|

市场调查报告书

商品编码

1850250

氮化镓射频半导体装置:市场份额分析、产业趋势、统计数据和成长预测(2025-2030 年)GaN RF Semiconductor Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

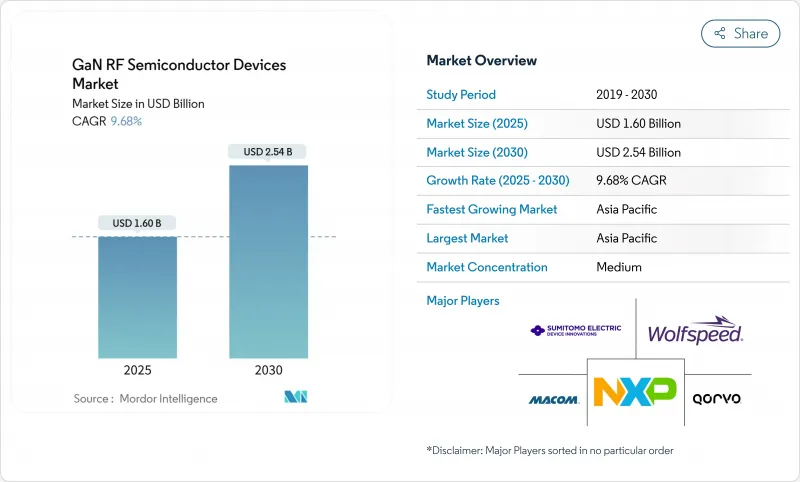

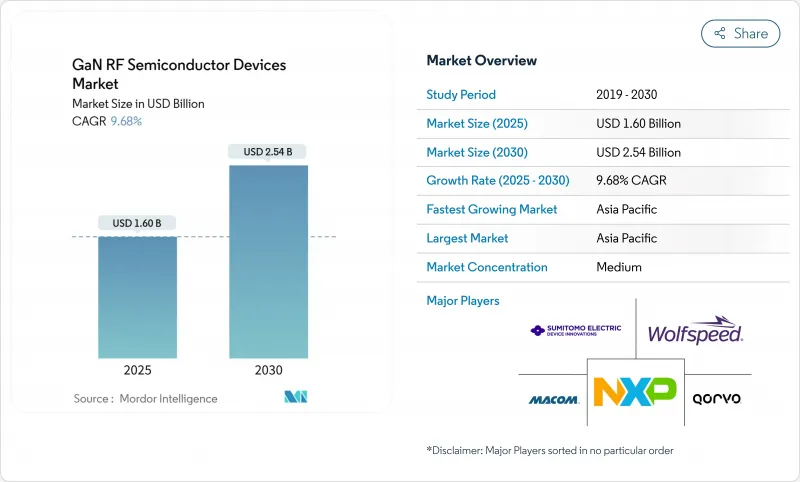

预计到 2025 年,GaN 射频半导体装置市场规模将达到 16 亿美元,到 2030 年将扩大到 25.4 亿美元,复合年增长率为 9.68%。

5G基础设施、主动电子扫描阵列(AESA)雷达、卫星有效载荷以及79 GHz车载成像雷达等领域对高频、高功率解决方案的需求不断增长,使得氮化镓(GaN)成为通讯、国防和行动通讯生态系统中的主流技术。 GaN-on-SiC仍然是热稳定性方面的性能标桿,而向200mm GaN-on-Si晶圆的过渡缩小了其与传统LDMOS的成本差距,从而扩大了其在对价格敏感的宽能带隙以下无线电单元中的应用。在区域层面,GaN射频半导体装置市场受益于亚太地区推动半导体自主发展的政策,以及美国和欧盟同时将宽禁带电子装置列为国防现代化预算优先事项。垂直整合製造商之间日益激烈的竞争促使企业快速提交专利申请、进行策略性收购并扩大产能,旨在缓解150mm和200mm磊晶圆的瓶颈,并确保新兴毫米波和6G研究项目所需的基板容差。

全球氮化镓射频半导体元件市场趋势及洞察

5G宏大型基地台和小型基地台部署加速氮化镓(GaN)技术的应用

在中国、韩国和日本部署的大规模MIMO基地台架构依赖多达64个功率放大器通道,而氮化镓(GaN)相比LDMOS实现了15-20%的能源效率提升,从而降低了站点级营运成本。开放式无线存取网路(Open-RAN)标准化将无线电硬体与系统供应商解耦,使得专业的GaN供应商能够获得用于远端无线电站升级的介面。中国移动创纪录的部署证明了GaN在实际应用中的可靠性,而Qorvo 0.013%的故障率进一步增强了营运商的信心。向200mm晶圆的过渡逐步降低了每瓦美元的功率输出,使得GaN射频半导体装置市场能够更广泛地渗透到农村地区和室内小型基地台等更深处。电讯的节能目标,加上GaN的低散热特性,推动了采购架构更重视效率指标而非组件价格。

美国/欧盟AESA雷达现代化推动高功率需求

美国国防部已将氮化镓(GaN)技术推进至製造成熟度10级,并为其下一代雷达计画拨款超过30亿美元,用于2024-2025年期间的研发。欧洲机构在其远距监视和电子战设备的更新换代过程中也采用了类似的策略,GaN卓越的功率密度显着提升了探测距离和干扰效能。Honeywell公司与美国海军签订的价值2990万美元的合同,用于对其低频宽发射机进行GaN维修,这体现了各方对降低设备过时风险和提高频谱灵活性的重视。能够承受200瓦/毫米热通量的封装技术突破已应用于下游的商用通讯无线电领域,从而将GaN射频半导体装置市场拓展至国防领域之外。

成本溢价限制了价格驱动型部署的应用。

2024年,在6GHz以下无线应用领域,GaN功率扩大机的价格仍比LDMOS低40%,减缓了新兴市场的转型步伐。儘管德克萨斯向8吋GaN-on-Silicon製造製程的转型使晶粒成本降低了10%以上,但宏观经济压力持续抑制着通讯业者的资本支出,尤其是在印度和东南亚部分地区,通讯业者OEM厂商继续采取双源筹资策略,维持LDMOS的产量,从而限制了GaN射频半导体元件市场近期的成长空间。

细分市场分析

到2024年,通讯基础设施将占总收入的43.2%,从而支撑氮化镓(GaN)射频半导体装置市场的发展。基地台供应商正在采用GaN技术来缩小装置尺寸,并将宏无线电单元的汲极效率基准提升至55.2%。这降低了冷却负荷并减轻了塔顶重量,对于高密度5G部署至关重要。 Soitec的工程基板可降低插入损耗,进而提高每个站点的覆盖范围。随着通讯业者开展基于GaN前端的6G亚太赫兹试验,GaN射频半导体装置市场在2025年之前保持了强劲的成长动能。

汽车雷达市场预计在2024年成长放缓后,到2030年将以18.5%的复合年增长率成长。中国的高级驾驶辅助系统强制令以及韩国的智慧网联汽车生态系统刺激了对79 GHz成像雷达的需求,而氮化镓(GaN)技术在不牺牲可靠性的前提下实现了毫米波功率密度。采用GaN功率放大器-低杂讯放大器(PA-LNA)模组的V2X通讯试点计画提升了其量产前景。 200毫米GaN-on-Si晶圆的成本降低蓝图有望使其与主流汽车电子产品接轨,从而创造一个更广泛的GaN射频半导体装置市场。

在国防和航太,雷达、电子战和卫星通讯有效载荷正充分利用氮化镓(GaN)的抗辐射性和输出功率。在家用电子电器,GaN功率放大器(PA)已被应用于Wi-Fi 7路由器和行动电话前端,检验在小讯号传输方面的潜力。在工业机器人领域,基于GaN HEMT的6.78 MHz无线充电发射器已被采用,凸显了其跨行业应用范围,并有助于实现收入来源多元化。

分离式功率电晶体在2024年占据了46.4%的市场份额,这反映了雷达、广播和大型基地台无线电等领域成熟的设计週期。 MACOM的产品组合涵盖2W至7kW的功率范围,展现了其支援GaN射频半导体装置市场的可扩展性。 [2] 散热增强型螺栓固定封装支援超过80%的汲极效率,从而在严苛的占空比下延长了装置寿命。

单晶片微波积体电路功率放大器将成为成长最快的细分市场,预计到2030年将以19.2%的复合年增长率成长。相位阵列模组、空间受限的卫星通讯终端以及毫米波回程传输都青睐MMIC,因为它可以将增益级和偏压网路整合在紧凑的晶粒上。 Qorvo的宽频QPA2210D正是这一趋势的典型代表,与分立装置相比,其功率附加效率提高了6 dB。射频开关和前端模组采用增强型GaN电晶体来应对热开关应力,而低杂讯放大器开始在C波段卫星链路中取代GaAs,从而拓展了整个产业的格局。

GaN 射频半导体元件市场按应用(国防和航太、通讯基础设施、其他)、装置类型(分离式射频功率电晶体、MMIC/单晶片功率放大器、其他)、基板技术(GaN-On-SiC、GaN-On-Si、其他)、频宽(VHF/UHF(低于 1 GHz)、L/S 频段(VHF/UHF(低于 1 频段)、L/SS 频段(VHF/UHF(低于 1 频段)、L/SS 频段)。 GHz)、其他)和地区(北美、南美、欧洲、亚太、中东和非洲)进行细分。

区域分析

亚太地区将在2024年以34.1%的营收占比领跑,预计到2030年将以18.4%的复合年增长率成长。中国5G基地台的快速成长、本土氮化镓代工厂的建设以及「第三次半导体浪潮」下的政策支持,加速了区域自主发展。韩国专注于人工智慧中心和汽车雷达,而日本则充分利用家用电子电器的传统优势和碳化硅基板供应。台湾先进的后端服务加速了硅基氮化镓(GaN-on-Si)的成本优化,从而强化了氮化镓射频半导体装置市场的成长循环。

北美位居第二,这主要得益于美国的国防预算和卫星互联网卫星群。政府对国内晶圆厂的资助,例如Polar Semiconductor公司在明尼苏达州的GaN-on-Si计划,增强了供应链的韧性。加拿大电信业的更新换代以及墨西哥汽车和电子产业丛集的发展,使北美大陆的需求多元化,从而使该地区的GaN射频半导体装置市场免受单一产业波动的影响。

欧洲将其在汽车雷达领域的领先地位与节能型工业驱动相结合。德国率先部署了79 GHz车载感测器,法国专注于航太有效载荷,英国则优先升级了以频率为主导的电子战系统。欧盟的战略自主方案为合资企业(例如IQE-X-FAB的650V氮化镓平台)提供了津贴,促进了区域价值链的发展,从而支持了该地区氮化镓射频半导体装置市场的扩张。巴西的新增应用、波湾合作理事会智慧城市的部署以及澳洲的低地球轨道回程传输试验,都标誌着这项技术在全球的普及应用。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚太地区5G大型基地台及小型基地台部署

- 美国/欧盟AESA雷达现代化改造的资金

- 低/中地球轨道卫星通讯卫星群的有效载荷需求

- 中国和韩国毫米波汽车成像雷达的应用

- 面向工业4.0机器人的高功率无线充电

- 快速采用开放式RAN远端无线电站

- 市场限制

- Sub-6GHz 基地台的成本溢价和 LDMOS 对比

- 功率超过 3 千瓦的战术雷达模组中碳化硅的侵蚀

- 外延片和基板供应瓶颈(150mm 和 200mm)

- 温度控管和可靠性超过 200W/mm

- 价值链分析

- 技术展望

- 氮化镓硅基元件的大规模生产及向200毫米晶圆的过渡

- 监理展望

- 国际电信联盟和美国联邦通讯委员会关于 5G/6G 和雷达频谱分配的公告

- 波特五力分析

- 买方的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- RF-GaN专利概况

- 宏观经济因素如何影响市场

第五章 市场规模与成长预测

- 透过使用

- 国防/航太

- 通讯基础设施

- 消费性电子产品

- 汽车(ADAS、V2X)

- 工业和能源

- 资料中心和高效能电源链路

- 依设备类型

- 分离式射频功率电晶体

- MMIC/单晶片功率放大器

- 射频开关和前端模组

- 低杂讯驱动放大器

- 透过基板技术

- GaN-on-SiC

- GaN-on-Si

- 氮化镓/钻石及先进复合材料

- 按频宽

- 甚高频/超高频(低于 1 GHz)

- L/S波段(1至4 GHz)

- C/ X波段(4-12 GHz)

- Ku/ Ka波段(12-40 GHz)

- 毫米波(40 GHz 以上,包括 5G FR2)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 台湾

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Wolfspeed, Inc.

- Qorvo, Inc.

- Sumitomo Electric Device Innovations

- NXP Semiconductors NV

- MACOM Technology Solutions-GaN-on-SiC

- Broadcom Inc.

- Infineon Technologies AG

- RFHIC Corp.

- Ampleon Netherlands BV

- Mitsubishi Electric Corporation

- Fujitsu Ltd.(GaN RF)

- Northrop Grumman Microelectronics

- Integra Technologies, Inc.

- Analog Devices Inc.

- WIN Semiconductors Corp.

- Finwave Semiconductor Inc.

- Tagore Technology Inc.

- Guerrilla RF

- SEDI-Silent-Solutions Engineering(EU)

- Teledyne e2v HiRel

第七章 市场机会与未来展望

The GaN RF semiconductor devices market size reached USD 1.60 billion in 2025 and is projected to advance to USD 2.54 billion by 2030, delivering a CAGR of 9.68%.

Rising demand for high-frequency, high-power solutions in 5G infrastructure, active electronically scanned array (AESA) radar, satellite payloads, and 79 GHz automotive imaging radar positioned gallium nitride as a mainstream technology across telecom, defense, and mobility ecosystems. GaN-on-SiC remained the performance benchmark for thermal robustness, while the transition to 200 mm GaN-on-Si wafers compressed cost gaps versus legacy LDMOS, amplifying adoption in price-sensitive sub-6 GHz radio units. Regionally, the GaN RF semiconductor devices market benefited from Asia-Pacific's policy-backed semiconductor self-reliance drive and concurrent U.S.-EU defense modernization budgets that prioritized wide-bandgap electronics. Intensifying competition among vertically integrated manufacturers triggered rapid patent filings, strategic acquisitions, and capacity expansions designed to ease 150 mm and 200 mm epi-wafer bottlenecks and secure substrate resilience for emerging mmWave and 6 G research programs.

Global GaN RF Semiconductor Devices Market Trends and Insights

5G macro- and small-cell roll-outs accelerate GaN adoption

Massive-MIMO base-station architectures installed across China, Korea, and Japan relied on up to 64 power-amplifier channels, where gallium nitride delivered a 15-20% energy-efficiency uplift versus LDMOS, cutting site-level operating costs. Open-RAN standardization further decoupled radio hardware from system vendors, enabling specialist GaN suppliers to win sockets for remote-radio-head upgrades. Record deployments by China Mobile validated field reliability, while Qorvo's 0.013% failure rate reinforced operator confidence. Progressive reductions in USD/W output through 200 mm wafer migration positioned the GaN RF semiconductor devices market for broader penetration of rural and deep-indoor small-cell layers. Telecom carriers' energy-saving targets aligned with GaN's lower heat dissipation, catalyzing procurement frameworks that rewarded efficiency metrics over component price.

U.S./EU AESA radar modernization drives high-power demand

The U.S. Department of Defense elevated GaN to Manufacturing Readiness Level 10 and allocated more than USD 3 billion for next-generation radar programs between 2024-2025, triggering multi-year production ramps for high-power monolithic microwave integrated circuits (MMICs). European ministries mirrored this trajectory through long-range surveillance and electronic-warfare refresh cycles, where GaN's superior power density increased detection range and jamming effectiveness. Honeywell's USD 29.9 million contract to retrofit Navy low-band transmitters with GaN exemplified obsolescence mitigation and spectrum agility priorities. Packaging breakthroughs that survived 200 W/mm heat flux migrated downstream to commercial telecom radios, expanding the GaN RF semiconductor devices market beyond defense silos.

Cost premium tempers penetration in price-sensitive deployments

In 2024, GaN power amplifiers carried a 40% price delta over LDMOS for sub-6 GHz radios, delaying transitions in emerging markets, even though energy savings absorbed the gap within 18 months of operation. Texas Instruments' move to 8-inch GaN-on-Si fabrication lowered die cost by more than 10%, but macroeconomic pressures still constrained carrier capex, especially in India and parts of Southeast Asia. Telecom OEMs, therefore, maintained dual-sourcing strategies, sustaining LDMOS volume and limiting near-term upside for the GaN RF semiconductor devices market.

Other drivers and restraints analyzed in the detailed report include:

- LEO/MEO sat-com constellation payload demand

- mmWave automotive imaging radar adoption in China and South Korea

- Epi-wafer and substrate shortages create production chokepoints

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Telecom infrastructure accounted for 43.2% of 2024 revenue, anchoring the GaN RF semiconductor devices market. Base-station vendors adopted GaN to unlock smaller footprints and a 55.2% drain efficiency benchmark in macro radio units. This translates to reduced cooling loads and lower tower-top weight, critical for dense 5G rollouts. Open-RAN disaggregation encouraged independent power-amplifier specialists to capture design wins, while Soitec's engineered substrates reduced insertion losses, boosting coverage per site. The GaN RF semiconductor devices market retained momentum through 2025 as operators trialed 6 G sub-THz pilots that presupposed GaN front ends.

Automotive radar remained a modest slice in 2024 but is forecast to expand at an 18.5% CAGR to 2030. China's mandatory advanced-driver-assistance mandates and South Korea's connected-car ecosystem spurred demand for 79 GHz imaging radar, where GaN handled millimeter-wave power density without compromising reliability. V2X communication pilots incorporating GaN PA-LNA modules amplify volume prospects. Cost-down roadmaps tied to 200 mm GaN-on-Si wafers promised alignment with mainstream vehicle electronics, creating scale for the wider GaN RF semiconductor devices market.

Across defense and aerospace, radar, electronic warfare, and sat-com payloads drew on GaN's radiation tolerance and output power. Consumer electronics adopted GaN PAs for Wi-Fi 7 routers and handset front ends, validating smaller-signal opportunities. Industrial robotics embraced 6.78 MHz wireless-charging transmitters powered by GaN HEMTs, underscoring cross-sector breadth that diversified revenue streams.

Discrete power transistors captured 46.4% share in 2024, reflecting entrenched design-in cycles across radar, broadcast, and macro-cell radios. MACOM's portfolio spanned 2 W to 7 kW, illustrating scalability that underpinned the GaN RF semiconductor devices market.[2] Thermal-enhanced bolt-down packages supported >80% drain efficiency, extending device lifetimes in harsh duty cycles.

Monolithic microwave integrated-circuit power amplifiers delivered the fastest growth, projected at 19.2% CAGR through 2030. Phased-array modules, space-constrained sat-com terminals, and mmWave backhaul radios favored MMICs that collapsed gain stages and bias networks into compact dies. Qorvo's wideband QPA2210D exemplified this trend, offering 6 dB higher power-added efficiency versus discrete alternatives. RF switches and front-end modules employed enhancement-mode GaN transistors to handle hot-switching stresses, while low-noise amplifiers began displacing GaAs in C-Band satellite links, broadening the GaN RF semiconductor devices industry landscape.

Gan RF Semiconductor Device Market is Segmented by Application (Defense and Aerospace, Telecom Infrastructure, and More), Device Type (Discrete RF Power Transistors, MMIC / Monolithic Power Amplifiers, and More), Substrate Technology (GaN-On-SiC, GaN-On-Si, and More), Frequency Band (VHF / UHF (<1 GHz), L / S-Band (1-4 GHz), and More), and Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa).

Geography Analysis

Asia-Pacific led with 34.1% of 2024 revenue and is projected to advance at an 18.4% CAGR through 2030. China's 5 G base-station surge, local GaN foundry build-outs, and policy support under the "third semiconductor wave" catalyzed regional self-reliance. Korea focused on AI-centers and automotive radar, while Japan leveraged consumer-electronics legacy and SiC substrate supply. Taiwan's advanced backend services accelerated GaN-on-Si cost optimization, reinforcing the GaN RF semiconductor devices market growth loop.

North America ranked second, buoyed by the U.S. defense budget and satellite-internet mega constellations. Government funding for domestic fabs, such as Polar Semiconductor's Minnesota GaN-on-Si project, supported supply-chain resiliency. Canada's telecom revamps and Mexico's automotive-electronics clusters created continental demand diversity that insulated the regional GaN RF semiconductor devices market from single-sector volatility.

Europe combined automotive radar leadership with energy-efficient industrial drives. Germany spearheaded 79 GHz vehicle sensor roll-outs, France emphasized aerospace payloads, and the United Kingdom prioritized spectrum-dominated electronic-warfare upgrades. EU strategic autonomy packages channelled grants to joint ventures such as IQE-X-FAB's 650 V GaN platform, nurturing a localized value chain that underpinned the GaN RF semiconductor devices market size expansion in the bloc. Emerging adoption across Brazil, Gulf Cooperation Council smart-city rollouts, and Australia's low-Earth-orbit backhaul trials showcased the technology's global diffusion trajectory.

- Wolfspeed, Inc.

- Qorvo, Inc.

- Sumitomo Electric Device Innovations

- NXP Semiconductors N.V.

- MACOM Technology Solutions - GaN-on-SiC

- Broadcom Inc.

- Infineon Technologies AG

- RFHIC Corp.

- Ampleon Netherlands B.V.

- Mitsubishi Electric Corporation

- Fujitsu Ltd. (GaN RF)

- Northrop Grumman Microelectronics

- Integra Technologies, Inc.

- Analog Devices Inc.

- WIN Semiconductors Corp.

- Finwave Semiconductor Inc.

- Tagore Technology Inc.

- Guerrilla RF

- SEDI - Silent-Solutions Engineering (EU)

- Teledyne e2v HiRel

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 5G Macro- and Small-Cell Roll-outs across Asia-Pacific

- 4.2.2 U.S./EU AESA Radar Modernization Funding

- 4.2.3 LEO / MEO Sat-Com Constellation Payload Demand

- 4.2.4 mmWave Automotive Imaging Radar Adoption in China and South Korea

- 4.2.5 High-Power Wireless Charging for Industrie 4.0 Robotics

- 4.2.6 Rapid Proliferation of Open-RAN Remote Radio Heads

- 4.3 Market Restraints

- 4.3.1 Cost Premium vs. LDMOS in Sub-6 GHz Base-Stations

- 4.3.2 SiC Encroachment in >3 kW Tactical Radar Blocks

- 4.3.3 Epi-wafer and Sub-strate Supply Bottlenecks (150 and 200 mm)

- 4.3.4 Thermal Management and Reliability at >200 W/mm

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.5.1 GaN-on-Si Mass-Production and 200 mm Transition

- 4.6 Regulatory Outlook

- 4.6.1 ITU and FCC Spectrum Releases for 5G/6G and Radar

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 RF-GaN Patent Landscape

- 4.9 Imapct of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Defense and Aerospace

- 5.1.2 Telecom Infrastructure

- 5.1.3 Consumer Electronics

- 5.1.4 Automotive (ADAS, V2X)

- 5.1.5 Industrial and Energy

- 5.1.6 Data Centers and High-Efficiency Power Links

- 5.2 By Device Type

- 5.2.1 Discrete RF Power Transistors

- 5.2.2 MMIC / Monolithic Power Amplifiers

- 5.2.3 RF Switches and Front-End Modules

- 5.2.4 Low-Noise and Driver Amplifiers

- 5.3 By Substrate Technology

- 5.3.1 GaN-on-SiC

- 5.3.2 GaN-on-Si

- 5.3.3 GaN-on-Diamond and Advanced Composites

- 5.4 By Frequency Band

- 5.4.1 VHF / UHF (<1 GHz)

- 5.4.2 L / S-Band (1-4 GHz)

- 5.4.3 C / X-Band (4-12 GHz)

- 5.4.4 Ku / Ka-Band (12-40 GHz)

- 5.4.5 mmWave (>40 GHz, incl. 5G FR2)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Taiwan

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Wolfspeed, Inc.

- 6.4.2 Qorvo, Inc.

- 6.4.3 Sumitomo Electric Device Innovations

- 6.4.4 NXP Semiconductors N.V.

- 6.4.5 MACOM Technology Solutions - GaN-on-SiC

- 6.4.6 Broadcom Inc.

- 6.4.7 Infineon Technologies AG

- 6.4.8 RFHIC Corp.

- 6.4.9 Ampleon Netherlands B.V.

- 6.4.10 Mitsubishi Electric Corporation

- 6.4.11 Fujitsu Ltd. (GaN RF)

- 6.4.12 Northrop Grumman Microelectronics

- 6.4.13 Integra Technologies, Inc.

- 6.4.14 Analog Devices Inc.

- 6.4.15 WIN Semiconductors Corp.

- 6.4.16 Finwave Semiconductor Inc.

- 6.4.17 Tagore Technology Inc.

- 6.4.18 Guerrilla RF

- 6.4.19 SEDI - Silent-Solutions Engineering (EU)

- 6.4.20 Teledyne e2v HiRel

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment