|

市场调查报告书

商品编码

1910503

越野车:市占率分析、产业趋势与统计、成长预测(2026-2031)Off-road Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

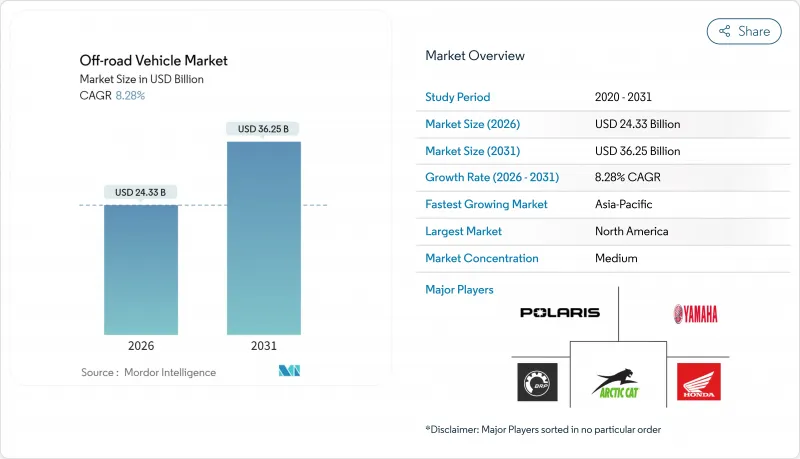

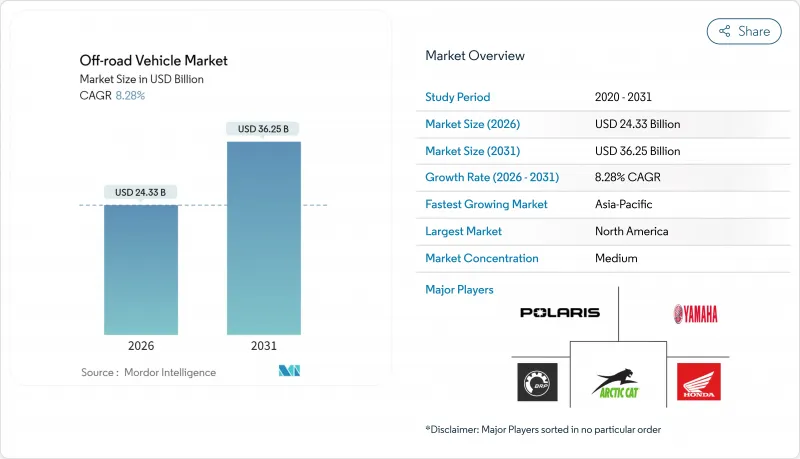

预计到 2026 年,越野车市场规模将达到 243.3 亿美元,高于 2025 年的 224.7 亿美元,预计到 2031 年将达到 362.5 亿美元,2026 年至 2031 年的复合年增长率为 8.28%。

这一增长得益于户外休閒参与度的提高、电气化进程的加速以及实用应用领域的拓展,这些因素持续抵消了主要製造商的周期性收入波动。步道基础设施建设资金的增加、精密农业的日益普及以及军事机动性现代化项目的推进进一步扩大了市场需求,而以电动方向盘(EPS)、远程信息处理和先进悬吊系统为核心的技术融合,则增强了产品对消费者和商业用户的价值提案。儘管主要供应商在 2024 年的收入有所下降,但越野车市场透过向电动车型多元化发展、获得专业国防合约以及拓展基于订阅的互联服务,展现出了强大的韧性,从而巩固了长期的收入来源。

全球越野车市场趋势与洞察

户外休閒旅游激增

2024年,户外休閒为美国GDP贡献了1.2兆美元(国内生产总值的2.3%),并创造了大量就业机会。参与人数的增加推动了全地形车(ATV)和多用途车(UTV)的购买,用于越野骑行和长途旅行。摩托车和全地形车创造了当年大部分的经济增加价值,证实了越野车市场的强劲需求。各州的津贴项目进一步放大了这一影响:科罗拉多的户外休閒基金为相关计划拨出了大量资金,而奥勒冈州的配套津贴则促进了当地製造业丛集的发展。步道系统产生了强大的溢出效应。明尼苏达州的雪上摩托车网路全年都能带来可观的旅游收入,增强了对当地经济的乘数效应,并稳定了季节性车辆销售。

国防部战术全地形车/多用途车采购

国防机构正在寻求轻型机动装备,用于边防安全、特种作战以及在复杂地形中的后勤保障。印度即将发布的北部边境竞标明确要求车辆具备直升机吊挂能力、四座布局以及自主导航选项,以最大限度地提高战术性柔软性。芬兰主导的欧洲FAMOUS计画专注于北极作战,该计画研发的车辆能够在摄氏零下46度的低温下启动,并在解冻期间具备两栖作战能力。美国每年都会拨出一定资金用于购买超轻型作战车辆(ULCV),其空载重量低于4500磅,续航里程达250英里。这些项目推动了供应商开发模组化底盘,以便加装甲套件、反无人机感测器和混合动力传动系统。儘管民用需求有周期性波动,但累积订单依然充足。

电动动力传动系统所需的锂供应链正变得越来越紧张。

中国目前占全球锂精炼量五分之三以上,电池产量占五分之四,随着需求激增,全球原始设备製造商(OEM)面临风险。儘管美国已根据《通货膨胀控制法案》拨款用于国内锂加工,但审批障碍和社区担忧导致矿山开采延迟。电化学萃取技术新兴企业承诺提供绿色解决方案,但仍处于商业化前期。在供应来源多元化之前,电池价格可能持续波动,这可能会限制总拥有成本(TCO)与传统电池价格持平的实现,而实现这一目标将加速电动全地形车(ATV)的普及,尤其是在对价格敏感的发展中市场。

细分市场分析

多功能越野车(UTV)和并排式越野车(Side-by-side)集载客、载货和悬吊性能于一体,预计到2025年将占据越野车市场50.68%的份额。在休閒、农业和国防领域需求的推动下,该衍生市场实现了强劲成长。电动UTV目前正以8.32%的复合年增长率(CAGR)快速成长,这得益于汽车製造商(OEM)推出的15kWh电池组,这些电池组可使UTV最高时速达到80公里/小时,充电时间缩短至3小时以内。

在那些对车身宽度有严格限制、更适合窄底盘的地区,全地形车 (ATV) 的需求仍然强劲。同时,在气候严寒的地区,两栖车和雪上摩托车等小众车型的需求也持续存在。差异化竞争优势主要体现在可调式悬吊、北极星动力公司的即时阀门架构以及配备触控萤幕 Ride Command 系统的数位化驾驶舱等。因此,我们的产品组合兼顾了传统内燃机 (ICE) 车型的产量和新兴的电气化成长动力,从而能够有效应对动力系统相关的不确定性。

到2025年,运动休閒领域将占越野车市场的41.05%,这主要得益于数百万美国人参与户外活动,导致越野车道使用率创历史新高。执法机关的需求预计将以8.35%的复合年增长率成长,这主要受采购机构寻求轻型战术机动车辆(配备直升机吊挂和混合静音监视模式)的推动。

农业和林业将采用配备动力输出轴驱动农具的中排量多用途越野车(UTV),建设公司将采购重型车辆用于偏远地区的后勤保障,而诸如嚮导式越野探险等新兴旅游模式将进一步拓展UTV的应用场景。因此,即使消费者可支配支出下降,多用途适应性仍将维持UTV的基本销售。

到 2025 年,内燃机将占非道路车辆市场份额的 83.05%,这得益于广泛的燃料供应基础设施和成熟的供应链;而电池电动车车型将实现最高的复合年增长率,达到 8.30%,这反映了政策激励和电池成本的下降。

这款混合增程器将10kWh电池组与紧凑型发电机相结合,在不牺牲低速扭矩的前提下延长了运作时间,从而消除了客户的顾虑。虽然氢燃料电池原型仍处于研发阶段,但它为需要在寒冷气候下快速加氢的重型救援车辆指明了方向。动力系统的多样化不仅降低了监管风险,还建构了一个以电池租赁和回收为中心的新型供应商生态系统。

区域分析

2025年,北美将占据越野车市场37.84%的份额,这主要得益于户外休閒对GDP的显着贡献以及各州补贴的广泛步道网络。雪带各州每年在维护项目上投入巨资,以刺激旅游收入。威斯康辛州和阿拉斯加州对符合条件的步道维护费用提供100%的补贴,即使在经济低迷时期也能维持稳定的需求。经销商融资合作关係(例如,谢菲尔德金融公司与北极星公司续约的协议)方便了买家获得融资,并维持了展示室的周转率。然而,加拿大省级保护区的法规带来了营运上的复杂性,迫使汽车製造商提供更安静的动力传动系统和符合排放气体的发动机,以满足许可标准。

预计到2031年,亚太地区将以8.42%的复合年增长率实现最快增速,这主要得益于都市化的中产阶级消费者对户外生活方式品牌的青睐,以及各国政府对农村交通的大力投入。在印度,受探险旅游行销和农业机械化程度提高的推动,全地形车(ATV)销量显着成长。像CFMOTO这样的区域性整车製造商利用其垂直整合的供应链,实现了价格竞争力,赢得了出口合同,并占据了全球五分之二的市场份额。

欧洲的成长虽然缓慢,但监管要求与电气化进程相契合。针对非道路机械的第五阶段排放气体法规增加了后处理装置和替代动力传动系统的研发投入,间接推动了混合动力和燃料电池技术的创新。将于2028年生效的新NRMM法规设定了70辆的小规模生产门槛,为新兴电动车製造商更容易获得认证铺平了道路。北欧国家已推出长期步道维护补助以促进旅游业发展,德国和奥地利也考虑在其阿尔卑斯山区采取类似措施。因此,儘管监管负担将在短期内抑制销量,但长期需求将转向低排放车型,使欧洲供应商能够透过溢价收回投资。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 户外休閒旅游激增

- 国防部战术全地形车/多用途车采购

- 中型农场的快速机械化

- 采用先进的电动方向盘(EPS)和远端资讯处理技术

- 无人机拍摄对低噪音电动全地形车的需求

- 北欧越野滑雪道维护补助金扩大了骑乘网络

- 市场限制

- 高昂的初始成本和生命週期成本

- 电动动力传动系统所需的锂供应链十分紧张。

- 加强伤害赔偿法规并引入速度限制

- 在保护区内禁止使用

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模及成长预测(价值(美元)及销售量(单位))

- 按车辆类型

- 全地形车(ATV)

- 多用途作业车辆(UTV)/并排式全地形车

- 越野摩托车

- 雪上摩托车

- 两栖特种越野车

- 透过使用

- 运动与休閒

- 农业和林业

- 工业与建筑

- 军事和执法机关

- 其他商业活动(旅游、搜救)

- 依推进类型

- 内燃机(汽油/柴油)

- 杂交种

- 电池式电动车

- 氢燃料电池

- 按引擎排气量(cc)

- 排气量低于400cc

- 400-800 cc

- 超过800cc

- 按输出功率(千瓦)

- 小于50千瓦

- 50~100 kW

- 100千瓦或以上

- 按驱动类型

- 两轮驱动

- 四轮驱动/全轮驱动

- 按座位数

- 1人

- 2人

- 3 位或以上客人

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 埃及

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Polaris Inc.

- Bombardier Recreational Products Inc.(Can-Am)

- Yamaha Motor Corp.

- Textron Inc.(Arctic Cat)

- Kawasaki Heavy Industries Ltd.

- Suzuki Motor Corp.

- Honda Motor Co. Ltd.

- CFMOTO Powersports Inc.

- Kwang Yang Motor Co. Ltd.(Kymco)

- American LandMaster

- Tracker Off-Road(Bass Pro Shops)

- Kubota Corp.(RTV)

- John Deere(Gator)

- Mahindra & Mahindra Ltd.

- Segway Powersports

- Hisun Motors Corp.

- Linhai Group

- TGB(Taiwan Golden Bee)

- DRR USA

第七章 市场机会与未来展望

Off-road Vehicle Market size in 2026 is estimated at USD 24.33 billion, growing from 2025 value of USD 22.47 billion with 2031 projections showing USD 36.25 billion, growing at 8.28% CAGR over 2026-2031.

This growth arises from a confluence of rising outdoor recreation participation, accelerating electrification, and expanding utility applications that continue to offset cyclical revenue fluctuations among leading manufacturers. Growing trail infrastructure funding, precision-farming uptake, and military mobility modernization programs further widen demand pools, while technology convergence around electronic power steering (EPS), telematics, and advanced suspension systems enhances value propositions for both consumer and commercial buyers. Even with revenue contractions at major suppliers during 2024, the off-road vehicle market shows resilience through diversification into electric variants, specialty defense contracts, and subscription-based connectivity services that solidify long-term revenue streams.

Global Off-road Vehicle Market Trends and Insights

Surge In Outdoor Recreational Tourism

Outdoor recreation contributed USD 1.2 trillion to U.S. GDP in 2024, equal to 2.3% of national output and supporting multiple jobs. Participation increased, spurring ATV and UTV purchases for trail riding and overlanding. In 2024, motorcycling and ATVing generated a large share of value-added economic output, underscoring strong demand in the off-road vehicle market. State grant programs amplify the effect: Colorado's Outdoor Recreation Fund distributed a massive amount to access projects, while Oregon's matching grants nurtured rural manufacturing clusters. Trail systems create powerful spillovers; Minnesota's snowmobile network generates significant annual tourism revenue, reinforcing the sector's multiplier effect on local economies and stabilizing seasonal vehicle sales.

Tactical ATV/UTV Procurement By Defense Forces

Defense agencies seek light mobility assets for border patrol, special operations, and logistics in difficult terrain. India's upcoming northern-border tender specifies helicopter-sling capability, four-seat layouts, and autonomous navigation options to maximize tactical flexibility. Europe's FAMOUS program, coordinated by Finland, focuses on Arctic operability with vehicles tolerating -46 °C start-up and amphibious functionality for thaw periods. The United States allocates some amount annually to acquire Ultra-Light Combat Vehicles with 4,500-pound curb-weight caps and 250-mile range requirements. Such multi-program momentum encourages vendors to develop modular chassis that accept armor kits, counter-drone sensors, and hybrid powertrains, strengthening order backlogs despite civilian cyclical swings.

Lithium Supply-Chain Crunch For E-Powertrains

China currently refines more than three-fifths of global lithium and fabricates four-fifths of batteries, creating exposure for global OEMs as demand surges. The United States allocated funding under the Inflation Reduction Act for domestic processing, but permitting hurdles and community concerns are delaying mine openings. Electro-chemical extraction startups promise lower-impact solutions yet remain pre-commercial. Until diversified supply materializes, battery prices may remain volatile, constraining the total-cost parity that accelerates electric ATV adoption, particularly in price-sensitive developing markets.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Mechanization Of Midsize Farms

- Adoption Of Advanced EPS & Telematics

- Rising Injury-Related Regulations & Speed Caps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

UTVs and side-by-sides captured 50.68% of the off-road vehicle market share in 2025 by blending passenger capacity, cargo utility, and suspension sophistication. The segment reached a robust level of off-road vehicle market size, buoyed by recreation, agriculture, and defense orders. Electric UTV derivatives now post the fastest 8.32% CAGR as OEMs introduce 15 kWh battery packs delivering 80 km/h top speed and sub-3-hour recharge cycles.

Demand for all-terrain vehicles (ATVs) remains robust in regions with strict width restrictions that favor narrower chassis. In contrast, niche demand for amphibious and snowmobile platforms persists where climatic extremes prevail. Competitive differentiation hinges on adjustable suspension, Polaris's DYNAMIX live valve architecture, and cabin digitization through touchscreen ride-command systems. The vehicle-type portfolio, therefore, balances legacy ICE volumes against emerging electric growth vectors, enabling OEMs to hedge against propulsion uncertainty.

Sports and recreation account for 41.05% of the off-road vehicle market in 2025, benefiting from record trail participation as millions of Americans venture outdoors. Military and law enforcement demand will escalate at an 8.35% CAGR as procurement agencies seek light tactical mobility with helicopter-sling compatibility and hybrid silent-watch modes.

Agriculture and forestry absorb mid-displacement UTVs outfitted with PTO-driven implements, while construction firms requisition high-payload units for remote-site logistics. Emerging tourism concepts such as guided overlanding expeditions further widen commercial use cases. Multi-role adaptability, therefore, sustains baseline volumes even when consumer discretionary spending dips.

Internal-combustion engines commanded 83.05% of the off-road vehicle market share in 2025, backed by ubiquitous fueling infrastructure and mature supply chains. Battery-electric models, however, record the steepest 8.30% CAGR, reflecting policy push and falling cell costs.

Hybrid range-extender concepts bridge customer anxiety by pairing 10 kWh packs with compact generators, extending runtime without compromising low-speed torque. Hydrogen fuel-cell prototypes remain R&D efforts but signal pathways for heavy-duty rescue fleets requiring rapid cold-weather refueling. Propulsion diversification mitigates regulatory risks while inviting new supplier ecosystems around battery leasing and recycling.

The Off-Road Vehicle Market Report is Segmented by Vehicle Type (All-Terrain Vehicles and More), Application (Sports & Recreation and More), Propulsion Type (Internal-Combustion and More), Engine Displacement (Less Than 400 Cc and More), Power Output (Less Than 50 KW and More), Drive Type (2-Wheel Drive and More), Seating Capacity, and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

North America secured 37.84% of off-road vehicle market share in 2025, underpinned by the outdoor recreation GDP contribution and extensive trail networks subsidized by state grants. Snowbelt states invested huge amount annually in grooming programs that stimulated in tourism receipts, while Wisconsin and Alaska reimbursed 100% of eligible trail maintenance costs, anchoring steady demand even during economic slowdowns. Dealer financing partnerships, such as Sheffield Financial's renewal with Polaris, ease credit access for buyers and sustain showroom turnover. Nevertheless, conservation-area restrictions across Canadian provinces introduce operational complexity, nudging OEMs to supply quieter powertrains and emission-compliant engines to satisfy permitting criteria.

Asia-Pacific delivers the fastest 8.42% CAGR through 2031 as urbanizing middle-class consumers embrace outdoor lifestyle brands and governments fund rural connectivity. India's ATV sales grew drastically which was supported by adventure-tourism marketing and agricultural mechanization drives. Regional OEMs such as CFMOTO leverage vertically integrated supply chains to offer competitive pricing, enabling them to capture export contracts and reach two-fifth global market share.

Europe's growth lags but regulatory thrust aligns with electrification imperatives. Stage V emission norms for non-road machinery elevate R&D spending on after-treatment and alternative powertrains, indirectly spurring innovation in hybrid and fuel-cell concepts. New NRMM rules effective 2028 set small-series thresholds of 70 units, granting boutique electric startups manageable certification pathways. Nordic countries deploy long-run trail-maintenance subsidies to catalyze tourism, a template that Germany and Austria now evaluate for alpine regions. Consequently, although compliance burdens restrain short-term volumes, long-term demand will pivot toward low-emission models, allowing European suppliers to recoup investments through premium pricing.

- Polaris Inc.

- Bombardier Recreational Products Inc. (Can-Am)

- Yamaha Motor Corp.

- Textron Inc. (Arctic Cat)

- Kawasaki Heavy Industries Ltd.

- Suzuki Motor Corp.

- Honda Motor Co. Ltd.

- CFMOTO Powersports Inc.

- Kwang Yang Motor Co. Ltd. (Kymco)

- American LandMaster

- Tracker Off-Road (Bass Pro Shops)

- Kubota Corp. (RTV)

- John Deere (Gator)

- Mahindra & Mahindra Ltd.

- Segway Powersports

- Hisun Motors Corp.

- Linhai Group

- TGB (Taiwan Golden Bee)

- DRR USA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge In Outdoor Recreational Tourism

- 4.2.2 Tactical ATV/UTV Procurement By Defense Forces

- 4.2.3 Rapid Mechanization Of Midsize Farms

- 4.2.4 Adoption Of Advanced EPS & Telematics

- 4.2.5 Demand For Low-Noise E-Atvs For Drone Cinematography

- 4.2.6 Nordic Trail-Maintenance Subsidies Expanding Riding Networks

- 4.3 Market Restraints

- 4.3.1 High Upfront & Lifecycle Costs

- 4.3.2 Lithium Supply-Chain Crunch For E-Powertrains

- 4.3.3 Rising Injury-Related Regulations & Speed Caps

- 4.3.4 Conservation-Area Usage Bans

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 All-Terrain Vehicles (ATV)

- 5.1.2 Utility Task Vehicles (UTV) / Side-by-Sides

- 5.1.3 Dirt / Off-road Motorcycles

- 5.1.4 Snowmobiles

- 5.1.5 Amphibious & Specialty ORVs

- 5.2 By Application

- 5.2.1 Sports & Recreation

- 5.2.2 Agriculture & Forestry

- 5.2.3 Industrial & Construction

- 5.2.4 Military & Law-Enforcement

- 5.2.5 Other Commercial (tourism, search-and-rescue)

- 5.3 By Propulsion Type

- 5.3.1 Internal-Combustion (Gasoline / Diesel)

- 5.3.2 Hybrid

- 5.3.3 Battery-Electric

- 5.3.4 Hydrogen Fuel-Cell

- 5.4 By Engine Displacement (cc)

- 5.4.1 Less than 400 cc

- 5.4.2 400 - 800 cc

- 5.4.3 More than 800 cc

- 5.5 By Power Output (kW)

- 5.5.1 Less than 50 kW

- 5.5.2 50 - 100 kW

- 5.5.3 More than 100 kW

- 5.6 By Drive Type

- 5.6.1 2-Wheel Drive

- 5.6.2 4-Wheel / All-Wheel Drive

- 5.7 By Seating Capacity

- 5.7.1 1 Rider

- 5.7.2 2 Riders

- 5.7.3 More than or equal to 3 Passengers

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Rest of North America

- 5.8.2 South America

- 5.8.2.1 Brazil

- 5.8.2.2 Argentina

- 5.8.2.3 Rest of South America

- 5.8.3 Europe

- 5.8.3.1 Germany

- 5.8.3.2 France

- 5.8.3.3 United Kingdom

- 5.8.3.4 Italy

- 5.8.3.5 Spain

- 5.8.3.6 Russia

- 5.8.3.7 Rest of Europe

- 5.8.4 Asia-Pacific

- 5.8.4.1 China

- 5.8.4.2 Japan

- 5.8.4.3 India

- 5.8.4.4 South Korea

- 5.8.4.5 Australia

- 5.8.4.6 Rest of Asia-Pacific

- 5.8.5 Middle East and Africa

- 5.8.5.1 United Arab Emirates

- 5.8.5.2 Saudi Arabia

- 5.8.5.3 Turkey

- 5.8.5.4 Egypt

- 5.8.5.5 South Africa

- 5.8.5.6 Rest of Middle East and Africa

- 5.8.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Polaris Inc.

- 6.4.2 Bombardier Recreational Products Inc. (Can-Am)

- 6.4.3 Yamaha Motor Corp.

- 6.4.4 Textron Inc. (Arctic Cat)

- 6.4.5 Kawasaki Heavy Industries Ltd.

- 6.4.6 Suzuki Motor Corp.

- 6.4.7 Honda Motor Co. Ltd.

- 6.4.8 CFMOTO Powersports Inc.

- 6.4.9 Kwang Yang Motor Co. Ltd. (Kymco)

- 6.4.10 American LandMaster

- 6.4.11 Tracker Off-Road (Bass Pro Shops)

- 6.4.12 Kubota Corp. (RTV)

- 6.4.13 John Deere (Gator)

- 6.4.14 Mahindra & Mahindra Ltd.

- 6.4.15 Segway Powersports

- 6.4.16 Hisun Motors Corp.

- 6.4.17 Linhai Group

- 6.4.18 TGB (Taiwan Golden Bee)

- 6.4.19 DRR USA

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment