|

市场调查报告书

商品编码

1851578

光子积体电路:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Photonic Integrated Circuit - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

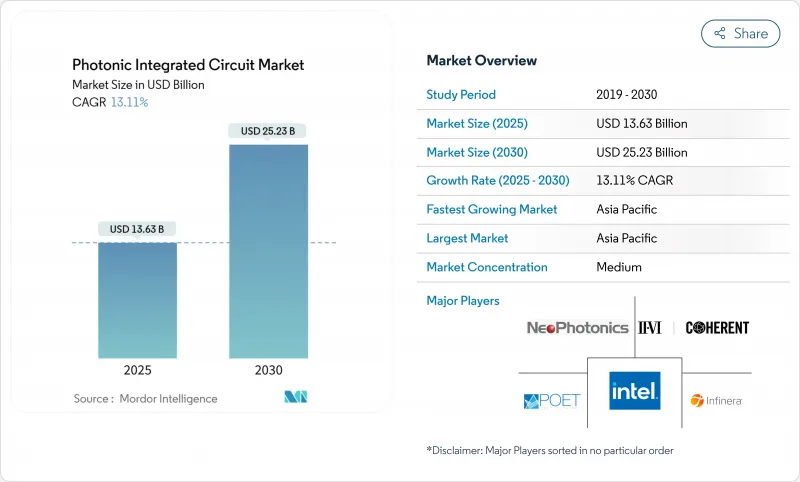

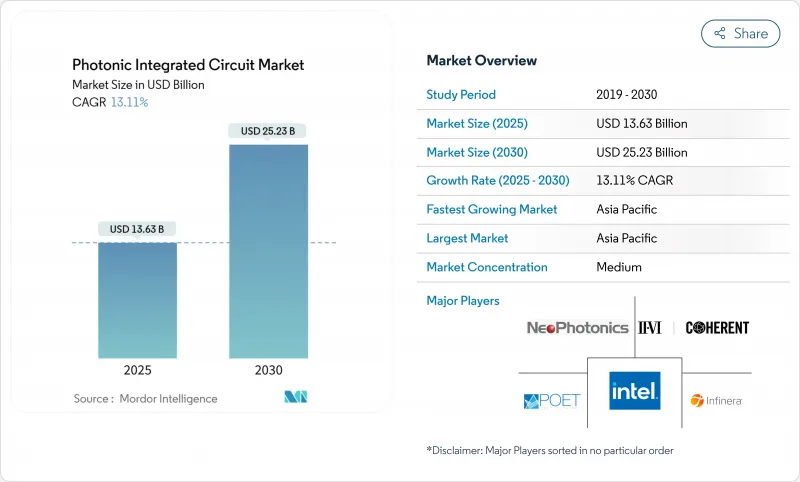

预计到 2025 年,光子积体电路市场规模将达到 136.3 亿美元,到 2030 年将达到 252.3 亿美元。

这项扩张反映了硅光电从实验应用转向资料中心、通讯网路和早期量子系统等生产规模部署。商业性发展动能主要得益于利用成熟的创业投资晶圆厂所获得的成本优势、活跃的创投管道以及政府为促进先进光电製造在地化而提供的激励措施。同时,共封装光学元件、薄膜铌酸锂调製器以及异质InP/硅雷射整合技术的快速发展,进一步拉大了与传统光学元件的性能差距。镓和锗供应链风险的加剧凸显了多元化材料平台和区域代工厂布局的战略价值。

全球光子积体电路市场趋势与洞察

硅光电在400G+资料中心收发器的应用

北美超大规模营运商已过渡到 400G 和 800G 光链路,以降低人工智慧丛集的延迟和功耗。相干公司 (Coherent Corp.) 展示了一款 1.6 T-DR8 模组,与传统插头电缆相比,每位元能耗降低了 20% 以上。英伟达 (NVIDIA) 的 Spectrum-X 交换器蓝图采用共封装光元件,可达到 30% 的功耗降低和 1.6 Tb/s 的连接埠速度。此类架构透过将光子引擎整合到交换器 ASIC 旁边,消除了电干扰损耗,并利用成熟的 300mm CMOS 生产线实现了大规模生产。对多机架 GPU 架构日益增长的需求,使硅光电成为下一代人工智慧基础设施的关键要素。

欧盟试点计画资金将促进区域PIC代工厂发展

晶片联合委员会 (Chips JU) 向 PIXEurope 联盟拨款 3.8 亿欧元(约 4.473 亿美元),巩固了欧洲在光子技术领域的自主竞标。位于埃因霍温和恩斯赫德的试点生产线将以开放式方式生产硅和氮化硅,使中小企业无需拥有晶圆厂即可进行原型开发。诸如倡议等计划将专注于晶圆级异质雷射键合技术,确保产能能够满足欧洲电讯和汽车产业从 2026 年开始逐步提升的需求。该计划与垂直整合的美国和亚洲同行形成鲜明对比,并有望建立一个去中心化且更具韧性的供应链。

InP光子积体电路产量比率挑战

将 InP 晶圆尺寸缩小到 4 吋以上会增加缺陷控制的难度,并提高晶粒成本。 Coherent 公司的 6 吋生产线使理论晶粒数量翻了四倍,但需要新的外延和计量製程来维持产量比率。 Fraunhofer ISE 展示了 InP/GaAs基板,成本降低了 80%,为 8 吋晶圆的研发铺平了蓝图。持续的产量比率下降继续限制 InP 在成本敏感应用领域的竞争力,减缓了其近期成长。

细分市场分析

预计到2025年,与原料销售相关的光子积体电路市场规模将达到49.3亿美元,其中硅在2024年将维持37.4%的市占率。 CMOS製程凭藉其在被动波导管和成本敏感型资料通讯组件方面的广泛应用,继续保持领先地位。然而,由于氮化硅具有低传播损耗和宽透明性,适用于实验室晶片和量子光电,预计其复合年增长率将达到15.4%。磷化铟仍然是高功率雷射的关键材料,而砷化镓因其异质雷射结能够简化硅光源的整合而备受青睐。

对扩充性和效能的追求塑造了供应商的发展蓝图。医疗保健新兴企业选择具有生物相容性的氮化硅用于照护现场诊断,而远距通讯供应商则坚持使用磷化铟调製器来实现 140 Gbaud 链路。 HyperLight 公司 3,700 万美元的资金筹措用于开发薄膜铌酸锂调製器,凸显了光电领域领导者对该领域的重新关注。日益增多的多层晶圆模糊了传统平台的界限,预示着未来多种材料可以共存于同一光阻上。

到2025年,组件收入将超过30亿美元,其中雷射将占26.3%。光开关矩阵的复合年增长率将达到14.1%,远超其他装置,这反映了人工智慧资料中心丛集对完全可重构架构的需求。 Lumentum公司400Gb/s/通道的电吸收调变雷射已达到性能标竿的巅峰。

整合式光生成仍然是总成本的关键组成部分。代工厂将InP或GaAs增益介质键结到硅片上,从而省去了外部雷射封装,但热问题和产量比率问题增加了复杂性。光电探测器和调变器受益于薄膜铌酸锂架构,该架构兼具超过100 GHz的频宽和低于1V的驱动效率。可变光衰减器和波长解多工器日趋成熟,但通道数量的增加推动了阵列实现的微型化。

光子积体电路依原料(InP、Si、Sin、GaAs、Linbo3 等)、元件(雷射、检测器、滤波器、开关、扩大机等)、整合製程(混合、单片等)、应用(通讯、资料中心、生物医学、生命科学等)、最终用户(通讯服务供应商、云端和超大规模资料中心。

区域分析

北美地区占据了最大的区域收入份额,在2024年占全球收入的35.4%。大规模超大规模资料中心和《晶片法案》(CHIPS Act)的奖励推动了超过7亿美元的硅光电新投资涌入纽约州马耳他。量子光电和人工智慧光电领域的风险投资,包括Lightsynq获得的1800万美元种子轮融资,促进了蓬勃发展的新兴企业发展。然而,对中国镓和锗的依赖使市场面临材料价格衝击,在2024年出口限制实施后,这些材料的价格上涨了75%至250%。

亚太地区以16.5%的复合年增长率成为成长最快的地区,这主要得益于政策制定者致力于实现光电的自主研发。中国投入82亿元人民币(约11.5亿美元)补贴其雷射硅一体化计画。日本与英特尔合作投资3.05亿美元,研发可降低资料中心电力消耗的光半导体。区域晶圆厂生产出6吋薄膜铌酸锂晶圆,弥合了晶圆技术差距。

欧洲将透过开放的晶圆代工厂和有针对性的併购活动,维持2019年至2024年製造业6.5%的复合年增长率。预计2025年,欧洲光子积体电路市场规模将达到30.2亿美元。 Sivers Photonics公司与Infinera公司合作开发了用于相干模组的窄线宽可调谐雷射器,诺基亚以23亿美元收购Infinera的交易也增强了欧洲大陆的光器件能力。该地区致力于维护自身主权,扶持中小企业发展,实现全球供应链多元化,并减少对单一製造节点地区的过度依赖。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 硅光电在400G+资料中心收发器的应用(北美)

- 欧盟试点计画资金助力本地PIC代工厂发展

- PIC赋能的连贯5G回程传输部署(亚洲)

- 降低自动驾驶汽车中固体雷射雷达的成本

- 量子互连PIC的创业投资

- 利用实验室晶片光子诊断进行快速检测

- 市场限制

- InP光子积体电路产量比率挑战

- 碎片化的EDA工具链会延长设计週期。

- 片上雷射温度控管的局限性

- 铸造设备供应集中且面临地缘政治风险

- 价值链分析

- 规章制度和标准

- 技术蓝图与製造流程分析

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 宏观经济影响评估

- 投资分析

第五章 市场规模与成长预测

- 按原料

- 磷化铟(InP)

- 硅(Si)

- 氮化硅(SiN)

- 砷化镓(GaAs)

- 铌酸锂(LiNbO3)

- 硅上二氧化硅

- 其他材料(聚合物、PLC 等)

- 按组件

- 雷射

- 数据机

- 光电探测器

- 筛选

- 转变

- 扩大机

- 多工器和解解多工器

- 衰减器和VOA

- 其他部件

- 透过整合过程

- 混合整合

- 整体集成

- 基于模组/子系统的集成

- 透过使用

- 通讯(远距和城际)

- 资料中心(短距离和高效能运算互连)

- 生物医学与生命科学

- 光学感测器和光达

- 仪器仪表和测试/测量

- 量子计算和量子光电

- 按最终用户行业划分

- 电信服务供应商

- 云端和超大规模资料中心营运商

- 医疗保健和诊断相关企业

- 汽车和出行设备原始设备製造商

- 工业和製造业

- 国防/航太

- 研究与学术界

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 北欧国家

- 其他欧洲地区

- 亚太地区

- 中国

- 台湾

- 韩国

- 日本

- 印度

- 亚太其他地区

- 南美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他南美洲

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 战略倡议和交易流

- 市占率分析

- 公司简介

- Infinera Corporation

- Lumentum Holdings Inc.

- Intel Corporation

- Coherent Corp.(II-VI)

- Cisco Systems Inc.(Acacia)

- NeoPhotonics Corporation

- POET Technologies Inc.

- EFFECT Photonics

- Celestial AI

- Source Photonics Inc.

- Sicoya GmbH

- HyperLight Corp

- Ayar Labs Inc.

- Lightmatter Inc.

- Marvell Technology

- Ligentec SA

- Xanadu Quantum Tech. Inc.

- Ciena Corporation

- OpenLight Photonic Inc.

- Juniper Networks(Aurrion IP)

第七章 市场机会与未来展望

The photonic integrated circuit market size stood at USD 13.63 billion in 2025 and is projected to reach USD 25.23 billion by 2030, reflecting a 13.11% CAGR.

This expansion mirrored the shift from experimental silicon photonics toward production-scale deployment in data centers, telecom networks, and early quantum systems, as rising AI workloads exposed the bandwidth and energy limits of copper interconnects. Commercial momentum benefited from cost advantages gained by leveraging established CMOS fabs, a vibrant venture capital pipeline, and growing government incentives to localize advanced photonic manufacturing. Meanwhile, rapid progress in co-packaged optics, thin-film lithium niobate modulators, and heterogeneous InP/silicon laser integration widened the performance gap with legacy optics. Intensifying supply-chain risks around gallium and germanium highlighted the strategic value of diversified materials platforms and regional foundry footprints.

Global Photonic Integrated Circuit Market Trends and Insights

Silicon-Photonics Adoption in >400 G Data-Center Transceivers

North American hyperscale operators transitioned to 400 G and 800 G optical links to curb latency and power in AI clusters. Coherent Corp demonstrated a 1.6 T-DR8 module that cut energy per bit by more than 20% versus conventional pluggables. NVIDIA's Spectrum-X switch roadmap adopted co-packaged optics that delivered 30% power savings and 1.6 Tb/s port speeds. Such architectures integrate photonic engines beside switch ASICs, eliminating electrical ingress losses and setting a volume pathway through established 300 mm CMOS lines. Growing demand for multi-rack GPU fabrics positions silicon photonics as an indispensable element of next-generation AI infrastructure.

EU Pilot-Line Funding Catalysing Local PIC Foundries

The EUR 380 million (USD 447.30 million) Chips JU award to the PIXEurope consortium underpinned Europe's bid for photonic sovereignty. Pilot lines in Eindhoven and Enschede will offer open-access silicon and silicon-nitride runs, enabling SMEs to prototype without owning fabs. Projects such as photonixFAB focus on heterogeneous laser attachment at wafer scale, positioning Europe to meet local telecom and automotive demand when volume ramps after 2026. The initiative contrasts with vertically integrated US and Asian peers, promising a distributed, resilient supply chain.

Wafer-Scale Yield Challenges for InP PICs

Scaling InP wafers beyond 4 inches, strained defect control, and pushing up the cost per die. Coherent Corp's six-inch line quadrupled theoretical die count yet required new epitaxy and metrology processes to maintain yield. Fraunhofer ISE demonstrated InP-on-GaAs substrates that cut cost by 80% and opened a roadmap to eight-inch scaling. Persistent yield drag continued to limit InP competitiveness in cost-sensitive applications, dampening near-term growth.

Other drivers and restraints analyzed in the detailed report include:

- PIC-Enabled Coherent 5G Backhaul Roll-outs

- Solid-State LiDAR Cost Downs in Autonomous Vehicles

- Fragmented EDA Toolchain Prolonging Design Cycles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The photonic integrated circuit market size associated with raw-material sales reached USD 4.93 billion in 2025, and silicon retained 37.4% of the photonic integrated circuit market share in 2024. A broad installed CMOS base sustained its lead for passive waveguides and cost-critical datacom parts. Yet silicon nitride deliveries rose at a 15.4% CAGR thanks to low propagation loss and wide transparency that suited lab-on-chip and quantum photonics. Indium phosphide stayed essential for high-power lasers, while gallium arsenide gained traction through heterogeneous laser bonding that simplified silicon light-source integration.

Competition between scalability and performance shaped vendor roadmaps. Healthcare startups selected silicon-nitride biocompatibility for point-of-care diagnostics, whereas long-haul telecom vendors adhered to InP modulators for 140 Gbaud links. HyperLight's USD 37 million raise to advance thin-film lithium-niobate modulators highlighted renewed interest in electro-optic champions. Increasing multilayer wafer stacking signalled a future where mixed materials co-reside on a single reticle, blurring traditional platform boundaries.

Component revenue surpassed USD 3 billion in 2025, with lasers accounting for 26.3% that year. Optical switch matrices outpaced all other devices at a 14.1% CAGR, reflecting demand for fully reconfigurable fabrics inside AI data-center clusters. Lumentum's 400 Gb/s-per-lane electro-absorption modulated laser exemplified cresting performance benchmarks.

Integrated light generation remained the linchpin of total cost. Foundries coupled InP or GaAs gain media onto silicon to curtail external laser packaging, but thermal and yield issues added complexity. Photodetectors and modulators benefited from thin-film lithium-niobate architectures that combined >= 100 GHz bandwidth with sub-1 V drive efficiency. Variable optical attenuators and wavelength demultiplexers matured, yet rising channel counts spurred miniaturized array implementations.

Photonic Integrated Circuit is Segmented by Raw Material (InP, Si, Sin, Gaas, Linbo3, and More), Component (Lasers, Modulators, Photodetectors, Filters, Switches, Amplifiers, and More), Integration Process (Hybrid, Monolithic, and More), Application (Telecommunications, Data Centers, Biomedical and Life-Sciences, and More), End-User (Telecom Service Providers, Cloud and Hyperscale Data-Center Operators, and More), and Geography.

Geography Analysis

North America generated the largest regional revenue share in 2024, of 35.4% of global sales 2024. Massive hyperscale data centers and CHIPS-Act incentives drew over USD 700 million of new silicon-photonics capex to Malta, New York. Venture rounds for quantum and AI photonics, such as Lightsynq's USD 18 million seed, fortified a vibrant start-up pipeline. However, reliance on Chinese gallium and germanium exposed material price shocks that climbed 75%-250% after 2024 export controls.

Asia-Pacific posted the fastest 16.5% CAGR as policymakers targeted photonic self-reliance. China subsidized CNY 8.2 billion (USD 1.15 billion) for integrated laser-silicon programs. Japan invested USD 305 million with Intel for optical semiconductors that cut data-center power use. Regional fabs produced six-inch thin-film lithium-niobate wafers that closed earlier Western technology gaps.

Europe combined open-access foundries with targeted M&A to sustain a 6.5% manufacturing CAGR from 2019-2024. The photonic integrated circuit market size for Europe was USD 3.02 billion in 2025. Sivers Photonics collaborated on narrow-linewidth tunable lasers to serve coherent modules, while Nokia's USD 2.3 billion Infinera deal consolidated continental optical competence. The region's emphasis on sovereignty and SME enablement diversified global supply and reduced overdependence on single-node manufacturing geographies.

- Infinera Corporation

- Lumentum Holdings Inc.

- Intel Corporation

- Coherent Corp. (II-VI)

- Cisco Systems Inc. (Acacia)

- NeoPhotonics Corporation

- POET Technologies Inc.

- EFFECT Photonics

- Celestial AI

- Source Photonics Inc.

- Sicoya GmbH

- HyperLight Corp

- Ayar Labs Inc.

- Lightmatter Inc.

- Marvell Technology

- Ligentec SA

- Xanadu Quantum Tech. Inc.

- Ciena Corporation

- OpenLight Photonic Inc.

- Juniper Networks (Aurrion IP)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Silicon-Photonics Adoption in >400 G Data-Center Transceivers (North America)

- 4.2.2 EU Pilot-Line Funding Catalysing Local PIC Foundries

- 4.2.3 PIC-Enabled Coherent 5G Backhaul Roll-outs (Asia)

- 4.2.4 Solid-State LiDAR Cost Downs in Autonomous Vehicles

- 4.2.5 Venture Capital for Quantum-Interconnect PICs

- 4.2.6 Lab-on-Chip Photonic Diagnostics for Rapid Testing

- 4.3 Market Restraints

- 4.3.1 Wafer-Scale Yield Challenges for InP PICs

- 4.3.2 Fragmented EDA Toolchain Prolonging Design Cycles

- 4.3.3 On-Chip Laser Thermal-Management Limitations

- 4.3.4 Concentrated Foundry Supply and Geopolitical Exposure

- 4.4 Value Chain Analysis

- 4.5 Regulatory and Standards Landscape

- 4.6 Technological Roadmap and Manufacturing Process Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitute Products

- 4.8 Macroeconomic Impact Assessment

- 4.9 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Raw Material

- 5.1.1 Indium Phosphide (InP)

- 5.1.2 Silicon (Si)

- 5.1.3 Silicon Nitride (SiN)

- 5.1.4 Gallium Arsenide (GaAs)

- 5.1.5 Lithium Niobate (LiNbO3)

- 5.1.6 Silica-on-Silicon

- 5.1.7 Other Materials (Polymer, PLC, etc.)

- 5.2 By Component

- 5.2.1 Lasers

- 5.2.2 Modulators

- 5.2.3 Photodetectors

- 5.2.4 Filters

- 5.2.5 Switches

- 5.2.6 Amplifiers

- 5.2.7 Multiplexers and Demultiplexers

- 5.2.8 Attenuators and VOA

- 5.2.9 Other Components

- 5.3 By Integration Process

- 5.3.1 Hybrid Integration

- 5.3.2 Monolithic Integration

- 5.3.3 Module-based/Subsystem Integration

- 5.4 By Application

- 5.4.1 Telecommunications (Long-haul and Metro)

- 5.4.2 Data Centers (Short-Reach and HPC Interconnects)

- 5.4.3 Biomedical and Life-Sciences

- 5.4.4 Optical Sensors and LiDAR

- 5.4.5 Metrology and Test/Measurement

- 5.4.6 Quantum Computing and Quantum Photonics

- 5.5 By End-user Industry

- 5.5.1 Telecom Service Providers

- 5.5.2 Cloud and Hyperscale Data-Center Operators

- 5.5.3 Healthcare and Diagnostics Companies

- 5.5.4 Automotive and Mobility OEMs

- 5.5.5 Industrial and Manufacturing

- 5.5.6 Defense and Aerospace

- 5.5.7 Research and Academia

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 France

- 5.6.2.3 United Kingdom

- 5.6.2.4 Nordics

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Taiwan

- 5.6.3.3 South Korea

- 5.6.3.4 Japan

- 5.6.3.5 India

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Mexico

- 5.6.4.3 Argentina

- 5.6.4.4 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Deal Flow

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global overview, Market overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Infinera Corporation

- 6.4.2 Lumentum Holdings Inc.

- 6.4.3 Intel Corporation

- 6.4.4 Coherent Corp. (II-VI)

- 6.4.5 Cisco Systems Inc. (Acacia)

- 6.4.6 NeoPhotonics Corporation

- 6.4.7 POET Technologies Inc.

- 6.4.8 EFFECT Photonics

- 6.4.9 Celestial AI

- 6.4.10 Source Photonics Inc.

- 6.4.11 Sicoya GmbH

- 6.4.12 HyperLight Corp

- 6.4.13 Ayar Labs Inc.

- 6.4.14 Lightmatter Inc.

- 6.4.15 Marvell Technology

- 6.4.16 Ligentec SA

- 6.4.17 Xanadu Quantum Tech. Inc.

- 6.4.18 Ciena Corporation

- 6.4.19 OpenLight Photonic Inc.

- 6.4.20 Juniper Networks (Aurrion IP)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment