|

市场调查报告书

商品编码

1687852

机上盒 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Set-Top Box - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

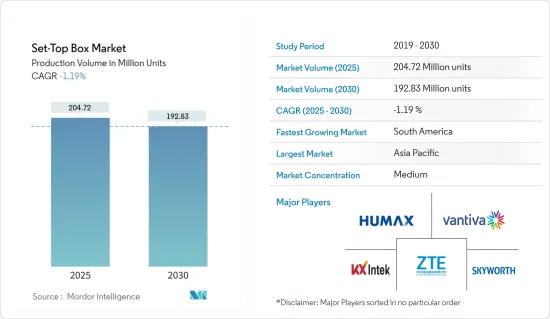

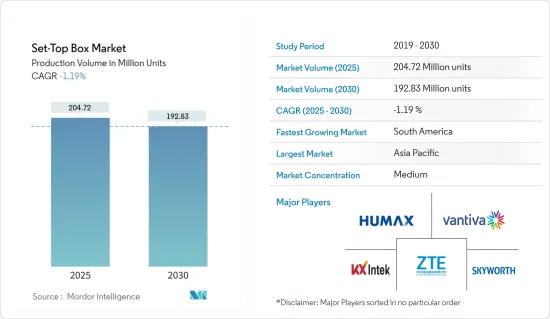

以生产量计算,机上盒市场规模预计将从 2025 年的 2.0472 亿台减少到 2030 年的 1.9283 亿台。

网路和宽频的广泛应用、对高清频道的日益增长的偏好以及点播视讯服务的兴起可能会为机上盒市场参与企业提供扩展服务的机会。

数位电视产业的发展深刻地改变了消费者与网路和电视媒体互动的方式。可支配收入的增加和中产阶级的壮大正在推动对富媒体家庭娱乐的需求。因此,下一代机上盒(STB)的需求正在蓬勃发展,尤其是那些支援基于互联网的服务、视讯点播(VoD)和传统电视广播的机上盒,市场参与者正在抓住机会。

机上盒(STB)彻底改变了电视内容的消费方式。其先进的功能和无缝集成使其成为您家中的必备品。机上盒提供丰富、身临其境的娱乐体验,从串流媒体和点播服务到互动功能。凭藉人工智慧整合和运动感测器等创新技术,该机上盒提供了用户友好的介面和一流的影像和音讯质量,确保带来愉快的观看体验。

新兴市场包括印度、中国和巴西。新兴市场互联网和宽频普及率的提高是影响网路机上盒成长的因素。根据中国互联网络资讯中心(CNNIC)的数据,2024年上半年,中国新增了740万名网路用户,网路人口已达10亿。此外,根据中国国家统计局的数据,到2022年,河北省约有100万户家庭拥有付费电视。

随着越来越多的个人采用订阅制的 OTT 串流服务,订阅疲劳正成为一个问题。作为回应,OTT 平台正在放弃传统的订阅方案和模式,转而采用按次付费等收益策略。按次付费允许观众透过私人广播为特定内容付费。

宏观经济因素对机上盒(STB)市场有重大影响。例如,更高的 GDP 成长可能会导致消费者在非必需电子产品(包括机上盒)上的支出增加。此外,随着GDP的成长,企业的收益和利润率也会随之上升,从而鼓励企业增加对技术,尤其是电子技术的投资。财务状况的改善通常会促使公司优先加强自身能力并改善客户体验。根据国际货币基金组织预测,2023年黑山GDP成长4.5%,成为欧洲成长最快的经济体。这一增长率超过了土耳其的4%和马耳他的3.8%。

机上盒市场趋势

IPTV正在经历巨大成长

- IPTV(网际网路协定电视)机上盒是一种透过网路而非传统有线或卫星讯号传送电视内容的装置。它解码并处理透过网路传输的数位视讯串流,使用户能够直接在电视上观看直播电视频道、随选视讯和其他多媒体内容。

- IPTV 的灵活性使其能够与其他数位服务(例如 Over-the-Top (OTT) 平台)无缝集成,从而创建吸引现代观众的混合模式。这些结合了 IPTV 和 OTT 服务的混合机上盒越来越受欢迎,因为它们为直播电视和串流内容提供了统一的介面,满足了消费者日益增长的随选观看偏好。

- 根据中国工业和资讯化部的数据,到 2023 年,中国 IPTV 用户将达到 4.01 亿,比 2022 年增加约 2,000 万人。

- 此外,TiVo 的 IPTV 平台以其领先的影像创新而闻名。我们提供视觉上引人注目、高度个人化的视讯解决方案。该平台确保轻鬆整合、自适应部署和可扩展性。它无缝整合了 FAST、AVOD、SVOD、OTT 和直播电视内容,以增强您的整个娱乐之旅。这一切都归功于 TiVo 传奇的通用搜寻和建议介面。此外,该平台还拥有 StartOver、CatchUp 和 OnePass 等功能。

亚太地区可望大幅成长

- 在亚太地区,随着消费者从传统有线和卫星技术转向 IPTV 和 OTT 服务,机上盒的使用率正在逐渐下降。高速网路的出现以及智慧型手机和智慧型电视的广泛普及推动了这一变化,使得获取内容变得更加容易和灵活。

- 随着 Netflix 和 Amazon Prime 等 OTT 平台以及本地参与企业提供点播观看选项,消费者越来越倾向于放弃有线电视。因此,DTT(数位地面电视)的使用也逐渐减少。 DTT 曾因无需订阅即可提供数位讯号而广受欢迎,但与 OTT 服务提供的庞大内容库相比,DTT 显得较为有限。

- 儘管存在这些变化,但市场上的一些参与者仍在试图透过推出支援 IPTV 和 OTT 功能的先进机上盒来保持相关性。这些混合盒子旨在弥合传统电视和现代串流媒体之间的差距,提供语音控制、整合应用程式和 4K 内容支援等功能。

- 印度的 Tata Sky 和马来西亚的 Astro 等公司都采用了这种混合方法,使他们能够满足更广泛的受众并留住基本客群。

- 2024年6月,领先的综合资讯和通讯技术解决方案供应商中兴通讯股份有限公司协助巴基斯坦通讯业者PTCL透过部署搭载安卓电视的B866V2F机上盒(STB)(品牌名称为SHOQ TV Box)转变其电视观看体验,升级其新闻和娱乐产品。该设备提供200个直播电视频道,其中包括60个高画质频道,以及15,000小时的随选节目,提供丰富的观赏体验。搭载Android TV的B866V2F是新一代4K IPTV/OTT机上盒,配备高效能四核心64位元晶片方案,提供高效率的视讯串流解码和快速的命令处理。

机上盒产业细分

机上盒产业处于半固体状态,各企业之间的竞争以价格、产品、市场占有率以及市场竞争强度为主导。参与企业包括 Vantiva SA、KX INTEK INC.、HUMAX(HUMAX HOLDINGS)、中兴通讯股份有限公司和深圳创维数位技术有限公司。

网路和宽频普及率的提高、对高清频道的日益偏好以及点播视讯服务的兴起可能会为机上盒市场参与企业提供扩展服务的机会。数位电视产业的发展深刻地改变了消费者与网路和电视媒体互动的方式。可支配收入的增加和中产阶级的壮大正在推动对富媒体家庭娱乐的需求。因此,下一代机上盒(STB)的需求正在蓬勃发展,尤其是那些支援基于互联网的服务、视讯点播(VoD)和传统电视广播的机上盒,市场参与者正在抓住机会。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业相关人员分析

- 评估市场的宏观经济趋势

第五章市场动态

- 市场驱动因素

- 先进技术创新

- 在新兴市场扩大采用

- 基于作业系统的设备部署

- 市场问题

- 线上OTT服务/平台的成长

- 市场机会

第六章 技术简介

第七章市场区隔

- 依技术

- 卫星/DTH

- IPTV

- 电缆

- 其他类型(DTT)

- 按决议

- SD

- HD

- 超高清以上

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 印度

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

8.供应商市场占有率分析

第九章竞争格局

- 公司简介

- Vantiva SA

- KX INTEK INC.

- HUMAX Co. Ltd(HUMAX HOLDINGS Co. Ltd)

- ZTE CORPORATION

- Shenzhen Skyworth Digital Technology Co. Ltd

- Sagemcom SAS

- Gospell Digital Technology Co. Limited

- Kaonmedia Co. Ltd

- Shenzhen Coship Electronics Co. Ltd

- Evolution Digital LLC

- Shenzhen SDMC Technology Co. Ltd

- Laxmi Remote (India) Private Limited

第十章投资分析

第11章:投资分析市场的未来

The Set-Top Box Market size in terms of production volume is expected to decline from 204.72 million units in 2025 to 192.83 million units by 2030.

Due to the increasing internet and broadband penetration, a growing preference for HD channels, and the rise of on-demand video services, the players in the set-top box market may have an opportunity to expand their services.

The digital TV industry's evolution has significantly shifted how consumers engage with media, both online and on television. With rising disposable incomes and a burgeoning middle class, there is a heightened demand for media-rich home entertainment. Consequently, market players are seizing opportunities, especially with the surging demand for next-generation set-top boxes (STBs) that cater to internet-based services, video-on-demand (VoD), and traditional television broadcasts.

Set-top boxes (STBs) have revolutionized TV content consumption. Their advanced features and seamless integration have made them indispensable in households. STBs deliver a versatile and immersive entertainment experience from streaming and on-demand services to interactive features. With innovations like AI integration and motion sensors, STBs provide a user-friendly interface and top-notch video and audio quality, guaranteeing an enjoyable viewing experience.

The emerging markets include India, China, and Brazil. The rising adoption of the internet and broadband in emerging markets is a factor influencing the growth of internet-based set-top boxes. According to the China Internet Network Information Center (CNNIC), in the first half of 2024, China reported adding 7.4 million new users to its massive one billion internet population. Furthermore, according to the National Bureau of Statistics China, in 2022, approximately one million households in the Hebei province used pay TV.

As more individuals turn to subscription-based OTT streaming services, Subscription Fatigue is becoming an increasing concern. In response, OTT platforms are moving away from traditional subscription bundles and models, opting for revenue strategies like pay-per-view. Pay-per-view allows viewers to pay for specific content via private telecast.

Macroeconomic factors wield considerable influence over the set-top box (STBs) market. For instance, higher GDP growth can increase consumer spending on nonessential electronics, including set-top boxes. Furthermore, as GDP grows, businesses tend to see a rise in revenue and profitability, prompting increased investments in technology, notably in electronic devices. This surge in financial health often directs companies to prioritize bolstering their capabilities and elevating customer experiences. According to the IMF, in 2023, Montenegro emerged as Europe's fastest-growing economy, with its GDP expanding by 4.5%. This growth outpaced Turkey, which saw a 4% increase, and Malta, which experienced a 3.8% rise.

Set-Top Box Market Trends

IPTV to Witness Major Growth

- An IPTV (Internet Protocol Television) set-top box is a device that delivers television content via the Internet instead of traditional cable or satellite signals. It decodes and processes the digital video streams transmitted over the Internet, allowing users to watch live TV channels, on-demand videos, and other multimedia content directly on their TV sets.

- The flexibility of IPTV enables it to integrate seamlessly with other digital services, such as OTT (Over-the-Top) platforms, creating hybrid models that appeal to modern viewers. These hybrid set-top boxes, which combine IPTV and OTT services, are gaining traction as they provide a unified interface for both live TV and streaming content, catering to the growing consumer preference for on-demand viewing.

- According to the Ministry of Industry and Information Technology (China), in 2023, China boasted 401 million IPTV users, marking an increase of approximately 20 million from 2022.

- In addition to this, TiVo's IPTV Platform stands out with its advanced video innovations. It provides a visually captivating and highly personalized video solution. The platform ensures easy integration, adaptable deployments, and scalability. It enhances the entire entertainment journey, seamlessly aggregating content across FAST, AVOD, SVOD, OTT, and live TV. This is all powered by TiVo's renowned universal search and recommendation interface. In addition, the platform boasts features like Start Over, Catch-up, and OnePass.

Asia-Pacific Expected to Witness Major Growth

- In the Asia-Pacific region, the use of set-top boxes is slowly declining as consumers shift away from traditional cable and satellite technologies, favoring IPTV and OTT services. The advent of high-speed internet and the widespread adoption of smartphones and smart TVs have driven this change, providing easier and more flexible access to content.

- With OTT platforms like Netflix, Amazon Prime, and local players offering on-demand viewing options, consumers find it increasingly appealing to cut the cord. This has led to a gradual reduction in the usage of DTT (Digital Terrestrial Television) as well, which, although once popular for offering digital signals without a subscription, is now seen as limited compared to the vast libraries of content provided by OTT services.

- Despite this shift, some players in the market are still trying to stay relevant by introducing advanced set-top boxes that support IPTV and OTT functionalities. These hybrid boxes aim to bridge the gap between traditional TV and modern streaming, offering features like voice control, integrated apps, and support for 4K content.

- Companies like Tata Sky in India and Astro in Malaysia have embraced this hybrid approach, allowing them to cater to a broader audience and maintain their customer base.

- In June 2024, ZTE Corporation, a key provider of integrated information and communication technology solutions, assisted the Pakistani operator PTCL in introducing the B866V2F Set Top Box (STB) powered by Android TV under the brand name SHOQ TV Box to transform the TV viewing experience and upgrade the news and entertainment offerings. The device offers 200 live television channels, including 60 channels in HD and 15,000 hours of on-demand content to deliver an enriched viewing experience. The B866V2F powered by Android TV is a new-generation 4K IPTV/OTT STB featuring a high-performance quad-core 64-bit chip solution to ensure efficient video stream decoding and speedy instruction processing.

Set-Top Box Industry Segmentation

The Set-top Box industry is semi-consolidated and has witnessed the moderate competitive rivalry between various firms is dependent on price, product, or market share, along with the intensity of competition in the market. Some of the players include Vantiva SA, KX INTEK INC., HUMAX Co. Ltd (HUMAX HOLDINGS Co. Ltd), ZTE CORPORATION, and Shenzhen Skyworth Digital Technology Co. Ltd.

Due to the increasing internet and broadband penetration, a growing preference for HD channels, and the rise of on-demand video services, the players in the set-top box market may have an opportunity to expand their services. The digital TV industry's evolution has significantly shifted how consumers engage with media, both online and on television. With rising disposable incomes and a burgeoning middle class, there is a heightened demand for media-rich home entertainment. Consequently, market players are seizing opportunities, especially with the surging demand for next-generation set-top boxes (STBs) that cater to internet-based services, video-on-demand (VoD), and traditional television broadcasts.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Stakeholder Analysis

- 4.4 An Assessment of the Macroeconomics Trends in the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Levels of Technological Innovations

- 5.1.2 Increasing Adoption in the Emerging Markets

- 5.1.3 Deployment of OS-based Devices

- 5.2 Market Challenges

- 5.2.1 Growing Online OTT Services/Platform

- 5.3 Market Opportunities

6 TECHNOLOGY SNAPSHOT

7 MARKET SEGMENTATION

- 7.1 By Technology

- 7.1.1 Satellite/DTH

- 7.1.2 IPTV

- 7.1.3 Cable

- 7.1.4 Other Types (DTT)

- 7.2 By Resolution

- 7.2.1 SD

- 7.2.2 HD

- 7.2.3 Ultra-HD and Higher

- 7.3 By Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia

- 7.3.3.1 India

- 7.3.4 Australia and New Zealand

- 7.3.5 Latin America

- 7.3.6 Middle East and Africa

8 VENDOR MARKET SHARE ANALYSIS

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Vantiva SA

- 9.1.2 KX INTEK INC.

- 9.1.3 HUMAX Co. Ltd (HUMAX HOLDINGS Co. Ltd)

- 9.1.4 ZTE CORPORATION

- 9.1.5 Shenzhen Skyworth Digital Technology Co. Ltd

- 9.1.6 Sagemcom SAS

- 9.1.7 Gospell Digital Technology Co. Limited

- 9.1.8 Kaonmedia Co. Ltd

- 9.1.9 Shenzhen Coship Electronics Co. Ltd

- 9.1.10 Evolution Digital LLC

- 9.1.11 Shenzhen SDMC Technology Co. Ltd

- 9.1.12 Laxmi Remote (India) Private Limited