|

市场调查报告书

商品编码

1687952

印度二手车融资:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)India Used Car Financing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

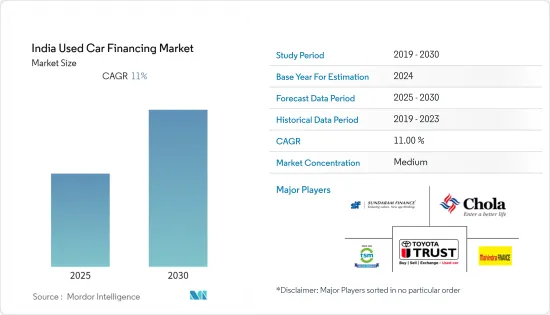

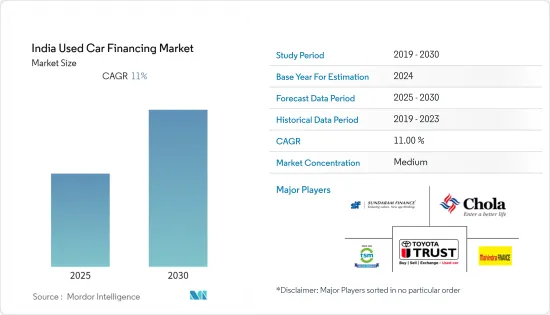

预计预测期内印度二手车融资市场的复合年增长率将达到 11%。

由于新车销售大爆发,全国主要消费者都面临财务挑战。因此,市场可能会经历显着成长。消费者越来越偏好拥有汽车并避免乘坐公共运输,这也是全国二手车市场的关键因素。拥有一辆汽车曾经是身份的象征,但如今它已成为一种必需品。汽车产业自诞生以来一直经历快速成长。消费者对二手车的青睐程度比以往任何时候都要高,有些人甚至比二手更喜欢二手车。

如今,大多数顾客在购买汽车时都会获得某种形式的经济援助。目前二手车融资利率约为13-15%,这对製造商和金融机构来说是一个巨大的机会。目前,印度的二手车产业规模约为新车产业的1.3倍,这可能会在市场上创造机会。

印度将于2020年起引入BS-VI标准,届时必要的安全设备将成为强制性要求,因此新车价格预计会上涨。此外,由于很少有製造商逐步淘汰柴油汽车产品,那些喜欢耐用性和燃油经济性的柴油汽车的消费者也开始转向二手车市场。预计这些因素将再次提振二手车融资。

二手车融资市场趋势

二手车产业快速成长带动融资市场

过去几年,印度的二手车业务呈指数级增长。 2016年二手车销售约330万辆,2019年突破400万辆,二手车销售超过新车销售。预计21财年印度二手车销售将达到约440万辆,将为二手车融资市场创造机会。

数位化的提高和新经营模式的新兴企业正在推动二手车融资市场的发展。数位化有助于储存、保留和搜寻资料。几乎所有资讯都是数位形式。这减少了所需的资本资源,也减少了文件储存的问题。汽车金融数位化的提高,延伸至端到端,包括电子签章和数位贷款文件,机会会让您在市场上占据优势。

- 2022年2月,Kuwy为线上汽车经销商推出了端到端数位借贷平台。该平台将使汽车製造商、经销商、聚合平台和贷方能够为其客户提供数位零售。

全国共享出行服务的兴起很可能成为二手车融资市场的主要驱动力。此外,二手车消费税税率从28%下调至12-18%也是推动市场发展的因素。随着各公司逐渐将重点放在减少柴油产量上,例如玛鲁蒂铃木决定在 2020 年 4 月前退出柴油市场,预计也将刺激二手车市场对小型柴油车的需求(主要原因是行驶里程数更高),除非出现对柴油车的强烈抵制。

玛鲁蒂铃木和塔塔汽车等OEM製造商占有重要地位,吸引了消费者对二手车的需求。奥迪等豪华汽车厂商也纷纷进入二手车市场,豪华车的二手车销售量不断成长。豪华车的需求也稳定成长,2018 年销量约为 50,000 辆,而上一年销量约为 40,800 辆。直到几年前,由于经济困难,拥有豪华车对许多消费者来说还是一个梦想,但这种情况正在慢慢改变,因为现在消费者可以轻鬆购买二手豪华车,而且市场变得更加有序,可以轻鬆获得融资选择、年度维护合约和更低的入门价格。

非银行金融公司倾向为二手车二手融资,以摆脱市场低迷

疫情过后,非银行金融公司 (NBFC) 的二手车融资需求正在增加。在基础设施租赁和金融服务公司 (IL&FS) 违约引发的流动性紧缩中,Mahindra Finance、Shriram Finance 和 Magma Fincorp 等大型 NBFC 正努力应对资金成本上升的问题。金融机构也正在加强借款人审查,并避免向风险相对较高的群体发放贷款。针对这种情况,一些金融机构纷纷转向二手车基金,以确保利润空间。例如

- Cholamandalam Investments & Finance Company (Chola) 的二手车融资份额在 21 财年和 22 财年为 27%,比 20 财年增长了 1%。光是上一财年(FY22)第四季度,获得融资的二手车数量就达到约 57,000 辆,与 2021 财年第四季相比大幅增加了 17,000 辆。

BS-VI 预购和流动性条件放宽将导致交易量回升,预计将为二手车金融业提供更多机会。 Cars24 是一家领先的线上汽车买卖平台,目前正进军融资业务。该公司于 2019 年 7 月从印度储备银行获得 NBFC 许可证,并计划在第一年贷款约 2,500 万美元。

二手车金融业概况

印度的二手车金融市场较为分散。大量有组织和无组织的参与企业的存在导致了这种市场局面。除了提供自己的融资外,大多数汽车製造商还与银行和其他金融机构合作,为客户提供更多选择。然而,由于从各个 NBFC 筹集贷款的程序相对简单,预计市场将向它们倾斜。 Maruti Suzuki Limited、Mahindra Finance、Poonawalla Fincorp、Sundaram Finance、Bluecarz、TSM Cars 等是该市场的主要企业。大型OEM已与 NBFC 合作,为消费者提供贷款。例如

- 2021 年 8 月,塔塔汽车与 Sundaram Finance 合作,为购买该公司乘用车系列的客户提供专属优惠。 Sundaram Finance 与塔塔汽车 (Tata Motors) 合作,在其新的「Forever」系列中列出了六年期贷款。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 汽车模型

- 掀背车

- 轿车

- 运动型多用途车

- 多用途车辆

- 投资者

- OEM

- 银行

- 金融机构

第六章 竞争格局

- 供应商市场占有率

- 公司简介

- Blue Carz

- Toyota Trust

- Mahindra Finance

- Tata Capital

- Bajaj Finserv

- Maruti Suzuki True Value

- Droom Credit

- TSM Cars

- Poonawalla Fincorp

- Sundaram Finance Ltd

- CHOLAMANDALAM

第七章 市场机会与未来趋势

The India Used Car Financing Market is expected to register a CAGR of 11% during the forecast period.

Major consumers across the country are facing financial issues due to the pandemic surge in the selling of newer cars. This is likely to witness major growth for the market. Rising consumer preference for owning a vehicle and avoiding public transportation is also a key factor for the used car market across the country. Ownership of cars, which used to be a status symbol long ago, has become a necessity in recent times. The automotive industry has witnessed exponential growth since its inception. Consumers are looking at used cars ever more than before, and some are even preferring them over two-wheelers.

Nowadays, the majority of customers opt to purchase an automobile, depending on some type of financial assistance. The current rate of financing for used cars is just around 13-15% and offers a tremendous opportunity for manufacturers as well as financial institutions alike. Currently, the used car industry is around 1.3 times the new car industry in India which is likely to create an opportunity for the market.

With BS-VI rolling out in the country from the year 2020 and subsequent mandates for necessary safety features, the cost of new cars is expected to grow up. Also, few manufacturers are phasing out their diesel portfolio, and consumers who prefer diesel cars for their durability and mileage figures are also looking toward the used car space. These factors are again expected to drive used car financing.

Second Hand Car Finance Market Trends

Burgeoning Used Car Industry Subsequently Driving the Financing Market

The used car business in India has been picking up pace over the past few years. In 2016, roughly 3.3 million used cars were sold, and in FY2019, the number breached the 4 million mark, with pre-owned cars registering more sales than new cars. In FY2021, around 4.4 million used cars were sold in India, which is likely to create an opportunity for the used car financing market.

Growing digitization and startup with new business models is promoting the used car financing market. Digitization helps to store, retain and retrieve data. Almost all information is in digital format. This reduces the capital resources required and reduces the problem of storing documents. An increase in digitization in auto finance will extend end to end, including e-signatures and digital loan documents have an opportunity to gain an advantage over the market. For instance,

- In February 2022, Kuwy launched end to end digital lending platform for online car sellers. The platform allows car manufacturers, dealers, aggregator platforms, and lenders to offer digital retailing to their customers.

The rise in shared mobility services across the country is likely to be a key factor for the used car financing market. Also, the revision of the GST rate on used cars from 28% to 12 - 18% is also acting as a driver of the market. With companies gradually focusing on reducing the production of diesel cars, for instance, Maruti Suzuki's decision to exit the diesel car segment by April 2020 is also expected to increase the demand for compact diesel cars (mainly due to their higher mileage figures) in the used car market, unless there is a backlash against diesel cars.

The major presence of OEMs, including Maruti Suzuki, Tata Motors, and others, are attracting consumers for used cars and offering better financing options owing to which the demand for used cars is increasing. Even luxury car makers, including Audi, also entered the used car market, which increased the sale of used premium cars. The demand for luxury cars is also witnessing a continual increase, with nearly 50,000 units sold in 2018 compared to around 40,800 in the previous year. Until a few years ago, owning a luxury car used to be a dream for numerous consumers, owing to financial hurdles, but this is gradually changing, as the consumers can easily buy pre-owned luxury vehicles, as the market is becoming more organized with easy access to financing options, annual maintenance contracts, and lower entry prices.

NBFC's inclined towards funding used cars to recover from market slump

Non-Banking Financial Companies (NBFCs) are witnessing an increase in demand for financing for used vehicles post-Covid. Leading NBFCs such as Mahindra Finance, Shriram Finance, and Magma Fincorp have been forced to struggle with the rising cost of funds amid a liquidity squeeze that was sparked by the default by Infrastructure Leasing & Financial Services (IL&FS). Even financiers have tightened screening of borrowers and are now going slow on the relatively higher risk segments. In lieu of this situation, several lenders have turned to fund used cars to protect their margins. For instance,

- Cholamandalam Investments & Finance Company (Chola) witnessed a share of used vehicle finance in FY21 and FY22 was 27%, an increase of 1% over FY20. In Q4 last fiscal (FY22) alone, the number of used vehicles that were financed rose to around 57,000, a jump by 17,000 vehicles, when compared with the corresponding fourth quarter of FY21.

Anticipatory volume recovery led by BS-VI pre-buying and easing of the liquidity situation is expected to provide further opportunity to the used car financing sector. Cars24, a leading online platform that facilitates buying and selling of cars, is now venturing into the financing business. The company acquired NBFC license from the Reserve Bank of India in July 2019 and is aiming for disbursement of nearly US$ 25 million in its maiden year.

Second Hand Car Finance Industry Overview

The market for used car financing in India is on the fragmented side. The presence of many organized and un-organized players has created such a market scenario. Also, most auto manufacturers, apart from offering their own financing, have tie-ups with banks and other financial institutions to offer a wider choice for their customers. But the relatively easier procedures to procure a loan from various NBFCs are expected to tilt the market in their favor. Maruti Suzuki Limited, Mahindra Finance, Poonawalla Fincorp, Sundaram Finance, Bluecarz, TSM Cars, etc., are some of the major players in the market. Major OEMs are partnering with the NBFCs to provide loans for the consumer. For instance,

- In August 2021, Tata Motors partnered with Sundaram Finance to offer exclusive offers to customers opting to purchase its range of passenger cars. Under the partnership with TATA Motors, Sundaram Finance would offer six-year loans on the new 'Forever' range of cars, and with 100% financing, that would require a minimal down payment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Car Type

- 5.1.1 Hatchbacks

- 5.1.2 Sedans

- 5.1.3 Sports Utility Vehicle

- 5.1.4 Multi-purpose Vehicle

- 5.2 Financier

- 5.2.1 OEMs

- 5.2.2 Banks

- 5.2.3 NBFCs

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Blue Carz

- 6.2.2 Toyota Trust

- 6.2.3 Mahindra Finance

- 6.2.4 Tata Capital

- 6.2.5 Bajaj Finserv

- 6.2.6 Maruti Suzuki True Value

- 6.2.7 Droom Credit

- 6.2.8 TSM Cars

- 6.2.9 Poonawalla Fincorp

- 6.2.10 Sundaram Finance Ltd

- 6.2.11 CHOLAMANDALAM