|

市场调查报告书

商品编码

1690922

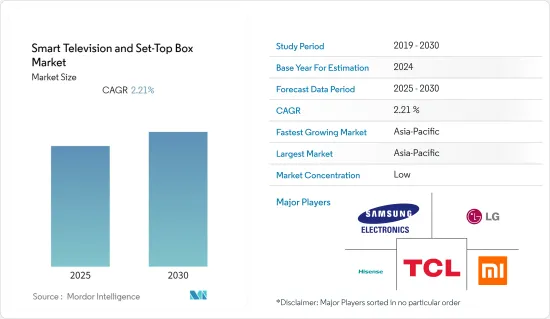

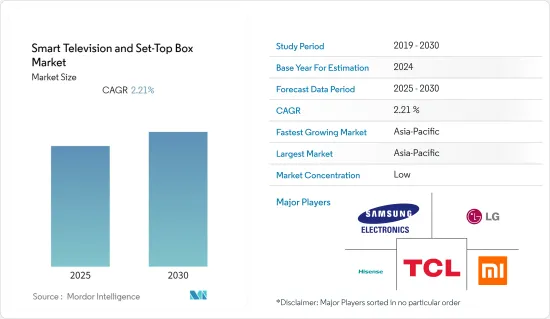

智慧电视和机上盒:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Smart Television and Set-Top Box - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计智慧电视和机上盒市场在预测期内的复合年增长率将达到 2.21%。

预计 2021 年全球机上盒市场规模将达到 2.2626 亿美元,预测期内(2022-2027 年)的复合年增长率为 -1.25%。

关键亮点

- 先进的技术创新正在推动市场成长。随着各种具有不同功能的机上盒的出现,机上盒公司之间的竞争也愈发激烈。数位录製是最理想的功能之一,因为它允许观众观看和录製他们喜欢的节目。

- 基于作业系统的设备的部署正在推动市场成长。政府法规强制安装机上盒、机上盒供应商推出基于开放作业系统的设备以及新兴国家的模拟关闭进一步推动了机上盒市场的需求。

- 例如,印度政府通过《有线电视网络(监管)法》修正案,强制安装机上盒。机上盒透过数位讯号提供更好的观看体验,并有助于防止非法频道在印度播出。

- 此外,随着高画质电视销售的不断增长,对更高影像解析度的需求正在推动提供高清和超高清内容的机上盒市场的发展。不过,美国消费者科技协会(CTA)根据其最新的「值得关注的科技趋势」调查预测,2021年美国电视出货量将下降8%至4,300万台。

- 智慧电视市场的主要参与企业包括LG电子、三星、小米、Vu、TCL、海信、索尼等。随着索尼、三星、LG和小米等多个国际品牌的进入,智慧型电视市场适度整合,少数主要企业占据了65%以上的市场占有率。这些公司正努力透过伙伴关係和频繁的产品开发来打造智慧型电视市场的下一个大热门。

- 此外,根据2021年欧洲数位电视产业调查,约35%的受访者认为机上盒是电视业者提案中有用的元素,但并非不可取代。此外,10% 的受访者认为,机上盒现在是、并且仍将是电视业者提案的核心。

- 市场现有企业正在采取强有力的竞争策略,包括技术创新、合作伙伴计画和市场扩张。例如,Technicolor 已采用注重整合优势的商家计画来吸引新业务商家。

- 新冠疫情爆发导致政府采取封锁措施以遏制病毒传播,影响了各通讯服务供应商的供应链。 2021 年 9 月,Airtel 的 DTH 部门宣布计划在 2021 年底前停止进口高清机上盒,并生产本地开发的机上盒,以应对 COVID-19 造成的供应链中断。 Airtel 的主要竞争对手 Tata Sky 已与 Technicolor 合作在印度国内生产机上盒。

智慧电视和机上盒市场趋势

先进技术创新驱动市场

- 人工智慧越来越多地被应用于机上盒,因为它有助于提高机上盒设备的影像品质。 2021年10月,SK Broadband宣布推出AI Sound Max。该机上盒将最新的人工智慧与丹麦高端音响公司 Bang & Olufsen 的音讯技术相结合。

- AI技术可以提升复杂应用中的语音能力,有助于改善客户体验。新的语音技术也被引入来导航内容。

- Android 机上盒配备了许多游戏、OTT 平台和音乐应用程式。这些重型应用程式需要处理器来确保平稳运行并提高观众参与度。

- Android 电视机上盒的需求量很大,因为它们提供更好的影像和声音品质以及串流内容存取。 2021年8月,住友电工宣布,截至2021年5月,其安卓电视机上盒「BS4K」*1在日本国内的累计出货量已突破100万台。该公司表示,销量受到了疫情的影响。

- 2021 年 10 月,捷克共和国的媒体平台供应商 nangu.TV 宣布推出一款新的 4K UHD Android TV Operator Tier 机上盒。该公司已与 Orange Slovensko、CommScope 和 Viaccess Orca 建立合作伙伴关係。它最近在斯洛伐克推出,为 Orange 客户提供直播和点播串流娱乐体验。

亚太地区占很大市场占有率

- 亚太地区是订阅视讯点播(SVOD)用户数量最多的地区之一。根据数位电视研究公司发布的资料,到2026年,亚太地区SVOD用户数量预计将达到6.98亿,较2021年(5.02亿)成长近39%。此外,预计到 2026 年,中国等国家将对 SVOD 订阅量做出重大贡献,订阅量将达到 3.54 亿。因此,预计在预测期内,SVOD 订阅量的增加和对大萤幕显示器的日益倾向将推动市场成长。

- 2022年1月,索尼电子宣布推出BRAVIA XR电视系列。该系列包括 MASTER 系列 Z9K 8K 和 X95K 4K Mini LED 型号、MASTER 系列 A90K、MASTER 系列 A95K、A80K 4K OLED 型号以及 X90K 4K LED 型号。在认知处理器 XR 的支援下,独特的 XR 背光主驱动器精确控制 Z9K 和 X95K 系列的最新一代 Mini LED 背光,实现令人难以置信的亮度。这些技术创新使公司能够提供最佳、最身临其境的观看体验,忠实地传达创作者的真实意图。据其亚太区代表称,该公司承诺为观众提供丰富的观影体验。

- 据 Netflix 印度部门称,印度是世界上最具前景的国家之一,拥有超过 2 亿个潜在电视家庭,但普及率仍较低。近几年来,智慧电视的价格变得越来越便宜,并被作为现代电视进行销售。据该公司称,印度人喜欢上网点播自己喜欢的电影和电视剧。该公司还发现,观众希望与家人一起在家中的智慧型电视上观看 Netflix 节目的需求日益增长。因此,知名公司对印度市场的乐观展望代表着该国智慧型电视市场的成长。

- 根据印度电讯监管局 (TRAI) 发布的资料显示,在疫情期间,有线电视和线性电视营运商的市场份额已被串流媒体服务夺走,而 Netflix、Amazon Prime Video 和 ALTBalaji 的用户则大幅增加。截至 2021 年 3 月,有线电视和 DTH 用户总数减少了 410 万人。

- 同样,通讯业者DTH 供应商也与 OTT参与企业合作提供完整的娱乐内容。 2021年9月,沃达丰Idea宣布,由于Over-The-Top平台消费的成长以及物联网的加速发展,通讯业正经历数位变革时期时期。该公司已与 Voot Select Sun NXT 等本地 OTT 平台合作。

- 该地区也正在出现 OTT 和 STB 供应商之间的合作。 2021 年 4 月,多系统营运商 (MSO) Siti Networks 推出了 Siti PlayTop Magic,这是一款提供 Android 和线性电视功能的 4K HDR 机上盒。

- 该地区其他地区的农村用户数量也有所增加。根据印度品牌资产基金会 (IBEF) 2021 年 7 月发布的报告,2021 年 3 月农村用户的电话普及率达到 60.27%,比 2020 年 3 月增长 1.48%。

智慧电视和机上盒产业概况

智慧电视市场由于前期投入高、市场主导参与企业少等原因,市场集中度较高。主要参与企业包括三星、TLC、LG。然而,机上盒市场细分化,有多个参与企业和区域供应商。然而,机上盒市场被认为是适度细分的。

- 2022 年 4 月-康普与 Orange Belgium 合作推出其最新的搭载 Android 电视作业系统 (OS) 的机上盒,能够为用户提供直播电视和优质串流服务。

- 2021 年 11 月-澳洲电视业者 Foxtel 与康普合作推出新款 iQ5 串流媒体机上盒。 iQ5 STB 提供超过 50,000 小时的 4K UHD 内容。其堆迭设计配备可移动 1TB 硬碟,可存取串流媒体应用程序,包括 Netflix、YouTube、ABC iView、SBS On Demand、Amazon Prime、Vevo、Paramount+ 和 10Play。康普为 Foxtel 提供全面託管服务,为 iQ5 设计、开发和部署旗舰机上盒软体。该公司还利用康普的 ECO 服务管理解决方案实现设备自动化。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围(机上盒市场)

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 市场影响

- 技术简介

- 机上盒的演变

- 主要合作

- 持续的技术发展

第五章市场动态

- 驱动程式

- 先进技术创新

- 在新兴市场扩大采用

- 部署基于作业系统的设备

- 限制因素

- 製造成本增加和供应商整合

第六章机上盒市场细分

- 依技术

- 卫星/DTH

- IPTV

- 电缆

- 其他类型(DTT)

- 按决议

- SD

- HD

- 超高清以上

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章电视市场细分

- 按决议

- HD/FHD

- 4K

- 8K

- 按显示尺寸(英吋)

- 32 或更少

- 39~43

- 48~50

- 55~60

- 65岁以上

- 依技术

- LCD

- 有机发光二极体

- QLED

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

8.供应商市场占有率分析

- 供应商市场占有率:机上盒市场

- 供应商市场占有率- 智慧电视市场

第九章竞争格局

- 公司简介 - 机上盒

- Arris International PLC(Commscope Holding Company, Inc)

- Technicolor SA

- Intek Digital Inc.

- Humax Holdings CO. Ltd

- ZTE Corporation

- Shenzhen Skyworth Digital Technology CO., Ltd

- Sagemcom SAS

- Gospell Digital Technology CO. Limited

- Kaonmedia CO. Ltd

- Shenzhen Coship Electronics CO. Ltd

- Evolution Digital LLC

- Shenzhen SDMC Technology CO. Ltd

- 公司简介 – 智慧电视

- Samsung Electronics CO., Ltd

- LG Electronics Inc.

- TCL Electronics Holdings Limited

- Hisense Group

- Xiaomi Corporation

第十章投资分析

第11章:投资分析市场的未来

The Smart Television and Set-Top Box Market is expected to register a CAGR of 2.21% during the forecast period.

The Global Set-Top Box Market was valued at USD 226.26 million in 2021 and is expected to register a CAGR of -1.25% over the forecast period (2022 - 2027).

Key Highlights

- High levels of technological innovations are driving the growth of the market. The development of a wide range of STBs equipped with various features has made the competition fierce among set-top-box companies. Digital video recording is one of the most desired features, as it enables the viewers to watch and record their favorite shows.

- The deployment of OS-Based devices drives the market growth. The government regulations mandating the installation of set-top boxes, deployment of open OS-based devices by STB vendors, and analog switch-off transition in emerging countries are further driving the demand of the STB market.

- For instance, the Government of India has made STBs compulsory through an amendment to the Cable Television Networks (Regulation) Act. Set-top boxes provide a better viewing experience because of digital signals and help in preventing illegal channels from being broadcasted in India.

- The demand for better picture resolution, in line with the increase in the sales of high-definition TVs, is also pushing the market for set-top boxes that deliver HD and UHD content. However, the Consumer Technology Association (CTA) projected that television shipments in the United States would drop by 8% to 43 million units in 2021, according to its latest "Tech Trends to Watch" research.

- Key players that are significantly active in the Smart TV market include LG Electronics, Samsung, Xiaomi, Vu, TCL, Hisense, and Sony. With the presence of various international brands such as Sony, Samsung, LG, Xiaomi, and many more, the Smart TV market is moderately consolidated, with more than 65% of the market share held by a few prominent companies. These companies are making significant efforts in the Smart TV Markets to create the next big thing by engaging in partnerships and making frequent product developments.

- Further, according to Digital TV Europe Industry Survey 2021, about 35% of the respondents suggested that the set-top is a useful element in the TV operator's proposition but is not irreplaceable, while a further 36% take the view that it is only one option the TV operator must reach customers today and is no more valuable than any other. In addition, 10% of the respondents suggested that the box is central to the TV operator's proposition and is here to stay.

- Market incumbents have been adopting robust competitive strategies involving innovation, partner programs, and market expansion, among others. For instance, Technicolor adopts an operator program focusing on integration benefits to leveraging new operators.

- The COVID-19 outbreak led to lockdowns imposed by the government to curb the spread of the virus, which affected the supply chains of various telecom service providers. In September 2021, the Airtel DTH arm announced plans to stop imports of high-definition set-top boxes by the end of 2021 to tackle the COVID-19-induced supply chain disruption and make locally-developed set-top boxes. Tata Sky, Airtel's major competitor, partnered with Technicolor for the domestic production of set-top boxes in India.

Smart Television & Set-Top Box Market Trends

High Levels of Technological Innovations to Drive the Market

- The adoption of artificial intelligence in set-top boxes has been increasing as it helps in enhancing the picture quality of STB devices. In October 2021, SK Broadband announced the launch of AI Sound Max. This set-top box combines the lasted artificial intelligence with the audio technology from the Danish luxury audio company Bang & Olufsen.

- AI technology improves the voice functions for complex applications and helps in improving customer experience. There has been the introduction of new voice technologies to navigate content.

- The Android set-top boxes come with many applications related to gaming, OTT platforms, and music. These heavy applications need a processor, which ensures smooth running, improving viewers' engagement.

- There is a strong demand for an Android TV set-top box, as it offers better picture quality and sound quality, along with access to streaming content. In August 2021, Sumitomo Electric announced that its BS4K*1 set-top box powered by Android TV exceeded a cumulative domestic shipment of one million units in May 2021. According to the company, the sales were influenced by the pandemic.

- In October 2021, the Czech Republic-based media platform provider nangu.TV unveiled a new 4K UHD Android TV Operator Tier set-top box. The company partnered with Orange Slovensko, CommScope, and Viaccess Orca. It recently launched in Slovakia and gave Orange customers a live and on-demand streaming entertainment experience.

Asia Pacific to Hold Significant Market Share

- The Asia Pacific region is one of the prominent regions for subscription video-on-demand (SVOD) subscribers. According to the data published by Digital TV Research, the Asia-Pacific region is anticipated to have 698 million SVOD subscriptions by 2026, up by almost 39% from 2021 levels, i.e., 502 million. Moreover, countries like China are expected to significantly contribute to SVOD subscriptions, with 354 million subscriptions by 2026. Therefore, the rising SVOD subscriptions and the growing inclination toward large-screen displays are anticipated to propel the market's growth over the forecast period.

- In January 2022, Sony Electronics announced the launch of the BRAVIA XR television series, which includes MASTER Series Z9K 8K and X95K 4K Mini LED models, MASTER Series A90K, MASTER Series A95K, A80K 4K OLED models, and X90K 4K LED model. Powered by Cognitive Processor XR, the unique XR Backlight Master Drive precisely controls with its latest generation Mini LED backlight in the Z9K and X95K series for incredible brightness. These innovations enable the company to deliver the best and most immersive viewing experiences, authentically delivering the creator's true intent. According to one of the company's representatives in the Asia-Pacific region, the company is committed to offering an enhanced viewing experience to the viewers.

- According to the Indian arm of Netflix, India is one of the most promising countries in the world, with more than 200 million potential TV households and still underpenetrated. Smart televisions have become more affordable over the past couple of years and represent the newest TVs sold. According to the company, Indian people love connecting to the internet and streaming their favorite films and series on demand. Also, the company witnessed an ever-growing need among audiences to watch Netflix on a smart TV at home with their family. Therefore, the positive outlook of renowned companies toward the Indian market represents the expanding market growth of smart TVs in the country.

- According to the data released by the Telecom Regulatory Authority of India (TRAI), cable and direct-to-home television service providers lost their market to streaming services during the pandemic as Netflix, Amazon Prime Video, and ALTBalaji reached a significant number of subscribers. The combined user base of cable TV operators and DTH companies declined by 4.1 million through March 2021.

- On similar lines, telecom DTH providers are also partnering with OTT players to offer complete entertainment content. In September 2021, Vodafone Idea announced that the telecom industry is undergoing a digital transformation due to the growing consumption of over-the-top (OTT) platforms, along with IoT acceleration. The company partnered with local OTT platforms such as Voot Select Sun NXT.

- The collaborations between OTT and STB vendors can also be witnessed in the region. In April 2021, multi-system operator (MSO) Siti Networks launched Siti PlayTop Magic, a 4K HDR STB offering Android and linear TV features.

- The increase in the teledensity of rural subscribers can also be witnessed in other parts of the region. According to a report published by India Brand Equity Foundation (IBEF) in July 2021, the teledensity of rural subscribers reached 60.27% in March 2021, an increase of 1.48% from March 2020, showcasing a high growth potential from the rural sector.

Smart Television & Set-Top Box Industry Overview

The Smart Television Market is concentrated due to the high initial investments and few dominant players in the market. Some of the key players are Samsung, TLC, and LG. However, the set-top box market is fragmented due to the presence of multiple players and regional providers. However, the set-top box market can be considered moderately fragmented.

- April 2022 - CommScope teamed with Orange Belgium to equip its subscribers with the latest set-top boxes powered by the Android TV operating system (OS), which can provide live television and premium streaming services.

- November 2021 - The Australian TV operator Foxtel partnered with Commscope to launch its new iQ5 streaming set-top box. The iQ5 STB offers over 50,000 hours of content in 4K UHD. Its stacked design features a detachable 1TB hard drive and access to streaming apps, including Netflix, YouTube, ABC iView, SBS On Demand, Amazon Prime, Vevo, Paramount+, and 10Play. Commscope has provided Foxtel with a fully managed service to design, develop, and deploy its flagship set-top box software for iQ5. It also leans on Commscope's ECO Service Management Solutions for device automation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study (Set-top Box Market)

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

- 4.5 Technology Snapshot

- 4.5.1 Evolution of Set-top Boxes

- 4.5.2 Key Collaborations

- 4.5.3 Ongoing Technological Developments

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 High Levels of Technological Innovations

- 5.1.2 Growing Adoption In The Emerging Markets

- 5.1.3 Deployment Of OS-based Devices

- 5.2 Restraints

- 5.2.1 Growing Production Costs and Vendor Consolidation

6 SET-TOP BOX MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Satellite/DTH

- 6.1.2 IPTV

- 6.1.3 Cable

- 6.1.4 Other Types (DTT)

- 6.2 By Resolution

- 6.2.1 SD

- 6.2.2 HD

- 6.2.3 Ultra-HD And Higher

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Rest of the World

7 TELEVISION MARKET SEGMENTATION

- 7.1 By Resolution

- 7.1.1 HD/FHD

- 7.1.2 4K

- 7.1.3 8K

- 7.2 By Display Size (in Inches)

- 7.2.1 32 And Below

- 7.2.2 39-43

- 7.2.3 48-50

- 7.2.4 55-60

- 7.2.5 65 And Above

- 7.3 By Technology

- 7.3.1 LCD

- 7.3.2 OLED

- 7.3.3 QLED

- 7.4 By Geography

- 7.4.1 North America

- 7.4.2 Europe

- 7.4.3 Asia Pacific

- 7.4.4 Rest of the World

8 VENDOR MARKET SHARE ANALYSIS

- 8.1 Vendor Market Share - Set-top Box Market

- 8.2 Vendor Market Share - Smart Television Market

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles - Set-top Box

- 9.1.1 Arris International PLC (commscope Holding Company, Inc)

- 9.1.2 Technicolor SA

- 9.1.3 Intek Digital Inc.

- 9.1.4 Humax Holdings CO. Ltd

- 9.1.5 ZTE Corporation

- 9.1.6 Shenzhen Skyworth Digital Technology CO., Ltd

- 9.1.7 Sagemcom SAS

- 9.1.8 Gospell Digital Technology CO. Limited

- 9.1.9 Kaonmedia CO. Ltd

- 9.1.10 Shenzhen Coship Electronics CO. Ltd

- 9.1.11 Evolution Digital LLC

- 9.1.12 Shenzhen SDMC Technology CO. Ltd

- 9.2 Company Profiles - Smart Television

- 9.2.1 Samsung Electronics CO., Ltd

- 9.2.2 LG Electronics Inc.

- 9.2.3 TCL Electronics Holdings Limited

- 9.2.4 Hisense Group

- 9.2.5 Xiaomi Corporation