|

市场调查报告书

商品编码

1851277

北美雷射雷达:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)North America LiDAR - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

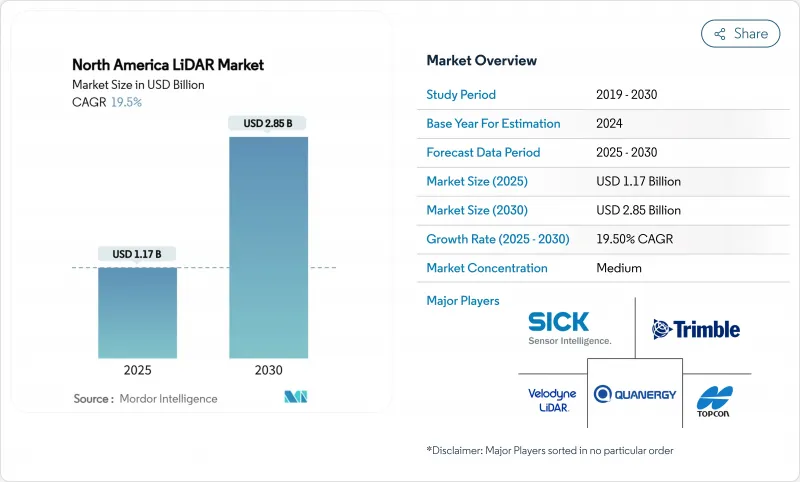

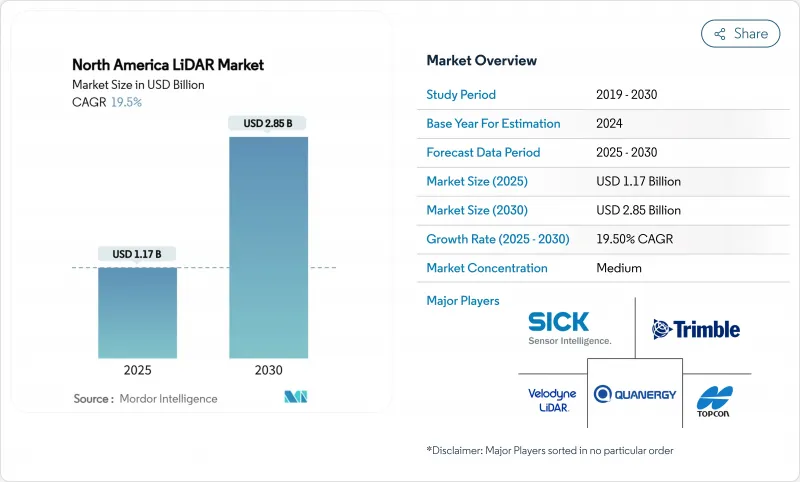

预计到 2025 年,北美光达市场规模将达到 11.7 亿美元,到 2030 年将达到 28.5 亿美元,年复合成长率为 19.5%。

随着固态技术的突破性进展缩小了感测器尺寸并降低了成本,联邦基础设施项目要求提供精确的资产数据,以及超视距无人机走廊扩大了空中测绘的范围,市场需求正在加速成长。汽车原始设备製造商(OEM)正在将光达(LiDAR)整合到L3级自动驾驶套件中,林业和公共机构也正在采用这项技术进行野火风险建模和电网巡检。价格下降、感测器融合技术的创新以及日益增长的环境监测需求将支撑整体两位数的成长。随着整合供应商将客製化软体与晶片级硬体相结合,以在平均售价下降的情况下保护利润率,市场竞争将更加激烈。

北美光达市场趋势与洞察

固态光达的整合加速了汽车生产计划

固态感测器正从有限的试点计画走向主流量产。 Luminar 为Volvo EX90 提供的系列产品,印证了 OEM 厂商对更高可靠性和更低机械复杂性的信心。 BMW i7 和大众 ID.Buzz 都整合了 Innoviz 的感测器单元,实现了 L3 级自动驾驶功能;丰田表示,晶片级成本的降低使得中阶车型也能采用这项技术。合赛 37% 的全球汽车市占率凸显了规模经济带来的价格竞争。在北美雷射雷达市场,随着单价优势的提升,感测器正被整合到电动皮卡中,以满足美国联邦汽车运输安全管理局 (FMCSA) 对大型车辆自动紧急煞车 (AEB) 的规定。

利用超视距无人机变革基础设施监控

加拿大运输部2025年无人机系统(RPAS)法规允许中型无人机进行超视距飞行(BVLOS),从而能够在偏远地区以经济高效的方式进行雷射雷达线路测量製图。美国联邦航空管理局(FAA)第107部分豁免条款也反映了这种弹性,并加快了公共工程和铁路巡检的进度。美国国家海洋暨大气总署(NOAA)的高空视距宣传活动显示了其运作的成熟度,而商业业者则在电动垂直起降飞行器(eVTOL)上部署轻型扫描仪,单次飞行即可完成数千公里的测绘。由此产生的数据降低了人工巡检成本,并有助于资产管理人员建立云端基础的数位双胞胎。

成本竞争力问题阻碍了市场渗透。

光达的成本是雷达的三到五倍,这限制了其在售价低于3万美元的车辆中的应用。 Luminar公司的Halo蓝图旨在将价格降低50%,但主流市场的价格持平不太可能在2028年之前实现。像合赛这样的中国供应商正透过降低人事费用和垂直整合光学技术来压缩利润空间。北美工厂正在透过自动化进行调整,但折旧免税额机制限制了北美光达市场价格的快速波动。

细分市场分析

到2024年,地面系统将占北美光达市场收入的42%。对高精度施工桩锚的持续需求支撑着销售,但该细分市场的成长仅限于两位数的低点。承包商在拓宽公路或维修桥樑时,将三脚架式设备视为可重复的基准。然而,ClearSkies Geomatics的租赁模式降低了拥有门槛,虽然会压缩製造商的利润空间,但会扩大装置量。

随着各机构对线性资产数位化,行动和无人机平台以25%的复合年增长率成长。基于RIEGL技术的垂直起降无人机巡检电力线的速度比地面团队快10倍,为面临野火责任风险的公共产业提供支援。 Phase One的整合式相机雷射吊舱可将飞行时间缩短40%,进而提高投资报酬率。随着检测公司采用功能强大的惯性测量单元(IMU)来稳定数据,机队运营商赢得了多年期检测合同,并带来了持续的传感器订单。这种转变提升了灵活供应商的市场份额,并提高了北美雷射雷达市场的业务收益。

到2024年,机械式雷射雷达仍将占据北美市场63%的份额,这得益于其成熟的测量范围和完善的供应链。旋转镜设计广泛应用于公路测绘车和航空测深,在这些应用中,360度全方位覆盖比耐用性更为重要。然而,维护週期和组装复杂性会增加生命週期成本。

由于晶圆级光学元件的活动部件较少,固态光学元件的复合年增长率高达22%。京瓷的融合感测器整合了摄影机和光达层,实现了无视差感知。海克斯康的单光子模组每秒可撷取1400万个数据点,使中高度飞机能够进行高速走廊扫描。随着产量的扩大,预计到2028年,其单位成本将与机械式雷射雷达持平,这将为北美光达市场的晶片整合供应商带来更多设计机会。

北美光达市场按产品(机载光达、地面光达)、类型(机械式光达、固体雷射雷达)、测量范围、组件(雷射扫描仪、GPS/GNSS接收器等)、应用(线路测量製图、ADAS和自动驾驶车辆等)、最终用户(汽车、工程和建设公司等)以及地区进行细分。市场预测以美元计价。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 美国汽车製造商正在迅速将固体雷射雷达整合到L3级自动驾驶汽车专案中。

- 美国联邦航空管理局超视距飞行豁免加速了加拿大对商用无人机走廊测绘的需求

- 美国老旧交通基础设施的数位双胞胎计划投资激增

- 美国)资助的雷射雷达增强型智慧走廊计划 (2024-2028)

- 电动卡车製造商迅速采用配备雷射雷达的ADAS系统,以满足美国联邦汽车运输安全管理局(FMCSA)日益严格的安全规定。

- 北美林业和环境机构将在2023年特大火灾后,利用光达技术进行野火风险建模。

- 市场限制

- 量产型L2+车辆中,雷达/视觉系统仍将维持较高的价格溢价。

- 缺乏熟练的光达数据处理人员导致州运输部计划延误

- 对高性能雷射的出口限制限制了加拿大航太供应商。

- Velodyne-Auster合併后采购不确定性;

- 价值/供应链分析

- 监理展望

- 技术展望

- 波特五力分析

- 买方/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场规模与成长预测

- 副产品

- 航空光达

- 地面光达

- 移动和无人机雷射雷达

- 按类型

- 机械光达

- 固体雷达

- 按范围

- 近距离(小于100公尺)

- 中程(100-300公尺)

- 远距(>300公尺)

- 按组件

- 雷射扫描仪

- GPS/GNSS接收器

- 惯性测量单元(IMU)

- 摄影机和其他感测器

- 透过使用

- 线路测量製图

- 高级驾驶辅助系统和自动驾驶汽车

- 工程与施工

- 环境与林业

- 安全与执法

- 最终用户

- 车

- 工程和建设公司

- 工业和公共产业

- 航太/国防

- 联邦和州政府机构

- 按国家/地区

- 美国

- 加拿大

- 墨西哥

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Ouster Inc.(incl. Velodyne)

- Teledyne Optech

- Trimble Inc.

- Leica Geosystems AG(Hexagon)

- Innoviz Technologies

- Sick AG

- Topcon Corporation

- LeddarTech Inc.

- Faro Technologies Inc.

- DENSO Corporation

- RoboSense(USA)

- AEye Inc.

- Luminar Technologies Inc.

- Valeo SA

- Quanergy Systems Inc.

- Hesai Technology(NA operations)

- Phoenix LiDAR Systems

- Geo-SLAM Ltd.

- RIEGL Laser Measurement Systems

- MicroVision Inc.

- Neptec Technologies Corp.

- Phantom Intelligence Inc.

- Continental AG

第七章 市场机会与未来展望

The North America LiDAR market is valued at USD 1.17 billion in 2025 and is forecast to reach USD 2.85 billion by 2030, advancing at a 19.5% CAGR.

Demand accelerates as solid-state breakthroughs shrink sensor size and cost, federal infrastructure programs mandate precise asset data, and BVLOS drone corridors expand aerial mapping. Automotive OEMs are locking LiDAR into Level 3 autonomy packages, while forestry and utility agencies adopt the technology for wildfire-risk modelling and grid inspections. Price declines, sensor-fusion innovation, and rising environmental monitoring needs collectively sustain double-digit growth. Competitive intensity rises as consolidated suppliers' pair bespoke software with chip-level hardware to protect margins amid falling average selling prices.

North America LiDAR Market Trends and Insights

Solid-State LiDAR Integration Accelerates Automotive Production Programs

Solid-state sensors are moving from limited pilots into mainstream production programs. Luminar's series supply on Volvo's EX90 confirms OEM confidence in higher reliability and reduced mechanical complexity. BMW's i7 and Volkswagen's ID.Buzz integrate Innoviz units for Level 3 capability, while Toyota reports chip-level cost reductions that open mid-segment adoption. Hesai's 37% global automotive share underscores how scale economics force price competition. As unit economics improve, the North America LiDAR market embeds sensors in electric pickups to satisfy forthcoming FMCSA automatic emergency braking rules for heavy vehicles.

BVLOS Drone Operations Transform Infrastructure Monitoring

Transport Canada's 2025 RPAS regulations authorize medium-sized drones for beyond-visual-line-of-sight operations, enabling cost-effective LiDAR corridor mapping in remote provinces. FAA Part 107 waivers mirror this flexibility south of the border, accelerating utility and rail inspections. NOAA's high-altitude BVLOS campaigns demonstrate operational maturity, while commercial operators deploy lightweight scanners on eVTOL craft to survey thousands of kilometres per flight. Resulting data reduces manual inspection costs and fuels cloud-based digital twins for asset managers.

Cost Competitiveness Challenges Limit Mass-Market Penetration

LiDAR units still cost three to five times more than radar alternatives, deterring inclusion in sub-USD 30,000 vehicles. Luminar's Halo roadmap targets a 50% price cut, yet mainstream parity remains elusive before 2028. Chinese suppliers such as Hesai pressure margins through lower labour costs and vertically integrated optics. North American factories respond with automation, but depreciation schedules constrain rapid price movements in the North America LiDAR market.

Other drivers and restraints analyzed in the detailed report include:

- Digital Twin Infrastructure Projects Drive Long-Term Demand

- Smart-Corridor Initiatives Leverage Federal Infrastructure Funding

- Workforce Development Gaps Constrain Project Execution

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ground-based systems held 42% of 2024 revenue in the North America LiDAR market. Continued demand for high-accuracy construction staking anchors sales, yet the segment's growth lags at low-double-digit rates. Contractors value tripod-mounted units for repeatable benchmarks during highway widening and bridge retrofits. However, rental models from ClearSkies Geomatics reduce ownership barriers, trimming manufacturer margins but enlarging the installed base.

Mobile and UAV platforms grow at 25% CAGR as agencies digitize linear assets. RIEGL-based VTOL drones cover transmission lines 10 times faster than terrestrial teams, supporting utilities facing wildfire liability. Phase One's integrated camera-laser pods cut flight hours 40%, enhancing ROI. As survey firms embed robust IMUs to stabilize data, fleet operators win multi-year inspection contracts, feeding sustained sensor orders. This migration boosts share for agile suppliers and elevate service revenues across the North America LiDAR market.

Mechanical architectures still command 63% share of the North America LiDAR market size in 2024 thanks to proven range and established supply chains. Rotating mirror designs service highway mapping vans and airborne bathymetric surveys where 360-degree coverage outweighs durability concerns. Yet maintenance intervals and assembly complexity inflate lifecycle costs.

Solid-state variants post 22% CAGR as wafer-level optics deliver fewer moving parts. Kyocera's fusion sensor merges camera and LiDAR layers for parallax-free perception, attractive to OEMs demanding slimmer housings. Hexagon's single-photon module pushes 14 million points per second, enabling fast corridor scans from mid-altitude aircraft. As volume scales, per-unit cost is projected to reach parity with mechanical peers by 2028, shifting design wins toward chip-integrated suppliers within the North America LiDAR market.

North America LiDAR Market Segmented by Product (Aerial LiDAR, Ground-Based LiDAR), Type (Mechanical LiDAR, Solid-State LiDAR), Range, Component (Laser Scanners, GPS/GNSS Receiver and More), Application (Corridor Mapping and Surveying, ADAS and Autonomous Vehicles, and More), End-User (Automotive, Engineering and Construction Firms, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Ouster Inc. (incl. Velodyne)

- Teledyne Optech

- Trimble Inc.

- Leica Geosystems AG (Hexagon)

- Innoviz Technologies

- Sick AG

- Topcon Corporation

- LeddarTech Inc.

- Faro Technologies Inc.

- DENSO Corporation

- RoboSense (USA)

- AEye Inc.

- Luminar Technologies Inc.

- Valeo SA

- Quanergy Systems Inc.

- Hesai Technology (NA operations)

- Phoenix LiDAR Systems

- Geo-SLAM Ltd.

- RIEGL Laser Measurement Systems

- MicroVision Inc.

- Neptec Technologies Corp.

- Phantom Intelligence Inc.

- Continental AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid integration of solid-state LiDAR in Level-3 autonomous vehicle programs by U.S. OEMs

- 4.2.2 FAA BVLOS waivers accelerating commercial drone corridor mapping demand in Canada

- 4.2.3 Surging investments in digital-twin projects for aging U.S. transportation infrastructure

- 4.2.4 LiDAR-enriched Smart-Corridor initiatives under U.S. IIJA funding (2024-2028)

- 4.2.5 Early-mover adoption of LiDAR-embedded ADAS by electric-truck makers to meet stricter FMCSA safety mandates

- 4.2.6 North-American forestry and environmental agencies pivoting to LiDAR for wildfire-risk modelling post-2023 mega-fires

- 4.3 Market Restraints

- 4.3.1 Persistent price-premium vs. radar/vision in mass-produced L2+ vehicles

- 4.3.2 Skilled-talent scarcity in LiDAR data processing delaying state-DOT projects

- 4.3.3 Export-control restrictions on high-performance lasers limiting Canadian aerospace suppliers

- 4.3.4 Post-merger procurement uncertainty after Velodyne-Ouster consolidation

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers/Consumers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product

- 5.1.1 Aerial LiDAR

- 5.1.2 Ground-based LiDAR

- 5.1.3 Mobile and UAV LiDAR

- 5.2 By Type

- 5.2.1 Mechanical LiDAR

- 5.2.2 Solid-state LiDAR

- 5.3 By Range

- 5.3.1 Short-range (<100 m)

- 5.3.2 Medium-range (100-300 m)

- 5.3.3 Long-range (>300 m)

- 5.4 By Component

- 5.4.1 Laser Scanners

- 5.4.2 GPS/GNSS Receiver

- 5.4.3 Inertial Measurement Unit (IMU)

- 5.4.4 Camera and Other Sensors

- 5.5 By Application

- 5.5.1 Corridor Mapping and Surveying

- 5.5.2 ADAS and Autonomous Vehicles

- 5.5.3 Engineering and Construction

- 5.5.4 Environmental and Forestry

- 5.5.5 Security and Law Enforcement

- 5.6 By End-User

- 5.6.1 Automotive

- 5.6.2 Engineering and Construction Firms

- 5.6.3 Industrial and Utilities

- 5.6.4 Aerospace and Defense

- 5.6.5 Federal and State Government Agencies

- 5.7 By Country

- 5.7.1 United States

- 5.7.2 Canada

- 5.7.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Ouster Inc. (incl. Velodyne)

- 6.4.2 Teledyne Optech

- 6.4.3 Trimble Inc.

- 6.4.4 Leica Geosystems AG (Hexagon)

- 6.4.5 Innoviz Technologies

- 6.4.6 Sick AG

- 6.4.7 Topcon Corporation

- 6.4.8 LeddarTech Inc.

- 6.4.9 Faro Technologies Inc.

- 6.4.10 DENSO Corporation

- 6.4.11 RoboSense (USA)

- 6.4.12 AEye Inc.

- 6.4.13 Luminar Technologies Inc.

- 6.4.14 Valeo SA

- 6.4.15 Quanergy Systems Inc.

- 6.4.16 Hesai Technology (NA operations)

- 6.4.17 Phoenix LiDAR Systems

- 6.4.18 Geo-SLAM Ltd.

- 6.4.19 RIEGL Laser Measurement Systems

- 6.4.20 MicroVision Inc.

- 6.4.21 Neptec Technologies Corp.

- 6.4.22 Phantom Intelligence Inc.

- 6.4.23 Continental AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment