|

市场调查报告书

商品编码

1850032

欧洲生质塑胶:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Europe Bioplastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

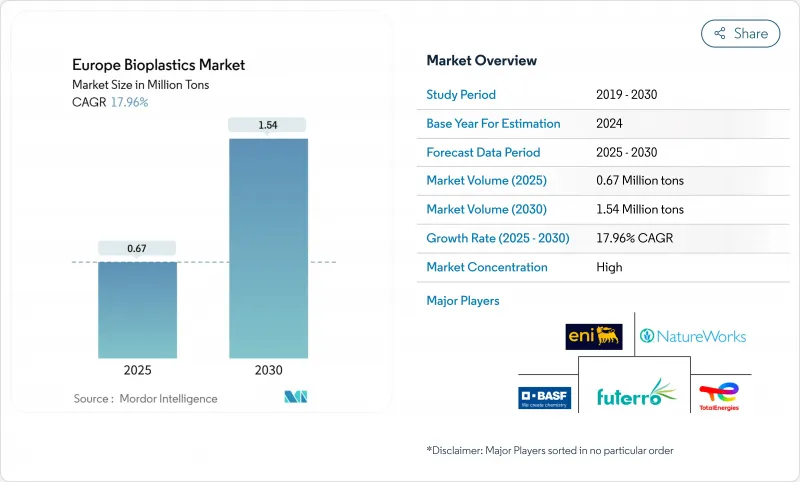

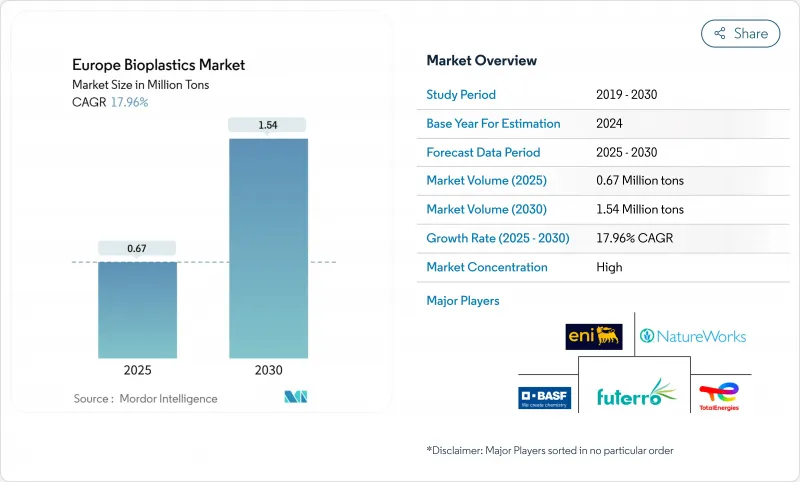

欧洲生质塑胶市场目前正按计画发展,到 2025 年将达到 67 万吨,到 2030 年将达到 154 万吨,2025 年至 2030 年的复合年增长率为 17.96%。

随着欧盟各国政策制定者收紧对化石基聚合物的限制,製造商将生物基替代品视为必不可少的升级,而不是可有可无的升级,这种转变正在渗透到食品、零售、汽车和消费品价值链的采购领域。

欧洲生质塑胶市场趋势与洞察

欧盟一次性塑胶指令触发了2030年实现可堆肥解决方案的强制性要求

该指令的逐步淘汰和再生材料含量配额正在推动咖啡盖、蔬果袋和快餐托盘等产品采用可堆肥生物聚合物。由于该法律采用材料性能标准而非品牌名称,生产商可以将PLA、PHA或淀粉混合物定位为符合规范且能降低碳排放强度的途径。成员国的实施时间表各不相同,因此拥有模组化生产方案的公司正在加速实施的市场中抢占先机。尤其是在波兰和爱尔兰,不同的收费系统鼓励在地采购可再生原料以减少运输足迹,从而潜移默化地将供应链转移到区域中心。

包装用生质塑胶的需求不断成长

软质包装目前已占据欧洲生质塑胶市场43%的份额,并以23%的复合年增长率持续成长。品牌商表示,从化石基聚乙烯(PE)转向生物基聚乙烯(bio-PE)和可堆肥复合材料所带来的行销优势足以抵消略高的价格。像蒙迪集团旗下的FlexStudios这样的创新中心正在展示,与客户共同开发如何能够缩短前置作业时间,并实现与现有树脂相当的生产线速度。这意味着,掌握挤出和阻隔涂层技术的加工商将在与跨国食品公司的谈判中获得更多议价能力。

除比荷卢经济联盟、义大利和法国以外,其他地区的工业堆肥能力有限。

因此,可堆肥包装最终可能被掩埋或污染机械回收流程。生产商正在透过推出双重认证产品来应对这一问题,这些产品既可回收又可工业堆肥,从而将风险分散到整个废物处理流程中。研究废弃物管理地图的投资人注意到,产能缺口与南欧旅游业发达地区重迭。这表明,基础设施瓶颈不仅会影响聚合物的选择,还会影响新建生质塑胶工厂的位置决策。

细分市场分析

生物基和生物分解性塑胶正巩固主导地位,预计到2024年将占据49%的市场份额,并预计在2030年之前以22.56%的复合年增长率增长。生产PLA和新兴PHA等级产品的高通量生产线采用有利的原料来源和车牌式生产技术,随着产量的增加,生产成本得以降低。速食连锁店采用可堆肥刀叉餐具的早期案例表明,与石油基餐具功能相匹配能够提升消费者对产品品质的感知,从而带来重复订单和可预测的规模化生产。这也表明,随着化石原料价格上涨,成本差距的缩小速度超出预期,成本持平的实现速度可能比先前预期的要快。

儘管生物基生物分解性塑胶在欧洲生质塑胶市场中所占比例较小,但由于它们能够融入现有的PET和PE回收流程,因此对那些不愿改变其逆向物流系统的饮料品牌来说极具吸引力。此次宣布的对植物来源PET的投资表明,阻碍成长的仍然是供应限制,而非需求疲软。

到2024年,甘蔗将占据约44%的原料市场份额,这主要得益于巴西和泰国工业发酵槽的全球运作,以及它们透过一体化物流向欧洲的供应。蔗糖稳定的产量和完善的认证系统降低了采购风险,促使买家签订多年合约。目前,林业纤维素残渣和麦秸的基数较小,但随着Deep Purple等计划证明了将都市废水污泥转化为PHA中间体的可行性,其市场正以22.3%的复合年增长率快速增长。目前的市场观点认为,纤维素路线将有助于实现地缘政治供应多元化,并缓解与糖业週期相关的价格波动。

欧洲生质塑胶市场报告按类型(生物基可生物降解、生物基不可生物降解)、原料(甘蔗/甜菜、玉米、其他)、加工技术(挤出、射出成型、其他)、应用(软包装、硬包装、汽车和组装、其他)以及国家(德国、英国、义大利、法国、荷兰、其他国家)对产业进行细分。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧盟一次性塑胶指令将于2030年强制要求使用可堆肥解决方案。

- 包装领域对生质塑胶的需求不断增长

- 推动模式转移的环境因素

- 政府采购政策优先考虑公共部门包装中的生物基材料。

- 禁止在某些应用中使用石化燃料基塑料

- 市场限制

- 除比荷卢经济联盟、义大利和法国以外,其他地区的工业堆肥能力有限。

- 欧盟27国产品标籤检视规则的不一致,使品牌推广变得复杂。

- 欧洲能源价格上涨推高了树脂挤出成本。

- 放宽新型生物单体的REACH认证途径

- 价值链分析

- 专利分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按类型

- 生物基且可生物降解

- 淀粉类

- 聚乳酸(PLA)

- 聚羟基烷酯(PHA)

- 聚酯(PBS、PBAT、PCL)

- 其他生物基和可生物降解材料

- 生物基不可生物降解

- 生物基聚对苯二甲酸乙二醇酯(PET)

- 生物聚乙烯

- 生物聚酰胺

- 生物聚对苯二甲酸丙二醇酯

- 其他生物基不可生物降解

- 生物基且可生物降解

- 按原料

- 甘蔗/甜菜

- 玉米

- 木薯和土豆

- 纤维素和木材废弃物

- 其他(藻类和微生物油)

- 透过加工技术

- 挤压

- 射出成型

- 吹塑成型

- 3D列印

- 其他(热成型等)

- 透过使用

- 软包装

- 硬包装

- 汽车及组装业务

- 农业和园艺

- 建造

- 纤维

- 电机与电子工程

- 其他用途

- 按国家/地区

- 德国

- 英国

- 义大利

- 法国

- 荷兰

- 西班牙

- 北欧的

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Arkema

- BASF

- BIO ON SpA

- Biome Bioplastics

- BIOTEC Biologische Naturverpackungen GmbH & Co. KG.

- Eni SpA(Novamont)

- Evonik Industries AG

- FKuR

- FUTERRO

- Green Dot Bioplastics Inc

- Innovia Films

- Lactips

- Minima

- Mitsubishi Chemical Group Corporation

- NatureWorks LLC

- Plantic

- Rodenburg Biopolymers

- Sulapac Oy

- TORAY INDUSTRIES, INC.

- TotalEnergies(Total Corbion)

第七章 市场机会与未来展望

The European bioplastics market is currently 0.67 million tons in 2025 and is on track to reach 1.54 million tons by 2030, supported by a forecast compound annual growth rate (CAGR) of 17.96% between 2025 and 2030.

Policymakers across the EU are tightening rules on fossil-based polymers, so manufacturers are treating bio-based alternatives as an essential rather than optional upgrade, a shift that is filtering through procurement departments in food, retail, automotive, and consumer-goods value chains.

Europe Bioplastics Market Trends and Insights

EU Single-Use Plastics Directive Triggering Mandatory Compostable Solutions by 2030

The Directive's phased bans and recycled-content quotas are creating structural pull for compostable biopolymers in items such as coffee caps, produce bags, and quick-service trays. Since the law uses material performance criteria rather than brand names, producers can position PLA, PHA, or starch blends as compliant pathways that also score carbon-intensity gains. Member-state timelines differ, so companies with modular production recipes are capturing early share in markets that front-load enforcement. An immediate observation is that differing fee structures, especially in Poland and Ireland, encourage local sourcing of renewable feedstocks to cut transport footprints, subtly tilting supply chains toward regionalised hubs.

Growing Demand for Bioplastics in Packaging

Flexible packaging already holds 43% European bioplastics market share and is growing at nearly 23% CAGR, because film and pouch makers can often substitute a single layer without overhauling entire filling lines. Brand owners report that switching from fossil PE to bio-PE or to a compostable laminate yields marketing benefits that offset modest price premiums, so sales teams pitch these materials as revenue protectors rather than pure cost items. Innovation hubs such as Mondi's FlexStudios demonstrate how co-development with customers cuts lead times and unlocks line-speed parity with incumbent resins. The implicit takeaway is that converters who master both extrusion and barrier-coating know-how gain bargaining power in negotiations with multinational food companies.

Limited Industrial-Composting Capacity Outside Benelux, Italy, and France

Only a fraction of EU regions operate certified industrial composting sites, so compostable packaging sometimes ends up in landfills or contaminates mechanical recycling streams. Producers respond by launching dual-certified grades that are both recyclable and industrially compostable, spreading risk across disposal pathways. Investors studying waste-management maps notice that capacity gaps overlap with high tourism regions in Southern Europe, suggesting that new composting plants could tap steady seasonal feedstock from hospitality waste. The inference here is that infrastructure bottlenecks will influence not just polymer selection but also plant-location decisions for new bioplastics facilities.

Other drivers and restraints analyzed in the detailed report include:

- Government Procurement Policies Favoring Bio-content in Public-Sector Packaging

- Ban on Fossil-Based Plastics in Specific Applications

- Inconsistent End-of-Life Labelling Rules Across EU-27 Complicate Brand Adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bio-based biodegradables command 49% Europe Bioplastics market share in 2024 and are forecast to post a 22.56% CAGR through 2030, reinforcing their leadership position. High throughput lines producing PLA and emerging PHA grades use advantaged feedstock sourcing and license plate technologies that compress production costs as volumes ramp. Early-stage evidence from fast-food chains adopting compostable cutlery shows that product-quality perception improves when functionality matches petro-based equivalents, leading to repeat orders and predictable scale-up. A telling inference is that cost-parity looks achievable earlier than once feared because rising fossil feedstock prices narrow the gap faster than forecast.

Bio-based non-biodegradables, while representing a smaller slice of Europe's Bioplastics market size, provide drop-in compatibility with existing PET and PE recycling streams, which appeals to beverage brands reluctant to alter reverse-logistics systems. Announced investments in plant-based PET confirm that supply constraints, rather than demand hesitation, remain the growth limiter.

Sugarcane accounts for roughly 44% Europe Bioplastics market share by feedstock in 2024 because industrial fermenters in Brazil and Thailand run at world-scale and supply Europe via integrated logistics. Stable sucrose yields and established certification schemes keep procurement risks low, so buyers lock multi-year contracts. Cellulosic residues from forestry and straw hold a smaller base today but expand at a rapid 22.3% CAGR as projects such as DEEP PURPLE demonstrate the feasibility of turning municipal wastewater sludge into PHA intermediates. A current market inference is that cellulosic routes will diversify geopolitical supply, dampening price volatility linked to sugar cycles.

The Europe Bioplastics Market Report Segments the Industry by Type (Bio-Based Biodegradables, Bio-Based Non-Biodegradables), Feedstock (Sugarcane/Sugar Beet, Corn, and More), Processing Technology (Extrusion, Injection Molding, Blow Molding, and More), Application (Flexible Packaging, Rigid Packaging, Automotive and Assembly Operations, and More), and Country (Germany, United Kingdom, Italy, France, Netherlands, and More).

List of Companies Covered in this Report:

- Arkema

- BASF

- BIO ON SpA

- Biome Bioplastics

- BIOTEC Biologische Naturverpackungen GmbH & Co. KG.

- Eni S.p.A. (Novamont)

- Evonik Industries AG

- FKuR

- FUTERRO

- Green Dot Bioplastics Inc

- Innovia Films

- Lactips

- Minima

- Mitsubishi Chemical Group Corporation

- NatureWorks LLC

- Plantic

- Rodenburg Biopolymers

- Sulapac Oy

- TORAY INDUSTRIES, INC.

- TotalEnergies (Total Corbion)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU Single-Use Plastics Directive Triggering Mandatory Compostable Solutions by 2030

- 4.2.2 Growing Demand for Bioplastics in Packaging

- 4.2.3 Environmental Factors Encouraging a Paradigm Shift

- 4.2.4 Government Procurement Policies Favoring Bio-Content in Public-Sector Packaging

- 4.2.5 Ban On Fossil-Based Plastics in Specific Applications

- 4.3 Market Restraints

- 4.3.1 Limited Industrial-Composting Capacity Outside Benelux, Italy, And France

- 4.3.2 Inconsistent End-Of-Life Labelling Rules Across the EU-27 Complicating Brand Adoption

- 4.3.3 High Energy Prices in Europe Inflating Resin Extrusion Costs

- 4.3.4 Slow REACH Certification Pathways for Novel Bio-Monomers

- 4.4 Value Chain Analysis

- 4.5 Patent Analysis

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Bio-based Biodegradables

- 5.1.1.1 Starch-based

- 5.1.1.2 Polylactic Acid (PLA)

- 5.1.1.3 Polyhydroxyalkanoates (PHA)

- 5.1.1.4 Polyesters (PBS, PBAT, PCL)

- 5.1.1.5 Other Bio-based Biodegradables

- 5.1.2 Bio-based Non-biodegradables

- 5.1.2.1 Bio Polyethylene Terephthalate (PET)

- 5.1.2.2 Bio Polyethylene

- 5.1.2.3 Bio Polyamides

- 5.1.2.4 Bio Polytrimethylene Terephthalate

- 5.1.2.5 Other Bio-based Non-biodegradables

- 5.1.1 Bio-based Biodegradables

- 5.2 By Feedstock

- 5.2.1 Sugarcane / Sugar Beet

- 5.2.2 Corn

- 5.2.3 Cassava and Potato

- 5.2.4 Cellulosic and Wood Waste

- 5.2.5 Others (Algae and Microbial Oil)

- 5.3 By Processing Technology

- 5.3.1 Extrusion

- 5.3.2 Injection Molding

- 5.3.3 Blow Molding

- 5.3.4 3D Printing

- 5.3.5 Others (Thermoforming, etc.)

- 5.4 By Application

- 5.4.1 Flexible Packaging

- 5.4.2 Rigid Packaging

- 5.4.3 Automotive and Assembly Operations

- 5.4.4 Agriculture and Horticulture

- 5.4.5 Construction

- 5.4.6 Textiles

- 5.4.7 Electrical and Electronics

- 5.4.8 Other Applications

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 Italy

- 5.5.4 France

- 5.5.5 Netherlands

- 5.5.6 Spain

- 5.5.7 Nordic

- 5.5.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)}

- 6.4.1 Arkema

- 6.4.2 BASF

- 6.4.3 BIO ON SpA

- 6.4.4 Biome Bioplastics

- 6.4.5 BIOTEC Biologische Naturverpackungen GmbH & Co. KG.

- 6.4.6 Eni S.p.A. (Novamont)

- 6.4.7 Evonik Industries AG

- 6.4.8 FKuR

- 6.4.9 FUTERRO

- 6.4.10 Green Dot Bioplastics Inc

- 6.4.11 Innovia Films

- 6.4.12 Lactips

- 6.4.13 Minima

- 6.4.14 Mitsubishi Chemical Group Corporation

- 6.4.15 NatureWorks LLC

- 6.4.16 Plantic

- 6.4.17 Rodenburg Biopolymers

- 6.4.18 Sulapac Oy

- 6.4.19 TORAY INDUSTRIES, INC.

- 6.4.20 TotalEnergies (Total Corbion)

7 Market Opportunities and Future Outlook

- 7.1 EU Circular Economy and Green Deal Strategies

- 7.2 White-space and Unmet-need Assessment