|

市场调查报告书

商品编码

1850363

企业行动管理:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Enterprise Mobility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

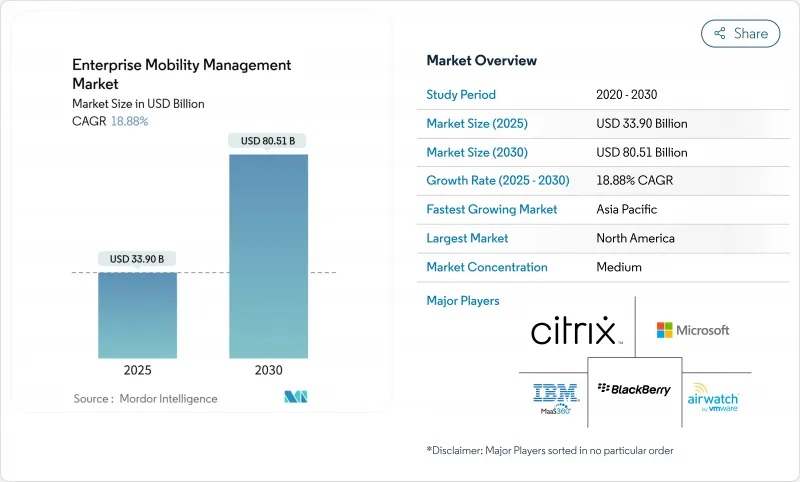

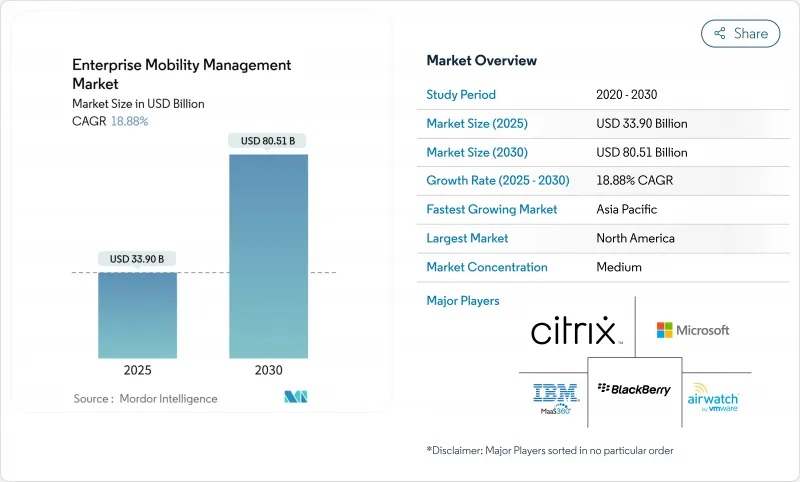

企业行动管理市场规模预计将在 2025 年达到 339 亿美元,到 2030 年将成长至 805.1 亿美元,复合年增长率为 18.88%。

零信任安全技术的日益普及、向云端的快速迁移以及人工智慧在策略编配中的应用,正在加速对统一行动平台的需求。如今,企业将端点控制视为业务永续营运优先事项,而非IT附加元件,推动了设备、应用和内容管治的投资创下历史新高。随着监管机构收紧资料外洩报告规则,北美企业正在加大投入;而亚太地区的企业则在行动优先的数位转型计画的支持下,迅速扩展部署规模。供应商正透过低延迟边缘架构来凸显自身优势,这些架构能够将检验流程本地化,从而减少用户摩擦并缩短事件回应时间。

全球企业行动管理市场趋势与洞察

企业行动装置和应用程式的激增

零售商、公用事业公司和公共机构如今管理的设备规模堪比通讯业者。日本7-Eleven便利商店集中管理遍布21,000家门市的300,000台平板电脑,充分展现了云端编配如何实现全国范围内的统一策略执行。微软Intune针对Apple Vision Pro推出的新策略集,展示了EMM主机必须在不牺牲用户体验的前提下,保护多么广泛的终端设备组合。内建于装置代理程式中的预测分析功能能够发现电池健康状况异常,并在异常演变为停机事件之前更新合规性。企业所有、个人启用(COPE)模式正在取代限制性封锁措施,在保障资料安全的同时,提升员工满意度。

自备设备办公室 (BYOD) 和远距办公文化的兴起

全球已有92%的企业允许某种形式的远端访问,高于2023年的76%,这使得安全团队面临越来越大的压力,需要透过加密容器将企业资料与个人内容隔离。医疗保健系统面临HIPAA合规性和临床医生便利性的双重压力,因此正在积极采用虚拟工作空间工具,以简化应用程序,同时避免将电子健康资讯(ePHI)留在未经管理的手机上。由45个机构组成的美国联邦行动小组正在製定一份共用的自带设备办公室(BYOD)评估清单,以简化采购流程并加快FedRAMP的核准。基于轮班的存取控制和快速企业擦拭巾功能现在已成为基本要求。

高昂的实施和升级成本

对于首次采用企业行动化方案的公司而言,整体拥有成本仍然难以确定。一项针对 150 位电话管理员的调查显示,31.3% 的受访者认为「成本透明度」是选择平台的最大障碍。合规性审核、证书续期和旧设备处置等隐性成本通常会超过第一年的订阅费用。供应商正在透过分拆功能来应对这一问题。微软目前将企业应用程式管理定价为每位用户每月 2 美元,使中小企业无需购买完整 SKU 即可添加高级修补程式功能。虽然云端传输降低了资本支出,但对于员工人数波动较大的公司而言,将预算转化为经常性支出仍然是一个挑战。

细分市场分析

到2024年,解决方案将占总收入的63%,巩固其作为设备、应用和内容层控制枢纽的地位。安全管理以20.8%的复合年增长率脱颖而出,反映了不断演变的威胁情势。设备管理仍然是吸引新客户的切入点,但越来越多地与人工智慧驱动的修復功能捆绑在一起。应用容器现在可以隔离个人行动电话上的企业数据,从而满足欧洲和加利福尼亚州的隐私法规要求。内容和电子邮件管理正从基本加密转向策略主导的数位浮水印,以防止未经授权的共用。通讯费用管理目前仍处于小众市场,但正受到寻求SIM卡级成本控制的物流公司的青睐。

服务线是产品系列。专业服务团队透过准备情况评估和分阶段切换计划来降低部署风险。託管服务提供全天候远端检测,这对于医疗保健和零售等行业人手不足的IT 团队至关重要。微软的高阶分析模组包含异常检测 API,合作伙伴可透过咨询服务获利。随着人工智慧的成熟,能够利用垂直产业资料优化模型的领域专家将获得更高的利润,从而使现有 MSP 相对于通用 MSP 更具优势。

到 2024 年,云端选项将占支出的 58.4%,复合年增长率 (CAGR) 将达到 19.2%,成为成长最快的领域。因此,企业行动管理市场正朝着可扩展的 SaaS主机方向发展,这些控制台配备自动更新的合规库。一家全国性零售连锁企业在 5000 个终端上运行了概念验证,并在四周内成功上线运作。对于需要确保资料驻留的银行而言,混合云仍然是理想的解决方案。敏感令牌储存在本机,而策略逻辑则在提供者的区域隔离云端中运作。在需要满足敏感资料安全要求的防御性部署中,本地部署仍然不可或缺,因为空气间隙的伺服器能够满足这些要求。

成本弹性是云端运算普及的根本原因。按需付费模式使中小企业能够根据设备采用情况灵活调整服务,而无需支付高额的授权费用。政府的全面采购协议,例如美国总务署 (GSA) 的「最佳行动通讯」合同,正在推动采购转向云端服务和 5G 服务。欧盟的《数位身分钱包条例》要求成员国在 24 个月内推出云端原生凭证库。预先认证本地匿名化标准的供应商更有可能超越依赖单一租户服务的竞争对手。

企业行动管理市场按类型(解决方案、服务)、部署类型(本地部署、云端基础、混合部署)、组织规模(大型企业、中小企业)、最终用户行业(银行、金融服务和保险、医疗保健和生命科学、其他)以及地区进行细分。市场预测以美元计价。

区域分析

北美地区将占2024年收入的32.8%,公共部门资料外洩事件加速了设备状态测试和持续身分验证的支出。网路安全和基础设施安全局的行动装置检查清单现已成为15个联邦部门采购范本的基础。加拿大《个人资讯保护法》修正案要求服务提供者将可识别资料储存在本地,从而推动了对国内SaaS服务的需求。墨西哥汽车产业正在工厂车间部署边缘运算平板电脑,促使工业整合商提供双语使用者介面和本地电信业者eSIM设定檔的身份验证。

亚太地区复合年增率最高,达22.3%,这主要得益于智慧型手机的普及和各国推行的数位化政策。在日本,便利商店和教育机构的试点计画展示了超大规模部署,凸显了集中式修补程式带来的营运效率优势。印度的《数位个人资料保护法》将资料外洩的报告期限缩短至最短72小时,迫使中小企业部署具备审核可用日誌的策略引擎。中国在设备数量方面占据主导地位,但对海外云端准入的限制却迫使跨国公司采用混合架构来应对网路安全审查。澳洲的《保护性安全指令001-2025》明确定义并规范了企业行动终端的强制性加密演算法。

在欧洲,《网路韧性法案》将加强产品安全监管,并强制要求2027年实现CE认证和事件回应流程。在德国,黑莓UEM获得BSI认证,为苹果机密部署铺平了道路,也反映了德国对认证解决方案的偏好。英国将完善脱欧后的资料传输规则,但会维持与欧盟充分性安排的互通性,以保障跨境SaaS的普及。南欧国家将优先推广配备EMM加密模组的数位身分钱包,以缩短公民服务的等待时间,并扩大包容性管治的范围。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 企业行动装置和应用程式的激增

- 自备设备办公室 (BYOD) 和远距办公文化的兴起

- 日益增长的行动网路安全威胁

- 加强资料保护条例(GDPR、CCPA 等)

- 零信任企业行动管理框架的出现

- 行动边缘运算在现场作业中的应用案例

- 市场限制

- 高昂的实施和升级成本

- 旧有系统整合的复杂性

- 对企业数据主权的担忧

- 由于 EMM 代理数量过多,导致电池/效能下降。

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 解决方案

- 设备管理

- 应用程式管理

- 安全管理

- 内容和电子邮件管理

- 通讯费用管理

- 服务

- 专业服务

- 託管服务

- 解决方案

- 透过部署模式

- 本地部署

- 云端基础的

- 杂交种

- 按组织规模

- 大公司

- 小型企业

- 按最终用户行业划分

- BFSI

- 医疗保健和生命科学

- 资讯科技和通讯

- 製造业和工业

- 零售与电子商务

- 政府和公共部门

- 运输/物流

- 其他(教育、能源、媒体)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- ASEAN

- 亚太其他地区

- 中东

- 海湾合作委员会国家

- 土耳其

- 以色列

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 肯亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析(2024 年)

- 公司简介

- VMware(AirWatch)

- Microsoft

- IBM(MaaS360)

- BlackBerry

- Citrix

- Ivanti(MobileIron)

- SOTI

- Sophos

- Broadcom(Symantec)

- ManageEngine(Zoho)

- Jamf

- Cisco Systems

- Samsung Knox

- Snow Software

- 42Gears

- Scalefusion(ProMobi)

- Hexnode(Mitsogo)

- Baramundi Software

- Matrix42

- Quest Software

- Absolute Software

第七章 市场机会与未来展望

The Enterprise mobility management market size reached USD 33.90 billion in 2025 and is forecast to grow to USD 80.51 billion by 2030, advancing at an 18.88% CAGR.

Heightened adoption of Zero Trust security, rapid cloud migration, and the embedding of artificial intelligence in policy orchestration are accelerating demand for unified mobility platforms. Organizations now view endpoint control as a business-continuity priority rather than an IT add-on, catalyzing record investments in device, application, and content governance. North American enterprises drive premium spending as regulators tighten breach-reporting rules, while Asia Pacific firms scale deployments fastest on the back of mobile-first digital-transformation programs. Vendors are differentiating through low-latency edge architectures that keep verification processes local, reducing user friction and lowering incident-response times.

Global Enterprise Mobility Management Market Trends and Insights

Proliferation of Enterprise Mobile Devices and Apps

Retailers, utilities, and public-sector agencies now oversee device fleets that rival telecom operators in scale. Seven-Eleven Japan centrally manages 300,000 tablets across 21,000 stores, demonstrating how cloud orchestration delivers uniform policy enforcement at national reach. Microsoft Intune's new policy set for Apple Vision Pro indicates a widening endpoint mix that EMM consoles must secure without sacrificing user experience. Predictive analytics embedded in device agents surface battery-health and update-compliance anomalies before they become downtime events. Corporate-owned-personally-enabled (COPE) models are replacing restrictive lockdowns, boosting employee satisfaction while preserving data custody.

Rising BYOD and Remote-Work Culture

Ninety-two percent of global firms now allow some form of remote access, up from 76% in 2023, forcing security teams to isolate corporate data from personal content through encrypted containers. Healthcare systems face twin pressures of HIPAA compliance and clinician convenience, pushing uptake of virtual workspace tools that stream applications without persisting ePHI on unmanaged phones. The U.S. Federal Mobility Group, comprising 45 agencies, is codifying shared BYOD assessment checklists to streamline procurement and speed FedRAMP approvals. Shift-based access control and rapid enterprise-wipe functions are now baseline requirements.

High Implementation and Upgrade Costs

Total-cost-of-ownership remains opaque for firms new to enterprise mobility. Surveys of 150 corporate phone managers show 31.3% cite "cost clarity" as the top barrier to platform selection. Hidden spend on compliance audits, certificate renewals, and end-of-life device disposal often exceeds the first-year subscription fee. Vendors respond with feature unbundling; Microsoft now prices Enterprise Application Management at USD 2 per user per month so smaller firms can add advanced patching without a full SKU uplift. Cloud delivery lowers capex but converts budgets into recurring opex, challenging organizations with fluctuating headcount.

Other drivers and restraints analyzed in the detailed report include:

- Escalating Mobile Cybersecurity Threats

- Emergence of Zero-Trust EMM Frameworks

- Legacy System Integration Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions accounted for 63% of 2024 revenue, confirming their role as the control nexus across device, application, and content layers. Security Management stood out with a 20.8% CAGR, reflecting relentless threat evolution. Device Management continues as the entry point for new customers yet increasingly bundles AI-guided remediation. Application containers now isolate corporate data on personal phones, meeting privacy statutes in Europe and California. Content and Email Management shifts from basic encryption to policy-driven watermarking that deters unauthorized sharing. Telecom Expense Management remains niche but gains traction among logistics firms seeking SIM-level cost control.

Service lines complement product portfolios. Professional Services teams de-risk rollouts through readiness assessments and phased cut-over plans. Managed Services supply round-the-clock telemetry review, crucial for understaffed IT groups in healthcare and retail. Microsoft's Advanced Analytics module packages anomaly detection APIs that partners monetize via consulting engagements. As AI matures, domain specialists that can fine-tune models on vertical data will capture margin uplift, giving incumbents an edge over generic MSPs.

Cloud options captured 58.4% of 2024 spend and posted the fastest 19.2% CAGR. The Enterprise mobility management market is therefore gravitating toward scalable SaaS consoles that auto-update compliance libraries. One national retail chain ran a proof of concept across 5,000 endpoints and achieved full production in four weeks, a timeline unthinkable on legacy on-premise stacks. Hybrid-cloud remains the bridge for banks requiring data-residency assurance; sensitive tokens stay on-site while policy logic executes in the provider's regionally fenced cloud. On-premise persists in defense deployments where air-gapped servers satisfy classified-data mandates.

Cost elasticity explains cloud traction. Consumption-based models let SMEs mirror device adoption curves without large license blocks. Government blanket-purchase agreements such as the U.S. GSA's Best-in-Class Mobility contract tilt procurement toward cloud and 5G-ready services. The EU Digital Identity Wallet regulation compels member states to spin up cloud-native credential vaults within 24 months. Vendors that pre-certify for local pseudonymization standards will outpace rivals still reliant on single-tenant offerings.

Enterprise Mobility Management Market is Segmented by Type (Solutions, Services), Deployment Mode (On-Premise, Cloud-Based, Hybrid), Organization Size (Large Enterprises, Small and Medium-Sized Enterprises), End-User Industry (BFSI, Healthcare and Life Sciences, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 32.8% of 2024 revenue as public-sector breach mandates accelerated spending on device posture checks and continuous authentication. The Cybersecurity and Infrastructure Security Agency's mobile checklist now underpins procurement templates across 15 federal departments. Canadian privacy law amendments mandate that service providers store identifiable data domestically, raising demand for in-country SaaS regions. Mexico's automotive corridor deploys edge-enabled tablets on factory floors, pushing industrial integrators to certify bilingual UIs and local-telco eSIM profiles.

Asia Pacific posts the highest 22.3% CAGR, propelled by smartphone ubiquity and national digital agendas. Japan's convenience-store and education pilots showcase hyperscale deployments, underscoring operational efficiency gains from centralized patching. India's Digital Personal Data Protection Act adds breach-reporting windows as short as 72 hours, compelling SMBs to adopt policy engines with audit-ready logs. China dominates device volume but restricts foreign cloud ingress, so multinationals operate hybrid architectures to meet cybersecurity reviews. Australia's Protective Security Direction 001-2025 explicitly lists mandatory encryption algorithms for enterprise mobility endpoints, creating standardized tender language.

Europe tightens product-security oversight via the Cyber Resilience Act, requiring CE-mark conformity and incident-response processes by 2027. Germany's BSI clearance for BlackBerry UEM paves the way for classified Apple deployments, evidencing national preference for certified solutions. The U.K. refines its post-Brexit data-transfer rules yet remains interoperable with EU adequacy arrangements, sustaining cross-border SaaS adoption. Southern European states prioritize digital-ID wallets that ride on EMM cryptographic modules, shortening citizen-service queues and expanding inclusive governance.

- VMware (AirWatch)

- Microsoft

- IBM (MaaS360)

- BlackBerry

- Citrix

- Ivanti (MobileIron)

- SOTI

- Sophos

- Broadcom (Symantec)

- ManageEngine (Zoho)

- Jamf

- Cisco Systems

- Samsung Knox

- Snow Software

- 42Gears

- Scalefusion (ProMobi)

- Hexnode (Mitsogo)

- Baramundi Software

- Matrix42

- Quest Software

- Absolute Software

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of enterprise mobile devices and apps

- 4.2.2 Rising BYOD and remote-work culture

- 4.2.3 Escalating mobile cybersecurity threats

- 4.2.4 Tightening data-protection regulations (GDPR, CCPA etc.)

- 4.2.5 Emergence of Zero-Trust EMM frameworks (under-reported)

- 4.2.6 Mobile edge computing use-cases in field operations (under-reported)

- 4.3 Market Restraints

- 4.3.1 High implementation and upgrade costs

- 4.3.2 Legacy system integration complexity

- 4.3.3 Enterprise data-sovereignty concerns

- 4.3.4 Battery/performance drain from heavy EMM agents (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Solutions

- 5.1.1.1 Device Management

- 5.1.1.2 Application Management

- 5.1.1.3 Security Management

- 5.1.1.4 Content and Email Management

- 5.1.1.5 Telecom Expense Management

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Deployment Mode

- 5.2.1 On-premise

- 5.2.2 Cloud-based

- 5.2.3 Hybrid

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium-sized Enterprises (SMEs)

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 IT and Telecom

- 5.4.4 Manufacturing and Industrial

- 5.4.5 Retail and E-commerce

- 5.4.6 Government and Public Sector

- 5.4.7 Transportation and Logistics

- 5.4.8 Others (Education, Energy, Media)

- 5.5 By Region

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 APAC

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 ASEAN

- 5.5.4.7 Rest of APAC

- 5.5.5 Middle East

- 5.5.5.1 GCC Countries

- 5.5.5.2 Turkey

- 5.5.5.3 Israel

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Kenya

- 5.5.6.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis (2024)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 VMware (AirWatch)

- 6.4.2 Microsoft

- 6.4.3 IBM (MaaS360)

- 6.4.4 BlackBerry

- 6.4.5 Citrix

- 6.4.6 Ivanti (MobileIron)

- 6.4.7 SOTI

- 6.4.8 Sophos

- 6.4.9 Broadcom (Symantec)

- 6.4.10 ManageEngine (Zoho)

- 6.4.11 Jamf

- 6.4.12 Cisco Systems

- 6.4.13 Samsung Knox

- 6.4.14 Snow Software

- 6.4.15 42Gears

- 6.4.16 Scalefusion (ProMobi)

- 6.4.17 Hexnode (Mitsogo)

- 6.4.18 Baramundi Software

- 6.4.19 Matrix42

- 6.4.20 Quest Software

- 6.4.21 Absolute Software

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment