|

市场调查报告书

商品编码

1693631

日本商用车市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Japan Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

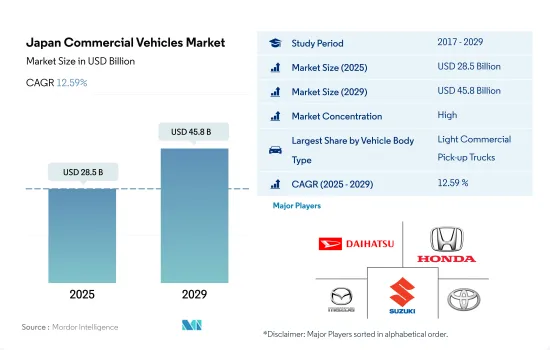

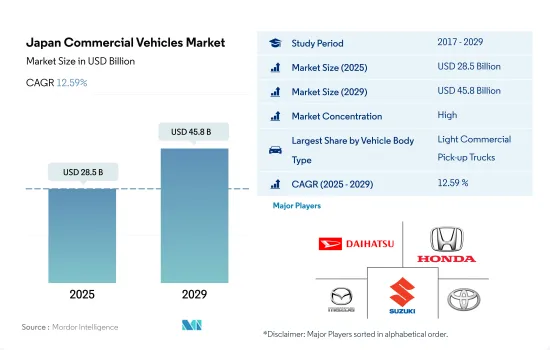

日本商用车市场规模预计在 2025 年为 285 亿美元,预计到 2029 年将达到 458 亿美元,预测期内(2025-2029 年)的复合年增长率为 12.59%。

日本政府制定了到 2050 年实现碳中和的宏伟目标,并采取了绿色投资奖励,儘管面临新冠疫情带来的挑战,但仍推动着电动车 (EV) 在日本的快速普及。

- 2020年,日本政府设定了「碳中和」目标,力争2050年实现零碳排放。儘管面临新冠疫情的挑战,豪斯登堡仍透过推出纯电动公车向环保目标迈出了一步。近年来,插混合动力汽车、燃料电池汽车和电池电动车等替代汽车市场出现了显着的繁荣。

- 儘管新冠疫情扰乱了许多行业,但在全球采用率上升的推动下,电动车 (EV) 市场正呈现显着成长。疫情爆发后,消费者正在寻找更具成本效益的选择。然而,占日本总排放19%的运输业在2019年贡献了惊人的11.1亿吨二氧化碳排放。为此,汽车产业正积极加强减少二氧化碳排放,扩大下一代汽车的供应,并提高燃油效率。

- 日本政府积极支持在汽油中使用乙醇。目标是到2030年代中期逐步淘汰汽油动力汽车,并推动向电动车(包括混合动力汽车汽车和燃料电池汽车)的转变。为了刺激经济成长,政府提供税收减免和财政激励政策,目标是到 2030 年每年将绿色投资和销售额提高 90 兆日圆(8,700 亿美元),到 2050 年提高 190 兆日圆(1.8 兆美元)。预计未来几年,对电池式电动车和全混合动力汽车的日益重视将决定市场的成长。

日本商用车市场趋势

日本电动车市场在政府和产业合作下逐渐成长

- 日本的电动车产业正在逐步发展,政府制定了在 2035 年实现所有新车电气化的规范和目标,推动日本走向电动车化。此外,补贴和回扣等政府措施正在推动日本电动车市场的发展。 2021年11月,日本政府宣布将对电动车提供补贴。不过,混合动力汽车并不在该补贴计画范围内。受这些因素影响,2022年电动车(乘用车)的成长率将比2021年增加11.11%。

- 各公司正在建立合作伙伴关係和合资企业,以增强全国各个领域的电动车发展。 2022 年 6 月,科技公司SONY和日本汽车製造商本田签署合资协议,共同致力于电动车领域。该合资公司的目标是到2025年在日本生产和销售电动车。此外,本田宣布将在2030年前推出30款电动车,每年生产200万辆。两家公司已向该合资企业投资约 3,752 万美元。预计这些因素将对电动车产生正面影响。

- 2022年4月,美国汽车製造商通用汽车宣布将扩大与本田的合作,生产电动车。作为扩大合作的一部分,两家公司将开发包括汽车在内的新型经济型电动车。该电动车预计将于 2027 年初开始生产。此外,这种国际扩张预计将开发出新的设计和增强型汽车,进一步增加 2024 年至 2030 年日本的电动车销售。

日本商用车产业概况

日本商用车市场格局较为集中,前五大厂商占81.27%的市占率。市场的主要企业是:大发汽车、本田汽车、马自达汽车公司、铃木汽车公司和丰田汽车公司(按字母顺序排列)

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均GDP

- 消费者汽车支出(cvp)

- 通货膨胀率

- 汽车贷款利率

- 电气化的影响

- 电动车充电站

- 电池组价格

- 新款 Xev 车型发布

- 物流绩效指数

- 燃油价格

- OEM生产统计

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 车辆类型

- 商用车

- 公车

- 大型商用卡车

- 轻型商用皮卡车

- 轻型商用厢型车

- 中型商用卡车

- 商用车

- 推进类型

- 混合动力和电动车

- 按燃料类别

- BEV

- FCEV

- HEV

- PHEV

- ICE

- 按燃料类别

- 天然气

- 柴油引擎

- 汽油

- 混合动力和电动车

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Daihatsu Motor Co. Ltd.

- Honda Motor Co. Ltd.

- Isuzu Motors Limited

- Mazda Motor Corporation

- Mitsubishi Motors Corporation

- Renault-Nissan-Mitsubishi Alliance

- Stellantis NV

- Subaru Corporation

- Suzuki Motor Corporation

- Toyota Motor Corporation

- Volkswagen AG

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 93019

The Japan Commercial Vehicles Market size is estimated at 28.5 billion USD in 2025, and is expected to reach 45.8 billion USD by 2029, growing at a CAGR of 12.59% during the forecast period (2025-2029).

The Japanese government's ambitious goal of carbon neutrality by 2050, coupled with incentives for green investments, is driving the rapid adoption of electric vehicles (EVs) in Japan, despite challenges posed by the COVID-19 pandemic

- In 2020, the Japanese government set a 'carbon neutral' target, aiming for zero carbon emissions by 2050. Despite the challenges posed by the COVID-19 pandemic, Huis Ten Bosch took a step toward its environmental objectives by introducing all-electric buses. The market for alternative vehicles, including plug-in hybrids, fuel cell electric vehicles, and battery electric vehicles, has witnessed a remarkable surge in recent years.

- While the COVID-19 pandemic disrupted numerous sectors, the electric vehicles (EVs) market has been on a notable expansion trajectory, driven by a rising global adoption rate. In the wake of the pandemic, consumers are increasingly seeking more cost-effective options. However, Japan's transportation industry, which accounted for 19% of the nation's total emissions, contributed to a staggering 1.11 billion tons of CO2 emissions in 2019. In response, the automotive sector is actively bolstering efforts to reduce CO2 emissions, ramping up the supply of next-gen vehicles and enhancing fuel efficiency.

- The Japanese government is actively endorsing the use of ethanol in gasoline. By the mid-2030s, the policy aims to phase out gasoline-powered vehicles, favoring a shift toward electric vehicles, including hybrids and fuel cells. To drive economic growth, the government is offering tax exemptions and financial incentives, targeting a boost of JPY 90 trillion (USD 870 billion) annually through green investments and sales by 2030, and a staggering JPY 190 trillion (USD 1.8 trillion) by 2050. This heightened emphasis on battery electric and full hybrid vehicles is poised to shape the market's growth in the coming years.

Japan Commercial Vehicles Market Trends

Japan's electric vehicle market grows gradually due to government and industry partnerships

- The electric vehicle industry in Japan is growing gradually, and the government's norms and targets to electrify all new car sales by 2035 are shifting the country toward electric mobility. Moreover, government efforts in terms of subsidies and rebates are driving the country's electric vehicle market. In November 2021, the government of Japan announced that it would provide subsidies on electric vehicles, i.e., up to USD 7200 per vehicle. However, hybrid vehicles are not included in the subsidy program. Such factors contribute to the growth of electric vehicles (passenger cars) by 11.11% in 2022 over 2021.

- Various companies are signing partnerships and ventures to enhance electric mobility in various sectors across Japan. In June 2022, the technology company Sony and the Japanese automaker Honda signed a joint venture to work on electric mobility together. The objective of the venture is to produce and sell electric cars in Japan by 2025. Moreover, Honda has announced the launch of 30 electric vehicles and the production of 2 million vehicles annually by 2030. Each company has invested approximately USD 37.52 million in the venture. Such factors are expected to impact electric mobility positively.

- In April 2022, the US-based automaker General Motors announced an expand its partnership with Honda to produce electric vehicles. As part of the expansion, the companies will develop new affordable electric vehicles, including cars. The production of the vehicles is expected to start in early 2027. Moreover, such international expansions are expected to develop new designs and enhanced cars, which further is expected to raise the sales of electric cars During the 2024-2030 period in Japan, which will also accelerate the demand for battery packs across Japan.

Japan Commercial Vehicles Industry Overview

The Japan Commercial Vehicles Market is fairly consolidated, with the top five companies occupying 81.27%. The major players in this market are Daihatsu Motor Co. Ltd., Honda Motor Co. Ltd., Mazda Motor Corporation, Suzuki Motor Corporation and Toyota Motor Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.1.1.1 Buses

- 5.1.1.2 Heavy-duty Commercial Trucks

- 5.1.1.3 Light Commercial Pick-up Trucks

- 5.1.1.4 Light Commercial Vans

- 5.1.1.5 Medium-duty Commercial Trucks

- 5.1.1 Commercial Vehicles

- 5.2 Propulsion Type

- 5.2.1 Hybrid and Electric Vehicles

- 5.2.1.1 By Fuel Category

- 5.2.1.1.1 BEV

- 5.2.1.1.2 FCEV

- 5.2.1.1.3 HEV

- 5.2.1.1.4 PHEV

- 5.2.2 ICE

- 5.2.2.1 By Fuel Category

- 5.2.2.1.1 CNG

- 5.2.2.1.2 Diesel

- 5.2.2.1.3 Gasoline

- 5.2.1 Hybrid and Electric Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Daihatsu Motor Co. Ltd.

- 6.4.2 Honda Motor Co. Ltd.

- 6.4.3 Isuzu Motors Limited

- 6.4.4 Mazda Motor Corporation

- 6.4.5 Mitsubishi Motors Corporation

- 6.4.6 Renault-Nissan-Mitsubishi Alliance

- 6.4.7 Stellantis N.V.

- 6.4.8 Subaru Corporation

- 6.4.9 Suzuki Motor Corporation

- 6.4.10 Toyota Motor Corporation

- 6.4.11 Volkswagen AG

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219