|

市场调查报告书

商品编码

1906017

马来西亚电力市场-份额分析、产业趋势与统计、成长预测(2026-2031)Malaysia Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

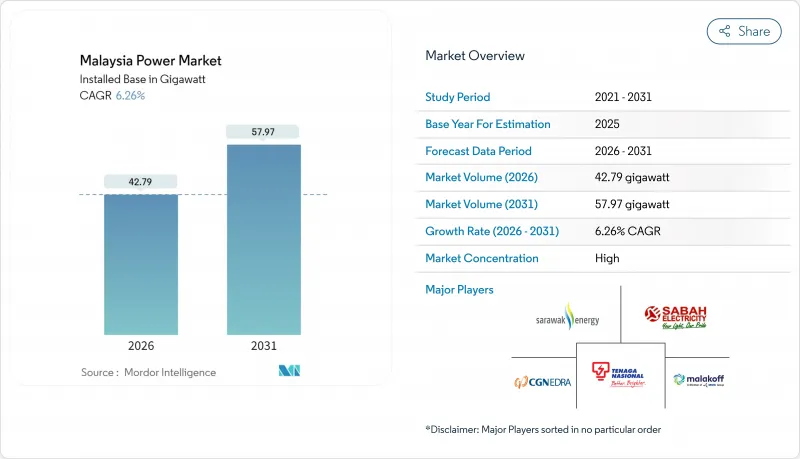

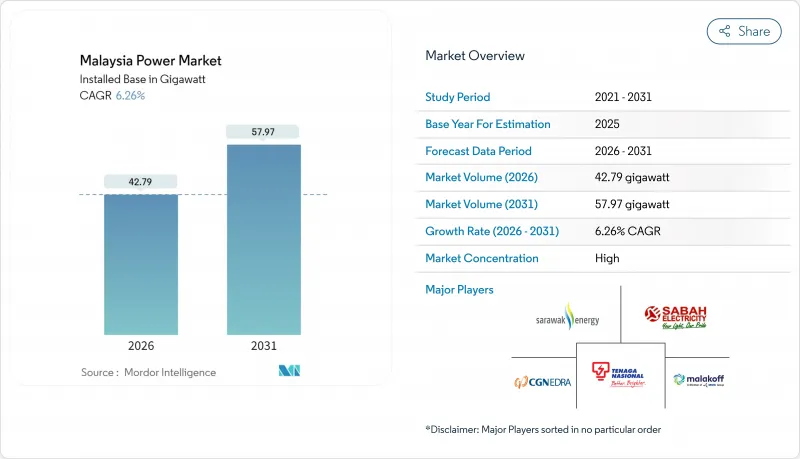

预计到 2026 年,马来西亚电力市场规模将达到 42.79 吉瓦。

这意味着从 2025 年的 40.27 吉瓦成长到 2031 年的 57.97 吉瓦,2026 年至 2031 年的复合年增长率为 6.26%。

超大规模资料中心丛集新增11吉瓦的用电需求,仅在两年内就翻了一番,迫使马来西亚国家能源公司(TNB)加速对发电和输电的投资。 2024年,火力发电技术占马来西亚电力市场的75.6%,但预计到2030年,可再生能源将以最快的速度成长,从而将资金重新分配到太阳能、水力发电和电池计划,而煤炭投资则会减少。第三方准入规则正在将采购权转移到商业用户手中,而关税和补贴改革则透过将价格与成本回收相匹配,改善了分散式太阳能发电的经济效益。槟城、雪兰莪和柔佛州的半导体製造地支撑着持续的工业需求,而天然气供应限制以及东马脆弱的输电网面临的限电风险则构成了关键的不确定性。

马来西亚电力市场趋势与分析

工业用电需求快速成长

英飞凌在吉灵投资20亿欧元建设的碳化硅工厂,标誌着马来西亚电力市场结构从传统石化产业向精密製造业的转型,而精密製造业正是马来西亚当前电力市场的基石。国有电力供应商TNB已确定仅数据中心总合需要11吉瓦的装置容量,这迫使其拨出马币亿令吉资本支出储备中的30%来应对意外的负载增长。儘管预计到2030年,工业需求仍将占总消费量的一半,但其中半导体和云端运算工作负载的需求日益增长,而这些工作负载需要低碳电力。构成比和输电发展若延误,可能会导致这些投资被拥有更先进可再生能源采购框架的区域竞争对手抢走。因此,地方政府正在加速变电站升级改造,并推广电池储能技术的应用,以维持充足的备用容量。

可再生能源引进目标

国家能源转型蓝图设定了2025年可再生能源装置容量占比达到31%,2035年达到40%的目标。实现这些目标需要每年新增约1.5吉瓦的装置容量,比以往的建造速度显着提高。第五轮大型太阳能光电竞标于2024年分配给马来西亚竞标2吉瓦,既确保了国产化率,也缩小了开发商的选择范围。国家能源公司(TNB)在水力发电水库上建造的2.5吉瓦浮体式太阳能发电厂计画将利用现有的输电走廊,最大限度地减少土地使用衝突。同时,砂拉越能源公司7,300兆瓦的水力发电装置容量使东马成为潜在的清洁能源出口地区,一旦跨境输电线路建成。 2050年实现70%的可再生能源比例意味着几乎完全淘汰燃煤发电。氢能复合循环燃气涡轮机被视为一种过渡技术,但燃料供应不稳定构成了一项挑战。

天然气供应受限和价格波动

国内天然气产量已趋于稳定,而马来西亚国家石油公司(Petronas)优先发展液化天然气(LNG)出口,导致燃料週期性短缺,迫使发电企业转向高成本更高的柴油。 2022年全球LNG价格飙升时,马来西亚的成本转嫁机制无法应付燃料成本的上涨,挤压了独立发电公司(IPP)的利润空间。规划中的氢能涡轮机旨在逐步以绿色氢气取代天然气,但工业规模的氢能基础设施仍处于起步阶段。除非在储气、进口和定价方面进行协调一致的改革,否则对天然气的依赖将抑制对灵活火力资产的投资,并拖慢马来西亚电力市场扩张的步伐。

细分市场分析

预计马来西亚可再生能源市场规模将以22.89%的复合年增长率成长,到2025年将削弱该国目前火力发电技术在电力市场74.92%的份额。太阳能发电正推动可再生能源的蓬勃发展,这得益于国家能源公司(TNB)已建成的2.5吉瓦浮体式光伏电站以及在第五轮大型太阳能竞标中分配的2吉瓦容量。水力发电在马来西亚东部仍发挥重要作用,但其扩张受到环境评估和社区咨询的限制。煤炭发电预计将大幅下降,到2030年将有9.1吉瓦的煤炭机组退役。同时,氢能燃气涡轮机正在提高备用容量,并为电网未来的燃料转换做好准备。电池储能是关键因素。充足的储能容量将提高光伏发电的渗透率,而储能容量不足则会延长中负载燃气电厂的运作寿命。

在储能技术引进之前,太阳能光电发电的平准化成本在2024年就已经低于燃气发电的边际成本,这促使独立发电商(IPP)在公共产业竞标中增加购电协议(PPA)。砂拉越的水力资源能够提供接近基本负载的电力,且变动成本低,一旦併网,该州有望成为电力出口州。风能和地热能仍处于试验阶段,而生质能的扩张则因原料价格上涨而放缓。这种发电结构的变化将影响马来西亚电力市场的发电调度、排放强度和投资分配。

马来西亚电力市场报告按能源类型(火力发电、核能、可再生能源)和终端用户(电力公司、商业/工业用户、住宅)进行细分。市场规模和预测以装置容量(吉瓦)为单位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 工业用电需求快速成长

- 可再生能源引进目标(2025年达31%,2035年达40%)

- 老旧燃煤发电厂退役后,兴建替代设施

- 推动输配电网路现代化,促进对输配电设施的投资

- 第三方接取规则支援企业间购电协定 (PPA)

- 超大规模资料中心丛集会形成热点

- 市场限制

- 天然气供应受限和价格波动

- 改革电费

- 大规模可再生能源发电用地及许可证取得障碍

- 东马脆弱的电网面临限电风险

- 供应链分析

- 监管环境

- 技术展望(智慧电网、氢能相容型燃气涡轮机联合循环发电系统、电池储能係统)

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- PESTEL 分析

第五章 市场规模与成长预测

- 透过电源

- 热感(煤炭、天然气、石油和天然气、柴油)

- 核能

- 可再生能源(太阳能、风能、水能、地热能、生质能/废弃物、潮汐能)

- 最终用户

- 公用事业

- 商业和工业

- 住宅

- 按输配电和电压等级(仅定性分析)

- 高压输电(230千伏特或更高)

- 二级电网(69-161千伏特)

- 中压配电(13.2 至 34.5 kV)

- 低压配电(1kV或以下)

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、伙伴关係、购电协议)

- 市场占有率分析(主要企业的市场排名和份额)

- 公司简介

- Tenaga Nasional Berhad(TNB)

- Sarawak Energy Berhad

- Sabah Electricity Sdn Bhd(SESB)

- Edra Power Holdings

- Malakoff Corporation Berhad

- YTL Power International

- Genting Sanyen Power

- Petronas Power Sdn Bhd

- Cypark Resources Berhad

- Solarvest Holdings Berhad

- ERS Energy Sdn Bhd

- Verdant Solar

- LYS Energy Group

- Pathgreen Energy Sdn Bhd

- Sunway Construction Group Bhd(RE EPC)

- JinkoSolar(Malaysia Module Fab)

- First Solar Malaysia

- KEPCO Engineering & Construction

- Huawei Digital Power Malaysia

- Siemens Energy Malaysia

第七章 市场机会与未来展望

Malaysia Power Market size in 2026 is estimated at 42.79 gigawatt, growing from 2025 value of 40.27 gigawatt with 2031 projections showing 57.97 gigawatt, growing at 6.26% CAGR over 2026-2031.

Hyperscale data-center clusters account for 11 GW of new load applications, a figure that has doubled in only two years and is forcing Tenaga Nasional Berhad (TNB) to accelerate generation and grid investments. While thermal technologies maintained 75.6% of the Malaysian power market in 2024, renewables are the fastest-growing through 2030 and will re-allocate capital toward solar, hydro, and battery projects at the expense of coal. Third-party access rules are shifting procurement power to corporate consumers, and tariff-subsidy reforms are aligning prices with cost recovery, which, in turn, improves the economics of distributed solar. Semiconductor fabrication and cloud infrastructure hubs in Penang, Selangor, and Johor underpin sustained industrial demand, yet natural-gas supply constraints and curtailment risk in weak East Malaysia grids serve as headline uncertainties.

Malaysia Power Market Trends and Insights

Industrial Electricity-Demand Surge

Infineon's EUR 2 billion silicon-carbide fab in Kulim exemplifies the structural shift from legacy petrochemicals toward precision manufacturing that now underpins the Malaysian power market. TNB has confirmed that data-center applications alone total 11 GW, compelling the utility to reserve 30% of its RM 16.3 billion contingent capital expenditure for unanticipated load growth. Industrial demand is expected to maintain half of total consumption through 2030, but the composition tilts toward semiconductor and cloud workloads that require low-carbon electricity. Any lapse in generation or transmission build-out risks divesting these investments to regional competitors with more advanced renewable procurement frameworks. Consequently, local authorities are fast-tracking substation upgrades and incentivizing battery storage to keep reserve margins adequate.

Renewable-Energy Capacity Targets

The National Energy Transition Roadmap sets milestones of 31% renewable capacity by 2025 and 40% by 2035. Achieving these goals requires annual additions near 1.5 GW, notably faster than historical build-out rates. Large-Scale Solar Round 5 allocated 2 GW in 2024 to Malaysian-controlled bidders, favoring domestic content capture but narrowing the developer field. TNB's 2.5 GW floating-solar program across hydro reservoirs leverages existing transmission corridors and minimizes land-use conflicts, while Sarawak Energy's 7,300 MW hydro fleet positions East Malaysia as a potential clean-power exporter once cross-border interconnections advance. The 70% renewable aspiration by 2050 implies near-zero coal, with hydrogen-ready combined-cycle gas turbines providing a bridge technology, albeit with fuel-supply uncertainties.

Natural-Gas Supply Constraints and Price Volatility

Domestic gas production has plateaued, and Petronas prioritizes LNG exports, resulting in periodic fuel shortages that force generators to switch to costlier diesel back-up.When global LNG prices spiked in 2022, Malaysia's tariff-pass-through mechanism lagged fuel costs, compressing IPP margins. Planned hydrogen-ready turbines assume green hydrogen will gradually displace gas, yet industrial-scale hydrogen infrastructure remains nascent. Unless coordinated storage, import, and pricing reforms materialize, gas exposure will weigh on Malaysia's power market expansion speed by suppressing investor appetite for flexible thermal assets.

Other drivers and restraints analyzed in the detailed report include:

- Aging Coal-Fleet Retirements Triggering Replacement Build-Outs

- Hyperscale Data-Center Clusters Driving Load Pockets

- Electricity-Tariff Subsidy Reforms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Malaysian power market size for renewables is projected to rise at a 22.89% CAGR, eating into thermal technology's 74.92% Malaysia power market share in Malaysia in 2025. Solar leads the renewable surge, propelled by TNB's 2.5 GW floating-solar roll-out and 2 GW of allocated capacity under Large-Scale Solar Round 5. Hydro remains pivotal in East Malaysia, yet expansion is bound by environmental assessment and community engagement. Coal will decline sharply, with 9.1 GW scheduled to retire by 2030, while hydrogen-ready gas turbines pick up reserve margins and prepare the grid for future fuel transitions. Battery storage adoption becomes a gating factor: adequate storage unlocks higher solar penetration, while shortfalls would keep mid-merit gas plants online longer.

Solar's levelized cost fell below marginal gas generation in 2024, even before storage, encouraging IPPs to stack corporate PPAs on top of utility tenders. Hydro assets in Sarawak supply near-baseload output at low variable cost, positioning the state as a potential exporter pending interconnection. Wind and geothermal remain exploratory, and biomass expansion slows due to rising feedstock prices. The evolving mix will influence dispatch order, emissions intensity, and investment allocation across the Malaysia power market.

The Malaysia Power Market Report is Segmented by Power Source (Thermal, Nuclear, and Renewables) and End-User (Utilities, Commercial and Industrial, and Residential). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Tenaga Nasional Berhad (TNB)

- Sarawak Energy Berhad

- Sabah Electricity Sdn Bhd (SESB)

- Edra Power Holdings

- Malakoff Corporation Berhad

- YTL Power International

- Genting Sanyen Power

- Petronas Power Sdn Bhd

- Cypark Resources Berhad

- Solarvest Holdings Berhad

- ERS Energy Sdn Bhd

- Verdant Solar

- LYS Energy Group

- Pathgreen Energy Sdn Bhd

- Sunway Construction Group Bhd (RE EPC)

- JinkoSolar (Malaysia Module Fab)

- First Solar Malaysia

- KEPCO Engineering & Construction

- Huawei Digital Power Malaysia

- Siemens Energy Malaysia

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Industrial electricity-demand surge

- 4.2.2 Renewable-energy capacity targets (31 % by 2025; 40 % by 2035)

- 4.2.3 Aging coal-fleet retirements triggering replacement build-outs

- 4.2.4 Grid-modernisation & T&D capex push

- 4.2.5 Corporate PPAs enabled by Third-Party Access rules

- 4.2.6 Hyperscale data-centre clusters driving load pockets

- 4.3 Market Restraints

- 4.3.1 Natural-gas supply constraints & price volatility

- 4.3.2 Electricity-tariff subsidy reforms

- 4.3.3 Land & permitting hurdles for utility-scale RE

- 4.3.4 Curtailment risk in East-Malaysia weak grids

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (Smart grid, hydrogen-ready CCGT, BESS)

- 4.7 Porters Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Power Source

- 5.1.1 Thermal (Coal, Natural Gas, Oil and Diesel)

- 5.1.2 Nuclear

- 5.1.3 Renewables (Solar, Wind, Hydro, Geothermal, Biomass & Waste, Tidal)

- 5.2 By End User

- 5.2.1 Utilities

- 5.2.2 Commercial and Industrial

- 5.2.3 Residential

- 5.3 By T&D Voltage Level (Qualitative Analysis only)

- 5.3.1 High-Voltage Transmission (Above 230 kV)

- 5.3.2 Sub-Transmission (69 to 161 kV)

- 5.3.3 Medium-Voltage Distribution (13.2 to 34.5 kV)

- 5.3.4 Low-Voltage Distribution (Up to 1 kV)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Tenaga Nasional Berhad (TNB)

- 6.4.2 Sarawak Energy Berhad

- 6.4.3 Sabah Electricity Sdn Bhd (SESB)

- 6.4.4 Edra Power Holdings

- 6.4.5 Malakoff Corporation Berhad

- 6.4.6 YTL Power International

- 6.4.7 Genting Sanyen Power

- 6.4.8 Petronas Power Sdn Bhd

- 6.4.9 Cypark Resources Berhad

- 6.4.10 Solarvest Holdings Berhad

- 6.4.11 ERS Energy Sdn Bhd

- 6.4.12 Verdant Solar

- 6.4.13 LYS Energy Group

- 6.4.14 Pathgreen Energy Sdn Bhd

- 6.4.15 Sunway Construction Group Bhd (RE EPC)

- 6.4.16 JinkoSolar (Malaysia Module Fab)

- 6.4.17 First Solar Malaysia

- 6.4.18 KEPCO Engineering & Construction

- 6.4.19 Huawei Digital Power Malaysia

- 6.4.20 Siemens Energy Malaysia

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment