|

市场调查报告书

商品编码

1850357

人力资本管理软体:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Human Capital Management Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

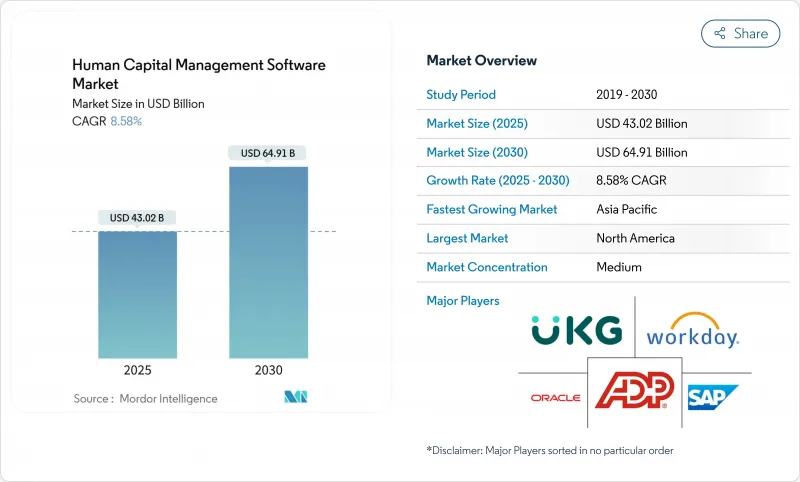

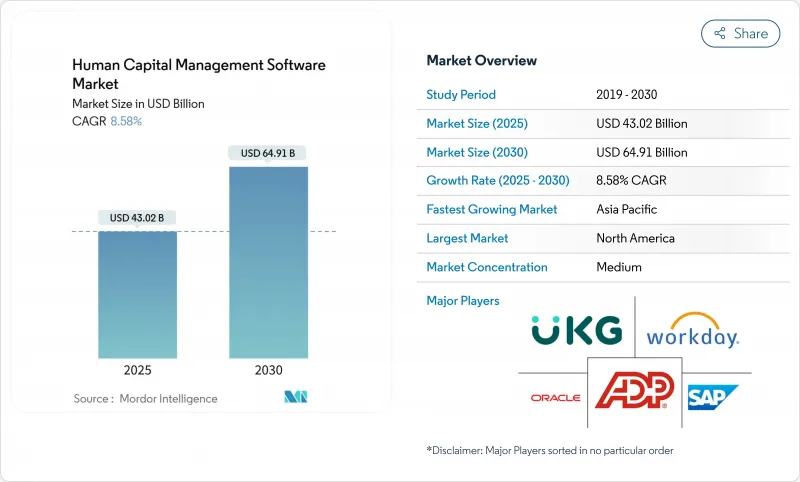

预计到 2025 年,人力资本管理软体市场规模将达到 430.2 亿美元,到 2030 年将达到 649.1 亿美元,年复合成长率为 8.6%。

云端迁移、嵌入式人工智慧和运作全球合规自动化正在再形成采购週期的每个阶段,从招标书设计到合约续签,没有例外。董事会现在将整合式云端原生人力资源套件视为重要的风险缓解工具,这些套件能够自动处理薪酬公平性调整、税务变更和隐私义务,同时提供即时劳动力分析,从而提高生产力和员工留存率。中小企业正在加速采用这些方案,因为基于订阅的部署方式消除了传统本地部署人力资源系统所需的资本成本和IT人员配置。能够提供通用资料模型、行动优先工作流程和透明人工智慧管道的供应商正在获得不成比例的市场份额,而那些仍然固守传统架构的后起之秀则正在失去续约机会。超过三分之一的北美扩张交易将机器学习主导的目标设定、流失风险评分和技能匹配作为预设权益捆绑在一起,这表明人工智慧不再是可选项,而是基本要求。

全球人力资本管理软体市场趋势与洞察

向云端原生HCM平台的转变

云端迁移已从硬体更新升级到董事会层级的强制性要求。超过90%的人力资源主管计划为云端分析和自动化更新合规引擎分配或增加预算。即时推播税表和特定司法管辖区的薪资平等规则只需一行程式码即可实现,从而消除季度补丁积压。然而,只有22%的雇主表示他们已做好充分准备来利用这些功能,这造成了执行上的差距,而实施合作伙伴和专业服务团队正努力从中收益。中阶市场买家占据了新客户数量的主导地位,因为他们无需维护资料中心即可获得企业级分析功能,而大型企业现在正在发布分阶段迁移的RFP,这些RFP采用容器化微服务,同时保留原有的自订逻辑。在人力资本管理软体市场,所有供应商都将解决长期存在的安全问题放在蓝图的核心位置,提供多租户扩展、自主云端选项和零停机升级服务。

整合式人力资源和薪资核算系统越来越受欢迎

使用独立的人才或薪资名册引擎会导致成本高昂的资料核对和不准确的分析。目前,85% 的雇主至少授权合约了两款付费人力资源产品,并在商业条件允许的情况下进行整合。在亚太地区,快速成长的公司在其第一阶段数位化中就采用了整合套件,从而避免了技术债务,并超越了西方国家的采用曲线。融合还能带来更丰富的洞见。薪资数据可以即时反映预算限制,人才模组可以揭示技能差距,并实现与学习成果相关的演算法薪酬提案。投资于涵盖薪酬、技能、资格和绩效的统一对像模型的供应商,其表现优于那些拼凑收购代码库的同行,这一趋势也体现在人力资本管理软体市场的续订价格中。

网路安全和资料隐私问题

GDPR、CCPA、CPRA 和巴西的 LGPD 对资料保留、居住和员工同意施加了严格的限制。包含银行详细资讯、社保号码和绩效考核记录的人力资源资料库是撞人员编制攻击的主要目标。因此,买家将 ISO 27001 认证、零信任网路设计和持续渗透测试作为优先选择标准。新的挑战在于如何证明个人识别资讯在传输和储存过程中均已加密,同时还要保持分析效能。供应商正在透过记忆体内标记化和基于属性的存取控制来应对这些挑战,但这些改进会延长部署时间并增加整体拥有成本,从而限制人力资本管理软体市场的成长。

细分市场分析

薪资核算仍是人力资源技术的核心支柱,预计到2024年将占人力资本管理软体市场收入的38.0%。其重要性源于法律要求企业必须准确、及时地支付员工薪资,这意味着外包造成的任何延误都是不可接受的。然而,到2030年,学习与发展领域的复合年增长率将达到9.5%。面临技能短缺的管理者更倾向于提升内部人才的技能,以避免不断上涨的招募成本和长期职缺。将学习目录、认证追踪和导师制工作流程与薪资核算整合到同一平台,可以创建一个闭环回馈机制:人工智慧可以将微证书的取得与封闭式连结起来,在提高员工敬业度的同时,满足薪资公平性报告的要求。

人才和人力资源管理、薪资核算和学习管理等模组的需求仍然强劲,这主要源自于雇主希望获得统一的绩效数据,以辅助排班、加班核准和提高薪资。核心人力资源管理仍然是必备模组,但除非与增值分析功能捆绑,否则很少会影响供应商的选择。在不断发展的人力资本管理软体市场中,供应商正在整合课程市场、技能本体和内部零工市场模组,将学习从一项合规义务提升为策略生产力引擎。随着客户将预算转向以结果为导向的应用,未能调整策略的供应商将面临市场份额下降的困境。

到2024年,本地部署仍将占总收入的68.4%,这是十年前ERP决策遗留下来的产物。许多公共部门和受严格监管的客户由于资料主权条款和复杂的整合问题而抵制迁移。然而,云端采用率正以10.1%的复合年增长率成长,推动人力资本管理软体市场迈入订阅模式时代。买家看重的是,他们能够将资本支出转化为可观的收益,同时还能获得季度功能更新和安全补丁,且无需停机。如今的合约还包括亚小时级的合规性推送和即时分析沙箱,这些都是静态本地部署架构所无法提供的优势。

我们也看到混合模式的出现,个人资讯和薪资核算运行在私有云端上,而前端分析则运行在超大规模执行个体上。提供容器化服务和基础设施即程式码蓝图的供应商正在获得市场预算,以缓解用户的迁移焦虑。最终,我们预计会出现曲折点,届时人工智慧的快速发展将迫使即使是较为保守的行业也重新评估其本地部署资产,从而进一步推动人力资本管理软体市场向云端倾斜。

人力资本管理软体市场报告按解决方案类型(薪资管理、人才管理、劳动力管理等)、部署类型(本地部署、云端部署)、组织规模(大型企业、中小企业)、垂直行业(IT 和通讯、银行、金融服务和保险等)和地区进行细分。

区域分析

2024年,北美将占人力资本管理软体市场收入的43.1%。长期以来对SaaS的熟悉、强大的创业投资资金以及完善的实施合作伙伴生态系统正在推动升级週期。薪酬公平立法正在加速报告模组的普及。仅加州就强制要求按性别和种族类别披露工资中位数,奖励即时分析。供应商正透过人工智慧驱动的可解释性和工作流程扩充性来脱颖而出。儘管转换成本仍然很高,但承诺提供消费级行动用户体验和透明定价的新兴参与企业正在快速扩张员工队伍的新创公司中找到立足之地。

德国、法国和北欧国家各自製定了不同的职工委员会工作流程。 GDPR 推动了严格的资料主权审查,许多买家要求资料中心设在本国境内。敏感的人事檔案保存在当地,机器学习工作负载运行在欧盟认证的公共云端上。永续性认证和对负责任人工智慧的承诺正日益影响采购决策,供应商强调其节能资料中心和偏差缓解框架,以期在竞标评分中获得通过。

亚太地区是成长最快的区域,复合年增长率高达9.6%。从印度到印尼,各国政府都在津贴中小企业的数位化,推动了第一代薪资核算和时间管理软体的采购。行动优先功能十分普遍,满足了外勤员工的需求。区域供应商透过整合法定申报、电子钱包支付和本地语言聊天机器人支援等功能取得了成功,但他们也经常与全球套件供应商合作,以获得更高级的分析功能。跨国公司正在寻求在中国、日本和东南亚地区实现流程统一,这促使供应商扩展语言包和本地税务内容。在人力资本管理软体市场,该地区呈现层级构造:掌握监管细微差别的本地领导企业和提供人工智慧强大分析功能的全球巨头。

其他好处

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 迁移到云端原生 HCM 平台

- 整合的人力资源和薪资核算系统正变得越来越普遍。

- 人才分析与人工智慧在策略性人力资源管理的应用

- 全球薪资核算和税务合规义务

- 薪酬公平法推动薪酬工具的发展

- 无固定办公人员及零工人员的行动优先型人力资本管理

- 市场限制

- 网路安全和资料隐私问题

- 传统系统迁移的成本与复杂性

- 复杂套件的最终用户接受度较低。

- 人工智慧偏见诉讼风险限制了其部署

- 价值链分析

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 评估宏观经济趋势对市场的影响

第五章 市场规模与成长预测

- 透过解决方案

- 薪资管理

- 人才管理

- 人力资源管理

- 核心人力资源管理

- 学习与发展

- 透过部署

- 本地部署

- 云

- 按组织规模

- 大公司

- 小型企业

- 按行业

- 资讯科技和通讯

- BFSI

- 製造业

- 卫生保健

- 零售与电子商务

- 政府和公共部门

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- ASEAN

- 澳洲和纽西兰

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲国家

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略倡议与发展

- 市占率分析

- 公司简介

- SAP SE

- Oracle Corporation

- Workday Inc.

- ADP LLC

- Ceridian HCM Holding Inc.

- UKG(Ultimate Kronos Group)

- Infor

- Cornerstone OnDemand Inc.

- IBM Corporation

- Ramco Systems

- BambooHR LLC

- Zoho Corporation(Zoho People)

- Namely Inc.

- Gusto Inc.

- Paycom Software Inc.

- Sage Group plc

- Epicor Software Corporation

- SumTotal Systems LLC

- PeopleFluent Inc.

- Meta4(Cegid)

- Talentia Software

- OrangeHRM Inc.

- Rippling

- Deel Inc.

第七章 市场机会与未来展望

The human capital management software market size is valued at USD 43.02 billion in 2025 and is projected to reach USD 64.91 billion by 2030, expanding at an 8.6% CAGR.

Cloud migration, embedded artificial intelligence, and always-on global compliance automation are the structural forces reshaping every stage of the purchase cycle, from RFP design to contract renewal. Boards now view integrated, cloud-native HR suites as essential risk-mitigation tools that automate pay-equity adjustments, tax changes, and privacy obligations, while simultaneously delivering real-time workforce analytics that lift productivity and retention. Small and medium enterprises are accelerating adoption because subscription-based deployments eliminate the capital costs and IT headcount traditionally associated with on-premise HRIS, creating a two-speed environment inside the human capital management software market where SME agility meets large-enterprise complexity. Vendors that can deliver universal data models, mobile-first workflows, and transparent AI pipelines are capturing a disproportionate share, whereas laggards tethered to legacy architectures are losing renewals. Over one-third of North American expansion deals already bundle machine-learning-driven goal-setting, attrition risk scoring, and skills matching as default entitlements, signaling that AI is no longer an optional add-on but a baseline requirement.

Global Human Capital Management Software Market Trends and Insights

Shift to Cloud-Native HCM Platforms

Cloud migration has progressed from hardware refresh to board-level mandate. Over 90% of HR leaders plan to protect or increase budgets specifically to unlock cloud analytics and auto-updated compliance engines. Real-time tax table pushes and jurisdiction-specific pay-equity rules arrive inside a single code line, eliminating quarterly patch backlogs. Yet only 22% of employers report full readiness to harness those capabilities, leaving an execution gap that implementation partners and professional-services teams are keen to monetize. Mid-market buyers dominate new-logo counts because they gain enterprise-class analytics without maintaining data centers, but large enterprises are now issuing phased migration RFPs that preserve prior custom logic while adopting containerized microservices. Within the human capital management software market, every provider's roadmap now centers on delivering multi-tenant scale, sovereign-cloud options, and zero-downtime upgrades to neutralize lingering security objections.

Integrated Talent and Payroll Suites Gain Traction

Stand-alone talent or payroll engines create costly data reconciliations that impede analytics accuracy. Eighty-five percent of employers currently license at least two paid HR products and are consolidating wherever commercial terms allow. In Asia-Pacific, fast-growing organizations deploy unified suites during first-generation digitization, avoiding technical debt and leapfrogging Western adoption curves. Convergence also unlocks richer insights: payroll data surfaces real-time budget constraints, while talent modules expose skills gaps, enabling algorithmic compensation recommendations linked to learning achievements. Vendors that invest in a unified object model-covering wages, skills, credentials, and performance-outperform peers still stitching together acquired codebases, a dynamic increasingly visible in renewal pricing inside the human capital management software market.

Cyber-Security and Data-Privacy Concerns

GDPR, CCPA, CPRA, and Brazil's LGPD impose strict constraints on data retention, residency, and employee consent. HR databases contain bank details, social-security numbers, and performance notes-prime targets for credential-stuffing attacks. Buyers, therefore, elevate ISO 27001 certification, zero-trust network designs, and continuous penetration testing to top selection criteria. The new hurdle is proving encryption of personally identifiable information both in transit and at rest while maintaining analytics performance. Vendors are responding with in-memory tokenization and attribute-based access controls, but those enhancements lengthen rollout timelines and raise total cost of ownership, tempering growth inside the human capital management software market.

Other drivers and restraints analyzed in the detailed report include:

- Workforce Analytics and AI for Strategic HR

- Compliance Mandates for Global Payroll and Taxation

- Legacy Migration Cost and Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Payroll remains the backbone of HR technology, accounting for 38.0% of 2024 revenue in the human capital management software market. Its criticality stems from legal requirements to pay employees accurately and on time, leaving little room for outsourcing delays. However, Learning and Development is advancing at a 9.5% CAGR toward 2030. Executives battling skill shortages prefer upskilling internal talent to avoid escalating recruiting costs and protracted vacancy periods. Incorporating learning catalogues, credential tracking, and mentorship workflows into the same platform that runs payroll unlocks a closed feedback loop: AI can correlate micro-credential completion with wage progression, boosting engagement while satisfying pay-equity reporting.

Beyond payroll and learning, demand for talent-management and workforce-management cubes remains steady, driven by employers seeking unified performance data that informs scheduling, overtime approval, and compensation bumps. Core HR Administration persists as a table-stakes module but rarely influences vendor selection unless bundled with value-add analytics. In the evolving human capital management software market, providers are embedding course marketplaces, skills ontologies, and internal gig-market modules to elevate learning from a compliance obligation to a strategic productivity engine. Those failing to retool will see wallet share erode as clients shift budget toward outcome-oriented applications.

On-premise still controls 68.4% of revenue in 2024, a legacy of decade-old ERP decisions. Many public-sector and highly regulated customers resist migration because of data-sovereignty clauses and integration tangles. Yet cloud implementations are climbing at a 10.1% CAGR, propelling the human capital management software market into a subscription-first era. Buyers appreciate converting capex to opex while gaining quarterly feature drops and security patches without downtime. Contracts now bundle sub-hour compliance pushes and real-time analytics sandboxes, benefits unattainable in static on-premise stacks.

A hybrid pattern is emerging: personal information and payroll calculations often remain on private or sovereign clouds, whereas front-end analytics run on hyperscaler instances for elasticity. Vendors offering containerized services and infrastructure-as-code blueprints capture implementation budgets because they reduce migration anxiety. Eventually, an inflection point will arise where artificial-intelligence feature velocity compels even conservative sectors to re-evaluate on-premise holdings, further tipping the human capital management software market toward cloud dominance.

The Human Capital Management Software Market Report is Segmented by Solution (Payroll Management, Talent Management, Workforce Management, and More), Deployment (On-Premise and Cloud), Organization Size (Large Enterprises and Small and Medium Enterprises), Industry Vertical (IT and Telecom, BFSI, and More), and Geography.

Geography Analysis

North America controls 43.1% of 2024 revenue inside the human capital management software market. Longstanding SaaS familiarity, strong venture funding, and dense implementation-partner ecosystems fuel upgrade cycles. Pay-equity legislation accelerates reporting module adoption; California alone mandates median-pay disclosure across gender and race categories, incentivizing real-time analytics. Vendors differentiate on AI explainability and workflow extensibility because functionality parity exists across payroll, benefits, and learning. Switching costs remain high, yet new entrants that promise consumer-grade mobile UX and transparent pricing still find footholds among venture-backed firms scaling headcount rapidly.

Europe presents a mosaic of labor codes; Germany, France, and the Nordics each impose unique works-council consultation workflows. GDPR drives strict data-sovereignty reviews; many buyers demand data centers within national borders. Hybrid deployments lead: sensitive HR files stay local, while machine-learning workloads run on EU-accredited public clouds. Sustainability credentials and responsible-AI commitments increasingly influence procurement; vendors highlight energy-efficient data centers and bias-mitigation frameworks to pass tender scoring.

Asia-Pacific is the fastest-growing region at 9.6% CAGR. Governments from India to Indonesia subsidize SME digitization, driving first-generation payroll and attendance purchases. Mobile-first features dominate, catering to field-based workforces. Regional providers thrive by integrating statutory returns, e-wallet disbursements, and chatbot support in local languages, yet often partner with global suites for advanced analytics. Multinational corporations seek unified processes across China, Japan, and Southeast Asia, pushing vendors to expand language packs and in-country tax content. Within the human capital management software market, this region showcases a two-tier structure: local champions owning regulatory nuance and global giants supplying AI-rich analytics.

- SAP SE

- Oracle Corporation

- Workday Inc.

- ADP LLC

- Ceridian HCM Holding Inc.

- UKG (Ultimate Kronos Group)

- Infor

- Cornerstone OnDemand Inc.

- IBM Corporation

- Ramco Systems

- BambooHR LLC

- Zoho Corporation (Zoho People)

- Namely Inc.

- Gusto Inc.

- Paycom Software Inc.

- Sage Group plc

- Epicor Software Corporation

- SumTotal Systems LLC

- PeopleFluent Inc.

- Meta4 (Cegid)

- Talentia Software

- OrangeHRM Inc.

- Rippling

- Deel Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift to cloud-native HCM platforms

- 4.2.2 Integrated talent and payroll suites gain traction

- 4.2.3 Workforce analytics and AI for strategic HR

- 4.2.4 Compliance mandates for global payroll and taxation

- 4.2.5 Pay-equity legislation spurs compensation tools

- 4.2.6 Mobile-first HCM for deskless and gig workforce

- 4.3 Market Restraints

- 4.3.1 Cyber-security and data-privacy concerns

- 4.3.2 Legacy migration cost and complexity

- 4.3.3 Low end-user adoption of complex suites

- 4.3.4 AI bias litigation risk restricts roll-outs

- 4.4 Value Chain Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution

- 5.1.1 Payroll Management

- 5.1.2 Talent Management

- 5.1.3 Workforce Management

- 5.1.4 Core HR Administration

- 5.1.5 Learning and Development

- 5.2 By Deployment

- 5.2.1 On-Premise

- 5.2.2 Cloud

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises

- 5.4 By Industry Vertical

- 5.4.1 IT and Telecom

- 5.4.2 BFSI

- 5.4.3 Manufacturing

- 5.4.4 Healthcare

- 5.4.5 Retail and E-Commerce

- 5.4.6 Government and Public Sector

- 5.4.7 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 ASEAN

- 5.5.3.6 Australia and New Zealand

- 5.5.3.7 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 UAE

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 SAP SE

- 6.4.2 Oracle Corporation

- 6.4.3 Workday Inc.

- 6.4.4 ADP LLC

- 6.4.5 Ceridian HCM Holding Inc.

- 6.4.6 UKG (Ultimate Kronos Group)

- 6.4.7 Infor

- 6.4.8 Cornerstone OnDemand Inc.

- 6.4.9 IBM Corporation

- 6.4.10 Ramco Systems

- 6.4.11 BambooHR LLC

- 6.4.12 Zoho Corporation (Zoho People)

- 6.4.13 Namely Inc.

- 6.4.14 Gusto Inc.

- 6.4.15 Paycom Software Inc.

- 6.4.16 Sage Group plc

- 6.4.17 Epicor Software Corporation

- 6.4.18 SumTotal Systems LLC

- 6.4.19 PeopleFluent Inc.

- 6.4.20 Meta4 (Cegid)

- 6.4.21 Talentia Software

- 6.4.22 OrangeHRM Inc.

- 6.4.23 Rippling

- 6.4.24 Deel Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment