|

市场调查报告书

商品编码

1693632

欧洲中型和重型商用车:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Europe Medium and Heavy-duty Commercial Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

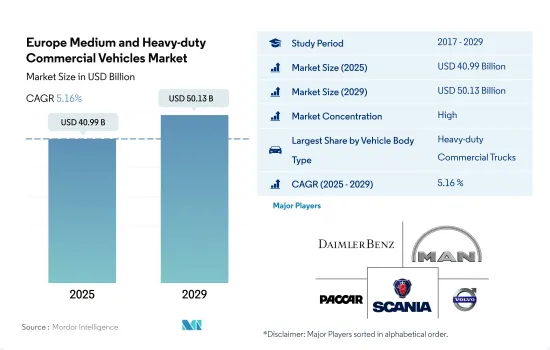

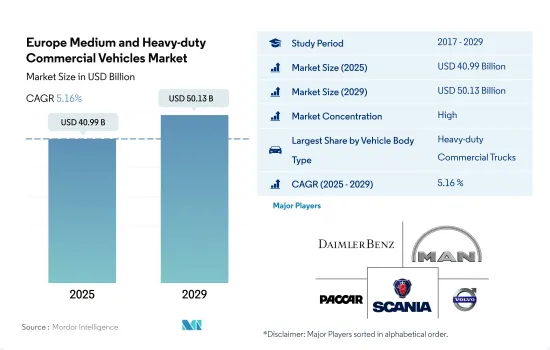

预计 2025 年欧洲中重型商用车市场规模为 409.9 亿美元,到 2029 年将达到 501.3 亿美元,预测期间(2025-2029 年)的复合年增长率为 5.16%。

中型和重型商用车在欧洲商业运输中的战略重要性使得公司更加重视效率和遵守监管规定。

- 交通运输在加强欧洲经济、促进成长和提高竞争力方面发挥着至关重要的作用。商用车产业正积极回应《巴黎协定》中所提出的气候变迁目标。儘管替代燃料和动力传动系统的采用日益增多,但商用车的充电和加油基础设施仍然有限。欧盟道路上有超过 630 万辆汽车每年运输 150 亿吨货物,占所有公路货运量的 76.7%。

- 欧洲首当其冲地受到了新冠疫情的影响,3月和4月产量下降了约5万辆。这主要是由于严格的工厂关闭、职场监管、供应链中断和居家令。截至2020年底,欧洲商用车产量与前一年同期比较下降近20%。值得注意的是,作为欧洲大陆卡车产业重要基地的国家,例如中欧的波兰和西欧的义大利,预计需求将出现最大幅度的下降。

- 物流和建设活动的成长刺激了对运输材料的需求,导致整个欧洲商用车销售量激增。预计这一趋势将在不久的将来进一步推动商用车市场的发展。随着建筑业和电子商务业务的活性化,市场有望实现成长。此外,向电动车的转变在未来几年为市场扩张带来了光明的前景。

欧洲中重型商用车市场趋势

环境问题、政府支持和脱碳目标刺激了欧洲电动车的需求和销售

- 近年来,欧洲国家对电动车的需求和销售量大幅成长。德国 2022 年电动车销量与 2021 年相比成长了 22%,其次是英国,2022 年电动车销量与 2021 年相比成长了 18.40%。日益增长的环境问题、严格的政府规范、电动车的优势(例如更好的燃油经济性、更低的服务成本、更少的碳排放)以及政府补贴是推动欧洲国家电动车成长的一些因素。

- 欧洲国家对电动商用车,特别是轻型卡车的需求逐渐增加。此外,各国政府也支持电动车的推广。 2021年11月,英国政府宣布承诺在2040年实现所有重型商用车零排放。这些因素将使英国2022年的电动商用车销量较2021年成长23.17%,各国类似做法将提振整个欧洲对电动商用车的需求。

- 预计未来几年欧洲国家的汽车电气化将呈指数级增长。预计政府在脱碳方面的努力将推动欧洲电动商用车市场的发展。例如,2022年1月,德国交通部长宣布了2030年道路上电动车保有量达到1,500万辆的目标。受这些因素影响,预计2024年至2030年间欧洲国家的电动车销售量将会成长。

欧洲中重型商用车产业概况

欧洲中重型商用车市场格局较为巩固,前五大厂商占87%的市场。该市场的主要企业是:戴姆勒股份公司(梅赛德斯-奔驰股份公司)、曼卡客车公司、帕卡公司、斯堪尼亚公司和沃尔沃集团(按字母顺序排列)

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均GDP

- 消费者汽车支出(cvp)

- 通货膨胀率

- 汽车贷款利率

- 电气化的影响

- 电动车充电站

- 电池组价格

- 新款 Xev 车型发布

- 物流绩效指数

- 燃油价格

- OEM生产统计

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 车辆类型

- 商用车

- 推进类型

- 混合动力汽车和电动车

- 按燃料类别

- BEV

- FCEV

- HEV

- PHEV

- ICE

- 按燃料类别

- 天然气

- 柴油引擎

- 汽油

- LPG

- 混合动力汽车和电动车

- 国家

- 奥地利

- 比利时

- 捷克共和国

- 丹麦

- 爱沙尼亚

- 法国

- 德国

- 爱尔兰

- 义大利

- 挪威

- 波兰

- 俄罗斯

- 西班牙

- 瑞典

- 英国

- 其他欧洲国家

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Daimler AG(Mercedes-Benz AG)

- Man Truck & Bus

- PACCAR Inc.

- Scania AB

- Volvo Group

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 93020

The Europe Medium and Heavy-duty Commercial Vehicles Market size is estimated at 40.99 billion USD in 2025, and is expected to reach 50.13 billion USD by 2029, growing at a CAGR of 5.16% during the forecast period (2025-2029).

Due to the strategic importance of medium and heavy-duty vehicles in Europe's commercial transport landscape, businesses are focusing on efficiency and regulatory compliance

- Transport plays a pivotal role in bolstering Europe's economy, fostering growth, and enhancing its competitiveness. The commercial vehicle sector is actively aligning with the climate goals outlined in the Paris Agreement. While the adoption of alternative fuels and powertrains is gaining traction, the availability of charging and refueling infrastructure for commercial vehicles remains limited. With over 6.3 million vehicles plying the roads of the EU, they account for a staggering 76.7% of all land-based freight, moving a colossal 15 billion tonnes annually.

- Europe bore the brunt of the COVID-19 impact, witnessing a production loss of approximately 50,000 units in March and April. This was primarily due to stringent factory closures, workplace regulations, supply chain disruptions, and stay-at-home orders. By the close of 2020, commercial vehicle manufacturing in Europe had plummeted by nearly 20% compared to the preceding year. Notably, countries like Poland in Central Europe and Italy in the West, pivotal hubs for the continent's trucking industry, are projected to witness the sharpest demand decline.

- The growth in logistics and construction activities has spurred the demand for material transportation, leading to a surge in commercial vehicle sales across Europe. This trend is expected to further bolster the business vehicle market in the near future. The market is poised for growth, driven by the uptick in construction and e-commerce operations. Additionally, the shift toward electric vehicles holds promising prospects for market expansion in the coming years.

Europe Medium and Heavy-duty Commercial Vehicles Market Trends

Environmental concerns, government support, and decarbonization goals fuel European electric vehicle demand and sales

- The demand and sales of electric vehicles in European countries have grown significantly over the past few years. Germany witnessed a growth in the sales of electric cars by 22% in 2022 over 2021, followed by the United Kingdom with an 18.40% increase in 2022 over 2021. Growing environmental concerns, stringent governmental norms, advantages of electric vehicles such as fuel efficiency, low service cost, no carbon emissions, and subsidies by the government are some of the factors contributing to the growth of electric vehicles in European countries.

- The demand for electric commercial vehicles, especially light trucks, is growing gradually in European countries. Moreover, the governments of various countries are also supporting the adoption of electric vehicles. In November 2021, the government of the United Kingdom announced a pledge that all heavy-duty vehicles would be zero-emission by the year 2040. Such factors have increased the sales of electric commercial vehicles in the United Kingdom by 23.17% in 2022 over 2021, and similar practices in various countries are enhancing the demand for electric commercial vehicles across Europe.

- It is projected that the electrification of vehicles in European countries is expected to grow tremendously in the next few years. The efforts of the governments in the regions for decarbonization are expected to drive the electric commercial vehicle market in Europe. For instance, in January 2022, the transport minister of Germany announced a goal to put 15 million electric vehicles on the road by 2030. Such factors are expected to increase the sales of electric vehicles during the 2024-2030 period in European countries.

Europe Medium and Heavy-duty Commercial Vehicles Industry Overview

The Europe Medium and Heavy-duty Commercial Vehicles Market is fairly consolidated, with the top five companies occupying 87%. The major players in this market are Daimler AG (Mercedes-Benz AG), Man Truck & Bus, PACCAR Inc., Scania AB and Volvo Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Impact Of Electrification

- 4.7 EV Charging Station

- 4.8 Battery Pack Price

- 4.9 New Xev Models Announced

- 4.10 Logistics Performance Index

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.2 Propulsion Type

- 5.2.1 Hybrid and Electric Vehicles

- 5.2.1.1 By Fuel Category

- 5.2.1.1.1 BEV

- 5.2.1.1.2 FCEV

- 5.2.1.1.3 HEV

- 5.2.1.1.4 PHEV

- 5.2.2 ICE

- 5.2.2.1 By Fuel Category

- 5.2.2.1.1 CNG

- 5.2.2.1.2 Diesel

- 5.2.2.1.3 Gasoline

- 5.2.2.1.4 LPG

- 5.2.1 Hybrid and Electric Vehicles

- 5.3 Country

- 5.3.1 Austria

- 5.3.2 Belgium

- 5.3.3 Czech Republic

- 5.3.4 Denmark

- 5.3.5 Estonia

- 5.3.6 France

- 5.3.7 Germany

- 5.3.8 Ireland

- 5.3.9 Italy

- 5.3.10 Norway

- 5.3.11 Poland

- 5.3.12 Russia

- 5.3.13 Spain

- 5.3.14 Sweden

- 5.3.15 UK

- 5.3.16 Rest-of-Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Daimler AG (Mercedes-Benz AG)

- 6.4.2 Man Truck & Bus

- 6.4.3 PACCAR Inc.

- 6.4.4 Scania AB

- 6.4.5 Volvo Group

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219