|

市场调查报告书

商品编码

1693667

欧洲建筑修復和维修化学品:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Europe Construction Repair and Rehabilitation Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

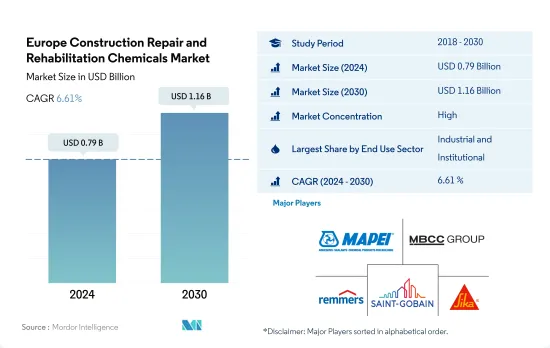

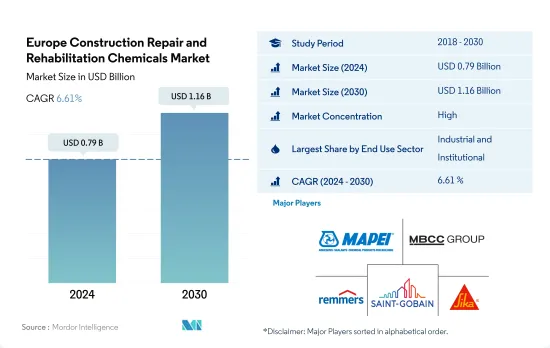

预计 2024 年欧洲建筑修復和维修化学品市场规模为 7.9 亿美元,到 2030 年将达到 11.6 亿美元,预测期内(2024-2030 年)的复合年增长率为 6.61%。

商业领域预计将成为市场成长最快的终端用途领域

- 2022年,欧洲建筑修復和维修化学品市场以金额为准成长3.65%,这得益于商业、工业和机构建筑领域需求的成长。到 2023 年,该市场预计将在全球占据约 26.71% 的份额。

- 工业和设施产业成为最大的消费产业,占 2022 年欧洲建筑修復和维修化学品市场的 47.03%。在工业、教育和医疗保健等领域投资增加的带动下,预计到 2030 年该地区的占地面积将增加 114 亿平方英尺,比 2023 年大幅成长。因此,预计到 2030 年,工业和设施产业的规模将比 2023 年增加 2.08 亿美元。

- 该地区的商业部门预计将成为建筑修復和维修化学品成长最快的消费领域,预测期内复合年增长率最高,为 7.59%。经济的快速扩张极大地影响了对办公室、酒店和零售商场等商业设施的需求,以满足商业需求。预计到 2030 年,该行业的现有占地面积将比 2023 年增加 104 亿平方英尺。因此,该地区的建筑修復和维修化学品预计将从 2023 年的 1.31 亿美元增长到 2030 年的 2.18 亿美元。

由于对现有生产单位的维修投资不断增加,预计法国对建筑修復化学品的需求将很高

- 建筑修復和维修化学品市场包括修补砂浆、水泥浆材料、纤维包覆系统和微混凝土砂浆等各种产品。这些化学产品对于建筑物和结构的修復和恢復至关重要。

- 2022年,欧洲建筑修復和维修化学品市场价值与前一年同期比较增3.65%。其中俄罗斯和西班牙分别以5.01%和4.42%的成长率领先。

- 2022年,建筑修復和维修化学品市场以德国为主,主要专注于基础建设,占了22%的较大以金额为准。例如,德国政府公路公司Autobahn已拨款5.78亿美元用于维修该国老化的基础设施,包括桥樑、道路和港口。因此,2022 年建筑业的价值与 2021 年相比成长了 4.51%。

- 预计预测期内,法国建筑修復和维修化学品市场的复合年增长率最高,为 7.36%。为了履行2050年实现零碳排放的承诺,法国计划投资327亿美元用于建筑物的热能维修。此外,根据法国-勒朗斯计划,为了吸引更多的工业公司,法国正在维修现有的製造设施。因此,预计产业建设将经历显着增长,预计 2030 年产业建设占地面积将比 2022 年增加 129 亿平方英尺。预计工业建筑业在预测期内的复合年增长率将达到 8.48%。

欧洲建筑修復维修化学品市场趋势

义大利、西班牙等国商业建筑计划增加,推动商业部门发展

- 2022年,受办公大楼、饭店和零售商场需求成长的推动,欧洲商业占地面积预计将年增与前一年同期比较%。预计这一增长将持续到 2023 年,欧洲的面积将增加约 12 亿平方英尺。这一成长主要由外国直接投资(FDI)的增加所推动,这需要开发新的办公室、仓库和零售空间。

- 欧洲商业领域延续了 2020 年的势头,2021 年占地面积扩大了 1.70%。这一增长得益于该行业的数位化努力和外国投资的激增。其中,2021年欧洲商业不动产外商投资达2,730亿欧元,与前一年同期比较增15%。德国办公大楼市场也呈现显着成长,交易额达305亿欧元,较2020年成长11%。

- 预计未来几年欧洲商业建筑业将经历强劲成长,预测期内现有占地面积的复合年增长率预计将达到 2.02%。值得关注的计划包括位于义大利米兰的美国总领事馆大楼,该项目计划于 2025 年完工,投资计划为 6500 万美元。西班牙Arteixo办公大楼扩建工程占地180万平方英尺,耗资2.6亿美元,计画于2024年投入运作。此外,欧洲消费者越来越喜欢实体零售体验,预计将导致零售购物中心的建设激增。到 2030 年,现有占地面积预计将增加 104.4 亿平方英尺,比 2022 年大幅成长。

住宅需求的增加和政府对住宅的投资可能会促进住宅产业的发展。

- 2022年欧洲住宅占地面积将年增与前一年同期比较%。这一增长是由都市化的上升所推动的,城镇人口将达到总人口的 75%,高于 2021 年的 73.5%。预计这一趋势将在 2023 年继续,住宅占地面积预计将增长 1.68%。此外,预计2023年欧洲住宅计划竣工量将成长2.7%,其中匈牙利、爱尔兰、挪威和波兰的成长最为显着。

- 2018年至2021年间,欧洲住宅占地面积增加了4.02%。仅在 2021 年,受住宅需求激增的推动,该地区就增加了约 45 亿平方英尺的住宅占地面积。例如,在法国,2021年独立住宅与前一年同期比较增0.025%,而多用户住宅成长了1.23%。

- 预计欧洲住宅占地面积将成长,预测期内复合年增长率为 1.58%。这一增长将受到持续的住宅需求、不断增加的投资和政府的支持性政策的推动。尤其是英国的经济适用房计画等倡议,该计画获得了80亿美元的投资,目标是到2026年提供13万套住宅。此外,预计到2030年,欧洲将投资约25亿欧元用于住宅维修。

欧洲建筑修復与维修化学品产业概况

欧洲建筑修復和维修化学品市场相当集中,前五大公司占据了 85.85% 的市场。市场的主要企业有:MAPEI SpA、MBCC Group、Remmers Gruppe AG、Saint-Gobain 和 Sika AG(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 终端使用领域的趋势

- 商业

- 工业/设施

- 住宅

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 最终用途领域

- 商业

- 工业/设施

- 基础设施

- 住宅

- 子产品

- 光纤缠绕系统

- 水泥浆料

- 微混凝土砂浆

- 改质砂浆

- 钢筋保护器

- 国家

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 英国

- 其他欧洲国家

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Ardex Group

- Fosroc, Inc.

- MAPEI SpA

- MBCC Group

- MC-Bauchemie

- Remmers Gruppe AG

- RPM International Inc.

- Saint-Gobain

- Sika AG

- Simpson Strong-Tie Company, Inc.

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 93128

The Europe Construction Repair and Rehabilitation Chemicals Market size is estimated at 0.79 billion USD in 2024, and is expected to reach 1.16 billion USD by 2030, growing at a CAGR of 6.61% during the forecast period (2024-2030).

The commercial sector is expected to be the fastest-growing end use sector in the market

- In 2022, the construction repair and rehabilitation chemicals market in Europe experienced a 3.65% growth in value, driven by increased demand from the commercial and industrial & institutional construction sectors. By 2023, the market was expected to hold a significant share of approximately 26.71% globally.

- The industrial & institutional sector emerged as the largest consumer, accounting for 47.03% of Europe's construction repair and rehabilitation chemicals market in 2022. With investments increasing in sectors like industrial, education, and healthcare, the floor area in the region is projected to increase by 11.4 billion square feet by 2030, a significant increase from 2023. Consequently, the industrial & institutional sector is projected to witness an increase in value of USD 208 million by 2030 compared to 2023.

- The commercial sector in the region is expected to be the fastest-growing consumer of construction repair and rehabilitation chemicals, recording the highest CAGR of 7.59% during the forecast period. The economy's rapid expansion has considerably impacted the need for commercial property to meet the demands of enterprises, such as offices, hotels, and retail shopping malls. The existing floor area for the sector is projected to increase by 10.4 billion sq. ft by 2030 compared to 2023. As a result, the construction repair and rehabilitation chemicals for the sector in the region are projected to reach USD 218 million in 2030 from USD 131 million in 2023.

High demand predicted for construction repair chemicals in France due to rising investments in the renovation of existing manufacturing units in the country

- The market for construction repair and rehabilitation chemicals contains a range of products, such as repair mortars, injection grouting materials, fiber wrapping systems, and microcrete mortars. These chemicals are crucial for the restoration and repair of buildings and structures.

- In 2022, the construction repair and rehabilitation chemicals market in Europe witnessed a 3.65% growth in value compared to the previous year. Notably, Russia and Spain led the pack with growth rates of 5.01% and 4.42%, respectively.

- Germany dominated the construction repair and rehabilitation chemicals market in 2022, capturing a significant share of 22% by value, primarily driven by its focus on infrastructure development. For instance, Autobahn, a German government road firm, allocated USD 578 million to revamp the nation's aging infrastructure, including bridges, roads, and seaports. Consequently, the construction sector witnessed a 4.51% growth in value in 2022 compared to 2021.

- France is poised to witness the highest CAGR of 7.36% in the construction repair and rehabilitation chemicals market during the forecast period. In line with its commitment to achieving zero carbon emissions by 2050, France has earmarked a significant investment of USD 32.7 billion for thermal renovations in buildings. Furthermore, under the France Relance plan, a move to attract more industrial firms, the country is revamping its existing manufacturing facilities. As a result, the industrial construction sector is projected to witness a notable surge, with the floor area for industrial construction expected to increase by 12.9 billion square feet in 2030 compared to 2022. This surge in industrial construction is anticipated to drive a CAGR of 8.48% in the value of the sector during the forecast period.

Europe Construction Repair and Rehabilitation Chemicals Market Trends

Rising commercial construction projects in countries, such as Italy, Spain, and others, will boost the commercial sector

- In 2022, the commercial floor area in Europe saw a 1.88% uptick from the previous year, driven by heightened demand for properties like offices, hotels, and retail malls. This growth continued into 2023, with Europe witnessing a volume increase of around 1.2 billion sq. ft. This surge was primarily fueled by a rise in foreign direct investment (FDI), necessitating the development of new offices, warehouses, and retail spaces.

- The commercial sector in Europe saw a 1.70% expansion in its floor area in 2021, building on the momentum from 2020. This growth was propelled by the sector's digitalization efforts and a surge in foreign investments. Notably, foreign investments in European commercial real estate reached EUR 273 billion in 2021, marking a 15% increase from the previous year. Germany's office real estate market also witnessed a notable uptick, with transactions amounting to EUR 30.5 billion, an 11% rise from 2020.

- Looking ahead, the commercial construction sector in Europe is poised for significant growth, with the existing floor area projected to achieve a CAGR of 2.02% during the forecast period. Noteworthy projects, such as the Milan US Consulate General Complex in Italy, are set to be completed by 2025 with a planned investment of USD 65 million. The Arteixo Office Building Expansion in Spain, spanning 1.8 million sq. ft, valued at USD 260 million, slated for operation in 2024, is set to bolster the commercial construction landscape. Furthermore, as European consumers increasingly favor brick-and-mortar retail experiences, the construction of retail shopping malls is expected to surge. By 2030, the existing floor area is projected to expand by 10.44 billion sq. ft, a significant jump from 2022.

The increase in the demand for housing units and government investments in housing are likely to boost the residential sector

- In 2022, the residential floor area in Europe saw a 1.43% volume increase from the previous year. This growth can be attributed to the rising urbanization rate, as the urban population reached 75% of the total population, up from 73.5% in 2021. This trend is expected to persist in 2023, with a projected growth of 1.68% in the residential floor area. Additionally, Europe is set to witness a 2.7% rise in housing project completions in 2023, with notable growth in Hungary, Ireland, Norway, and Poland.

- Between 2018 and 2021, Europe witnessed a 4.02% increase in its residential floor area. In 2021 alone, the region added approximately 4.5 billion sq. ft of residential floor area, driven by a surge in housing demand. For instance, France saw a .025% rise in standalone houses and a 1.23% increase in collective housing units in 2021, compared to the previous year.

- Europe's residential floor area is projected to grow, registering a CAGR of 1.58% during the forecast period. This growth is fueled by sustained housing demand, increased investments, and supportive government policies. Notably, initiatives like the UK's Affordable Homes Programme, backed by an USD 8 billion investment, aim to deliver 130,000 housing units by 2026. Moreover, Europe is expected to invest approximately EUR 2.5 billion in residential dwelling renovations by 2030.

Europe Construction Repair and Rehabilitation Chemicals Industry Overview

The Europe Construction Repair and Rehabilitation Chemicals Market is fairly consolidated, with the top five companies occupying 85.85%. The major players in this market are MAPEI S.p.A., MBCC Group, Remmers Gruppe AG, Saint-Gobain and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End Use Sector Trends

- 4.1.1 Commercial

- 4.1.2 Industrial and Institutional

- 4.1.3 Residential

- 4.2 Regulatory Framework

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size, forecasts up to 2030 and analysis of growth prospects.)

- 5.1 End Use Sector

- 5.1.1 Commercial

- 5.1.2 Industrial and Institutional

- 5.1.3 Infrastructure

- 5.1.4 Residential

- 5.2 Sub Product

- 5.2.1 Fiber Wrapping Systems

- 5.2.2 Injection Grouting Materials

- 5.2.3 Micro-concrete Mortars

- 5.2.4 Modified Mortars

- 5.2.5 Rebar Protectors

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Russia

- 5.3.5 Spain

- 5.3.6 United Kingdom

- 5.3.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Ardex Group

- 6.4.2 Fosroc, Inc.

- 6.4.3 MAPEI S.p.A.

- 6.4.4 MBCC Group

- 6.4.5 MC-Bauchemie

- 6.4.6 Remmers Gruppe AG

- 6.4.7 RPM International Inc.

- 6.4.8 Saint-Gobain

- 6.4.9 Sika AG

- 6.4.10 Simpson Strong-Tie Company, Inc.

7 KEY STRATEGIC QUESTIONS FOR CONCRETE, MORTARS AND CONSTRUCTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219