|

市场调查报告书

商品编码

1687728

越南生物肥料市场占有率分析、产业趋势和成长预测(2025-2030年)Vietnam Biofertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

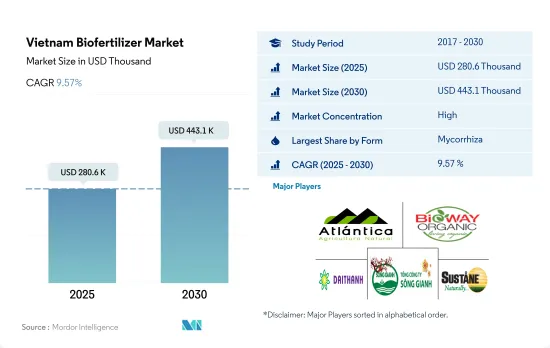

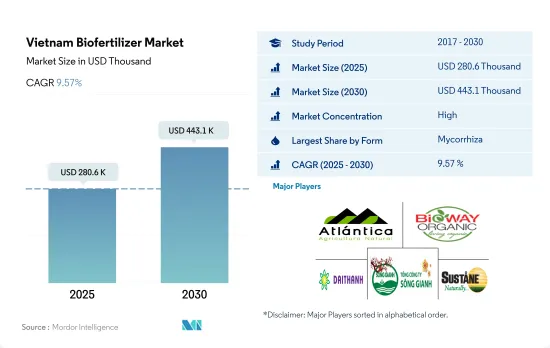

预计 2025 年越南生物肥料市场规模将达到 280,600 美元,到 2030 年将达到 443,100 美元,预测期内(2025-2030 年)的复合年增长率为 9.57%。

- 2017-2021年期间,该国生物肥料市场成长了2.1%。该国生物肥料市场成长有限主要是由于整体有机种植面积成长有限,2017-2021年期间增加了3,200公顷。然而,预计到预测期结束时生物肥料的市场规模将成长约 71.6%。

- 基于菌根真菌的生物肥料消费将在该国占据主导地位,到 2022 年将达到约 143,700 美元。这些生物肥料之所以占主导地位,是因为菌根菌群具有增强土壤中磷、其他营养物质和水的吸收的潜力,支持植物的生长和发育,并使产量提高约 30-50%。预计在 2023 年至 2029 年期间,以根瘤菌为基础的生物肥料(其中菌根真菌占据市场主导地位)的成长速度将超过其他生物肥料。

- 园艺作物将在生物肥料消费中占主导地位,2022 年约为 123,300 美元。园艺作物的主导地位主要归因于该国的种植面积较大,即占 2021 年有机作物总面积的约 59.4%。

- 国内和国际市场对有机产品的需求庞大。过度使用化学肥料是越南面临的主要挑战之一。越南政府当局正在透过各种计划和方案推广永续有机农业实践,为生物肥料提供奖励,这可能会在预测期内推动市场发展。

越南生物肥料市场趋势

该国计划扩大有机农业,由于需求不断增长,水果和蔬菜将成为首要任务。

- 过去20年来,受欧洲和越南消费者对安全有机食品需求不断增长的推动,越南的有机农业稳步发展。 2022年,越南有机作物作物面积将达38,000公顷,占亚太地区有机农地总面积的1.0%。 2021年,越南约有17,000家有机生产商、555家加工商和60家出口商。

- 有机种植以蔬果为主,2022年占种植面积的58.8%,其次是经济作物,占35.7%,重茬作物占5.5%。越南主要的有机农产品包括米、椰子、咖啡、可可、茶叶、蔬菜、肉桂和茴香。

- 由于消费者的健康意识日益增强,全球对有机农产品的需求不断增长,越南一直在寻找增加有机农产品出口的方法。美国和欧盟是越南有机农产品的最大市场,总合占市场占有率的90.0%。根据最新估计,越南目前有 60 家专注于有机农产品出口的公司,2021 年总合营业累计5.5 亿美元。

- 越南已设定目标,2030年将有机农地面积提高到农业用地总面积的2.5-3.0%。随着2017年以来国家政策的出台以及《促进有机农业发展的国家有机标准》、《有机农业法令》、《2020-2030年国家有机农业计划》等政府计划的出台,更多省市正在积极制定地方计划和计划,发展有机农业。

约 88% 的河内消费者愿意购买有机农产品,导致人均支出增加。

- 越南人民逐渐比以前更重视产品的品质和健康。健康和健身仍然是越南消费者最关注的五大议题之一。越南的人均收入逐年增加,鼓励人们在营养食品上花更多钱。

- 蔬菜中高浓度的农药和化肥一直对越南人民来说是危险的。政府控制并安全认证了河内30%的蔬菜生产区。研究采用说明统计数据,分析了河内四家大型超级市场185 名受访者的样本,得出结论,大约 15% 的消费者已经在使用有机蔬菜。然而,88%的受访者表示,如果市面上有有机蔬菜,他们愿意购买。

- 有机食品消费有限的主要原因是缺乏有机市场资讯和购买不便。有机蔬菜的平均价格比一般蔬菜高出约70%。高所得的顾客更关心蔬菜的安全性,过去的顾客更有可能为有机蔬菜支付更高的价格。这些调查结果表明,未来有必要向消费者广泛传播有关有机蔬菜的讯息。

- 越南有机食品消费量的增加将导致国内需求增加,因此需要将更多的土地转化为有机农业以生产理想的产品。为了确保农产品的质量,对有机保护和营养产品的需求不断增加,这表明该国生物肥料市场具有潜在的成长潜力。

越南生物肥料产业概况

越南生物肥料市场相当集中,前五大公司占97.08%的市占率。市场的主要企业包括 Atlantica Agricola、BIOWAY ORGANIC HIGH TECH JOINT STOCK COMPANY、DAI THANH JOINT STOCK COMPANY、Song Gianh Corporation Joint Stock Company、Sustane Natural Fertilizer Inc. 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 有机种植区

- 有机产品人均支出

- 法律规范

- 越南

- 价值炼和通路分析

第五章市场区隔

- 形式

- 固氮螺菌

- 固氮菌

- 菌根真菌

- 解磷细菌

- 根瘤菌

- 其他生物肥料

- 作物类型

- 经济作物

- 园艺作物

- 田间作物

第六章竞争格局

- 重大策略倡议

- 市场占有率分析

- 商业状况

- 公司简介.

- Atlantica Agricola

- BIoTech Bio-Agriculture

- BIOWAY ORGANIC HIGH TECH JOINT STOCK COMPANY

- DAI NAM MANUFACTURING & TRADING COMPANY LIMITED

- DAI THANH JOINT STOCK COMPANY

- Que Lam Group

- Song Gianh Corporation Joint Stock Company

- Sustane Natural Fertilizer Inc.

第七章 CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

The Vietnam Biofertilizer Market size is estimated at 280.6 thousand USD in 2025, and is expected to reach 443.1 thousand USD by 2030, growing at a CAGR of 9.57% during the forecast period (2025-2030).

- The biofertilizer market in the country grew by 2.1% between 2017 and 2021. The limited growth of the biofertilizer market in the country is mainly attributed to the limited increase in overall organic cultivation area, which increased by 3.2 thousand hectares between 2017 and 2021. However, the market value of biofertilizers is anticipated to increase by about 71.6% by the end of the forecast period.

- The consumption of mycorrhiza-based biofertilizers is dominant in the country, accounting for about USD 143.7 thousand in 2022. The dominance of these biofertilizers is because the mycorrhizal association has the potential to boost phosphorus, other nutrients, and water absorption from the soil, supporting plant growth and development and increasing yield by about 30-50%. Even though mycorrhiza dominates the market, Rhizobium-based biofertilizers are anticipated to increase faster than other biofertilizers between 2023 and 2029.

- The consumption of biofertilizers is dominant in horticultural crops, accounting for about USD 123.3 thousand in 2022. The domination of horticultural crops is mainly due to their large cultivation area in the country, i.e., about 59.4% of the total organic crop area in 2021.

- There is a huge demand for organic products in domestic and international markets. The overuse of chemical fertilizers is one of the major challenges in the country. The Vietnamese government authorities are promoting sustainable or organic cultivation practices through various schemes or programs by providing incentives for biofertilizers, which may drive the market during the forecast period.

Vietnam Biofertilizer Market Trends

The country plans to expand organic farming, with fruits and vegetables as the top priority due to increasing demand

- Over the past two decades, organic farming in Vietnam has expanded steadily, driven by increasing demand for safe and organic food by European and Vietnamese consumers. The area under organic crop cultivation in Vietnam was 38.0 thousand ha in 2022, 1.0% of the overall organic agricultural land in Asia-Pacific. In 2021, there were approximately 17,000 organic agriculture producers, 555 processors, and 60 exporters in Vietnam.

- Organic cultivation of fruit and vegetable crops dominates the country, accounting for 58.8% of the area in 2022, followed by cash crops and row crops, accounting for 35.7% and 5.5%, respectively. Vietnam's main organic agricultural products include rice, coconut, coffee, cocoa, tea, vegetables, cinnamon, and anise.

- Vietnam has been looking for ways to increase the export of organic farm produce due to increased global demand as consumers become more health conscious. The United States and the European Union are the largest markets for Vietnamese organic products, holding a combined market share of 90.0%. According to recent estimates, Vietnam currently has 60 firms focusing on the export of organic agricultural goods, which accounted for a combined revenue of USD 550.0 million in 2021.

- Vietnam has set the target of increasing the total organic land area to 2.5-3.0% of the agricultural land area by 2030. With the national policies that have been issued since 2017 and government programs, such as the National Organic Standard, the Decree on Organic Agriculture, and the National Organic Agriculture Project 2020-2030 to promote organic agriculture, more provinces and cities are actively developing local programs and projects to develop organic agriculture.

Approximately 88% of the Hanoi consumers are willing to by organic produce, leads to increase in per capita spending.

- Vietnamese have gradually begun to pay more attention to product quality and health than they had previously. Health and fitness are still among the top five concerns of Vietnamese consumers. Vietnam's per capita income has continuously increased over the years, encouraging people to spend more money on nutritious food.

- High levels of pesticides and chemical fertilizers inside vegetables are always risky to the Vietnamese population. The government controls and safely certifies 30% of the area for vegetable production in Hanoi. Samples of 185 respondents surveyed at four big supermarkets in Hanoi were analyzed by descriptive statistics, and the results concluded that about 15% of the consumers had already used organic vegetables. However, 88% wanted to try and buy if organic products were available in the market.

- Major reasons for the limitation in the consumption of organic foods were the lack of information about the organic market and the inconvenience of buying. The average price paid for organic vegetables was about 70% higher than that of conventional ones. High-income customers are concerned about the safety of vegetables, and people who have used them in the past would likely pay more for organic vegetables. These findings suggest that information about organic vegetables should be widely publicized to consumers in the future.

- The rising organic food consumption in Vietnam leads to increasing domestic demand, requiring a higher conversion of land to organic farming to produce the desired product. The demand demand for organic protection and nutrition products is increasing to ensure the quality of the produce, thus indicating a potential growth in the biofertilizer market in the country.

Vietnam Biofertilizer Industry Overview

The Vietnam Biofertilizer Market is fairly consolidated, with the top five companies occupying 97.08%. The major players in this market are Atlantica Agricola, BIOWAY ORGANIC HIGH TECH JOINT STOCK COMPANY, DAI THANH JOINT STOCK COMPANY, Song Gianh Corporation Joint Stock Company and Sustane Natural Fertilizer Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.3.1 Vietnam

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Form

- 5.1.1 Azospirillum

- 5.1.2 Azotobacter

- 5.1.3 Mycorrhiza

- 5.1.4 Phosphate Solubilizing Bacteria

- 5.1.5 Rhizobium

- 5.1.6 Other Biofertilizers

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Atlantica Agricola

- 6.4.2 Biotech Bio-Agriculture

- 6.4.3 BIOWAY ORGANIC HIGH TECH JOINT STOCK COMPANY

- 6.4.4 DAI NAM MANUFACTURING & TRADING COMPANY LIMITED

- 6.4.5 DAI THANH JOINT STOCK COMPANY

- 6.4.6 Que Lam Group

- 6.4.7 Song Gianh Corporation Joint Stock Company

- 6.4.8 Sustane Natural Fertilizer Inc.

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms