|

市场调查报告书

商品编码

1906208

欧洲活动管理产业:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Europe Event Management Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

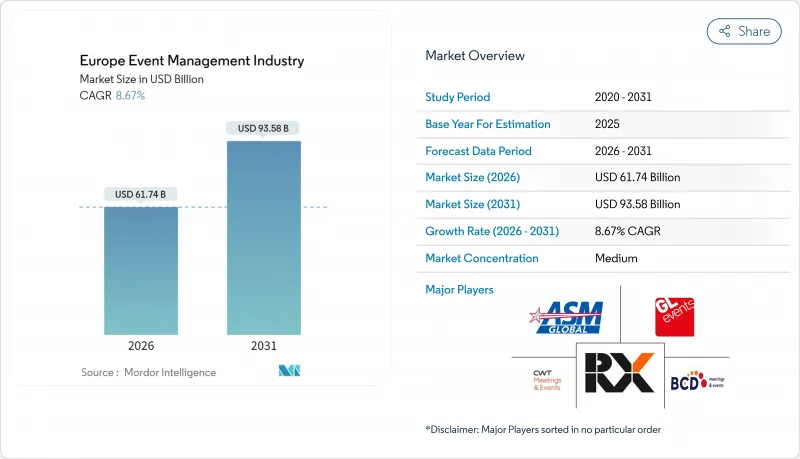

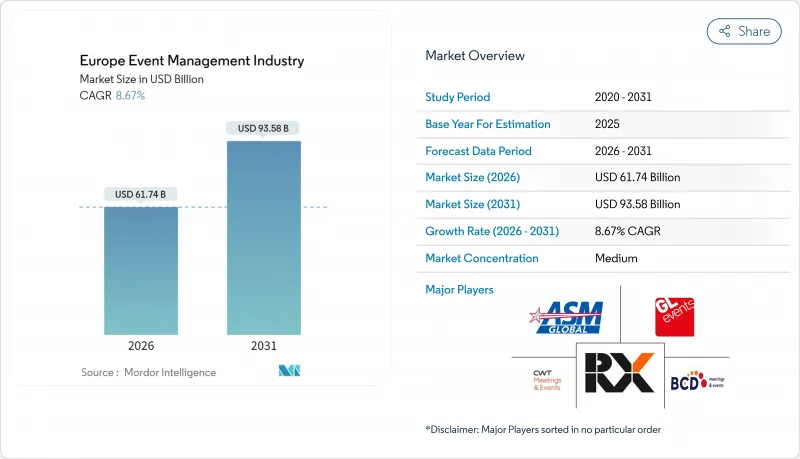

2025 年欧洲活动管理产业市场价值为 568.1 亿美元,预计从 2026 年的 617.4 亿美元成长到 2031 年的 935.8 亿美元,在预测期(2026-2031 年)内复合年增长率为 8.67%。

这一成长轨迹证实了强劲的復苏势头,其动力源于企业差旅的恢復、大型集会的常态化以及融合线上线下互动的混合交付模式的普及。上升趋势反映了人们对线下人际互动的积压需求与持续投资于虚拟基础设施之间的平衡,后者能够保护组织者免受旅行中断的影响。持续的身临其境型行销活动投入、政府对永续实践的稳定支持以及不断提升的数据分析能力,进一步提高了欧洲活动管理行业市场的成长上限。同时,中型机构正利用其灵活的成本结构赢得细分市场的交易,而场地营运商则寻求更高的定价以弥补与通货膨胀相关的营运成本。

欧洲活动管理产业趋势与洞察

线下会展活动的回归

预计到2027年,欧洲商务旅行支出将达到4,500亿美元,因此,面对面会议再次成为策略重点。企业认为,举办线下活动的主要优势在于能够提高交易成交率、缩短产品检验週期并加深客户信任。由于人工智慧匹配功能,展览组织者报告称,与2023年相比,已安排的会议数量增加了44%。会议中心运转率在2024年回升至74.8%,但由于成本上升,场馆业者的利润率仍面临压力。即使面临通货膨胀,企业仍愿意支付更高的每日费用,凸显了线下互动在欧洲活动管理产业市场的重要性日益凸显。

数位化和平台采用

如今,活动技术已将註册、内容传送、客户关係管理 (CRM) 整合和即时分析整合到一个统一的平台上。总部位于瑞典的 InvitePeople 公司在引入人工智慧驱动的个人化功能后,实现了 95% 的客户维繫率,与会者互动也提升了 48%。在欧洲,73% 的活动策划者认为混合功能是必备条件,而隐私设计架构仍然是采购的一大障碍。北欧在宽频品质和无现金支付方面的领先地位正在加速相关技术的试验,并逐渐扩展到中欧。这些趋势正为欧洲活动管理产业市场带来新的发展动力。

通货膨胀导致场地和人事费用上涨。

儘管荷兰场地平均每日租金较2019年上涨了38%,但薪资成本的急剧上升已将利润率降低至35.3%。餐饮和製作部门人手短缺影响了服务质量,并推高了加班成本。能源价格上涨迫使场地实施浮动定价和最低消费条款,对企业预算造成压力。中小型机构融资困难,这推动了融资整合,但也略微限制了欧洲活动管理产业的市场成长。

细分市场分析

2025年,企业活动将占欧洲活动管理产业市场的35.02%,这一主导地位得益于经营团队竞相建构后远距办公文化和客户关係。儘管基准较小,但奖励旅游活动仍以9.88%的复合年增长率成长,因为企业正利用旅行和体验来打造差异化的人才保留策略。协会主办的会议正在恢復大型场馆的举办,并为远距与会者实施混合模式。慈善机构正在采用线上线竞标结合的方式,以扩大捐赠者群体。虽然由于保险成本和人群控制规定,节庆活动和娱乐表演尚未恢復到2020年之前的峰值,但户外活动的参与人数保持稳定。同时,体育赛事正利用球迷被压抑的需求,运作迎宾套房。混合模式的活动正在成为一个永续的细分市场,为精明的策划者提供了多元化的选择。这种多元化的组合为欧洲活动管理产业市场持续的收入来源奠定了基础。

随着董事会核准的体验式预算不断增加,欧洲活动管理行业的企业活动市场将持续成长,而奖励旅游活动目前仅占市场份额的不到10%,这为精明的旅游组织者留下了尚未开发的市场空间。将碳排放追踪与体验式故事叙述相结合的供应商正在赢得注重永续性的跨国公司的中期订单。

到2025年,线下活动仍将维持62.76%的市场份额,因为亲身参与有利于建立信任和进行复杂的谈判。混合模式将以12.27%的复合年增长率成长,在向全球受众传递内容的同时,也能有效规避旅行的不确定性。虚拟会议的市占率将稳定在15%左右,主要用于内部培训和新进员工入职。多点触控行程的组织者发现,从网路研讨会前的参与到现场参加的转换率很高。音视频供应商和云端串流媒体整合商受益于先进的技术规范,这些规范能够同时支援线上和线下观众。这种市场细分錶明,欧洲活动管理产业市场正在采用组合式策略,而非零和博弈式的替代模式。

混合模式的兴起扩大了欧洲活动管理产业平台供应商的市场规模,而纯线上服务商的市占率成长则受到与会者疲劳的限制。执行的复杂性促使大型企业将端到端製作外包,扩大了业务收益来源。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

第五章 市场概览

- 市场驱动因素

- 疫情后线下会展活动的回归

- 实施数位化和活动管理平台

- 公司在体验式行销方面的支出

- 欧盟和政府为促进永续和包容性活动所采取的倡议

- 基于人工智慧的匹配和投资收益回报率 (ROI) 分析

- 欧盟数位产品护照将促进资料共用服务

- 市场限制

- 通货膨胀导致场地和人事费用上涨。

- GDPR/网路安全负担

- 强制性碳足迹报告会推高成本

- 虚拟替代方案降低了区域城市的需求

- 价值/供应链分析

- 监管环境

- 技术展望

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第六章 市场规模及成长预测(价值,单位:十亿美元)

- 按事件类型

- 企业活动

- 协会和会议活动

- 非营利组织和慈善活动

- 节庆活动

- 体育赛事

- 混合/虚拟优先活动

- 其他的

- 按模式

- 面对面

- 杂交种

- 虚拟的

- 透过服务

- 策略与规划

- 通讯与物流

- 场地/地点租赁

- 参与者管理与互动

- 虚拟/混合相容

- 餐饮和酒店

- 团队建立与体验项目

- 最终用户

- 企业组织

- 小型企业

- 公共部门/政府机构

- 个人消费者

- 非营利组织和协会

- 按地区

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比荷卢经济联盟(比利时、荷兰、卢森堡)

- 北欧国家(丹麦、芬兰、冰岛、挪威、瑞典)

- 其他欧洲地区

第七章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- GL events

- Reed Exhibitions

- ASM Global

- CWT Meetings & Events

- BCD Meetings & Events

- Informa(RX)

- Forum Europe

- Smart Works Events

- Absolute Event Services

- DFA Productions

- Eclipse Leisure

- Felix Events

- Hughes Productions

- Irwin Video

- JP Events Ltd

- Off Limits

- Owl Live

- GL Events Live

- Maritz Global Events

- Messe Frankfurt Venue GmbH

第八章:市场机会与未来展望

- 閒置频段与未满足需求评估

The Europe event management industry market was valued at USD 56.81 billion in 2025 and estimated to grow from USD 61.74 billion in 2026 to reach USD 93.58 billion by 2031, at a CAGR of 8.67% during the forecast period (2026-2031).

This trajectory affirms a strong rebound underpinned by renewed corporate travel, the normalization of large gatherings, and the widespread integration of hybrid delivery models that blend on-site interaction with digital reach. Upward momentum reflects a balance between pent-up demand for in-person networking and persistent investment in virtual infrastructure that insulates organizers from travel disruptions. Sustained marketing outlays on immersive activations, steady government backing for sustainable practices, and improving data analytics capabilities further raise the growth ceiling of the Europe event management industry market. Meanwhile, mid-sized agencies exploit flexible cost bases to win niche mandates, and venue operators pursue premium pricing to recoup inflation-linked overheads.

Europe Event Management Industry Trends and Insights

Resurgence of In-Person MICE Gatherings

Face-to-face meetings re-emerged as a strategic priority when European business-travel outlays started climbing toward USD 450 billion for 2027. Corporations cite higher deal-conversion rates, quicker product-validation cycles, and deeper client trust as the principal benefits of convening onsite. Trade-show organizers report that AI-powered matchmaking lifted scheduled meetings by 44% compared with the 2023 editions. Convention-center occupancy recovered to 74.8% in 2024, yet venue operators still wrestle with margin compression caused by cost inflation. Enterprise willingness to pay premium day-rates despite inflation underscores the revived importance of physical interaction inside the Europe event management industry market.

Digitalization and Platform Adoption

Event technology now spans registration, content streaming, CRM integration, and real-time analytics in one unified stack. Sweden-based InvitePeople posted 95% retention and 48% higher attendee interactions after embedding AI-driven personalization. Across Europe, 73% of planners deem hybrid capability non-negotiable, while privacy-by-design architecture remains a gating factor for procurement. Nordic leadership in broadband quality and cashless payments accelerates experimentation, which then diffuses into Central Europe. These dynamics add fresh tailwinds to the Europe event management industry market.

Inflation-Driven Venue and Staffing Costs

Average daily venue rates in the Netherlands climbed 38% over 2019 levels, yet profit margins fell to 35.3% as wage expenses surged. Staff shortages across catering and production disciplines hamper service quality and inflate overtime payments. Elevated energy tariffs oblige venues to implement dynamic pricing and minimum-spend clauses, squeezing corporate budgets. Smaller agencies face liquidity strain, driving consolidation that marginally tempers the Europe event management industry market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Rising Experiential Marketing Budgets

- EU Drive for Sustainable and Inclusive Events

- GDPR and Cybersecurity Compliance Burden

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Corporate Events commanded 35.02% of the Europe event management industry market in 2025, a lead reinforced by executives eager to rebuild culture and client rapport post-remote work. Incentive gatherings, albeit smaller in baseline volume, grow at a brisk 9.88% CAGR as companies use travel and experiences to differentiate retention packages. Association conferences returned to large auditoriums, adding hybrid layers to serve remote professionals. Charity organizers pair live galas with online auctions to widen donor funnels. Festivals and entertainment productions trail the pre-2020 peak because of insurance premiums and crowd-control mandates, but open-air formats draw steady footfall. Meanwhile, sports events reboot hospitality suites, capitalizing on pent-up fan appetite. Hybrid-first events crystallize as a durable niche, granting risk-hedged reach to cautious planners. This diversified mix anchors recurring revenue streams across the Europe event management industry market.

The Europe event management industry market size for Corporate Events climbed alongside board-approved experiential budgets, while the Europe event management industry market share of Incentive Events still sits below 10%, leaving white space for providers fluent in curated travel logistics. Vendors that fuse carbon tracking with experiential storytelling win mid-decade bids from sustainability-minded multinational clients.

In-person formats retained 62.76% market share in 2025 because trust-building and complex negotiation favor physical presence. Hybrid models, advancing at 12.27% CAGR, extend content to global users and hedge against travel uncertainties. Virtual sessions stabilize near 15% share, serving internal trainings and onboarding. Organizers designing multi-touchpoint journeys observe higher conversion from pre-event webinars into on-site attendance. AV suppliers and cloud-streaming integrators profit from elevated technical specifications that accompany simultaneous live and digital audiences. This segmentation underscores how the Europe event management industry market adopts a portfolio approach rather than a zero-sum substitution path.

Hybrid's ascent expands the Europe event management industry market size for platform vendors, while the incremental Europe event management industry market share gain for virtual-only providers plateaus due to audience fatigue. Execution complexity encourages large enterprises to outsource end-to-end production, widening the service revenue pool.

The Europe Event Management Market Report is Segmented by Event Type (Corporate Events, Association & Conference Events, and More), by Mode (In-Person, Hybrid, Virtual), by Service (Strategy & Planning, Communication & Logistics, and More), by End User (Corporate Organizations, Smes, and More), and by Geography (United Kingdom, Germany, France, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- GL events

- Reed Exhibitions

- ASM Global

- CWT Meetings & Events

- BCD Meetings & Events

- Informa (RX)

- Forum Europe

- Smart Works Events

- Absolute Event Services

- DFA Productions

- Eclipse Leisure

- Felix Events

- Hughes Productions

- Irwin Video

- JP Events Ltd

- Off Limits

- Owl Live

- GL Events Live

- Maritz Global Events

- Messe Frankfurt Venue GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

5 Market Overview

- 5.1 Market Drivers

- 5.1.1 Resurgence of in-person MICE events post-pandemic

- 5.1.2 Digitalisation & adoption of event-management platforms

- 5.1.3 Experiential marketing spend by corporates

- 5.1.4 EU & government push for sustainable, inclusive events

- 5.1.5 AI-driven matchmaking & ROI analytics

- 5.1.6 EU Digital Product Passport spurring data-sharing services

- 5.2 Market Restraints

- 5.2.1 Inflation-driven venue & staffing cost surge

- 5.2.2 GDPR / cyber-security compliance burdens

- 5.2.3 Mandatory carbon-foot-print reporting raises costs

- 5.2.4 Virtual alternatives dent demand in Tier-2 cities

- 5.3 Value / Supply-Chain Analysis

- 5.4 Regulatory Landscape

- 5.5 Technological Outlook

- 5.6 Industry Attractiveness - Porter's Five Forces Analysis

- 5.6.1 Threat of New Entrants

- 5.6.2 Bargaining Power of Buyers

- 5.6.3 Bargaining Power of Suppliers

- 5.6.4 Threat of Substitutes

- 5.6.5 Intensity of Competitive Rivalry

6 Market Size & Growth Forecasts (Value, In USD Billion)

- 6.1 By Event Type

- 6.1.1 Corporate Events

- 6.1.2 Association & Conference Events

- 6.1.3 Non-profit & Charity Events

- 6.1.4 Festivals & Entertainment

- 6.1.5 Sports Events

- 6.1.6 Hybrid / Virtual-First Events

- 6.1.7 Others

- 6.2 By Mode

- 6.2.1 In-person

- 6.2.2 Hybrid

- 6.2.3 Virtual

- 6.3 By Service

- 6.3.1 Strategy & Planning

- 6.3.2 Communication & Logistics

- 6.3.3 Venue / Location Rental

- 6.3.4 Attendee Management & Engagement

- 6.3.5 Virtual / Hybrid Enablement

- 6.3.6 Catering & Hospitality

- 6.3.7 Team-building & Experiences

- 6.4 By End User

- 6.4.1 Corporate Organisations

- 6.4.2 SMEs

- 6.4.3 Public Sector / Government

- 6.4.4 Individual Consumers

- 6.4.5 Non-profits & Associations

- 6.5 By Geography

- 6.5.1 United Kingdom

- 6.5.2 Germany

- 6.5.3 France

- 6.5.4 Italy

- 6.5.5 Spain

- 6.5.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 6.5.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 6.5.8 Rest of Europe

7 Competitive Landscape

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 7.4.1 GL events

- 7.4.2 Reed Exhibitions

- 7.4.3 ASM Global

- 7.4.4 CWT Meetings & Events

- 7.4.5 BCD Meetings & Events

- 7.4.6 Informa (RX)

- 7.4.7 Forum Europe

- 7.4.8 Smart Works Events

- 7.4.9 Absolute Event Services

- 7.4.10 DFA Productions

- 7.4.11 Eclipse Leisure

- 7.4.12 Felix Events

- 7.4.13 Hughes Productions

- 7.4.14 Irwin Video

- 7.4.15 JP Events Ltd

- 7.4.16 Off Limits

- 7.4.17 Owl Live

- 7.4.18 GL Events Live

- 7.4.19 Maritz Global Events

- 7.4.20 Messe Frankfurt Venue GmbH

8 Market Opportunities & Future Outlook

- 8.1 White-space & Unmet-Need Assessment