|

市场调查报告书

商品编码

1911294

日本电力:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Japan Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

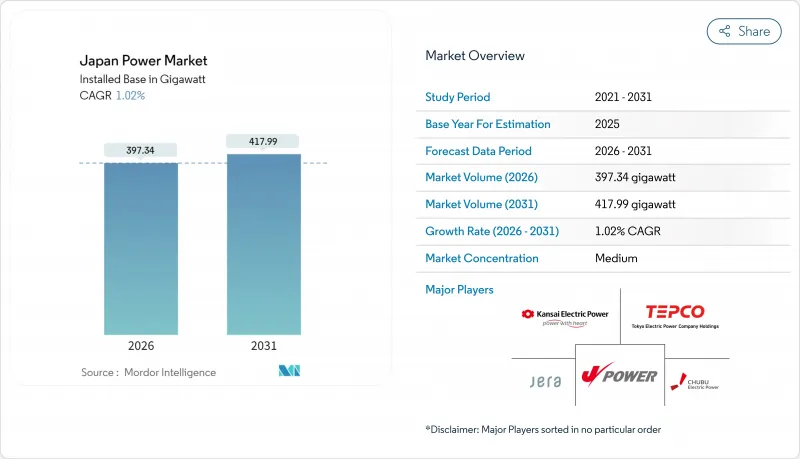

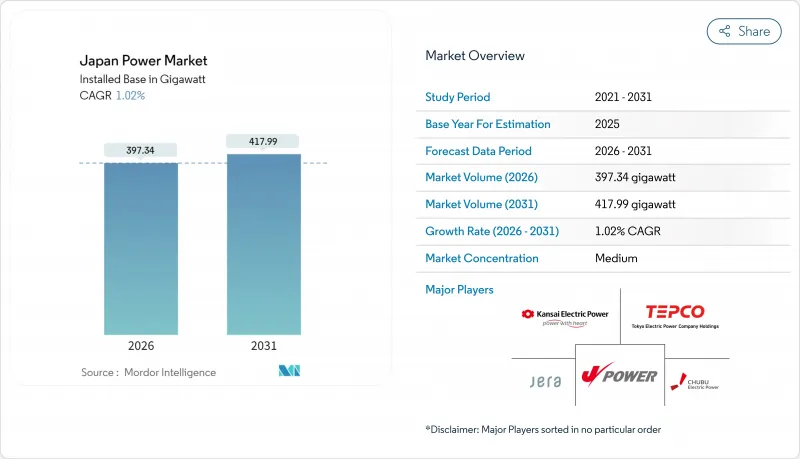

预计到 2026 年,日本电力市场规模将达到 397.34 吉瓦,高于 2025 年的 393.33 吉瓦。

预计到 2031 年,发电量将达到 417.99 吉瓦,2026 年至 2031 年的复合年增长率为 1.02%。

稳定的成长率正在酝酿结构性变革。政府正将1兆美元的绿色转型(GX)预算用于扩大可再生能源、运作核能发电厂以及建造高压直流(HVDC)互联繫统,从而将历史上分散的50Hz和60Hz电网整合到一个统一的商业市场中。太阳能光电(PV)成本的下降、强劲的离岸风竞标以及电网级电池部署的加速,都加剧了传统液化天然气(LNG)电厂的竞争压力。同时,一项氢气-氨气混烧试点计画已经启动,旨在对冲燃料价格风险。此外,日本内阁也设定了2040年可再生能源占比达到40-50%、核能发电占比达到20%的目标,以确保高耗能半导体和人工智慧产业丛集的能源供应。在人口减少但用电量高峰仍存在的都市区走廊中,企业对企业购电协议 (PPA)、智慧电錶数据分析和需量反应计画透过电网柔软性货币化,进一步加速了这些变化。

日本电力市场趋势与洞察

降低光学模组和安装成本

组件价格已从2018年的17.6日圆/千瓦时降至2024年多竞标后低于8日圆/千瓦时,这使得批发市场无需补贴即可实现竞争。硬体价格的下降和软成本效率的提高正推动该技术摆脱对上网电价补贴的依赖,转向基于竞价的定价模式。随着屋顶光电和农光互补系统的普及,竞标曲线也不断演变,这些系统避开了土地稀缺的问题。像村田製作所这样的製造商已透过虚拟购电协议(PPA)获得了70兆瓦的装置容量,以满足RE100的目标,并将需求锚定在工业园区。电池价格的下降正日益将白天的太阳能用电高峰转移到晚间,挤压调峰电厂的利润空间,并重塑容量市场动态。

扩大离岸风电竞标渠道

第三竞标于2024年12月举行,最终以每千瓦时3日圆(约30日圆)的价格得标1吉瓦项目,证实了其与传统发电方式的成本竞争力。浮体式基础技术绕过了近岸水深限制,实现了深海域开发,而由日本能源研究协会(JERA)主导的团队正在开发抗颱风平台。政府为保障电网安全制定的指南将海底租赁与电网建设相结合,从而消除了传统的瓶颈。目前正在开发混合模式,由欧洲开发商转移在恶劣环境下的专业知识,日本公司提供企划案融资,从而建立国内供应链。能否实现2030年10吉瓦的目标,将取决于与渔业相关人员的谈判进度以及港口基础设施的建设。

液化天然气价格波动与进口依赖性

日本能源进口依赖高达96%,液化天然气现货价格的突然上涨导致隔日电价突破每度1美元,对电力公司的利润率带来压力。儘管自2014年核能发电恢復以来,液化天然气消费量已下降25%,但日本的能源依赖度仍然很高。公司已开始将已签订合约的货物转售至海外,这表明需求正在结构性下降。同时,九州电力公司正在美国投资建造出口终端,以对冲价格波动风险。目前,氨和氢的混烧试验正在进行中,但尚未达到商业规模。

细分市场分析

预计到2025年,可再生能源在日本电力市场的份额将达到40.05%,并在2031年之前保持3.72%的复合年增长率,这主要得益于太阳能和离岸风电的快速发展。太阳能光电发电累积装置容量已达91吉瓦,主要得益于组件价格的下降和商业购电协议(PPA)的普及。离岸风电目前仅有0.3吉瓦的运作资产,但随着政府设定在2030年达到10吉瓦、到2040年达到45吉瓦的支持目标,预计离岸风电将成为所有能源中绝对成长速度最快的。地热能和生质能由于许可证限制和进口原料成本较高,目前仍处于小众市场。

预计到2025年,火力发电在日本电力市场仍占51.80%的份额,但不断上涨的碳价和强制性氨气混烧正对其长期经济可行性构成压力。日本能源研究机构(JERA)在其装置容量为4.1吉瓦的碧南燃煤发电厂开展的试点项目成功实现了20%的氨气混烧率,政府计划到2030年在所有电厂推广这项技术,这将需要每年进口300万吨氨气。核电预计将于2024年运作,核能发电为826兆瓦,随着民众接受度的提高,核电可望逐步实现20%的发电份额目标。水力发电装置容量保持稳定,约50吉瓦,因为新建水坝工程面临环境法规的限制。这些市场份额的波动表明,日本电力市场的投资正在转移到低碳设施。

日本电力市场报告按能源类型(火力发电、核能、可再生能源)和终端用户(电力公司、工商业用户、住宅)进行细分。市场规模和预测以装置容量(GW)为单位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 降低光学模组和安装成本

- 扩大离岸风力发电竞标渠道

- 根据GX政策运作核子反应炉

- 电网级电池成本下降

- 重工业的购电协议(PPA)需求

- 智慧电錶部署和需量反应的潜力

- 市场限制

- 液化天然气价格波动与进口依赖性

- 公用事业太阳能用地短缺

- 老化的输电设施和审批程序延误

- 当地居民反对新建高压输电线路

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- PESTEL 分析

第五章 市场规模与成长预测

- 透过电源

- 火力发电(煤炭、天然气、石油/天然气、柴油)

- 核能

- 可再生能源(太阳能、风能、水能、地热能、生质能/废弃物、潮汐能)

- 最终用户

- 公用事业

- 商业和工业

- 住宅

- 按输配电和电压等级(仅定性分析)

- 高压输电(230千伏特或更高)

- 二次输电(69 至 161 千伏特)

- 中压输电(13.2 至 34.5 千伏特)

- 低压输电(1千伏特或以下)

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、伙伴关係、购电协议)

- 市场占有率分析(主要企业的市场排名和份额)

- 公司简介

- Tokyo Electric Power Company Holdings(TEPCO)

- Kansai Electric Power Company

- Chubu Electric Power

- Hokkaido Electric Power

- Tohoku Electric Power

- Hokuriku Electric Power

- Chugoku Electric Power

- Shikoku Electric Power

- Kyushu Electric Power

- Okinawa Electric Power

- JERA Co., Inc.

- Electric Power Development Co.(J-POWER)

- Japan Renewable Energy Corporation

- Hitachi Energy

- Mitsubishi Electric Corporation

- Toshiba Energy Systems & Solutions

- Sumitomo Corporation(Renewables)

- Marubeni Corporation(Power)

- Mitsubishi Heavy Industries(Energy)

- Orsted Japan KK

第七章 市场机会与未来展望

Japan Power Market size in 2026 is estimated at 397.34 gigawatt, growing from 2025 value of 393.33 gigawatt with 2031 projections showing 417.99 gigawatt, growing at 1.02% CAGR over 2026-2031.

Steady headline growth conceals structural change: policy now channels the USD 1 trillion Green Transformation (GX) budget into renewable build-out, nuclear restarts, and high-voltage direct-current (HVDC) interties that knit the historically fragmented 50 Hz/60 Hz grids into one commercial arena. Declining solar photovoltaic (PV) costs, offshore wind auction momentum, and accelerating grid-scale battery storage sharpen competitive pressure on legacy liquefied natural gas (LNG) plants, while hydrogen and ammonia co-firing pilots begin hedging fuel-price risk. Energy Storage News. At the same time, Japan's Cabinet now targets a 40-50% renewable share and a 20% nuclear contribution by 2040 to secure supply for energy-intensive semiconductor and artificial-intelligence clusters. Corporate power-purchase agreements (PPAs), smart-meter data analytics, and demand-response programs amplify these shifts by monetizing grid flexibility in urban corridors where consumption peaks persist despite population decline.

Japan Power Market Trends and Insights

Declining PV Module & Installation Costs

Module prices fell from 17.6 yen/kWh in 2018 to below 8 yen/kWh for several 2024 bids, letting solar compete in wholesale markets without subsidies. Hardware deflation and streamlined soft costs now move the technology from feed-in-tariff reliance toward auction-based price discovery. This cost curve dovetails with rooftop and agrivoltaic deployment that circumvents land scarcity. Manufacturers such as Murata locked 70 MW through virtual PPAs to meet RE100 goals, anchoring demand in industrial corridors. As battery prices drop, midday solar peaks increasingly shift into evening demand, eroding peaking-plant margins and reshaping capacity-market dynamics.

Offshore Wind Auction Pipeline Expansion

Round-3 tenders in December 2024 awarded 1 GW at JPY 3/kWh, confirming cost parity with conventional generation. Floating foundations unlock deeper waters and sidestep coastal depth constraints, with JERA-led groups targeting typhoon-resilient platforms. Government grid-reservation directives now coordinate seabed leases with transmission build-outs, mitigating a historic bottleneck. European developers transfer harsh-environment know-how, while Japanese trading houses supply project finance in a hybrid model that builds domestic supply chains. Resolution of fishing-industry consultations and port-infrastructure upgrades will decide whether the sector can hit the 10 GW by 2030 milestone.

LNG Price Volatility & Import Reliance

Japan imports 96% of its energy, so LNG spot surges once drove day-ahead power prices above USD 1/kWh, compressing utility margins. Although nuclear restarts cut LNG burn 25% since 2014, residual dependency persists. Trading houses now resell contracted cargoes abroad, signalling structural demand erosion, while Kyushu Electric pursues upstream stakes in US export terminals to hedge volatility. Co-firing ammonia or hydrogen is under trial but lacks commercial scale.

Other drivers and restraints analyzed in the detailed report include:

- Nuclear Reactor Restarts Under GX Policy

- Grid-Scale Battery Storage Cost Declines

- Limited On-Shore Land for Utility Solar

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The renewables slice of the Japan power market size climbed to 40.05% in 2025 and is tracking a 3.72% CAGR through 2031 as solar and offshore wind scale rapidly. Solar alone reached 91 GW cumulative capacity, bolstered by low module prices and merchant PPA uptake. Offshore wind holds just 0.3 GW of operating assets but 10 GW of government-backed targets by 2030 and up to 45 GW by 2040, setting the stage for the fastest absolute growth among resources. Geothermal and biomass remain niche due to permitting limits and imported feedstock costs.

Thermal generation defended 51.80% Japan's power market share in 2025, yet escalating carbon prices and ammonia co-firing mandates pressure long-term economics. JERA's pilot at the 4.1 GW Hekinan coal plant blends 20% ammonia, and government policy seeks fleet-wide adoption by 2030, requiring 3 million t of annual imports. Nuclear restarts added 826 MW in 2024 and will climb toward the 20% generation share goal if community consent improves. Hydropower remains flat at roughly 50 GW because new dam sites face environmental limits. Collectively, shifting shares underscore how investment is tilting toward zero-carbon capacity within the Japan power market.

The Japan Power Market Report is Segmented by Power Source (Thermal, Nuclear, and Renewables) and End-User (Utilities, Commercial and Industrial, and Residential). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Tokyo Electric Power Company Holdings (TEPCO)

- Kansai Electric Power Company

- Chubu Electric Power

- Hokkaido Electric Power

- Tohoku Electric Power

- Hokuriku Electric Power

- Chugoku Electric Power

- Shikoku Electric Power

- Kyushu Electric Power

- Okinawa Electric Power

- JERA Co., Inc.

- Electric Power Development Co. (J-POWER)

- Japan Renewable Energy Corporation

- Hitachi Energy

- Mitsubishi Electric Corporation

- Toshiba Energy Systems & Solutions

- Sumitomo Corporation (Renewables)

- Marubeni Corporation (Power)

- Mitsubishi Heavy Industries (Energy)

- Orsted Japan K.K.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Declining PV Module & Installation Costs

- 4.2.2 Offshore Wind Auction Pipeline Expansion

- 4.2.3 Nuclear Reactor Restarts Under GX Policy

- 4.2.4 Grid-Scale Battery Storage Cost Declines

- 4.2.5 Corporate PPA Demand from Heavy Industry

- 4.2.6 Smart-Meter Roll-Out & Demand-Response Upside

- 4.3 Market Restraints

- 4.3.1 LNG Price Volatility & Import Reliance

- 4.3.2 Limited On-Shore Land for Utility Solar

- 4.3.3 Ageing Transmission Assets & Permitting Delays

- 4.3.4 Local Opposition to New High-Voltage Lines

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Power Source

- 5.1.1 Thermal (Coal, Natural Gas, Oil and Diesel)

- 5.1.2 Nuclear

- 5.1.3 Renewables (Solar, Wind, Hydro, Geothermal, Biomass & Waste, Tidal)

- 5.2 By End User

- 5.2.1 Utilities

- 5.2.2 Commercial and Industrial

- 5.2.3 Residential

- 5.3 By T&D Voltage Level (Qualitative Analysis only)

- 5.3.1 High-Voltage Transmission (Above 230 kV)

- 5.3.2 Sub-Transmission (69 to 161 kV)

- 5.3.3 Medium-Voltage Distribution (13.2 to 34.5 kV)

- 5.3.4 Low-Voltage Distribution (Up to 1 kV)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Tokyo Electric Power Company Holdings (TEPCO)

- 6.4.2 Kansai Electric Power Company

- 6.4.3 Chubu Electric Power

- 6.4.4 Hokkaido Electric Power

- 6.4.5 Tohoku Electric Power

- 6.4.6 Hokuriku Electric Power

- 6.4.7 Chugoku Electric Power

- 6.4.8 Shikoku Electric Power

- 6.4.9 Kyushu Electric Power

- 6.4.10 Okinawa Electric Power

- 6.4.11 JERA Co., Inc.

- 6.4.12 Electric Power Development Co. (J-POWER)

- 6.4.13 Japan Renewable Energy Corporation

- 6.4.14 Hitachi Energy

- 6.4.15 Mitsubishi Electric Corporation

- 6.4.16 Toshiba Energy Systems & Solutions

- 6.4.17 Sumitomo Corporation (Renewables)

- 6.4.18 Marubeni Corporation (Power)

- 6.4.19 Mitsubishi Heavy Industries (Energy)

- 6.4.20 Orsted Japan K.K.

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment

- 7.2 Progress in Japan's Offshore Wind Power Sector

- 7.3 Grid Digitalisation & Advanced Analytics

- 7.4 Hydrogen/Ammonia Co-Firing in Thermal Plants