|

市场调查报告书

商品编码

1851655

企业影片:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Enterprise Video - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

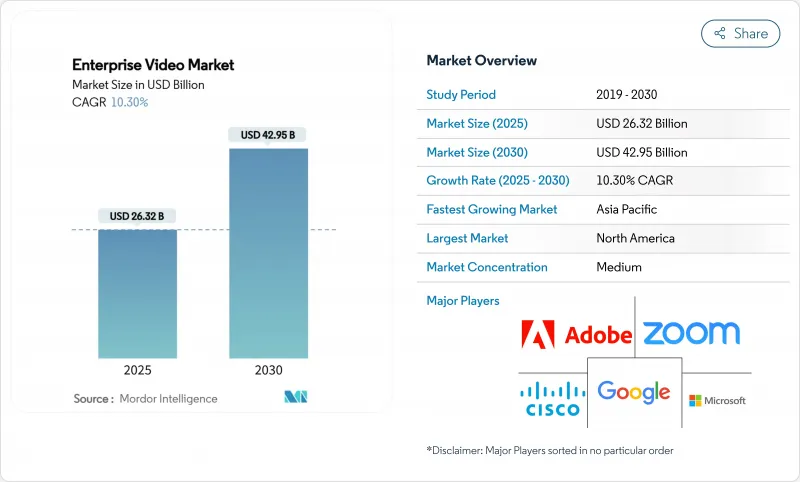

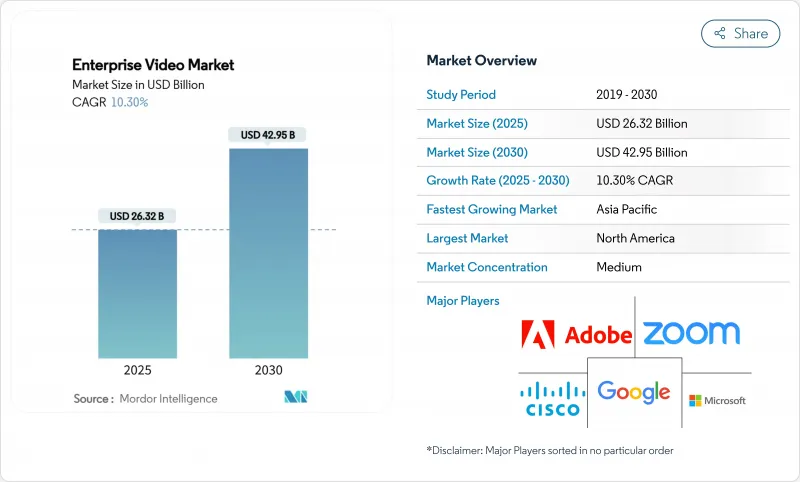

企业视讯市场预计将从 2025 年的 263.2 亿美元成长到 2030 年的 429.5 亿美元,复合年增长率为 10.3%。

这种扩展反映了视讯应用从单纯的会议工具向支援工作流程自动化、数据主导决策和全球协作的关键基础设施的转变。云端原生平台、人工智慧驱动的分析和私有5G网路正在提升可扩展性、字幕准确性和低于25毫秒的端到端延迟,所有这些都促使用户期望获得始终在线、超快速响应的体验。以Brightcove收购案为例的供应商整合,预示着一场朝向全端式解决方案迈进的平台竞赛。同时,不断上涨的网路安全保险费和影片工作流程编配技能的短缺,正在阻碍后进企业的普及。

全球企业视讯市场趋势与洞察

采用云端优先的影片架构

迁移到云端原生架构能够以较低的前期成本实现弹性扩展、API驱动的整合和全球内容传送。企业透过将运算密集分析迁移到公有云,同时将敏感归檔资料保留在本地,从而减少了本地硬体的更新周期。多重云端路由可以避免厂商锁定和延迟波动,并允许IT团队将不同的工作负载匹配到性价比最高的区域。然而,一些企业正在采取「云端退出」策略,当每月退出费用超过弹性扩展带来的收益时,他们会将支出转移到私人基础设施。

利用人工智慧大幅提升即时字幕准确率

在良好的声学环境下,自动语音辨识模型的准确率高达 98%,使视讯无障碍功能超越了合规要求,成为提升生产力的关键优势。对 140 种语言的丰富语言支援促进了跨国协作,搜寻的文字记录则建构了一个持续更新的知识库。企业可以将这项 AI 字幕功能直接整合到内容管理系统中,从而提升用户参与度并加速内容在地化。此外,它还使听障员工能够即时参与会议,无需第三方负责人,从而促进包容性招聘实践。

超低延迟基础设施的总成本很高

追求低于 25 毫秒往返效能的企业必须投资私人 5G 网路、边缘 CDN 节点和 GPU 加速编码器。超大规模资料中心营运商计划在 2025 年投入 750 亿美元用于人工智慧和网路骨干网路建设,而其资本计画往往超出预算拨款。光是电视墙的成本就高达每平方英尺 380 至 1200 美元,使得大尺寸显示器只有财力雄厚的企业才能负担得起。从随叫随到的工程师到冗余电路等持续营运成本,进一步增加了整体拥有成本。

细分市场分析

到2024年,视讯会议领域将创造110.8亿美元的收入,占企业视讯市场份额的42.1%。视讯分析虽然目前规模较小,但预计到2030年将为企业视讯市场贡献超过40亿美元的收入,以18.7%的复合年增长率超越所有其他类别。这一成长势头源于人工智慧引擎,这些引擎能够检测异常情况、提取元资料,并在安防、製造和零售等行业触发工作流程自动化。

采用模式显示,曾经各自独立的类别正在融合。会议供应商将演讲者情绪分析功能捆绑销售,内容管理平台整合直播模组以支援混合型活动。诸如Google Veo 3 之类的 AI 影片产生器,让非专业人士也能在几秒钟内创建品牌素材,从而模糊了製作和分发之间的界限。由此催生了 Mosaic 生态系统,企业倾向于选择透过开放 API 整合的灵活模组,而不是单一的整体式套件。这种趋势进一步加速了企业视讯市场的创新週期。

到2024年,软体产品将维持企业视讯市场51.7%的份额,支援会议、串流媒体和存檔功能。然而,服务类别将以14.2%的复合年增长率成长,成为成长最快的类别。外包编配、全天候监控服务等级协定 (SLA) 和人工智慧调优服务对缺乏内部专业知识的企业极具吸引力。虽然硬体对于编码、会议室终端和边缘快取仍然至关重要,但价值正在转移到预先安装在通用装置上的软体定义元件。

捆绑式「视讯即服务」产品正是这种转变的体现。服务提供者以固定的月费提供託管编码器机架、转码软体和分析仪表板,并捆绑主动维护和功能更新。这种模式降低了整体拥有成本,并为以前无力组建专门视讯团队的中小型企业提供了支援。因此,随着纯软体授权价格的竞争力日益增强,服务供应商正在迅速扩展其咨询部门、认证专案和託管式eCDN产品组合,以确保其利润。

该报告涵盖了全球企业视讯市场的成长情况,并按类型(视讯会议、视讯内容管理、网路直播和即时串流、视讯分析和其他类型)、组件(硬体、软体和服务)、部署方式(本地部署和云端部署)、最终用户垂直行业(银行、金融服务和保险、医疗保健、IT 和通讯等)、组织规模(中小企业和大型企业)以及地区进行了细分。

区域分析

北美在2024年占据了34.6%的企业视讯市场份额,这主要得益于宽频普及率的提高、SaaS的早期应用以及联邦政府对远程办公基础设施的大力投资。随着大型企业优化现有部署,并将人工智慧附加元件和进阶分析功能置于新用户许可之上,市场成长速度有所放缓。儘管如此,二线城市週边边缘加速节点正在将低延迟串流服务扩展到服务不足的地区,从而维持了收入成长。

亚太地区是成长最快的地区,年复合成长率达12.8%,主要得益于行动宽频升级和5G专网试验的激增。中国的腾讯会议和日本的易用会议室(由伊藤忠商事株式会社支持)正在定制界面、合规模块和语言包,以满足当地标准。 [3] 政府数位化计画和製造业现代化措施正在推动对检测级视讯分析的需求,进一步巩固企业视讯市场在亚太地区的普及。

欧洲正稳定地推动GDPR强制合规进程。企业纷纷倾向选择提供本地资料中心和严格隐私认证的供应商,这推动了美国平台与欧盟云端主机之间的合作。南美和中东/非洲地区是新兴的立足点,云端优先策略正在取代传统的本地部署方案。与通讯业者伙伴关係,将视讯套件与高速网路连线捆绑销售,降低了这些地区中型企业采用云端服务的门槛。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 采用云端优先视讯架构

- 利用人工智慧大幅提升即时字幕准确率

- 混合办公和远距办公模式的成长

- 自备设备办公室 (BYOD) 在企业中的普及

- 校园内低延迟5G专用网络

- 合规主导的安全归檔要求

- 市场限制

- 超低延迟基础设施的总成本很高。

- 国家间的数据主权壁垒

- IT人员缺乏视讯工作流程编配的技能

- 影像外洩事件导致网路保险费上涨

- 关键法规结构评估

- 价值链分析

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 关键相关人员影响评估

- 主要用例和案例研究

- 宏观经济因素对市场的影响

- 投资分析

第五章 市场区隔

- 按类型

- 视讯会议

- 影片内容管理

- 网路直播及现场直播

- 影片分析

- 其他类型

- 按组件

- 硬体

- 软体

- 服务

- 透过部署模式

- 本地部署

- 云

- 按最终用户行业划分

- BFSI

- 卫生保健

- 资讯科技/通讯

- 零售与电子商务

- 教育

- 政府/公共部门

- 製造业

- 媒体与娱乐

- 其他的

- 按组织规模

- 中小企业

- 大公司

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 其他欧洲地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 其他非洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 澳洲

- 纽西兰

- 亚太其他地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Cisco Systems, Inc.

- Microsoft Corporation

- Zoom Video Communications, Inc.

- Google LLC

- Adobe Inc.

- Brightcove Inc.

- IBM Corporation

- Kaltura Inc.

- Panopto

- Poly(HP Inc.)

- Avaya Inc.

- Vbrick Systems, Inc.

- Mediaplatform, Inc.

- Vidyo, Inc.

- Vimeo, Inc.

- Qumu Corporation

- Harmonic Inc.

- JW Player

- Lifesize, Inc.

- Ooyala(Telstra)

第七章 市场机会与未来展望

The enterprise video market is valued at USD 26.32 billion in 2025 and is forecast to grow to USD 42.95 billion by 2030, advancing at a 10.3% CAGR.

The expansion reflects the shift from video as a meeting tool to a mission-critical infrastructure that supports workflow automation, data-driven decision making, and global collaboration. Cloud-native platforms, AI-powered analytics, and private 5G networks are improving scalability, caption accuracy, and sub-25 millisecond end-to-end latency, which together elevate user expectations for always-on, ultra-responsive experiences. Rising hybrid-work norms continue to anchor budget allocations for video, while vendor consolidation-illustrated by the Brightcove acquisition-signals a platform race toward full-stack offerings. Concurrently, mounting cybersecurity insurance premiums and skills shortages in video-workflow orchestration temper adoption curves for some late-moving enterprises.

Global Enterprise Video Market Trends and Insights

Cloud-first video architecture adoption

The migration to cloud-native stacks enables elastic scaling, API-driven integrations, and global content distribution at lower upfront cost. Enterprises retain sensitive archives on-premises yet push compute-heavy analytics to public clouds, reducing local hardware refresh cycles. Multi-cloud routing safeguards against vendor lock-in and latency variation, and it lets IT teams match diverse workloads with the optimal cost-performance region. Even so, "cloud-exit" strategies are surfacing as some firms rebalance spend toward private infrastructure when monthly egress fees outweigh elasticity benefits.

AI-powered live-caption accuracy breakthroughs

Automatic speech recognition models now deliver up to 98% precision under favorable acoustics, lifting video accessibility beyond regulatory compliance into a productivity advantage. Rich language support-spanning 140 tongues-facilitates cross-border collaboration while searchable transcripts unlock evergreen knowledge repositories. Enterprises embed these AI captions directly in content management systems to raise engagement metrics and speed content localization. The advance also fuels inclusive hiring practices because Deaf and hard-of-hearing employees access meetings in real time without third-party captioners.

High total cost of ultra-low-latency infrastructure

Enterprises seeking sub-25 millisecond round-trip performance must invest in private 5G, edge CDN nodes, and GPU-accelerated encoders. Capital plans frequently exceed budget allocations, as hyperscalers earmark USD 75 billion in 2025 capex for AI and networking backbones that downstream customers must partially absorb. LED video walls alone range between USD 380 and USD 1,200 per ft2, making large-format displays viable only for cash-rich organizations. Ongoing operational costs-from on-call engineers to redundancy circuits-further widen total cost of ownership.

Other drivers and restraints analyzed in the detailed report include:

- Growth of hybrid and remote workforces

- BYOD proliferation across enterprises

- IT staff skill shortages in video-workflow orchestration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Video Conferencing segment delivered USD 11.08 billion and held 42.1% of enterprise video market share in 2024, reflecting its entrenchment as the default collaboration medium. Video Analytics, though smaller in absolute value, is projected to outpace all other categories at an 18.7% CAGR, adding more than USD 4 billion to enterprise video market size by 2030. This momentum stems from AI engines that detect anomalies, extract metadata, and trigger workflow automations across security, manufacturing, and retail settings.

Adoption patterns reveal convergence between once-distinct categories. Conferencing vendors bundle analytics for speaker sentiment, while content-management platforms embed live-stream modules to support hybrid events. AI video generators, such as Google's Veo 3, blur production and distribution boundaries by enabling non-specialists to create branded assets in seconds. The result is a mosaic ecosystem where enterprises choose flexible modules that integrate through open APIs rather than monolithic suites, a dynamic that further accelerates innovation cycles within the enterprise video market.

Software products retained 51.7% share of enterprise video market size in 2024, underpinning meeting, streaming, and archival functions. Yet the Services category will rise fastest at a 14.2% CAGR. Outsourced orchestration, 24/7 monitoring SLAs, and AI tuning services appeal to organizations lacking in-house expertise. Hardware remains essential for encoding, room endpoints, and edge caching, but value is migrating to software-defined components pre-installed on commodity devices.

Bundled "video-as-a-service" offerings illustrate the shift. Providers supply managed encoder racks, transcoding software, and analytics dashboards under a predictable monthly fee, bundling proactive maintenance and feature updates. This model lowers total cost of ownership and supports SMEs that previously could not justify dedicated video teams. As a result, service providers are rapidly expanding consulting arms, certification programs, and managed eCDN portfolios, defending margins as pure software licensing becomes price-competitive.

The Report Covers the Global Enterprise Video Market Growth and It is Segmented by Type (Video Conferencing, Video Content Management, Webcasting and Live Streaming, Video Analytics, and Other Types), Component (Hardware, Software, and Services), Deployment (On-Premises, and Cloud), End-User Industry (BFSI, Healthcare, IT and Telecommunications, and More), Organization Size (SMEs, and Large Enterprises), and Geography.

Geography Analysis

North America secured 34.6% of enterprise video market share in 2024 on the back of expansive broadband penetration, early SaaS adoption, and robust federal investment in telework infrastructure. Growth is moderating as large enterprises optimize existing deployments, prioritizing AI add-ons and advanced analytics rather than net-new seat licenses. Even so, edge acceleration nodes around tier-2 cities extend low-latency streaming into under-served areas, preserving incremental revenue.

Asia-Pacific is the fastest-growing territory, registering a 12.8% CAGR as mobile broadband upgrades and 5G private-network pilots proliferate. Indigenous champions-Tencent Meeting in China and Itochu-backed EasyRooms in Japan-tailor interfaces, compliance modules, and language packs to local norms[3]. Government digitalization programs and manufacturing modernization efforts underpin demand for inspection-grade video analytics, further bolstering regional uptake within the enterprise video market.

Europe follows a steady trajectory shaped by GDPR compliance mandates. Enterprises gravitate toward vendors offering in-region data centers and stringent privacy certifications, driving cooperation between U.S. platforms and EU-based cloud hosts. South America plus the Middle East and Africa represent emerging footholds where cloud-first strategies leapfrog legacy on-premises rollouts. Telco partnerships that bundle video suites with high-speed connectivity lower adoption hurdles for mid-market firms across these regions.

- Cisco Systems, Inc.

- Microsoft Corporation

- Zoom Video Communications, Inc.

- Google LLC

- Adobe Inc.

- Brightcove Inc.

- IBM Corporation

- Kaltura Inc.

- Panopto

- Poly (HP Inc.)

- Avaya Inc.

- Vbrick Systems, Inc.

- Mediaplatform, Inc.

- Vidyo, Inc.

- Vimeo, Inc.

- Qumu Corporation

- Harmonic Inc.

- JW Player

- Lifesize, Inc.

- Ooyala (Telstra)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-first video architecture adoption

- 4.2.2 AI-powered live-caption accuracy breakthroughs

- 4.2.3 Growth of hybrid and remote workforces

- 4.2.4 BYOD proliferation across enterprises

- 4.2.5 Low-latency 5G private networks in campuses

- 4.2.6 Compliance-driven demand for secure archival

- 4.3 Market Restraints

- 4.3.1 High total cost of ultra-low-latency infrastructure

- 4.3.2 Inter-country data-sovereignty barriers

- 4.3.3 IT staff skill shortages in video-workflow orchestration

- 4.3.4 Rising cyber-insurance premiums on video breaches

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact Assessment of Key Stakeholders

- 4.9 Key Use Cases and Case Studies

- 4.10 Impact on Macroeconomic Factors of the Market

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Video Conferencing

- 5.1.2 Video Content Management

- 5.1.3 Webcasting and Live Streaming

- 5.1.4 Video Analytics

- 5.1.5 Other Types

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By Deployment Mode

- 5.3.1 On-Premises

- 5.3.2 Cloud

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Healthcare

- 5.4.3 IT and Telecommunications

- 5.4.4 Retail and E-commerce

- 5.4.5 Education

- 5.4.6 Government and Public Sector

- 5.4.7 Manufacturing

- 5.4.8 Media and Entertainment

- 5.4.9 Others

- 5.5 By Organization Size

- 5.5.1 Small and Medium Enterprises (SMEs)

- 5.5.2 Large Enterprises

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Nordics

- 5.6.3.7 Rest of Europe

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 Saudi Arabia

- 5.6.4.1.2 United Arab Emirates

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Egypt

- 5.6.4.2.3 Nigeria

- 5.6.4.2.4 Rest of Africa

- 5.6.5 Asia-Pacific

- 5.6.5.1 China

- 5.6.5.2 India

- 5.6.5.3 Japan

- 5.6.5.4 South Korea

- 5.6.5.5 ASEAN

- 5.6.5.6 Australia

- 5.6.5.7 New Zealand

- 5.6.5.8 Rest of Asia-Pacific

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cisco Systems, Inc.

- 6.4.2 Microsoft Corporation

- 6.4.3 Zoom Video Communications, Inc.

- 6.4.4 Google LLC

- 6.4.5 Adobe Inc.

- 6.4.6 Brightcove Inc.

- 6.4.7 IBM Corporation

- 6.4.8 Kaltura Inc.

- 6.4.9 Panopto

- 6.4.10 Poly (HP Inc.)

- 6.4.11 Avaya Inc.

- 6.4.12 Vbrick Systems, Inc.

- 6.4.13 Mediaplatform, Inc.

- 6.4.14 Vidyo, Inc.

- 6.4.15 Vimeo, Inc.

- 6.4.16 Qumu Corporation

- 6.4.17 Harmonic Inc.

- 6.4.18 JW Player

- 6.4.19 Lifesize, Inc.

- 6.4.20 Ooyala (Telstra)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment