|

市场调查报告书

商品编码

1910886

欧洲施工机械租赁市场:市场份额分析、行业趋势、统计数据和成长预测(2026-2031 年)Europe Construction Machinery Rental - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

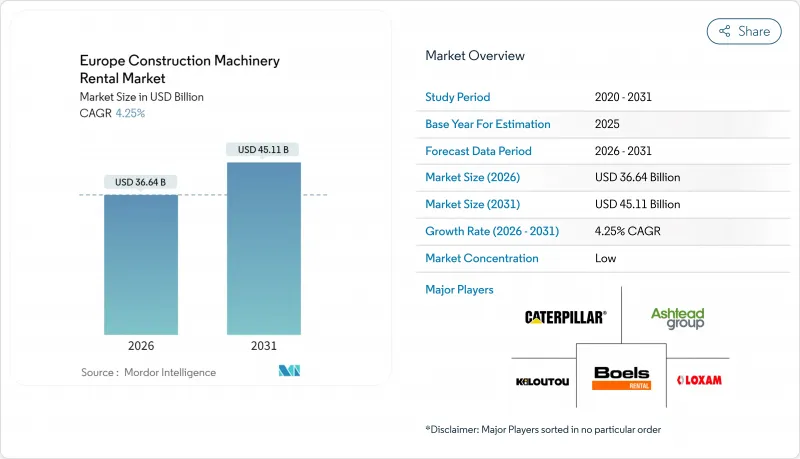

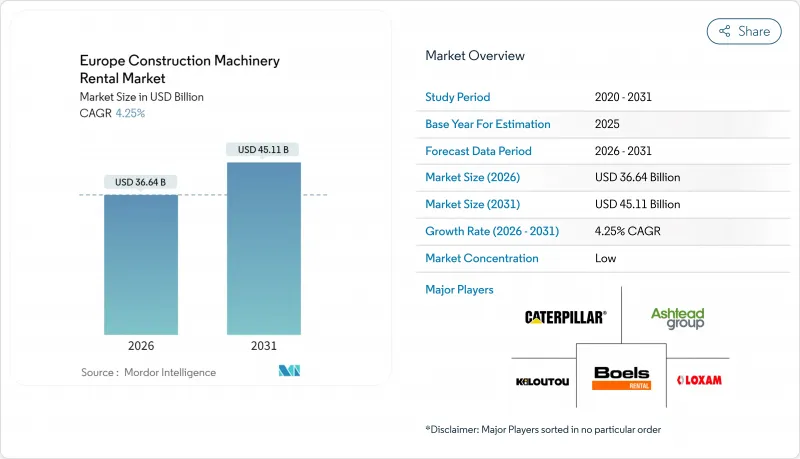

欧洲施工机械租赁市场预计将从 2025 年的 351.5 亿美元成长到 2026 年的 366.4 亿美元,预计到 2031 年将达到 451.1 亿美元,2026 年至 2031 年的复合年增长率为 4.25%。

这一稳步增长反映了对租赁机械的强劲需求、设备即服务 (EaaS) 合约的扩张以及全部区域因排放气体法规而进行的车队更新。欧洲施工机械租赁市场受益于欧盟支持的基础设施奖励策略、快速的电气化强制措施以及降低永续车队资本成本的 ESG 相关融资。营运商优先考虑透过远端资讯处理技术提高运转率,而各国政府则透过绿色交通走廊和数位连接计划来刺激需求。随着原始设备製造商 (OEM) 建立直接租赁部门、传统租赁巨头加快在欧洲的收购步伐以及数位市场降低搜寻和与承包商交易的成本,竞争日益激烈。

欧洲施工机械租赁市场趋势与洞察

欧盟基础设施奖励策略规模扩大(2025年及以后)

欧洲投资银行已承诺在2030年投入1.1兆欧元用于气候友善基础设施建设,而交通和数位走廊的计划带动了对挖土机、铺路机和塔式起重机租赁的持续需求。德国正大力推动基础设施和数位化能力的现代化。未来几年,德国已获得大量投资,用于升级交通网络并加速数位转型,催生了对专用土方车辆的需求。与以往週期不同,目前的预算拨款专注于可再生能源和光纤部署,迫使租赁公司采购诸如电缆犁和风力发电机机安装起重机等专用设备。供应紧张导致运转率上升,并引发短期价格上涨。经济奖励策略的连锁反应也正蔓延至交通枢纽週边的私人住宅和商业建设领域。

加速推进车辆电气化

欧盟委员会的「Fit for 55」计画要求到2030年将排放减少55%,迫使租赁公司从柴油动力系统转向电池氢动力系统。 JCB的氢燃料引擎计画目前正在11个国家进行试点,这是原始设备製造商(OEM)应对这项挑战的一个例证。瑞典和挪威的领先利用补贴来弥补更高的购买成本,并将这些溢价转让给旨在进入零排放区的承包商。此强制性要求还鼓励对充电站、技术人员再培训和数位化监控系统进行同步投资,从而在提高资本密集度的同时降低生命週期成本。

非道路移动机械引入中的不协调之处 第五阶段

非道路移动机械第五阶段排放法规于2019年生效,但各成员国的处罚力度不一,迫使租赁车队业者应对双重合规标准。跨境营运的公司为了确保每台设备都符合最严格的区域标准,正面临日益增长的物流和改装成本。

细分市场分析

截至2025年,土木机械占欧洲施工机械租赁市场的41.88%,预计到2031年,该类别将以4.55%的复合年增长率成长。履带挖土机尤其在主导,而轮式挖土机则为都市区交通提供支援。滑移装载机在需要紧凑型移动性的维修计划中需求日益增长。平地平土机和推土机则协助东欧高速公路网的扩建。欧洲施工机械租赁市场中挖掘和平整领域的规模也是电气化试点计画的重点,例如日立计画于2027年推出的1.7吨电池驱动挖土机。

随着建筑公司在不影响性能的前提下寻求满足城市排放法规,该行业的电气化进程正在加速。原始设备製造商 (OEM) 正在试验可更换电池组以减少充电运作,而租赁公司则引入行动充电器以维持运转率。领先的租赁公司正在将土木机械与现场电源装置捆绑销售,以提供整合式增值解决方案。

由于液压系统拥有久经考验的可靠性和广泛的服务网络,预计到2025年,其在欧洲施工机械租赁市场仍将占据77.95%的份额。然而,在北欧国家补贴政策和都市区低排放区不断扩大的推动下,纯电动驱动系统预计将实现11.85%的复合年增长率。柴油-电动混合动力系统则提供了一种过渡方案,既能节省燃油,又能避免在偏远地区出现续航里程焦虑。

欧洲施工机械租赁市场不同机型的普及速度各不相同。小型挖土机和剪式升降机正迅速完成运作,因为电池能量密度的提升使其能够实现全班作业。而大型设备则在等待下一代固态电池和氢燃料电池的到来,JCB正在进行的试验显示其具有长期发展潜力。租赁公司正透过引入可在柴油和电力驱动系统之间切换的模组化车队来分散风险。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 欧盟基础设施奖励策略大幅成长(2025年及以后)

- 加速车队电气化强制措施

- 透过与环境、社会及公司治理(ESG)相关的融资方式降低资本支出(CAPEX)。

- 转向设备即服务模式

- 重点关注欧盟分类法中的碳含量报告

- 用于零空转运转的现场安装式模组化电源单元

- 市场限制

- 非道路移动机械(NRMM)第五阶段实施中的不协调

- 由于操作人员短缺,人事费用不断上升。

- 由于柴油资产过时,次市场供应过剩

- 老旧机队遥测改造高成本

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

5. 市场规模及成长预测(价值,百万美元)

- 按机器类型

- 土木工程施工机械

- 挖土机

- 履带

- 带轮子的

- 装载机

- 滑移装载机

- 车轮

- 后铲

- 平土机机

- 推土机

- 挖土机

- 起重和物料输送

- 起重机

- 移动式起重机

- 塔式起重机

- 伸缩臂堆高机

- 高空作业平台

- 起重机

- 道路施工机械

- 摊舖机

- 压路机

- 沥青搅拌机

- 其他机器类型

- 土木工程施工机械

- 按驱动类型

- 油压

- 柴油-电力混合动力

- 全电动

- 氢燃料电池

- 透过使用

- 建筑施工

- 住宅

- 商业的

- 产业

- 基础设施建设

- 公路/高速公路

- 铁路

- 飞机场

- 能源基础设施

- 采矿和采石

- 灾害/紧急救援

- 其他用途

- 建筑施工

- 按负载容量

- 轻型车辆(小于3吨)

- 中型(3至10吨)

- 大型(10至30吨)

- 超大型(超过30吨)

- 按国家/地区

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 瑞典

- 波兰

- 俄罗斯

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Loxam Group

- Ashtead Group(Sunbelt Rentals)

- Kiloutou Group

- Boels Rental

- Cramo(Renta Group)

- Zeppelin Rental

- Ahern Rentals

- Ramirent

- Ardent Hire Solutions

- Mateco

- Caterpillar Inc.

- Deere & Company

- Komatsu Ltd

- Hitachi Construction Machinery

- Liebherr Group

- JCB

- Manitou Group

- MECALAC

- Wacker Neuson

- Yanmar CE

第七章 市场机会与未来展望

The European construction machinery rental market is expected to grow from USD 35.15 billion in 2025 to USD 36.64 billion in 2026 and is forecast to reach USD 45.11 billion by 2031 at 4.25% CAGR over 2026-2031.

This steady climb reflects resilient demand for rented machinery, expanding equipment-as-a-service agreements, and emission-driven fleet renewal across the region. The European construction equipment rental market benefits from EU-backed infrastructure stimulus, rapid electrification mandates, and ESG-linked lending that lowers capital costs for sustainable fleets. Operators prioritize telematics-enabled utilization gains, while governments reinforce demand with green transport corridors and digital connectivity projects. Competitive intensity is growing as OEMs form direct rental units, traditional rental giants accelerate pan-European acquisitions, and digital marketplaces shrink search and transaction costs for contractors.

Europe Construction Machinery Rental Market Trends and Insights

Surging EU Infrastructure Stimulus (Post-2025)

The European Investment Bank has earmarked EUR 1.1 trillion for climate-aligned infrastructure through 2030, triggering a sustained uptick in rentals of excavators, pavers, and tower cranes as projects break ground across transport and digital corridors . Germany is making a bold push to modernize its infrastructure and digital capabilities. A substantial investment commitment has been set aside to upgrade transport networks and accelerate digital transformation over the coming years, creating demand for specialized earthmoving fleets. Unlike past cycles, current allocations stress renewable energy and fiber rollout, forcing rental companies to secure niche machinery such as cable plows and wind-turbine erection cranes. Supply tightness amplifies utilization rates and elevates short-term pricing. Stimulus-driven linkages also ripple into private housing and commercial builds around upgraded transit hubs.

Accelerated Fleet Electrification Mandates

The European Commission's Fit for 55 package requires a 55% emissions cut by 2030, pressuring rental firms to pivot from diesel to battery and hydrogen powertrains . JCB's hydrogen engine program, now trialed in 11 countries, exemplifies OEM response. Early adopters in Sweden and Norway leverage subsidies to recoup higher purchase prices and pass premium rates to contractors looking to enter zero-emission zones. The mandate stimulates parallel investment in charging depots, technician retraining, and digital monitoring systems, raising capital intensity yet lowering lifecycle costs.

Disharmony in NRMM Stage V Adoption

Non-Road Mobile Machinery Stage V rules entered force in 2019 yet penalty rigor differs by member state, compelling rental fleets to juggle dual compliance standards. Companies operating across borders incur surging logistics and refitting costs to ensure each unit meets the strictest locale.

Other drivers and restraints analyzed in the detailed report include:

- ESG-Linked Financing Lowering CAPEX

- EU Taxonomy Focus on Embodied-Carbon Reporting

- Secondary Market Glut from Diesel Obsolescence

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Earthmoving equipment accounted for 41.88% of the European construction equipment rental market share in 2025, and this category is forecast to grow at a 4.55% CAGR through 2031. Excavators, particularly crawler variants, dominate heavy civil works while wheeled models support urban mobility. Skid-steer loaders gain traction in refurbishment projects that demand compact maneuverability. Motor graders and dozers sustain demand from Eastern Europe's expanding highway corridors. The European construction equipment rental market size within earthmoving is also a focal point for electrification pilots such as Hitachi's 1.7-ton battery excavator slated for 2027 rollout.

The segment's electrification cadence accelerates as contractors seek to meet city-center emission caps without compromising performance. OEMs experiment with swappable battery packs to mitigate charging downtime, and rental houses deploy mobile chargers to keep utilization high. Tier-one rental firms bundle earthmoving packages with on-site power units to capture higher value from integrated offerings.

Hydraulic systems retained 77.95% share of the European construction equipment rental market size in 2025 because of their proven reliability and wide service network. Yet purely electric drives are posting a 11.85% CAGR, aided by Nordic subsidies and expanding urban low-emission zones. Diesel-electric hybrids offer a transitional path, providing fuel savings without range anxiety on remote sites.

The European construction equipment rental market registers divergent adoption curves by equipment class. Compact excavators and scissor lifts shift first as battery energy density now supports full-shift operation. Heavier equipment awaits next-generation solid-state batteries or hydrogen fuel cells, where JCB's ongoing trials signal longer-term promise. Rental firms hedge by procuring modular fleets that can swap between diesel and electric drivelines.

The Europe Construction Machinery Rental Market Report is Segmented by Machinery Type (Earthmoving, and More), Drive Type (Hydraulic, Diesel-Electric Hybrid, and More), Application (Building Construction, and More), End-User Industry (Construction Contractors, and More), Payload Capacity (Light-Duty, Medium-Duty, and Heavy-Duty), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Loxam Group

- Ashtead Group (Sunbelt Rentals)

- Kiloutou Group

- Boels Rental

- Cramo (Renta Group)

- Zeppelin Rental

- Ahern Rentals

- Ramirent

- Ardent Hire Solutions

- Mateco

- Caterpillar Inc.

- Deere & Company

- Komatsu Ltd

- Hitachi Construction Machinery

- Liebherr Group

- JCB

- Manitou Group

- MECALAC

- Wacker Neuson

- Yanmar CE

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging EU Infrastructure Stimulus (Post-2025)

- 4.2.2 Accelerated Fleet Electrification Mandates

- 4.2.3 ESG-Linked Financing Lowering CAPEX

- 4.2.4 Shift Toward Equipment-as-a-Service Models

- 4.2.5 EU Taxonomy Focus on Embodied-Carbon Reporting

- 4.2.6 On-Site Modular Power Units Enabling Zero-Idle Use

- 4.3 Market Restraints

- 4.3.1 Disharmony in NRMM Stage V Adoption

- 4.3.2 Operator Talent Shortage Inflating Labor Costs

- 4.3.3 Secondary Market Glut from Diesel Asset Obsolescence

- 4.3.4 High Telemetry Retrofit Cost for Legacy Fleets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD Million)

- 5.1 By Machinery Type

- 5.1.1 Earthmoving Machinery

- 5.1.1.1 Excavators

- 5.1.1.1.1 Crawler

- 5.1.1.1.2 Wheeled

- 5.1.1.2 Loaders

- 5.1.1.2.1 Skid-Steer

- 5.1.1.2.2 Wheel

- 5.1.1.2.3 Backhoe

- 5.1.1.3 Motor Graders

- 5.1.1.4 Dozers

- 5.1.1.1 Excavators

- 5.1.2 Lifting and Material-Handling

- 5.1.2.1 Cranes

- 5.1.2.1.1 Mobile Cranes

- 5.1.2.1.2 Tower Cranes

- 5.1.2.2 Telescopic Handlers

- 5.1.2.3 Aerial Work Platforms

- 5.1.2.1 Cranes

- 5.1.3 Road Construction Equipment

- 5.1.3.1 Pavers

- 5.1.3.2 Road Rollers

- 5.1.3.3 Asphalt Mixers

- 5.1.4 Other Machinery Types

- 5.1.1 Earthmoving Machinery

- 5.2 By Drive Type

- 5.2.1 Hydraulic

- 5.2.2 Diesel-Electric Hybrid

- 5.2.3 Fully Electric

- 5.2.4 Hydrogen Fuel Cell

- 5.3 By Application

- 5.3.1 Building Construction

- 5.3.1.1 Residential

- 5.3.1.2 Commercial

- 5.3.1.3 Industrial

- 5.3.2 Infrastructure Construction

- 5.3.2.1 Road and Highway

- 5.3.2.2 Rail

- 5.3.2.3 Airport

- 5.3.2.4 Energy Infrastructure

- 5.3.3 Mining and Quarrying

- 5.3.4 Disaster and Emergency Relief

- 5.3.5 Other Applications

- 5.3.1 Building Construction

- 5.4 By Payload Capacity

- 5.4.1 Light-Duty (Below 3 tons)

- 5.4.2 Medium-Duty (3-10 tons)

- 5.4.3 Heavy-Duty (10-30 tons)

- 5.4.4 Super Heavy-Duty (Above 30 tons)

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Netherlands

- 5.5.7 Sweden

- 5.5.8 Poland

- 5.5.9 Russia

- 5.5.10 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Loxam Group

- 6.4.2 Ashtead Group (Sunbelt Rentals)

- 6.4.3 Kiloutou Group

- 6.4.4 Boels Rental

- 6.4.5 Cramo (Renta Group)

- 6.4.6 Zeppelin Rental

- 6.4.7 Ahern Rentals

- 6.4.8 Ramirent

- 6.4.9 Ardent Hire Solutions

- 6.4.10 Mateco

- 6.4.11 Caterpillar Inc.

- 6.4.12 Deere & Company

- 6.4.13 Komatsu Ltd

- 6.4.14 Hitachi Construction Machinery

- 6.4.15 Liebherr Group

- 6.4.16 JCB

- 6.4.17 Manitou Group

- 6.4.18 MECALAC

- 6.4.19 Wacker Neuson

- 6.4.20 Yanmar CE