|

市场调查报告书

商品编码

1836474

货柜运输:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Shipping Containers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

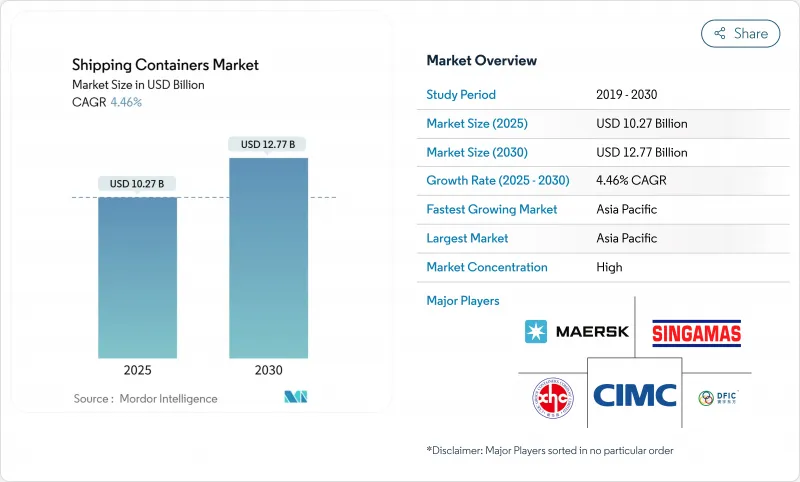

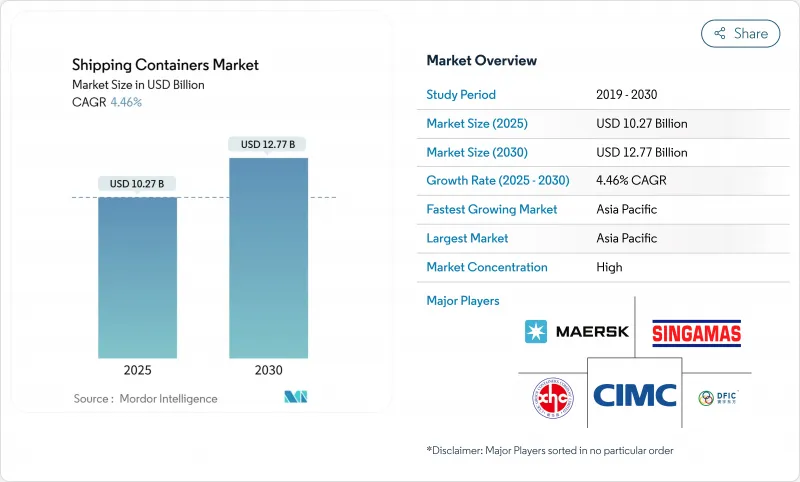

预计 2025 年货柜市场价值将达到 102.7 亿美元,到 2030 年预计将达到 127.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.46%。

电子商务履约、不断扩展的医药低温运输以及更有效率的多式联运正在推动稳定的结构性需求。容器化在处理90%的全球贸易中发挥着重要作用,支撑着这一增长,而数位化追踪工具和更聪明的设计则有助于营运商缩短港口停留时间并提高周转率。永续性目标正在推动材料创新,转向更轻质的复合材料,航运公司之间的联盟重组正在重塑运力部署策略,以支持规模更大、技术型船队的发展。地缘政治动盪不仅加剧了短期波动,也凸显了多元化贸易航线和动态航线的重要性。

全球货柜运输市场趋势与洞察

跨境电子商务的爆炸性成长推动了24小时週转时间的期望

电子商务的扩张推动了货运频率的提升和小批量运输的出现,将焦点从船舶运力转向港口速度。航运公司正在为高频次航线增添设备,港口也在投资自动化起重机,以便在一个班次内完成船舶清关。智慧追踪使托运人能够在货物抵达前完成清关并预留铁路舱位。这些营运优势缩短了库存週期,增强了对标准干箱的偏好,即使在贸易量波动的情况下也能保持较高的运转率。随着线上市场渗透到新兴经济体,货柜运输市场在各贸易航线上都经历了持续的基准需求。

低温运输的全球扩张加速了先进冷藏货物的订单

製药商正在将远距运输从空运转向海运,以降低成本和排放,同时不影响温度控制。最新的冷藏船保持±0.5 度C的精度,并整合遥测技术,可即时标记偏差,从而能够在航行途中采取纠正措施。易腐食品出口商也正在采用类似的技术,以最大限度地减少腐败并送达远距离消费者。提供双燃料冷冻设备的製造商透过降低能耗并满足低全球暖化潜势 (GWP) 法规,实现了更高的单箱价格。随着杂货电商拓展到新的市场,对先进冷藏船的需求持续超过普通货物的需求成长。

疫情后,箱子供应过剩将导致利用率下降

2021年至2023年期间创纪录的新造船数量将造成暂时的供过于求,从而压低租赁费率,并促使运营商推迟新订单。贸易疲软将导致门户港口閒置库存积压,迫使堆场降低仓储费以吸引船舶调配业务。製造商将透过减少生产班次并将产能转向需求更稳定的专业设计来适应这项变化。一旦报废船队赶上老化船队的速度,贸易恢復正常,预计这项调整将得以解决。

报告中分析的其他驱动因素和限制因素

- D2C 品牌要求客製化带有标誌的容器

- 企业 ESG 义务推动采用可重复使用包装

- 热捲钢价格波动带来预算不确定性

細項分析

高柜产品的需求日益增长,因为其13%的余量可以最大限度地提升电商小包裹和轻型家电等物品的运输容量。累计增长52.64%,显示其在海运领域将继续受到欢迎,而到2030年,40英尺高柜产品的复合年增长率预计将达到5.61%。高柜货柜的市场规模反映了托运人对更大容量且不违反重量限制的偏好。

港口基础设施升级可容纳更高的堆垛,码头营运商正在增加正面吊运机,以有效处理这些货物。物流整合商正在推动40英尺货柜的标准化,以简化铁路货车分配和场站交换。 Triton Containers正在推广并推广高柜租赁,并提供灵活的取货选项,以减少搬迁。总体而言,托运人正专注于货柜效率和包装整合,这将使高柜货柜在主要贸易走廊中持续受到青睐。

到2024年,干货仓储箱将占到出货量的72.75%,凸显其作为全球商品流通支柱的地位。相较之下,随着生鲜食品出口商和製药商拓展其海运航线,到2030年,冷藏货柜的复合年增长率将达到6.42%。目前,冷藏货柜是货柜运输市场的高端产品,租金比干货货柜高出两到三倍。

技术升级包括变速压缩机和太阳能辅助电源模组,以降低空转期间的能耗。药品运输商需要冗余温度探头和门感测器,以便在出现偏差的几秒钟内发出警报,从而推动製造商之间的差异化。冷藏货柜也受益于脱碳,因为将对温度敏感的货物从空运转移到海运可以避免高达 80% 的相关排放。

货柜运输市场按尺寸(20 英尺 (TEU)、40 英尺 (FEU)、其他)、货柜类型(干式储运(标准)、冷藏、其他)、材质(耐候钢、不銹钢、其他)、终端行业(消费品/零售、其他)、运输方式(近海/深海、其他地区)和地区(北美、南美、其他地区)。市场预测以美元计算。

区域分析

到2024年,亚太地区将占全球货柜总收入的60.50%,到2030年,复合年增长率将达到5.67%。中国将继续保持製造业主导,而随着企业采购多元化,东南亚地区的货柜吞吐量正在不断增长。马来西亚和印度的大型港口计划每年将新增超过2500万个标准箱的吞吐量,从而稳定区域吞吐量,并刺激支线网路的货柜需求。货币稳定和有利的贸易协定也鼓励区域租赁市场扩大船队规模。

北美将受益于近岸外包,将电子产品和汽车组装转移到更靠近消费市场的地方。美国港口当局已核准数十亿美元的疏浚和泊位电气化项目,增强了其与墨西哥和加拿大港口的竞争力。美国中西部地区的铁路多式联运发展将在八天内建造连接大西洋和太平洋的经济高效的陆桥,从而推动与堆迭列车相容的货柜设计的采用。

欧洲地区成长喜忧参半,地缘政治紧张局势导致亚欧航线绕道非洲,导致运输时间延长,而地中海枢纽的停靠次数则增加。伦敦门户港和鹿特丹马斯平原港的自动化投资将提高每台起重机的小时作业能力,并降低每箱成本指标。更严格的环保法规正在加速淘汰老旧、重型货柜,转而使用可回收集装箱,儘管贸易量低迷,但仍支撑了更换需求。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 跨境电子商务的爆炸性成长使得人们对标准干货货柜24小时送达时间的期望越来越高。

- 低温运输在新鲜食品和食材自煮包宅配领域的兴起加速了先进冷藏箱的订单。

- 直接面向消费者 (D2C) 的品牌要求为行动快闪店和履约中心提供客製化的、印有标誌的容器。

- 由于托运人寻求可重复使用的多模态货柜而非一次性托盘包装,企业 ESG 要求正在推动更换需求。

- 采用支援物联网的智慧箱来提供即时位置和状况数据将增加托运人购买优质设备的意愿。

- 订阅式和模组化住房概念正在推动退役货柜的二次利用。

- 市场限制

- 疫情爆发后,货柜供应过剩导致运转率下降,并抑制了新的建设投资。

- 热轧钢卷钢价格的波动给了货柜买家预算不确定性。

- 从摇篮到坟墓的监管和延伸生产者责任 (EPR) 规则正在推高终身所有权成本。

- 替代性折迭式容器的迅速出现已经蚕食了传统硬质箱的需求。

- 价值/供应链分析

- 监管和技术展望

- 五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 定价分析-标准货柜与专用货柜

- 焦点:多式联运与铁路使用

- 全球货柜情势

- 地缘政治事件如何影响市场

第五章市场规模与成长预测(价值、数量)

- 按尺寸

- 20英尺(标准箱)

- 40英尺(FEU)

- 40英尺高立方体

- 其他(>45 英尺等)

- 依货柜类型

- 干式(标准)

- 冷藏(冷藏箱)

- 储槽(ISO 储槽、低温储槽)

- 平板架和开顶架

- 特殊应用(侧门、隧道、绝缘、折迭式)

- 按材质

- 耐候钢

- 防锈的

- 铝合金

- 玻璃纤维/复合材料

- 其他的

- 按行业

- 消费品和零售

- 饮食

- 工业机械和汽车

- 化工/石油

- 製药和医疗保健

- 其他的

- 交通方式

- 海上运输

- 近海/海岸

- 铁路联运

- 陆运及现场仓储

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 秘鲁

- 智利

- 阿根廷

- 其他南美

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 东南亚(新加坡、马来西亚、泰国、印尼、越南、菲律宾)

- 其他亚太地区

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 比荷卢经济联盟(比利时、荷兰、卢森堡)

- Nordix(丹麦、芬兰、冰岛、挪威、瑞典)

- 其他欧洲国家

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争态势

- 市场集中度

- 策略趋势(併购、合资、土地储备收购、IPO)

- 市占率分析

- 公司简介

- China International Marine Containers(CIMC)

- Dong Fang International Containers

- CXIC Group(CSSC)

- Maersk Container Industry A/S

- Singamas Container Holdings

- W&K Container

- Sea Box Inc.

- TLS Offshore Containers

- Storstac Inc.

- CARU Containers BV

- China Eastern Containers

- Valisons & Co.

- YMC Container Solutions

- American Intermodal Container Manufacturing

- Triton International

- Textainer Group Holdings

- Florens Container Services

- CAI International

- Touax Group

- UES International

第七章 市场机会与未来展望

The Shipping Containers Market size is estimated at USD 10.27 billion in 2025, and is expected to reach USD 12.77 billion by 2030, at a CAGR of 4.46% during the forecast period (2025-2030).

E-commerce fulfillment, pharmaceutical cold-chain expansion, and rising intermodal efficiency provide stable, structural demand. Containerization's role in handling 90% of global trade underpins this growth, while digital tracking tools and smarter designs help operators shorten port stays and boost asset turnover. Sustainability targets are pushing material innovation toward lighter composites, and alliance restructuring among carriers is reshaping capacity deployment strategies in favor of larger, technology-enabled fleets. Geopolitical disruptions add short-term volatility but also reinforce the importance of diversified trade lanes and dynamic routing.

Global Shipping Containers Market Trends and Insights

Explosive Growth of Cross-Border E-Commerce Creating 24-Hour Turnaround Expectations

E-commerce expansion drives more frequent, smaller shipments, shifting focus from vessel capacity toward port velocity. Carriers commit additional equipment to high-frequency loops, while ports invest in automated cranes that clear vessels inside one shift. Smart tracking allows shippers to pre-clear customs and book rail slots before docking. These operational gains shorten inventory cycles and reinforce preference for standard dry boxes, keeping utilization high even when trade volumes fluctuate. As online marketplaces penetrate emerging economies, the shipping container market sees sustained baseline demand across diverse trade lanes.

Worldwide Cold-Chain Penetration Accelerates Advanced Reefer Orders

Pharmaceutical producers are migrating long-haul shipments from air to ocean to cut costs and emissions without compromising temperature control. Modern reefers maintain +-0.5 °C accuracy and integrate telemetry that flags deviations in real time, allowing corrective actions mid-voyage. Fresh grocery exporters adopt similar technology to reach distant consumers with minimal spoilage. Manufacturers offering dual-fuel refrigeration units reduce energy consumption and meet low-GWP regulations, enabling higher price realisation per box. As grocery e-commerce extends to new markets, advanced reefer demand continues to outpace general cargo growth.

Post-Pandemic Oversupply of Boxes Eroding Utilization Rates

Record new builds made during 2021-2023 create a temporary surplus, pushing lease rates down and prompting operators to delay fresh orders. Idle inventories accumulate in gateway ports when trade softens, forcing depots to lower storage fees to attract repositioning business. Manufacturers adapt by trimming production shifts and redirecting capacity toward specialized designs with steadier demand. The correction is expected to resolve once scrappage catches up with ageing fleets and trade normalizes.

Other drivers and restraints analyzed in the detailed report include:

- Direct-to-Consumer Brands Demanding Bespoke, Logo-Printed Containers

- Corporate ESG Mandates Pushing Reusable Container Adoption

- Volatility in Hot-Rolled Coil Steel Prices Creating Budget Uncertainty

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

High-cube offerings are capturing incremental demand because their 13% extra headroom maximizes volumetric loads such as e-commerce parcels and lightweight consumer electronics. 40-ft formats generated 52.64% revenue in 2024, demonstrating entrenched popularity for ocean freight, whereas 40-ft high-cube units are forecast to grow at 5.61% CAGR to 2030. The shipping container market size for high-cube units reflects shipper preference for greater capacity without breaching weight restrictions.

Port infrastructure upgrades accommodate taller stacks, and terminal operators add reach-stackers with extended lifting heights to handle these units efficiently. Logistics integrators promote standardization on the 40-ft profile to streamline rail wagon allocation and depot interchange. Triton Containers markets high-cube leases with flexible pick-up options to reduce repositioning, reinforcing adoption. Overall, shipper focus on cubic efficiency and consolidation of packaging drives continued high-cube traction across primary trade corridors.

Dry storage boxes accounted for 72.75% of 2024 shipments, underscoring their status as the backbone of global commodity flows. In contrast, reefer units record a 6.42% CAGR to 2030 as fresh produce exporters and drug makers scale ocean routes. Refrigerated boxes currently represent the premium slice of the shipping container market, commanding rental rates two to three times higher than dry units.

Technology upgrades include variable-speed compressors and solar-assisted power modules that cut energy draw during idle periods. Pharmaceutical shippers require redundant temperature probes and door sensors that trigger alerts within seconds of deviation, driving differentiation among manufacturers. Reefers also benefit from decarbonization, as shifting temperature-sensitive goods from air to sea avoids up to 80% of related emissions.

The Shipping Container Market is Segmented by Size (20-Ft (TEU), 40-Ft (FEU) and More), by Container Type (Dry Storage (Standard), Refrigerated, and More), by Material (Corten Steel, Stainless Steel and More), End-Use Industry (Consumer Goods & Retail and More), by Mode of Transport (Maritime Deep-Sea and More), by Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated with 60.50% revenue in 2024 and is set to grow at a 5.67% CAGR to 2030. China retains manufacturing leadership, yet Southeast Asia captures incremental volumes as firms diversify sourcing. Malaysian and Indian mega-port projects add more than 25 million TEU of annual capacity, anchoring regional throughput and stimulating container demand across feeder networks. Currency stability and supportive trade agreements also encourage regional leasing pools to expand their fleets.

North America benefits from nearshoring that shifts electronics and automotive assembly closer to consumption markets. United States port authorities approve multi-billion-dollar dredging and berth electrification programs, enhancing competitiveness against Mexican and Canadian gateways. The rail intermodal build-out across the Midwest unlocks cost-effective land bridges that connect Atlantic and Pacific basins in under eight days, driving uptake of stack-train compatible container designs.

Europe records mixed growth as geopolitical tensions divert Asia-Europe sailings around Africa, extending transit times but also directing additional calls to Mediterranean hubs. Investments in automation at London Gateway and Rotterdam Maasvlakte raise throughput per crane hour, cushioning cost-per-box metrics. Stringent environmental regulations accelerate the retirement of older, heavier boxes in favor of recycled-content steel units, supporting replacement demand despite subdued trade volume growth.

- China International Marine Containers (CIMC)

- Dong Fang International Containers

- CXIC Group (CSSC)

- Maersk Container Industry A/S

- Singamas Container Holdings

- W&K Container

- Sea Box Inc.

- TLS Offshore Containers

- Storstac Inc.

- CARU Containers B.V.

- China Eastern Containers

- Valisons & Co.

- YMC Container Solutions

- American Intermodal Container Manufacturing

- Triton International

- Textainer Group Holdings

- Florens Container Services

- CAI International

- Touax Group

- UES International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosive growth of cross-border e-commerce creating 24-hour turnaround expectations for standard dry containers.

- 4.2.2 Worldwide cold-chain penetration of fresh grocery and meal-kit delivery accelerating orders for advanced reefer boxes.

- 4.2.3 Direct-to-consumer (D2C) brands demanding bespoke, logo-printed containers to double as mobile pop-up stores and fulfilment hubs.

- 4.2.4 Corporate ESG mandates pushing shippers toward reusable, multimodal containers over single-use pallet wrap, lifting replacement demand.

- 4.2.5 Adoption of IoT-enabled -smart- boxes providing real-time location & condition data, raising shipper's willingness to pay for premium units.

- 4.2.6 Subscription-based and modular housing concepts spurring second-life conversions of retired shipping containers.

- 4.3 Market Restraints

- 4.3.1 Post-pandemic oversupply of boxes eroding utilisation rates and discouraging new-build investment.

- 4.3.2 Volatility in hot-rolled coil steel prices creating budget uncertainty for container purchasers.

- 4.3.3 Stricter cradle-to-grave regulations and extended-producer-responsibility (EPR) rules inflating lifetime ownership costs.

- 4.3.4 Rapid emergence of foldable and collapsible container alternatives cannibalising demand for conventional rigid boxes.

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory & Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Pricing Analysis - Standard vs. Special Containers

- 4.8 Spotlight: Intermodal & Rail Uptake

- 4.9 Global Container Leasing Landscape

- 4.10 Impact of Geopolitical Events on the Market

5 Market Size & Growth Forecasts (Value, Volume)

- 5.1 By Size

- 5.1.1 20-ft (TEU)

- 5.1.2 40-ft (FEU)

- 5.1.3 40-ft High-Cube,

- 5.1.4 Others ( >45-ft, etc)

- 5.2 By Container Type

- 5.2.1 Dry Storage (Standard)

- 5.2.2 Refrigerated (Reefer)

- 5.2.3 Tank (ISO Tank, Cryogenic)

- 5.2.4 Flat-Rack & Open-Top

- 5.2.5 Special Purpose (Side-Door, Tunnel, Insulated, Collapsible)

- 5.3 By Material

- 5.3.1 Corten Steel

- 5.3.2 Stainless Steel

- 5.3.3 Aluminium Alloy

- 5.3.4 FRP & Composite

- 5.3.5 Others

- 5.4 By End-Use Industry

- 5.4.1 Consumer Goods & Retail

- 5.4.2 Food & Beverage

- 5.4.3 Industrial Machinery & Automotive

- 5.4.4 Chemicals & Petroleum

- 5.4.5 Pharmaceuticals & Healthcare

- 5.4.6 Others

- 5.5 By Mode of Transport

- 5.5.1 Maritime Deep-Sea

- 5.5.2 Short-Sea & Coastal

- 5.5.3 Rail Intermodal

- 5.5.4 Road Inland Haulage & Off-Site Storage

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Peru

- 5.6.2.3 Chile

- 5.6.2.4 Argentina

- 5.6.2.5 Rest of South America

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 Australia

- 5.6.3.5 South Korea

- 5.6.3.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.6.3.7 Rest of Asia-Pacific

- 5.6.4 Europe

- 5.6.4.1 United Kingdom

- 5.6.4.2 Germany

- 5.6.4.3 France

- 5.6.4.4 Spain

- 5.6.4.5 Italy

- 5.6.4.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.6.4.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.6.4.8 Rest of Europe

- 5.6.5 Middle East And Africa

- 5.6.5.1 United Arab of Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Nigeria

- 5.6.5.5 Rest of Middle East And Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Capacity Expansion, Leasing Deals)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 China International Marine Containers (CIMC)

- 6.4.2 Dong Fang International Containers

- 6.4.3 CXIC Group (CSSC)

- 6.4.4 Maersk Container Industry A/S

- 6.4.5 Singamas Container Holdings

- 6.4.6 W&K Container

- 6.4.7 Sea Box Inc.

- 6.4.8 TLS Offshore Containers

- 6.4.9 Storstac Inc.

- 6.4.10 CARU Containers B.V.

- 6.4.11 China Eastern Containers

- 6.4.12 Valisons & Co.

- 6.4.13 YMC Container Solutions

- 6.4.14 American Intermodal Container Manufacturing

- 6.4.15 Triton International

- 6.4.16 Textainer Group Holdings

- 6.4.17 Florens Container Services

- 6.4.18 CAI International

- 6.4.19 Touax Group

- 6.4.20 UES International

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment