|

市场调查报告书

商品编码

1850220

穿戴式感测器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Wearable Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

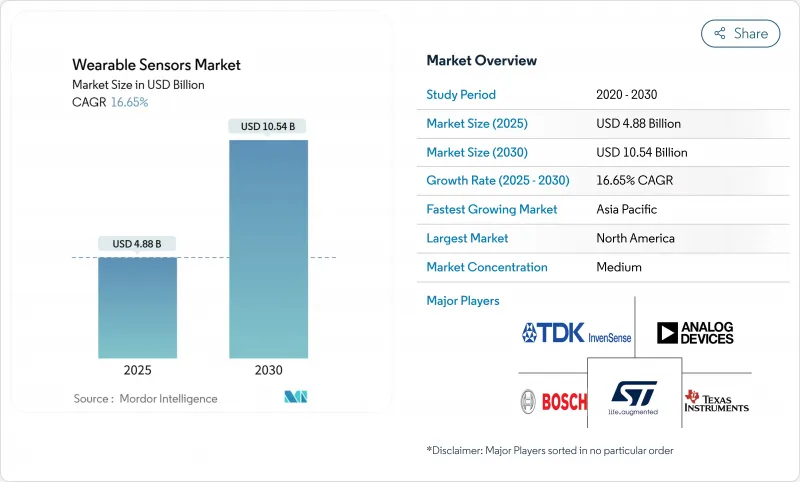

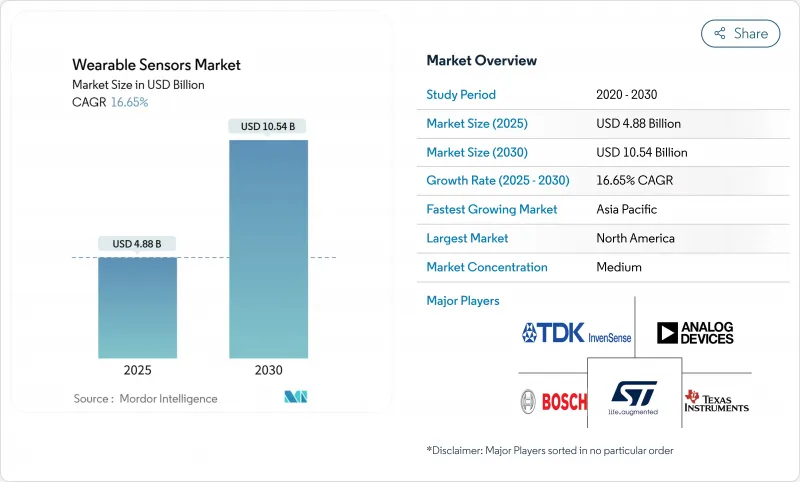

预计到 2025 年,穿戴式感测器市场规模将达到 48.8 亿美元,到 2030 年将达到 105.4 亿美元,年复合成长率为 16.65%。

对持续生理追踪的强劲需求、MEMS製造成本的下降以及监管机构对远端患者监护的支持,共同推动了穿戴式感测器市场的扩张。半导体供应商正在降低系统功耗,并整合设备端机器学习核心,以实现全天候分析;同时,5G的部署降低了资料传输延迟,提高了临床工作流程效率。以雪佛龙公司推出补水贴片为例,企业健康计画正在扩大企业规模,并拓展终端市场。儘管电池材料短缺和隐私法的实施增加了执法风险,但这些因素共同推动穿戴式感测器市场保持高速成长。

全球穿戴式感测器市场趋势与洞察

健身与预防保健热潮

消费者正从一次性治疗转向持续健康管理,这推动了对智慧型手錶和贴片的持续需求,这些产品能够追踪代谢、睡眠和压力讯号。企业正透过大规模的健康推广活动来提高用户接受度,这些活动在生产力和安全性方面带来了可衡量的投资回报率,例如雪佛龙的补水贴片就减少了中暑事件的发生。人工智慧驱动的指导模组,例如三星的产品,可以将原始指标转化为个人化指导,从而保持用户的日常参与度,并扩大演算法训练的资料池。一项高血压远端患者监测计画透过减少急诊就诊次数实现了 22.2% 的投资回报率,检验了报销途径的有效性,这将进一步扩大穿戴式感测器市场。

智慧型手錶出货量快速成长

随着苹果、三星以及新兴的智慧戒指製造商纷纷将血压和神经讯号感测器整合到智慧手錶中,以在外形规格的智慧手錶市场中脱颖而出,全球智慧型手錶货量持续攀升。意法半导体2024年第四季MEMS销售量增至11.98亿美元,凸显了其製造流程的韧性和价格弹性,从而有效控制了平均售价。三星对Oura提起的先发制人式诉讼等智慧财产权之争表明,智慧手錶领域已日趋成熟,专利不再只是产品上市速度的关键战略槓桿,而是製胜法宝。

加强资料隐私法规

华盛顿州的《我的健康我的资料法案》和欧盟的《医疗器材法规》增加了重迭的知情同意和文件要求,提高了遵循成本,并减缓了跨区域的推广。欧洲只有43家公告机构,涵盖约50万种医疗器械,造成了认证瓶颈,使得拥有传统授权的现有机构获益。

細項分析

到2024年,动作感测器将占据穿戴式感测器市场34%的份额,为健身手环和手势控制介面提供使用者运动分析功能。儘管平均售价面临压力,但加速计、陀螺仪和磁力计的成本曲线仍然成熟,毛利率也保持稳定。然而,生物感测器的复合年增长率将达到19.4%,随着与皮肤相容的化学技术拓展应用范围(从血糖监测到皮质醇监测),生物感测器将挑战这一市场格局。

生物感测器的发展势头源自于聚合物微射流无需静脉穿刺即可实现实验室层级的特异性。化学和气体感测器在工业安全领域占据一席之地,而压力感测器则支援无袖带血压测量应用。温度感测器在职业健康领域中用于预防热应激,并获得了广泛认可。成像和光学感测器的应用范围从心率光强度扩展到基于光学相干性的创伤护理,预示着多模态融合的到来,这将进一步拓展可穿戴感测器市场。

健康与保健类产品占总收入的46%,这反映了消费行为以及由于与智慧型手机应用程式的协同效应而导致的低解约率。预计到2025年,健康与保健穿戴式感测器市场规模将达到22.5亿美元,目前正随着加值指导服务与硬体订阅捆绑销售而不断扩张。

随着支付方对透过早期检测降低成本的需求不断增长,远端患者监护将以20.1%的复合年增长率成长。由云端人工智慧驱动的多感测器闸道将缩短临床医生的回应时间,而与门诊就诊相同的报销标准将增强医疗机构的经济效益。运动分析将继续扩大至生物力学领域,而工业安全穿戴装置将凭藉可衡量的工伤减少效果占据采购预算,例如在试点工厂中,肌肉骨骼索赔减少了30%。

区域分析

北美地区将占2024年总收入的38%,这主要得益于联邦医疗保险远端病患监护(RPM)代码对持续监测的报销以及企业健康预算对设备部署的津贴。创业投资正在推动一批提供神经介面等专用感测器的新兴企业。然而,各州的数据法规增加了合规成本,并可能削弱跨国数据科学的综效。

亚太地区将以18.7%的复合年增长率引领成长,这主要得益于中国零件工厂缩短前置作业时间以及印度中产阶级对低成本腕带的接受度提高。日本的银髮经济将推动对医院生命征象监测的持续投资,而韩国的5G网路覆盖将加速从云端到边缘的分析循环。儘管地缘政治摩擦可能会扰乱出口,但区域电池供应优势也有助于降低成本上行风险。

欧洲市场持续保持中等个位数成长。医疗器材法规 (MDR) 的审批能力限制阻碍了 CE 标誌的更新周期,实际上延长了设备的使用寿命,并减缓了创新。然而,公共部门对电子医疗的需求仍然强劲,尤其是在德国,其《数位医疗法》为与应用程式连接的设备提供补贴。随着远端医疗填补医疗服务提供者在服务取得方面的空白,南欧和东欧的需求也不断增长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概况

- 市场驱动因素

- 健身和预防保健蓬勃发展

- 智慧型手錶的数量正在迅速增长。

- 降低MEMS成本

- 远端患者监护指令

- 皮肤相容型生物感测器取得突破

- 企业ESG相关穿戴装置项目

- 市场限制

- 加强资料隐私法规

- 多模态感测器的高平均售价

- 锂离子电池长期短缺

- 算法种族歧视引发诉讼的风险

- 价值/供应链分析

- 监管格局

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争的激烈程度

第五章 市场规模与成长预测

- 依感测器类型

- 化学品和气体

- 压力

- 成像/光学

- 运动

- 温度

- 生物感测器

- 按用途

- 健康与保健

- 安全监控

- 运动与健身

- 军工

- 按设备外形尺寸

- 智慧型手錶

- 修补

- 智慧服装

- 智慧眼镜

- 可听设备

- 鞋类

- 按最终用户产业

- 消费者

- 医疗保健提供者

- 行业/公司

- 国防和紧急应变人员

- 透过连接技术

- Bluetooth

- Wi-Fi

- NFC

- 蜂窝网路(LTE/5G)

- ANT+/专有标准

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 其他亚太地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- STMicroelectronics

- Texas Instruments

- Infineon Technologies

- Analog Devices

- TDK/InvenSense

- AMS-OSRAM

- Panasonic

- NXP Semiconductors

- TE Connectivity

- Bosch Sensortec

- Apple

- Fitbit(Google)

- Samsung Electronics

- Huawei

- Sensirion

- Knowles Corporation

- Valencell

- Murata Manufacturing

- Honeywell International

- Qualcomm

第七章 市场机会与未来展望

The wearable sensors market stood at USD 4.88 billion in 2025 and is forecast to reach USD 10.54 billion by 2030, advancing at a 16.65% CAGR.

Robust demand for continuous physiological tracking, declining MEMS production costs, and regulatory support for remote patient monitoring underpin this expansion. Semiconductor suppliers are embedding on-device machine-learning cores that cut system power budgets and unlock always-on analytics, while 5G rollouts reduce data-transfer latency and enhance clinical workflow efficiency. Corporate wellness programs, exemplified by Chevron's hydration-patch deployment, add enterprise-scale volumes and diversify end-market exposure chevron.com. Together, these factors keep the wearable sensors market on a high-growth trajectory even as battery-material shortages and privacy statutes raise execution risk.

Global Wearable Sensors Market Trends and Insights

Fitness & Preventive-Health Boom

Consumers are shifting from episodic treatment toward continuous wellness management, driving recurring demand for smartwatches and patches that track metabolic, sleep, and stress signals. Corporations reinforce uptake through large-scale wellness deployments that deliver measurable ROI in productivity and safety, such as Chevron's hydration patches that lowered heat-related incidents. AI-powered coaching modules from Samsung and others convert raw metrics into personalized guidance, which sustains day-to-day engagement and expands data pools for algorithm training . Health-plan providers also gain: a hypertension RPM program posted a 22.2% ROI through reduced emergency visits, validating reimbursement pathways that further enlarge the wearable sensors market .

Smart-Watch Unit Surge

Global smartwatch shipments continue to climb as Apple, Samsung, and emerging ring vendors integrate blood-pressure and neuro-signal sensors to differentiate in a saturating form-factor race. STMicroelectronics' MEMS volume increased to USD 1.198 billion in Q4 2024, underscoring manufacturing resilience and price elasticity that keep average selling prices in check. IP battles, such as Samsung's pre-emptive lawsuit against Oura, signal a maturing arena where patents become a key strategic lever rather than speed-to-market alone

Data-Privacy Regulation Tightenings

Washington's My Health My Data Act and the EU MDR add overlapping consent and documentation obligations that lift compliance spend and slow multi-region rollouts. Only 43 notified bodies cover roughly 500,000 devices in Europe, creating certification bottlenecks that reward incumbents with legacy approvals

Other drivers and restraints analyzed in the detailed report include:

- MEMS Cost Downsizing

- Remote-Patient-Monitoring Mandates

- High ASP for Multimodal Sensors

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Motion sensors captured 34% of wearable sensors market share in 2024, anchoring user motion analytics across fitness bands and gesture-controlled interfaces. Accelerometers, gyroscopes, and magnetometers hold mature cost curves, preserving gross margins despite ASP pressure. Biosensors, however, post a 19.4% CAGR and will challenge this hierarchy as skin-conformal chemistry extends use cases from glucose to cortisol monitoring.

Biosensor momentum derives from polymer microfluidics that deliver laboratory-grade specificity without venipuncture. Chemical and gas sensors fill industrial safety niches, while pressure devices support cuff-less blood-pressure applications. Temperature sensors win occupational-health mandates for heat-stress prevention. Image and optical sensors migrate from heart-rate photoplethysmography toward optical coherence-based wound care, foreshadowing multimodal fusion that enlarges the wearable sensors market.

Health and wellness held 46% revenue, reflecting entrenched consumer behavior and smartphone app synergies that keep churn low. The wearable sensors market size for health and wellness reached USD 2.25 billion in 2025 and still expands as value-added coaching services bundle subscriptions with hardware.

Remote patient monitoring, advancing at 20.1% CAGR, gains ground as payers seek cost-avoidance through early detection. Multi-sensor gateways feeding cloud AI shorten clinician response times, and reimbursement parity with in-clinic visits strengthens provider economics. Sports analytics continue to grow into biomechanics, while industrial safety wearables earn procurement budgets through measurable injury reduction, such as 30% fewer musculoskeletal claims in pilot factories

The Wearable Sensors Market is Segmented by Sensor Type (Chemical and Gas, Pressure and More), Application (Health and More), Device Form Factor (Smartwatches and More), End-User Industry (Consumer, Healthcare Providers and More), Connectivity Technology (NFC and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commands 38% of 2024 revenue, underpinned by Medicare RPM codes that reimburse continuous monitoring and corporate wellness budgets that subsidize device rollouts. Venture-capital density anchors a startup pipeline that feeds specialized sensor modalities such as neural interfaces. Nonetheless, state-level data laws amplify compliance overhead and could dilute cross-border data-science synergies.

Asia-Pacific leads growth with an 18.7% CAGR as China's component factories compress lead times and India's middle-income cohort adopts low-cost wristbands. Japan's silver-economy drives hospital investments in continuous vitals patches, while South Korea's 5G coverage accelerates cloud-to-edge analytic loops. Regional dominance in battery supply also moderates cost inflation risks, though geopolitical frictions could disrupt export flows.

Europe sustains mid-single-digit growth. MDR capacity constraints impede CE-mark renewal cycles, effectively lengthening device replacement lifetimes and slowing innovation churn. Yet public-sector appetite for e-health remains strong, especially in Germany's Digital Healthcare Act framework that subsidizes app-linked devices. Southern and Eastern Europe see incremental demand as telemedicine fills provider-access gaps.

- STMicroelectronics

- Texas Instruments

- Infineon Technologies

- Analog Devices

- TDK / InvenSense

- AMS-OSRAM

- Panasonic

- NXP Semiconductors

- TE Connectivity

- Bosch Sensortec

- Apple

- Fitbit (Google)

- Samsung Electronics

- Huawei

- Sensirion

- Knowles Corporation

- Valencell

- Murata Manufacturing

- Honeywell International

- Qualcomm

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Fitness and preventive-health boom

- 4.2.2 Smart-watch unit surge

- 4.2.3 MEMS cost downsizing

- 4.2.4 Remote-patient-monitoring mandates

- 4.2.5 Skin-conformal bio-sensor breakthroughs

- 4.2.6 Corporate ESG-linked wearables programs

- 4.3 Market Restraints

- 4.3.1 Data-privacy regulation tightenings

- 4.3.2 High ASP for multimodal sensors

- 4.3.3 Chronic Li-ion cell shortages

- 4.3.4 Algorithmic racial-bias litigation risk

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Sensor Type

- 5.1.1 Chemical and Gas

- 5.1.2 Pressure

- 5.1.3 Image / Optical

- 5.1.4 Motion

- 5.1.5 Temperature

- 5.1.6 Biosensors

- 5.2 By Application

- 5.2.1 Health and Wellness

- 5.2.2 Safety Monitoring

- 5.2.3 Sports and Fitness

- 5.2.4 Military and Industrial

- 5.3 By Device Form Factor

- 5.3.1 Smartwatches

- 5.3.2 Patches

- 5.3.3 Smart Clothing

- 5.3.4 Smart Glasses

- 5.3.5 Hearables

- 5.3.6 Footwear

- 5.4 By End-User Industry

- 5.4.1 Consumer

- 5.4.2 Healthcare Providers

- 5.4.3 Industrial/Enterprise

- 5.4.4 Defense and First Responders

- 5.5 By Connectivity Technology

- 5.5.1 Bluetooth

- 5.5.2 Wi-Fi

- 5.5.3 NFC

- 5.5.4 Cellular (LTE/5G)

- 5.5.5 ANT+ / Proprietary

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 APAC

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Rest of APAC

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 UAE

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 STMicroelectronics

- 6.4.2 Texas Instruments

- 6.4.3 Infineon Technologies

- 6.4.4 Analog Devices

- 6.4.5 TDK / InvenSense

- 6.4.6 AMS-OSRAM

- 6.4.7 Panasonic

- 6.4.8 NXP Semiconductors

- 6.4.9 TE Connectivity

- 6.4.10 Bosch Sensortec

- 6.4.11 Apple

- 6.4.12 Fitbit (Google)

- 6.4.13 Samsung Electronics

- 6.4.14 Huawei

- 6.4.15 Sensirion

- 6.4.16 Knowles Corporation

- 6.4.17 Valencell

- 6.4.18 Murata Manufacturing

- 6.4.19 Honeywell International

- 6.4.20 Qualcomm

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment