|

市场调查报告书

商品编码

1906081

中东和非洲施工机械:市场份额分析、行业趋势、统计数据和成长预测(2026-2031 年)Middle East And Africa Construction Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

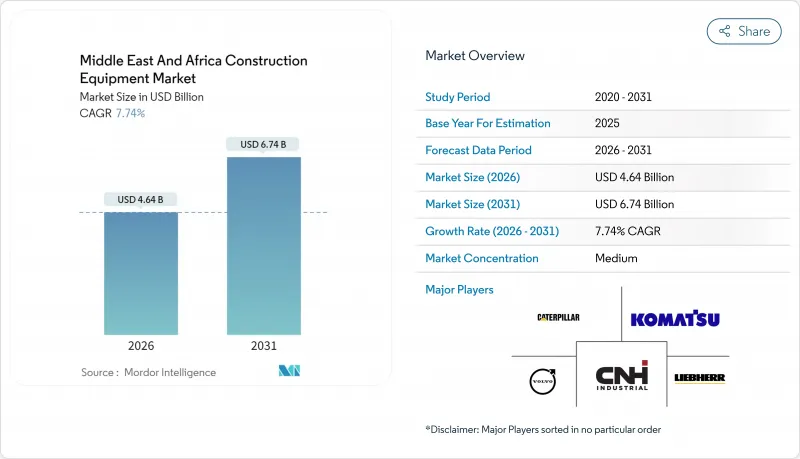

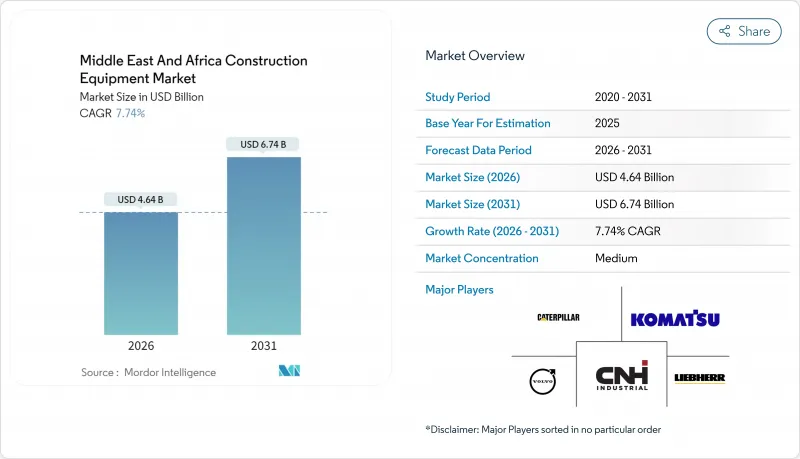

预计到 2026 年,中东和非洲施工机械市场规模将达到 46.4 亿美元,高于 2025 年的 43.1 亿美元,预计到 2031 年将达到 67.4 亿美元,2026 年至 2031 年的复合年增长率为 7.74%。

波湾合作理事会(GCC)正经历创纪录的2兆美元基础设施发展计划,施工机械市场成长远高于全球平均水准。沙乌地阿拉伯正透过其「2030愿景」大型企划推动投资,而卡达则在世界杯后的投资热潮中保持成长势头,并继续推进其「2030国家愿景」多元化发展计画。承包商充足的订单、向数位化车队优化方向的明显转变以及不断扩大的电池矿物开采活动,共同增强了市场需求的韧性。同时,儘管混合动力和纯电子机械的普及速度加快,但柴油动力车队仍然保持着主导地位,因为承包商需要在可靠性和新的永续性要求之间寻求平衡。

中东及非洲施工机械市场趋势及分析

海湾合作委员会大型企划计画推动资本需求

沙乌地阿拉伯的「2030愿景」计画累计1兆美元用于基础建设,其中包括需要塔式起重机的NEOM新城开发计划。为此,沃尔夫克兰和扎米尔集团在该地区建立了首个塔式起重机製造厂。在阿联酋,超过6500亿美元的在建和订单计划推动着建筑业的发展,而卡达耗资250亿美元的国家铁路项目也为建筑业提供了持续的动力。像NEOM与三星物产签订的价值13亿沙特里亚尔的机器人合约这样的合资项目,将减少80%的人工钢筋作业,进一步刺激了对自动化设备的需求。长期前景和政府资金的支持帮助施工机械市场抵御了全球经济放缓的影响,保持了原始设备製造商和经销商订单的稳定性。

全部区域的所有权模式正从所有权模式转向租赁模式

为了因应设备购置成本上涨(自2020年以来已上涨20%),承包商正转向租赁模式。联合租赁公司(United Rentals)报告称,由于其中东客户扩大了包含远端资讯处理服务操作员培训的短期合同,该公司2024年的收入将有所增长。哈克租赁公司(Hark Rentals)也预计,在类似综合服务产品的推动下,2025年该地区将实现成长。沙乌地阿拉伯的租赁市场正以两位数的复合年增长率成长,这主要得益于在高利率环境下优化现金流。这种模式有助于提高产能运转率,并符合永续性目标,使用户无需大量前期投资即可使用新一代电动挖土机,从而推动施工机械市场的发展。

原油价格波动会延后资本投资决策。

原油价格飙升导致承包商重新谈判成本加成合同,并缩减可自由支配的船队预算,因为他们预计资金筹措。 2020年,海上油气产业大幅削减了资本支出,推迟了需要专用起重机和派饼的平台扩建项目。尼日利亚的情况凸显了这种影响的严重性。布兰特原油价格上涨导致建筑材料成本飙升,儘管GDP成长,但信贷紧缩,新设备订单却放缓。然而,海湾合作委员会(GCC)国家经济多元化,政府担保的公共工程项目稳定了采购进度,有助于缓衝市场波动,并限制施工机械市场的下行风险。

细分市场分析

至2025年,挖土机将占中东和非洲施工机械市场35.75%的份额,凸显其在公共大型企划、采矿和住宅开发中的核心角色。预计到2031年,挖土机相关施工机械市场规模将以7.79%的复合年增长率成长,主要受卡达国家铁路计画大规模沟槽挖掘和埃及水泥厂石灰石表土清除需求的推动。配备自动坡度控制设备和高空拆除臂的挖土机可将工作效率提高五分之一,促使大型建设公司重复订购。

刚果民主共和国的电池矿物开采需求也反映了这一趋势,该国深层钴矿需要配备加固底盘的90吨级挖土机。严格的建筑安全标准促使人们更倾向于配备360度摄影机和远端资讯处理系统的挖土机,从而使其运转率提高了五倍。轮式装载机和履带起重机等配套设备用于骨材运输和高层建筑吊装,但其成长势头落后于挖土机。在沙乌地阿拉伯,模组化住宅工厂对伸缩臂叉装机的需求不断增长,而后铲式装载机则被用于挖掘城市多式联运道路上的公共工程沟渠。

到2025年,柴油和内燃机(ICE)车型将占中东和非洲施工机械市场72.63%的份额,证实了非洲沙漠地区和偏远地区对传统动力传动系统的持续依赖。耐高温引擎结合多级过滤器,即使在高达50°C的温度下也能确保运作。然而,随着海湾合作委员会(GCC)的脱碳政策推动范围1排放目标的实现,电动和混合动力车型预计将以7.75%的复合年增长率成长。

卡特彼勒320电动挖土机单次充电即可运作8小时,并可直接连接至车队远端资讯处理系统,方便在混合动力车队中部署。零排放设备正越来越多地被指定用于杜拜地铁隧道项目,矿业营运商也正利用地下通风成本降低的优势。儘管电池因高温而劣化以及充电基础设施不足等挑战减缓了都市区的普及速度,但租赁公司正透过将行动充电器纳入其设备服务包来加速推广。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 海湾合作委员会大型企划管道专案推动设备需求成长

- 全部区域的所有权模式正从所有权模式转向租赁模式

- 非洲各地快速城市住宅计划

- 在地采购法规推动了整车製造商和本地合资企业的组装发展。

- 远端资讯处理即服务在偏远沙漠地区车队优化的应用

- 电池矿物开采(锂、锰)需要大型装载机

- 市场限制

- 原油价格週期性波动会延后资本投资决策。

- 政治和安全热点问题阻碍了计划实施

- 港口拥塞导致关键备件分发延误

- 新一代电子机械工程师短缺

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模及成长预测(价值(美元))

- 按机器类型

- 挖土机

- 轮式装载机

- 履带起重机

- 伸缩臂堆高机

- 后铲式装载机

- 滑移装载机和小型履带装载机

- 平土机机

- 推土机和推土铲

- 沥青铺筑机和压路机

- 铰接式自动卸货卡车

- 挖沟工人和其他人

- 按驱动类型

- 柴油/内燃机

- 电动和混合动力

- 油压

- 透过输出

- 100马力或以下

- 101-200马力

- 201-400马力

- 超过400马力

- 透过使用

- 基础设施和交通运输

- 石油和天然气

- 采矿和采石

- 商业建筑

- 住宅

- 工业/製造业

- 最终用户

- 承包商

- 设备租赁公司

- 政府/市政当局

- 矿业公司

- 按国家/地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 阿曼

- 科威特

- 巴林

- 南非

- 其他中东和非洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Caterpillar Inc.

- Komatsu Ltd.

- Volvo AB

- Hitachi Construction Machinery

- Liebherr Group

- CNH Industrial(Case CE)

- JCB Ltd.

- Doosan Corporation

- Kobelco Construction Machinery

- Tadano Ltd.

- Manitowoc Company Inc.

- Sumitomo Construction Machinery

- Mitsubishi Corporation

- XCMG

- SANY Heavy Industry

- Hyundai Genuine

- Deere & Company(Wirtgen)

- Bobcat Company

- Zoomlion Heavy Industry

- Terex Corporation

第七章 市场机会与未来展望

The Middle East And Africa Construction Equipment Market size in 2026 is estimated at USD 4.64 billion, growing from 2025 value of USD 4.31 billion with 2031 projections showing USD 6.74 billion, growing at 7.74% CAGR over 2026-2031.

The construction equipment market benefits from an unprecedented USD 2 trillion infrastructure pipeline across the Gulf Cooperation Council (GCC), positioning regional growth far ahead of the global average. Saudi Arabia drives spending through Vision 2030 mega-projects, while Qatar sustains momentum with post-World-Cup investments and continues to implement National Vision 2030 diversification programs. Robust contractor backlogs, a clear pivot toward digital fleet optimization, and expanding mining activity for battery minerals collectively reinforce demand resilience. Meanwhile, the diesel-powered fleet maintains dominance despite accelerating adoption of hybrid and fully electric machines as contractors balance reliability with emerging sustainability requirements.

Middle East And Africa Construction Equipment Market Trends and Insights

GCC Mega-Projects Pipeline Accelerates Equipment Demand

Saudi Arabia's Vision 2030 agenda earmarks USD 1 trillion for infrastructure, including NEOM development that requires tower cranes, prompting Wolffkran and Zamil Group to establish the region's first tower-crane manufacturing facility. The UAE supports momentum with more than USD 650 billion in active or awarded projects, while Qatar's USD 25 billion National Rail Scheme sustains construction work. Joint ventures such as NEOM's SAR 1.3 billion robotics deal with Samsung C&T cut manual rebar labor by 80% yet intensify demand for automated equipment fleets. Long-term visibility and sovereign funding insulate the construction equipment market from global slowdowns, ensuring steady machine order books for OEMs and dealers.

Region-Wide Shift From Ownership To Rental Models

Contractors are pivoting toward rental to combat the two-fifth surge in equipment purchase prices since 2020. United Rentals reported a revenue uptick in 2024 as Middle East customers expand short-term contracts covering telematics, service, and operator training. Herc Rentals projects regional growth in 2025 on similar bundled offerings. Saudi Arabia's rental niche is tracking a double-digit CAGR, driven by cash-flow optimization during a high-interest environment. The model improves fleet utilization and opens access to next-generation electric excavators without large upfront capital, keeping the construction equipment market aligned with evolving sustainability targets.

Oil-Price Cyclicality Defers Capex Decisions

Sharp upward shifts in crude prices reduce discretionary fleet budgets because contractors anticipate cost-plus contract renegotiations and financing constraints. The offshore sector slashed in CAPEX in 2020, postponing platform expansions that otherwise require specialized cranes and pipelayers. Nigeria showcases the sensitivity: construction input costs spike when Brent exceeds tightening lending and dampening new equipment orders despite GDP growth. Nonetheless, diversified GCC economies cushion volatility via sovereign-backed public works that hold procurement schedules steady, limiting downside risk for the construction equipment market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Urban Housing Programmes Across Africa

- Local-Content Rules Driving Oem-Local Jv Assembly Lines

- Political & Security Hotspots Curb Project Execution

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Excavators accounted for 35.75% of Middle East and Africa construction equipment market in 2025, underscoring their pivotal role across public mega-projects, mining, and housing developments. The construction equipment market size attached to excavators is on track to rise at a 7.79% CAGR through 2031 in response to heavy trenching needs on Qatar's National Rail Scheme and limestone overburden removal at Egyptian cement sites. Excavators equipped with grade-control automatics and high-reach demolition booms deliver one-fifth efficiency gains, prompting repeat orders from Tier 1 contractors.

Demand also reflects battery-mineral extraction in the DRC, where deep-pit cobalt mines require 90-ton units with reinforced undercarriages. Stringent construction safety codes boost preference for excavators with 360-degree cameras and telematics, enabling one-fifth utilization improvements. Complementary categories including wheel loaders and crawler cranes, support aggregate transfer and high-rise lifts yet trail excavators in growth momentum. Telescopic handlers grow within modular housing plants in Saudi Arabia, while backhoe loaders supply utility trenching across mixed-traffic urban roads.

Diesel and ICE models represented 72.63% of Middle East and Africa construction equipment market in 2025, validating continued reliance on conventional powertrains in desert and off-grid African sites. High thermal-tolerance engines paired with multi-stage filtration safeguard uptime against 50 °C ambient conditions. Nevertheless, the electric and hybrid cohort is advancing at a 7.75% CAGR as GCC decarbonization policies push clients toward lower Scope 1 emissions targets.

Caterpillar's 320 Electric excavator delivers an eight-hour shift on a single charge and slots directly into fleet telematics dashboards, simplifying adoption within mixed-power fleets. Urban metro tunneling in Dubai increasingly specifies zero-tailpipe machines, while mining operators exploit reduced ventilation costs underground. Persistent constraints-battery degradation under heat and limited charging infrastructure-slow penetration outside metropolitan hubs, yet rental firms accelerate exposure by bundling mobile chargers into equipment-as-a-service packages.

The Middle East and Africa Construction Equipment Market Report is Segmented by Machinery Type (Excavators, Wheel Loaders, and More), Drive Type (Diesel/ICE and More), Power Output (Less Than or Equal To 100 HP and More), Application (Infrastructure & Transport, Oil & Gas, and More), End-User (Contractors, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Caterpillar Inc.

- Komatsu Ltd.

- Volvo AB

- Hitachi Construction Machinery

- Liebherr Group

- CNH Industrial (Case CE)

- JCB Ltd.

- Doosan Corporation

- Kobelco Construction Machinery

- Tadano Ltd.

- Manitowoc Company Inc.

- Sumitomo Construction Machinery

- Mitsubishi Corporation

- XCMG

- SANY Heavy Industry

- Hyundai Genuine

- Deere & Company (Wirtgen)

- Bobcat Company

- Zoomlion Heavy Industry

- Terex Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 GCC Mega-Projects Pipeline Accelerates Equipment Demand

- 4.2.2 Region-Wide Shift From Ownership To Rental Models

- 4.2.3 Rapid Urban Housing Programmes Across Africa

- 4.2.4 Local-Content Rules Driving Oem-Local Jv Assembly Lines

- 4.2.5 Telematics-As-A-Service For Remote Desert Fleet Optimisation

- 4.2.6 Battery-Mineral Mining (Lithium, Manganese) Needs Heavy Loaders

- 4.3 Market Restraints

- 4.3.1 Oil-Price Cyclicality Defers Capex Decisions

- 4.3.2 Political & Security Hotspots Curb Project Execution

- 4.3.3 Port Congestion Delays Critical Spare-Parts Flow

- 4.3.4 Shortage Of Technicians For Next-Gen Electric Machines

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Machinery Type

- 5.1.1 Excavators

- 5.1.2 Wheel Loaders

- 5.1.3 Crawler Cranes

- 5.1.4 Telescopic Handlers

- 5.1.5 Backhoe Loaders

- 5.1.6 Skid-Steer & Compact Track Loaders

- 5.1.7 Motor Graders

- 5.1.8 Bulldozers & Dozers

- 5.1.9 Asphalt Pavers & Road Rollers

- 5.1.10 Articulated Dump Trucks

- 5.1.11 Trenchers & Misc.

- 5.2 By Drive Type

- 5.2.1 Diesel / ICE

- 5.2.2 Electric & Hybrid

- 5.2.3 Hydraulic

- 5.3 By Power Output

- 5.3.1 Less than or equal to 100 HP

- 5.3.2 101-200 HP

- 5.3.3 201-400 HP

- 5.3.4 More than 400 HP

- 5.4 By Application

- 5.4.1 Infrastructure & Transport

- 5.4.2 Oil & Gas

- 5.4.3 Mining & Quarrying

- 5.4.4 Commercial Buildings

- 5.4.5 Residential

- 5.4.6 Industrial / Manufacturing

- 5.5 By End-User

- 5.5.1 Contractors

- 5.5.2 Equipment Rental Companies

- 5.5.3 Government & Municipalities

- 5.5.4 Mining Firms

- 5.6 By Country

- 5.6.1 Saudi Arabia

- 5.6.2 United Arab Emirates

- 5.6.3 Qatar

- 5.6.4 Oman

- 5.6.5 Kuwait

- 5.6.6 Bahrain

- 5.6.7 South Africa

- 5.6.8 Rest of Middle East and Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Caterpillar Inc.

- 6.4.2 Komatsu Ltd.

- 6.4.3 Volvo AB

- 6.4.4 Hitachi Construction Machinery

- 6.4.5 Liebherr Group

- 6.4.6 CNH Industrial (Case CE)

- 6.4.7 JCB Ltd.

- 6.4.8 Doosan Corporation

- 6.4.9 Kobelco Construction Machinery

- 6.4.10 Tadano Ltd.

- 6.4.11 Manitowoc Company Inc.

- 6.4.12 Sumitomo Construction Machinery

- 6.4.13 Mitsubishi Corporation

- 6.4.14 XCMG

- 6.4.15 SANY Heavy Industry

- 6.4.16 Hyundai Genuine

- 6.4.17 Deere & Company (Wirtgen)

- 6.4.18 Bobcat Company

- 6.4.19 Zoomlion Heavy Industry

- 6.4.20 Terex Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment