|

市场调查报告书

商品编码

1693572

东协货运与物流:市场占有率分析、产业趋势与成长预测(2025-2030 年)ASEAN Freight and Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

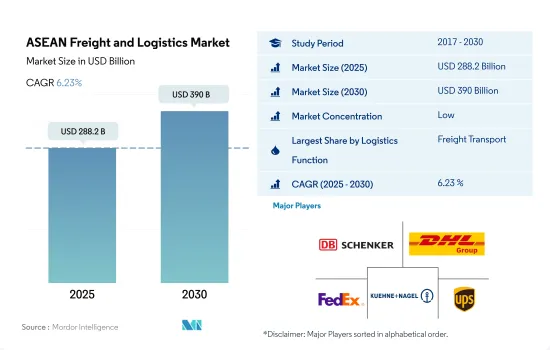

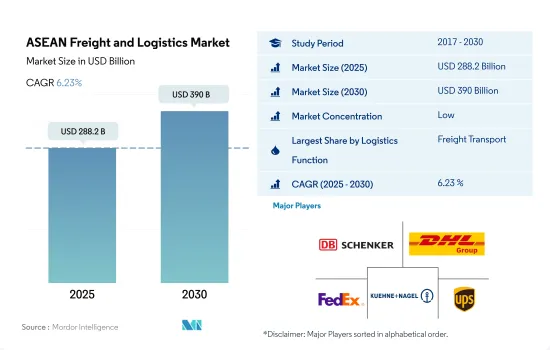

预计 2025 年东协货运和物流市场规模为 2,882 亿美元,到 2030 年将达到 3,900 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.23%。

东南亚国协GDP贡献增加带动物流业发展

- 马来西亚致力于向清洁能源转型,本土企业和政府营业单位都走在技术进步的前沿,推动基础设施发展。这些努力涉及多个领域,包括屋顶和浮体式太阳能、电池储存和氢气。一个值得注意的例子是 Masama 私人有限公司于 2022 年 5 月授予砂拉越联合工业有限公司 (SCIB) 的价值马币(861 万美元)的合约。该合约包括工程、采购、施工和试运行,是连接马来西亚砂拉越多个地点的道路计划,预计将于 2023 年 3 月顺利完工。

- 越南拥有3,260公里长的海岸线和河流网络,为海运提供了绝佳的机会。越南政府制定了雄心勃勃的目标,到2030年将越南转变为海洋强国。这些目标包括将海洋部门对越南GDP的贡献率提高到10%,提高28个沿海城市和省份的经济重要性,并将其在越南整体GDP的比例从65%提高到70%。

电子商务趋势的兴起和政府倡议推动市场成长

- 越南运输部计划开工14个计划计划,包括南北高速公路的关键路段,到2025年完成另外50个项目。这是越南到2025年将高速公路总长从目前的2,021公里扩建至3,000公里的目标的一部分。此外,位于同奈省、计划金额达141.2亿美元的隆城国际机场预计2025年完工。完工后,它将成为越南最大的机场,并将缓解胡志明市新山一机场的交通拥堵。

- 2023 年 11 月,BBN 印尼航空将增加第三架货机,扩大其机队规模。 ACMI 航空公司是 AviaSolutions 集团的子公司,该公司宣布购买一架波音 737-400SF,扩充其现有的两架 737-800F 机队。该飞机将于 2024 年开始商业营运。由于印尼群岛面积广阔,绵延 5,150 公里,拥有 17,000 个岛屿,因此航空运输至关重要。国际航空运输协会(IATA)预测,到2034年,印尼将成为世界第六大航空运输市场。

东协货运及物流市场趋势

在政府基础建设计划,对东南亚国协的直接投资不断增加,推动了经济成长

- 2024年5月,日本政府宣布贷款约1,407亿日圆(9亿美元),用于在印尼雅加达兴建高速铁路线。东西铁路计划全长84.1公里,将于2026年至2031年分两期完工。新铁路线的列车和号誌系统将采用日本技术。透过这样的努力,预计运输和仓储业将对GDP做出贡献。

- 2024 年 2 月,运输部宣布计划在 2025 年底投资 188.3 亿美元用于约 150 个交通计划,以加强泰国的基础设施建设。 2024 年将有 64 个计划开工,另有 31 个计划(价值 112.3 亿美元)正在筹备中。 2025年计画新计画,总投资额达75.9亿美元。这些倡议包括18个公路计划、9个铁路计划和一项区域港口发展计划,旨在加强运输和仓储行业未来对GDP的贡献。

两以衝突、乌俄战争对东南亚国协的影响,导致油价上涨、供应链中断。

- 印尼在壳牌和雪佛龙近期撤出后加大了钻探和探勘,预计 2024 年其石油和天然气行业的投资将增长 29%。在石化燃料计划资金筹措日益困难的当下,这项措施对于印尼应对长期产量下滑至关重要。埃尼、埃克森美孚和英国石油等外国公司将贡献2024年计画投资的40%。此外,在2024年初,石油和天然气部宣布,儘管伊朗-以色列衝突有可能将原油价格推高至每桶100美元,但加油站的燃油价格至少在2024年6月之前将保持稳定。

- 作为马来西亚总理安瓦尔·易卜拉欣 (Anwar Ibrahim) 改革长期燃油补贴制度的努力的一部分,2024 年 6 月马来西亚柴油价格上涨了 50% 以上。改革的目的是透过取消普遍能源补贴并将援助重点放在最需要的人身上来缓解国家财政压力。此举也旨在解决补贴柴油被走私到邻国并以高价交易的问题。

东协货运及物流业概况

东协货运和物流市场细分化,主要有主要企业:德国铁路股份公司(包括德铁信可)、DHL集团、联邦快递、Kuhne Nagel和美国联合包裹服务公司(UPS)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口统计

- 按经济活动分類的GDP分布

- 经济活动GDP成长

- 通货膨胀率

- 经济表现及概况

- 电子商务产业趋势

- 製造业趋势

- 交通运输仓储业GDP

- 出口趋势

- 进口趋势

- 燃油价格

- 卡车运输成本

- 卡车持有量(按类型)

- 物流绩效

- 主要卡车供应商

- 模态共享

- 海运能力

- 班轮连结性

- 停靠港和演出

- 货运趋势

- 货物吨位趋势

- 基础设施

- 法律规范(公路和铁路)

- 印尼

- 马来西亚

- 泰国

- 越南

- 法律规范(海运和空运)

- 印尼

- 马来西亚

- 泰国

- 越南

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 农业、渔业和林业

- 建设业

- 製造业

- 石油和天然气、采矿和采石

- 批发和零售

- 其他的

- 物流功能

- 快递、快递和小包裹(CEP)

- 目的地

- 国内的

- 国际的

- 货物

- 按交通方式

- 航空

- 海上和内陆水道

- 其他的

- 货物

- 交通方式

- 航空

- 管道

- 铁路

- 路

- 海上和内陆水道

- 仓库存放

- 温度管理

- 无温度控制

- 温度管理

- 其他的

- 快递、快递和小包裹(CEP)

- 国家

- 印尼

- 马来西亚

- 泰国

- 越南

- 其他东南亚国协

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Alps Logistics

- 德国铁路公司(包括德铁信可)

- DHL Group

- DP World

- DSV A/S(De Sammensluttede Vognmaend af Air and Sea)

- FedEx

- JWD Group

- Kuehne+Nagel

- NYK(Nippon Yusen Kaisha)Line

- Tiong Nam Logistics Holdings Bhd

- United Parcel Service of America, Inc.(UPS)

- YCH Group

第七章 CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(市场驱动因素、限制因素、机会)

- 技术进步

- 资讯来源及延伸阅读

- 图表清单

- 关键见解

- 数据包

- 词彙表

- 外汇

简介目录

Product Code: 92671

The ASEAN Freight and Logistics Market size is estimated at 288.2 billion USD in 2025, and is expected to reach 390 billion USD by 2030, growing at a CAGR of 6.23% during the forecast period (2025-2030).

Rising GDP contributions from ASEAN countries in the logistics sector leading to sector development

- Malaysia's focus on clean energy transition is driving its infrastructure development, with both local companies and government-owned entities spearheading technological advancements. These initiatives span various sectors, including rooftop and floating solar, battery storage, and hydrogen. A notable example is the RM 38 million (USD 8.61 million) contract awarded by Masama Sdn Bhd to Sarawak Consolidated Industries Bhd (SCIB) in May 2022. The contract, encompassing engineering, procurement, construction, and commissioning, was for a road project connecting multiple locations in Sarawak, Malaysia, and was successfully completed in March 2023.

- Vietnam, with its extensive coastline of 3,260 km and a network of rivers, presents significant opportunities in maritime freight transportation. The Vietnamese government has set ambitious targets, aiming to position the nation as a leading maritime power by 2030. These goals include elevating the maritime sector's GDP contribution to 10% and amplifying the economic significance of its 28 coastal cities and provinces, targeting a 65% to 70% share of the overall Vietnamese GDP.

Rising e-commerce trends and initiatives imposed by the government are driving the market's growth

- Vietnam's Ministry of Transport plans to break ground on 14 infrastructure projects and complete 50 more by 2025, including key parts of the North-South Expressway. This is part of the goal to expand the country's expressways to 3,000 km by 2025, up from the current 2,021 km. Additionally, the Long Thanh International Airport, a USD 14.12 billion project in Dong Nai province, is on track to finish in 2025. Once completed, it will be the country's largest airport, easing congestion at Tan Son Nhat in Ho Chi Minh City.

- In November 2023, BBN Airlines Indonesia expanded its fleet by adding a third freighter, underscoring the robust growth of the nation's all-cargo market. The ACMI carrier, a subsidiary of Avia Solutions Group, announced the acquisition of a Boeing 737-400SF, enhancing its current fleet of two 737-800Fs. The aircraft, began commercial operations in 2024. Given Indonesia's vast archipelago, which spans 17,000 islands over 5,150 km, air transportation is crucial. The International Air Transport Association (IATA) forecasts that by 2034, Indonesia will rank as the world's sixth-largest air transport market.

ASEAN Freight and Logistics Market Trends

Rising FDI in ASEAN countries supported by infrastructure construction projects by country governments driving economic growth

- In May 2024, the Japanese government announced a loan of about JPY140.7 billion (USD 900 million) to build a high-speed rail line in Jakarta, Indonesia. The East-West rail project will cover 84.1 km and be completed in two phases, starting in 2026 and finishing by 2031. The new rail line will feature Japanese technology for trains and signaling systems. Such initiatives are expected to boost GDP contribution from transport and storage sector.

- In February 2024, the Transport Ministry announced plans to invest USD 18.83 billion in around 150 transport projects by the end of 2025 to enhance Thailand's infrastructure. In 2024, 64 projects will commence, with an additional 31 projects valued at USD 11.23 billion in the pipeline. For 2025, there are 57 new projects planned, totaling USD 7.59 billion. These initiatives include 18 motorway projects, 9 railway projects, and plans for regional port development, all aimed at bolstering the transport and storage sector's contribution to GDP in the future.

Impact of the Iran-Israel conflict and Ukraine-Russia war on ASEAN countries led to increased fuel prices and supply chain disruptions

- Indonesia expects a 29% increase in oil and gas sector investments in 2024 to boost drilling and exploration after Shell and Chevron's recent exits. This push is vital for Indonesia to counter a long-term decline in output amid rising financing challenges for fossil fuel projects. Foreign companies like Eni, Exxon Mobil, and BP will contribute 40% of 2024's planned investments. Also, in early 2024, the Ministry of Oil and Gas announced that fuel prices at gas stations will stay stable until at least June 2024, despite the Iran-Israel conflict potentially raising oil prices to USD 100 per barrel.

- Diesel prices in Malaysia surged by over 50% in June 2024 as part of Prime Minister Anwar Ibrahim's efforts to reform the country's long-standing fuel subsidy system. The restructuring aimed to alleviate pressure on national finances by eliminating universal energy subsidies and focusing assistance on those most in need. This move also aims to address issues like the smuggling of subsidized diesel to neighboring countries, where it fetches higher prices.

ASEAN Freight and Logistics Industry Overview

The ASEAN Freight and Logistics Market is fragmented, with the major five players in this market being Deutsche Bahn AG (including DB Schenker), DHL Group, FedEx, Kuehne+Nagel and United Parcel Service of America, Inc. (UPS) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Logistics Performance

- 4.13 Major Truck Suppliers

- 4.14 Modal Share

- 4.15 Maritime Fleet Load Carrying Capacity

- 4.16 Liner Shipping Connectivity

- 4.17 Port Calls And Performance

- 4.18 Freight Pricing Trends

- 4.19 Freight Tonnage Trends

- 4.20 Infrastructure

- 4.21 Regulatory Framework (Road and Rail)

- 4.21.1 Indonesia

- 4.21.2 Malaysia

- 4.21.3 Thailand

- 4.21.4 Vietnam

- 4.22 Regulatory Framework (Sea and Air)

- 4.22.1 Indonesia

- 4.22.2 Malaysia

- 4.22.3 Thailand

- 4.22.4 Vietnam

- 4.23 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes 1. Market value in USD for all segments 2. Market volume for select segments viz. freight transport, CEP (courier, express, and parcel) and warehousing & storage 3. Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode Of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode Of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.3 Country

- 5.3.1 Indonesia

- 5.3.2 Malaysia

- 5.3.3 Thailand

- 5.3.4 Vietnam

- 5.3.5 Rest of ASEAN

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Alps Logistics

- 6.4.2 Deutsche Bahn AG (including DB Schenker)

- 6.4.3 DHL Group

- 6.4.4 DP World

- 6.4.5 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.6 FedEx

- 6.4.7 JWD Group

- 6.4.8 Kuehne+Nagel

- 6.4.9 NYK (Nippon Yusen Kaisha) Line

- 6.4.10 Tiong Nam Logistics Holdings Bhd

- 6.4.11 United Parcel Service of America, Inc. (UPS)

- 6.4.12 YCH Group

7 KEY STRATEGIC QUESTIONS FOR FREIGHT AND LOGISTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

02-2729-4219

+886-2-2729-4219