|

市场调查报告书

商品编码

1692579

亚太建筑胶合剂和密封剂:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Asia-Pacific Construction Adhesives & Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

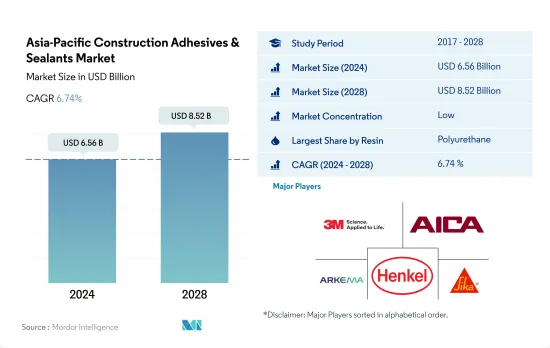

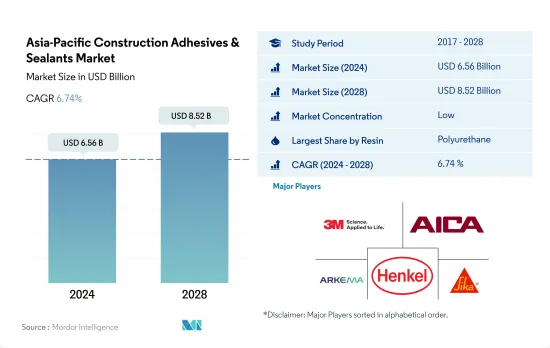

亚太地区建筑胶合剂和密封剂市场规模预计在 2024 年为 65.6 亿美元,预计到 2028 年将达到 85.2 亿美元,预测期内(2024-2028 年)的复合年增长率为 6.74%。

基础设施计划支持中国和日本建筑胶粘剂和密封胶的成长

- 在历史时期(2017-2021 年)和基准年(2021 年)中,聚氨酯和丙烯酸树脂基黏合剂和密封剂是其他树脂类型中使用最多的。由于这些树脂具有很强的黏合强度和可用作结构性黏着剂,预计它们将成为预测期内使用最广泛的树脂类型。在亚太地区,2021年约有49%的丙烯酸基建筑胶黏剂采用水性技术生产,而聚氨酯基建筑胶黏剂主要采用密封胶技术生产。

- 根据地区划分,2019-20 年期间建筑胶合剂和密封剂的需求增加了约 13%,预计预测期(2022-2028 年)将增加约 4.6%。在所有树脂类型中,预计预测期内(2022-2028 年)硅胶树脂基黏合剂和密封剂的复合年增长率最高,约为 5%。

- 中国占全球建筑胶黏剂和密封剂需求的最大份额。 2021年,中国的需求量为12亿公斤,预计到2028年将达到18亿公斤,复合年增长率为6.9%。聚氨酯、丙烯酸和硅树脂基胶黏剂和密封剂产品预计将占中国建设产业总需求的50%以上。日本是建筑胶合剂的第二大消费国,2021 年的份额约为 12%,预计在预测期内(2022-2028 年)的复合年增长率约为 2.7%。日本的高层建筑和高层建筑建筑建设计划数量正在增加,这是黏合剂需求的主要驱动力。

建筑投资的增加可能会在未来推动对黏合剂和密封剂的需求。

- 亚太地区是建筑胶黏剂蓬勃发展的市场。儘管由于新冠疫情影响亚太国家,2020 年上半年建筑和房地产活动有所放缓,但预计 2021 年将迅速復苏,并在整个 2022-2028 年预测期内保持强劲增长。预计2030年亚太地区将成为最重要的建筑和房地产市场,占全球产量的约40%。

- 在2022年至2028年的预测期内,中国预计将引领全球建筑和房地产产业,刺激该地区的成长。几十年来,中国对基础设施建设的大量投资、城市人口的激增以及对中国工业设施的大规模外国直接投资(FDI)极大地促进了中国建筑业的崛起。受新冠疫情影响,2020年上半年中国住宅和非住宅建筑业出现下滑,但随着消费者和企业信心的恢復,建筑业迅速復苏。随着金属、木材等建筑材料全球价格飙升,中国建筑企业的生产成本大幅上升,但他们仍能将这些成本转嫁给最终客户。

- 政府对基础设施的投资对于新冠疫情后建筑业和房地产业的復苏至关重要。预计中国、印度、日本和其他地区领先国家的大规模投资将在短期至中期推动亚太市场的成长。预计所有这些因素将在预测期内增加全部区域对建筑黏合剂和密封剂的需求。

亚太地区建筑胶合剂和密封剂市场趋势

增加对扩大基础设施活动的投资将扩大产业规模

- 亚太地区由世界主要经济体推动:中国、日本和印度。中国正处于持续都市化进程中,目标是2030年都市化率达到70%。都市化的加速将增加都市区居住空间的需求,鼓励中等收入都市区寻求改善的居住条件,这将影响住宅市场,进而增加中国的住宅建设。

- 非住宅基础设施可能会大幅扩张。 2019年,中国政府核准了26个基础建设计划,总价值约1420亿美元,预计2023年完工。中国拥有全球最大的建筑市场,占全球建筑投资的20%。到2030年,政府计划在建设方面投资超过13兆美元。因此,预计预测期内(2022-2028 年)建筑市场的复合年增长率为 4.48%。

- 建筑业是亚太地区最大的产业之一,2019 年取得了可喜的成长。由于该地区包含越南、马来西亚、印尼、泰国和其他南亚国家等许多新兴国家,该产业持续成长。然而,受新冠疫情影响,全部区域政府实施封锁,建筑业大幅下滑,严重影响了包括印度、中国、日本和东南亚国协在内的开发中国家。

- 亚太地区的建筑业也越来越受到外国投资者的兴趣。由于发展中国家为投资者提供更好的利益和机会,建筑开发领域的外国直接投资(FDI)正在增加。

亚太地区建筑胶合剂及密封剂产业概况

亚太建筑胶黏剂和密封剂市场分散,前五大公司占17.60%。该市场的主要企业有:3M、Aica Kogyo、阿科玛集团、汉高股份公司和西卡股份公司(按字母顺序排列)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 建造

- 法律规范

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 新加坡

- 韩国

- 泰国

- 价值炼和通路分析

第五章市场区隔

- 树脂

- 丙烯酸纤维

- 氰基丙烯酸酯

- 环氧树脂

- 聚氨酯

- 硅胶

- VAE・EVA

- 其他树脂

- 科技

- 热熔胶

- 反应性

- 密封剂

- 溶剂型

- 水性

- 国家

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 新加坡

- 韩国

- 泰国

- 其他亚太地区

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- 3M

- Aica Kogyo Co..Ltd.

- Arkema Group

- HB Fuller Company

- Henkel AG & Co. KGaA

- Momentive

- Shin-Etsu Chemical Co., Ltd.

- Sika AG

- Soudal Holding NV

- THE YOKOHAMA RUBBER CO., LTD.

第七章:CEO面临的关键策略问题

第 8 章 附录

- 全球黏合剂和密封剂产业概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 驱动因素、限制因素和机会

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 92416

The Asia-Pacific Construction Adhesives & Sealants Market size is estimated at 6.56 billion USD in 2024, and is expected to reach 8.52 billion USD by 2028, growing at a CAGR of 6.74% during the forecast period (2024-2028).

Infrastructure projects to support the growth of construction adhesives and sealants in China and Japan

- Polyurethane and Acrylic resin-based adhesives and sealants are the most used among other reins types during the historical period, 2017-2021, and base year, 2021. They are expected to be the most used resin types during the forecast period because of the strong bonds and their applicability as structural adhesives. In Asia-Pacific, about 49% of the acrylic-based construction adhesives were manufactured in water-borne technology in 2021 and polyurethane based products were manufactured majorly in sealant technology.

- Regionally, during 2019-20, the demand for construction adhesives and sealants grew by about 13% and is expected to grow by about 4.6% during the forecast period (2022 - 2028). Among all the resin types, silicone resin-based adhesives and sealants are expected to register the largest CAGR of around 5% during the forecast period (2022 - 2028).

- China occupied the largest share of the demand for construction adhesives and sealants globally. In 2021, the demand generated from China was 1.2 billion kilograms and the demand is expected to reach 1.8 billion kilograms with a CAGR of 6.9% by 2028. Polyurethane, acrylic, and silicon resin-based adhesives and sealants products are expected to occupy more than 50% of the total demand generated by China's construction industry. Japan is the second-largest consumer of construction adhesives, and it had about 12% of shares in 2021, is expected to register a CAGR of about 2.7% during the forecast period (2022 - 2028). Japan is seeing an increased number of skyscraper and high-rise building projects, which has been the major source of the demand for adhesives.

Rising construction investments likely to propel the demand for adhesives & sealants in the future

- Asia-Pacific is a booming market for construction adhesives. Despite a slowdown in construction and real estate activities during the first half of 2020 as the COVID-19 pandemic affected Asia-Pacific countries, the area rebounded fast in 2021 and is expected to maintain solid growth throughout the forecast period 2022-2028. The Asia-Pacific region is expected to be the most important construction and real estate market, accounting for roughly 40% of global production value by 2030.

- Over the forecast period 2022-2028, China is expected to be the leading global construction and real estate industry, fueling regional growth. Decades of substantial Chinese investments in infrastructure expansions, a fast-rising urban population, and extensive foreign direct investment (FDI) into industrial facilities in the nation have contributed significantly to the rise of the Chinese construction sector. Due to the COVID-19 outbreak, China suffered a drop in residential and non-residential buildings in the first half of 2020 but recovered quickly as consumers' and corporate confidence returned. With the global surge in building material prices, including metals and wood, Chinese construction businesses are seeing a significant increase in manufacturing costs but are still able to pass these costs on to final customers.

- Government infrastructure investment is critical to the building and real estate industries' revival following the COVID-19 pandemic. Major investments planned in China, India, Japan, and other regional leaders are expected to boost the Asia-Pacific market's growth in the short to medium term. All such factors are expected to increase the demand for construction adhesives and sealants across the region over the forecast period.

Asia-Pacific Construction Adhesives & Sealants Market Trends

Raising investment to expand infrastructural activities will augment the industry size

- Asia-Pacific is driven by the world's major economies, such as China, Japan, and India. China is promoting and undergoing a process of continuous urbanization, with a target rate of 70% for 2030. The increased living spaces required in the urban areas resulting from increasing urbanization and the desire of middle-income urban residents to improve their living conditions may impact the housing market and, thereby, increase the residential constructions in the country.

- Non-residential infrastructure is likely to expand significantly. The Chinese government approved 26 infrastructure projects worth approximately USD 142 billion in 2019, with completion due in 2023. The country has the largest construction market globally, accounting for 20% of all worldwide construction investments. By 2030, the government plans to spend over USD 13 trillion on construction. Thus, the construction market is expected to register a 4.48% CAGR during the forecast period (2022-2028).

- The construction industry is one of the largest industries in Asia-Pacific and recorded promising growth in 2019. The industry continues to grow as the region constitutes many developing countries such as Vietnam, Malaysia, Indonesia, Thailand, and other South Asian countries. However, due to the COVID-19 pandemic, the construction sector witnessed a significant decline owing to lockdowns by governments across the region, which severely affected developing countries, including India, China, Japan, and ASEAN countries.

- The Asia-Pacific region is also witnessing significant interest from international investors in the construction space. Foreign Direct Investment (FDI) in the construction development sector is increasing as developing countries provide better returns and opportunities for investors.

Asia-Pacific Construction Adhesives & Sealants Industry Overview

The Asia-Pacific Construction Adhesives & Sealants Market is fragmented, with the top five companies occupying 17.60%. The major players in this market are 3M, Aica Kogyo Co..Ltd., Arkema Group, Henkel AG & Co. KGaA and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Building and Construction

- 4.2 Regulatory Framework

- 4.2.1 Australia

- 4.2.2 China

- 4.2.3 India

- 4.2.4 Indonesia

- 4.2.5 Japan

- 4.2.6 Malaysia

- 4.2.7 Singapore

- 4.2.8 South Korea

- 4.2.9 Thailand

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 Resin

- 5.1.1 Acrylic

- 5.1.2 Cyanoacrylate

- 5.1.3 Epoxy

- 5.1.4 Polyurethane

- 5.1.5 Silicone

- 5.1.6 VAE/EVA

- 5.1.7 Other Resins

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Sealants

- 5.2.4 Solvent-borne

- 5.2.5 Water-borne

- 5.3 Country

- 5.3.1 Australia

- 5.3.2 China

- 5.3.3 India

- 5.3.4 Indonesia

- 5.3.5 Japan

- 5.3.6 Malaysia

- 5.3.7 Singapore

- 5.3.8 South Korea

- 5.3.9 Thailand

- 5.3.10 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Aica Kogyo Co..Ltd.

- 6.4.3 Arkema Group

- 6.4.4 H.B. Fuller Company

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Momentive

- 6.4.7 Shin-Etsu Chemical Co., Ltd.

- 6.4.8 Sika AG

- 6.4.9 Soudal Holding N.V.

- 6.4.10 THE YOKOHAMA RUBBER CO., LTD.

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219