|

市场调查报告书

商品编码

1693389

美国密封剂:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)United States Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

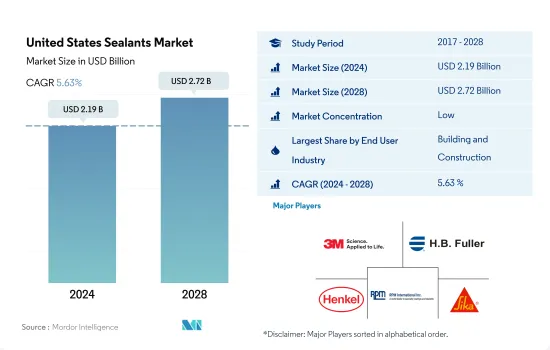

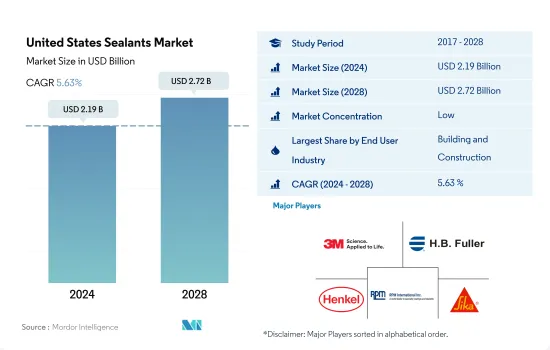

预计 2024 年美国密封剂市场规模为 21.9 亿美元,到 2028 年将达到 27.2 亿美元,预测期内(2024-2028 年)的复合年增长率为 5.63%。

美国家用电器销售成长 4.3%,推动了密封胶的需求

- 密封剂因其用途广泛,在建设产业中广泛应用,包括防水、防风雨密封、裂缝密封和接缝密封。预计到 2030 年,美国建设产业将占全球建筑业成长的 11.1%,因此占美国密封剂市场的最大份额。建设产业是密封剂的主要终端用户,具有多种应用。

- 密封剂广泛应用于汽车工业,因为它们可以应用于各种表面,包括玻璃、金属、塑胶和涂漆表面,其特性有利于汽车工业,包括极端耐候性、耐用性和长寿命。它也用于引擎和汽车垫圈。 2020 年电动车销量成长了 2.4%。预计这将在预测期内增加对汽车硅胶密封胶的需求。

- 各种密封胶广泛应用于电子、电气设备製造中,扮演灌封和材料保护的角色。它们用于密封感测器、电缆等。美国消费电子市场预计将成长 4.3%,从而推动 2022-2028 年预测期内对硅胶密封胶的需求。在医疗保健行业,密封剂用于组装和密封医疗设备组件。预计在 2022-2028 年预测期内,美国市场医疗保健投资的增加也将导致对密封剂的需求增加。

美国密封胶市场趋势

政府投资,例如 2022-2026 年价值 72.5 亿美元的「重组美国基础设施」(INFRA)计划,将推动国内建设

- 美国是北美最大的建筑业国家。该国人均GDP为25,350美元,预计到2022年将成长与前一年同期比较%。建筑业占美国GDP的近4.2%。影响美国建筑业的因素包括新投资、住宅和非住宅建筑以及政府政策。

- 2021 年公共部门建筑支出降至 3,463 亿美元,而 2020 年为 3,612 亿美元。然而,私部门建筑支出在 2021 年有所增加,达到 12,454 亿美元,而 2020 年为 11,079 亿美元。

- 1 月建筑许可中的住宅建筑(包括私人住宅)经季节性已调整的的年率为 189.9 万套。这比12月修订后的188.5万辆高出0.7%,比2021年1月的188.3万辆高出0.8%。

- 2022年3月,美国运输部(USDOT)宣布,重组美国基础设施(INFRA)计画将在2022至2026财年期间向各州和地区拨款72.5亿美元,用于建设具有国家或地区重要性的多式联运货运和公路计划。预计这些因素将活性化预测期内美国的建设活动增加。

由于政府达成协议,75% 的汽车零件将在美国、加拿大和墨西哥生产,汽车产量将会增加。

- 2019年,美国汽车业年产量下降约3.5%,原因包括美国对美国的製裁以及对钢铁和铝进口征收关税,尤其是对加拿大和墨西哥这两个美国汽车业最大的进口金属来源国征收关税。由于营运和供应链限制,加上新冠疫情和随后的停工导致工人无法工作,2020 年汽车产量与 2019 年相比下降了约 20%。 2021年疫情过后,半导体晶片短缺和其他供应链限制正在限制汽车产量的成长。

- 在美国,商用车产量从 2017 年的 73% 增加到 2020 年的 79%。这是因为皮卡和其他轻型商用车 (LCV) 因其效用需求不断增加。预计在预测期内,轻型商用车的需求将持续成长。

- 美国是继中国和欧洲之后的第三大电动车製造国。美国44 家主要组装厂中有 7 家参与生产电动车 (EV),约占美国生产能力的 16%。通用汽车拥有三辆,特斯拉拥有两辆,Rivian 和 Lucid Motors 各拥有一辆。 2020 年至 2021 年,电动车的需求增加了 85%,预计该国电动车需求的持续成长将在预测期内推动产量成长。 《美国-加拿大-墨西哥协议》的实施预计将在预测期内促进汽车产量成长,该协议规定 75% 的汽车必须在三个参与国之一生产,以享受零关税优惠。

美国密封剂产业概况

美国密封剂市场分散,前五大公司占33.35%的市场。该市场的主要企业有:3M、HB Fuller Company、Henkel AG & Co. KGaA、RPM International Inc. 和 Sika AG(按字母顺序排列)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑与施工

- 法律规范

- 美国

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 航太

- 车

- 建筑与施工

- 卫生保健

- 其他最终用户产业

- 树脂

- 丙烯酸纤维

- 环氧树脂

- 聚氨酯

- 硅胶

- 其他树脂

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- 3M

- Arkema Group

- Dow

- HB Fuller Company

- Henkel AG & Co. KGaA

- Illinois Tool Works Inc.

- MAPEI SpA

- Pecora Corporation

- RPM International Inc.

- Sika AG

第七章:CEO面临的关键策略问题

第 8 章 附录

- 全球黏合剂和密封剂产业概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 驱动因素、阻碍因素和机会

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 92445

The United States Sealants Market size is estimated at 2.19 billion USD in 2024, and is expected to reach 2.72 billion USD by 2028, growing at a CAGR of 5.63% during the forecast period (2024-2028).

Consumer electronics register a growth of 4.3% in the United States to boost the demand for sealants

- Sealants are widely used in the construction industry because of their diverse applications, such as waterproofing, weather sealing, cracks sealing, and joint sealing. The US construction industry is expected to account for 11.1% of global growth in construction up to 2030, thus, accounting for the highest share of the US sealants market by volume. The construction industry is the primary end-user industry of sealants owing to the varied applications and high awareness of the usage of sealants in the region.

- Sealants are widely used in the automotive industry because of their applicability to various surfaces such as glass, metal, plastic, painted surfaces, etc., and their features are helpful in the automotive industry, such as for extreme weather resistance, durability, and long-lasting. They are used in engines and car gaskets. Electric vehicle sales increased by 2.4% in 2020 because of its increased demand for personal mobility. This is expected to increase the demand for automotive silicone sealants in the forecast period.

- Different sealants are widely used in electronics and electrical equipment manufacturing for potting and protecting materials. They are used for sealing sensors and cables, etc. The consumer electronics market is expected to register a 4.3% growth in the United States and increase the demand for silicone sealants in the forecast period 2022-2028. Sealants are used in the healthcare industry for assembling and sealing medical device parts. The increase in healthcare investments in the US market is also anticipated to lead to a rise in the demand for sealants over the forecast period 2022-2028.

United States Sealants Market Trends

Government's' investments such as the Infrastructure for Rebuilding America (INFRA) program of USD 7.25 billion for FY 2022-2026 to increase construction in the country

- The United States is the largest country for construction activities in the North American region. The country had a GDP of USD 25,350 per capita, with an expected growth rate of 3.7% Y-o-Y in 2022. The construction industry contributes nearly 4.2% of the US GDP. The factors affecting the US construction industry are new investments, residential & non-residential constructions, government policies, and others.

- Public sector construction spending declined in 2021, recording USD 346.3 billion compared to USD 361.2 billion in 2020. However, the private sector construction spending increased in 2021 and was valued at USD 1,245.4 billion in 2021 compared to USD 1107.9 billion in 2020.

- The residential house construction, including privately-owned housing units authorized by building permits in January, was at a seasonally adjusted annual rate of 1,899,000. This was 0.7% above the revised December rate of 1,885,000 and 0.8% above the January 2021 rate of 1,883,000.

- In March 2022, the US Department of Transportation (USDOT) announced that the Infrastructure for Rebuilding America (INFRA) program would distribute USD 7.25 billion for FY 2022-2026 to all states and regions to build multimodal freight and highway projects of national or regional significance. These factors are expected to boost construction activities in the United States over the forecast period.

Government's United States-Canada-Mexico agreement of having 75% of automobile components produced in these 3 countries will increase the automotive production

- The US automotive industry witnessed a decline in annual production by around 3.5% in 2019 due to multiple factors, such as US sanctions on China and tariffs on steel and aluminum imports, especially from Canada and Mexico, two of the largest sources for imported metals for the US automotive industry. Automotive production fell by around 20% in 2020 compared to 2019 due to operational and supply chain restrictions coupled with worker unavailability resulting from the COVID-19 pandemic and the subsequent lockdowns. The semiconductor chip shortages and other supply chain constraints in 2021, which followed the pandemic, have been holding back automotive production growth.

- In the United States, the percentage of commercial vehicles manufactured increased from 73% in 2017 to 79% in 2020. This was due to the rising demand for pickup trucks and other Light Commercial Vehicles (LCVs) because of their multipurpose utility. This growth in the demand for LCVs is expected to continue in the forecast period.

- The United States is the third largest electric vehicle manufacturer after China and Europe. Seven of the 44 major US assembly plants, representing about 16% of US production capacity, are engaged in producing electric vehicles (EVs). General Motors own three, two are owned by Tesla, and Rivian and Lucid Motors own one site each. Demand for EVs grew 85% from 2020 to 2021, and this continuously increasing demand for EVs in the country is expected to drive production growth during the forecast period as well. The implementation of the United States-Canada-Mexico agreement, which mandates 75% of the cars to be produced in one of the three participating countries to avail zero tariffs, is expected to increase automotive production during the forecast period.

US Sealants Industry Overview

The United States Sealants Market is fragmented, with the top five companies occupying 33.35%. The major players in this market are 3M, H.B. Fuller Company, Henkel AG & Co. KGaA, RPM International Inc. and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.2 Regulatory Framework

- 4.2.1 United States

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Healthcare

- 5.1.5 Other End-user Industries

- 5.2 Resin

- 5.2.1 Acrylic

- 5.2.2 Epoxy

- 5.2.3 Polyurethane

- 5.2.4 Silicone

- 5.2.5 Other Resins

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Dow

- 6.4.4 H.B. Fuller Company

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Illinois Tool Works Inc.

- 6.4.7 MAPEI S.p.A.

- 6.4.8 Pecora Corporation

- 6.4.9 RPM International Inc.

- 6.4.10 Sika AG

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219