|

市场调查报告书

商品编码

1693925

自由职业平台-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Freelance Platforms - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

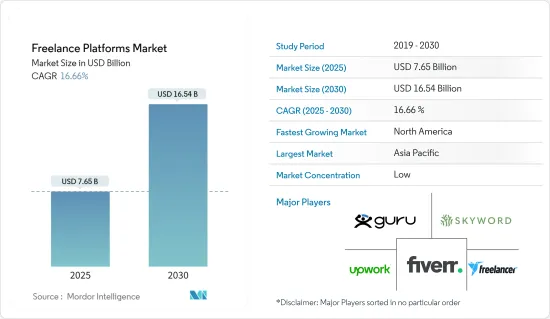

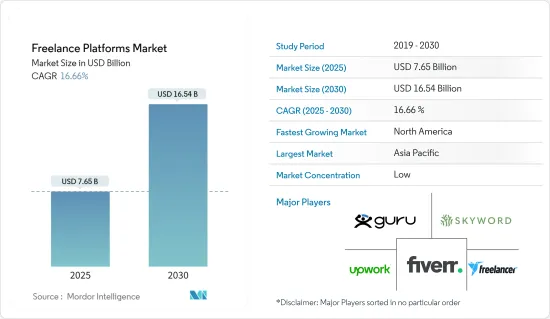

自由职业平台市场规模预计在 2025 年为 76.5 亿美元,预计到 2030 年将达到 165.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 16.66%。

自由职业平台是一个将技术熟练、才华横溢的自由工作者与企业联繫起来的市场。企业可以利用自由工作平台,根据经验和技能等多种因素搜寻自由工作者来僱用临时劳动力。此外,希望成为自由工作者的个人可以在平台上建立个人资料并与雇主联繫。

关键亮点

- 随着企业寻求灵活地适应不断变化的需求,对灵活劳动力的日益增长的需求正在推动全球对自由职业平台和服务的需求。自由职业平台还可以让企业快速获得专业技能,而不受全职工作的束缚,从而有效地扩大规模并控製成本。

- 对灵活劳动力的需求日益增长,使得企业可以藉助自由职业平台接触来自不同地区的具有不同技能的专业人士。透过僱用具有专业技能的承包商和自由工作者,公司可以利用他们的专业知识,而无需支付全职薪水。这使得企业能够保持领先地位并为客户提供优质的产品和服务。这一趋势正在推动对自由职业平台和服务的需求

- 对专业技能的需求日益增长,促使企业将自由职业平台作为一种策略解决方案,为企业提供一个可以找到熟练的专业人员来服务各个行业的市场。随着产业因各种业务需求而不断发展,自由职业平台对这些企业的作用已变得至关重要。

- 平台交易费、付款延迟以及复杂的外汇流程是造成付款流程缺乏信任和不确定性的关键因素,这可能会阻碍企业和自由工作者使用该平台,并影响自由工作者的收入。

- 由于这种情况,公司开始关注远距工作和自由职业的好处,并开始重新思考他们的工作方式。在意识到这些效率后,许多公司开始使用临时工来满足其企划为基础的需求,从而促使其人才获取策略发生转变。根据西班牙国家能源局(INE)的报告,到2023年,从事混合角色的工人比例将从2020年的4.2%上升到7%。

自由职业平台市场的趋势

服务业显着成长

- 该市场提供的服务包括託管服务和技术服务。这些服务涵盖了业务的不同方面。託管服务包括人才参与、策略咨询、人力资源和组织咨询、工程服务和自由工作者招募。

- 同时,市场参与企业提供的技术服务包括云端、品质保证、应用和资讯安全服务。这些服务支持并增强了自由职业体验,使企业和自由工作者的工作更加轻鬆。

- 此外,远距工作的兴起进一步加速了对自由职业服务的需求,使得人们能够不受地理限制地接触到多样化的人才库。这一趋势与工作性质的演变相一致,强调企划为基础的协作以及根据特定计划要求组建团队的能力。

- 根据英国国家统计局的数据,到2023年,约有442万英国员工将在僱佣合约中享受灵活的工作安排。英国第二种最常见的弹性工作安排是年薪,即员工每年可以工作指定的小时数,而不是每週或每月工作相同的小时数。

预计亚太地区将出现显着成长

- 亚太地区自由职业平台市场的成长主要得益于零工经济的成长、不收取服务费的机会的出现以及数位化的快速发展。

- 此外,年轻且多元化的劳动力正在推动灵活工作安排的趋势,创造大量潜在的自由工作者,并使该地区成为自由职业平台的主要市场。

- 随着自由工作者数量的快速增长以及企业转向自由职业平台聘请专家从事特定工作,自由职业平台的使用正在获得发展势头。根据新加坡政府发布的劳工报告,新加坡有257,000名自由工作者,包括全职专业和学生。

- 此外,根据专业平行职业自由工作者协会进行的一项线上调查,选择在日本从事自由职业的主要原因包括「时间和地点的灵活性」、「能够更好地发挥技能和能力」以及「能够根据自己的判断开展工作」。

自由职业平台产业概览

自由职业平台市场比较分散,许多参与企业在全球开展业务。市场上的主要企业包括 Upwork Global Inc.、Fiverr International Ltd.、Guru.com、Skyword Inc. 和 Freelancer Limited。这些公司面临激烈的竞争,并积极推行合併、收购和联盟等无机策略。

- 2023 年 12 月,SAP Fieldglass 和 Flextrack 宣布计画与 Upwork 合作,提供更全面、更统一的劳动力管理方法。这些整合和伙伴关係有望帮助 Upwork 客户提高效率并优化和扩大其整个劳动力队伍,包括工人、独立员工和永久员工。

- 2023 年 8 月,WorkGenius 以 1.5 亿美元收购了总部位于柏林的科技公司 Expertlead,该公司以将技术自由工作者与公司进行匹配以及P2P即时编码评估而闻名。 Expertlead 的服务和产品(包括其评估技术)将完全融入 WorkGenius,扩大 WorkGenius 在技术自由职业市场的影响力。 WorkGenius 和 Expertlead 的客户都将受益于合併平台的协同效应。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 对灵活劳动力的需求日益增长

- 对专业技能的需求不断增加

- 市场问题

- 对付款缺乏信任和不确定性

第六章市场区隔

- 按组件

- 平台

- 按服务

- 按应用

- 计划管理

- 销售与行销

- IT服务

- 网页与平面设计

- 其他的

- 按最终用户

- 雇主

- 自由工作者

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章竞争格局

- 公司简介

- Upwork Global Inc.

- Fiverr International Ltd

- Skyword Inc.

- Guru.com

- Freelancer Limited

- People Per Hour Ltd

- DesignCrowd

- Contently Inc.

- WorkGenius

- WorkMarket Inc.

第八章投资分析

第九章:市场的未来

The Freelance Platforms Market size is estimated at USD 7.65 billion in 2025, and is expected to reach USD 16.54 billion by 2030, at a CAGR of 16.66% during the forecast period (2025-2030).

Freelance platforms are the marketplaces that connect skilled and qualified freelancers and businesses. Businesses can leverage freelance platforms for hiring temporary workforce by searching for freelancers based on several factors like experience, skill, and others. Moreover, individuals looking to freelance can create their profiles on the platform and contact employers.

Key Highlights

- The growing need for a flexible workforce is driving demand for freelance platforms and services globally as businesses look for agility in adapting to changing demands. Also, the quick access to specialized skills by freelance platforms without the commitment of full-time hires allows companies to scale efficiently and manage costs effectively.

- A rising need for a flexible workforce enables businesses to access a diverse pool of skilled professionals from different geographic regions with the help of freelance platforms. By hiring contract workers or freelancers with specialized skills, businesses benefit from their expertise without having to pay full-time salaries. This allows businesses to stay ahead and deliver high-quality products and services to their customers. With this trend, the demand for freelance platforms and services is increasing.

- The increasing demand for specialized skills is driving businesses to turn to freelance platforms as a strategic solution, which provides a marketplace where companies can find skilled professionals for various business functions. As industries continuously evolve with different business needs, the role of freelance platforms becomes essential for these businesses.

- Platform transaction fees, payment delays, and complex currency exchange processes are primary factors creating a lack of trust and uncertainty in the payment process, deterring businesses and freelancers from using platforms, and potentially impacting freelancer income.

- The outbreak has prompted businesses to reevaluate their work structures, highlighting the advantages of remote work and freelance setups. Recognizing the efficiency, many have turned to temporary workers for project-based needs, prompting a shift in talent acquisition strategies. INE (Spain) reports that the percentage of workers in hybrid roles rose from 4.2% in 2020 to 7% by 2023.

Freelance Platforms Market Trends

Services Component to Witness Major Growth

- The service offerings in the market comprise managed and technology services. These services cover different aspects of freelancing work. The managed services include talent engagement, strategy consulting, people and organization consulting, engineering services, and freelance recruiting.

- Meanwhile, technological services offered by the market players include cloud, quality assurance, application, and information security services. These services support and enhance the freelancing experience, making it easier for businesses and freelancers.

- Additionally, the rise of remote work has further accelerated the demand for freelance services, enabling access to a diverse talent pool regardless of geographical constraints. This trend aligns with the evolving nature of work, emphasizing project-based collaboration and the ability to assemble teams based on specific project requirements.

- According to the Office for National Statistics UK, around 4.42 million UK employees had flexible working arrangements on employment contracts in 2023. The second most common practice of flexible arrangement in the United Kingdom was an annualized hours contract, which allowed employees to work a specified number of hours per year rather than the same number of hours weekly or monthly.

Asia-Pacific Expected to Witness Significant Growth

- The growth of the freelance platform market in the Asia-Pacific region is mainly attributed to the growth of the gig economy, the introduction of platforms that offer opportunities without service charges, and rapid growth in digitalization.

- Further, the large and diverse population with a younger workforce is increasingly seeking flexible work options, creating a large pool of potential freelancers and making the region a key market for freelance platforms.

- Due to the rapidly increasing number of freelancers and the use of freelance platforms by businesses to hire professionals for specific work, the use of freelance platforms is gaining momentum. According to a labor report published by the Government of Singapore, there were 257 thousand freelancers in Singapore, including full-time professionals, students, and others.

- According to an online survey conducted by the Professional and Parallel Career Freelance Association, in Japan, the key reasons for choosing to work freelance by people include the need for flexibility in time and place, better use of skills and abilities, and work on own discretion.

Freelance Platforms Industry Overview

The freelance platforms market is fragmented, with numerous players operating globally. Key players in the market include Upwork Global Inc., Fiverr International Ltd, Guru.com, Skyword Inc., and Freelancer Limited. These companies face intense competition and are actively pursuing inorganic strategies such as mergers, acquisitions, and partnerships.

- December 2023: SAP Fieldglass and Flextrack announced that they are planning to partner with Upwork to deliver a more comprehensive and unified approach to workforce management. These integrations and partnerships would help Upwork customers drive efficiency and optimize and scale their overall workforces, including workers, independent talent, and full-time employees.

- August 2023: WorkGenius acquired Expertlead, a Berlin-based technology firm known for matching tech freelancers with companies and offering peer-to-peer live coding assessments, for USD 150 million. Expertlead's services and products, including their assessment technology, will be fully integrated into WorkGenius, expanding WorkGenius's reach in the technology freelance market. Both WorkGenius and Expertlead's clients will benefit from the synergies of the combined platforms.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Need for Flexible Workforce

- 5.1.2 Increasing Demand for Specialized Skills

- 5.2 Market Challenges

- 5.2.1 Lack of Trust and Uncertainty about Payments

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Platform

- 6.1.2 Services

- 6.2 By Application

- 6.2.1 Project Management

- 6.2.2 Sales and Marketing

- 6.2.3 IT

- 6.2.4 Web and Graphic Design

- 6.2.5 Other Applications

- 6.3 By End User

- 6.3.1 Employers

- 6.3.2 Freelancers

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Upwork Global Inc.

- 7.1.2 Fiverr International Ltd

- 7.1.3 Skyword Inc.

- 7.1.4 Guru.com

- 7.1.5 Freelancer Limited

- 7.1.6 People Per Hour Ltd

- 7.1.7 DesignCrowd

- 7.1.8 Contently Inc.

- 7.1.9 WorkGenius

- 7.1.10 WorkMarket Inc.