|

市场调查报告书

商品编码

1850327

产品资讯管理(PIM):市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Product Information Management (PIM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

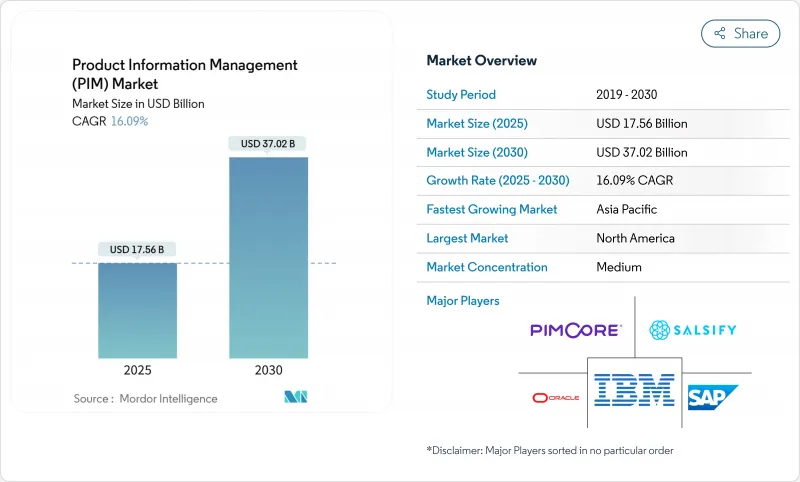

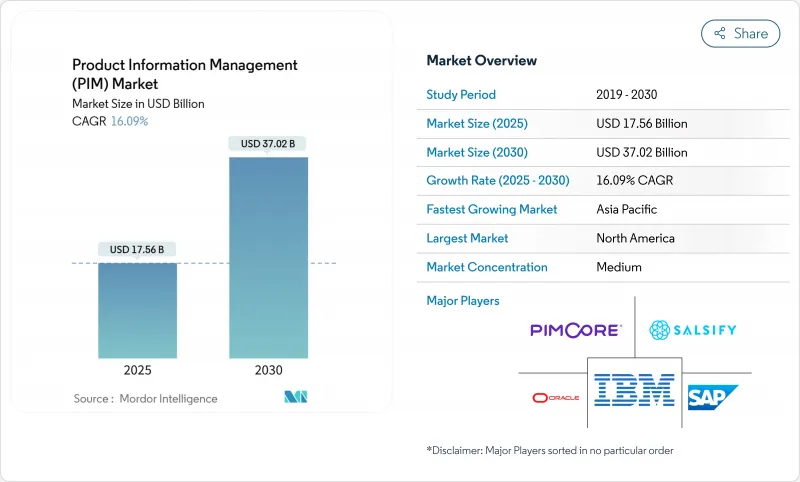

预计到 2025 年,产品资讯管理市场价值将达到 175.6 亿美元,预计到 2030 年将达到 370.2 亿美元,年复合成长率为 16.09%。

产品资讯管理 (PIM) 日益被视为数位商务的基石,这得益于人工智慧驱动的内容生成和全通路体验的迫切需求。企业正迅速转向云端订阅模式,以降低整体拥有成本、加速产品推出并确保功能自动更新。零售商、製造商和串流媒体平台如今产生大量复杂的产品数据,促使他们投资于集中式系统,以维护网站、市场、门市和社群媒体等各个管道的数据一致性。诸如计划于 2026 年实施的欧盟数位产品护照等监管倡议,加剧了合规压力;而生成式人工智慧工具则提升了 PIM 在快速内容在地化和搜寻引擎优化 (SEO) 方面的战略价值。

全球产品资讯管理 (PIM) 市场趋势与洞察

电子商务的蓬勃发展和SKU的激增

如今的零售商在2020年需要管理的产品种类是之前的3倍,这给电子表格和传统工具带来了巨大压力。集中式产品资讯管理(PIM)平台需要编配数百万个属性,以同步亚马逊、沃尔玛和本地市场平台上的产品资讯。季节性时尚系列需要数百种颜色和尺寸组合,并在15个以上的管道上保持一致的展示,而国际扩张则增加了语言在地化和监管标籤方面的负担。

透过采用云端运算降低总体拥有成本

迁移到云端 PIM 系统,透过消除伺服器维护和提供自动升级,可将整体拥有成本降低 45-55%。系统可动态扩展以应对假日尖峰时段流量,而无需过度配置硬体。 SAP 报告称,2025 年第一季云端收入成长 27%,证实了企业对 SaaS 资料管理的需求。

网路安全与资料外洩问题

拥有专有配方和价格表的公司不愿将敏感资料储存在多租户云端环境中。在资料迁移过程中,资料外洩的风险会增加 40%,这促使製药和金融公司转向采用更严格加密和零信任存取控制的专用基础设施。

细分市场分析

预计到2024年,云端技术将占产品资讯管理市场63.5%的份额,并在2030年之前以18.2%的复合年增长率成长。集中式SaaS平台消除了地理基础设施的限制,并可自动更新人工智慧功能,而无需企业内部IT资源。本地部署在严格监管的领域仍占有一席之地,但随着合规框架采用认证的云端架构,其市场份额正在萎缩。

在对系统弹性和全球可用性的需求驱动下,云端仍然是绿地计画的主要选择。 SAP 的云端收益飙升 27%,凸显了客户对订阅模式的偏好,这种模式能够提供可预测的成本和强大的服务等级协定 (SLA)。跨国零售商优先考虑 3-6 个月的较短部署週期,而不是 12 个月以上的周期,以便快速实现季节性商品的收益。

到2024年,解决方案将占总收入的65.9%,但随着越来越多的公司寻求整合、资料清洗和变更管理的帮助,服务收入将以17.5%的复合年增长率超过解决方案。企业级产品资讯管理(PIM)部署目前包括人工智慧模型调优、全通路分发以及数位产品护照的资料层,所有这些都需要专业技能。

随着客户不断应对架构变更和内容丰富化,培训和託管服务需求日益增长。咨询合作伙伴指导客户完成分类法设计、机器学习管道建置和KPI仪表板构建,确保客户从核心软体授权中获得长期价值。

产品资讯管理市场按部署类型(云端、本地部署)、交付类型(解决方案/服务)、组织规模(大型企业、中小企业)、最终用户行业(零售/电子商务、银行、金融服务和保险 (BFSI)、其他)和地区进行细分。市场预测以美元计价。

区域分析

北美地区以24.5%的市占率领跑,预计2024年将维持稳定成长,这得益于各公司在成熟的产品资讯管理(PIM)基础架构之上迭加人工智慧内容功能。美国零售商投资于与核心PIM直接关联的数位化货架分析,加拿大製造商为整个北美大陆的贸易数位化做好准备,而墨西哥汽车供应商则采用PIM以满足美墨加协定(USMCA)的文件要求。

亚太地区是成长最快的地区,年复合成长率达 16.7%。中国製造商正在将 PIM 与 MES 和出口门户网站集成,以满足全球标籤要求;印度製药和汽车出口商正在采用基于 SaaS 的 PIM 来实现多市场合规;日本公司正在将 PIM 扩展到支援物联网的工厂,以支援自动化品质检测系统;澳洲零售商正在利用云端技术快速推出全通路推出。

在欧洲,计划引入数位产品护照,允许进口商和生产商集中管理永续性和来源数据,这一倡议正引起强烈的需求:德国工业公司正在实施产品资讯管理 (PIM) 来管理多语言技术文件,英国出口商正在透过统一的目录来处理脱欧后的文件工作,法国奢侈品牌正在使用产品资讯管理 (PIM) 来保持跨语言的品牌形象。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电子商务的蓬勃发展和SKU的激增

- 透过云端采用降低总体拥有成本

- 全通路客户体验势在必行

- 符合欧盟数位产品护照要求

- 人工智慧赋能的产品内容管道

- 市场「快速商务」API要求

- 市场限制

- 网路安全与资料外洩问题

- 与传统ERP系统整合的复杂性

- ESG数据审核成本不断上升

- 具备产品资讯管理 (PIM) 技能的资料管理员短缺

- 供应链分析

- 监管格局

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 评估市场中的宏观经济因素

第五章 市场规模与成长预测

- 按部署模式

- 云

- 本地部署

- 报价

- 解决方案

- 服务

- 按组织规模

- 大公司

- 小型企业

- 按最终用户产业

- 零售与电子商务

- BFSI

- 製造业

- 媒体与娱乐

- 资讯科技和通讯

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲国家

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介{包括全球概览、市场层级概览、核心业务板块、财务资讯、策略资讯、主要企业的市场排名/份额、产品和服务、近期发展等。 }

- SAP SE

- IBM Corp.

- Oracle Corp.

- Pimcore GmbH

- Salsify Inc.

- Syndigo LLC

- Stibo Systems A/S

- inRiver AB

- Akeneo SAS

- Contentserv AG

- Bluestone PIM AS

- Precisely Holdings LLC

- Plytix Ltd.

- InsightSoftware LLC

- Riversand(Syndigo)

- Informatica LLC

- Pimberly Ltd.

- Adobe(Experience Manager Assets)

- Acquia Inc.

- Ergonode Sp. z oo

第七章 市场机会与未来展望

The product information management market size is estimated at USD 17.56 billion in 2025 and is forecast to reach USD 37.02 billion by 2030, advancing at a 16.09% CAGR.

Rising recognition of PIM as the digital-commerce backbone, combined with AI-powered content generation and omnichannel experience imperatives, underpins this expansion. Enterprises shift quickly to cloud subscription models to reduce total cost of ownership, speed product launches, and secure automatic feature updates. Retailers, manufacturers, and streaming platforms now generate vast volumes of complex product data, prompting investments in centralized systems that maintain consistency across websites, marketplaces, stores, and social media. Regulatory momentum-most notably the EU Digital Product Passport due in 2026-adds compliance pressure, while generative-AI tooling increases the strategic value of PIM for rapid content localization and SEO optimization.

Global Product Information Management (PIM) Market Trends and Insights

E-commerce boom and SKU proliferation

Retailers today handle triple the product variants managed in 2020, straining spreadsheets and legacy tools. Centralized PIM platforms now orchestrate millions of attributes to keep Amazon, Walmart, and regional marketplace listings synchronized. Seasonal fashion lines present hundreds of color-size combinations that must appear consistently across 15-plus channels, and international rollouts add the burden of language localization and regulatory labeling.

Cloud adoption lowering TCO

Migrating to cloud PIM trims 45-55% in ownership costs by eliminating server upkeep and delivering automatic upgrades. Dynamic scaling fits peak holiday traffic without over-provisioning hardware. For mid-market firms, subscription pricing removes large capital outlays, while SAP recorded 27% cloud revenue growth in Q1 2025, underscoring enterprise appetite for SaaS data management.

Cyber-security and data-breach concerns

Firms handling proprietary formulas or price books hesitate to place sensitive data in multitenant clouds. Breach risk spikes 40% during migration phases, pushing pharmaceuticals and finance toward dedicated infrastructure with stricter encryption and zero-trust access controls.

Other drivers and restraints analyzed in the detailed report include:

- Omnichannel customer-experience mandates

- Gen-AI-ready product-content pipelines

- Integration complexity with legacy ERPs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud installations accounted for 63.5% of the product information management market in 2024, and the segment is set to grow at 18.2% CAGR to 2030. Centralized SaaS platforms remove geographic infrastructure constraints and push automatic AI feature updates without internal IT resourcing. On-premise retains a foothold in highly regulated fields, yet its share inches downward as compliance frameworks now accept certified cloud architectures.

Demand for elasticity and global availability ensures cloud remains the primary route for greenfield projects. SAP's 27% cloud revenue spike highlights customer preference for subscription models that deliver predictable spend and robust SLAs. Multinational retailers cite faster rollouts-three to six months instead of 12-plus-as pivotal to monetizing seasonal assortments swiftly.

Solutions held 65.9% revenue in 2024, but Services will outpace at 17.5% CAGR as firms seek integration, data-cleansing, and change-management assistance. Enterprise PIM rollouts now include AI model tuning, omnichannel syndication, and Digital Product Passport data layers, all requiring specialist skills.

Training and managed-service contracts rise as clients grapple with ongoing schema changes and content enrichment. Consulting partners guide taxonomy design, machine-learning pipeline setup, and KPI dashboards, ensuring long-term value extraction from core software licenses.

Product Information Management Market is Segmented by Deployment Mode (Cloud, On-Premises), Offering (Solutions Services), Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)), End User Industry (Retail and E-Commerce, BFSI, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 24.5% share in 2024 and will maintain steady growth as enterprises layer AI content capabilities atop mature PIM foundations. United States retailers invest in digital shelf analytics that link directly into core PIM, and Canadian manufacturers prepare for continent-wide trade digitization. Mexico's automotive suppliers adopt PIM to meet USMCA documentation rules.

Asia-Pacific is the fastest-growing region at 16.7% CAGR. Chinese manufacturers integrate PIM with MES and export portals to satisfy global labeling mandates, while Indian pharma and auto exporters adopt SaaS PIM for multi-market compliance. Japanese firms extend PIM into IoT-enabled factories to feed automated quality-inspection systems, and Australian retailers leverage cloud deployments for rapid omnichannel launches.

Europe enjoys entrenched demand thanks to the upcoming Digital Product Passport, compelling every importer and producer to centralize sustainability and provenance data. German industrials deploy PIM for multilingual technical files, UK exporters tackle post-Brexit paperwork through unified catalogs, and French luxury houses rely on PIM to preserve brand voice across languages.

- SAP SE

- IBM Corp.

- Oracle Corp.

- Pimcore GmbH

- Salsify Inc.

- Syndigo LLC

- Stibo Systems A/S

- inRiver AB

- Akeneo SAS

- Contentserv AG

- Bluestone PIM AS

- Precisely Holdings LLC

- Plytix Ltd.

- InsightSoftware LLC

- Riversand (Syndigo)

- Informatica LLC

- Pimberly Ltd.

- Adobe (Experience Manager Assets)

- Acquia Inc.

- Ergonode Sp. z o.o.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce boom and SKU proliferation

- 4.2.2 Cloud adoption lowering TCO

- 4.2.3 Omnichannel customer-experience mandates

- 4.2.4 EU Digital Product Passport compliance

- 4.2.5 Gen-AI-ready product-content pipelines

- 4.2.6 Marketplace "quick-commerce" API requirements

- 4.3 Market Restraints

- 4.3.1 Cyber-security and data-breach concerns

- 4.3.2 Integration complexity with legacy ERPs

- 4.3.3 Rising ESG data-audit costs

- 4.3.4 Shortage of PIM-skilled data stewards

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Model

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 By Offering

- 5.2.1 Solutions

- 5.2.2 Services

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By End-user Industry

- 5.4.1 Retail and E-commerce

- 5.4.2 BFSI

- 5.4.3 Manufacturing

- 5.4.4 Media and Entertainment

- 5.4.5 IT and Telecom

- 5.4.6 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments}

- 6.4.1 SAP SE

- 6.4.2 IBM Corp.

- 6.4.3 Oracle Corp.

- 6.4.4 Pimcore GmbH

- 6.4.5 Salsify Inc.

- 6.4.6 Syndigo LLC

- 6.4.7 Stibo Systems A/S

- 6.4.8 inRiver AB

- 6.4.9 Akeneo SAS

- 6.4.10 Contentserv AG

- 6.4.11 Bluestone PIM AS

- 6.4.12 Precisely Holdings LLC

- 6.4.13 Plytix Ltd.

- 6.4.14 InsightSoftware LLC

- 6.4.15 Riversand (Syndigo)

- 6.4.16 Informatica LLC

- 6.4.17 Pimberly Ltd.

- 6.4.18 Adobe (Experience Manager Assets)

- 6.4.19 Acquia Inc.

- 6.4.20 Ergonode Sp. z o.o.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment