|

市场调查报告书

商品编码

1906128

欧洲苛性钠:市场占有率分析、产业趋势、统计数据和成长预测(2026-2031)Europe Caustic Soda - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

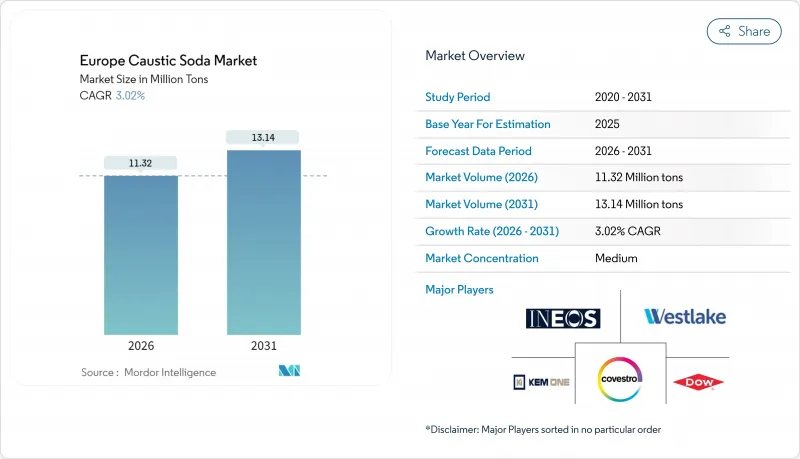

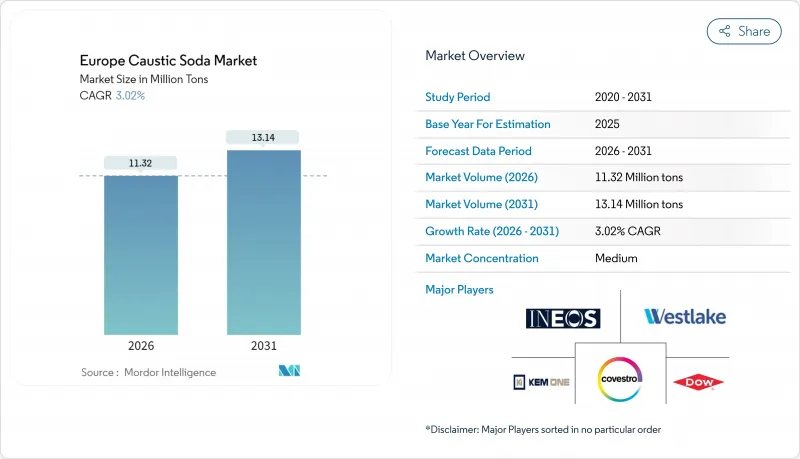

2025年欧洲苛性钠市场价值为1,099万吨,预计2031年将达到1,314万吨,高于2026年的1,132万吨。

预计在预测期(2026-2031 年)内,复合年增长率将达到 3.02%。

这种稳定扩张标誌着该行业已进入成熟阶段,节能技术和监管利好因素超过了电力价格上涨等成长阻碍因素。欧盟《基本化学品法》将苛性钠列为关键化学品,凸显了其在保护该地区工业自主性方面的战略作用。随着现货价格飙升至275欧元/兆瓦时的压力测试水平,膜电极技术透过降低电力消耗保持了竞争优势。下游一体化继续有利于液态产品,而对污水处理、电池氧化铝提纯和纤维基包装材料的持续投资则确保了需求即使在周期性低迷时期也能保持韧性。同时,来自亚洲低成本出口商的进口套利和能源成本的波动正在挤压利润空间,并加速老牌生产商的产品组合最佳化。

欧洲苛性钠市场趋势与分析

水处理应用需求不断成长

欧盟新的都市废水处理法规强制要求进行三级和四级处理,这导致用于控制pH值和去除磷的苛性钠用量激增。西班牙和德国的污水处理厂升级改造正在扩大,各市政当局必须在2045年前实现能源中和目标,以确保即使设施向可再生能源过渡,也能维持基准的能源消费量。更严格的微量污染物去除标准进一步扩大了苛性钠在高级氧化和沈淀过程中的应用。由于市政升级改造是数十亿欧元的计划,欧洲苛性钠市场享有长期稳定的市场需求,不受更广泛的工业放缓的影响。产业数据显示,氯碱製程每吨氯消耗约2600千瓦时电能,因此苛性钠供应与能源效率投资直接相关。

电动车电池供应链对氧化铝的需求不断增长

围绕欧洲超级工厂而建的电池氧化铝精炼厂,其纯度要求更高,苛性钠消费量也高于传统产品。德国的汽车产业是推动这项需求的主要力量,而法国和比利时的工厂则正竞相取得当地原料。儘管Northvolt公司2024年的破产令市场情绪承压,但汽车电气化仍是结构性成长的引擎。该产业历来占全球苛性钠消费量的21%,如今受惠于溢价,足以抵销能源成本,从而巩固了其长期需求基础。

欧洲能源成本高企

由于电力成本占氯碱生产现金成本的一半以上,俄乌衝突导致的波动使得当电价接近275欧元/兆瓦时,区域产能运转率骤降。BASF国内化学品产量下降了25%,决定安装一座54兆瓦的绿色氢气电解,预计每年可生产8,000吨氢气,并减少7.2万吨排放。在电网透过增加可再生能源而趋于稳定之前,生产商将被迫承担更高的电价,导致利润空间受压,并出现部分停产的情况。

细分市场分析

截至2025年,膜电解将占据欧洲苛性钠市场77.48%的份额,体现了其卓越的能源效率和合规性。不断上涨的电力成本正促使製造商加速从隔膜电解系统转型为膜电解系统。预计到2031年,这项转变将推动膜电解产能以3.14%的复合年增长率成长。新兴的电渗析技术可望进一步降低单位电力消耗量,进而巩固膜技术的长期优势。随着环境法规强制淘汰汞电解槽,欧洲膜苛性钠市场预计将稳定扩张。同时,欧洲工程公司在沙乌地阿拉伯的计划为区域技术供应商提供了全球出口机会,从而形成创新与应用的良性循环。

随着奥林等业者关闭无法满足能源效率标准的旧生产线,传统膜分离设备正在萎缩。儘管维修活动需要大量资金投入,但由于贷款机构越来越多地将信贷成本与排放绩效挂钩,使得膜分离升级的投资回报更加可量化,因此资金筹措依然畅通。汞电解槽曾经普遍使用,如今仅在一些独立的整合设施中仍有应用,并且由于欧盟指令的规定,预计将在2027年之前完全淘汰。总体而言,生产工艺格局为欧洲苛性钠市场提供了逐步提高效率的机会,这在一定程度上抵消了电价上涨的不利影响。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 水处理应用需求不断成长

- 电动车电池供应链对氧化铝的需求不断增长

- 纤维基包装的成长

- 扩大肥皂和清洁剂製造地

- 化学合成需求不断成长

- 市场限制

- 欧洲能源成本高企

- 职业健康与安全以及 REACH 合规成本

- 进口套利挤压欧盟利润率

- 价值链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 贸易分析

- 价格趋势

- 生产分析

第五章 市场规模和成长预测(价值和数量)

- 透过製造工艺

- 膜细胞

- 膈肌细胞

- 其他製造流程(汞电池(旧式)、新兴的电渗析和直接电合成)

- 按形式

- 固体的

- 液体

- 透过使用

- 纸浆和造纸

- 有机化学品

- 无机化学品

- 肥皂和清洁剂

- 氧化铝

- 水处理

- 其他用途(食品和饲料加工等)

- 按地区

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- BASF

- Covestro

- Dow

- Ercros

- INEOS

- Kem One

- Nouryon

- Olin Corporation

- PCC SE

- Spolchemie

- Vynova Group

- Westlake Corporation

- WeylChem International GmbH

第七章 市场机会与未来展望

The Europe Caustic Soda Market was valued at 10.99 Million tons in 2025 and estimated to grow from 11.32 Million tons in 2026 to reach 13.14 Million tons by 2031, at a CAGR of 3.02% during the forecast period (2026-2031).

This steady expansion signals a mature phase in which energy-efficient technologies and regulatory tailwinds outweigh growth constraints such as elevated power prices. Caustic soda's classification as a critical chemical under the proposed EU Critical Chemicals Act underscores its strategic role in safeguarding regional industrial autonomy. Membrane cell technology dominates the competitive arena because it cuts electricity consumption at a time when spot prices have spiked to stress-test levels of EUR 275/MWh. Downstream integration continues to favor the liquid form, while sustained investments in wastewater treatment, battery-grade alumina refining and fiber-based packaging keep demand resilient across cyclical downturns. At the same time, import arbitrage from low-cost Asian exporters and volatile energy costs create margin pressure that accelerates portfolio rationalization among incumbent producers.

Europe Caustic Soda Market Trends and Insights

Increasing Demand from Water Treatment Application

New urban-wastewater rules require tertiary and quaternary treatment across the bloc, triggering a surge in caustic-soda dosing for pH control and phosphorus removal. Spain and Germany are scaling plant upgrades, and municipalities must comply with an energy-neutral target by 2045, guaranteeing baseline consumption even as facilities pivot to renewable power. Micropollutant removal standards further broaden caustic-soda usage in advanced oxidation and precipitation. Because municipal upgrades are multi-billion-euro projects, the European caustic soda market enjoys stable long-cycle demand insulated from broader industrial slowdowns. Industry data show chlor-alkali processes consume roughly 2,600 kWh per ton of chlorine, linking caustic-soda supply directly to energy-efficiency investments.

Rising Alumina Demand from EV-Battery Supply Chain

Battery-grade alumina refineries that cluster near European gigafactories require higher caustic-soda purity and volumes per output ton than legacy grades. German automotive hubs anchor this pull, while French and Belgian sites race to secure regional feedstock. Although Northvolt's 2024 bankruptcy dented sentiment, vehicle electrification remains a structural growth engine. The sector historically consumes 21% of global caustic soda and now benefits from premium pricing that offsets energy costs, strengthening the long-run demand case.

High Energy Costs in Europe

Electricity accounts for over half of chlor-alkali cash costs, so volatility tied to the Russia-Ukraine conflict slashed regional operating rates when prices neared EUR 275/MWh. BASF lost 25% domestic chemical output, prompting a 54 MW green-hydrogen electrolyzer that should yield 8,000 t of H2 annually and curb 72,000 t of emissions. Producers must absorb higher power tariffs until renewable additions stabilize the grid, translating into margin compression and selective shutdowns.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Fiber-Based Packaging

- Expansion of Soap and Detergent Manufacturing Hubs

- Import Arbitrage Squeezing EU Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The membrane cell route commands 77.48% of the European caustic soda market share in 2025, reflecting its superior energy profile and regulatory compliance advantages. Producers accelerated diaphragm-to-membrane conversions as electricity costs soared, a shift that lifted membrane capacity additions to 3.14% CAGR through 2031. Emerging electro-electrodialysis technologies promise further cuts in specific power consumption, reinforcing the long-term dominance of membranes. The European caustic soda market size for membrane-based output is forecast to widen steadily because legacy mercury cells face mandatory phase-outs under environmental statutes. In parallel, Saudi projects supplied by European engineering firms signal global export opportunities for the region's technology providers, sustaining a virtuous cycle of innovation and deployment.

Traditional diaphragm assets are shrinking as operators such as Olin shutter older lines that cannot meet energy-intensity benchmarks. Retrofit activity is capital-heavy, yet financing remains accessible because lenders increasingly link credit costs to emissions performance, giving membrane upgrades a quantifiable payback. Mercury cells, once common, linger only in isolated integrated complexes and will exit entirely before 2027 under EU directives. Overall, the production-process landscape positions the European caustic soda market for incremental efficiency gains that partly offset power-price headwinds.

The Caustic Soda Europe Market Report Segments the Industry by Production Process (Membrane Cell, Diaphragm Cell, Other Production Processes), Form (Solid, Liquid), Application (Pulp and Paper, Organic Chemical, Inorganic Chemical, Soap and Detergent, Alumina, Water Treatment, Other Applications), and Geography (Germany, United Kingdom, Italy, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (tons).

List of Companies Covered in this Report:

- BASF

- Covestro

- Dow

- Ercros

- INEOS

- Kem One

- Nouryon

- Olin Corporation

- PCC SE

- Spolchemie

- Vynova Group

- Westlake Corporation

- WeylChem International GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand from Water Treatment Application

- 4.2.2 Rising Alumina Demand from EV-Battery Supply Chain

- 4.2.3 Growth of Fiber-Based Packaging

- 4.2.4 Expansion of Soap and Detergent Manufacturing Hubs

- 4.2.5 Growing Requirement for Chemical Synthesis

- 4.3 Market Restraints

- 4.3.1 High Energy Costs in Europe

- 4.3.2 Occupational-Safety and REACH Compliance Costs

- 4.3.3 Import Arbitrage squeezing European Union's margins

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

- 4.8 Trade Analysis

- 4.9 Price Trends

- 4.10 Production Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Production Process

- 5.1.1 Membrane Cell

- 5.1.2 Diaphragm Cell

- 5.1.3 Other Production Processes (Mercury Cell (legacy), Emerging Electro-electrodialysis and Direct Electro-synthesis)

- 5.2 By Form

- 5.2.1 Solid

- 5.2.2 Liquid

- 5.3 By Application

- 5.3.1 Pulp and Paper

- 5.3.2 Organic Chemicals

- 5.3.3 Inorganic Chemicals

- 5.3.4 Soap and Detergents

- 5.3.5 Alumina

- 5.3.6 Water Treatment

- 5.3.7 Other Applications (Food and Feed Processing, etc.)

- 5.4 By Geography

- 5.4.1 Germany

- 5.4.2 United Kingdom

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Russia

- 5.4.7 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF

- 6.4.2 Covestro

- 6.4.3 Dow

- 6.4.4 Ercros

- 6.4.5 INEOS

- 6.4.6 Kem One

- 6.4.7 Nouryon

- 6.4.8 Olin Corporation

- 6.4.9 PCC SE

- 6.4.10 Spolchemie

- 6.4.11 Vynova Group

- 6.4.12 Westlake Corporation

- 6.4.13 WeylChem International GmbH

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment