7 American LandMaster

- 6.2.8 Kwang Yang Motor Co. Ltd

- 6.2.8.1 Honda Company Motor Ltd