|

市场调查报告书

商品编码

1689918

欧洲消费品包装:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Europe Consumer Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

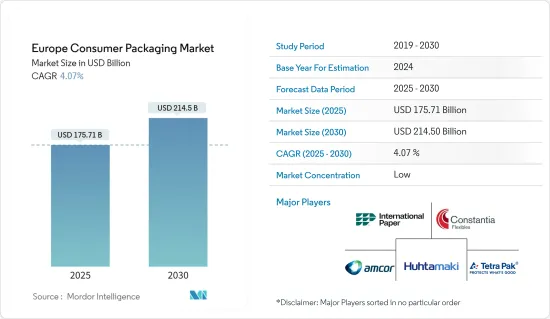

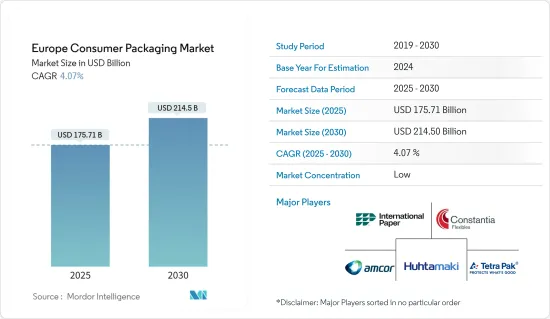

预计 2025 年欧洲消费包装市场规模为 1,757.1 亿美元,到 2030 年将达到 2,145 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.07%。

主要亮点

- 技术创新、永续性问题和有吸引力的经济因素是推动消费包装成长的因素。包装在消费品产业中发挥着至关重要的作用,它可以使产品对潜在买家具有吸引力,并确保消费者收到精緻、安全、方便和合适的产品。

- 塑胶包装因其重量轻、不易破碎、易于处理而受到消费者的欢迎。大型製造商也青睐塑胶包装,因为其生产成本低。此外,聚对苯二甲酸乙二醇酯(PET)和高密度聚苯乙烯(HDPE)等聚合物的引入扩大了塑胶包装的应用范围。然而,减少包装中使用的对环境有害的聚合物的数量是消费包装市场研究最多的领域之一。

- 此外,欧盟正在透过推广循环经济原则来开放塑胶市场。一次性塑胶包装的广泛使用受到了严格审查,重点是塑胶废弃物。为解决这个问题,人们正在采取多种策略,包括投资开发替代材料和生物基塑胶、设计更可回收的包装以及改善塑胶废弃物的回收和处理。

- 原材料市场仍承受着巨大的压力。市场需求仍然高涨,而供应却在下降,导致整个欧洲的原物料价格处于前所未有的水平。再生塑胶的价格因原生塑胶价格造成需求变化而波动。当原生塑胶的价格上涨时,对再生塑胶的需求就会增加,导致成本上升。

欧洲消费品包装市场趋势

预计化妆品行业将出现显着增长。

- 向电子商务成长的转变反映了订单种类的增加、复杂性的增加和包装的多变性。劳动力和季节性也会影响履约业务的订单能力,使包装变得复杂并增加损失。此外,网路运输限制和成本上升预计仍将持续。为了有效竞争并赢得客户忠诚度,您可能需要更多客製化和独特的解决方案。

- 由于美容行业消费者偏好的不断变化,有机和天然化妆品的潜在市场目前在欧洲。根据全球网路指数对超过 2,300 名经常购买有机和天然美容产品的英国网友进行的调查,80% 的人这样做是出于健康和环境方面的考虑。由于拥有庞大的消费群,欧洲化妆品市场预计将继续蓬勃发展并保持领先地位。

- 欧洲管材製造商协会(ETMA)表示,2023年上半年市场维持稳定。化妆品和牙科保健市场呈现正面的市场发展,需求分别成长约2%。就软管市场永续发展而言,显然单靠消费后塑胶包装的机械回收无法达到塑胶软管所需的产量。此外,充满挑战的政治和经济背景仍在继续。儘管订单大幅减少,订单仍然很大。正如 ETMA 所言,今年剩余时间的市场前景尚不明朗。

- 根据深度购物者和消费者洞察提供者IKW预测,2023年德国身体保养产品销售额将达到约174.9亿美元,高于2017年的约149.6亿美元。随着身体保养产品需求的增加,化妆品包装的需求也将随之增加。包装是化妆品的关键方面,随着身体保养产品消费的增长,製造商将需要更具创新性和吸引力的包装解决方案。

波兰:一个正在经历显着成长的市场

- 波兰是欧洲消费品包装供应商的主要市场之一。这是因为各个终端用户产业对先进和创新包装的投资增加,并且越来越关注轻质、便携、灵活和环保的包装。

- 该国已见证了各类市场参与者的多项投资,并且包括食品和饮料在内的各个行业对消费包装的需求不断增长。

- UFlex 位于波兰的包装膜工厂先前年产能为 30,000 吨(TPA),但随着新的 10.4 公尺宽 BOPET 生产线的运作,年产能为 45,000 吨,UFlex 子公司 Flex Films 已成为欧盟最大的 BOPET 生产商之一。

- 许多波兰包装公司也透过开设新的製造部门来扩大其地理影响力,预计这将增加该地区软包装市场的规模。例如,波兰和欧洲领先的塑胶包装製造商之一Plast-Box集团在华沙附近开设了一个占地超过3,800平方公尺的新仓库和物流中心。

- 据欧盟统计局称,到2025年,波兰塑胶包装产品生产收益预计将达到约62.9亿美元。波兰塑胶包装产品产量的增加将带来供应链更大程度的整合。其结果将是更有效率的製造流程、更低的成本和更好的供应链控制,从而使整个欧洲消费包装市场受益。

欧洲消费品包装产业概况

欧洲消费品包装市场分散,供应商众多。该报告提供了市场参与者竞争格局的信息,并分析了主要的消费包装公司及其产品。

- 2024 年 4 月,国际纸业宣布收购 DS Smith,打造一家在北美和欧洲拥有强大影响力的差异化瓦楞包装公司。该协议旨在创建一家主要从环保纤维包装中获取收益的公司,收入将占总收益的 90% 左右。

- 2023 年 10 月,利乐宣布与 AB Biotek 人类营养与健康部门合作推出创新的后生元食品解决方案。后生元可以在食品和饮料、乳製品、冰淇淋和起司等超高温(UHT)产品的混合阶段以粉末的形式与食品加工相结合。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

第五章市场动态

- 市场驱动因素

- 终端用户产业对软塑胶包装解决方案的需求不断增长

- 扩大便利商店、电子商务等流通管道的使用

- 市场限制

- 原物料价格波动

第六章市场区隔

- 按材质

- 塑胶

- 材料类型

- PE(聚乙烯)

- PP(聚丙烯)

- PVC(聚氯乙烯)

- PET(聚对苯二甲酸乙二醇酯)

- 其他的

- 硬质塑胶包装

- 软塑胶包装

- 纸

- 纸板

- 箱板纸/挂面纸板

- 其他的

- 玻璃

- 金属

- 能

- 瓶盖和瓶塞

- 其他的

- 塑胶

- 按最终用户产业

- 食物

- 饮料

- 製药和医疗保健

- 化妆品、个人护理和家居用品

- 按国家

- 英国

- 德国

- 法国

- 义大利

- 波兰

第七章竞争格局

- 公司简介

- Huhtamaki Oyj

- Amcor Group GmbH

- The Tetra Pak Group

- International Paper Company

- Constantia Flexibles Group GmbH

- Sealed Air Corporation

- DS Smith PLC

- Mondi Group

- Ardagh Group

- Crown Holdings Inc.

- Massilly Holding SAS

- Tubex GmbH

- Owens-Illinois Inc.

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 69296

The Europe Consumer Packaging Market size is estimated at USD 175.71 billion in 2025, and is expected to reach USD 214.50 billion by 2030, at a CAGR of 4.07% during the forecast period (2025-2030).

Key Highlights

- Technological innovations, sustainability trepidations, and attractive economics are the factors driving the growth of consumer packaging. Packaging plays a crucial role in the consumer goods industry in making the product appealing to the potential buyer and delivering products to the consumer that are sufficiently sophisticated, safe, convenient, and appropriate.

- Plastic packaging has become popular among consumers, as it is lightweight and unbreakable, making it easier to handle. Even significant manufacturers prefer plastic packaging, owing to the lower cost of production. Moreover, introducing polymers, such as polyethylene terephthalate (PET) and high-density polyethylene (HDPE), expands plastic packaging applications. However, reducing the amount of environmentally harmful polymers used in packaging is one of the most researched areas in the consumer packaging market.

- Furthermore, the European Union is pioneering the plastic market with its drive toward circular economy principles. It is mainly focused on plastic waste, as the high-volume, single-use item plastic packaging has come under scrutiny. Multiple strategies are being advanced to address this issue, including substituting alternative materials, investing in the development of bio-based plastics, designing packaging that is easier to process in recycling, and improving the recycling and processing of plastic waste.

- The raw materials market continues to be under considerable strain. Market demand remains high, coupled with reduced supply, and this continues to keep material prices at rates never previously seen across Europe. Recycled plastic prices fluctuate due to changes in demand, which can be attributed to the price of virgin plastics. Demand for recycled plastic will increase in times of higher prices for virgin plastic, leading to its increased cost.

Europe Consumer Packaging Market Trends

The Cosmetics Segment is Anticipated to Witness Significant Growth

- The shift toward e-commerce growth reflects the expansion of order mix, greater complexity, and more packaging diversity. Labor and seasonality also affect the ability of fulfillment operations to meet orders, complicating packaging and resulting in increased damages. Furthermore, network shipping constraints and rising costs are expected to continue. More customization and unique solutions may be needed to compete effectively and achieve customer loyalty.

- The potential market for organic and natural cosmetic products is currently in Europe, driven by the shifting consumer preferences toward the beauty industry throughout time. According to a poll by Global Web Index on more than 2,300 web users from the United Kingdom who routinely purchase organic and natural cosmetics, 80% of them do so out of concern for their health and the environment. The European cosmetics market is anticipated to flourish going forward and hold onto its top spot in the next years due to its big consumer base.

- The European Tube Manufacturers Association (ETMA) indicated market stability in the first half of 2023. Positive development was observed in demand from the cosmetics and dental care markets, with an increase of about 2% each. In terms of sustainable progress within the tube market, it is evident that the quantities required for plastic tubes cannot be achieved through mechanical recycling of used plastic packaging alone. In addition, the challenging political and economic backdrop persists. Even though there is a notable decrease in incoming orders, the order backlog remains substantial. The market outlook for the latter half of the year is uncertain, as alleged by ETMA.

- According to IKW, a provider of in-depth shopper and consumer insights, in 2023, body care products generated a revenue of roughly USD 17.49 billion in Germany compared to 2017, which was around USD 14.96 billion. With a rising demand for body care products, there will be a corresponding increase in the demand for cosmetic packaging. Packaging is a crucial aspect of cosmetic products, and as the consumption of body care products grows, manufacturers will require more innovative and appealing packaging solutions.

Poland to Witness Significant Market Growth

- Poland is one of the significant markets for European consumer packaging vendors. This is due to the high rate of investment in advanced and innovative packaging across its various end-user industries and the country's growing focus on lightweight, portable, flexible, and environment-friendly packaging.

- The country has witnessed multiple investments by various market players and the rising demand for consumer packaging in various industries, such as food and beverages.

- The earlier capacity of UFlex's packaging films plant in Poland was 30,000 TPA, and an additional 10.4-m BOPET line of 45,000 TPA has been commissioned, making UFlex's subsidiary Flex Films one of the largest BOPET manufacturers in the European Union.

- Many Polish packaging companies are also expanding their geographical presence by opening new manufacturing units, which is expected to boost the scope of the region's flexible packaging market. For instance, Plast-Box Group, one of Poland's and Europe's prominent plastic packaging producers, opened a new warehouse and logistics center near Warsaw with an area of over 3,800 sq. m.

- According to Eurostat, the revenue from manufacturing plastic packing goods in Poland is projected to amount to approximately USD 6.29 billion by 2025. Increased production of plastic packaging goods in Poland will lead to better integration within the supply chain. This will result in more efficient manufacturing processes, reduced costs, and improved overall supply chain management, benefiting the entire European consumer packaging market.

Europe Consumer Packaging Industry Overview

The consumer packaging market in Europe is fragmented due to the presence of many vendors. This report offers information about the competitive environment among players in this market and analyzes key consumer packaging companies and their products.

- In April 2024, International Paper announced the acquisition of DS Smith to form a distinct corrugated packaging enterprise with a strong presence in North America and Europe. The agreement aims to create a company primarily generating revenue from environmentally friendly fiber-based packaging, constituting around 90% of its total revenue.

- In October 2023, Tetra Pak announced the introduction of a range of innovative postbiotic food solutions through its collaboration with AB Biotek Human Nutrition & Health. Postbiotics can be integrated with food processing in a powder form at the mixing stage of ultra-high temperature (UHT) products, such as beverages, dairy products, ice cream, and cheeses.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Flexible Plastic Packaging Solutions Across End-user Industries

- 5.1.2 Growing Utilization of Distribution Channels such as Convenience Stores and E-commerce

- 5.2 Market Restraints

- 5.2.1 Increasing Price Volatility of Raw Materials

6 MARKET SEGMENTATION

- 6.1 Material

- 6.1.1 Plastic

- 6.1.1.1 Material Type

- 6.1.1.1.1 PE (Polyethylene)

- 6.1.1.1.2 PP (Polypropylene)

- 6.1.1.1.3 PVC (Poly Vinyl Chloride)

- 6.1.1.1.4 PET (Polyethylene Terephthalate)

- 6.1.1.1.5 Other Material Types

- 6.1.1.2 By Type

- 6.1.1.2.1 Rigid Plastic Packaging

- 6.1.1.2.2 Flexible Plastic Packaging

- 6.1.2 Paper

- 6.1.2.1 Type

- 6.1.2.1.1 Carton Board

- 6.1.2.1.2 Containerboard and Linerboard

- 6.1.2.1.3 Other Types

- 6.1.3 Glass

- 6.1.4 Metal

- 6.1.4.1 Type

- 6.1.4.1.1 Cans

- 6.1.4.1.2 Caps and Closures

- 6.1.4.1.3 Other Types

- 6.1.1 Plastic

- 6.2 End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Pharmaceutical and Healthcare

- 6.2.4 Cosmetics, Personal Care, and Household Care

- 6.3 Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Italy

- 6.3.5 Poland

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Huhtamaki Oyj

- 7.1.2 Amcor Group GmbH

- 7.1.3 The Tetra Pak Group

- 7.1.4 International Paper Company

- 7.1.5 Constantia Flexibles Group GmbH

- 7.1.6 Sealed Air Corporation

- 7.1.7 DS Smith PLC

- 7.1.8 Mondi Group

- 7.1.9 Ardagh Group

- 7.1.10 Crown Holdings Inc.

- 7.1.11 Massilly Holding SAS

- 7.1.12 Tubex GmbH

- 7.1.13 Owens-Illinois Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219