|

市场调查报告书

商品编码

1850203

製造业企业移动性:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Enterprise Mobility In Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

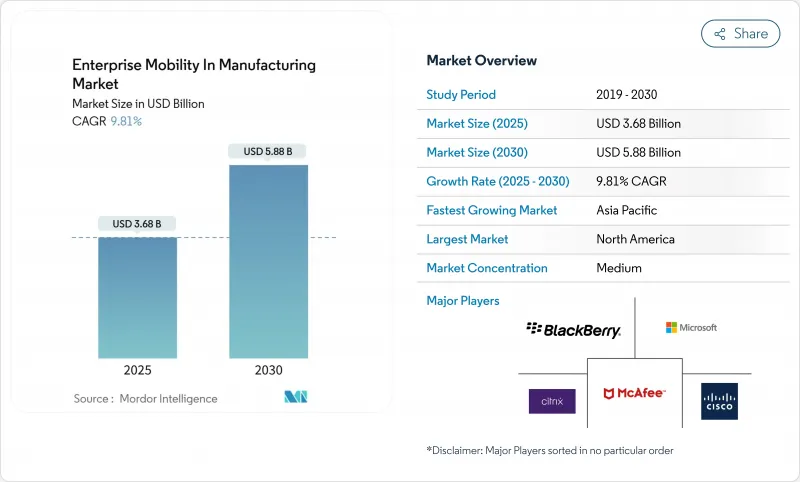

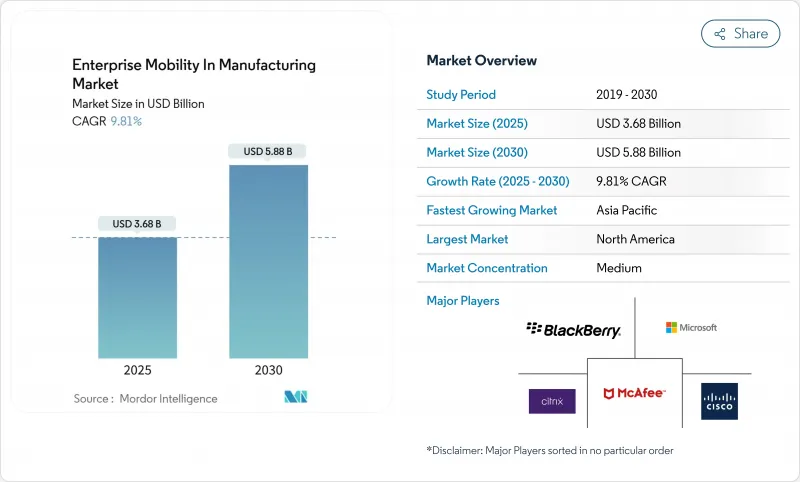

预计到 2025 年製造业企业行动市场规模将达到 36.8 亿美元,到 2030 年将达到 58.8 亿美元,复合年增长率为 9.8%。

这一成长趋势反映了向工业 4.0 的快速转变,其中移动化工作流程缩短了回应时间,提高了资产可视性,并增强了营运韧性。私有 5G 网路的日益普及、行动装置与製造执行系统 (MES) 整合度的提升,以及基于边缘的扩增实境应用的广泛应用,共同拓宽了车间移动化的使用场景。然而,只有 16% 的製造商能够享受即时生产视觉性,这凸显了打破长期资讯孤岛的数位化工具的巨大潜力。网路实体安全漏洞和资料主权限制阻碍了行动化的采用,迫使供应商转向零信任架构和针对特定区域的云端战略。

全球製造企业移动市场趋势与洞察

加速工业 4.0 和 IIoT 的采用

製造商正在将其工业物联网部署从概念验证计划扩展到全厂范围,将感测器、机器和行动端点连接到整合式资料环路。 83% 的製造商计划到 2024 年将生成式人工智慧纳入决策支持,这反映出他们对行动仪表板能够在边缘执行复杂分析的信心。这种影响在製程工厂尤为明显,移动网实整合系统使操作员能够在几分钟内(而不是几小时)远端微调参数。亚洲工厂在准备方面处于领先地位,53% 的管理人员计划在 2040 年实现自主运营,而西方工厂中这一比例不到一半。随着工业物联网 (IIoT) 的成熟度不断提高,对集扫描、可视化和语音功能于一体的坚固耐用型智慧型手机的需求也日益增长,这些智慧型手机旨在简化维护和品质任务。将硬体与低程式码应用程式建置器预先整合的供应商可以缩短引进週期并降低 IT 开销。

BYOD/CYOD 政策扩大了互联劳动力

工厂政策正在从限制性设备规则转变为结构化的自选设备和自选设备计划,以扩大员工对数位工具的存取权限。虽然 63% 的製造商已经允许使用个人设备,但只有 17% 的製造商实施了正式的 BYOD 框架,这表明采用方面存在巨大差距。正式的方案允许新员工使用熟悉的设备,在人手不足期间提高灵活性。三星的八步 CYOD 蓝图强调了高阶主管支援、基于风险的细分和用户培训的必要性,以在保持生产力的同时保护资料。成功的部署将公司凭证嵌入安全容器中,透过零信任网关路由流量,并与 MES 和 ERP 后端同步。与专用的公司硬体设备相比,早期采用者报告班次交接更快,配置成本更低。

网路安全漏洞和行动恶意软体

IT 与 OT 的整合使生产资产面临更大风险。去年,93% 的公司记录了 OT 入侵事件,而只有 13% 的公司享受到整合监控。行动端点扩大了攻击面,因为传统的防毒和补丁週期很少与持续营运保持一致。勒索软体宣传活动越来越多地瞄准人机介面平板电脑,导致主管无法控制系统。製造商正在利用微分段、行动威胁防御代理和严格的最小权限策略进行反击,但双技能安全专业人员的短缺正在减缓专案的成熟度。保险承保人对此作出回应,要求在续签网路风险保险之前提供零信任框架的证明,这增加了弥补漏洞的财务压力。

細項分析

到2024年,该细分市场将占总收入的48.7%,这证实了智慧型手机是工厂员工的主要行动闸道。一体化扫描、语音和数据功能减少了硬体成本,并减轻了IT配置负担。在审查期间,供应商改进了外形规格,包括MIL-STD-810H机壳、热插拔电池和手套操作触控屏,以适应恶劣的车间环境。操作员青睐内藏相机,用于远端协助和基于人工智慧的缺陷识别,而主管则利用高解析度显示器在现场巡查时查看KPI仪表板。

穿戴式装置细分市场的复合年增长率达 9.9%,这得益于免提拣选、抬头维护和人体工学负载平衡。智慧眼镜与数位双胞胎相结合,透过在工人视野中迭加维修步骤和感测器活动,减少了认知工作量。平板电脑支援品质保证工作台和工程工作单元,其更大的萤幕支援 CAD 图纸和偏差日誌。笔记型电脑仍停留在利基应用领域,例如模拟和 MES 管理任务,这些任务需要完整的键盘。新兴的智慧戒指和工业手持设备属于「其他」类别,这表明我们将继续尝试针对特定任务的外形设计,并可能在 2030 年临近时重构设备层次结构。

2024年,行动装置管理将占总收入的46.2%,这反映了其长期以来作为企业自有行动电话合规性支柱的地位。 MDM套件强制执行密码安全、远端擦除和应用程式白名单,并符合ISO 27001和NIST CSF指南的审核要求。然而,向包括笔记型电脑、扫描仪和物联网感测器在内的异质设备群的转变将推动统一端点管理的复合年增长率达到10.1%。 UEM整合了Windows、Android、iOS和编配的策略擦拭巾和修补程式状态,减少了冗余的管理工作。

製造业客户对 UEM 的自动化钩子功能感到兴奋,当设备跨越地理围栏或异常流量触发零信任规则时,该钩子会触发纠正措施。行动应用管理功能支援在参与 BYOD 方案时对个人装置容器化,无需拥有硬体即可隔离公司资料。独立的行动安全插件添加了基于机器学习的威胁搜寻功能。所有解决方案类型都支援模组化订阅包,可灵活适应计划范围,并整合原生分析主机,从而为财务团队展示投资回报率。

区域分析

北美将引领製造业企业行动市场,在成熟的自动化文化和资金雄厚的数位化蓝图的推动下,到2024年将占全球收入的39.1%。美国汽车和航太产业将把现有的行动试点计画升级到企业级,将5G园区网路覆盖到棕地PLC上,以支援自主物料输送和预测服务。加拿大食品加工产业将成为利基市场应用者,利用平板电脑进行过敏原管理和低温运输记录。

欧洲受到德国工业4.0计画和中小型企业的推动,他们正在用移动仪錶板改装传统的机器园区。法国製药公司正在采用本质安全型智慧型手机来记录无尘室的文檔,而义大利机械公司则正在部署扩增实境可穿戴设备,用于远端现场服务。欧盟的《一般资料保护规则》正在推动对设备加密和资料主权云端选项的需求激增,从而影响整个欧盟的采购标准。

随着中国、印度和东南亚经济体逐步取代旧有系统,亚太地区成为成长最快的地区,复合年增长率达 10.4%。领先的中国电子公司正在其大型工厂部署私人 5G 切片,以协调人工和机器人任务。在印度,政府在「生产挂钩奖励计画」下提供的激励措施正在加速中小企业采用云端基础的行动仪表板。新加坡和韩国是先锋试点区,技术人员配戴智慧眼镜与託管在主权云上的数位孪生互动。该地区的发展势头表明,随着工厂采用高密度自动化技术并结合日益增长的行动劳动力,2030 年后收益领先地位可能会发生转变。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场状况

- 市场概况

- 市场驱动因素

- 加速工业 4.0 和 IIoT 的采用

- BYOD/CYOD 政策扩大了互联劳动力

- 私有 5G 和 Wi-Fi 6 实现低延迟移动性

- 将行动装置与 MES 和云端 PLM 集成

- 由边缘运算驱动的扩增实境数位双胞胎将推动对坚固型平板电脑的需求

- 无纸化 ESG 合规推动行动电子日誌

- 市场限制

- 网路安全漏洞和行动恶意软体

- 传统 OT 整合的复杂性

- 行动云端中的资料主权障碍

- ATEX认证的本质安全设备供应有限

- 价值链分析

- 监管格局

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 评估宏观经济趋势对市场的影响

第五章市场规模及成长预测

- 依设备类型

- 智慧型手机

- 药片

- 笔记型电脑

- 穿戴式装置

- 其他设备类型

- 按解决方案

- 行动装置管理 (MDM)

- 行动应用程式管理(MAM)

- 行动安全和威胁预防

- 统一端点管理 (UEM)

- 其他解决方案

- 依部署方式

- 本地部署

- 云

- 按组织规模

- 大公司

- 小型企业

- 按製造垂直

- 离散製造

- 车

- 电子和半导体

- 航太和国防

- 工业机械

- 其他的

- 流程製造

- 食品/饮料

- 製药和生命科学

- 化学品

- 石油和天然气

- 金属和采矿

- 其他的

- 离散製造

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争态势

- 市场集中度分析

- 策略倡议和发展

- 市占率分析

- 公司简介

- VMware, Inc.

- Microsoft Corporation

- Cisco Systems, Inc.

- Blackberry Limited

- Citrix Systems, Inc.

- IBM Corporation

- SAP SE

- Oracle Corporation

- Broadcom Inc.(Symantec)

- MobileIron(Ivanti)

- SOTI Inc.

- Zebra Technologies Corporation

- Honeywell International Inc.

- Samsung SDS Co., Ltd.

- Infosys Limited

- Tata Consultancy Services Limited

- Tech Mahindra Limited

- McAfee, LLC

- Workspot, Inc.

- Tylr Mobile, Inc.

第七章 市场机会与未来展望

The enterprise mobility in manufacturing market size was USD 3.68 billion in 2025 and is forecast to reach USD 5.88 billion by 2030, expanding at a 9.8% CAGR.

The uptrend mirrors the sector's rapid transition toward Industry 4.0, where mobile-enabled workflows shorten response times, elevate asset visibility, and reinforce operational resilience. Growing deployment of private 5G networks, tighter integration between mobile devices and Manufacturing Execution Systems (MES), and the spread of edge-based augmented-reality applications collectively widen use cases for shop-floor mobility. Yet only 16% of manufacturers enjoy real-time production visibility, underscoring the sizeable headroom for digital tools that dissolve long-standing information silos. Cyber-physical security gaps and data-sovereignty constraints temper adoption, pushing vendors toward zero-trust architectures and region-specific cloud strategies.

Global Enterprise Mobility In Manufacturing Market Trends and Insights

Accelerating Industry 4.0 and IIoT adoption

Manufacturers are scaling Industrial Internet of Things deployments from proof-of-concept projects to plant-wide rollouts, linking sensors, machines, and mobile endpoints into unified data loops. Eighty-three percent of producers intend to embed generative AI in decision support during 2024, reflecting confidence that mobile dashboards can operationalize complex analytics at the edge. The pronounced impact shows in process plants where mobile cyber-physical systems let operators tweak parameters remotely in minutes rather than hours. Asian factories lead readiness, with 53% of managers targeting autonomous operations by 2040 compared to under half in Western facilities. Increased IIoT maturity lifts demand for rugged smartphones that merge scanning, visualization, and voice in a single device, streamlining maintenance and quality tasks. Vendors that pre-integrate hardware with low-code app builders shorten deployment cycles and reduce IT overhead.

BYOD/CYOD policies expand connected workforce

Factory policies are shifting from restrictive device rules toward structured Bring-Your-Own-Device and Choose-Your-Own-Device programs that broaden workforce access to digital tools. Sixty-three percent of manufacturers already tolerate personal devices on the floor, yet only 17% run formal BYOD frameworks, signalling a wide adoption gap. Formalized schemes improve agility during labor shortages by allowing new hires to onboard with familiar gear. Samsung's eight-step CYOD blueprint highlights the need for executive sponsorship, risk-based segmentation, and user training to safeguard data while sustaining productivity. Successful rollouts embed enterprise credentials into secure containers, route traffic through zero-trust gateways, and synchronize with MES and ERP back ends. Early adopters report shorter shift handovers and lower provisioning costs relative to a corporate-only hardware fleet.

Cybersecurity vulnerabilities and mobile malware

The fusion of IT and OT domains leaves production assets more exposed, with 93% of firms recording an OT intrusion last year while only 13% enjoy consolidated oversight. Mobile endpoints enlarge the attack surface as legacy antivirus and patch cycles rarely align with continuous operations. Ransomware campaigns increasingly target human-machine interface tablets, locking out supervisors from control systems. Manufacturers counter with micro-segmentation, mobile threat defense agents, and strict least-privilege policies, yet shortages in dual-skilled security professionals slow program maturity. Insurance underwriters respond by demanding proof of zero-trust frameworks before renewing cyber-risk coverage, adding financial pressure to remediate weaknesses.

Other drivers and restraints analyzed in the detailed report include:

- Private 5G and Wi-Fi 6 enable low-latency mobility

- Integration of mobile devices with MES and cloud PLM

- Legacy OT integration complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The segment generated 48.7% of total revenue in 2024, confirming smartphones as the primary mobile gateway for factory staff. Their all-in-one scanning, voice, and data functions cut hardware counts and lighten IT provisioning. Over the review period, vendors ruggedized form factors with MIL-STD-810H housings, hot-swappable batteries, and glove-friendly touchscreens, widening suitability for harsh shop-floor conditions. Operators value integrated cameras for remote assistance and AI-driven defect recognition, while supervisors exploit high-resolution displays for KPI dashboards during gemba walks.

The wearables sub-segment nonetheless records a 9.9% CAGR, propelled by hands-free picking, heads-up maintenance, and ergonomic load balancing. Smart glasses paired with digital twins reduce cognitive effort by overlaying repair steps and sensor trends in the worker's line of sight. Tablets anchor quality-assurance benches and engineering work cells where larger screens support CAD drawings and deviation logs. Laptops remain niche-bound to simulation and MES administration tasks that demand full keyboards. Emerging smart rings and industrial handhelds cluster under "other" but signal continual experimentation with task-specific form factors that could reshape device hierarchies as 2030 approaches.

Mobile Device Management held 46.2% revenue in 2024, a reflection of its long tenure as the compliance backbone for corporate-owned phones. MDM suites enforce password hygiene, remote wipe, and application whitelists, aligning with audit mandates under ISO 27001 and NIST CSF guidelines. However, the shift toward heterogenous fleets spanning laptops, scanners, and IoT sensors elevates Unified Endpoint Management to a 10.1% CAGR. UEM consolidates policy orchestration and patch status across Windows, Android, iOS, and Linux, reducing duplicated administrative effort.

Manufacturing clients gravitate to UEM's automation hooks that trigger remedial actions when a device crosses geofences or anomalous traffic trips a zero-trust rule. Mobile Application Management delivers containerization where personal devices participate in BYOD schemes, isolating corporate data without owning the hardware. Stand-alone mobile security plugins add machine-learning-based threat hunts, an asset in plants subject to critical infrastructure standards. Across all solution types, the momentum favors modular subscription bundles that flex with project scope and integrate native analytics consoles to evidence ROI for finance teams.

The Enterprise Mobility in Manufacturing Market is Segmented by Device Type (Smartphones, Tablets, and More), Solution (Mobile Device Management (MDM), and More), Deployment (On-Premise and Cloud), Organization Size (Large Enterprises and Small and Medium Enterprises (SMEs)), Manufacturing Vertical (Discrete Manufacturing and Process Manufacturing), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led the enterprise mobility in manufacturing market with 39.1% of 2024 global revenue, benefiting from entrenched automation cultures and well-funded digitization road-maps. United States automotive and aerospace clusters upgrade existing mobility pilots to enterprise scopes, layering 5G campus networks over brownfield PLCs to support autonomous material handling and predictive service. Canada's food-processing sector rises as a niche adopter, harnessing tablets for allergen control and cold-chain documentation.

Europe follows, anchored by Germany's Industry 4.0 program and its Mittelstand champions that retrofit legacy machine parks with mobile dashboards. French pharmaceuticals employ intrinsically safe smartphones for clean-room documentation, while Italian machinery firms deploy augmented-reality wearables for remote field service. EU General Data Protection Regulation drives high demand for on-device encryption and data-sovereign cloud options, shaping procurement criteria across the bloc.

Asia-Pacific is the fastest-growing territory, posting a 10.4% CAGR as China, India and Southeast Asian economies leapfrog legacy systems. Chinese electronics giants deploy private 5G slices across megafactories to coordinate human and robotic tasks. India's government incentives under the Production Linked Incentive scheme accelerate SME adoption of cloud-based mobility dashboards. Singapore and South Korea spearhead pilot zones where smart-glasses equipped technicians interface with digital twins hosted in sovereign clouds. The region's momentum signals a potential shift in revenue leadership beyond 2030 as plants embrace high-density automation paired with mobile workforce augmentation.

- VMware, Inc.

- Microsoft Corporation

- Cisco Systems, Inc.

- Blackberry Limited

- Citrix Systems, Inc.

- IBM Corporation

- SAP SE

- Oracle Corporation

- Broadcom Inc. (Symantec)

- MobileIron (Ivanti)

- SOTI Inc.

- Zebra Technologies Corporation

- Honeywell International Inc.

- Samsung SDS Co., Ltd.

- Infosys Limited

- Tata Consultancy Services Limited

- Tech Mahindra Limited

- McAfee, LLC

- Workspot, Inc.

- Tylr Mobile, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating Industry 4.0 and IIoT adoption

- 4.2.2 BYOD/CYOD policies expand connected workforce

- 4.2.3 Private 5G and Wi-Fi 6 enable low-latency mobility

- 4.2.4 Integration of mobile devices with MES and cloud PLM

- 4.2.5 Edge-powered AR and digital twins boost rugged-tablet demand

- 4.2.6 Paperless ESG compliance drives mobile e-logbooks

- 4.3 Market Restraints

- 4.3.1 Cybersecurity vulnerabilities and mobile malware

- 4.3.2 Legacy OT integration complexity

- 4.3.3 Data-sovereignty barriers to mobile cloud

- 4.3.4 Limited supply of ATEX-certified intrinsically-safe devices

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Device Type

- 5.1.1 Smartphones

- 5.1.2 Tablets

- 5.1.3 Laptops

- 5.1.4 Wearables

- 5.1.5 Other Device Types

- 5.2 By Solution

- 5.2.1 Mobile Device Management (MDM)

- 5.2.2 Mobile Application Management (MAM)

- 5.2.3 Mobile Security and Threat Defense

- 5.2.4 Unified Endpoint Management (UEM)

- 5.2.5 Other Solutions

- 5.3 By Deployment Mode

- 5.3.1 On-Premise

- 5.3.2 Cloud

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

- 5.5 By Manufacturing Vertical

- 5.5.1 Discrete Manufacturing

- 5.5.1.1 Automotive

- 5.5.1.2 Electronics and Semiconductor

- 5.5.1.3 Aerospace and Defense

- 5.5.1.4 Industrial Machinery

- 5.5.1.5 Others

- 5.5.2 Process Manufacturing

- 5.5.2.1 Food and Beverage

- 5.5.2.2 Pharmaceuticals and Life Sciences

- 5.5.2.3 Chemicals

- 5.5.2.4 Oil and Gas

- 5.5.2.5 Metals and Mining

- 5.5.2.6 Others

- 5.5.1 Discrete Manufacturing

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Egypt

- 5.6.5.2.3 Nigeria

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Analysis

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 VMware, Inc.

- 6.4.2 Microsoft Corporation

- 6.4.3 Cisco Systems, Inc.

- 6.4.4 Blackberry Limited

- 6.4.5 Citrix Systems, Inc.

- 6.4.6 IBM Corporation

- 6.4.7 SAP SE

- 6.4.8 Oracle Corporation

- 6.4.9 Broadcom Inc. (Symantec)

- 6.4.10 MobileIron (Ivanti)

- 6.4.11 SOTI Inc.

- 6.4.12 Zebra Technologies Corporation

- 6.4.13 Honeywell International Inc.

- 6.4.14 Samsung SDS Co., Ltd.

- 6.4.15 Infosys Limited

- 6.4.16 Tata Consultancy Services Limited

- 6.4.17 Tech Mahindra Limited

- 6.4.18 McAfee, LLC

- 6.4.19 Workspot, Inc.

- 6.4.20 Tylr Mobile, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment