|

市场调查报告书

商品编码

1851709

定位服务:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Location Based Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

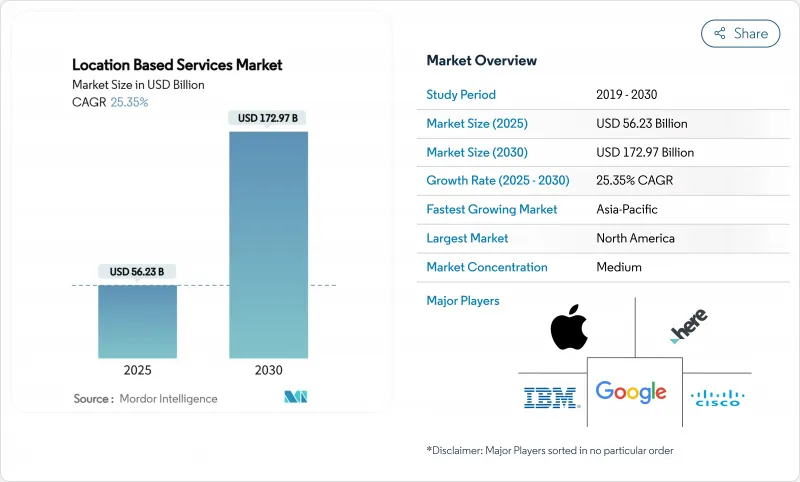

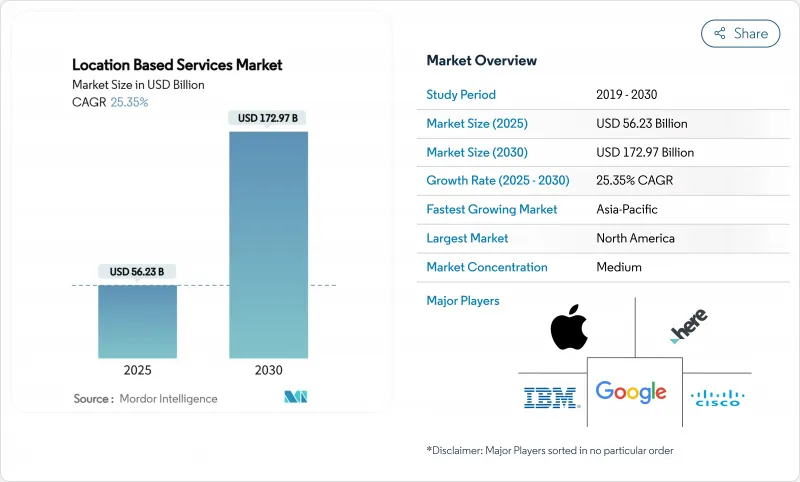

预计到 2025 年,定位服务市场规模将达到 562.3 亿美元,到 2030 年将达到 1,729.7 亿美元,年复合成长率为 25.35%。

这一积极发展趋势得益于5G网路切片技术的推出(可确保亚米级定位精度)、强制执行高级移动定位资讯的紧急呼叫指令,以及依赖即时定位系统的数位双胞胎物流中心的兴起。不断成长的在地化广告预算、公分级卫星的普及以及人工智慧主导的室内定位技术,都在拓展定位应用场景,促使企业将位置智慧融入行销、安全和工业自动化工作流程。因此,市场参与企业正转向多模态定位引擎,这些引擎融合了GPS、UWB、BLE、Wi-Fi FTM和感测器融合技术,以提供无缝的室内外覆盖。併购、高价值伙伴关係和合规支出正在推动产业整合,而隐私法规则正在塑造以明确同意为基础的商业模式。

全球定位服务市场趋势与洞察

在超当地语系化广告预算正在爆炸性成长

负责人计划在2025年将超过20%的预算分配给本地宣传活动,高于2024年的46%。谷歌地图每年透过广告创造111亿美元的收入。采用基于位置的推播通知的零售商报告称,店内转换率大幅提升,验证了收入成长的假设。更精细的位置定位也实现了动态创新优化,使品牌能够向细分市场推送客製化讯息。因此,定位服务市场正持续受到广告科技平台、出版商和品牌的青睐,他们都希望将线上意图与线下购买路径连接起来。

经合组织市场中关于电子911和反洗钱紧急情况准确性的要求

欧洲电子通讯法典规定所有智慧型手机必须配备自动定位定位(AML)功能,在87%的紧急情况下,能够提供50公尺以内的呼叫者座标。英国的经验表明,与基地台定位(Cell-ID)相比,AML的定位精度提高了4000倍,缩短了反应时间,并有望在10年内挽救7500人的生命。目前已有超过30个国家采用了AML,美国也在加强E-911的垂直定位精度要求。因此,电信业者必须升级其定位核心网路和切换应用程式介面(API),从而推动对混合式全球导航卫星系统(GNSS)、Wi-Fi和感测器辅助解决方案的投入。合规预算直接扩大了定位服务市场,因为通讯业者将先进的定位中间件嵌入其网路核心网路和终端用户应用程式中。

消费者对位置隐私的抵抗情绪日益高涨

研究表明,71% 的用户只有在获得明确同意后才会共用位置资讯。 GDPR 强制要求资料最小化,CCPA 则强制要求使用者选择退出,从而将持续追踪的范围减少了高达 30%。印度的 DPDP 法案引入了额外的同意机制,并强制服务提供者投资于差分隐私和联邦学习模型,这增加了工程成本。这些变化减缓了资料收集速度,并抑制了定位服务市场中某些广告收入来源。

细分市场分析

到2024年,随着企业将设计、部署和支援外包给託管服务专家,服务收入将占总收入的47.5%。然而,软体预计将实现26.8%的复合年增长率,凸显了人工智慧分析如何将原始数据转化为业务行动。大型第三方物流公司整合数位双胞胎指挥中心,显示承包工程套件为何能吸引高额合约。同时,随着超宽频(UWB)锚点和蓝牙低功耗(BLE)网关在医疗机构中日益普及,硬体业务也保持着积极的成长动能。

随着 Mapbox 的 MapGPT 和 TomTom 的 Azure 整合使汽车製造商无需更换车载设备即可推广无线升级,软体订阅定位服务市场规模正在稳步扩大。服务整合商透过捆绑硬体、云端仪表板和分析功能,降低了客户的整体拥有成本,并提高了对经常性收入的可见度。

儘管全球导航卫星系统(GNSS)生态系统日趋成熟,室外定位仍占据主导地位,但室内部署正在迅速扩张。预计到2024年,室外定位服务市占率将达到68.6%,而室内定位市场将逐渐趋于融合,到2030年复合年增长率(CAGR)将达到28.6%。医院、购物中心和机场正在部署低功耗蓝牙(BLE)和超宽频(UWB)标籤,以缩短资产搜寻週期并引导访客。

混合解决方案可在 GPS、5G、Wi-Fi 和蓝牙之间实现无缝切换,从而保持使用者体验。标准化联盟不断完善精度基准,降低校准成本,释放潜在需求,并扩大定位服务的整体市场。

区域分析

北美地区将在2024年占据最大的市场份额,达到36.8%,这主要得益于支援AML功能的智慧型手机的广泛普及和强大的云端基础设施。 HERE Technologies与AWS达成的10亿美元合作等高价值交易,充分体现了该地区的规模优势。联邦政府对E-911紧急呼叫系统的最后期限确保了营运商的持续投资,而汽车製造商正在试验车道级高清地图,以实现L3级自动驾驶。

亚太地区预计将以25.8%的复合年增长率实现最快成长,到2030年将拥有21亿独立行动用户,并为GDP贡献8,800亿美元。中国、韩国和日本独立部署5G网路将促进基于网路的定位应用程式介面(API)的发展,而像GAGAN这样的卫星增强系统(SBAS)卫星群将与全球导航卫星系统(GNSS)互补,用于精密农业。各国政府正在支持平衡创新与隐私的资料管治框架,促进国内生态系统的构建,并扩大全部区域的定位服务市场规模。

欧洲透过严格的隐私保护指南,稳步推动基于位置的服务发展,从而增强了消费者的信任。从2022年起,所有智慧型手机都将强制使用反洗钱功能,这将推动通讯业者和公共安全应答中心(PSAP)进行后端升级。专注于隐私权保护的新兴企业正积极采用差分隐私技术,以满足GDPR的要求,并丰富服务的多样性。南美洲和中东/非洲地区仍在发展中,但已展现出巨大的潜力。巴西正在航空领域推广基于位置的服务(SBAS)技术,海湾地区的智慧城市专案正在大型购物中心部署蓝牙低功耗(BLE)行动商务信标。非洲区域航空组织正在合作开发SatNav-Africa SBAS项目,为未来的精密农业和交通运输服务奠定基础。这些努力共同扩大了定位服务市场的地理覆盖范围。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 市场定义与研究假设

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 在地化广告预算正在爆炸性成长

- 经合组织市场中关于电子911和反洗钱紧急情况准确性的要求

- BLE、UWB 和感测器融合在室内定位领域的崛起

- 5G网路切片实现亚计量位置服务

- 「数位双胞胎」物流枢纽的激增需要即时定位系统(RTLS)。

- 基于卫星的增强技术(SBAS、多GNSS)可实现公分级精度

- 市场限制

- 消费者对位置隐私的抵抗情绪日益高涨

- 法规碎片化(GDPR、CCPA、印度DPDP法案)

- 室内地图标准化的缺失增加了整合成本。

- 密集城区射频讯号多路径效应及干扰

- 价值链分析

- 关键法规结构评估

- 关键相关人员影响评估

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素的影响

第五章 市场规模与成长预测

- 按组件

- 硬体

- 软体

- 服务

- 按位置类型

- 室内的

- 户外的

- 核心技术

- GPS/A-GPS

- Wi-Fi 与 WLAN 三角定位

- Bluetooth Low Energy(BLE)

- 超宽频(UWB)

- RFID和NFC

- 透过使用

- 导航与地图绘製

- 基于位置的广告和促销

- 资产和车队跟踪

- 紧急服务和公共

- 游戏与扩增实境

- 社群媒体与互动

- 按最终用户行业划分

- 零售和快速消费品

- 运输与物流

- 医疗保健和生命科学

- 电信和资讯技术服务

- 石油、天然气和能源

- 政府/公共部门

- 製造业和工业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Google LLC(Alphabet Inc.)

- Apple Inc.

- Cisco Systems, Inc.

- IBM Corporation

- HERE Global BV(Nokia Corporation)

- Microsoft Corporation

- Ericsson AB

- Alcatel-Lucent Enterprise International Limited(ALE International)

- Hewlett Packard Enterprise Company(Aruba Networks)

- Zebra Technologies Corporation

- Maxar Technologies Inc.

- Esri Global Inc.

- Qualcomm Technologies Inc.

- Garmin Ltd.

- TomTom NV

- Baidu Inc.

- IndoorAtlas Ltd.

- Sewio Networks sro

- Ubiquicom Srl

- HID Global Corporation(ASSA ABLOY AB)

- Teldio Corporation

- Creativity Software Ltd.

- GL Communications Inc.

第七章 市场机会与未来趋势

- 閒置频段与未满足需求评估

The location-based services market size equals USD 56.23 billion in 2025 and is forecast to advance at a 25.35% CAGR, reaching USD 172.97 billion by 2030.

This brisk trajectory stems from 5G network-slicing deployments that guarantee sub-meter accuracy, mandatory emergency-call regulations that enforce Advanced Mobile Location, and the rise of digital-twin logistics hubs that depend on real-time location systems. Intensifying hyper-local advertising budgets, centimeter-grade satellite augmentation, and AI-driven indoor positioning all expand addressable use cases, prompting enterprises to embed location intelligence across marketing, safety, and industrial automation workflows. Market participants therefore focus on multi-modal positioning engines that blend GPS, UWB, BLE, Wi-Fi FTM, and sensor fusion to deliver seamless indoor-outdoor coverage. Mergers, high-value partnerships, and compliance spending drive consolidation, while privacy regulation shapes commercial models toward explicit-consent engagement.

Global Location Based Services Market Trends and Insights

Explosion of hyper-local advertising budgets

Marketers plan to allocate 20%-plus of budgets to local campaigns in 2025, up from 46% in 2024, as geofencing proves effective for foot-traffic uplift. Google Maps already monetizes USD 11.1 billion annually through ad placements. Retailers adopting location-triggered push notifications report sharp increases in in-store conversions, validating the revenue-expansion thesis. Greater location granularity also supports dynamic creative optimization, letting brands tailor messages to micro-markets. As a result, the location-based services market gains sustained demand from advertising technology platforms, publishers, and brands eager to link online intent with offline purchase paths.

Mandates for e-911 and AML emergency accuracy in OECD markets

The European Electronic Communications Code requires AML on all smartphones, delivering caller coordinates within 50 m for 87% of emergencies . The UK experience shows a 4,000-fold accuracy boost versus Cell-ID, cutting response times and potentially saving 7,500 lives over 10 years. More than 30 nations have adopted AML, while the US is tightening E-911 vertical-accuracy rules. Telcos must therefore upgrade positioning cores and hand-off APIs, fueling spending on hybrid GNSS, Wi-Fi, and sensor-assisted solutions. Compliance budgets directly expand the location-based services market as operators embed advanced location middleware within network cores and end-user apps.

Heightened consumer push-back on location privacy

Surveys show 71% of users will only share location after explicit consent. GDPR mandates data-minimization, while CCPA imposes opt-out mechanics, reducing always-on tracking coverage by up to 30%. India's DPDP Act introduces extra consent layers, compelling providers to invest in differential-privacy and federated-learning models that add engineering cost. These shifts slow data-collection velocity, tempering certain advertising revenue streams inside the location-based services market.

Other drivers and restraints analyzed in the detailed report include:

- Rise of Indoor Positioning via BLE, UWB and Sensor Fusion

- 5G Network Slicing Enabling Sub-meter Latency LBS

- Regulatory fragmentation (GDPR, CCPA, India DPDP Act)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services represented 47.5% of 2024 revenue as enterprises outsourced design, deployment, and support to managed-service experts. Software, however, is forecast to log a 26.8% CAGR, underscoring how AI analytics convert raw pings into business actions. Large 3PLs integrating digital-twin command centers illustrate why turnkey suites attract premium subscriptions. Meanwhile, hardware growth stays positive as UWB anchors and BLE gateways proliferate in healthcare campuses.

The location-based services market size for software subscriptions climbs steadily as Mapbox's MapGPT and TomTom's Azure integrations let automakers push over-the-air upgrades without refreshing on-board units. Service integrators bundle hardware, cloud dashboards, and analytics, ensuring lower total cost of ownership for clients and reinforcing recurring-revenue visibility.

Outdoor positioning still dominates owing to mature GNSS ecosystems, yet indoor deployments are scaling fast. The location-based services market share for outdoor stood at 68.6% in 2024; indoor positioning is tracking a 28.6% CAGR through 2030, suggesting convergence down the line. Hospitals, malls, and airports deploy BLE and UWB tags to cut asset-search cycles and guide visitors, inching the indoor slice toward parity with outdoor during the forecast horizon.

Hybrid solutions hand-off seamlessly between GPS, 5G, Wi-Fi, and Bluetooth, preserving user experience. Standardisation consortia continue refining accuracy benchmarks, which should trim calibration costs and unlock pent-up demand, expanding the overall location-based services market.

The Location Based Services Market Report is Segmented by Component (Hardware, Software, Services), Location Type (Indoor, Outdoor), Core Technology (GPS/A-GPS, Wi-Fi and WLAN Triangulation, and More), Application (Navigation and Mapping, and More), End-User Industry (Retail and FMCG, Transportation and Logistics, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated the largest slice at 36.8% in 2024 on the back of AML-ready smartphone penetration and robust cloud infrastructure. High-value contracts such as HERE Technologies' USD 1 billion AWS alliance illustrate the region's scale. Federal E-911 deadlines ensure continuous operator investment, while automotive OEMs trial lane-level HD maps for Level-3 autonomy.

Asia-Pacific is the fastest-growing at 25.8% CAGR, with unique mobile subscribers on track to hit 2.1 billion by 2030 and contribute USD 880 billion to GDP . Standalone 5G rollouts in China, Korea, and Japan foster network-based positioning APIs; SBAS constellations such as GAGAN complement GNSS for precision farming. Governments champion data-governance frameworks that balance innovation with privacy, encouraging domestic ecosystem formation and enlarging the location-based services market size across the region.

Europe maintains steady momentum through stringent privacy leadership that nurtures consumer trust. AML has been mandatory on all smartphones since 2022, catalyzing backend upgrades among carriers and PSAPs. An emerging crop of privacy-focused startups employs differential-privacy to meet GDPR, enriching service diversity. Southern and Eastern European cities trial U-Space corridors requiring reliable drone positioning, adding a new adjacency.South America and Middle East and Africa remain nascent but promising. Brazil adopts SBAS for aviation, while Gulf smart-city programs deploy BLE m-commerce beacons in mega-malls. African regional aviation bodies collaborate on SatNav-Africa SBAS, sowing foundational infrastructure for future precision-agriculture and transport services. Collectively these initiatives broaden the geographic footprint of the location-based services market.

- Google LLC (Alphabet Inc.)

- Apple Inc.

- Cisco Systems, Inc.

- IBM Corporation

- HERE Global B.V. (Nokia Corporation)

- Microsoft Corporation

- Ericsson AB

- Alcatel-Lucent Enterprise International Limited (ALE International)

- Hewlett Packard Enterprise Company (Aruba Networks)

- Zebra Technologies Corporation

- Maxar Technologies Inc.

- Esri Global Inc.

- Qualcomm Technologies Inc.

- Garmin Ltd.

- TomTom N.V.

- Baidu Inc.

- IndoorAtlas Ltd.

- Sewio Networks s.r.o.

- Ubiquicom S.r.l.

- HID Global Corporation (ASSA ABLOY AB)

- Teldio Corporation

- Creativity Software Ltd.

- GL Communications Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosion of hyper-local advertising budgets

- 4.2.2 Mandates for e-911 and AML emergency accuracy in OECD markets

- 4.2.3 Rise of indoor positioning via BLE, UWB and sensor fusion

- 4.2.4 5G network slicing enabling sub-meter latency LBS

- 4.2.5 Proliferation of 'digital twin' logistics hubs needing RTLS

- 4.2.6 Satellite-based augmentation (SBAS, multi-GNSS) for cm-grade precision

- 4.3 Market Restraints

- 4.3.1 Heightened consumer push-back on location privacy

- 4.3.2 Regulatory fragmentation (GDPR, CCPA, India DPDP Act)

- 4.3.3 Indoor mapping standardisation lag increases integration cost

- 4.3.4 RF-signal multipath and interference in dense urban cores

- 4.4 Value Chain Analysis

- 4.5 Evaluation of Critical Regulatory Framework

- 4.6 Impact Assessment of Key Stakeholders

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Impact of Macro-economic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Location Type

- 5.2.1 Indoor

- 5.2.2 Outdoor

- 5.3 By Core Technology

- 5.3.1 GPS / A-GPS

- 5.3.2 Wi-Fi and WLAN Triangulation

- 5.3.3 Bluetooth Low Energy (BLE)

- 5.3.4 Ultra-Wideband (UWB)

- 5.3.5 RFID and NFC

- 5.4 By Application

- 5.4.1 Navigation and Mapping

- 5.4.2 Location-Based Advertising and Promotion

- 5.4.3 Asset and Fleet Tracking

- 5.4.4 Emergency Services and Public Safety

- 5.4.5 Gaming and Augmented Reality

- 5.4.6 Social Media and Engagement

- 5.5 By End-user Industry

- 5.5.1 Retail and FMCG

- 5.5.2 Transportation and Logistics

- 5.5.3 Healthcare and Life Sciences

- 5.5.4 Telecom and IT Services

- 5.5.5 Oil, Gas and Energy

- 5.5.6 Government and Public Sector

- 5.5.7 Manufacturing and Industrial

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia and New Zealand

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Egypt

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Google LLC (Alphabet Inc.)

- 6.4.2 Apple Inc.

- 6.4.3 Cisco Systems, Inc.

- 6.4.4 IBM Corporation

- 6.4.5 HERE Global B.V. (Nokia Corporation)

- 6.4.6 Microsoft Corporation

- 6.4.7 Ericsson AB

- 6.4.8 Alcatel-Lucent Enterprise International Limited (ALE International)

- 6.4.9 Hewlett Packard Enterprise Company (Aruba Networks)

- 6.4.10 Zebra Technologies Corporation

- 6.4.11 Maxar Technologies Inc.

- 6.4.12 Esri Global Inc.

- 6.4.13 Qualcomm Technologies Inc.

- 6.4.14 Garmin Ltd.

- 6.4.15 TomTom N.V.

- 6.4.16 Baidu Inc.

- 6.4.17 IndoorAtlas Ltd.

- 6.4.18 Sewio Networks s.r.o.

- 6.4.19 Ubiquicom S.r.l.

- 6.4.20 HID Global Corporation (ASSA ABLOY AB)

- 6.4.21 Teldio Corporation

- 6.4.22 Creativity Software Ltd.

- 6.4.23 GL Communications Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-need Assessment