|

市场调查报告书

商品编码

1906883

北美汽车市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031)North America Automotive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

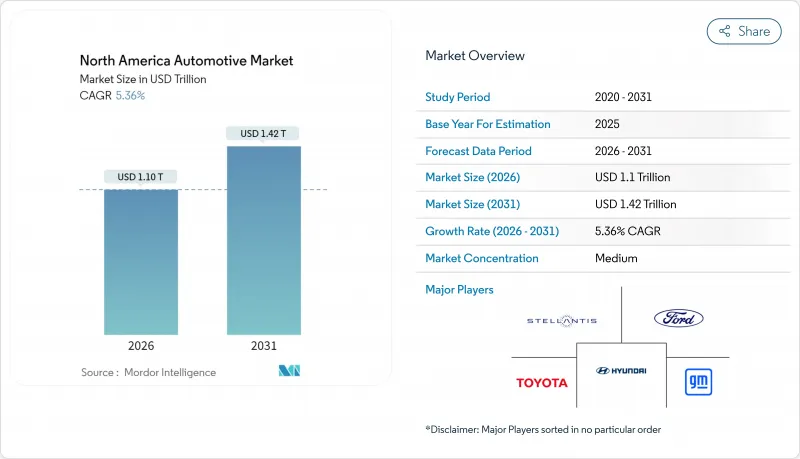

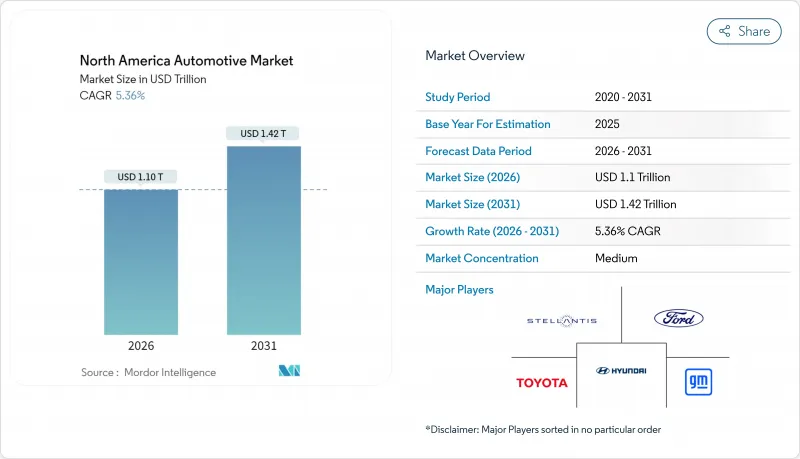

2025年北美汽车市场价值1.04兆美元,预计到2031年将达到1.4222兆美元,高于2026年的1.0957兆美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 5.36%。

联邦和州政府强有力的零排放车辆法规,以及通膨控制法案下的财政激励措施,都为预期的扩张提供了支撑。汽车製造商正以前所未有的速度推进电池和整车生产的本地化,力求在轻型卡车和SUV销售带来的短期盈利与长期电气化计划之间取得平衡。随着车队营运商优先考虑降低总拥有成本,商用车电气化进程正在加速,而直销模式也给现有经销商网路带来了压力。关税政策收紧和关键矿产供应瓶颈仍是近期面临的不利因素。

北美汽车市场趋势与洞察

联邦和州零排放车辆(ZEV)法规

加州的「先进清洁汽车II」法规要求到2026年零排放汽车的销售比例达到35%,到2035年达到100%。包括华盛顿特区在内的11个州也采用了类似的时间表。加拿大的联邦零排放汽车法规也设定了2035年的最终目标,并制定了2026年达到20%、2030年达到60%的阶段性目标。美国环保署(EPA)提案的法规要求到2030年中型和重型卡车的零排放汽车销售比例达到30%,到2040年达到100%。该法规采用信用银行体系,允许领先采用者透过合规获利,而落后者则面临更严厉的处罚。因此,这个法规结构鼓励了积极的电气化投资,并加速了北美汽车市场的供应商整合。

区域电池“自动阵列”

到2023年底,北美电池供应链的累积投资将超过2,500亿美元,电池工厂与最终组装厂的平均距离为284英里(约457公里)。电池製造约占投资的一半,上游矿物加工和下游电动车组装则占剩余部分。加拿大已跃居锂离子电池供应链排名榜首,主要得益于本田投资150亿加元的综合性工厂,该工厂计划于2028年运作。同时,墨西哥的类似计划,例如BMW投资8亿美元的圣路易斯波托西扩建计划,在确保成本竞争力的同时,也符合《美国墨加协定》(USMCA)的贸易合格。区域丛集有助于降低北美汽车市场的物流成本和关税风险。

车辆价格负担加重

创纪录的交易价格已将平均月供推至历史新高,迫使许多普通购车者放弃购车计画。不断上涨的奖励挤压了利润空间,但并未恢復购车的可负担性。自2023年起,租赁成本的飙升促使消费者越来越多地考虑二手车。电池式电动车(BEV)车型受此衝击最大,其高昂的前期成本对许多家庭而言超过了终身节省的费用。儘管预期利率下降将起到一定的缓解作用,但消费者对价格的高度敏感预计将在短期内限制北美汽车市场的销售成长。

细分市场分析

儘管中型和重型商用车的绝对销量仍然较小,但预计到2031年,其复合年增长率将达到8.22%,远超乘用车在北美汽车市场的主导地位。从监管角度来看,加州的「先进清洁卡车」法规和美国环保署(EPA)的提案旨在2040年实现100%的卡车零排放销售。车队买家由于能够集中管理充电和可预测的运作週期,因此渴望拥抱电气化。

到2025年,乘用车仍将占汽车总收入的68.63%,但面临价格承受能力和监管成本不断上涨的压力。工厂产能改造以适应多种动力传动系统,使製造商能够调整产量以满足不断变化的市场需求。到2035年,零排放卡车的总拥有成本将与乘用车持平,这将推动对商用车领域的进一步投资,并巩固北美汽车市场这一细分领域的结构性成长。

到 2025 年,内燃机动力传动系统将占市场份额的 82.11%,但电池电动车 (BEV) 的市场份额将以 9.58% 的复合年增长率增长,这主要得益于高达 7,500 美元的清洁车辆税额扣抵。混合模式将作为过渡技术,福特报告称,2024 年混合动力汽车的销量将实现两位数成长。

插电式混合动力汽车为长途驾驶者提供续航里程保障,同时也有助于实现部分电气化目标。由于氢基础设施不足,燃料电池汽车仍是一个有限的小众市场。动力系统多元化使汽车製造商能够降低资本配置风险,同时扩展电池和软体平台,而这些平台对于不断发展的北美汽车市场规模至关重要。

北美汽车市场报告按车辆类型(乘用车、轻型商用车等)、动力类型(内燃机等)、销售管道(OEM 直销商等)、自动化程度(0-1 级、2 级、3 级、4-5 级)和国家/地区(美国、加拿大、北美其他地区)进行细分。市场预测以价值(美元)和销售(辆)为单位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 联邦和州政府的零排放车辆(ZEV)强制规定

- 汽车贷款利率下降和被压抑的需求

- NEVI资助的电动车充电基础设施扩建

- 轻型卡车和SUV组合的变化将提高利润率。

- 电池「汽车产业群聚」的区域化

- 软体定义汽车的收入模式

- 市场限制

- 汽车价格购买能力收紧

- 半导体和电池用矿物供应受限

- 美墨加协定审查下的关税边缘政策

- 尖峰时段「充电排队」问题令人担忧

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按车辆类型

- 搭乘用车

- 轻型商用车

- 中型和大型商用车辆

- 摩托车

- 依推进类型

- 内燃机(ICE)

- 混合动力电动车(HEV)

- 插电式混合动力汽车(PHEV)

- 电池电动车(BEV)

- 燃料电池电动车(FCEV)

- 天然气汽车(NGV)

- 按销售管道

- OEM授权经销商销售

- D2C(线上)

- 车队和租赁销售

- 按自动化级别

- 0-1级(基础/无ADAS)

- 二级(部分自动化)

- 3级(有条件自动驾驶)

- 4-5级(高度/完全自动驾驶)

- 按国家/地区

- 美国

- 加拿大

- 北美其他地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- General Motors Company

- Toyota Motor Corporation

- Ford Motor Company

- Stellantis NV

- Hyundai Motor Company

- Honda Motor Co., Ltd.

- Nissan Motor Co., Ltd.

- BMW AG

- Tesla, Inc.

- Volkswagen AG

- Mercedes-Benz Group AG

- Kia Corporation

- Subaru Corporation

- Mazda Motor Corporation

- Rivian Automotive, Inc.

- Lucid Group, Inc.

- BYD Company Ltd.

- Volvo Car Corporation

- Mitsubishi Motors Corporation

- Daimler Truck Holding AG

- PACCAR Inc.

- Navistar International Corp.

- Harley-Davidson, Inc.

- Yamaha Motor Co., Ltd.

第七章 市场机会与未来展望

The North America automotive market was valued at USD 1040 billion in 2025 and estimated to grow from USD 1095.7 billion in 2026 to reach USD 1422.2 billion by 2031, at a CAGR of 5.36% during the forecast period (2026-2031).

Robust federal and provincial zero-emission vehicle mandates and fiscal incentives in the Inflation Reduction Act underpin the projected expansion. Automakers are localizing battery and vehicle production at unprecedented speed, balancing short-term profitability from light-truck and SUV sales with long-term electrification commitments. Commercial vehicle electrification is accelerating as fleet operators prioritize total cost-of-ownership gains, while direct-to-consumer sales models pressure entrenched dealer networks. Intensifying tariff policies and critical-mineral bottlenecks remain near-term headwinds.

North America Automotive Market Trends and Insights

Federal and State ZEV Mandates

California's Advanced Clean Cars II regulation requires 35% zero-emission sales by 2026 and 100% by 2035; eleven additional states and Washington, D.C. have adopted identical timelines. Canada's federal ZEV rule mirrors the 2035 deadline with interim 20% and 60% milestones for 2026 and 2030, respectively. Proposed U.S. EPA limits push 30% zero-emission medium- and heavy-truck sales by 2030, rising to 100% by 2040. Credit banking lets early movers monetize compliance, whereas laggards face increasing penalties. The mandate architecture, therefore, rewards proactive electrification investments and accelerates supplier realignment across North America automotive market participants.

Battery "Auto-Alley" Localization

Cumulative North American battery supply-chain commitments topped USD 250 billion by end-2023, with cell plants positioned a median 284 miles from final assembly sites. Cell fabrication absorbs roughly half of the outlays, with upstream mineral processing and downstream EV assembly splitting the remainder. Canada rose first in the lithium-ion supply-chain ranking, buoyed by Honda's CAD 15 billion integrated complex slated for 2028. Parallel Mexican projects, such as BMW's USD 800 million San Luis Potosi expansion, secure cost-competitive capacity while preserving USMCA trade eligibility. Localized clusters mitigate logistics expense and tariff risk across the North America automotive market.

Vehicle Affordability Squeeze

Record transaction prices have pushed average monthly payments to historic highs, sidelining a swath of mainstream buyers. Rising incentives strain margins yet fail to restore affordability. Leasing costs have climbed sharply since 2023, nudging consumers toward used-vehicle substitutes. The pinch is most acute for battery-electric models whose upfront premiums outweigh lifetime savings for many households. Although falling interest-rate expectations offer relief, price sensitivity will cap near-term volume upside in the North America automotive market.

Other drivers and restraints analyzed in the detailed report include:

- NEVI-Funded EV-Charging Build-Out

- Software-Defined-Vehicle Revenue Model

- Peak-Hour "Charging-Queue" Anxiety

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Medium-and heavy-commercial vehicles, though smaller in absolute volume, expand at 8.22% CAGR through 2031, materially outpacing passenger cars' dominion in the North American automotive market. A regulatory push-California's Advanced Clean Trucks rule and U.S. EPA proposals-targets 100% zero-emission truck sales by 2040. Fleet buyers embrace electrification, where charging can be centralized and duty cycles predictable.

Passenger cars still anchor 68.63% 2025 revenue but contend with affordability pressures and rising compliance outlays. Plant retooling for multi-powertrain flexibility enables manufacturers to modulate output amid shifting demand. Total cost-of-ownership parity for zero-emission trucks by 2035 will further tilt investment toward commercial applications, reinforcing structural growth in this segment of the North America automotive market.

Internal-combustion powertrains command an 82.11% share in 2025; however, battery-electric vehicles will capture incremental gains at 9.58% CAGR, supported by up to USD 7,500 clean-vehicle tax credits. Hybrid models act as a bridge technology, with Ford reporting double-digit hybrid sales gains in 2024.

Plug-in hybrids provide range assurance for long-distance drivers while meeting partial electrification quotas. Fuel-cell offerings remain niche, limited by hydrogen infrastructure gaps. Propulsion diversification allows OEMs to de-risk capital allocation while scaling batteries and software platforms central to the evolving North America automotive market size.

The North America Automotive Market Report is Segmented by Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Propulsion Type (ICE, and More), Sales Channel (OEM-Franchised Dealer, and More), Level of Automation (Level 0-1, Level 2, Level 3, and Level 4-5), and Country (United States, Canada, Rest of North America). The Market Forecasts are Provided in Terms of Value (USD) and Volume in Units.

List of Companies Covered in this Report:

- General Motors Company

- Toyota Motor Corporation

- Ford Motor Company

- Stellantis N.V.

- Hyundai Motor Company

- Honda Motor Co., Ltd.

- Nissan Motor Co., Ltd.

- BMW AG

- Tesla, Inc.

- Volkswagen AG

- Mercedes-Benz Group AG

- Kia Corporation

- Subaru Corporation

- Mazda Motor Corporation

- Rivian Automotive, Inc.

- Lucid Group, Inc.

- BYD Company Ltd.

- Volvo Car Corporation

- Mitsubishi Motors Corporation

- Daimler Truck Holding AG

- PACCAR Inc.

- Navistar International Corp.

- Harley-Davidson, Inc.

- Yamaha Motor Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Federal and State ZEV Mandates

- 4.2.2 Falling Auto-Loan Rates and Pent-Up Demand

- 4.2.3 NEVI-Funded EV-Charging Build-Out

- 4.2.4 Light-Truck/SUV Mix Shift Lifts Margins.

- 4.2.5 Battery "Auto-Alley" Localization

- 4.2.6 Software-Defined-Vehicle Revenue Model

- 4.3 Market Restraints

- 4.3.1 Vehicle Affordability Squeeze

- 4.3.2 Chip and Battery-Grade Mineral Bottlenecks

- 4.3.3 Tariff Brinkmanship Under USMCA Review

- 4.3.4 Peak-Hour "Charging-Queue" Anxiety

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Light Commercial Vehicles

- 5.1.3 Medium & Heavy Commercial Vehicles

- 5.1.4 Two-Wheelers

- 5.2 By Propulsion Type

- 5.2.1 Internal Combustion Engine (ICE)

- 5.2.2 Hybrid Electric Vehicles (HEV)

- 5.2.3 Plug-in Hybrid Vehicles (PHEV)

- 5.2.4 Battery Electric Vehicles (BEV)

- 5.2.5 Fuel-Cell Electric Vehicles (FCEV)

- 5.2.6 Natural-Gas Vehicles (NGV)

- 5.3 By Sales Channel

- 5.3.1 OEM-Franchised Dealer Sales

- 5.3.2 Direct-to-Consumer (Online)

- 5.3.3 Fleet and Rental Sales

- 5.4 By Level of Automation (Value)

- 5.4.1 Level 0 - 1 (Basic / No ADAS)

- 5.4.2 Level 2 (Partial Automation)

- 5.4.3 Level 3 (Conditional Automation)

- 5.4.4 Level 4 - 5 (High / Full Automation)

- 5.5 By Country

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Rest of North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 General Motors Company

- 6.4.2 Toyota Motor Corporation

- 6.4.3 Ford Motor Company

- 6.4.4 Stellantis N.V.

- 6.4.5 Hyundai Motor Company

- 6.4.6 Honda Motor Co., Ltd.

- 6.4.7 Nissan Motor Co., Ltd.

- 6.4.8 BMW AG

- 6.4.9 Tesla, Inc.

- 6.4.10 Volkswagen AG

- 6.4.11 Mercedes-Benz Group AG

- 6.4.12 Kia Corporation

- 6.4.13 Subaru Corporation

- 6.4.14 Mazda Motor Corporation

- 6.4.15 Rivian Automotive, Inc.

- 6.4.16 Lucid Group, Inc.

- 6.4.17 BYD Company Ltd.

- 6.4.18 Volvo Car Corporation

- 6.4.19 Mitsubishi Motors Corporation

- 6.4.20 Daimler Truck Holding AG

- 6.4.21 PACCAR Inc.

- 6.4.22 Navistar International Corp.

- 6.4.23 Harley-Davidson, Inc.

- 6.4.24 Yamaha Motor Co., Ltd.