|

市场调查报告书

商品编码

1910864

电力:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

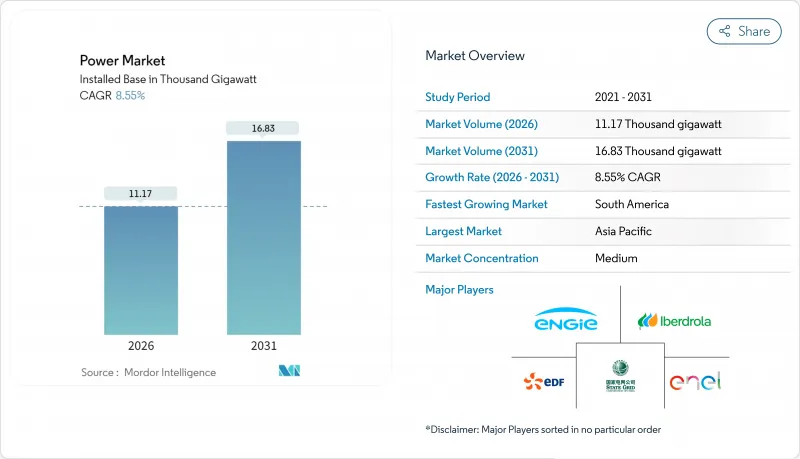

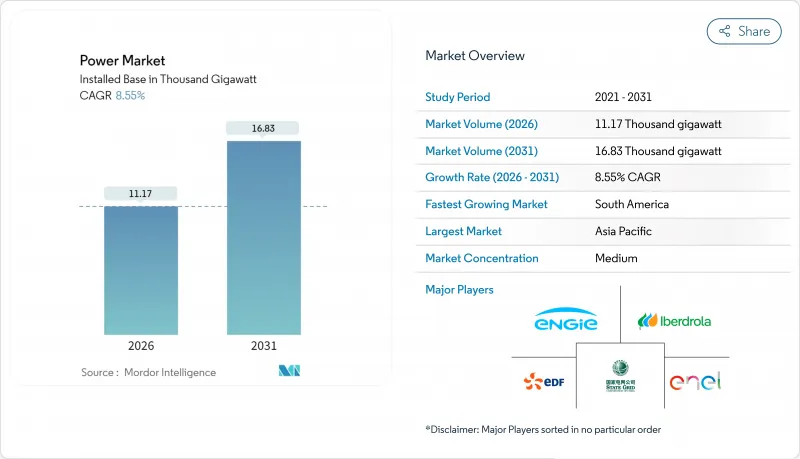

2025 年电力市场价值为 10,290 吉瓦,预计到 2031 年将达到 16,830 吉瓦,高于 2026 年的 11,170 吉瓦。

预计在预测期(2026-2031 年)内,复合年增长率将达到 8.55%。

资料中心扩张、工业电气化以及绿氢能的早期应用,都推动了电力需求的激增,进而推动了电力产能的成长。可再生能源占新增产能的近一半,这得益于电池储能成本的快速下降,从而实现了电网数小时的柔软性。主权财富基金和退休基金每年持续投入1800亿美元用于高压输电网路的升级改造,加剧了输电领域的竞争。同时,电网瓶颈和审核延误可能导致23%的已通过核准清洁能源计划停滞不前,凸显了发电目标与基础设施建设之间的不匹配。

全球电力市场趋势与洞察

资料中心电力需求爆炸性成长

2024年,资料中心的电力消耗量达到460兆瓦时(TWh),相当于阿根廷的年总用电量,占全球电力消耗量的2%。超大规模资料中心的平均持续电力消耗量达到100-200兆瓦(MW),迫使电力公司重新协商併网规则,并加速变电站升级。 2024年,随着科技巨头放弃传统的电力供应模式,寻求全天候可再生能源,与企业买家签订的清洁能源合约规模达到23.7吉瓦。维吉尼亚的「资料中心集群」已经消耗了该州25%的电力,迫使监管机构重新评估容量市场参与规则[PJM.com]。这些集中负载增加了电压稳定性风险,并推高了溢价容量合约价格,最终转嫁到零售电价上。因此,全球电力市场正在围绕十年前并不常见的区域基本负载激增进行重新平衡。

工业供热和交通电气化

到2024年,电弧炉将占新增钢铁产能的73%,而热泵将在欧洲40%的工业热源维修中取代天然气。在交通运输领域,1,410万辆电动车新增了85太瓦时(TWh)的净需求,同时提供了280吉瓦时(GWh)的车网互动(V2G)储能,有助于缓解晚间用电高峰。北欧电网正是这种融合的典范。电动车充电和工业热泵循环的同步运作形成了时间捆绑式用电高峰,并透过精细化的定价讯号和基于人工智慧的调度进行平衡。铝提炼和化学联合企业已经开始迁往风能资源丰富的地区,以确保获得价格合理且可靠的可再生能源。这促成了15至20年购电协议的签署,从而支持了区域电网的扩建。类似的趋势正在全球蔓延,全球电力市场预测工业电力消耗将持续成长15%至20%,这意味着每年需要扩大价值450亿美元的配电网。

电网瓶颈及审核延误

输电瓶颈导致127吉瓦已具备建设条件的可再生能源专案在2024年前被迫搁置,造成3,400亿美元的投资延误。美国电网併网积压容量已飙升至2,600吉瓦,是目前电网容量的五倍,平均审批週期也延长至5.2年。欧洲跨境输电线路在风电高峰期运转率高达95%,迫使西班牙和德国等国削减了47太瓦时的发电量。政策制定者已根据欧盟《净零排放产业法案》将预先规划计划的审批週期限制在12个月,但地方政府的反对意见仍然导致四分之一的高压直流输电(HVDC)项目延期。如果这些问题无法解决,可能会延缓资金流入,削弱投资者信心,并阻碍全球电力市场的脱碳进程。

细分市场分析

至2025年,可再生能源装置容量将占总装置容量的47.95%,并在2031年之前以13.70%的复合年增长率持续成长。这主要得益于创纪录的年度新增装置容量,其中太阳能346吉瓦,风能116吉瓦。离岸风电的复合年增长率将达到23.10%,浮体式基础结构正在占据深海域区,并在日本、韩国和加州加速部署。同时,核能发电厂运作和小型模组化反应器(SMR)试点计画正在为工业供热合约提供新兴但具有战略意义的低碳能源选择。燃煤和燃油电厂仍在持续退役或维修,预计到2024年将有47吉瓦的燃煤发电厂改造为氢气混烧发电,但商业性可行性仍取决于碳价高于每吨80美元。

随着可再生能源渗透率的提高,规划重点将转向柔软性资产。 2026年至2031年间,全球电网营运商需要累计投资2.8兆美元用于电池储能、抽水蓄能、需量反应和併网容量。电池併网将缓解白天光伏发电过剩的问题,而跨境高压直流输电(HVDC)线路将把多余的风电输送到负载中心。随着这些工具的扩展,全球电力市场将透过多元化的资源组合而非单一能源的主导地位来增强韧性。因此,可再生能源的快速成长将重新定义全球电力系统的资本配置、法规结构和市场定价。

本电力市场报告按能源类型(火力发电、核能、可再生能源)、终端用户(电力公司、商业/工业、住宅)和地区(北美、欧洲、亚太、南美、中东/非洲)进行细分。市场规模和预测以装置容量(吉瓦)为单位。

区域分析

到2025年,亚太地区将以44.20%的装置容量份额引领全球电力市场,其中中国(1411吉瓦)和印度(425吉瓦)运作主导地位。中国当年新增可再生能源装置容量216吉瓦,超过了德国现有的总装置容量。同时,中国也新增了47吉瓦燃煤发电装置容量,以应对电网惯性问题。印度正在进行区域电池储能竞标,目标是在2026年之前实现50吉瓦时的储能容量,这与印度扩大太阳能发电的目标一致。日本和韩国正着力发展离岸风电和先进核能发电,以减少对进口燃料的依赖。日本计画在2040年实现45吉瓦的离岸风电装置容量,而韩国正在示范建造一座12吉瓦的浮体式太阳能电站。区域一体化仍然是一项严峻的挑战。在中国西北地区,由于输电网的限制,可再生能源弃用率超过 8.2%,凸显了省际间接输电(HVDC)线路建设的迫切性。

南美洲已成为全球电力市场成长最快的地区,年复合成长率高达15.10%,主要得益于智利的绿色氢能中心以及阿根廷和巴西对併网锂电池储能的需求。巴西拥有195吉瓦的装置容量,并正利用低成本的风能和水力发电来实现采矿业和农业的脱碳。智利阿塔卡马沙漠的太阳能发电热潮不仅满足了采矿需求,也为氢气出口终端提供了电力,使其平准化电力成本低于30美元/兆瓦时。除了可再生能源,阿根廷的瓦卡穆埃尔塔页岩气也为强劲的新增装置容量提供了支持,稳定了日益波动的发电能力。包括安地斯-太平洋高压直流输电线路在内的跨国联网线路,促进了区域间电力交易,从而优化了雨季和旱季的水力发电。

2025年,欧洲将维持全球22.80%的装置容量,并在2022年天然气危机后,专注于加强电力系统的柔软性和能源安全。德国新增了17吉瓦的可再生能源装置容量,并依赖北欧水力发电和法国核能发电进口进行频率调节。英国新增了3.2吉瓦的离岸风电,巩固了其在浮体式基础技术的主导地位。然而,随着负电价的增加、储能经济效益的提升以及批发电力市场结算週期迅速调整至五分钟,英国成熟的电网正面临饱和。北美和中东/非洲的市占率落后,但被视为极具成长潜力的地区。在IRA税收优惠政策的支持下,美国将在2024年新增32吉瓦的可再生能源装置容量。美国已将5.6吉瓦的太阳能光电发电纳入2071年净零排放计画。这种地域多角化的增强将有助于全球电力市场抵御特定地区政策和资源衝击的影响。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 资料中心电力需求激增

- 工业供热和交通电气化

- 政府清洁能源补贴政策趋势(IRA、REPowerEU 等)

- 公用事业规模电池成本迅速下降

- 建置跨境高压直流输电超级电网

- 绿色氢电解装置的扩建将提升基本负载需求。

- 市场限制

- 电网瓶颈及审核延误

- 关键矿产供应链波动

- 在饱和电网中增加可再生能源弃用

- 气候变迁导致水力发电量波动

- 供应链分析

- 监管环境

- 技术展望(智慧电网、储能係统、基于人工智慧的调度)

- 可再生能源结构概述(2024 年)

- 已安装发电容量预测(吉瓦)

- 发电量预测(太瓦时)

- 初级能源消耗趋势(百万吨油当量)

- 波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过发电源

- 火力发电(煤炭、天然气、石油、柴油)

- 核能

- 可再生能源(太阳能、风能、水能、地热能、生质能/废弃物、潮汐能)

- 最终用户

- 公共产业

- 商业和工业

- 住宅

- 依输配电电压等级(仅定性分析)

- 高压输电(230千伏特或更高)

- 电网(69-161千伏特)

- 中压配电(13.2 至 34.5 千伏特)

- 低压配电(1kV或以下)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 北欧国家

- 俄罗斯

- 其他欧洲

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性措施(併购、合资、资金筹措、购电协议)

- 市场占有率分析(主要企业的市场排名和份额)

- 公司简介

- State Grid Corporation of China

- Engie SA

- Enel SpA

- Tokyo Electric Power Co. Holdings

- NTPC Ltd

- Dominion Energy

- China Huaneng Group

- Duke Energy

- E.ON SE

- Siemens Energy

- Hitachi Energy

- Electricite de France(EDF)

- Iberdrola SA

- Korea Electric Power Corp.(KEPCO)

- NextEra Energy

- Southern Company

- Exelon Corporation

- China Three Gorges Corp.

- Orsted A/S

- RWE AG

- General Electric Vernova

- Mitsubishi Electric

第七章 市场机会与未来展望

The Power Market was valued at 10.29 Thousand gigawatt in 2025 and estimated to grow from 11.17 Thousand gigawatt in 2026 to reach 16.83 Thousand gigawatt by 2031, at a CAGR of 8.55% during the forecast period (2026-2031).

Capacity growth stems from spiraling electricity demand created by data-center build-outs, industrial electrification, and early green-hydrogen uptake. Renewables account for nearly half of all new capacity and benefit from steep battery-storage cost declines that unlock multi-hour grid flexibility. Sovereign wealth and pension funds continue to channel USD 180 billion each year into high-voltage grid upgrades, tightening competition in the transmission segment. At the same time, grid bottlenecks and slow permitting threaten to stall 23% of approved clean-energy projects, exposing a mismatch between generation ambitions and infrastructure readiness.

Global Power Market Trends and Insights

Explosive Data-Center Electricity Demand Surge

Data centers consumed 460 TWh in 2024, equaling Argentina's entire annual load and representing 2% of world electricity. Average hyperscale campuses now draw 100-200 MW of continuous power, forcing utilities to renegotiate interconnection rules and fast-track substation upgrades. Corporate buyers contracted 23.7 GW of clean energy in 2024 as tech giants sidestepped traditional utility supply models to secure 24/7 renewables. Virginia's "data-center alley" already absorbs 25% of statewide generation, prompting regulators to revise capacity-market participation rules [PJM.com]. These concentrated loads heighten voltage-stability risk and drive premium capacity-contract pricing that flows through to retail tariffs. The global power market is therefore recalibrating around localized baseload spikes that were uncommon a decade ago.

Electrification of Industrial Heat & Transport

Electric arc furnaces captured 73% of new steel capacity in 2024, and heat pumps displaced natural gas in 40% of European industrial heating retrofits. On the mobility side, 14.1 million EVs added 85 TWh of net demand yet supplied 280 GWh of vehicle-to-grid storage that helped shave evening peaks. Nordic grids illustrate the convergence: synchronized EV charging and industrial heat-pump cycles create time-bundled consumption spikes that are balanced through granular tariff signals and AI-based dispatch. Aluminum smelters and chemical complexes are already relocating to wind-rich zones to capture cheap, firmed renewable power, locking in 15-20-year offtakes that underpin local transmission expansion. As similar patterns echo worldwide, the global power market anticipates sustained 15-20% rises in industrial consumption that call for USD 45 billion of annual distribution hardening.

Grid Bottlenecks & Permitting Delays

Transmission constraints sidelined 127 GW of shovel-ready renewables in 2024, translating into a USD 340 billion investment backlog. U.S. interconnection queues ballooned to 2,600 GW, five times the present grid capacity, with average study cycles extending 5.2 years. European cross-border lines ran at 95% utilization during windy hours, forcing 47 TWh of curtailment, particularly in Spain and Germany. Policymakers reacted by capping review periods to 12 months for pre-zoned projects under the EU Net-Zero Industry Act, yet community opposition still delays one in four HVDC builds. If unaddressed, these chokepoints could undercut the global power market's decarbonization pathway by deferring capital and eroding investor confidence.

Other drivers and restraints analyzed in the detailed report include:

- Government Clean-Energy Subsidy Waves

- Rapid Cost Decline in Utility-Scale Battery Storage

- Critical-Mineral Supply-Chain Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Renewables commanded 47.95% of 2025 installed capacity and are scaling at 13.70% CAGR through 2031, underpinned by a record 346 GW of new solar and 116 GW of wind commissioned during the year. Solar photovoltaics, cheaper than marginal gas in most regions, dominate daytime supply and compress peak-price spreads. Wind plays the complementary role during evening hours, though integration challenges rise as variable output surpasses 30% of national mixes in 15 countries. Offshore wind, growing at a 23.10% CAGR, captures deep-water sites through floating foundations, accelerating uptake in Japan, South Korea, and California. Simultaneously, nuclear restarts and small modular reactor pilots add a nascent but strategic avenue for firm, low-carbon generation that can anchor industrial heat contracts. Coal and oil plants continue to retire or retrofit; 47 GW of coal capacity announced hydrogen co-firing conversions in 2024, though commercial viability remains tied to carbon prices above USD 80 per ton.

High renewable penetration tilts planning toward flexibility assets. Grid operators worldwide will require USD 2.8 trillion in cumulative investment for batteries, pumped-hydro, demand response, and expanded interconnectors over 2026-2031. Battery storage integration softens solar midday oversupply, while cross-border HVDC links move surplus wind to load centers. As these levers scale, the global power market embeds resilience through diversified resource stacks rather than single-fuel dominance. The renewables boom, therefore, redefines capital allocation, regulatory frameworks, and merchant-price formation across global electricity systems.

The Power Market Report is Segmented by Power Source (Thermal, Nuclear, and Renewables) and End-User (Utilities, Commercial and Industrial, and Residential), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

Geography Analysis

Asia-Pacific led the global power market with 44.20% capacity share in 2025, anchored by China's 1,411 GW fleet and India's 425 GW. China commissioned 216 GW of new renewables during the year, more than Germany's installed base, yet also added 47 GW of coal to safeguard grid inertia. India, by contrast, balances solar ambition with regional battery tenders that target 50 GWh of storage by 2026. Japan and South Korea lean on offshore wind and advanced nuclear to curb imported-fuel dependence; Japan intends to reach 45 GW of offshore turbines by 2040, while South Korea experiments with 12 GW of floating solar. The region's integration strain remains high, with renewable curtailment surpassing 8.2% in northwest China due to limited transmission, underscoring the urgency of interprovincial HVDC lines.

South America emerged as the fastest-expanding slice of the global power market at 15.10% CAGR, propelled by green-hydrogen hubs in Chile and lithium-driven grid storage demand in Argentina and Brazil. Brazil boasts 195 GW of installed capacity, leveraging low-cost wind and hydro to decarbonize mining and agriculture. Chile's Atacama solar boom supplies both mining loads and hydrogen export terminals, achieving sub-USD 30/MWh levelized costs. Beyond renewables, Argentina's Vaca Muerta shale gas underpins firm capacity additions that stabilize an increasingly variable generation fleet. Cross-border interconnectors, including the Andes-Pacific HVDC, unlock regional trade that optimizes hydropower between wet and dry seasons.

Europe sustained 22.80% of global capacity in 2025, concentrating on flexibility and energy-security upgrades after the 2022 gas crisis. Germany installed 17 GW of renewables while leaning on Nordic hydro and French nuclear imports to balance frequency. The United Kingdom added 3.2 GW of offshore wind, cementing its leadership in floating foundations. Yet mature grids confront rising saturation; negative-price hours proliferate, storage economics improve, and wholesale markets scramble to reconfigure settlement periods to five minutes. North America and the Middle East & Africa lag in share but represent promising growth. The United States installed 32 GW of renewables in 2024, buoyed by IRA tax credits, and the UAE put 5.6 GW of solar into its 2071 net-zero roadmap. Regional diversification, therefore, buffers the global power market against policy or resource shocks in any single geography.

- State Grid Corporation of China

- Engie SA

- Enel SpA

- Tokyo Electric Power Co. Holdings

- NTPC Ltd

- Dominion Energy

- China Huaneng Group

- Duke Energy

- E.ON SE

- Siemens Energy

- Hitachi Energy

- Electricite de France (EDF)

- Iberdrola SA

- Korea Electric Power Corp. (KEPCO)

- NextEra Energy

- Southern Company

- Exelon Corporation

- China Three Gorges Corp.

- Orsted A/S

- RWE AG

- General Electric Vernova

- Mitsubishi Electric

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosive data-center electricity demand surge

- 4.2.2 Electrification of industrial heat & transport

- 4.2.3 Government clean-energy subsidy waves (IRA, REPowerEU, etc.)

- 4.2.4 Rapid cost decline in utility-scale battery storage

- 4.2.5 Cross-border HVDC super-grid build-outs

- 4.2.6 Green-hydrogen electrolyzer build-outs raising baseload demand

- 4.3 Market Restraints

- 4.3.1 Grid bottlenecks & permitting delays

- 4.3.2 Critical-mineral supply-chain volatility

- 4.3.3 Rising renewable curtailment in saturated grids

- 4.3.4 Climate-induced hydropower variability

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (Smart Grids, BESS, AI-enabled Dispatch)

- 4.7 Renewable Energy Mix Snapshot (2024)

- 4.8 Installed Power-Generation Capacity Outlook (GW)

- 4.9 Electricity Generation Outlook (TWh)

- 4.10 Primary Energy Consumption Trend (Mtoe)

- 4.11 Porter's Five Forces

- 4.11.1 Bargaining Power of Suppliers

- 4.11.2 Bargaining Power of Consumers

- 4.11.3 Threat of New Entrants

- 4.11.4 Threat of Substitutes

- 4.11.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Power-Generation Source

- 5.1.1 Thermal (Coal, Natural Gas, Oil and Diesel)

- 5.1.2 Nuclear

- 5.1.3 Renewables (Solar, Wind, Hydro, Geothermal, Biomass & Waste, Tidal)

- 5.2 By End-User

- 5.2.1 Utilities

- 5.2.2 Commercial and Industrial

- 5.2.3 Residential

- 5.3 By T&D Voltage Level (Qualitative Analysis only)

- 5.3.1 High-Voltage Transmission (Above 230 kV)

- 5.3.2 Sub-Transmission (69 to 161 kV)

- 5.3.3 Medium-Voltage Distribution (13.2 to 34.5 kV)

- 5.3.4 Low-Voltage Distribution (Up to 1 kV)

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Spain

- 5.4.2.5 Nordic Countries

- 5.4.2.6 Russia

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Malaysia

- 5.4.3.6 Thailand

- 5.4.3.7 Indonesia

- 5.4.3.8 Vietnam

- 5.4.3.9 Australia

- 5.4.3.10 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Egypt

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JVs, Funding, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Products & Services, Recent Developments)

- 6.4.1 State Grid Corporation of China

- 6.4.2 Engie SA

- 6.4.3 Enel SpA

- 6.4.4 Tokyo Electric Power Co. Holdings

- 6.4.5 NTPC Ltd

- 6.4.6 Dominion Energy

- 6.4.7 China Huaneng Group

- 6.4.8 Duke Energy

- 6.4.9 E.ON SE

- 6.4.10 Siemens Energy

- 6.4.11 Hitachi Energy

- 6.4.12 Electricite de France (EDF)

- 6.4.13 Iberdrola SA

- 6.4.14 Korea Electric Power Corp. (KEPCO)

- 6.4.15 NextEra Energy

- 6.4.16 Southern Company

- 6.4.17 Exelon Corporation

- 6.4.18 China Three Gorges Corp.

- 6.4.19 Orsted A/S

- 6.4.20 RWE AG

- 6.4.21 General Electric Vernova

- 6.4.22 Mitsubishi Electric

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment