|

市场调查报告书

商品编码

1851014

资料中心浸没式冷却:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Data Center Immersion Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

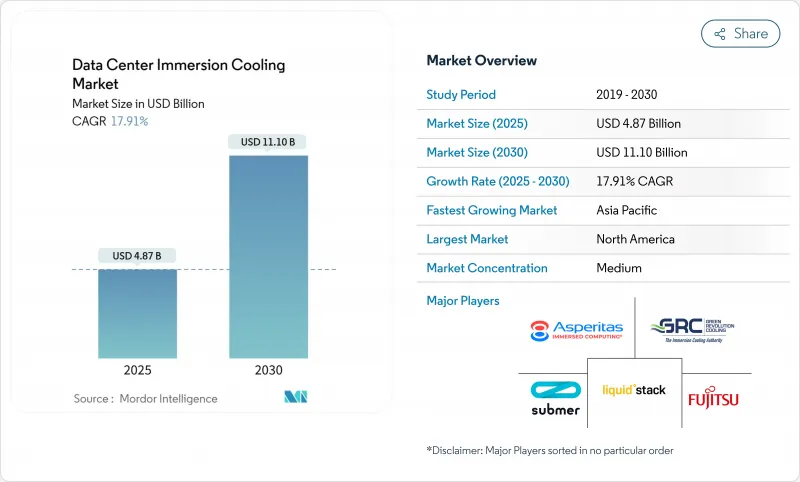

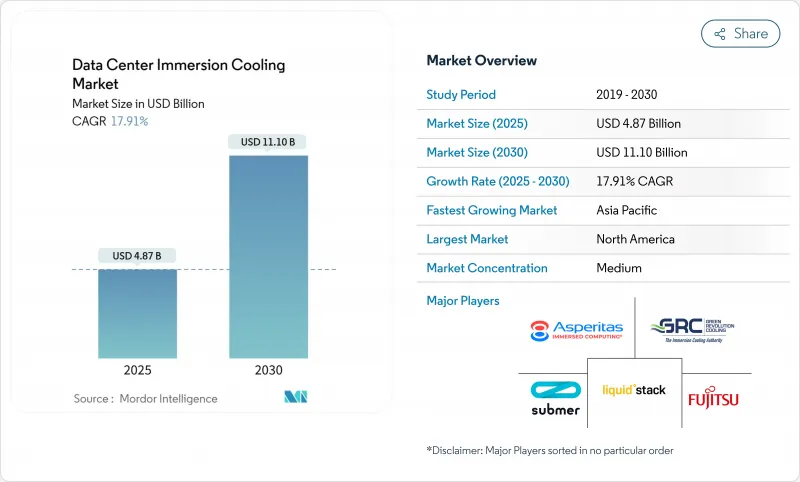

预计到 2025 年资料中心浸没式冷却市场规模将达到 48.7 亿美元,到 2030 年将达到 111 亿美元,复合年增长率为 17.91%。

这种快速成长反映了业界对机架功率密度飙升的反应,因为人工智慧和机器学习工作负载的功率密度已超过每个机架 50kW。营运商将浸没式冷却技术视为维持性能、缩小设施占地面积并符合即将出台的含 PFAS 冷却剂法规的有效途径。在北美,超大规模云端服务供应商的生产级部署占据主导地位,而在亚太地区、日本、中国和南美洲,液冷人工智慧丛集的应用也呈现快速成长趋势。在技术方面,单相繫统由于其易于安装而保持着主导地位,而两相设计则在需要极高密度和无泵架构的试点项目中脱颖而出。

全球资料中心浸没式冷却市场趋势与洞察

超大规模资料中心的兴起

对生成式人工智慧服务需求的激增正迫使大型云端服务供应商建造新的超大规模资料中心,目标是机架密度超过 100kW。谷歌采用浸没式冷却 TPU 舱表明,大型服务提供者正在将液冷技术标准化,以减少房地产需求和建筑扩建的资本支出。微软在华盛顿州昆西的园区检验了生产级两相储罐,因为它们易于扩展密度,整体拥有成本指标良好。在产品组合层面应用浸没式冷却技术,营运商可以在相同的占地面积内实现 10 到 15 倍的运算能力提升,从而直接加快人工智慧服务的收入实现速度。提高每平方英尺的使用率仍然是超大规模部署最重要的经济驱动因素。

利用人工智慧/机器学习工作负载提高机架功率密度

来自KDDI货柜式资料中心的现场资料显示,单相浸没式加热技术使伺服器机架的功耗降低了43%,PUE值低于1.07。能源紧张地区的业者正利用这些节省的电费来抵消不断上涨的电费和碳排放税。欧盟能源效率指令要求欧洲设施在2030年将能源消耗降低11.7%。浸没式加热技术能够达到低于1.1的PUE值,为实现此目标提供了切实可行的途径。持续的加速频率提升能够提高每瓦运算能力,为伺服器带来更多效益。

面向 5G/物联网的边缘微资料中心扩展

为了满足 5G 的延迟目标,电讯和工业企业正在将微型模组部署在更靠近终端用户的位置。在暖通空调基础设施有限或气候恶劣的地区,密封的单相水箱能够使自主边缘节点无需冷水机组即可运作。东南亚的早期试验表明,浸没式系统能够承受灰尘、湿度和温度波动,而这些因素足以使传统的风冷机架瘫痪。

细分市场分析

2024年,单相繫统占据了80.9%的市场份额,但预计到2030年,两相繫统将以每年21.6%的速度成长。这种加速成长反映了低压沸腾卓越的散热能力,以及被动式冷凝器无需泵浦或二次迴路即可散热。微软的昆西部署专案展示了相变储槽如何为100kW的生产机架提供电力支援。

矿物油和合成烃具有可预测的黏度和与多种组件的兼容性,这一点尤其重要。然而,采用最新1kW GPU的AI晶圆厂越来越多地选择两相冷却系统,以避免泵浦故障,并将资料中心的废热用于区域供热。随着供应商缩小储罐尺寸并推出预充注组件,两相冷却系统的学习曲线正在缩短,为其在未来长期占据市场份额奠定了基础。因此,资料中心浸没式冷却市场将演变为一个双轨生态系统:单相冷却系统将主导传统系统的升级改造,而两相冷却系统将占据高密度新建资料中心的市场份额。

由于合成烃流体具有低黏度和良好的材料相容性,预计2024年将占销售额的41.2%,成为大多数单相应用的实际基准。矿物油曾经被局限于加密货币挖矿,如今重回主流市场,预计到2030年将成长18.4%,因为炼油商为了满足延长使用寿命的目标,会提供更干净的馏分油。相较之下,含氟化合物混合物将面临PFAS法规的更严格审查,这将对生物基衍生物的研发构成阻力,促使其进入测试阶段。

路博润的CompuZol系列产品采用合成烃,可将导热係数提升至0.15 W/m·K,同时保持闪点高于170°C。道达尔能源的BioLife产品则证明,可追溯的植物来源冷却液性能可与石油化学产品媲美,且具有快速生物降解的特性,符合欧盟的废弃物处理法规。由于冷却液的选择会影响密封件的兼容性、介电强度和处置途径,营运商仍在实施耗时的资格确认程序,这使得流体供应商对资料中心浸没式冷却市场的发展轨迹拥有越来越大的影响力。

资料中心浸没式冷却市场按类型(单相浸没式冷却系统、两相浸没式冷却系统)、冷却液(矿物油、去离子水、其他)、应用(高效能运算 (HPC)、边缘运算、其他)、资料中心类型(超大规模/自建、託管/批发、其他)和地区进行细分。市场预测以美元计价。

区域分析

2024年,北美将占LiquidStack销售额的44.8%,这主要得益于超大规模的资本投资以及鼓励从试点计画快速过渡到量产的创新文化。 LiquidStack位于德克萨斯州的新工厂将使当地储罐产量增加两倍,缩短前置作业时间并加强国内供应链。与强制规定设备要求不同,LiquidStack的政策框架着重于自愿性效率目标,这使得营运商能够灵活地试验浸没式技术,而无需担心监管方面的延误。

亚太地区正经历最快的成长,复合年增长率高达19.6%,这主要得益于政府支持的人工智慧超级电脑和资料主权计画。日本KDDI公司部署了一套货柜式单钻机,其PUE值接近1.05,证明了浸没式安装技术在通讯边缘应用场景的有效性。中国一个沿海水下资料中心的概念验证专案展示了一种新型的安装策略,该策略利用浸没式安装来降低腐蚀和湿度的影响。

在欧洲,监管是推动科技普及的主要动力。欧盟2024年永续性资讯揭露要求鼓励业者减少能源和水的消耗,使浸没式冷却更具吸引力。在荷兰,强制性的27 度C送风温度上限规定(对于风冷系统而言难以达到)正在加速阿姆斯特丹各设施的液体维修。诸如丹麦游泳池的余热回收试点计画进一步提升了浸没式冷却计划的经济效益,使营运商能够透过余热回收协议收回成本。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 超大规模资料中心的兴起

- 利用人工智慧/机器学习工作负载提高机架功率密度

- 与空气冷却相比,具有更高的能源效率和更低的PUE值

- 加强对不含 PFAS 的生物基冷却剂的监管

- 面向 5G/物联网的边缘微资料中心扩展

- 发布热设计功耗超过 1kW 的浸没式相容硅封装

- 市场限制

- 高昂的初始投资和设施改造成本

- 标准碎片化和厂商间互通性差距

- 含氟介电材料供应链风险

- 材料相容性问题导致保固失效

- 供应链分析

- 监管环境

- 技术展望

- 资料中心冷却技术的演变

- 能耗和计算密度指标

- 流体、处理器、GPU、机架、基础设施拆卸

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 竞争程度

- 替代品的威胁

- 评估市场的宏观经济因素

第五章 市场规模与成长预测

- 按类型

- 单相浸没式冷却系统

- 两相浸没式冷却系统

- 透过冷却剂

- 矿物油

- 去离子水

- 氟碳液压油

- 合成烃流体

- 生物基液体

- 透过使用

- 高效能运算(HPC)

- 边缘运算

- 人工智慧和机器学习

- 加密货币挖矿

- 云端运算和超大规模资料中心

- 其他用途

- 依资料中心类型

- 超大规模/自建

- 託管/批发

- 企业/边缘资料中心

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 荷兰

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Fujitsu Limited

- Green Revolution Cooling(GRC)Inc.

- Submer Technologies SL

- LiquidStack Inc.

- Asperitas

- LiquidCool Solutions

- Midas Green Technologies

- Iceotope Technologies Ltd.

- Wiwynn Corporation

- DCX Ltd.

- Dell Technologies

- Intel Corporation

- Schneider Electric SE

- Vertiv Holdings Co.

- NVIDIA Corporation

- Asetek A/S

- Shell plc(Immersion Cooling Fluids)

- Cargill Inc.(NatureCool)

- 3M Company

- Chemours Company

- Molex LLC

- Hypertec Group

- Alibaba Cloud

- Tencent Cloud

第七章 市场机会与未来展望

The data center immersion cooling market is valued at USD 4.87 billion in 2025 and is forecast to reach USD 11.10 billion by 2030, registering a 17.91% CAGR.

This rapid climb mirrors the industry's response to soaring rack power densities driven by AI and machine-learning workloads that regularly exceed 50 kW per rack. Operators view immersion technology as a route to maintain performance, shrink facility footprints, and comply with upcoming restrictions on PFAS-based coolants. North America anchors adoption through production-scale rollouts by the hyperscale cloud providers, while Asia-Pacific exhibits the steepest growth as Japan, China, and South Korea champion liquid-cooled AI clusters. On the technology front, single-phase systems retain the lion's share because of installation familiarity, yet two-phase designs are winning pilots where extreme density and pump-free architectures are essential.

Global Data Center Immersion Cooling Market Trends and Insights

Proliferation of Hyperscale Data Centers

Surging demand for generative-AI services compels the leading cloud providers to erect new hyperscale sites that often target rack densities above 100 kW. Google's use of immersion-cooled TPU pods illustrates how large providers are standardizing liquid technologies to curtail real-estate requirements and capex for building expansion. Microsoft has validated production two-phase tanks at its Quincy, Washington, campus, citing easier density scaling and favorable total-cost-of-ownership metrics. When applied atthe portfolio level, immersion cooling enables operators to pack 10-15X more compute into the same footprint, directly translating into faster time-to-revenue for AI services. The ability to drive higher utilization from every square foot remains the strongest economic lever motivating hyperscale adoption.

Rising Rack-Power Densities from AI/ML Workloads

Field data from KDDI's containerized sites shows single-phase immersion cutting server-rack power draw by 43% while achieving PUE below 1.07. Operators in energy-constrained locales exploit such savings to offset rising electricity tariffs and carbon taxes. European facilities face the EU Energy Efficiency Directive's mandated 11.7% reduction in energy use by 2030; immersion's ability to hit sub-1.1 PUE values provides a practical compliance pathway. Further benefits emerge at the server level, as sustained higher boost frequencies translate into more compute per watt.

Expansion of Edge Micro-Data Centers for 5G/IoT

Telecom carriers and industrial firms are rolling out micro-modules close to end-users to meet 5G latency targets. In regions with limited HVAC infrastructure or hostile climates, sealed single-phase tanks enable autonomous edge nodes that run without chilled-water plants. Early pilots across Southeast Asia illustrate that immersion systems can survive dust, humidity and temperature swings that cripple traditional air-cooled racks.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push Toward PFAS-Free, Bio-Based Coolants

- Fragmented Standards and Vendor Interoperability Gaps

- High Upfront CAPEX and Facility-Redesign Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Single-phase systems dominated 2024 with 80.9% share; however, two-phase designs are forecast to compound at 21.6% annually to 2030. That acceleration reflects superior heat-flux removal through low-pressure boiling, which allows passive condensers to reject heat without pumps or secondary loops. Microsoft's Quincy deployment showcases how phase-change tanks sustain 100 kW racks in production.

In enterprise pilots, operators prefer single-phase solutions for ease of maintenance and established supply chains, particularly where mineral oil or synthetic hydrocarbons offer predictable viscosity and broad component compatibility. Yet AI fabs built on the latest 1 kW GPUs increasingly select two-phase setups to eliminate pump failures and tap datacenter waste heat for district-heating schemes. As suppliers shrink tank footprints and introduce pre-charged cassettes, the learning curve shortens, setting the stage for two-phase systems to claim incremental share over the forecast horizon. The data center immersion cooling market consequently evolves toward a dual-track ecosystem where single-phase dominates legacy refresh spend while two-phase captures new-build footprints geared for extreme density.

Synthetic hydrocarbon fluids held 41.2% of 2024 revenue thanks to their low viscosity and strong material compatibility, making them the de-facto baseline across most single-phase deployments. Mineral oils, once relegated to cryptocurrency mines, re-enter mainstream consideration and are projected to grow 18.4% through 2030 as refiners deliver cleaner cuts that meet extended service-life targets. In comparison, fluorocarbon blends face heightened scrutiny under PFAS regulation, a headwind that propels bio-derivatives into pilot stages.

Lubrizol's CompuZol family demonstrates synthetic hydrocarbons pushing thermal conductivity to 0.15 W/m-K while preserving flash points above 170 °C. TotalEnergies' BioLife products illustrate how traceable plant-based stocks can equal petrochemical performance yet biodegrade rapidly, satisfying EU waste directives. Because coolant selection dictates seal compatibility, dielectric strength and disposal pathways, operators continue to conduct lengthy qualification programs, reinforcing fluid suppliers' influence over the data center immersion cooling market trajectory.

Data Center Immersion Cooling Market is Segmented by Type ( Single-Phase Immersion Cooling System, Two-Phase Immersion Cooling System), Cooling Fluid ( Mineral Oil, De-Ionized Water, and More), Application ( High-Performance Computing (HPC), Edge Computing, and More), Data Center Type (Hyperscale/Self-Built, Colocation / Wholesale, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 44.8% of 2024 revenue, underpinned by hyperscale capital expenditure and an innovation culture that embraces pilot-to-production transitions rapidly. LiquidStack's new Texas facility triples local tank output, shortening lead times and reinforcing domestic supply chains Policy frameworks focused on voluntary efficiency goals rather than prescriptive equipment mandates grant operators leeway to trial immersion without regulatory delays.

Asia-Pacific is the fastest-growing region at 19.6% CAGR, spurred by government-backed AI supercomputers and data-sovereignty initiatives. Japan's KDDI recorded PUE values approaching 1.05 after deploying containerized single-phase rigs, validating immersion for telecom edge use cases. China's coastal underwater data center proofs of concept illustrate novel siting strategies that rely on immersion to mitigate corrosion and humidity.

Europe leans on regulation as the primary adoption driver. The 2024 EU sustainability disclosure requirement pushes operators to cut both energy and water usage, making immersion attractive. The Netherlands enforces 27 °C supply-air ceilings that air-cooling systems struggle to meet, accelerating liquid retrofits in Amsterdam facilities. Heat-reuse pilots, such as feeding swimming pools in Denmark, further improve immersion project economics, enabling operators to recoup costs via heat-offtake agreements.

- Fujitsu Limited

- Green Revolution Cooling (GRC) Inc.

- Submer Technologies SL

- LiquidStack Inc.

- Asperitas

- LiquidCool Solutions

- Midas Green Technologies

- Iceotope Technologies Ltd.

- Wiwynn Corporation

- DCX Ltd.

- Dell Technologies

- Intel Corporation

- Schneider Electric SE

- Vertiv Holdings Co.

- NVIDIA Corporation

- Asetek A/S

- Shell plc (Immersion Cooling Fluids)

- Cargill Inc. (NatureCool)

- 3M Company

- Chemours Company

- Molex LLC

- Hypertec Group

- Alibaba Cloud

- Tencent Cloud

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of hyperscale data centers

- 4.2.2 Rising rack-power densities from AI/ML workloads

- 4.2.3 Superior energy-efficiency and PUE gains over air cooling

- 4.2.4 Regulatory push toward PFAS-free, bio-based coolants

- 4.2.5 Expansion of edge micro-data-centers for 5G/IoT

- 4.2.6 Launch of immersion-ready silicon packages greater than1 kW TDP

- 4.3 Market Restraints

- 4.3.1 High upfront CAPEX and facility-redesign costs

- 4.3.2 Fragmented standards and vendor interoperability gaps

- 4.3.3 Supply-chain risk for fluorinated dielectrics

- 4.3.4 Material-compatibility concerns voiding warranties

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.6.1 Evolution of Data-Center Cooling

- 4.6.2 Energy-consumption and compute-density metrics

- 4.6.3 Teardown of fluids, processors, GPUs, racks and infra

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Degree of Competition

- 4.7.5 Threat of Substitutes

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE and GROWTH FORECASTS(VALUE)

- 5.1 By Type

- 5.1.1 Single-Phase Immersion Cooling System

- 5.1.2 Two-Phase Immersion Cooling System

- 5.2 By Cooling Fluid

- 5.2.1 Mineral Oil

- 5.2.2 De-ionized Water

- 5.2.3 Fluorocarbon-based Fluids

- 5.2.4 Synthetic Hydrocarbon Fluids

- 5.2.5 Bio-based Fluids

- 5.3 By Application

- 5.3.1 High-Performance Computing (HPC)

- 5.3.2 Edge Computing

- 5.3.3 Artificial Intelligence and Machine Learning

- 5.3.4 Cryptocurrency Mining

- 5.3.5 Cloud and Hyperscale Data Centers

- 5.3.6 Other Applications

- 5.4 By Data Center Type

- 5.4.1 Hyperscale/Self-Built

- 5.4.2 Colocation / Wholesale

- 5.4.3 Enterprise/Edge Data Centers

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Netherlands

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Nigeria

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Fujitsu Limited

- 6.4.2 Green Revolution Cooling (GRC) Inc.

- 6.4.3 Submer Technologies SL

- 6.4.4 LiquidStack Inc.

- 6.4.5 Asperitas

- 6.4.6 LiquidCool Solutions

- 6.4.7 Midas Green Technologies

- 6.4.8 Iceotope Technologies Ltd.

- 6.4.9 Wiwynn Corporation

- 6.4.10 DCX Ltd.

- 6.4.11 Dell Technologies

- 6.4.12 Intel Corporation

- 6.4.13 Schneider Electric SE

- 6.4.14 Vertiv Holdings Co.

- 6.4.15 NVIDIA Corporation

- 6.4.16 Asetek A/S

- 6.4.17 Shell plc (Immersion Cooling Fluids)

- 6.4.18 Cargill Inc. (NatureCool)

- 6.4.19 3M Company

- 6.4.20 Chemours Company

- 6.4.21 Molex LLC

- 6.4.22 Hypertec Group

- 6.4.23 Alibaba Cloud

- 6.4.24 Tencent Cloud

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment