|

市场调查报告书

商品编码

1693377

北美建筑胶合剂和密封剂:市场占有率分析、行业趋势、成长预测(2025-2030 年)North America Construction Adhesives & Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

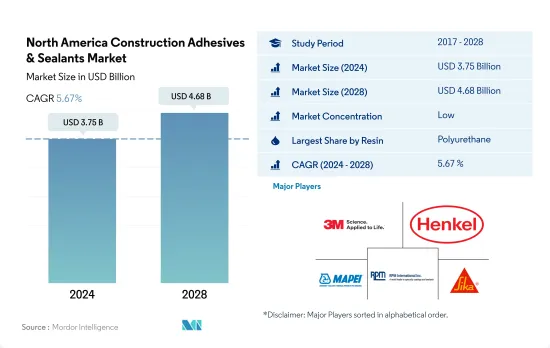

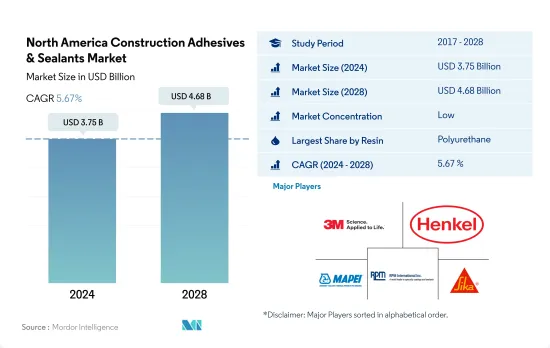

北美建筑胶合剂和密封剂市场规模预计在 2024 年达到 37.5 亿美元,预计到 2028 年将达到 46.8 亿美元,预测期内(2024-2028 年)的复合年增长率为 5.67%。

该地区新占地面积的增加推动了对黏合剂和密封剂的需求

- 树脂赋予黏合剂特定应用所需的物理和化学特性,例如抗紫外线、耐热性和抗拉强度。预计新建筑面积将从 2021 年的 71 亿平方英尺增加到 2022 年的 74 亿平方英尺。

- 2021年,建筑胶合剂和密封剂的销售量强劲成长5.8%。这得益于经济復苏、原料供应恢復正常,以及2020年许多受到新冠疫情影响的国家(如美国、加拿大和墨西哥)重新开放生产设施,而这些国家先前实施的封锁导致生产设施关闭,导致北美胶合剂销量稳步增长。

- 这些黏合剂分为不同的树脂,其中聚氨酯和丙烯酸树脂基黏合剂广泛用于建筑应用。这些黏合剂被称为结构性黏着剂,其抗拉强度高达 5-8N/mm2。因此,它被用于粘合装饰地板材料和瓷砖、将金属部件封装在混凝土中、将门框粘合到砖石上以及许多其他应用。

- 美国是建筑胶合剂和密封剂的最大消费国,占北美市场的近 70%,这得益于该国住宅和非住宅建筑需求的不断增长。预计到2028年,该国的新建筑建设将达到71亿套,从而推动北美未来对黏合剂和密封剂的需求。

不断涌现的倡议和传统建筑的替代解决方案将推动该地区对建筑黏合剂和密封剂的需求。

- 黏合剂和密封剂主要在北美生产,用于各种建筑应用,包括黏合和密封接头、建筑内外应用以及门窗框架密封。这些建筑黏合剂和密封剂的生产主要依赖北美的建筑产量。预计 2022 年新建筑和施工面积将达到 74 亿平方公尺,高于 2021 年的 71 亿平方公尺。

- 2021年,这些黏合剂和密封剂的产量突然增加了4900万吨,原因是经济復苏以及一些国家重新开放了国际边界,而2020年由于新冠疫情的影响而关闭了国际贸易边界,导緻北美一些国家关闭了生产设施、供应链中断和封锁,从而减缓了同年的增长率。

- 在北美,美国是建筑胶合剂和密封剂消费量最大的国家。该国每年建筑业产值达1.4兆美元,对GDP的贡献率为4.2%。全国有 100 多家製造商(包括许多跨国公司)生产这些黏合剂和密封剂,以满足建筑业日益增长的需求。它是该地区成长最快的国家,预计在 2022-2028 年预测期内复合年增长率为 5.78%。

- 美国绿色建筑的兴起、加拿大木造住宅的趋势以及墨西哥预製建筑构件製造的增加预计将推动北美对黏合剂和密封剂的需求。

北美建筑胶合剂和密封剂市场趋势

政府采取措施发展基础建设以支持建筑业

- 北美是继亚太地区、中东和非洲之后的第三大建设活动地区。北美人均GDP为29,010与前一年同期比较,预估2022年年增3.6%,建筑业部门占北美GDP的近7%。影响北美建筑业的因素包括新投资、住宅和非住宅建筑以及政府政策。

- 2020年,受新冠疫情影响,建筑业面临许多挑战。过去一年,钢铁、铜、铝、石材和建筑材料等原料的供应量均减少。由于世界各国实施封锁,美国的钢铁进口额从 2019 年的 240 亿美元下降至 187 亿美元。

- 受国际边境重新开放贸易交流、供应链正常化等一系列因素影响,建筑业在 2021 年再次復苏,成长率达 5.6%。北美的住宅建设正在兴起。例如,加拿大2021年住宅量预计为2.7188亿套,比2020年高出20%。

- 2022年3月,美国运输部(USDOT)宣布,重组美国基础设施(INFRA)计画将在2022至2026财年期间向各州和地区拨款72.5亿美元,用于建设具有国家或地区重要性的多式联运货运和公路计划。这些因素将推动北美地区未来建设活动的成长,到2030年建筑业产出将变动2.7%。

北美建筑胶合剂和密封剂产业概况

北美建筑胶合剂和密封剂市场分散,前五大公司占36.96%的市场。该市场的主要企业包括 3M、汉高股份公司、MAPEI SpA、RPM International Inc.、西卡股份公司等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 建筑与施工

- 法律规范

- 加拿大

- 墨西哥

- 美国

- 价值炼和通路分析

第五章市场区隔

- 树脂

- 丙烯酸纤维

- 氰基丙烯酸酯

- 环氧树脂

- 聚氨酯

- 硅胶

- VAE・EVA

- 其他的

- 科技

- 热熔胶

- 反应性

- 密封剂

- 溶剂型

- 水性

- 国家

- 加拿大

- 墨西哥

- 美国

- 北美其他地区

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- 3M

- Arkema Group

- Dow

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Illinois Tool Works Inc.

- MAPEI SpA

- RPM International Inc.

- Sika AG

第七章 CEO 的关键策略问题

第 8 章 附录

- 全球黏合剂和密封剂产业概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 驱动因素、限制因素和机会

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 92432

The North America Construction Adhesives & Sealants Market size is estimated at 3.75 billion USD in 2024, and is expected to reach 4.68 billion USD by 2028, growing at a CAGR of 5.67% during the forecast period (2024-2028).

Rising new floor area in the region to drive the demand for adhesives and sealants

- Resins impart the required physical properties and chemical properties such as UV resistance, heat resistance, tensile strength, and others in the adhesives that can be used in specific applications. The new construction area is expected to register a growth of up to 7.4 billion square feet in 2022 from 7.1 billion square feet in 2021.

- The construction adhesives and sealants have shown a sudden growth of 5.8% in terms of volume in 2021. This has happened due to the economic recovery, regular supply of raw materials, and reopening of production facilities in many countries, such as the United States, Canada, and Mexico, which were impacted by the COVID-19 outbreak in 2020 where lockdowns in countries caused a shutdown of production facilities and steady growth of adhesives in North America.

- These adhesives are segmented into different resins in which polyurethane and acrylic resin-based adhesives are widely used in construction applications. These adhesives are known as structural adhesives, which offer high tensile strength in the range of 5 to 8 N/mm2. So that they are used in construction to bond decorative floor coverings and ceramic tiles adhesives, seal metal parts into concrete, bond a door frame into masonry, and many other applications.

- The United States is the highest consumption country of construction adhesives and sealants, accounting for nearly 70% of the North American market because of the rising demand for residential and non-residential construction in the country. The new building constructions in the country will reach 7.1 billion units by 2028 and hence will drive the demand for North American adhesives and sealants in the future.

Rising green initiatives and alternative solutions for conventional buildings to propel the demand for construction adhesives and sealants in the region

- Adhesives and sealants are majorly produced in North America for various construction applications like bonding and sealing joints, the interior and exterior of buildings, and doors and window frame sealing. The production of these construction adhesives and sealants mainly depends on North America's construction output. The new buildings and constructions were expected to reach 7.4 billion square footage in 2022 from 7.1 billion in 2021.

- Production of these adhesives and sealants suddenly increased in 2021 by 49 million tons in volume owing to the economic recovery and the reopening of international borders for trade exchange in the countries that were closed due to the impact of the COVID-19 pandemic in 2020, which caused a shut down of production facilities, supply chain disruptions, and lockdowns in several countries of North America and resulted in a slow growth rate in the same year.

- In North America, the United States accounts for the highest consumption of construction adhesives and sealants. The annual construction industry output in the country amounts to USD 1.4 trillion, contributing 4.2% of the GDP. More than 100 manufacturers in the country, including many multinational companies, are producing these adhesives and sealants to cater to rising demand from the construction industry. It is the fastest-growing country in the region and is expected to record a CAGR of 5.78% during the forecast period 2022-2028.

- The rising number of green buildings in the United States, the wooden housing trend in Canada, and the increasing manufacturing of prefabricated building parts in Mexico are expected to drive the demand for adhesives and sealants in North America.

North America Construction Adhesives & Sealants Market Trends

Government initiatives for infrastructure developments to support the construction industry

- North America is the third largest region in performing construction activities after Asia-Pacific and MENA regions. North America has a GDP of 29,010 USD per capita, with an expected growth rate of 3.6% y-o-y in 2022. The construction industry sector contributes nearly 7% of North America's GDP. The factors affecting the North American construction industry are new investments, residential and non-residential constructions, government policies, and others.

- In 2020, the construction industry faced many challenges due to the impact of the COVID-19 pandemic. The supply of raw materials such as steel, copper, aluminum, stone, and fixtures was shrunk during the year. In the United States, the import of iron and steel was reduced to USD 18.7 billion from USD 24 billion in 2019 due to the lockdowns in many countries across the world.

- The building and construction sector recovered again in 2021 with a growth rate of 5.6% owing to the reopening of international borders for trade exchange, regularized supply chains, and many other factors. Residential construction is increasing in North America. For instance, the number of new housing starts in Canada was 271,880 thousand in 2021, which is 20% more than in 2020.

- In March 2022, the US Department of Transportation (USDOT) announced that the Infrastructure for Rebuilding America (INFRA) program would distribute USD 7.25 billion for FY 2022-2026 to all states and regions to build multimodal freight and highway projects of national or regional significance. These factors will raise the construction activities in the North American region in the future, with a construction output change of 2.7% by 2030.

North America Construction Adhesives & Sealants Industry Overview

The North America Construction Adhesives & Sealants Market is fragmented, with the top five companies occupying 36.96%. The major players in this market are 3M, Henkel AG & Co. KGaA, MAPEI S.p.A., RPM International Inc. and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Building and Construction

- 4.2 Regulatory Framework

- 4.2.1 Canada

- 4.2.2 Mexico

- 4.2.3 United States

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 Resin

- 5.1.1 Acrylic

- 5.1.2 Cyanoacrylate

- 5.1.3 Epoxy

- 5.1.4 Polyurethane

- 5.1.5 Silicone

- 5.1.6 VAE/EVA

- 5.1.7 Other Resins

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Sealants

- 5.2.4 Solvent-borne

- 5.2.5 Water-borne

- 5.3 Country

- 5.3.1 Canada

- 5.3.2 Mexico

- 5.3.3 United States

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Dow

- 6.4.4 H.B. Fuller Company

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Huntsman International LLC

- 6.4.7 Illinois Tool Works Inc.

- 6.4.8 MAPEI S.p.A.

- 6.4.9 RPM International Inc.

- 6.4.10 Sika AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219