|

市场调查报告书

商品编码

1906038

法国可再生能源市场-份额分析、产业趋势与统计、成长预测(2026-2031)France Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

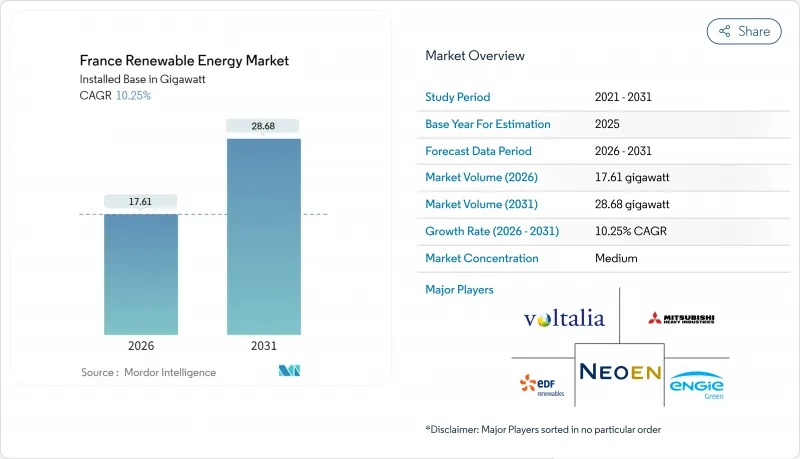

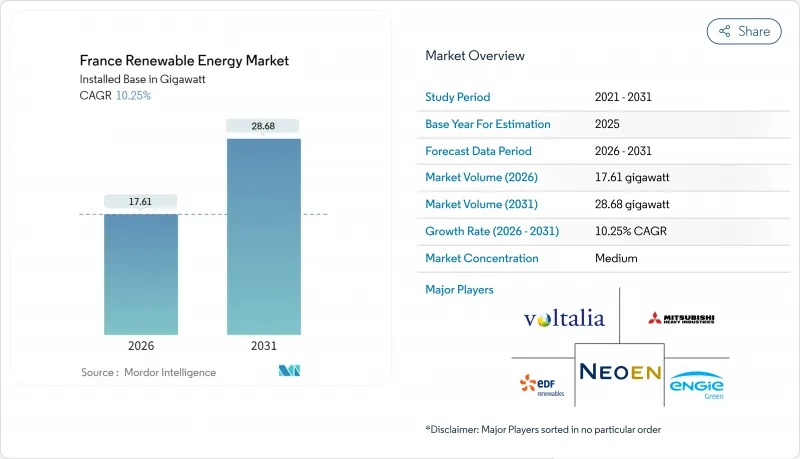

法国可再生能源市场预计将从 2025 年的 15.97 吉瓦成长到 2026 年的 17.61 吉瓦,从 2026 年到 2031 年的复合年增长率为 10.25%,到 2031 年达到 28.68 吉瓦。

这一稳步增长反映了具有约束力的欧盟再生能源指令(REPowerEU Directive)、国际可再生能源机构(IRENA)报告的2024年太阳能光伏安装成本下降20%以及2024年企业购电协议(PPA)项目储备超过1842吉瓦时(GWh)。平准化成本的下降已使计划回报率超过法国退休基金所青睐的8%门槛,从而帮助公共产业和独立发电商(IPP)加快专案储备的转换。根据修订后的多年能源计画(PPE2),离岸风电竞标正在扩大技术多样性,并促进国内银行提供长期企划案融资。同时,2024年《农光互补法》将允许在葡萄和谷物种植区50万公顷土地上进行双重用途,为下一阶段的商业规模太阳能成长奠定基础。随着 EDF Renewables、TotalEnergies 和 Engie Green 等综合公共产业与 Neoen、Voltalia 和 Akuo Energy 等公司争夺上网电价补贴和商业购电协议,竞争日益激烈。同时,预计到 2040 年,布列塔尼和普罗旺斯-阿尔卑斯-蓝色海岸地区需要 1000 亿欧元的电网升级改造,以消除电网瓶颈。

法国可再生能源市场趋势与分析

欧盟「Fit for 55」和「REPowerEU」目标加速了法国可再生能源的普及。

布鲁塞尔呼吁法国将可再生能源在最终能源消耗的比例从2024年的20.7%提高到2030年的42.5%。来自復苏与韧性基金的54亿欧元津贴将用于支持电网强化、许可程序数位化以及储能示范项目,以促进併网。法国更新后的《国家能源与气候计画》承诺在2030年新增54-60吉瓦太阳能装置容量和33-35吉瓦陆上风电装置容量,使年新增装置容量翻三倍。由于欧盟排放交易体系(EU ETS)的排放权价格超过每吨80欧元,边际经济效益已显着向风能和太阳能倾斜。同时,可再生热能和交通运输配额正在加速生物甲烷的部署。每两年一次的合规查核点提供了严格的保障,维持了政策压力,并增强了投资者对法国可再生能源市场的信心。

多年能源计画2(PPE2)扩大离岸风电竞标计画范围

修订后的PPE2计画分四轮竞标,总合装置容量达17.2吉瓦离岸离岸风力发电。其中,2024年AO7轮招标的得标价格为每兆瓦时69欧元,比先前的价格上限降低了30%。大西洋固定风计划的运转率超过50%,而地中海浮体式竞标则促进了圣纳泽尔和瑟堡当地製造地的发展。欧盟的在地采购要求规定,机舱价值的40%和下部结构的60%必须在欧盟境内采购,这有助于供应链在地化和创造就业机会。该计画每兆瓦的资本密集度为300万欧元,主要依靠法国巴黎银行和法国兴业银行主导的企业联合组织贷款。由于其商业运营后的市场风险较低,对于寻求长期投资的退休基金而言,该项目极具吸引力。

冗长的审批程序和法律诉讼延缓了併网可再生能源发电。

陆域发电工程从可行性研究到商业营运平均需要七到九年,此外还需要四年用于行政审批,以及长达三年的法律诉讼。距离住宅500公尺的退让距离限制了60%的潜在开发地块,而军用机场周围的雷达限制又排除了另外10%的地块。 2024年,15%的都道府县知事核准因诉讼而被推翻,迫使开发人员重新进行研究,并降低了专案的净现值。这种负担对没有内部法律团队的小规模开发商影响最大,使得市场力量向大型公用事业公司倾斜。

细分市场分析

预计到2024年,太阳能光电发电将新增2.8吉瓦装置容量,并在2031年之前以18.55%的年平均成长率持续成长,成为法国可再生能源市场中成长最快的领域。两大关键驱动因素分别是农光互补(将在50万公顷土地上实现水电两用)以及对面积超过1000平方米的新建商业建筑强制安装屋顶光伏系统。到2025年,水力发电将占总装置容量的33.12%,即使在环境限制了新专案的开发,水力发电仍能提供必要的抽水柔软性。风力发电正迎头赶上,新增装置容量达3吉瓦,离岸风电竞标达17.2吉瓦。生质能源的目标是到2030年达到44兆瓦时的生物甲烷产量。海洋能和地热能仍处于示范阶段,总合占不到1%。

太阳能发电的蓬勃发展正加速法国可再生能源市场的成长,双面组件的效率已达22%,追踪器在奥克西塔尼和新阿基坦大区的应用也日益普及。离岸风电规模庞大且多样化,大西洋的固定式离岸风计划和地中海的浮动式风力发电充分利用了深海域的潜力。水力发电的老旧机组正在进行大规模维修,到2030年,法国也将新增2吉瓦抽水蓄能电站,以整合剩余的太阳能电力。生质能源的成长依赖沼气池处理法规的完善,阿尔萨斯地区的地热试点计画正致力于在扩大规模前大幅降低成本。

法国可再生能源市场报告按技术(太阳能、风能、水力、生质能源、地热能和海洋能)和最终用户(公共产业、商业和工业以及住宅)进行细分。市场规模和预测以装置容量(吉瓦)为单位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧盟「Fit for 55」和「REPowerEU」目标加速了法国可再生能源的普及。

- 多年能源计画2(PPE2)将导致离岸风电竞标数量增加

- 降低太阳能和陆域风力发电的平准化度电成本可提高计划内部收益率

- 随着40家CAC公司透过范围1-2排放实现脱碳,企业购电协议(PPA)激增

- 运作老旧风电场,无需额外土地即可使发电量增加一倍。

- 农光互补技术允许农业用地实现双重用途

- 市场限制

- 冗长的审批程序和法律诉讼延缓了可再生能源併网进程。

- 布列塔尼和普罗旺斯-阿尔卑斯-蓝色海岸大区(PACA)的电网拥塞限制了新增容量。

- 核能发电厂扩建工程造成技术纯熟劳工短缺。

- 锂离子电池供不应求限制了并联储能係统的引入。

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- PESTEL 分析

第五章 市场规模与成长预测

- 透过技术

- 太阳能(光伏和聚光太阳能)

- 风力发电(陆上和海上)

- 水力发电(小规模、大型、抽水蓄能)

- 生质能源

- 地热

- 海洋能(潮汐和波浪)

- 最终用户

- 公用事业

- 商业和工业

- 住宅

第六章 竞争情势

- 市场集中度

- 策略性措施(併购、合资、资金筹措、购电协议)

- 市场占有率分析(主要企业的市场排名和份额)

- 公司简介

- EDF Renewables

- TotalEnergies Renewables

- Engie Green

- Neoen SA

- Voltalia SA

- Akuo Energy

- Albioma SA

- Boralex Inc

- WPD Offshore France

- RWE Renewables France

- Iberdrola(Ailes Marines)

- Enel Green Power France

- Orsted France

- Vestas France

- Siemens Gamesa RE France

- GE Vernova France

- Nordex France

- BayWa re France

- Envision France

第七章 市场机会与未来展望

The France Renewable Energy Market is expected to grow from 15.97 gigawatt in 2025 to 17.61 gigawatt in 2026 and is forecast to reach 28.68 gigawatt by 2031 at 10.25% CAGR over 2026-2031.

Steady momentum reflects binding REPowerEU mandates, a 20% fall in solar-PV installed costs reported by IRENA in 2024, and a corporate PPA pipeline that surpassed 1,842 GWh during 2024. Falling levelized costs have lifted project returns above the 8% hurdle preferred by French pension funds, helping utilities and independent power producers accelerate the conversion of their pipelines. Offshore wind auctions under the revised Multi-year Energy Programme (PPE2) are broadening the diversity of technology and crowding in long-term project finance from domestic banks. At the same time, agrivoltaics legislation enacted in 2024 is unlocking dual land use across 500,000 hectares of viticulture and cereal zones, laying the groundwork for the next growth leg of commercial-scale solar. Competitive intensity is rising as integrated utilities, such as EDF Renewables, TotalEnergies, and Engie Green, vie with Neoen, Voltalia, and Akuo Energy for feed-in tariff contracts and corporate off-take agreements. Meanwhile, grid bottlenecks in Brittany and Provence-Alpes-Cote d'Azur are expected to require EUR 100 billion of transmission upgrades through 2040.

France Renewable Energy Market Trends and Insights

EU Fit-for-55 And REPowerEU Targets Accelerate French RES Uptake

Brussels requires France to lift the renewable share of final energy consumption to 42.5% by 2030, up from 20.7% in 2024. Recovery and Resilience Facility grants of EUR 5.4 billion support grid reinforcement, permitting digitalization, and storage pilots that ease integration. France's updated National Energy and Climate Plan commits to 54-60 GW of solar and 33-35 GW of onshore wind by 2030, requiring a threefold increase in annual installation rates. Allowance prices above EUR 80 per ton under the EU ETS shift marginal economics decisively in favor of wind and solar, while renewable heat and transport mandates accelerate the injection of biomethane. Compliance checkpoints every two years create a hard back-stop that keeps policy pressure high and maintains investor confidence in the France renewable energy market.

Multi-year Energy Programme (PPE2) Raises Offshore Wind Auction Pipeline

The revised PPE2 schedules 17.2 GW of offshore wind capacity across four auction rounds, with strike prices in the 2024 AO7 round clearing at EUR 69 /MWh, 30% below earlier ceilings. Atlantic fixed-bottom projects boast capacity factors exceeding 50%, while Mediterranean floating auctions are driving the development of local manufacturing hubs in Saint-Nazaire and Cherbourg. Local-content rules that require 40% nacelle value and 60% foundation fabrication within the EU are fostering supply-chain localization and job creation. Capital intensity of EUR 3 million per MW concentrates financing in syndicates led by BNP Paribas and Societe Generale; however, the low merchant exposure after COD makes the assets attractive to pension funds seeking duration.

Lengthy Permitting & Court Appeals Delay Grid-Connected RES

Onshore wind projects average 7-9 years from feasibility to COD, with administrative steps consuming four years and court appeals adding up to three more. Setback distances of 500 m from residences curtail 60% of otherwise viable parcels, while radar rules near military airbases eliminate an additional 10%. Appeals overturned 15% of prefectural approvals in 2024, forcing developers to restart studies and eroding net present value. The burden falls hardest on small developers lacking in-house legal teams, tilting market power toward large utilities.

Other drivers and restraints analyzed in the detailed report include:

- Falling LCOE of Solar-PV & Onshore Wind Improves Project IRR

- Corporate PPAs Surge As CAC-40 Firms Decarbonize Scopes 1-2

- Grid Congestion In Brittany & PACA Limits Additional Capacity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solar added 2.8 GW in 2024 and is forecast to expand at a 18.55% CAGR through 2031, the strongest uplift in the France renewable energy market. Two drivers dominate: agrivoltaics, which open up dual land use on 500,000 hectares, and rooftop mandates on new commercial buildings exceeding 1,000 m2. Hydropower retained 33.12% of installed capacity in 2025, providing indispensable pumped-storage flexibility even as environmental constraints cap greenfield development. Wind energy follows, buoyed by 3 GW of repowering and 17.2 GW of offshore auctions, while bioenergy pursues France's 44 TWh biomethane target for 2030. Ocean and geothermal energy remain at the demonstration stage, adding, accounting for less than 1% combined capacity.

Solar's momentum accelerates the France renewable energy market as bifacial modules reach 22% efficiency and tracker penetration deepens across Occitanie and Nouvelle-Aquitaine. Offshore wind contributes scale and diversity, with fixed-bottom Atlantic projects and floating Mediterranean farms capturing deep-water potential. Hydropower's aging fleet receives targeted upgrades that add 2 GW of pumped storage by 2030 to integrate solar oversupply. Bioenergy growth hinges on digestate disposal regulations, and geothermal pilots in Alsace aim to achieve cost breakthroughs before scaling up.

The France Renewable Energy Market Report is Segmented by Technology (Solar Energy, Wind Energy, Hydropower, Bioenergy, Geothermal, and Ocean Energy) and End-User (Utilities, Commercial and Industrial, and Residential). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- EDF Renewables

- TotalEnergies Renewables

- Engie Green

- Neoen SA

- Voltalia SA

- Akuo Energy

- Albioma SA

- Boralex Inc

- WPD Offshore France

- RWE Renewables France

- Iberdrola (?Ailes Marines)

- Enel Green Power France

- Orsted France

- Vestas France

- Siemens Gamesa RE France

- GE Vernova France

- Nordex France

- BayWa r.e. France

- Envision France

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU Fit-for-55 & REPowerEU targets accelerate French RES uptake

- 4.2.2 Multi-year Energy Programme (PPE2) raises offshore wind auction pipeline

- 4.2.3 Falling LCOE of solar-PV & onshore wind improves project IRR

- 4.2.4 Corporate PPAs surge as CAC-40 firms decarbonise scopes 1-2

- 4.2.5 Repowering ageing wind farms doubles yield without extra land

- 4.2.6 Agrivoltaics law unlocks dual-land use in agri-regions

- 4.3 Market Restraints

- 4.3.1 Lengthy permitting & court appeals delay grid-connected RES

- 4.3.2 Grid congestion in Brittany & PACA limits additional capacity

- 4.3.3 Nuclear life-extension works squeeze skilled labour pool

- 4.3.4 Li-ion cell shortages constrain co-located storage roll-outs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTEL Analysis

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Energy (PV and CSP)

- 5.1.2 Wind Energy (Onshore and Offshore)

- 5.1.3 Hydropower (Small, Large, PSH)

- 5.1.4 Bioenergy

- 5.1.5 Geothermal

- 5.1.6 Ocean Energy (Tidal and Wave)

- 5.2 By End-User

- 5.2.1 Utilities

- 5.2.2 Commercial and Industrial

- 5.2.3 Residential

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JVs, Funding, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Products & Services, Recent Developments)

- 6.4.1 EDF Renewables

- 6.4.2 TotalEnergies Renewables

- 6.4.3 Engie Green

- 6.4.4 Neoen SA

- 6.4.5 Voltalia SA

- 6.4.6 Akuo Energy

- 6.4.7 Albioma SA

- 6.4.8 Boralex Inc

- 6.4.9 WPD Offshore France

- 6.4.10 RWE Renewables France

- 6.4.11 Iberdrola (?Ailes Marines)

- 6.4.12 Enel Green Power France

- 6.4.13 Orsted France

- 6.4.14 Vestas France

- 6.4.15 Siemens Gamesa RE France

- 6.4.16 GE Vernova France

- 6.4.17 Nordex France

- 6.4.18 BayWa r.e. France

- 6.4.19 Envision France

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment